Page 1 :

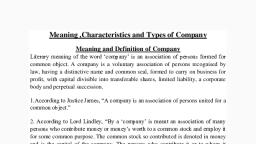

I UKE, TRANSFER FOR BENEFIT OF UNBORN PERSON, [Sections 13 and 14], Sections 13 and 14 of the Transfer of Property Act, 1882 lay, down the provisions relating to 'Transfer for benefit of unborn, person'. Section 13 refers to 'Transfer for benefit of unborn person,, while Section 14 speaks about 'the Rule against perpetuity'. Section, 13 represents the common law rule against the remoteness of, limitation, while Section 14 represents the English rule against, perpetuity. Therefore, this lecture deals with-, eirT, 1. Transfer for benefit of unborn person (Section 13)., 2. Rule against perpetuity (Section 14); and, dua iesb, 3. Rule against Accumulation or Direction for Accumulation, (Section 17)., bonie, 1. TRANSFER FOR BENEFIT OF UNBORN PERSON, [Section 13], The Transfer of Property Act, 1882 deals mainly with the, transfer of immovable properties between two living persons, i.e., transfers inter vivos. According to Section 5 of the Act, the general, rule is that, both the parties to a transfer of property must be living, persons. The expression 'living person' includes "juristic person", viz. Company or association or body of individuals, whether, incorporated or not. Section 13, which deals with transfer by born, to unborn is a special law and is an exception to this general rule, i.e, transfer inter vivos. Section 13 runs as follows:, boul A (S), Where, on a transfer of property, an interest therein is created, for the benefit of a person not in existence at the date of the, transfer, subject to a prior interest created by the same transfer, the, interest created for the benefit of such person shall not take effect,, unless it extends to the whole of the remaining interest of the, transferor in the, property., 53, 1

Page 2 :

created for the benefit of the eldest son does not take effect, because, A transfers property of which he is the owner to B in trust for, death of the survivor, for the eldest son of the intended marriage, (3) A bequeaths a sum of money to B for life, and directs that, 54, Lectures on Transfer of Property Act, Illustration:, the, A and his intended wife successively for their lives, and after, SO, for life, and after his death for A's second son. The interest, it does not extend to the whole of A's remaining interest in th, property., This Section (Section 13 T.P.Act) corresponds to Section 113, of the Indian Succession Act, 1925, which runs as follows:, Section 113: Bequest to person not in existence at testator's, death subject to prior bequest - Where a bequest is made to a, person not in existence at the time of the testator's death, subject to, a prior bequest contained in the will, the latter bequest shall be, void, unless it comprises the whole of the remaining interest of the, testator in the thing bequeathed.', Illustrations:, (1) Property is bequeathed to A for life, and after his death to, his eldest son for life, and after the death of the latter to his eldest, son. At the time of the testator's death, A has no son. Here the, bequest to A's eldest son is a bequest to a person not in existence, at the testator's death. It is not a bequest to the whole interest that, remains to the testator. The bequest to A's eldest son for his life is, void., (2) A fund is bequeathed to A for his life, and after his death, to his daughters. A survives the testator. A has daughters some of, who were not in existence at the testator's death. The bequest to, A's daughters comprises the whole interest that remains to the, testator in the thing bequeathed. The bequest to A's daughters s, valid., upon the death of B the fund shall be settled, among, his daughters,, 2

Page 3 :

Transfer for Benefit of Unborn Person, 55, so that the portion of each daughter may belong to herself, for life,, and may be divided among her children after her death. B has no, daughter living at the time of testator's death. In this case the only, bequest to the daughters of B is contained in the direction to settle, the fund, and this direction amounts to a bequest to persons not yet, born of a life interest in the fund, that is to say, of something which, is less than the whole interest that remains to the testator in the, thing bequeathed. The direction to settle the fund upon the daughters, of B is void., Who is an unborn person: An unborn person is one, who is, not in existence or who is yet to born or who will come into, existence in future at any time or who is not even in uterus (in the, womb of mother)., Scope of the section: A person who is not in existence can, neither be a transferee of property, nor a beneficiary under a trust, until he comes into existence. There can, therefore, be no immediate, transfer of property or trust in favour of a person not in existence., The principle is recognised by this Act as well as by the Indian, Trusts Act. Section 5 of this Act provides that 'transfer of property', means a transfer in favour of a living person; and the expression, 'living person' will not include a person, not in existence. Similarly, Section 9 of the Indian Trusts Act, 1882, provides that a beneficiary, under a trust must be a person 'capable of holding property' and, this expression also excludes a person not in existence. However,, Section 13 of the T.P. Act as stated above is an exception to this, general rule., For every property, there must be an owner. Naturally a, person may wish to adopt a device to retain the property in his own, family. Section 13 makes provision to such persons to retain/sustain, the property within their family members, who will come into, existence in future. If a person/testator is allowed to reserve his, properties from generation to generations, it leads to certain, problems/complications. The object of Section 13 is to regulate/, harmonise such transfers., 3

Page 4 :

Conditions: For transfer of property to an unborn person, the, (i) No direct transfer: There can be no transfer of property, favour of an unborn person must always be preceded by a prior, Lectures on Transfer of Property Act, an, following conditions are to be satisfied., for the benefit of an unborn person directly, but through the, machinery of trusts. In case a trust is not created, the interest in, interest in favour of a living person. This condition is intended that, if it is made directly to unborn person, the property will be leftout, without the owner after the death of testator or transferor and before, coming into existence of unborn transferee. So it should not be, kept in abeyance without ownership., (ii) Prior Interest: Life interest may be created upon the, existing persons till an unborn person comes into existence – In, case a trust is not created, the property must be held by some, persons who existing at the time of transfer. They can enjoy the, limited interest one after another or collectively., (iii) Unborn person must come into existence before the, death of last life estate holder: If the life interest is created one, after another or collectively the unborn person must come into, existence before the death of the last life estate holder. It is not, necessary that the unborn person must come into the actual world,, but it is enough that if he is in its mother's womb (a child inventre, sa mere, is equals to a child in esse which means a child in the, mother's womb is equal to a child in existence)., (iv) The whole remaining interest must be vested to unborn, person the moment he comes into existence: When an unborn, person gets the actual life, he will be the absolute owner of the, property which was created in his favour and the life estate holders, cannot retain anything which remains in their hands. So they must, give the entire interest to the unborn person., If the above four conditions are satisfied the enjoyment of, property may be postponed during period of minority of unborn, beneficiary., olant doua sei, 4

Page 5 :

Transfer for Benefit of Unborn Person, 57, It is clear from the above that the transfer under Section 13, an be made/possible to an unborn person but not to the issue of, the unborn person., vs. Administrator General of Bengal (1944 PC 67) -, Sopher, In this case, A, a testator executed a will stating that his property, chall be divided between the sons to be born, after the death of the, each of sons/daughters and thereafter to the grand children until, they attained the age of 18 years. The grand children after attaining, their majority would only be entitled for the absolute rights on the, property., The Privy Council had considered the effect of Section 113, of The Indian Succession Act, 1925 in this case. Their Lordships, had before them will which provided for an ultimate bequest in, favour of persons not born at the time of the testator's death, and, the question that arose for decision was whether the bequest, comprised the whole of the testator's remaining interest in the, thing bequeathed. Two clauses in the will provided for the forfeiture, of the interests of the unborn beneficiaries in certain contingencies., Before the passing of the Transfer of Property Act, 1882,, transfer in favour of unborn person was not allowed. In 1872, the, Privy Council in:, Tagore vs. Tagore (1872 ILR 356 PC) – laid down that a, transfer even to one generation before it reaching to unborn person, was not valid., After the passing of the T.P.Act, transfer in favour of an, unborn, person, is allowed. Section 13 is applicable to Hindus since, Hindu Law allows transfers in favour of unborn persons. This, Section is not applicable to Mohammedans. A gift to (unborn) a, person not in existence is void except in the case of a waqf under, Mohammedan Law (Abdul Khadur vs. Turner, ILR 9B 158)., English Law (Rule in Whitby vs. Mitchell (1890) 44 Ch.D.85), or the Rule of Double Possibilities: The principle laid down in