Page 1 :

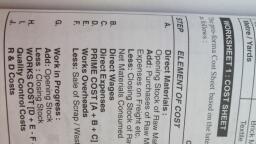

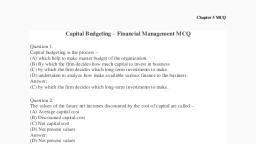

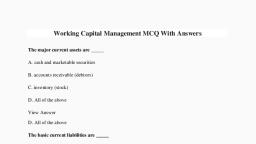

y 4, ont -1(S:Y.B.BLe SEM.), f nico or?, , , , , , , , , , 152 Financial Managem for investme gor mee, , d for inv ent. iy? . S, AP8- In. hahaa G period method, the project which is BOE Sea period want eat ti, , akes short payback period | (b) takes very 10nd a 4 «c eo'?, , @ yields highest rate of return (d) is having Labeaaeeot 2 . ge? yacw, 19.Which factor is given utmost importance under payback perio? ™ h pay of, , (a) liquidity | (b) flexibility A on 6., , (c) time value of money | (d) none of thes? elected. b pO m, 20. In’ the project which yields the highest rate of return Is $ , wr ide, (a) net present value method Mi (b) pay-back pened fr pon m, (c) accounting rate of return, method ia) None of ese initial cash outla wn ns, 21. Under _______ if the present value of future cash flow is higher than the initia’ ce Be Rt Vc a f, , project is selected otherwise rejected. | : % wn, aA) thod ‘, , (a) net present value method ea WG (b) accounting rate of return me ‘ } not be, (c) payback period method sy aa (d) none of these ; ee tne 4, ind i i n annual = 0., , 22. An engineering project involves an initial investment of = 2,00,000 and will give is oO \ cash, inflow of 40,000 for 8 Years: Find out payback period. ! | , ne, , (a) 5 years 4 . i (b) 6 years Pf +ne, (c) 8 years (a) A years ee a ran, 23. Net salvage value of fixed assets is equal to. | ; Ne | The, (a) Excess of salvage value over book value | Ne ake i Cat, (b) Excess of book value over salvage value — ) ‘4. pal, (c) Working capital requirement in the first year | 15.7%, (d) Salvage value of fixed assets less any) rae tax pee on the excess of salvade Value 16.Ne, over book value My 47, 0%, 14.2 FILLIN THE BLANKS Dien | ry C, Cash Outflows HAE nailed a 20.\", 1. Payback Period = , ( "UR rao am, Cost of Investment at } es |, , 2. Payback Period = TT i | 22., 3. FV = PV (1+i)"; In the above formula, FV means - i Bei! ii . 23,, 4. FV = PV (1+i)"; In the above formula, PV means — Be $i |, 9. FV = PV (1+i)"; In the above formula, i means - oe ef, }. FV = PV (1+i)":In the above formula, n means 2, , 14.3 MATCH THE FOLLOWING COLUMNS, , ’ COLUMN A COLUMN B a, , , , ml, , , , , , , 1. Cash Inflows for Capital Budgeting /| (a) Cost of Asset + Installation 6, decisions : - Salvage + Working Capit —, 2. Initial Cash Ouflows (b) Accounting profit Less Tax, 3. | The payback period - Accounting pro* | “a, 4, In case of a project having equal =, | (Cc) Total Cash Inflc ‘ ¢, anniial inflawe tha navhack nannd ot Investment _