Page 1 :

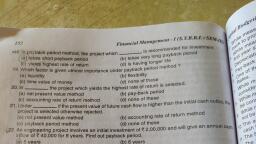

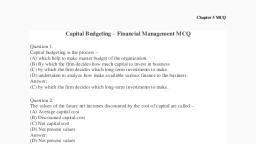

jal Management « (8, se, Pinar, , EXERCISES, , in, pudge" 7 Panaiey 5, , a project, uf ae cvestriani, 2 at of investment + Rig gg s, F et of investment, w ash Inflows fans, Tot TP rofitabiiy ane, Be conn ag, p) ost of investment + nual, , oe of investment leg A, 6) rota cash Inflows less 6, g) resent Value ofa, Ne’ Ky of Cash Inflows, oy of cash Inflows + &, © oy) of Net profit after, 7 EV of Cash Inflows Less, ¢ ofitability Index, 7 oy of Cash Inflows, @ pv of Cash Inflows + PV 9, ©’ Net cost of machine +, \y otal Cash Inflows less ¢, , Bo ital budgeting is the proce, , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , 13. Theory Questions, , 14. Objective Questions |, 74.7 Multiple Choice Questions, , 74.2 Fill in the Blanks, , 74.3 Match the Following Columns, 74.4 State Whether True or False, 74.5 Check Your Answers, 45. Short Problems (NPV) [7 or 8 Marks], 96. Practical Problems [15 Marks], , 47. Check Your Answers, , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , ay QUE s 7 . i diture, (2 THES ‘ Ss ZL y,) capital expen, \ a 7 . UI RX Ce ‘STION, , | a ©, deferred revenue expenc, , | ee » nditures ineurr, , (1) What is meant by capital budgeting ? Bring out the various types of a poo, Bye Cc Pital bug, ic). nua of years ‘0 a, , ns.: ‘i : “ae ae, add ae capital outlays.", Na) C.T. Horngren, Bic) Eric Helfert apm, | What is the source of fu, a) only internal ib oa, ic) both internal and exte, ® The capital expenditure det si, a) reversible " tat, “(c) reversible or irreversib, , @ A sound capital exper d, , WOT ECG x % f. en © (c) decrease the prof | ‘, FF e F, increase overall gi, ss ; Bo, © (a) payback period t, Dic) NPV method,, 15. The number of years tak S|, ((a) payback period, (c) profit period, 46. In payback period me, > (a) net income after tax, | (b) net income before te, > (c) net income before |, © (d) net income ale, ‘3. The payback period is the period 4 FF he anntal ca it 4, , () a project takes to pay back the loan taken to purchase the capital assets. - (a) aera ei, (b) equal to the useful life of the machines q , @ cumula |, (c) a project takes to recover its initial cash ouflow. _ :, , (d) over which the project will be getting operating cash inflows. ‘@ i, , PS, t, , . j j lai, , (2) Explain the features and importance of capital budgeting ? Briefly exp, , process. a is, (3) Explain the payback method of evaluating capital investment. Also indicate the ‘, which this method is specially useful. { a, (4) Discuss the characteristics and relative merits and demerits rl aed hy, capital investment proposals. Which method would you pre era i ‘ pe oe, , (5) What is the discounted cash flow method of evaluating investm prop, , method superior to the payback method?, , , , rate of return? atti : iqnific {, (7) “Despite all limitations of the method of payback period, it has still got signi a, appraisal”. - Explain., , , , 14.1 MULTIPLE CHOICE QUESTIONS, , , J Cash Inflows for Capital Budgeting decisions mean _, ; (a) Accounting profit - Depreciation+ Tax (b) Accounting profit + Tax - Depreciat, H (c) Accounting profit - Tax + Depreciation (d) Accounting profit - Depreciation 2, Initial Cash Ouflows, (a) Cost of Asset + Installation Expenses - Salvage - Working Capital, (b) Cost of Asset + Installation Expenses + Salvage + Working Capital, (c) Cost of Asset + Installation Expenses + Working Capital, (d) None of the above