Page 1 :

)Raw Materials : Next, the consumption of raw materials (also called 'direct materials') is shown, expenses incurred for processing., The value of Work-in-Process is made up of the cost of raw material and the manufacturing, materials not yet fully converted into finished goods, also known as partly finished goods., on the debit side of the Manufacturing Account. Work-in-process (or, Work-in-progress) means, nded.... It is divided into two equal sides Debit and Credit. (see Worksheet 5 for specimen, Manutacturing Account' to find out his cost of manufacture. Manufacturing Account means an, iount showing the summary of the cost of the manufacturing activity during the accounting year., ,on the manufacturing process, on the factory etc. The manufacturer, therefore prepares a, eans of machinery and labour at a factory. So, it is necessary for a manufacturer to spend on wages, urchased by him. A manufacturer purchases raw materials and converts them into finished goods by, manufacturer sells finished goods manufactured by him in his factory; while a trader sells goods, MANUFACTURING ACCOUNT, Opening Stock of WIP:The opening stock of Work-in-process (WIP) is shown as the first item, LAccounts of a Sole Proprietor, Manufacturing Account contains the following items:, 1fanufacturing Account is a ledger account. Its title is written as Manufacturing Account for the year, pinal, 415, MEANING, 4.1, Horkers,, a, FORM, 4.2, lanufacturing Account)., ITEMS, 4.3, raw, follows:, as, Opening stock of raw materials, Purchases of raw materials, Add, :, Add, Direct Purchase Expenses, (carriage inwards, freight inwards, octroi, customs duties), Purchase returns of raw materials, Closing stock of raw materials, Less, Less, = Consumption of raw materials, Direct Purchase Expenses means all expenses incurred in connection with purchase of raw, materials e.g. transportation, loading and unloading, coolie, insurance etc. Goods may be purchased, locally or imported from other countries. Local purchases involve expenses of Carriage inward,, Freight inward, Coolie and cartage etc. Imports involve expenses of dock dues, customs duties,, insurance etc. These expenses increase the cost of purchase of raw materials., Carriage Inward : Carriage expenses means expenses for transporting goods. These are also, known as freight, cartage, coolie and cartage etc. The expenses for transporting the goods, purchased from the supplier to manufacturer's premises, known as Carriage inward, Freight inward, etc. are debited to the Manufacturing Account. The expenses on transporting the goods sold from, manufacturer's premises to the customer, known as Carriage outward, Freight outward, are debited, to the Profit & Loss A/c. The expenses on transporting new machinery etc. purchased are debited, to the Machinery A/c., Octroi Duty : Octroi duties mean the taxes paid to a Municipality on goods brought within the, municipal area from outside. Octroi on purchase of goods is debited to the Manufacturing Account, Octroi on machinery purchased is debited to the Machinery A/c., Dock Dues, Custom Duties : Dock dues mean the expenses of unloading the goods in a port, Custom duties means the taxes paid to the Government on goods imported from other countries, eiso known as import duties. Freight, insurance, dock dues and customs duties on imports o, Scanned By Scanner Go

Page 2 :

direct or productive wages or direct labour costs. (A combined item of Wages and Salaries, as royalty, hire charges of special machinery, design expenses etc. While royalty for using know-, appearing in the trial balance is shown in the Manufacturing Account, while a combined item of, expenses on such exports (freight, dock dues for loading the goods on ship, export duties etc.), how connected with manufacturing process is taken to Manufacturing Account, royalty for use of, (3) Wages : These include the wages paid to workers directly engaged in production, also known as, grease (b) salary to supervisors (c) power and fuel (d) repairs and maintenance of factory building, and machinery (e) depreciation of factory assets such as factory building and machinery (î) rent,, Financial Accounting - I (F. Y.B. B.I., : SEM-I), 416, machinery imported, Should be debited to the Profit & Loss Account, Dock dues, custom duties on, are debited to the Machinery A/c., Salaries and Wages is shown in the Profit & Loss Account)., such, rade mark is a selling expense shown in the profit and loss account., (5) Factory Expenses : These include all expenses incurred at the factory such as, (a) stores, oil,, rates and taxes, insurance, lighting of factory building and so on., (6) Closing Stock of WIP : The value of closing stock of work-in-process is shown on the cred, side of the Manufacturing Account., INote : Alternatively, instead of showing opening WIP on debit and closing WIP on, difference between the opening and closing stocks of WIP is calculated first. If opening stock i, more than closing stock, the difference (opening stock of WIP - closing stock of WIP) is shown on, the debit of the Manufacturing A/c; if closing stock is more than opening stock (closing stock of, WIP - opening stock of WIP), the difference is shown on the credit side of the Manufacturing A/e, (7) Sale of Scrap : Sale of scrap is shown on the credit side of the Manufacturing Account., (8) Cost of Production : The cost of production of goods is found out by balancing the Manufacturing, Account. The Manufacturing Account is balanced like a ledger account. We take the totals of, both the debit and credit sides of the Manufacturing A/c. In a Manufacturing A/c, the debit side, will always be bigger than the credit side. This indicates the Net Cost of Production of the concem, Thus, Gross cost of production Less WIP (Closing) and Sales of scrap = Net cost of production., We write the amount of cost of production on the credit side of the Manufacturing, A/c and carry it down to the debit side of the Trading Account. The cost of production (also, known as cost of manufacture or cost of goods manufactured) is transferred to the Trading Account, in order to find out the Gross Profit or Gross Loss on sale of finished goods., credit, the, 4.4, CLOSING ENTRIES, The following worksheet shows entries to be passed to transfer the closing balances of the Goods, Accounts and other Manufacturing Expenses Accounts, to the Manufacturing Account:, WORKSHEET 1: CLOSING ENTRIES (MANUFACTURING A/C), No., Entries, Amount, Transfer Debit Balances:, Manufacturing Account, To Opening Stock of WIP A/c, To Raw Material Purchases A/c, To Direct Purchase Expenses A/c, To Wages A/c, To Manufacturing Expenses A/c, To Factory Expenses A/c, Closing Stock of WIP :, Closing Stock of WIP A/c, To Manufacturing Account, Sale of Scrap :, Sale of Scrap A/c, To Manufacturing Account, (1), Dr., (2), Dr., (3), Scanned By Scanner Go, Dr.

Page 3 :

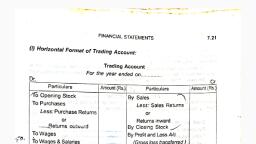

le Proprietor, (5) Closing Stock of FG: The closing stock of Finished Goods is shown as the next item on the, Since goods go out, these accounts show a credit balance. These balances are transferred to the, Finished Goods A/cs: Sometimes, the Trial Balance may contain Other Goods Accounts, 6) Sales of FG : The net sales of finished goods (sales less returns) are shown on the credit side of, )Cost of FG manufactured : Next, the Cost of goods manufactured transferred from the, 0Opening Stock of FG : The opening stock of Finished Goods (FG) is shown as the first item on, the debit side of the Trading Account., Manufacturing Account is shown on debit side of the Trading Account., Transfer Cost of Production to Trading A/c:, such as Goods Lost by Fire A/c, Goods Withdrawn by Proprietor A c. Goods Distributed as Free, Samples A/c etc. These accounts record the cost of finished goods lost, withdrawn or distributed., pinal, (4), Trading Account, To Manufacturing Account, Dr., 5., TRADING ACCOUNT OF A MANUFACTURER, 5.1 ITEMS, the Trading Account., (4)0, 4) Other, contain, credit of the Trading Account., credit side of the Trading Account., 16 Gross Profit or Gross Loss : The final result is found out by balancing the Trading ACcot, The Trading Account is balanced like a ledger account We take the totals of both the debit and, credit sides of the Trading A/c. If the credit side is bigger, it indicates that the Value of Sales is, more than the Cost of Goods Manufactured & Sold This is called the Gross Profit carned by the, business. Thus, Income From Goods Sold Less Cost of Goods Sold = Gross Profit. We write the, amount of Gross Profit on the debit side and carry it down to the Profit and Loss Account. If the, debit side is bigger, it indicates that the cost of manufacture is more than the value of sales. This, is called Gross Loss. Thus, Cost of Goods Sold Less Income From Goods Sold, write the amount of Gross Loss on the credit side of the Trading A/c and carry it down to the debit, side of the Profit and Loss Account. The Gross Profit or Gross Loss is transferred to the Profit, and Loss Account in order to find out the Net Profit or Net Loss after deducting other expenses., Thus, Gross Profit Less Expenses = Net Profit., Gross Loss. We, 5.2 CLOSING ENTRIES, The following worksheet shows entries to be passed to transfer the closing balances of the Sales, Accounts and other Accounts, to the Trading Account:, WORKSHEET 2: CLOSING ENTRIES (TRADING A/C), Amount, No., Entries, Transfer Debit Balances:, Trading Account, To Opening Stock of Finished Goods A/c, To Returns lInwards A/c, (1), Dr., Transfer Credit Balances:, Sales of Finished Goods A/c, Finished Goods Lost/Taken/Distributed A/c, To Trading Account, Closing Stock:, Closing Stock of Finished Goods A/c, To Trading Account, (2), Dr., Dr., Dr., (3), Seanned By Scannel Go

Page 4 :

of goods, on bringing such goods to his shop etc. The trader, therefore prepares a Trading Account', Financial Accounting - I (F.Y.B.B.I. : SEM-I), 418, Transfer Gross Profit or Gross Loss to Profit & Loss A/c:, (i) Gross Profit :, Trading Account, To Profit & Loss A/c, OR, (4), Dr., (ii) Gross Loss:, Profit & Loss A/c, Dr., To Trading ACcount, 6., TRADING ACCOUNT OF A TRADER, 6.1, MEANING, A trader sells finished goods purchased by him. So, it is necessary for a trader to spend on, purchase, to find out the result of his trading activity. Trading Account means an account showing the., and final result of the trading activity during the accounting year. Trading activity means purchase, sale or return of goods. The final result of the trading activity during the year may be either tradine, profit (gross profit) or trading loss (gross loss)., summary, 6.2, CLOSING ENTRIES, The following worksheet shows the entries to be passed to transfer the closing balances of the Goods, Accounts and other Purchase Expenses Accounts, to the Trading Account:, WORKSHEET 3: CLOSING ENTRIES (TRADING A/C OF TRADER), No., Entries, Amount, Transfer Debit Balances:, Trading Account, To Opening Stock A/c, To Purchases A/c, To Returns Inwards A/c, To Carriage Inwards A/c, To Octroi A/c, To Dock Dues/Custom Duties A/c, (1), Dr., Transfer Credit Balances :, Sales A/c, (2), Dr., Returns Outwards A/c, Goods Lost/Taken/Distributed A/c, Dr., Dr., To Trading Account, Closing Stock:, Closing Stock A/c, To Trading Account, Transfer Gross Profit or Gross Loss to Profit & Loss A/c :, (i), Trading Account, To Profit & Loss A/c, (3), Dr., (4), Gross Profit :, Dr., OR, (ii) Gross Loss:, Profit & Loss A/c, Dr., To Trading Account, Scanned By Scanner Go

Page 5 :

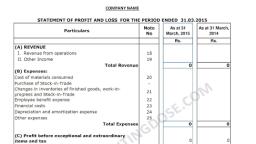

r ended.... It is divided into two equal sides : Debit and Credit as per the specimen shown in, Profit & Loss Account is a ledger account. Its title is written as Profit & Loss Account for the, .Selling Expenses, Financial Expenses, Depreciation, and other Unusual Expenses and, and expenses. Debit side of the Profit & Loss A/c shows Expenses like Administrative, PROFIT & LOSS ACCOUNT, the P&LA/c is transferred to the Capital Account of the proprietor., PALAC shows the result of business operations during the year. The net profit or net loss shown by, Losses. Credit side of the P & LA/c shows Other Business Income and Gains. The balance of the, Protit&Loss A/c (P& LA/c) shows closing balances of all nominal accounts relating to the remaining, 7., 419, MEANING, 7.1, come, Eypenses,, 7.2 FORM, L arksheet 6. The same form of Profit & Loss Account is used for manufacturer as well as a hadei, a, 7.3, ITEMS, The following items normally appear in a Profit & Loss Account., (1) Gross Profit or Gross Loss b/d: The Gross profit b/d from the Trading Account is the first item, on the credit of the Profit & Loss Account. If there is Gross loss, it is the first item shown on the, debit side of the Profit & Loss Account., (2) Administrative Expenses : Administrative expenses are the expenses incurred to plan. organise., administer and control the business. Examples are (a) salaries to office staff. (b) rent. rates., insurance, lighting of office, (c) printing, telephones, telex, postage. (d) depreciation and repairs, of office equipments, building, furniture, vehicles, (e) legal charges. audit charges. bank charges, etc., (3) Selling and Distribution Expenses : Selling expenses are the expenses incurred to create and, increase demand for goods. Distribution expenses are the expenses incurred from the time the, goods sold leave the trader's premises till the goods reach the customer. Examples are : (a), packing materials (b) salaries of Sales and Distribution staff (c) travelling, conveyance (d), commission or discount on sales (e) advertisement or showroom expenses (f) warehouse or sales, office rent, rates, insurance, lighting etc. (g) freight outward, carriage outwards, expenses on, exports (j) depreciation and repairs or delivery van, vehicles etc., (4) Finance & Interest Expenses : Finance expenses are the expenses incurred to obtain loan., loans., Profit & Loss Account., are credited to the Profit & Loss Account., of the P & L A/c., Scanned By Scanner Gö