Page 1 :

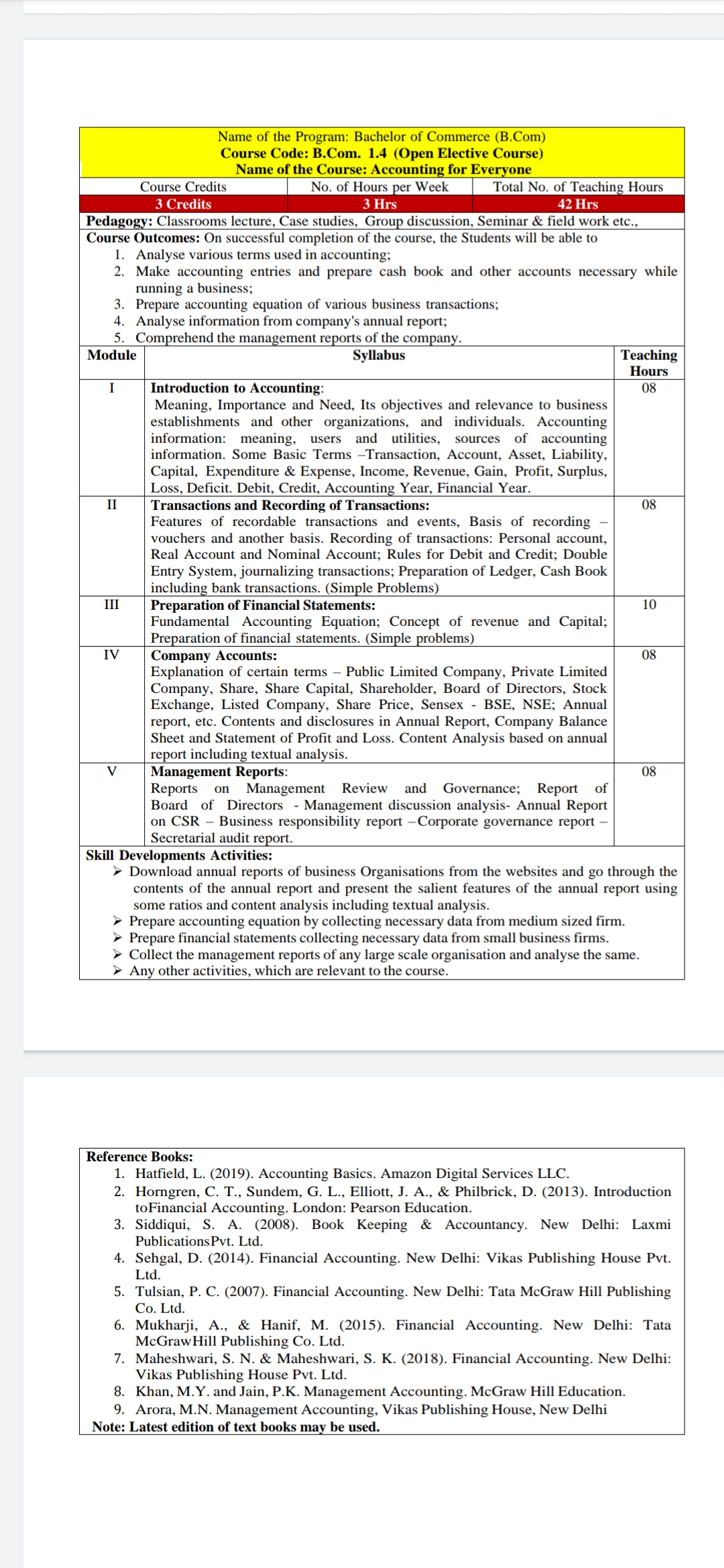

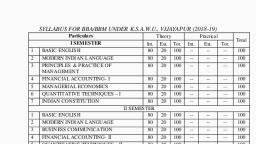

Course Credits No. of Hours per Week Total No. of Teaching Hours, 3 Credits 3 Hrs poate, Pedagogy: Classrooms lecture, Case studies, Group discussion, Seminar & field work etc.,, , , , , , Course Outcomes: On successful completion of the course, the Students will be able to, 1. Analyse various terms used in accounting;, 2. Make accounting entries and prepare cash book and other accounts necessary while, running a business;, 3. Prepare accounting equation of various business transactions;, 4, Analyse information from company's annual report;, 5._Comprehend the management reports of the company., , , , , , Module Syllabus Teaching, Hours, I Introduction to Accounting: 08, , Meaning, Importance and Need, Its objectives and relevance to business, establishments and other organizations, and individuals. Accounting, information: meaning, users and utilities, sources of accounting, information. Some Basic Terms —Transaction, Account, Asset, Liability,, Capital, Expenditure & Expense, Income, Revenue, Gain, Profit, Surplus,, Loss, Deficit. Debit, Credit, Accounting Year, Financial Year., , II Transactions and Recording of Transactions: 08, Features of recordable transactions and events, Basis of recording —, vouchers and another basis. Recording of transactions: Personal account,, Real Account and Nominal Account; Rules for Debit and Credit; Double, Entry System, journalizing transactions; Preparation of Ledger, Cash Book, including bank transactions. (Simple Problems), , il Preparation of Financial Statements: 10, Fundamental Accounting Equation; Concept of revenue and Capital;, Preparation of financial statements. (Simple problems), , IV Company Accounts: 08, Explanation of certain terms — Public Limited Company, Private Limited, Company, Share, Share Capital, Shareholder, Board of Directors, Stock, Exchange, Listed Company, Share Price, Sensex - BSE, NSE; Annual, report, etc. Contents and disclosures in Annual Report, Company Balance, Sheet and Statement of Profit and Loss. Content Analysis based on annual, report including textual analysis., , Vv Management Reports: 08, Reports on Management Review and Governance; Report of, Board of Directors - Management discussion analysis- Annual Report, on CSR — Business responsibility report -Corporate governance report —, Secretarial audit report., , Skill Developments Activities:, , » Download annual reports of business Organisations from the websites and go through the, contents of the annual report and present the salient features of the annual report using, some ratios and content analysis including textual analysis., , » Prepare accounting equation by collecting necessary data from medium sized firm., , » Prepare financial statements collecting necessary data from small business firms., , » Collect the management reports of any large scale organisation and analyse the same., , » Any other activities, which are relevant to the course., , , , , , , , , , , , , , , , , , , , , , , , Reference Books:, 1. Hatfield, L. (2019). Accounting Basics. Amazon Digital Services LLC., 2. Horngren, C. T., Sundem, G. L., Elliott, J. A., & Philbrick, D. (2013). Introduction, toFinancial Accounting. London: Pearson Education., 3. Siddiqui, S. A. (2008). Book Keeping & Accountancy. New Delhi: Laxmi, PublicationsPvt. Ltd., 4. Sehgal, D. (2014). Financial Accounting. New Delhi: Vikas Publishing House Pvt., Ltd., 5. Tulsian, P. C. (2007). Financial Accounting. New Delhi: Tata McGraw Hill Publishing, Co. Ltd., 6. Mukharji, A., & Hanif, M. (2015). Financial Accounting. New Delhi: Tata, McGrawHill Publishing Co. Ltd., 7. Maheshwari, S. N. & Maheshwari, S. K. (2018). Financial Accounting. New Delhi:, Vikas Publishing House Pvt. Ltd., 8. Khan, M.Y. and Jain, P.K. Management Accounting. McGraw Hill Education., 9. Arora, M.N. Management Accounting, Vikas Publishing House, New Delhi, Note: Latest edition of text books may be used.