Page 1 :

Scanned By Scanner Go, 103, Less : 50% of Debt, b., 00, Minimum Own Funds, 20,00,000, с., 100, 20,00,000, Maximum No. of Shares at par, Offer Price Given, a., 00, 0., 2,50,000, 25,000, 20, b., Buy-back at Offer Price (a x b), 151 Maximum Possible Amount of Buy-Back, be, 5,00,000, [Least 1 - 4], 5,00,000, Conclusion : Therefore Maximum number of shares the company can buy back at the given on, price of 20 = 3 5,00,000 ÷ 20 = 25,000 which is equal to the Maximum No. of Shares (25,000), eligible for buy-back,, Illustration 11, Following is the Balance Sheet of Creative Ltd. as on 31-3-2013 :, %3D, %3D, Liabilities, Assets, 9,00,000, 1,00,000, 3,00,000 Net Block of Fixed Assets, 1,00,000| Long Term Investments, 1,00,000 Bank Balance, 1,00,000, 1,00,000, 8,00,000, 5,00,000, Equity Shares of { 10 each, Preference Shares of 10 each, 10,50,000, Securities Premium, General Reserve, Profit and Loss Account, Debentures, Trade Payables, 20,50,000, 20,50,000 Total, Keeping in view all the legal requirements, ascertain the maximum number of equity shares that, Creative Ltd. can buy back @ 30 per share, being the current market price., Total, (T.Y.B.Com., Oct. 2014, adapted), Solution :, CONDITIONS FOR BUY-BACK [When Offer Price is given]

Page 2 :

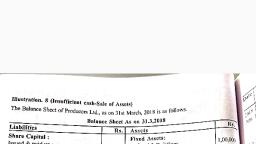

Scanned By Scanner, Illustratiok 14)., he Balance Sheet to Ketan Ltd. (a non-listed company) as on 31st March, 2015 is as follows :, Liabilities, Assets, Equity Shares of 10,each, 10% Preference Shares, 6,00,000| Fixed Assets, Investments, |20,90,00원, 6,00,000, 8,10,00, 1,50,000 Current Assets, 1,20,000, 2,00,000, 1,80,000, 10,00,000, 8,00,000, 4,50,000, of 100 each, (including Bank Balance, { 1,25,000), Securities Premium, General Reserve, Profit and Loss Account, 10% Debentures, Term Loan from Dena Bank, Current Liabilities, Total, 35,00,000 Total, 35,00,000, Keeping in view all the legal requirernents, ascenain the maxirnum no. of equity shares that Ketan, I td can buy back @ 50 per share Assune inat the buy back is acutally carried out. Investment, costing ? 3,00,000 sold för 7 3,20,000. Pass journal entries, Solution :, (T.Y.B.Com., April 2018, IDOL, April 2015, adapted), Step Condition, [1] Sources, General Reserve, а., n-alit ond Los s A/c., 2,00,000, ...

Page 3 :

Scanned By Scanner Go, - VII aie, y vuipliaiice with conditions for buy back., -...vu mat investments are sold before checking conditions of buy, back. The answer will change accordingly., llustration 15):, Following is the summarised Balance Sheet of Surya Ltd. as on 31-03-15 :, Liabilities, Assets, 16,00,000 Equity Shares of, 7 10 each, 8 paid up, Profit and Loss Account, Security Premium, 10% Debentures, Bank Term Loan, Creditors, Land and Buildings, 1,28,00,000 Plant and Machinery, 1,20,00,000 Furniture, 40,00,000| Investments, 40,00,000| Debtors, 40,00,000 Bank Balance, 60,00,000| Stock, 60,00,000, 60,00,000, 44,00,000, 30,00,000, 94,00,000, 1,00,00,000, 40,00,000, 4,28,00,000, 4,28,00,000, The company decides to buy-back maximum number of equity shares as may be permitted at a, price of 20 per share being the current market price., Assuming that the buy back is actually carried out, you are required to :, (a) Pass necessary Journal Entries in the books of the company and, (b) Prepare Notes to Accounts of Share Capital and Reserve and Surplus as they would appear in, Notes to Accounts forming part of the Balance Sheet of Surya Ltd. as on 31st March, 2015. (Do, not prepare the Balance Sheet), (FYBBI, April 2019, T.Y.B.Com., April 2016, adapted), Solution :, In the Books of Surya Ltd., CONDITIONS FOR BUY-BACK [When Offer Price is given]

Page 4 :

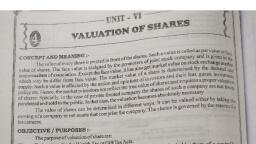

Scanned By Scanner Go, Buy Back of Equity Shares, M-, 113, Working Notes :, , Amount of Bonus Shares = 25% of (1,200 – 300) lakhs = 225 lakhs., 2. In the given solution, it is possible to adjust transfer to capital redemption reserve account for, capitalization of bonus shares from any other free reserves also., 31s, Illustratiok 19, Following is the Summary Balance Sheet of Suyog Ltd. (a non-listed company) as on 31st March,, khs, B00, 226, 74, S00, 60, 40, 2012., Liabilities, Assets, Fixed Assets, Land and Building, Plant and Machinery, Share Capital, Authorised :, 10,00,000 Equity Share of, { 10 each, Issued :, 8,00,000 Equity shares of, R 10 each ? 8 paid up, 30,00,000, 30,00,000, 22,00,000, 15,00,000, 1,00,00,000 Furniture, Investments, Current Assets, 47,00,000, 10,00,000, 40,00,000, 20,00,000, DO, 64,00,000 | Debtors, Bill Receivables (Trade), Reserves, 10,00,000 | Bank Balance, 50,00,000 Stock, 20,00,000, per, General Reserve, Profit and Loss Account, Securities Premium, ny, by, Secured Loans, 20,00,000, 11% Debentures, Unsecured Loans, Bank Term Loan, Current Liabilities, Creditors, 20,00,000, 15,00,000, 15,00,000, Bills Payable, 2,14,00,000, 2,14,00,000, The company decides to by back the maximum number of equity shares as may be permitted at a, price of 20 per share. Find out maximum number of shares to be bought back and pass Journal, Entries, (T.Y.B.Com., Oct. 06, 07, adapted), Solution :, Price is given], Ofe, CONDITIONS

Page 5 :

Scanned ByScahneł Go, Dr., |20,00, mium A/c, To Premium on Buy-back of Shares A/c, (Being the premium on buy-back adjusted), 20,00,000, Illustration 20):, he summary Balance Sheet of AFCONS LTD. (a non-listed company) as on 31st March, 2018 was, as follows :, Liabilities, Assets, Équity Shares of 10 each, Preference Shares of 100 each, Security Premium, General Reserves, Profit & Loss Account, 4,00,000 Net Block of Fixed Assets, 1,00,000| Trade Investments, 1,27,500 Bank, 1,00,000, 1,22,500, 8,00,000, 1,50,000, 7,50,008, 50,00, 10,00,00, Debentures, Trade Payables, 18,00,000, 18,00,000, Keeping in view the legal requirements, ascertain the maximum number of equity shares that AFCONS, LTD. can buy back @ 25 per share., Pass Journal entries to record buy back., (T.Y.B.Com., Oct. 2005, adapted), Solution :, In the Books of Afcons Ltd., Maximum Possible Buy-back at an offer price or 25 per share, (A), Step Condition, [1], Sources, .00.000