Page 1 :

Small items like stationery etc, are sold only against full payment of price in cash. However, costy, items like vehicles, machinery etc. may be sold on hire purchase basis. In case of hire purchase, the, final instalment is paid. Till the final instalment is paid, the seller remains the owner of the article, buyer pays for an article in periodical instalments but becomes the owner of the article only after the, However, the buyer gets the possession of the article immediately and can start using it. Also, the, buyer has to pay interest in addition to the purchase price on the outstanding amount. If the buyer, HIRE PURCHASE, 16, TRANSACTIONS, THEORY AND ILLUSTRATIONS, OUTLINE, Page, No., Topic, 1., Hire Purchase, 304, 1.1, Meaning, 1.2, Features, 2., Hire Purchase Agreement, 305, 2.1, Contents / Terms, 2.2., Hire Purcahse Vs. Instalment, 3., Calculation of Interest, 306, 4., Calculation of Depreciation, 310, Accounting Methods, Full Cash Price Method (Credit Purchase / Sale Method), 5., 310, 6., 311, 6.1, Books of Hire Purchaser, 6.2, Books of Hire Vendor, 7., Illustrations, 312, 1., HIRE PURCHASE, 1.1, MEANING, fails to pay any instalment, the seller can take away (repossess) the article., 1.2, FEATURES, Salient features of Hire-Purchase System are:, 1. Hire-Purchase System governed by Hire-Purchase Act, 1972., is, 2. It is an agreement of hiring., 3. It is an agreement between Hirer and Hire Versanned By Scanner Go

Page 2 :

6. The title to goods passes on last payment., 5. Cash price of goods is paid in instalment on agreed terms., 4. Terms and conditions between the parties are entered and recorded in a docunent called }fire-, 305, Purchase Agreement., " The Hirer Vendor (Seller) can take possession of goods if Hirer fails to pay instalment., " The Hirer is not responsible for risk of loss of goods, till the ownership is transferred., . The Hirer cannot mortgage, hire or sell or pledge the goods., 0 The Hirer has got a right to terminate the agreement at any time before the property so passes., 2., HIRE PURCHASE AGREEMENT, 2.1, CONTENTS/TERMS, A person who acquires an article under hire purchase is known as hire purchaser (or hirer). The, Owner who gives his article on hire purchase is known as the hire vendor (or vendor). The hirer and, the vendor enter into a written agreement known as Hire Purchase Agreement, which contains the, following details :, (1) Cash Price : This is the purchase price payable if full payment is made immediately., (2) Interest : The agreement states the rate of interest charged by the vendor on the unpaid amount., (3) Hire Purchase Price : This means the total amount payable by the hirer, (also known as hire, price) made up of the Cash Price of the article and Interest., (4) Down Payment : This is the initial amount payable at the time of signing the agreement. As soon, as down payment is made, the hirer gets possession of the article and can start using it immediately., (5) Instalment : The agreement indicates the number of total instalments in which the balance amount, is payable. The balance amount is equal to the Hire Purchase Price Less Down Payment. The, agreement contains details of the amount and due date of each instalment. Each instalment amount, is made up of part payment towards cash price plus interest., Illustration 1 :, The purchase price of a motor car purchased by Car Mart Co. on hire purchase from Autoriders, Company is ? 37,250. It is available on hire purchase on the following terms (a) Initial amount, payable is ? 10,000. (b) total amount of interest @ 5% p.a. comes to ? 2,750. (c) Balance amount is, payable in three instalments of 10,000 each, Analyse the terms of above hire purchase agreement., Solution :, The terms of above the purchase agreement can be analysed as follows :, 1) Hire Purchaser : The Car Mart Co. is the hire purchaser or hirer., (2) Hire Vendor : Autoriders Company is the hire vendor or vendor., 19) Cash Price : The purchase price of ? 37,250 is the cash price., (4) Interest : Interest charged by the vendor @ 5% p.a. on the unpaid amounts comes to ? 2,750., 15) Hire Purchase Price : This is equal to 37,250 + 2,750 = 7 40,000., 10) Down Payment :7 10,000 is the down payment., n Instalments : The balance amount is equal to (Hire Purchase Price - Down Payment) = 40,000, ** 10,000 = ? 30,000, payable in three instalments of 10,000 each., 2.2, HIRE PURCAHSE VS. INSTALMENT, ure Purchase Agreement differs from Instalment Purchase Agreement in the following respects:, (A), Basis of Distinction, (B), Hire Purchase Agreement, (C), Instalment Purchase, It is governed by Hire, Purchase Act, 1972., Agreement, It is governed by the Sale of, Goods Act, 1930., 1. Act governing, Scanned By Scanner Go

Page 3 :

306, The seller can sue for price, cannot take possession ol te, Unless seller defaults, goo, 2. Nature of Contract It is an Agreement of Hiring. | It is an Agreement of Sale, The title to goods, 3. Passing of Title, (Ownership), The title to goods passes on, last payment., immediately, usual sale., passos, as in the cas, The hirer may return goods, without further payment., except for accrued instalment., are not returnable., 4. Right to Return, Goods, The seller may take, possession of the goods if, hirer is in default., the buyer is in default. Ha, 5. Seller's Right to, Repossess, Hirer cannot hire out, sell,, pledge or assign entitling, transferee to retain, possession as against the, hire vendor., goods., The buyer may dispose oh, the goods and give good tile, to the bonafide purchaser., 6. Right to Dispose, off, The hirer is not responsible The buyer is responsiblef, for risk of loss of goods if he, has taken reasonable, precaution because the, ownership has not yet, transferred., 7. Responsibility for, Risk of Loss, risk of loss of goods because, of the ownership has, transferred., The parties involved are called, 8. Name of Parties, Involved, The parties involved are, called Hirer and Hire vendor. buyer and seller., 9. Relationship, between Parties, involved, The relationship between, hirer and hire vendor is that, of Bailee and Bailor., The relationship between the, buyer and seller is that of a, debtor and creditor till last, instalment is paid., 10. Component Other Component other than Cash, Price included in instalment, is called Hire charges., 1. Sales Method for goods, of substantial sales values, 2. Stock Methods for Goods, of small sales values., Component other than Cash, price included in instalment, is called Interest., than Cash Price, 11. Method of, Interest Suspense Method, Accounting, 3., CALCULATION OF INTEREST, The entries in the books depend upon the total amount of interest as well as the interest paid in eacihi, instalment. If the interest rate is given interest paid in cash instalment = Interest Rate % x Opening, Cash Price O/S. Sometimes, the details regarding rate of interest etc. may not be available. How, interest amount paid in each instalment is calculated in such circumstances is explained below., (A)When the cash price, rate of interest and the amount of instalments are given, In this situation, the total anmount of interest is to be ascertained first. It is the difference between the, hire purchase price (down payment + total instalments) and the cash price. To calculate the amount, of interest involved in each instalment the following steps are followed:, Step 1: Deduct down payment from the cash price. Calculate the interest at the given rate on the, remaining balance. This represents the amount of interest included in the first instalment., Step 2 : Deduct the interest of Step 1 from the amount of first instalment. The resultant figure is the, cash price included in the first instalment., Scanned By Scanner Go

Page 4 :

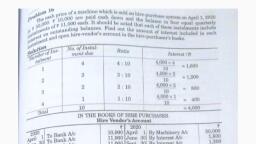

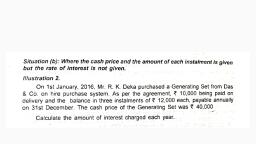

instalment. It represents the amount outstanding after the 2nd instalment is paid., Deduct this interest from the amount of the 2nd instalment to get the cash price included in the 2nd, s the amount outstanding after the 1st instalment is paid., following steps are followed to calculate the interest :, Step 3: Deduct the cash price of the 1 st instalment (Step 2) from the balance due after down payment., t the above steps till the last instalment is paid., Nep 5: Deduct the cash price of the 2nd instalment (Step 4) from the balance due after the 1st, (B)When the cash price and the amount of instalments are given, but the rate of interest is not, Step 4: Calculate the interest at the given rate on the balance outstanding after the Ist instalment., down payment + (amount of instalment x number of instalments).], 307, prepresents, instalment., It, Repeat, given, she rate of interest is not given, but the cash price and the amount of instalments are given, the, oun 1: Calculate the total interest by deducting the cash price from the hire purchase price (i.e.,, Sen 2 : Deduct down payment from the hire purchase price., Sep 3: Calculate the amount of outstanding balance of the hire purchase price at the beginning of, each year., Step 4 : Calculate the ratio of outstanding balance of Step 3., Step 5 : Calculate the amount of interest of each instalment on the basis of the ratio of Step 4., llustration 2 : (Cash Price, Rate of Interest and the Amount of Instalments are Given), The Car Mart Company purchases a motor car from Autoriders Company on a hire purchase, agreement on January 1, 2011, paying cash ? 10,000 and agreeing to pay further three instalments, of 10,000 each on 31st December each year. The cash price of the car is 37,250 and the, Autoriders Company charges interest at 5% p.a. Compute the amount of yearly interest., Solution :, The interest included in each instalment can be calculated as follows :, (1) Total amount of Interest = Total Hire Purchase Price Cash Price, = 40,000 - 37,250 = ? 2,750, (2) Interest in Each Instalment is equal to Rate of interest x Amount Outstanding in the beginning of, each instalment. The Interest is worked out either in a Statement or a Table., (3) Calculation of Interest (Statement), Particulars, Date / Period, 37,250, 10,000, 1-1-2011, Cash Price as on, 1-1-2011, Less : Down Payment on, Amount Outstanding as on, Add : Interest @5% for, 1-1-2011, Jan. to Dec. 2011, 27,250, 1,363, 31-12-2011, 28,613, Amount Outstanding as on, Less : Instalment paid on, 31-12-2011, 10,000, 1-1-2012, 18,613, Amount Outstanding as on, Add : Interest @ 5% for, Jan. to Dec. 2012, 931, 31-12-2012, 31-12-2012, 19,544, 10,000, Amount Outstanding as on, Less : Instalment paid on, Amount Outstanding as on, Add : Interest (Bal. Fig.), ..., 1-1-2013, 9,544, 456, Jan. to Dec. 2013, 31-12-2013, 31-12-2013, 10,000, 10,000, Amount Outstanding as on, Less : Instalment paid on, Amount Outstanding on, The above details can be presented in a more convenient manner in the following table :, 31-12-2013, Nil, ..... .........., Scanned By Scanner Go, :::, : :: :, : :, : :, : ::: : :, :: : :, : :, ::

Page 5 :

Under the hire purchase system, the asset is not owned by the hirer (hire purchaser). Neverthelew,, depreciation is provided by the hire purchaser on such assets since : (a) it is used for the business and, (b) it is likely to be owned in near future on payment of the last instalment. Depreciation may he, depreciation is charged with reference to the cost of the asset i.e. its cash price and not its hite, charged either under the straight line method or the written down method. It should be noted that, 1,2, 5., (2) Work-out Ratio of closing hire price., (3) Apportion Interest in this ratio in row 3., (4) Fill-up row no, 4 = row 2 - row 3., 4., CALCULATION OF DEPRECIATION, purchase price., Illustration 6:, The Car Mart company purchases a motor car from Autoriders Company.on a hire purchasa, agreement on January 1, 2011, paying cash { 10,000, and agreeing to pay further three instalments, of 10,000 each on 31st December each year. The cash price of the car is 37,250 and the, Autoriders Company charges interest at 5% p.a. The Car Mart company writes off 10% p.a. as, depreciation on the reducing instalments system. Compute the amount of yearly depreciation., Solution :, Calculation of Depreciation, Particulars / Year, Year 1, Year 2, Year 3, 2011, 2012, 2013, Opening W.D.V. (1-1), Less : Depreciation @10% on Opening W.D.V., 37,250, 3,725, 33,525, 3,353, 30,172, 3,017, Closing W.D.V. (31-12), 33,525, 30,172, 27,155, %3D, 5., ACCOUNTING METHODS, How hire purchase transactions are recorded depends upon the frequency and value of such, transactions. If the vendor is basically a hire purchase trader, dealing in many such transactions, involving even small values, he will need to prepare a separate Hire Purchase Trading Account to, ascertain his gross profits from hire purchase dealings. He will then follow the "Stock method"., However, if the vendor only sometimes enters into a, deal involving a substantial amount, he will follow the "Sales Method" to record his hire purchase, transactions. Sales method is further divided into the following : (1) Full Cash Price method (also, known as Credit Purchase Method or Sales Method); (2) Actual Cash Price Method (also known as, Asset Accrual Method); and (3) Interest Suspense Method. We will be studying only the Full Cash, Price Method (Sales Method) as per the syllabus., purchase transaction by way of a special, Scanned By Scanner Go