Page 1 :

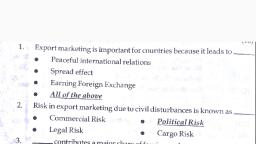

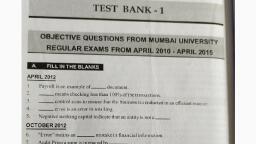

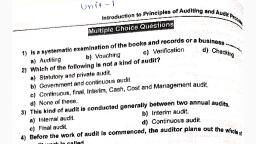

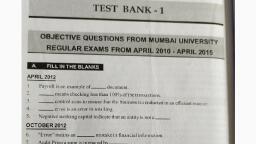

(b) Checking the Supporting Documents, ОВJE, 20., Select the appropriate option and rewrite the following sentences :, The following points should be noted or checked by the auditor in vouching :, (a) Checking the Voucher, 20.1 MULTIPLE CHOICE QUESTIONS, 11,, 1., (d) All the above, (c) Checking the Entry in the Books, Checking serial no. of vouchers during vouching helps the auditor to, 2., (b) Detect errors of omission, (a), Detect errors of principle, (d) None of the above, (c) Detect compensating errors, Checking the head of account debited or credited during vouching helps the auditor, 3., (а), (b) Detect errors of omission, Detect errors of principle, (d), None of the above, (c) Detect compensating errors, Checking the amount in words during vouching of cash transactions helps the auditor, (a) Detect errors of principle, (c) Detect misappropriation, Verifying the signature of the authorised official on the voucher during vouching helns a, auditor to check the, 4., (b) Detect errors of commission, (d) None of the above, 5., (a) Occurrence of the transaction, (b) Validity of the transaction, (c), Amount of the transaction, Checking the serial no. of vouchers on the voucher during vouching helps the auditor to obtu, evidence that, (d) Period of the transaction, 6., (a) The transaction took place, (b) There are no unrecorded transactions, (c) The transaction is recorded in the books on the right date, (d) The transaction is valid

Page 2 :

Fix responsibility for errors in making entry of the voucher, verifying the signature of the person preparing the voucher helps the auditor to, The transaction relates to current year, (d) Prove that the bill is genuine and valid, Checking the date of entry of voucher in the books mainly helps the auditor to obtain evidence, Verifying the signature on the supporting purchase bill attached to a voucher helps the auditor to, Serial no. of supporting bill from supplier attached with a voucher helps the auditor to, Checking the signature of the payee during vouching of cash payments helps the auditor to, oi voucher on the voucher during vouching mainty helps the auditor, Checkns, (a), The transaction is legal, 207, Al the transactions are recorded in the books, (c), Transactions take place every day, age, 206, (d), 206, (a), Fix responsibility for errors in preparing the voucher, P09, (b), Casure that the voucher is posted in the ledger, 09, (c), Gasure that the voucher has proper supporting documents, 10, (d), Verify that the payment is properly authorised, (b), Verify that the cash received is acknowledged, (a), Verify that the cheque was signed by an authorised per son, (c), (a), Detect entry of duplicate bill in the register, (b), Verify that all the bills are entered serially, (c), Verify that all the vouchers are entered serially, d) None of the above, (a), Identify the person who received the payment for the bill, Fix responsibility for errors in preparing the bill, Identify the person who made the payment for the bill, that, le) Entry was made on the same day as that of the voucher, There are no missing vouchers, (b), The vouchers are filed every day, (c), The accountant was not absent on that day, Which of the following documents is not relevant for vouching sales, (a) Daily Cash Sales Summary, (b) Delivery Challans, (c) Credit Memos, To check whether all sales have been recorded, auditor should check, (d). Sale Dept. Attendance Record, (a) Salesmen's payroll, (b) Sales bills, (c) Sales orders, 15. The auditor will examine Bill of Lading in order to vouch, (d) Goods Received Notes, (a) Sales within the State, (b) Sales outside the State, (d) Sales on approval, (c) Exports, 16. The auditor will examine Bill of Entry in order to vouch, (a) Local Purchases, (b), Purchases on consignment basis, (c) Imports, (d), Cash Purchases

Page 3 :

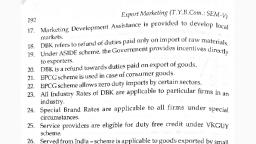

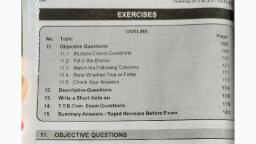

208, Vouc, 17., mea, Oral explanations, 1., 2., thereof., Documents, 3., As soon as, External documents, (9), 1, 2, 5, 4, 3, (p), 1, 2, 3, 4, 5, 4., Purchase I, 3., Payroll is, 5., Internal documents, (e), 2, 1, 4, 3, 5, ()), 5, 4, 2, 1, 3, A, Date of t, The amo, Vendor invoice, (9), (d) Sales order, 18., The pay, Sales invoice, (e), Customer order, (ɔ), Checkir, 19., Bill of lading, Sales order, (a), Sales invoice, (ɔ), (9), Customer order, The au, 9., wheth, (p), 20., marke, the, The, Sales invoice, (2), (c) Purchase order, (9), Sales order, Bill of lading, 10., (i)., 21., (p), 20.3 N, (a) sales are invoiced, (c), goods are shipped, 22., transactions and updating the debtors accounts is the, recording, Sales order, (e), (c) Sales journal, (b) Bill of lading, es, 23., (d) Sales invoice, are normally compared with, (a) the original invoices, (b) an approved master price list, the amounts recorded in the sales journal for that transaction, (ɔ), (d) the amounts posted to the customer's account in the accounts receivable master fil,, To verify that all goods received by the company have been recorded properly, auditor sho, 24., check all, Vendor invoices, (a), (c) Goods received notes, Purchase orders, (9), Cash payments to creditors, (p), 25., The auditor gets highlyreliable evidence about individual purchase transactions by examini, (a) Supplier's invoices, 2., (b) Supplier's statements, (c) Confirmations of accounts payable balances, (d) Detailed inventory counting instructions, called the, Bill of lading, (a), Materials requisition, (), (b), Goods received note, (d) Inventory acquisition summary, 26. Receipt of ordered materials by the receiving department can be verified from a documa

Page 4 :

market prices at the relevant time., As soon as any transaction takes place, a., whether the rates charged to such group concerns are-, The auditor of a company has to comment in his report, in case of sales to group concerns,, Checking the date of entry helps to prevent and detect frauds in the nature of-, The payee should sign on a., means comparing the entries in books of accounts with documentary evidence in support, The dividend received should be vouched from the following supporting documents:, Payroll is an example of (internal/external) document., 20.3 MATCH THE FOLLOWING COLUMNS, Date of the Voucher is checked to see that the transaction pertains to the., selnability), FILL IN THE BLANKS, 209, 20.2, thereot, Purchase bill is an example of, is prepared giving details of the transaction, (internal/external) document., The amount in, усar., in a voucher helps to prevent alteration of amount in figures., stamp, if the payment exceeds 5,000., the, and, ent due date is, or not with regard to the prevailing, of Dividend Warrants, (ii)., (i)., for deposits in Bank Account., Column A, astomer, Transaction, Column B, Supporting Document, Sales, arding sales, 1., (a), Dividend Warrants, 2., Goods despatched, (b) Signature of payee on revenue stamp, 3., Exports, (c), Cash Memo, Income from investments, (d) Delivery Challan, Lease Deed, 4., Royalty, Cash payment exceeding 20,000, 5., (e), (f), s invoices, Pay rolls, (g) Bill of lading, (h) Goods Received Note, (i), 6., 7., Purchases, 8., Salary, Disallowed in Income-tax, r file, 20.4 STATE WHETHER TRUE OR FALSE, GIVING REASONS, IN BRIEF, A statutory auditor is not mainly concerned that prevailing market price is charged uniformly, to all customers., r shouid, The auditor has to comment in his report, in case of sales to group concerns, whether the rates, charged to such group concerns are reasonable or not with regard to the prevailing market, prices at the relevant time., amining, Iftax is deducted at source (TDS) from interest, auditor should see that interest is shown in the, Auditor should verify whether the payee has signed on a revenue stamp, if the sum exceeds, 50., accounts net of TDS., Auditor should ensure that Remuneration to directors is disclosed separately and it is within, the limits prescribed under the Companies Act., Auditor need not check the Goods Received Note in case of cash purchases.

Page 5 :

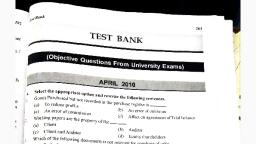

Audising (S. Y.B. Com.:, 210, sinuching, What, 20.5 CHECK YOUR ANSWERS, 20.1, What, 21., (c), 17., (b), 25, 1., (d), 5., 13., (d), 22., (d), (b), 9., (c), (c), 26., 18., For w, 2., (b), (b), 23., (b), 6., (b), 10., (a), 14., (b), 19., (a), 3., (a), 7., (a), 11., (d), 15., (c), 24., (c), 20., For w, 4., (c), 8., 16., (c), (b), 12., (a), the v, Wha, List, supp, 20.4 True : 1, 2, 6;, False : 3, 4, 5, Wh, 3., see that, 26., intere, VOU, 27., pe se, WI, tax., the, 4., it, exceeds 5,000., the, 28., 5., to, 29., ve, ESTIONS, 30.