Page 2 : •, , Head Office : B-32, Shivalik Main Road, Malviya Nagar, New Delhi-110017, , •, , Sales Office : B-48, Shivalik Main Road, Malviya Nagar, New Delhi-110017, Tel. : 011-26691021 / 26691713, , Price : ` 170, , Typeset by Disha DTP Team, , DISHA PUBLICATION, ALL RIGHTS RESERVED, , © Copyright Publisher, No part of this publication may be reproduced in any form without prior permission of the publisher. The author and the, publisher do not take any legal responsibility for any errors or misrepresentations that might have crept in. We have tried, and made our best efforts to provide accurate up-to-date information in this book., , For further information about the books from DISHA,, Log on to www.dishapublication.com or email to

[email protected]

Page 3 :

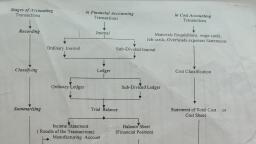

1., , History of Banking—its Evolution and Development�, , 2., , Banking and Banking Structure–Legal Aspects�, , 13-35, , 3., , Reserve Bank of India—Structure and Functions�, , 36-67, , 4., , Money Supply�, , 68-75, , 5., , Banking and Commercial Laws�, , 76-97, , 6., , Banker—Customer Relationship�, , 7., , Regional Rural Banks�, , 122-129, , 8., , Co-operative Banks in India�, , 130-138, , 9., , Priority Sector Advances : Origin�, , 139-164, , 10. Non-performing Assets : Important Points�, , 1-12, , 98-121, , 165-173

Page 4 :

11. Modern Aspects of Banking�, , 174-185, , 12. Foreign Trade and Banking�, , 186-201, , 13. Credit Function of Banks�, , 202-226, , 14. Para Banking Services�, , 227-244, , 15. Financial Awareness�, , 245-265, , 16. Current Development in Banking�, , 266-288

Page 5 :

CHAPTER, , 1, , History of Banking—its, Evolution and Development, , ROLE OF BANKS IN INDIAN ECONOMY - SALIENT FEATURES, Banks play a crucial role in the economic development of any country. Many developed, countries such as Japan, Germany etc. owe their growth and development to strong financial, system including banking system. In most of the growing economies including India strong, healthy banks are pivotal to development. In countries with growing economies like India,, banks are important from four angles. These are:, One, banks help in developing other financial intermediaries and markets as per the need, of the country., Two, help the corporate sector to meet its money needs because of less developed equity, and bond markets., Third, banks help mobilize the savings of large number of savers, which look for assured, income and liquidity and safety of funds, and, Lastly, Banks also provide financial stability in the economy., , HOW BANKS HAVE CHANGED OVER YEARS?, Banking has changed with the needs of the economy over the years and evolved as a strong, instrument of development. The various phases of changes that have made banks an instrument, of development are given below:, 1. Countries world over have been divided into two major groups viz. “underdeveloped”, (backward) and “developed” (advanced) countries., FYP defined “underdeveloped” economy as one where the economy has not been able to, unutilize the given/available resources or have underutilized the resources like natural, resources, manpower resources etc. “Developed” economy on the other hand means, where full or large utilization of such resources have taken place for the growth and, development of the economy. Underdeveloped or growing economies like India, are, also characterized by nature of occupational pattern which in India is mainly agriculture,, and the population is largely “agrarian population”., Reason for non-utilization of resources could be:, • non-availability of technology;, • prevailing socio-economic factors that may hinder the use of available resources etc., Under-developed economies are normally characterized by “poverty”., 2. Agriculture largely remains labour intensive in India. Most farmers as well as labourers, live at subsistence level or even below subsistence level. In order to increase agricultural, production, investment in agriculture is necessary which will generate surplus to form, capital base of the farmers.

Page 6 :

2, , History of Banking—its Evolution and Development, , At present majority of farmers and farm labourers are unable to save anything because, of poor to low surplus. Poor Capital level results in low to even no reinvestment in the, business which may lead to poor standard of living. Addition in population is also one, of the many major causes of poor savings and poor standard of living., 3. Common basis for comparing underdeveloped economies and developed economies has, been per capita income. India’s per capita income as compared to many developed and, even underdeveloped countries has been low., 4. Capital–Output ratio is also a determinant of economic development. It means number, of units of capital required to produce one unit of output. In other words, this term refers to the, productivity of capital in various economic sectors at a point of time., 5. In order to reduce the economic disparity, it is necessary to increase capital–out ratio and, improve public savings. For this, investment level is required to increase. For investments, to increase there is need for generating surpluses and savings. To avoid diversification of, savings there is need to mobilize public or community savings. Purpose of mobilization, of savings are:, (i) to help improve production through reinvestment thus improving capital output, ratio and,, (ii) to channelise the idle funds from the public into the productive channels., , STEPS TAKEN TO MOBILIZE RESOURCES, 6. In order to mobilize public savings, Government initiated many steps through Five Year, Plans., (i) Taxation is first measure., (ii) Other measures to mobilize monies from the people by spreading of banking facilities, in the needed areas., (iii) Other steps included encouraging surplus of public sector enterprises, and, (iv) mobilization of internal and external loans/deposits., 7. Public sector and other organizations like Banks and private organizations became major, source of mobilizing small savings of the people from all sectors of the economy as well, as from every corner of the country., 8. There may not always be dearth of savings in the rural areas but it may be failure of, deposit mobilization efforts which allow the savings being put into unproductive channels., Government found enough scope of deposit mobilization, both in the rural and non-rural, areas and took decisions to create infrastructure for collecting savings., 9. As a step towards such mopping up of savings, banking industry took the initiative to, open up new banks and branches all over the country., , HISTORY AND EVOLUTION STAGES OF BANKING - HIGHLIGHTS, For reaching the modern day banking business, banking industry has to pass through various, stages of evolution and development. The stages are briefly discussed below:, , Stage-1 Indigenous Banks, •, , Business of banking has been reported origin in Vedic period. Records show giving and, receiving of credits during that period.

Page 7 :

History of Banking—its Evolution and Development, , •, •, •, •, •, , 3, , Indigenous money lenders were known as Seths or Shahs existed during that period and, ran lucrative business in money lending., Discounting of bills was common in those times., Hundi (traditional bills) system was in vogue during that time., During 17th century, a foreign traveller quoted the existence of money changer in India, known as Shroffs., Moghul period also refers to Jagat Seth called Manak Chand. Lord Clive also mentioned, about him around 1859., , Defects of Indigenous Banking, Certain shortcomings were observed in the indigenous banking in India vis-à-vis the, requirement of trade and commerce. Some important shortcomings that existed at that time, are listed below:, (i) Indigenous banking is unorganized and does not sensitize the need and working of the, different sectors of the economy, including banking sector., (ii) They only do business for trade and commerce and work on commission basis resulting, into trade risk in their financial business., (iii) They did not distinguish between short term and long term finance purposes., (iv) Methods of accounting was based on local practices and hence could not match with, modern methods of financial accounting., (v) Many of the indigenous bankers charged very high rate of interest., , Stage-2 Opening of Presidency Banks, (a) Bank of Hindustan established in 1770 was founded by M/s Alexander & Co., an English, agency in Calcutta., (b) First Presidency Bank namely Bank of Calcutta came up in 1806 in Calcutta in collaboration, with Government of Bengal and East India Company. Total capital was Rs.50 lakh of which, Rs.10 lakh was share of East India Company., (c) However, in 1809, Bank of Calcutta was renamed as Bank of Bengal., (d) Bank of Bombay, as second Presidency Bank was established in 1840 in the then Bombay, (now Mumbai)., (e) Third Presidency bank came up in Madras (now Chennai) in the year 1843., In 1860, concept of limited liability was introduced in India leading to the establishment, of Joint Stock Banks., All banks in India are registered under the Indian Companies Act as Joint Stock Company., , MODERN BANKING - ADVENT AND DEVELOPMENT, The commercial banking industry in India started in 1786 with the establishment of the, Bank of Bengal in Calcutta., It was only with the establishment of Reserve Bank of India (RBI) as the central bank of the, country in 1935 under the Reserve Bank of India Act (1934) that the quasi-central banking role, of the Imperial Bank of India came to an end., In 1865, the Allahabad Bank was established with Indian shareholders., Punjab National Bank came into being in 1895 by purely Indian nationalist people like Lala, Lajpat Rai, Babu Purshotam Lal Tandon, S.Dayal Singh and others.

Page 8 :

4, , History of Banking—its Evolution and Development, , Between 1906 and 1913, other banks like Bank of India, Central Bank of India, Bank of, Baroda, Canara Bank, Indian Bank, Bank of Mysore etc. were set up., • The brand ambassador of bank of Baroda is Rahul Dravid., • The branding line of Bank of Baroda is ‘India’s International Bank’., • The logo of Bank of Baroda is known as ‘Baroda Sun’., In 1921, the three Presidency banks were amalgamated to form the Imperial Bank of India,, which took up following roles:, (i) role of a commercial bank,, (ii) a bankers’ bank, and, (iii) a banker to the Government. (quasi central banking role), The Imperial Bank of India was established with mainly European shareholders., Reserve Bank of India was established in 1935 under RBI Act (1934), After independence, the Government of India started taking steps to encourage the spread, of banking in India that led to the stage -3 of banking development in India., , Stage-3 Banking in Post Independence Period, After independence, in order to serve the economy better, the All India Rural Credit Survey, Committee was set up by RBI. This Committee recommended that Imperial Bank of India be, taken over and with it are merged / integrated former state-owned and state-associate banks., Accordingly, State Bank of India (SBI) was constituted in 1955 under the State Bank of India, Act (1955). Subsequently in 1959, the State Bank of India (subsidiary bank) Act was passed,, enabling the SBI to take over five major former state-associate banks as its subsidiaries. These, were State Bank of Patiala; State Bank of Hyderabad; State Bank of Travancore; State Bank of, Bikaner & Jaipur and State Bank of Mysore., After creating a subsidiary of SBI, arrangement made was that 55 per cent of the capital will, be owned by the SBI and rest 45 per cent remains with old shareholders., However, this arrangement also saw some weaknesses like reduced bank profitability,, weak capital base, and banks getting / burdened with large amounts of bad loans (unrecovered loans)., Commercial banks in India have traditionally focused on meeting the short-term financial, needs of industry, trade and agriculture but long term financial needs were left for other agencies, or government to meet. There was no coordination between commercial banks and long term, lending organizations. Hence when one was available the other was not available., • As such with the growing need for long term funds for financing industrial projects, Government established Industrial Development Bank of India (IDBI) in 1964 to help, industrial sector with long term financial resources to boost industrial growth., , ADVENT OF MODERN BANKING - STAGES OF DEVELOPMENT, •, •, , Present day banking is the result of continuous research and development in the field of, financial and economic aspects of Indian banking system., After independence of the country, today’s banking has passed through various stages, of development. Banking was held to be a strong institution to respond to the growing, financial needs of various sectors of the economy. Many policy decisions, amendments in, laws, new enactments etc. were initiated to make banking industry respond to growing, financial requirements of different sectors of the economy.

Page 9 :

History of Banking—its Evolution and Development, , 5, , Broadly, four stages could be identified that Indian banking has passed through or is passing, through after independence. These are as follows:, Stage-1 �Period covering 1948 onwards till late sixties (say 1969), identifies with the, foundation stage. During this period government ensured the enactment of, necessary legal / legislative framework for consolidating and reorganization, of the banking system. Banking during this period was cautious, selective, and securitized. Loans were advanced against tangible securities only i.e., to persons who were able to offer good securities and deposits to the bank., Banks overlooked the importance of project (purpose), person (borrower) and, repayment capacity., • In order to overcome above difficulties and others, social control on banks was initiated, in 1968 on the recommendations of the National Credit Council in 1967. (Gadgil Study, Group, established by RBI)., , SOCIAL CONTROL AND NATIONALIZATION OF BANKS – NEED AND OBJECTIVE, Factors that led to the decision to nationalize commercial banks were:, 1. Ownership and control in few hands., 2. Concentration of wealth and power by few big industrial houses who used the bank, funds to build their own empires., 3. Failure of banks to mobilize resources from small towns and villages by not opening, branches in small towns and villages, 4. Misutilization of resources and powers by some vested interests. In other words money, mobilized by banks was not being used for the economic benefit or development., 5. Discrimination against small business units., 6. Needs of the agriculture sector of the economy was neglected by banks by ignoring small, farmers taking the plea that it is risky sector., 7. Misuse of funds by banks. Some banks were financing anti-social elements who in order, to get large profits created shortages of essential commodities, thus affecting the general, public at large., 8. Banks failed to follow the objectives of the five year plan policies and framework wherein, priority sectors of the economy were given priority. Private control of the banks led to, various development obstacles to the achievement of the plan objectives., , NATIONALIZATION OF BANKS, •, , •, , To make banking system align itself to the needs of economy and policies of the, Government, on July 19, 1969 fourteen (14) of the major private sector banks were, nationalized as a part of social control over banks. This was an important milestone in, the history of Indian banking. This was followed by the nationalization of another six, private banks in 1980., The 14 banks were nationalized under the Banking Companies (Acquisition and Transfer, of Undertakings) Act, 1970. Criterion for selection of these banks was that those which, had deposit of Rupees 50 crores and above as on the date of Ordinance issued on 19th, July, 1969. These banks were:, 1. Allahabad Bank, 2. Bank of Baroda, 3. Bank of India, 4. Central Bank of India, 5. Dena bank, 6. Canara Bank

Page 10 :

6, , History of Banking—its Evolution and Development, , 7. Indian Overseas Bank 8. Bank of Maharashtra, 9. Punjab National Bank 10. United Bank of India, 11. Union Bank of India 12. Syndicate Bank, 13. Indian Bank, 14. United Commercial Bank, This process was followed again in 1980 when another lot of six banks were nationalized, under Banking Companies (Acquisition and Transfer of Undertakings) Act, 1980. Banks, nationalized in second stage were:, 1. Punjab & Sind Bank, 2. Oriental Bank of Commerce, 3. New bank of India (now merged with Punjab National Bank), 4. Vijay Bank, 5. Andhra Bank, 6. Corporation Bank, With the nationalization of these banks, the major segment of the banking sector came under, the control of the Government. The nationalization of banks imparted major impetus to branch, expansion in un-banked, rural and semi-urban areas, which in turn resulted in huge deposit, mobilization, thereby giving boost to the overall savings rate of the economy. It also resulted, in scaling up of lending to agriculture and its allied sectors., In 1975 five Regional Rural banks were established on 2.10.1975 through an Ordinance. The, ordinance was replaced by Regional Rural Banks Act, 1976, with the main objective to extend, banking facilities to the un-banked rural areas along with commercial banks and cooperative, banks., , Stage-2 Expansion Stage, This stages / phase covers the period from late sixties (1969 to mid eighties). There was, rapid expansion, both vertical and horizontal i.e. geographical spread as well as administrative, spread. There was effort to fulfill nationalization objectives of expansion., There was re-orientation of credit flow policy during this period so as to benefit the neglected, sectors of the economy, like agriculture, small scale industries and small borrowers., , Stage-3 Consolidation Phase, This phase started from early eighties to start nineties when rapid expansion of banks, faced with certain serious problems of control and economic viability of certain branches, more, particularly rural branches. This phase also saw the problem of manpower, their training and, positioning of branches. Branch expansion was slowed down during this period and banks, started addressing the gaps that occurred during period. Staff productivity, recovery of advances,, profitability etc. were some major problems., , Stage-4 Banking Reform Phase, To create a strong and competitive banking system, a number of reform measures were, initiated in 1991. The thrust of the reforms was on increasing operational efficiency, strengthening, supervision over banks, creating competitive conditions and developing technological and, institutional infrastructure. These measures led to the improvement in the financial health,, soundness and efficiency of the banking system., One important feature of the reforms of the 1990s was the permission to open new private, sector banks. Following this decision, new banks such as ICICI Bank, HDFC Bank, IDBI Bank,

Page 11 :

History of Banking—its Evolution and Development, , 7, , Development Credit Bank (DCB), Kotak Mahindra Bank, InduSind Bank, Yes Bank and UTI, Bank (now Axis bank) were set up., From 1991 onwards till today, banking industry has seen the reforms in terms of their, management and business policies. The main aim of reforms is to create a vibrant financial sector, that is efficient, competitive and responsive to the needs of the economy and the people at large., (a) Main focus of the reforms was:, (b) Strengthening of financial institutions, and integration of domestic financial system with, global system of banking and economic system., Policies were made in such a way that it could provide banks with:(a) greater flexibility in banking operations, (b) greater accountability to shareholders, and, (c) greater control over bank functions, and, (d) safety through prudential norms and supervision., Based on the happenings in the domestic and international market, Indian banking system, is gearing up for meeting new challenges like:, (i) Banks entering into greater specialized business like retail, housing, personal sector,, corporate sector etc., (ii) Banks have to look for more non-fund based business (NFB), like advisory services., merchant banking advisory services, guarantee business, consultancy business services, etc., (iii) Creating a strong image of the organization (brand image); customer delight and excellence, etc., (iv) The concept of Universal Banking is catching up fast. (Universal bank means where a, bank takes up both the functions of long term lending development financial institutions, as well as that of commercial banks. In other words a universal bank lends both short, term (working capital) as well as term loan (long tern finance)., • Export-Import Bank (Exim Bank) was established in 1982 (1.1.1982) to help entrepreneurs, financially, in terms of long term and short term funds, to increase exports and to act as, a controller of the business of the export and import., • Then came the National Bank for Agriculture & Rural Development (NABARD) in 1984, on the recommendation of Committee to Review Arrangements for Institutional Credit, for Agriculture and Rural Development (CRAFICARD). NABARD was set up under the, Parliament Act 61 of 1981., , FINANCE COMMISSION AND ITS ROLE, The Finance Commission was established in 1951 to look into the following aspects:, • To suggest as to how the revenues earned by the government through taxes etc. at centre, could be shared between the States and the Centre., • Finance Commission is set up under Articles 280 of the Constitution of India., • Since 1951, 13 Finance Commissions have been set up. The Fourteenth Finance Commission, has been set up under the Chairmanship of ex-Governor of Reserve Bank of India, Y V, Reddy. Thirteenth Finance Commission was headed by Finance Secretary Vijay Kelkar., The first Finance Commission was constituted in 1951 and was headed by K C Neogy., • Period of Commission is five years.

Page 12 :

8, , History of Banking—its Evolution and Development, , •, •, •, , Finance Commission has four other members. Finance Commission is appointed by the, President of India., Main focus of the Finance Commission is to reduce the imbalances between taxation, fixation and expenditure controls of the Centre and the States respectively., Presently the 13th Finance Commission has recommended that States share from the, Central Revenue should be 32 per cent.

Page 13 :

9, , History of Banking—its Evolution and Development, , PAST EXERCISE, 1. Which of the following is considered an, informal method of getting credit/finance?, �, [Vijaya Bank 2008], (a) Internet banking, (b) Branch visits, (c) Going to moneylenders, (d) Telebanking, (e) All of these, 2. Which of the following is NOT a Public, Sector Unit/Undertaking/Agency?�[Vijaya, Bank 2008], (a) ECGC, (b) SEBI, (c) SIDBI, (d) Axis Bank, (e) BHEL, 3. Which of the following is NOT a foreign, bank working in India?, [Vijaya Bank 2008], (a) HSBC, (b) Barclays, (c) Standard Chartered, (d) Yes Bank, (e) All are foreign banks, 4. Who amongst the following is the Chairman, of the 13th Finance Commission?� [Vijaya, Bank 2008], (a) Bimal Jalan, (b) Y V Reddy, (c) C Rangarajan, (d) Vijay Kelkar, (e) None of these, 5. Who is Brand Endorsing Personality of, Bank of Baroda?�, [BOB 2008], (a) Juhi Chawla, (b) Kiran Bedi, (c) Amitabh Bachchan, (d) Kapil Dev, (e) None of these, , 6. The branding line of Bank of Baroda is, �, [BOB 2008], (a) International Bank of India, (b) India’s International Bank, (c) India’s Multinational Bank, (d) World’s local Bank, (e) None of these, 7. Which of the following is/are the major, concepts visible in today’s banking industry, in India?, [IOB 2008], (1) Risk Based management, (2) Growing competition, (3) IT initiatives, (a) Only (1), (b) Only (2), (c) Only (3), (d) Both (2) & (3), (e) All (1), (2) & (3), 8. Which of the following commissions setup by the President of India decides the, distribution of tax incomes between the, Central and State Governments?, [United Bank of India 2009], (a) Central Law Commission, (b) Pay Commission for Government, Employees, (c) Administrative Reforms Commission, (d) Planning Commission, (e) Finance Commission, 9. Nationalization of banks aimed at all of the, following except __________ ., [IBPS 2012], (a) Provision of adequate credit for, agriculture, SME and exports, (b) Removal of control by a few capitalists, (c) Provision of credit to big industries, only, (d) Access of banking to masses, (e) Encouragement of a new class of, entrepreneurs, , ANSWER KEY, 1., , (c), , 2., , (d), , 3., , (d), , 7., , (e), , 8., , (e), , 9., , (b), , 4., , (d), , 5., , (e), , 6., , (b)

Page 14 :

10, , History of Banking—its Evolution and Development, , PRACTICE EXERCISE, 1. In India, the first bank of limited liabilities, managed by Indians and founded in 1881, was, (a) Hindustan Commercial Bank, (b) Oudh Commercial Bank, (c) Punjab National Bank, (d) Punjab and Sind Bank, (e) National Bank, 2. How many banks were first nationalised?, (a) 10, (b) 12, (c) 14, (d) 16, (e) 24, 3. When was the second phase of, nationalisation done?, (a) 9th July, 1969, (b) 10th July, 1968, (c) 16th August, 1985, (d) 15th April, 1980, (e) None of the above, 4. How many banks were in second phase of, nationalisation?, (a) 4, (b) 5, (c) 6, (d) 7, (e) 9, 5. Match the following:, List I, , List II, , A. Allahabad Bank, , 1., , 1894, , B., , Oriental Bank of, Commerce, , 2., , 1943, , C., , Punjab National Bank, , 3., , 1943, , 4., , 1865, , D. UCO Bank, , Codes:, A B C D A B C D, (a) 2 4 3 1 (b) 2, 3 4 1, (c) 4 3 2 1 (d) 4, 1 3 2, (e) 3 1 4 2, 6. Which of the following Indian Banks is not, a Nationalised Bank?, (a) Corporation Bank, (b) Dena Bank, (c) Federal Bank, (d) Vijaya Bank, (e) Oriental Bank of Commerce, , 7. Consider the following statements:, 1. Allahabad Bank was the first bank to be, established exclusively by Indians., 2. Seven banks forming subsidiary of State, Bank of India was nationalised in 1960., Which of the statements given above is/are, correct?, (a) Only 1, (b) Only 2, (c) Both 1 and 2 (d) Neither 1 nor 2, (e) Can’t say, 8. Which was the first Bank corporated by the, Indians?, (a) Imperial Bank of India, (b) State Bank of India, (c) Avadh Commercial Bank, (d) Reserve Bank of India, (e) National Bank, 9. When was the Avadh Commercial Bank, established?, (a) 1881, (b) 1894, (c) 1898, (d) 1899, (e) 1864, 10. Imperial Banks were amalgamated and, changed as ......., (a) Reserve Bank of India, (b) State Bank of India, (c) Subsidiary Banks, (d) Union Bank of India, (e) Corporation Bank, 11. When was Imperial Bank was changed as, State Bank of India?, (a) 1st January, 1935, (b) 26th February, 1947, (c) 1st July, 1955, (d) 1st July, 1959, (e) 26th February, 1955, 12. In the second nationalisation of commercial, banks, ......... where nationalised., (a) 4, (b) 5, (c) 6, (d) 8, (e) 9, 13. The first wholy Indian Bank was set-up in, (a) 1794, (b) 1894, (c) 1896, (d) 1902, (e) 1918

Page 15 :

11, , History of Banking—its Evolution and Development, , 14. When was SBI established?, (a) 1st April, 1935, (b) 31st July, 1969, (c) 5th May, 1955, (d) 1st July, 1955, (e) 5th May, 1960, 15. The origin of the State Bank of India goes, back to the first decade of the 19th century, with the establishment of, (a) Bank of Calcutta, (b) Bank of Bengal, (c) Bank of Bombay, (d) Bank of Madras, (e) None of these, 16. Which bank came into existence in 1921, when three banks namely, Bank of Bengal, (1806), Bank of Bombay (1840) and Bank, of Madras (1843) were reorganised and, amalgamated to form a single banking, entity?, (a) Imperial Bank of India, (b) State Bank of India, (c) Reserve Bank of India, (d) Punjab National Bank, (e) None of the above, 17. Which bank became the State Bank of India, in 1955?, (a) General Bank of India, (b) Bank of Hindustan, (c) Imperial Bank of India, (d) Federal Bank of India, (e) None of the above, 18. Which of the following banks has acquired, the ‘Centurion Bank of Punjab’?, (a) ICICI Bank (b) IDBI Bank, (c) HDFC Bank (d) AXIS Bank, (e) None of these, 19. What was the deposits criteria of 14 banks, nationalised on 19th July, 1969?, (a) ` 1000 crore (b) ` 500 crore, (c) ` 100 crore (d) ` 50 crore, (e) None of these, 20. Name the premier institution that is taking, care of the financial needs of importers, and exporters of our country which was, established in the year 1981., (a) EXPO Bank, (b) Export Import Bank (EXIM), (c) Merchant Bank, , 21., , 22., , 23., , 24., , 25., , 26., , 27., , 28., , (d) ECGC, (e) None of the above, The first nationalisation of banks exercise, was done on, (a) 19th June, 1969, (b) 19th June, 1970, (c) 19th June, 1967, (d) 15th July, 1967, (e) None of the above, How many banks were nationalised in the, second phase in 1980?, (a) 5, (b) 6, (c) 7, (d) 4, (e) 1, Axis Bank is the changed name of, (a) IDBI, (b) ICICI, (c) UTI, (d) UTO, (e) RBI, Which one of the public sector bank has, completed 100 years of its establishment on, 21st December, 2011?, (a) Central Bank of India, (b) State Bank of India, (c) Punjab National Bank, (d) Bank of Baroda, (e) Allahabad Bank, Which institution provides long run finance, to industries?, (a) UTI, (b) LIC, (c) GIC, (d) IDBI, (e) All of these, Open Added Money Market Scheme was, firstly introduced by, (a) UTI, (b) IDBI, (c) ICICI, (d) LIC, (e) None of these, The Export Import Bank of India was set-up, in, (a) July, 1969, (b) April, 1970, (c) January, 1982 (d) April, 1982, (e) None of the above, Exim Bank also provides, (a) refinance facilities, (b) consultancy and technology services, (c) services of finding foreign markets for, exporters, (d) All of the above, (e) None of the above

Page 16 :

12, , History of Banking—its Evolution and Development, , 29. Exim Bank concentrates on, (a) medium-term financing, (b) short-term financing, (c) short and medium-term financing, (d) short and long-term financing, (e) None of the above, 30. Exim Bank extends facility of, (a) rediscounting of foreign bills of, commercial banks, (b) advisory services to the exporters, (c) research and market surveys, (d) All of the above, (e) None of the above, 31. The branding line of Bank of Baroda is, (a) International Bank of India, (b) India’s International Bank, (c) India’s Multinational Bank, (d) World’s Local Bank, (e) None of the above, 32. Nationalisation of banks aimed at all of the, following, except, (a) provision of adequate credit for, agriculture, SME and exports, (b) removal of control by a few capitalists, (c) provision of credit to big industries, only, (d) access of banking to masses, (e) encouragement of a new class of, entrepreneurs, 33. Which of the following banks has been, included in the second Schedule to the RBI, Act, 1934 with effect from 21st August,, 2004 and thus, is the latest entrant in Indian, banking as a new generation private sector, bank?, , (a) ICICI Bank Limited, (b) HDFC Bank Limited, (c) Kotak Mahindra Bank Limited, (d) Yes Bank Limited, (e) None of the above, 34. The word ‘Bank’ is derived from, (a) German word ‘back’ which means a, joint stock fund’, (b) Italian word ‘banco’, (c) words ‘bancus’ or banque’ which means, ‘a bench’, (d) All of the above, (e) None of the above, 35. Which is the largest associates bank of State, Bank of India?, (a) State Bank of Patiala, (b) State Bank of Hyderabad, (c) State Bank of Bikaner and Jaipur, (d) State Bank of Saurashtra, (e) State Bank of Assam, 36. The formation of the 14th Finance, Commission in India has been finalized., Who has been appointed to head the, commission?, (a) D. Subba Rao, (b) Y. V. Reddy, (c) Montek Singh Ahluwalia, (d) Raghuram Rajan, (e) Rakesh Mohan, , ANSWER KEY, 1., 6., 11., 16., 21., 26., 31., 36., , (b), (c), (c), (a), (a), (b), (b), (b), , 2., 7., 12., 17., 22., 27., 32., , (c), (c), (c), (c), (b), (c), (c), , 3., 8., 13., 18., 23., 28., 33., , (d), (c), (c), (c), (c), (d), (d), , 4., 9., 14., 19., 24., 29., 34., , (e), (a), (d), (d), (a), (a), (d), , 5., 10., 15., 20., 25., 30., 35., , (c), (b), (a), (b), (d), (d), (b)

Page 17 :

CHAPTER, , Banking and Banking, Structure–Legal Aspects, , 2, , DEFINITION OF BANK AND BANKING, After independence, steps were taken in order to regulate the banking and banking business, in India. Government brought in a law in this regard, wherein banking and banking business, in India has been defined. This law became an Act and called the Banking Regulation Act, (BR, Act), 1949., As per the Act, Section 5(c) provides that ‘a banking company is a company which transacts, the business of banking in India.’, Further, Section 5(b) of the BR Act defines banking business as, ‘accepting, for the purpose of, lending or investment of deposits of money from the public, repayable on demand or otherwise,, and withdrawable by cheque, draft, order or otherwise.’, , BANKING STRUCTURE, RESERVE BANK OF INDIA (As Apex Regulator), ORGANIZED SECTOR, , UNORGANIZED SECTOR, , Commercial Banks, , Cooperative Banks, Organized Sector, , Commercial Banks, Scheduled Banks, Nationalized, Banks, , State Bank, of India, , SBI subsidiaries, , Foreign Banks, , Non-scheduled Banks, Private, Sector, Old Private, Sector banks, , RRBs, , LABs, Banks, , New Private, Sector banks

Page 18 :

14, , Banking and Banking Structure–Legal Aspects, Cooperative Banks - Structure, Urban Cooperative, Credit, Coop. Credit Societies, , Rural Cooperative, Credit, , Urban Cooperative Banks, , Scheduled, , Non-Scheduled, State Coop., Banks, , Short Term, , Central Coop., Banks, , Long Term, Primary Agri., Credit Societies, , State Coop., , PrimaryCoop. Agri., & Rural Develop., , Agri.& Rural, Development, Banks, , Banks, , Unorganized Sector, Indigenous Banks, , Money, , Chit, , lenders, , funds, , Nidhis, , •, , Scheduled Banks have been defined in the Reserve Bank of India Act as those which are, included in the second schedule of the RBI Act, 1934., • In order to be included in the second schedule of the RBI Act, a bank must fulfill the, following three criteria:, (i) the paid up capital and reserves together should not be less than Rupees 5 lakhs., (ii) working of the bank should not be detrimental to the interests of the depositors., (iii) the banks to be included in the second schedule should either be a company as per the, Companies Act, 1956 or a State Cooperative Bank or a corporation or any institution, notified by the Government of India in this behalf., • On the other hand a non-scheduled bank is one whose paid up capital is less than Rupees, 5 lakhs., A Unit Banking System comprises of a main corporate office having single branch doing, banking business in a given area of operation., MONEY MARKET FINANCIAL INSTRUMENTS types and structure, �, �, , %CNN�/QPG[�, +PUVTWOGPVU�, , ��������$KNN�/CTMGV�, �������KPUVTWOGPVU, , Treasury Bills, , $CPM�%TGFKV, , General Bills, , The governance of banks in India is largely controlled by some important laws / Acts., Illustratively, these are:, 1. The Reserve Bank of India Act (1934)

Page 19 :

Banking and Banking Structure–Legal Aspects, , 15, , 2. The Banking Regulation Act (1949) that applies to all activities of all banking companies, including sections applicable to Cooperative Banks in India., 3. Negotiable Instruments Act (1881)., 4. Bankers’ Books Evidence Act (1891),, 5. SBI Act (1955),, 6. Regional Rural Bank Act (1976),, The Reserve Bank of India is responsible for the regulation and supervision of banks as, empowered under the Banking Regulation Act., , FIMMDA:, What is FIMMDA?, FIMMDA stands for The Fixed Income Money Market and Derivatives Association of India, (FIMMDA). It is an Association of Commercial Banks, Financial Institutions and Primary Dealers., FIMMDA is a voluntary market body for the bond, Money and Derivatives Markets., , INVESTOR PROTECTION FUND(IPF) :, ISE has set up an Investor Protection Fund (IPF) to meet the claims of investors against defaulter, Members, in accordance with the Guidelines issued by the Ministry of finance, Government, of India., ISE has established an Inter-connected Stock Exchange Investor Protection Fund Trust, (ISE-IPF Trust) with the objective of compensating investors in the event of defaulters' assets, not being sufficient to meet the admitted claims of investors, promoting investor education,, awareness and research. The Investor Protection Fund (IPF) is administered by way of registered, Trust created for the purpose. The Inter-connected Stock Exchange Investor Protection Fund, Trust is managed by Trustees., The Inter-connected Stock Exchange Investor Protection Fund Trust, based on the, recommendations of the Defaulters' Committee, compensates the investors to the extent of, funds found insufficient in Defaulters' account to meet the admitted value of claim, subject to, a maximum limit as per decided by Trust per investor per defaulter/expelled member., , LEGAL REQUIREMENTS FOR SETTING UP NEW BANKS AND BRANCH AUTHORIZATION, POLICY, •, •, •, , The minimum statutory requirements for setting up new banks in India are stipulated, in the BR Act, 1949., The RBI explicates the eligibility criteria for the entry of new banks. At present, the capital, requirement for any new bank entry is Rupees 500 crores., Reserve Bank of India also releases some guidelines / directive on various issues relating, to banking operations including expansion, control etc. Some areas on which guidelines, / directives are issued are:, , •, , Guidelines / directives to update its branch authorization policy, which governs the, opening of new branches by all Scheduled Commercial Banks in the country., , •, , Under the banking structure, private money lenders do not form the part of scheduled, banking structure.

Page 20 :

16, , Banking and Banking Structure–Legal Aspects, , •, , Legally, banks are not permitted to create a charge upon any unpaid capital of the company, as per Banking Regulation Act, 1949 (section-14)., , •, , Under the Banking Companies (Acquisition & Transfer of Undertaking) Acts of 1970 and, 1980, as amended in 1994, public sector banks are permitted to offer their equity shares, to public up to 49 per cent of the capital of the bank., , •, , For the uniform and fair conduct of the banking business by banks in India, a Banking, Codes and Standard Board of India (BCSBI) has been created., , •, , At present there are 19 public sector banks (nationalized banks); State Bank of India (1), and SBI Associates (5)., , •, , Government introduced the Banking Companies (Acquisition and Transfer of Undertaking), and Financial Institution Laws (Amendment) Bill, 2000 which allowed Government to, dilute its sharing holding to 33 per cent, mainly for the purpose of raising fresh equity., , •, , This bill empowers the Government to supersede the Board of Directors of public sector, banks., , TYPES OF BANK ACCOUNTS AND THEIR FEATURES, 1. Savings Bank Account, Meaning, Savings Bank accounts as the name implies, are intended for savings for future. The very, purpose of this type of account is to promote savings habit of the general public. As such, there, is no restriction on the number and amount of deposits that can be made. The credit balance, outstanding in this account will earn interest as per the current directives of the Bank. When, needed, the amount can be withdrawn, subject to certain conditions., , Introduction of the Savings account, All savings bank accounts are required to be introduced by someone known to the bank or, customer having an account in that bank., , For whom to open Savings Bank Accounts, Savings Bank Accounts may be opened in the names of:(i) Individual - Single Accounts, (ii) Two or more individuals - Joint Accounts, (iii) Illiterate persons, (iv) Blind persons, (v), , Minors, , (vi) Associations, Clubs, Societies., (vii) Trusts, (viii) �Institutions/Agencies specially permitted by the RBI., •, , Savings bank accounts of military units may be opened for funds of Regimental Units, which mainly consists of contributions from individual members of the unit, income, from Regimental properties, collections made on Army day, etc.

Page 21 :

Banking and Banking Structure–Legal Aspects, , 17, , •, , Interest is paid on daily basis calculated between 10th and 30th of each month., , •, , At present banks pay an interest of 4% on the savings bank account., , •, , Minimum balance to open a normal savings bank account is Rupees 1000=00. However,, poor people defined by the Government of India, can open a savings bank account with, zero balance called No-Frill Savings Bank Account., , 2. Current Account, Meaning & Purpose, Current Accounts are active accounts opened by such section of the public like Traders,, Businessmen, Corporate Bodies, etc. who like to operate their accounts continuously due to, many receipts and payments of money in connection with their business. In these accounts,, there is no restriction on the number of withdrawals and deposits., , Opening of Current Accounts - Introduction, All current accounts should be introduced by persons well known to the bank. Introduction by, an existing current account holder should generally be insisted upon., For whom to open Current Accounts, Current Accounts may be opened in the names of following:(i) Accounts in the name of a single person., (ii) Joint Accounts of two or more individuals., (iii) Sole-Proprietory Concern., (iv) Partnership Firms., (v) Joint Hindu Family or Hindu Undivided Family., (vi) Associations, Clubs, Societies., (vii) Trusts/Other Trust Accounts like Provident Fund A/cs., (viii) Private and Public Limited Companies and other undertakings registered under, Companies Act, 1956., (ix) Executors and Administrators., (x) Other Banks., (xi) State Financial Corporations., (xii) Government/Quasi Government Departments /Boards/Bodies etc., No interest is paid in current accounts. However banks may charge a reasonable amount, from the customer / clients if the balance falls below the stipulated amount., , 3. Fixed Deposits / Term Deposits, Meaning & Scope of Fixed / Term Deposits, •, , The term fixed deposit will include both deposits made for a fixed period and deposits, made subject to notice of withdrawal., , •, , Fixed deposits are term deposits repayable after an agreed period fixed at the time of, deposit.

Page 22 :

18, , Banking and Banking Structure–Legal Aspects, , •, , On the other hand, call deposits (accounts) can be treated as demand or term liabilities, subject to terms of repayment and notice of withdrawal agreed at the time of accepting, these deposits., , Who can open Fixed Deposit Accounts, Fixed Deposits can be opened in the name of:, •, , Individuals,, , •, , Joint names of two or more individuals,, , •, , Clubs, Association, Societies, Trusts, etc., , •, , Limited Companies,, , •, , Minor under the guardianship of the natural guardians or guardians appointed by the, Court of Law,, , •, , Partnership or Proprietory concerns., , Other Features, •, , Money is deposited in the account and period is decided by the customer., , •, , Premature withdrawal is allowed in such accounts. In case of premature withdrawal, customer is paid rate of interest charged is the one that is applicable for the period the, deposit remained in the bank. The interest is calculated for the duration it remained with, the bank., , •, , The customer / client has to pay some reasonable penalty fixed by each bank for premature, withdrawal., , •, , Fixed deposits are not transferable instruments., , •, , Fixed deposits / term deposits attract higher rate of interest than other deposit schemes., , •, , Normally longer the period of deposit higher the interest rate. In some, banks it is called time liability deposit accounts. However this principle does not always, hold good due to the banks deposit needs and market conditions., , 4. DEMAT Accounts, DEMAT means Dematerialized Account. This account is opened to buy and sell shares in the, market. It is opened like any other bank account with the difference that in such accounts only, shares are transacted and not money as is the case with other bank accounts., Indian Depository Receipit:, An IDR is a receipt, declaring ownership of shares of a foreign company. These receipts can, be listed in India and traded in rupees. Just like overseas investors in the US-listed American, Depository Receipts (ADRs) of Infosys and Wipro get receipts against ownership of shares held, by an Indian custodian, an IDR is proof of ownership of foreign company’s shares. The IDRs are, denominated in Indian currency and are issued by a domestic depository and the underlying, equity shares are secured with a custodian. An Indian investor pays in Indian rupees for the, IDR whereas a shareholder in the issuer’s home country pays in home currency.

Page 23 :

Banking and Banking Structure–Legal Aspects, , 19, , 5. Public Provident Fund Accounts (PPF), •, , Public Provident Fund (PPF) is the scheme floated under the PPF Act 1968 by central, government. It is a safe and government backed investment scheme which provides, besides higher interest rate a tax benefit under section 80C of IT Act., , Features of the PPF Scheme, •, •, •, •, •, •, •, , •, •, •, , The period for which money could be invested in PPF is 15 years., Minimum investment is Rs.500 and Maximum investment is Rs.1,00,000 per year., Amount invested more than Rs.1,00,000 will not be eligible for interest and for tax benefit, under Sec 80C., One is eligible to open only one PPF account in one’s name. But if found that second, account is opened it will be deactivated. You will receive only principal of what you paid., PPF can’t be opened in joint names. However, PPF accounts can be opened in the names, of spouse or children., PPF account can be opened in your minor child name also., You can’t invest more than 12 installments in a year. It means if you planned for, contribution of Rs.1,000 per month, then maximum contribution you can make is 12,000, in a year., This account cannot be attached for your debt or liability. So this is totally safest form, of investment., PPF account can be opened at all nationalized banks, post offices or other banks so, permitted., If you forget to contribute the minimum amount in any year then the account will be, deactivated. To activate you need to pay Rs.50 as penalty for each inactive year and, also you need to pay Rs.500 for each inactive year’s contribution. Such provision can be, modified from time to time by appropriate authority., , •, , NRIs cannot open PPF account. But they can continue their existing account till its maturity, only. Scheme does not provide any extension of period., , •, , In case death of account holder then the balance amount will be paid to his nominee or, legal heir even before 15 years. Nominees or legal heirs are not eligible to continue the, deceased account., , •, , PPF can be transferred from one place to another place. But can’t be transferred from, one name to another., , •, , A person having an Employee’s Provident Fund Account can open a Public Provident, Fund Account since both are different., , •, , Once your account completes 15 years then following options are available to subscriber:, (a) You can withdraw your whole amount., (b) You can extend for a 5 years block as many times as you wish., , 6. Senior Citizen’s Account, •, , As per the Government guidelines, people above the age of 60 years are treated as senior, citizen.

Page 24 :

20, , Banking and Banking Structure–Legal Aspects, , •, , Senior Citizen accounts are normal savings accounts with the difference that an interest, benefit of between 0.25% and 0.50% per annum or as decided by respective banks from, time to time is given to the beneficiary account holder., , •, , This scheme became effective from April 19, 2001., , •, , In such accounts where a senior citizen opens a joint account, the first name in the account, should be that of senior citizen only then the benefit of the scheme goes to senior citizen., , •, , The accounts under senior citizen scheme are applicable to those senior citizens who are, residents of India., , NON-RESIDENT INDIAN (NRI) ACCOUNTS, Who is Non-Resident Indian?, Definition of NRI, Foreign Exchange Management Act (FEMA) 1999, defines a Non-Resident Indian as:, (a) A person resident outside India who is a citizen of India, i.e., (i) �Indian citizens who go abroad for employment or for carrying on any business or, vacation etc. indicating indefinite period of stay outside India., (ii) �I ndian citizens working abroad on assignments with Foreign Governments,, Government Agencies or International/Multinational Monetary Fund (IMF), and, World Bank etc., (iii) �Officials of Central and State Governments and Public Sector Undertaking deputed, abroad on assignments with Foreign Govt. Agencies/Organization or posted to their, own offices including Indian Diplomatic Missions abroad., (b) A person of Indian origin who is a citizen of any country other than Bangladesh or, Pakistan, if, (i) He, at any time, held an Indian passport., (ii) �He or either of this parents or any of its grand parents were a citizen of India by virtue, of Constitution of India or Citizenship Act 1955 (57 of 1955), (iii) �The person is a spouse of an Indian Citizen or a person referred in sub clause b (i) or, (ii) above., The above definition of NRI in simple words means:, •, , A person of Indian nationality or origin, who resides abroad for business or vocation, or employment, or having an intention of employment or vocation, when the period of, stay abroad is indefinite., , •, , A person is of Indian origin is an NRI if he has held an Indian passport, or he/she or any, of his/heir parents or grandparents were/are a citizen of India., , •, , While a spouse, who is a foreign citizen, of an Indian citizen or a person of Indian origin, is, also treated as a person of Indian origin, for the purpose of opening of bank accounts and, other facilities granted for investments into India, provided such accounts or investments, are in the joint names of spouse., , •, , For instance, students going abroad for higher studies, are not NRIs, while, government officials, going abroad on posting to Indian missions or World Bank, IMF, etc., are NRIs., , •, , Tourists on brief visit to foreign countries are not categorized as NRIs.

Page 25 :

Banking and Banking Structure–Legal Aspects, , 21, , Types of NRI accounts and their features, Different types of non-resident accounts can be opened by banks in India. Their types, important, features, requirements and operational aspects are briefly given below:, , NRI Accounts-Rupee and Foreign Currency Accounts, A Non-resident Indian can open following types of accounts:, 1. Non-resident (External) Rupee Account (NRE), 2. Non-resident Ordinary Rupee account (NRO), 3. �Foreign Currency (Non-resident) Account (Banks) [FCNR(B)], , Features of Accounts, 1. Non-resident (External) Rupee Account (NRE Accounts), •, , •, •, •, •, , NRE accounts can be opened and maintained by Non Resident Indians through any of, the following modes:, (i) �remittances from abroad by way of TT, checks, drafts, or even transfer from another, Non-Resident account., (ii) �by tendering of foreign currency travellers cheques or notes by the NRI during his, temporary visit to India, provided the bank is satisfied about his non-resident status., NRE account can be opened as Saving Bank account or Current Account, or Recurring, Deposit Account or Term Deposit for a minimum period of one year., An NRI can open NRE accounts as Joint Accounts, in the name of two or more nonresident individuals. Such individuals could be of Indian nationality or Indian origin., Opening of NRE account, jointly with a person resident in India is not permitted., No lien is permitted to be marked on the balances held in NRE savings account., , Permitted Credits, The RBI has permitted the following important credits that can be put into the NRE accounts:, (a) Remittance to India in any permitted currency., (b) Personal cheques drawn on foreign currency account of the account holder., (c) Travellers cheques and bank drafts drawn in any permitted currency, (d) Foreign currency/bank notes tendered during his temporary visit., (e) Transfer from any other NRE/FCNR (B) Accounts., (f) Any other credit if covered under general permission or specific permission granted by, Reserve Bank of India., , Permitted debits, The following debits are freely permitted in the NRE accounts:, (a) Local disbursements/payments, (b) Remittance outside India, (c) Transfer to any NRE/FCNR(B) Account, (d) Investments in shares/securities, etc.

Page 26 :

22, , Banking and Banking Structure–Legal Aspects, , Other facilities, NRE accounts also, offer following other facilities to NRI depositor:, (a) A cheque book facility in saving or Current account is allowed., (b) Full repatriation of deposit amount including interest permitted., (c) Maturity proceeds can be transferred to another bank, as desired by the depositor., (d) Nomination facility is permitted. Nominee can be either resident or non-resident., (e) Income by way of interest on balances held in NRE account is exempted from income, tax as on date., (f) Residents Indian can operate the account on the basis of power of attorney granted by, account holder. However the power of attorney holder cannot repatriate funds outside, India., (g) Banks may allow temporary overdrawing up to Rs.50,000/- (at present) in NRE saving, account, to be adjusted within 2 weeks of availment., , Interest on NRE Deposits, Interest varies from time to time at the discretion of the respective banks., , 2. Non-resident Ordinary Rupee Account (NRO), •, •, •, •, •, , •, •, •, •, , NRO accounts are Rupee accounts., NRO accounts can be opened and maintained by any person resident outside India and, also by Foreign Tourist, who are on a short visit to India on tourist visa., The new accounts can be opened by sending fresh remittances from abroad or by transfer, of funds from NRO/NRE/FCNR accounts., When a resident becomes a non-Resident, his domestic Rupee account, is re-designated, as an NRO account., NRO account of an NRI is just like any other domestic account, opened and maintained, to facilitate credits which accrue in India from investments that were made prior to his, leaving the country., NRO accounts can be opened in Indian rupees only as saving bank account, current, account, recurring deposit account and term deposit account., Most of the regulations for interest rates, amount or tenor, etc., applicable to NRO accounts, are similar to those for domestic deposit accounts., The interest on NRO accounts is subject to deduction of Income Tax at source, as prescribed, from time to time by the appropriate authority., NRO accounts can be opened as Joint Accounts, with resident Indians., , Permissible Credits, The following credits are freely permitted to be credited to NRO accounts:, (a) Any remittance from abroad in permitted currency., (b) Currency tendered during visit to India of the account holder., (c) Any legitimate dues in India of the account holder can be credited to such account. For, instance, rent, interest, dividend, and maturity proceeds of Units of UTI, LIC policy, maturities, etc. can be credited.

Page 27 :

Banking and Banking Structure–Legal Aspects, , 23, , Permissible Debits, •, •, •, , All local payments in Indian rupees., Remittance outside India of the account holder, net of applicable taxes. For example,, interest, dividend, rent, etc. can be debited to such account., Any other transactions if covered under general or specific permission granted by RBI., , 3. �FOREIGN CURRENCY (NON-RESIDENT) ACCOUNT (BANKS),, [FCNR (B) ACCOUNTS], FCNR accounts are foreign currency accounts which can be opened and maintained by NonResident Indians, in Designated Currencies only, viz., US dollar, EURO, Great Britain Pounds,, Japanese Yen,. Canadian dollar and Australian dollar as of now., NRIs can open these accounts only in the form to Term Deposits, for a minimum period of, ONE year and maximum period of FIVE years., Joint accounts can be opened in the name of two or more non-resident individuals, who are, persons of Indian nationality or Indian origin., SEPA:, The Single Euro Payments Area (SEPA) is where more than 500 million citizens, over 20 million, businesses and European public authorities can make and receive payments in euro under the, same basic conditions, rights and obligations, regardless of their location., The introduction of the euro has helped to make cash payments anywhere in the euro, area just as easy as at home. But until recently it was not so easy to pay for goods or services, electronically in another euro area country., , Permitted Credits and Debits, Credits permissible in FCNR (B) accounts are the same as that in NRE Rupee account. Other, Facilities, (a) There is no exchange risk for the account holder as the account is maintained in foreign, currency., (b) Repatriation of principal amount along with interest is permitted., (c) The interest on the deposit shall be paid on the basis of 360 days to a year, cumulative, on half-yearly intervals of 180 days., (d) Nomination facility is available., (e) Income earned by way of Interest is exempted from income tax., (f) No operation by way of power of attorney to the resident is permitted, since there are, no local withdrawals., (g) Forward Cover can be booked to hedge the balance held in FCNR account., Interest on FCNR (B) accounts: Interest rate can vary from time to time as per the policy, of the RBI and respective banks., , POST OFFICE SCHEMES, Post Office Savings Accounts – types and features, •, , Period / duration of the savings account is normal as in other cases.

Page 28 :

24, , Banking and Banking Structure–Legal Aspects, , •, , Rate of interest is 4% per annum., , •, •, , Interest is tax free up to Rs.10,000/=., Earlier maximum amount that could be accumulated in savings bank was Rs.2,00,000/=, but now there is no limit., Cheque book facility is available., , •, , Term Deposit Accounts, •, •, •, •, , These term deposits are for different periods, i.e. 1, 2, 3, and 5 years., Rate of interest per annum varies with duration or period of deposit. As on 31.3.2014 it, is 8.2% for 1-2 year; 8.3% for 3 years and 8.4% for 5 years duration term deposits., Income tax benefit is available under section 80 C in case of term deposit for 5 years, duration., Interest is chargeable quarterly., , Monthly Income Scheme (MIS), •, •, •, , Duration of deposits under monthly income scheme is 5 years., Rate of interest as on 31.3.2014 is 8.4% p.a., No tax benefit is available in MIS of post office., , Senior Citizen Scheme (SCS), •, , The senior citizen scheme is having deposit duration of 5 years., , •, , Rate of interest per annum is 9.2% as on 31.3.2014., , •, , Tax is deducted at source in SCS., , •, , There is no tax benefit in SCS. All existing income tax rules will apply in such accounts., , •, , A depositor may operate more than one account in individual capacity or jointly with, spouse., , •, , Minimum age for opening such account is 60 years., , •, , Interest is chargeable on quarterly basis., , •, , Maximum amount that can be deposited in SCS is Rupees 15,00,000/=., , •, , Interest is paid on 31st March / 30th June / 30th September and 31st December every year., , Public Provident Fund Scheme, •, , The scheme is the same with the same features as discussed in earlier paragraph on PPF, scheme, , National Savings Scheme (VIII issue), •, •, •, •, , The period is 5 years from the date of deposit., Minimum amount is Rs.100/=. No maximum limit prescribed., Denominations of certificates available are for Rs.100/-, 500/- 1000/-, 5000/- and, Rs.10,000/=., Rate of interest is 8.5% p.a. as on 31.3.2014.

Page 29 :

Banking and Banking Structure–Legal Aspects, , •, •, •, , 25, , Income Tax rebate is available under section 80C., Interest is chargeable half yearly and paid annually and is deemed to be reinvested., Any individual person can buy these certificates as an adult himself or on behalf of a, minor; or a Trust can buy such certificates, , National Savings Scheme (IX issue), •, •, •, •, , Duration of such deposits is 10 years., Rate of interest is 8.8% p.a., Income Tax rebates is available under section 80 C of the Income Tax Act., Interest is chargeable half yearly and is deemed reinvested., , Opening of Post Office Accounts ( Requirement of documents), •, •, , One recent photograph (passport size) for individual cases and in case of joint accounts,, photographs of all joint holders., Any one of the following documents for identification of account holder:, • Election photo Identity card, • Ration card with photograph, • Passport, • Driving License, • Job card issued under MG-NREGA duly signed by an officer of State Government, • Post office identity card, • Identity card issued by Central/State government or PSU, • Photo identity card issued by recognized university/education board/college/school, • Aadhaar card with number and address (UIDAI)., , For Address Proof any of the following one document, •, •, •, •, •, •, •, •, , Bank or post office passbook / Statement with current address., Passport with current address, Ration card with current address, Electricity bill not more than 3 month old., Telephone bill not more than 3 months old., Salary slip of reputed employer with current address, Certificate from Public Authority/Postman or Gram Dak Sewak or Branch Postmaster, UIDAI letter containing address and name of the prospective account opener., , Attestation of Documents, •, •, •, •, , Documents could be self-attested., In case of illiterate depositors should be attested by Gazetted Officer / Sarpanch / Branch, Sub-head / Chief Post Master or Postman/ Gram Dak Sewak., In case money is invested / deposited through an agent, the agent can attest the same., In case savings go beyond Rs.50,000/=, a copy of PAN Card be obtained or Declaration, form 60 be submitted.

Page 30 :

26, , Banking and Banking Structure–Legal Aspects, , PAST EXERCISE, 1. As per the newspaper reports, some, economically developed states only hold, about 60% of the total 'Demat Accounts' in, India. A demant Account is�, [BOI 2008], (a) an account which is opened by the people, of the lower income groups of society., (b) an account in which trading of the, shares is done., (c) an account which can be opened only, by minors., (d) an account which can be operated by, big corporate houses and are mainly, business accounts like current acounts., (e) None of these, 2. What is an Indian Depository Receipt?, �, [BOB 2008], (a) A deposit account with a public Sector, Bank, (b) A depository account with any of the, Depositories India, (c) An instrument in the form of depository, receipt created by an Indian depository, against underlying, equity shares, of the issuing company, (d) An instrument in the form of deposit, receipt issued by Indian depositories, (e) None of these, 3. What is Call Money? �, [BOB 2008], (a) Money borrowed or lent for a day or, overnight, (b) Money borrowed for more than one, day but up to 3 days, (c) Money borrowed for more than one, day but up to 7 days, (d) Money borrowed for more than one, day but up to 14 days, (e) None of these, 4. Many a time we read a term 'SEPA' in, financial newspapers. What is the full form, of the term? �, [UBI 2009], (a) Single Exchange Processing Agency, (b) Single Euro Payments Area, (c) Single Electronic Processing Agency, (d) Super Electronic Purchase Agency, (e) None of these, , 5. What is Forex ?, [Punjab & Sindh 2011], (a) It is buying of foreign currency., (b) It is selling of foreign currency., (c) It is buying of one currency and selling, of another currency., (d) It is simultaneous buying of one currency, and selling of another currency., (e) None of these, 6. Which of the following is not a part of the, scheduled banking structure in India ?, �, [Corporation Bank 2011], (a) Money Lenders, (b) Public Sector Banks, (c) Private Sector Banks, (d) Regional Rural Banks, (e) State Co-operative Banks, 7. Which of the following is not a part of, the scheduled banking structure in India?, �, [Indian Overseas Bank 2011], (a) State Co-operative Banks, (b) Public Sector Banks, (c) Private Sector Banks, (d) Regional Rural Banks, (e) Moneylenders, 8. Which of the following is the most active, segment of the money market in India?, [Indian Overseas Bank 2011], (a) Call Money/Notice Money Market, (b) Repo/Reverse Repo, (c) Commercial Paper (CP), (d) Certificate of Deposit (CD), (e) None of these, 9. Govt of India has created a special fund, called India Micro Finance Equity Fund of, ` 100 crores. The fund is maintained by, [Corporation Bank 2011], (a) IDBI Bank (b) RBI, (c) ECGC, (d) SIDBI, (e) NABARD, 10. Accounts are allowed to be operated by, cheques in respect of�, [IBPS 2011], (a) Both savings bank accounts and fixed, deposit accounts, (b) Savings bank accounts and current, accounts, (c) Both savings bank accounts and loan, accounts

Page 31 :

27, , Banking and Banking Structure–Legal Aspects, , 11, , 12., , 13., , 14., , (d) Both savings bank accounts and cash, accounts only, (e) Both current accounts and fixed deposit, accounts, Which of the following is a correct, statement?�, [IBPS 2011], (a) Normally no interest is paid on current, deposit accounts., (b) Interest is paid on current accounts at, the same rate as term deposit accounts., (c) The rate of interest on current account, and savings account are the same., (d) No interest is paid on any deposit by, the bank., (e) Savings deposits are the same as current, deposits., The usual deposit accounts of banks are, �, [IBPS 2011], (a) Current accounts, electricity accounts, and insurance premium accounts, (b) Current accounts, post office savings, bank accounts and term deposit, accounts, (c) Loan accounts, savings bank accounts, and term deposit accounts, (d) Current accounts, savings bank, accounts and term deposit accounts, (e) Current bill accounts and term deposit, accounts, Fixed deposits and recurring deposits are, �, [IBPS 2011], (a) repayable after an agreed period., (b) repayable on demand., (c) not repayable., (d) repayable after death of depositors., (e) repayable on demand or after an agreed, period as per bank,s choice., Interest on savings bank account is now, calculated by banks on�, [IBPS 2011], (a) minimum balance during the month, (b) minimum balance from 7th to last day, of the month, (c) minimum balance from 10th to last day, of the month, (d) maximum balance during the month, (e) daily product basis, , 15. With a view to facilitating payment of, balance in the deposit account to the person, named by the depositor without any hassles, in the event of death of the account holder,, the following facility was introduced for, bank accounts in our country:� [IBPS 2011], (a) Will, (b) Registration, (c) Nomination (d) Indemnity, (e) Guarantee, 16. Banks in our country normally publicise, that additional interest rate is allowed on, retail domestic term deposits of�[IBPS 2011], (a) Minors, (b) Married women, (c) Senior citizens (d)Govt employees, (e) Rural residents, 17. Drawing, accepting, making or issuing of any, promissory note, hundi or bill of exchange, expressed to be payable to bearer on, demand by a person other than the Reserve, Bank of India or the Central Government is, prohibited under�, [IBPS 2011], (a) Banking Regulation Act, 1949, (b) Section 31 (1) of the Reserve Bank of, India Act, 1934, (c) Negotiable Instruments Act, 1881, (d) Indian Contract Act, 1872, (e) None of the above, 18. A bank without any branch network that, offers its services remotely through online, banking, telephone/mobile banking and, interbank ATM network alliances is known, as�, [IBPS 2013], (a) Universal Banking, (b) Indirect Bank, (c) Door Step Bank, (d) A Direct Bank, (e) Unit Banking, 19. Which of the following is an investment, advisory discipline?, [IBPS 2013], (a) Corporate Industrial Finance, (b) Offshare Banking, (c) Wholesale Banking, (d) Wealth Management, (e) Trade Finance, , ANSWER KEY, 1., , (b), , 2., , (c), , 3., , (a), , 4., , (b), , 5., , (d), , 6., , (a), , 7., , (e), , 8., , (a), , 9., , (d), , 10., , (b), , 11., , (a), , 12., , (d), , 13., , (a), , 14., , (c), , 15., , (c), , 16., , (c), , 17., , (b), , 18., , (d), , 19., , (d)

Page 32 :

28, , Banking and Banking Structure–Legal Aspects, , PRACTICE EXERCISE, 1. Consider the following statements:, 1. In Indian Commercial Banking System,, the number of the Non-scheduled Bank, is more than the Scheduled Banks., 2. The Non-scheduled Banks in Indian, Commercial Banking Systems are even, less than a dozen in number., Which of the statements given above is/are, correct?, (a) Only 1, (b) Only 2, (c) Both 1 and 2 (d) Neither 1 nor 2, (e) Can’t say, 2. Which one of the following banks can be, included in the Scheduled Commercial, Banking System of India?, (a) Regional Rural Banks, (b) Private Sector Banks, (c) Foreign Banks in India, (d) All of the above, (e) None of the above, 3. Match the following:, List I, , List II, , A. Allahabad Bank, , 1., , Delhi, , B., , Central Bank of, India, , 2., , Kolkata, , C. Indian Overseas, Bank, , 3., , Mumbai, , D. Punjab National, Bank, , 4., , Chennai, , Codes:, A B C D, (a) 2 4 3 1, (b) 2 3 4 1, (c) 4 3 2 1, (d) 4 1 3 2, (e) 1 2 3 4, 4. Consider the following statements:, 1. Scheduled Commercial Banks are those, which have been included in the First, Scheduled of RBI Act, 1934., 2. Non-scheduled Commercial Banks are, those which have been included in the, Second Scheduled of RBI act, 1934., , Which of the statements given above is/are, correct?, (a) Only 1, (b) Only 2, (c) Both 1 and 2 (d) Neither 1 nor 2, (e) Can’t say, 5. A scheduled bank is the one which is, included in the, (a) II Schedule of Banking Regulation Act, (b) II Schedule of Constitution, (c) II Schedule of RBI Act, (d) All of these, (e) None of these, 6. Presently, the number of the public sector, banks in India is, (a) 8, (b) 20, (c) 28, (d) 14, (e) None of these, 7. Which of the following is popular ‘saving, bank’ among the poor children?, (a) Core banking, (b) Credit banking, (c) Debit banking, (d) Merchant banking, (e) Piggy banking, 8. Who is a very senior citizen?, (a) A person who is 65 years and above, (b) A person who is 75 years and above, (c) A person who is 80 years and above, (d) A person who is 90 years and above, (e) A person who completed 100 years of, age, 9. When banks accept fixed sum of money, from an individual for a definite term and, pay on maturity with interest, the deposit is, known?, (a) Term deposit, (b) Demand deposit, (c) Bond, (d) Mortagage, (e) Advance, 10. Which one of the following whose activities, are not systematically coordinated by the, monetary authority?, I. Organised sector, II. Unorganised sector, III. Co-operative sector

Page 33 :

Banking and Banking Structure–Legal Aspects, , Select the correct answer using the codes, given below, (a) Only II, (b) I and III, (c) Only I, (d) II and III, (e) Only III, 11. Which one of the following dominate the, organised sector?, (a) RBI, (b) Commercial Bank, (c) Co-operative Bank, (d) RRBs, (e) SBI, 12. National Saving Scheme (NSS-922) has, been closed by the government since, (a) 1st November, 1999, (b) 1st November, 2000, (c) 1st November, 2001, (d) 1st November, 2002, (e) 1st November, 2003, 13. Match the following:, List I, , List II, , A. Agricultural, Sector, , 1., , Unit Fund, , B., , 2., , Enacted by, Parliament, in 1976, , C. Unorganised, Sector, , 3., , NABARD, , D. RRB, , 4., , Public Issue, , Industrial Sector, , Codes:, A B C D A B C D, (a) 3 4 1 2 (b) 4, 3 2 1, (c) 1 2 3 4 (d) 3, 2 4 1, (e) 2 3 1 4, 14. A scheduled bank is one, (a) which conforms to the requirements of, Schedule III of the Banking Regulation, Act, 1949, (b) which has been declared as a, scheduled bank by the Government of, India, (c) which has deposits exceeding ` 10, crore, (d) which has its name added to the, second schedule of the Reserve Bank of, India Act, 1934, (e) None of the above, , 29, 15. Which of the following can be identified as, a demat account?, (a) Accounts which can have zero balance, (b) Accounts, opened, to, facilitate, repayment of loan, (c) Accounts in which shares of companies, are traded in electronic form, (d) Accounts maintained by mutual fund, companies for investors, (e) None of the above, 16. Which of the following is not a money, market instrument?, (a) Treasury Bills, (b) Commercial Paper, (c) Certificate of Deposit, (d) Equity Share, (e) None of these, 17. Treasury Bills means, (a) salary bills drawn by Government, officials on the treasury, (b) bills drawee by the Government, contractors and other suppliers on the, treasury for the dues owed to them by, the Government, (c) obligation of the Government of India, issued by the Reserve Bank of India and, payable normally 91 days after issue, (d) a mode of drawings by the Treasury, Office on the Reserve Bank of India, (e) None of the above, 18. Which one of the following countries is the, first borrower of fund from the International, Monetary Fund?, (a) United States (b) France, (c) Spain, (d) India, (e) Sri Lanka, 19. Which one of the following statements is, true regarding IMF?, (a) It is not an agency of UNO, (b) It can grant loan to any country of the, world, (c) It can grant loan to State Government of, a country, (d) It grants loan only to member nations, (e) All of the above, 20. Voting rights in the IMF are distributed on, the basis of, (a) one country, one vote, (b) proportion to the share of the income of, the country in the world income

Page 34 :

30, , 21., , 22., , 23., , 24., , 25., , 26., , Banking and Banking Structure–Legal Aspects, , (c) proportion to contributions given by, each country, (d) proportion to quota allotted to countries, from time to time, (e) None of the above, The headquarters of IMF and World Bank, are located at, (a) Geneva and Montreal, (b) Geneva and Vienna, (c) New York and Geneva, (d) Washington DC, (e) Nigeria, Which one of the following institutions, publish the report of ‘World Economic, Outlook’?, (a) IMF, (b) World Bank, (c) RBI, (d) UNCTAD, (e) Citi Bank, The capital of IMF is made up by, contribution of the, (a) credit, (b) deficit financing, (c) member nations, (d) borrowing, (e) All of these, Special drawing right is an international, practice of drawing funds. Which of the, following institutions control this special, finding facility?, (a) World Bank, (b) Asian Development Bank, (c) Federal Reserve, (d) European Common Market, (e) All of the above, Nationalised banks have been permitted, to offer their equity shares to the public, to the extent of 49% of their capital as per, amendments made in 1994, in, (a) Banking Regulation Act, 1949, (b) Banking, Companies, (Acquisition, and Transfer of Undertakings) Acts, 1970/1980, (c) RBI Act, 1935, (d) Nationalisation of Banks Act, 1980, (e) None of the above, How many banks are presently associates, of State Bank of India?, (a) 8, (b) 7, (c) 6, (d) 5, (e) 4, , 27. The paid-up capital of non-scheduled bank, is less than, (a) ` 5 lakh, (b) ` 10 lakh, (c) ` 12 lakh, (d) ` 15 lakh, (e) None of these, 28. A foreign bank is one, (a) whose most of the branches are situated, outside India, (b) in which atleast 40% equity shares are, held by non-resident Indians, (c) which is incorporated outside India, (d) All of the above, (e) None of the above, 29. How many banks are presently nationalised, banks in India?, (a) 14, (b) 15, (c) 19, (d) 20, (e) 6, 30. Which of the following are the scheduled, banks?, (a) State Bank of Mauritius Limited, (b) HDFC Bank Limited, (c) ICICI Bank, (d) None of the above, (e) All of the above, 31. Which of the following is not the part of the, scheduled banking structure in India?, (a) Money lenders, (b) Public sector banks, (c) Private sector banks, (d) Regional rural banks, (e) State co-operative banks, 32. BCSBI stands for, (a) Banking Codes and Standards Board of, India, (b) Banking Credit and Standards Board of, India, (c) Banking Codes and Service Board of, India, (d) Banking Credit and Service Board of, India, (e) None of the above, 33. Scheduled bank means a bank, (a) incorporated under the Companies Act,, 1956, (b) authorised to transact government, business, (c) governed by the Banking Regulation, Act, 1949

Page 35 :