Page 1 :

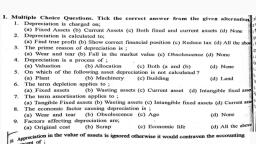

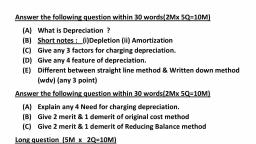

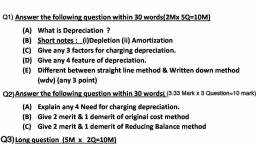

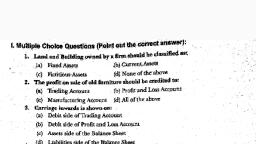

Q1) MCQ, GROUP-A (Objective Type Compulsory Questions)., I. Multiple Choice Questions (Point out the correct answer):, 1. Depreciation is:, (b) an income, (d) a loss, (a) an asset, [CHSE 2016 (A)], (c) a liability, 2. Depreciation is a charge on:, (a) Current Assets, (c) Fictitious Assets, 3. In Machinery Account, depreciation charged is shown:, (a) on the debit side, (b) Liquid Assets, (d) Fixed Assets, [CHSE 2013 (A)], (b) on the credit side, (c) as closing balance, 4. Depreciation arises due to:, (a) wear and tear in assets, (d) All of the above, (b) efflux of time, (c) obsolescence, 5. A machinery costing 75,00,000 is depreciated @20% p.a. at straight line method basis., At the end of three years, the book value of the machinery will be:, (a) 3,50,000, (d) All of the above, (b) 2,50,000, (c) { 2,00,000, 6. What will be the rate of depreciation under straight line method in the following case:, Original cost of machine = 4,50,000, (d) 3,00,000, Scrap value after 9 years =3 45,000, Repair charges in 2nd year = 7 30,000, (a) 10%, (b) 15%, (c) 4.5%, 7. Asset Disposal Account is prepared:, (a) at the time of purchase of an asset, (d) 11.11%, (b) at the time of sale of an asset, (c) at the time of purchase of additional machinery, (d) when the scrap value of asset is zero.

Page 2 :

8. Under which method of providing depreciation, a fixed percentage of depreciation is, applied every year on the book value?, (a) Written Down Value Method, (b) Straight Line Method, (c) Depreciation Fund Method, (d) Insurance Policy Method, 9. Loss on sale of machinery is shown on:, (a) debit side of machinery account, (b) credit side of depreciation account, (c) debit side of depreciation account, (d) credit side of machinery account., 10. Depreciation is charged on:, (a) Fixed Assets, (b) Current Assets, (c) Liquid Assets, 11. Depletion method of depreciation is applicable to:, (c) Fictitious Assets [CHSE 2016(A), 2009 (A), 2008 (A)], (a) Patents, (b) Loose tools, (c) Machineries, (c) Quarries, 12. The method of depreciation applicable to a mine is:, (a) Machine-hour method, [CHSE 2015 (A)], (b) Depletion method, (c) Diminishing balance method(d) Straight Line method, 13. Depletion method of depreciation is applicable to:, (a) Current Assets, [CHSE 2014 (4)], (b) Fictitious Assets, (c) Intangible Assets, 14. The main objective of providing depreciation is:, (a) to ascertain true profit, (d) Wasting Assets, [CHSE 2013 (A)], (b) to reduce the income tax amount, (c) to know the true financial position, (d) All of the above, 15. The term 'amortisation' is used in term of:, (b) Intangible Assets, (d) Wasting Assets, (a) Fixed Assets, (c) Tangible Assets, 16. Straight line method of charging depreciation is also known as:, (a) Original cost method, (b) Equal instalment method, (c) Fixed instalment method, (d) All of the above, Under which of the following method, depreciation is charged at a fixed percentage on, the original cost of assets?, 17,

Page 3 :

(a) Straight line method, (b) Written down value method, (c) Depreciation fund method (d) None of the above, 18. Under written down value method, the amount of depreciation:, (a) increases every year, (b) decreases every year, (c) remains constant every year (d) All of the above, 19. Which of the following asset is generally not depreciable?, (b) Plant and Machinery, (a) Land, (c) Building, 20. Depreciation account is a:, (d) Office Furniture, (a) Personal Account, (b) Real Account, (c) Nominal Account, (d) Natural Account, 21. Which method of depreciation is approved by income tax authorities?, (a) Straight line method, (b) Written down value method, (c) None of the above, (d) All of the above, 22. Profit on sale of machinery is shown:, MERLO (a) on the credit side of machinery account, (b) on the debit side of machinery account, (c) on the debit side of depreciation account, (d) on the credit side of depreciation account, 23. Which of the following is a cause, depreciation?, (b) Expiry of time, (a) Constant use, (c) Obsolescence, (d) All of the above, 24. Depreciation is calculated on:, (a) Cost price, (b) Market price, (c) Cost price or market price whichever is lower, (d) Cost price or market price whichever is higher, 25. When depreciation is charged under straight line method, the amount of depreciation:, (a) decreases every year, (b) increases every year, (c) remains constant, (d) increases some year and decreases some years, 26. Depletion method of depreciation is applicable to:, [CHSE 2016 (A)], (a) Building, (b) Machinery, (c) Colliery, (d) Loose Tools, [CHSE 2012 (A)]

Page 4 :

27. Depreciation, on diminishing balance method on a machinery of 720,000 at 10% p.a. at, the end of the third year, shall be:, (a) 14,580, (b) 1,458, (c) 16,200, (d) 1,620, [CHSE 2010 (A)], 28. Where will you transfer the balance of 'Asset Disposal Account'?, (a) Depreciation Account, (b) Statement of Profit and Loss, (c) Trading ACcount, (d) Balance Sheet, Q2) fill in blank, 1. Depreciation is the process of apportionment of the cost of the asset over its, 2., Under, method, depreciation is charged at a fixed percentage on the, original cost of the asset., 3. The amount of depreciation charged, the amount of profit., is the estimated sale value of an asset after its useful working life., 4., 5. The book value of an asset cannot be zero under, method of, depreciation., 6. Depreciation is shown on the, side of machinery account., 7., method is used to express the decrease in value of mines, oil wells, etc., 8., method is not approved by income tax authorities for charging, brin, depreciation., 9. Discarding old plant and machinery due to new inventions is called, 10. Under fixed instalment method, depreciation is calculated on the, the machinery., of, Q3) What is depreciation ? Give it's 6 feature & 3 Need, for charges for depreciation. (10 Mark), Q4) Explain different cause of depreciation. (10 mark), Q5) (A) What is Straight line Method? Give it's 3 merit, & 3 demerits., Q6) (A) What is WDV? Give it's 3 merit & 3 demerits.