Page 1 :

CHAPTER, , 13, , ACCOUNTING FOR BRANCHES, INCLUDING FOREIGN, BRANCHES, LEARNING OUTCOMES, After studying this unit, you will be able to–, , , Understand concept of branches and their classification from, accounting point of view., , , , Distinguish between the accounting treatment of dependent, branches and independent branches., , , , Learn various methods of charging goods to branches., , , , Solve the problems, when goods are sent to branch at wholesale, price., , , , Prepare the reconciliation statement of branch and head office, transactions after finding the reasons for their disagreement., , , , Incorporate branch balances in the head office books., , , , Differentiate, branches., , , , Learn the techniques of foreign currency translation in case of, foreign branches., , between, , integral, , © The Institute of Chartered Accountants of India, , and, , non-integral, , foreign

Page 2 :

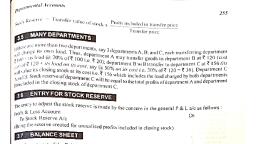

13.2, , ACCOUNTING, , Classification of Branches, , Inland Branches, , Independent Branches which, maintain independent, accounting records, , Foreign Branches, , Dependent Branches for which, whole accounting records are, kept at Head Office, , Methods of maintaining accounts of Dependent, Branches, Goods invoiced at, cost or selling price, , Debtors, Method, , Stock and, Debtors, Method, , Goods invoiced at, wholesale price, Trading and profit, and loss account, method (final, Accounts method, , © The Institute of Chartered Accountants of India, , Whole sale, branches, method

Page 3 :

ACCOUNTING FOR BRANCHES INCLUDING FOREIGN, , 13.3, , 1. INTRODUCTION, A branch can be described as any establishment carrying on either the same or, substantially the same activity as that carried on by head office of the company. It, must also be noted that the concept of a branch means existence of a head office;, for there can be no branch without a head office - the principal place of business., From the accounting point of view, branches may be classified as follows:, •, , Inland Branches which can be further classified as:, , •, , Independent Branches which maintain independent accounting records, , •, , Dependent Branches for which whole accounting records are kept at Head, Office, , •, , Foreign Branches, , 2. DISTINCTION, ACCOUNTS, ACCOUNTS, , BETWEEN, BRANCH, AND, DEPARTMENTAL, , Basis of distinction, , Branch Accounts, , 1., , Maintenance, of accounts, , Branch accounts may be Departmental accounts are, maintained either at maintained at one place only., branch or at head office., , 2., , Allocation, common, expenses, , 3., , Reconciliation, , of No allocation problem, arises, since, the, expenses in respect of, each branch can be, identified., , Departmental Accounts, , Common, expenses, are, distributed, among, the, departments concerned on, some, equitable, basis, considered suitable in the, case., , Reconciliation of head No such problem arises., office, and, branch, accounts is necessary in, case, of, Branches, maintaining, independent accounting, records at the end of, the accounting year., , © The Institute of Chartered Accountants of India

Page 4 :

13.4, , 4., , ACCOUNTING, , Conversion of At, the, time, of No such problem arises in, foreign, finalization of accounts, departmental accounts., currency, conversion of figures of, figures, foreign, branch, is, necessary., , 3. DEPENDENT BRANCHES, When the business policies and the administration of a branch are wholly, controlled by the head office and its accounts also are maintained by it the, branch is described as Dependent branch. Branch accounts, in such a case, are, maintained at the head office out of reports and returns received from the, branch. Some of the significant types of branches that are operated in this, manner are described below:, (a), , A branch set up merely for booking orders that are executed by the head, office. Such a branch only transmits orders to the head office;, , (b), , A branch established at a commercial center for the sale of goods supplied, by the head office, and under its direction all collections are made by the, H.O.; and, , (c), , A branch for the retail sale of goods, supplied by the head office., , Accounting in the case of first two types is simple. Only a record of expenses, incurred at the branch has to be maintained., But however, a retail branch is essentially a sale agency that principally sells, goods supplied by the head office for cash and, if so authorized, also on credit to, approved customers. Generally, cash collected is deposited into a local bank to, the credit of the head office and the head office issues cheques thereon for, meeting the expenses of the branch. In addition, the Branch Manager is provided, with a ‘float’ for petty expenses which is replenished from time to time on an, imprest basis. If, however, the branch also sells certain lines of goods, directly, purchased by it, the branch retains a part of the sale proceeds to pay for the, goods so purchased., , © The Institute of Chartered Accountants of India

Page 5 :

ACCOUNTING FOR BRANCHES INCLUDING FOREIGN, , 4. METHODS OF, BRANCHES, , CHARGING, , 13.5, , GOODS, , TO, , Goods may be invoiced to branches (1) at cost; or (2) at selling price; or (3) in case, of retail branches, at wholesale price; or (4) arbitrage price., Selling price method is adopted where the goods would be sold at a fixed price, by the branch. It is suitable for dealers in tea, petrol, ghee, etc. In this way, greater, control can be exercised over the working of a branch in as much as that the, branch balance in the head office books would always be composed of the value, of unsold stock at the branch and remittances or goods in transit. The arbitrary, price method is usually adopted if the selling price is not known or when it is not, considered desirable to disclose to the branch manager the profit made by the, branch., , 5. ACCOUNTING FOR DEPENDENT BRANCHES, Dependent branch does not maintain a complete record of its transactions. The, Head office may maintain accounts of dependent branches in any of the following, methods:, Methods of maintaining accounts of Dependent Branches, •, , If Goods are invoiced at cost or selling price: Debtors Method; Stock and, Debtors Method; Trading and profit and loss account method (Final, Accounts method), , •, , If Goods are invoiced at wholesale price: Whole Sale branch method, , 5.1 When goods are invoiced at cost, If goods are invoiced to the branch at cost, the trading results of branch can be, ascertained by following any of the three methods: (i) Debtors Method, (ii)Stock, and Debtors method, (iii) Trading and Profit and Loss Account (Final, Accounts) Method., For finding out the trading results of branch, it is assumed that the branch is an, entity separate from the head office. On the basis, a Branch Account is stated in, the head office books to which the price of goods or services provided or, expenses paid out are debited and correspondingly, the value of benefits and, cash received from the branch are credited., , © The Institute of Chartered Accountants of India

Page 6 :

13.6, , ACCOUNTING, , Debtors method This method of accounting is suitable for small sized branches., Under this method, separate branch account is maintained for each branch to, compute profit or loss made by each branch. The opening balance of stock,, debtors (if any), petty cash (if any), are debited to the Branch Account; the cost of, goods sent to branch as well as expenses of the branch paid by the head office,, e.g., salaries, rent, insurance, etc., are also debited to it. Conversely, amounts, remitted by the branch and the cost of goods returned by the branch are, credited. At the end of the year, the value of unsold stock, the total of customers’, balances outstanding and that of petty cash are brought into the branch account, on the credit side and then the branch account will reveal profit or loss; Debit, ‘balance’ will be the loss suffered by the working of the branch and vice versa. If, the branch is allowed to make small purchases of goods locally as well as to incur, expenses out of its cash receipts, it will be necessary for the branch to supply to, the head office a copy of the Cash Account, showing details of cash collections, and disbursements. To illustrate the various entries which are made in the Branch, Account, the proforma of a Branch Account is shown below:, Proforma Branch Account, To Balance b/d, Cash, Stock, Debtors, , Petty Cash, Fixed Assets, Prepaid Expenses, To Goods sent to Branch, , By Bank A/c (Cash remitted), By Return to H.O., By, , To Bank A/c, , Sundry Expenses, , To Profit & Loss A/c—Profit, , Cash, Stock, Debtors, Petty Cash, , Fixed Assets, , Salaries, Rent, , Balance c/d, , Prepaid Expenses, , By, , (if credit side is larger), , © The Institute of Chartered Accountants of India, , Profit and Loss A/c—Loss, , (if debit side is larger)

Page 7 :

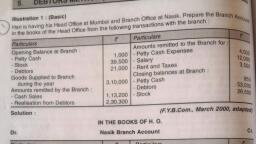

13.7, , ACCOUNTING FOR BRANCHES INCLUDING FOREIGN, Note:, 1., , Having credited the Branch Account by the actual cash received from, debtors, it would be wrong to debit the Branch Account, in respect of, discount or allowances to debtors., , 2., , The accuracy of the trading results as disclosed by the Branch Account, so, maintained, if considered necessary, can be proved by preparing a, Memorandum Branch Trading and Profit & Loss Account, in the usual way,, from the balances of various items of income and expenses contained in the, Branch Account., , Illustration 1, Buckingham Bros, Bombay have a branch at Nagpur. They send goods at cost to, their branch at Nagpur. However, direct purchases are also made by the branch for, which payments are made at head office. All the daily collections are transferred, from the branch to the head office., From the following, prepare Nagpur branch account in the books of head office by, Debtors method:, , `, Opening balance (1-1-20X1), Imprest Cash, , `, Bad Debts, , 1,000, , 2,000, , Sundry Debtors, , 25,000 Discount to Customers, , Stock: Transferred from H.O., , 24,000 Remittances to H.O., , Direct Purchases, , 16,000 (recd. by H.O.), , Cash Sales, , 45,000 remittances to H.O., , Credit Sales, Direct Purchases, Returns from Customers, Goods sent to branch from, H.O., Transfer from H.O. for Petty, , 1,65,000, , 1,30,000 (not recd. by H.O. so far), 45,000 Branch Exp. directly paid, by H.O., 3,000 Closing, 20X1), , Balance, , © The Institute of Chartered Accountants of India, , 5,000, 30,000, , (31-12-, , 60,000 Stock: Direct Purchase, 4,000 Transfer from H.O., , 2,000, , 10,000, 15,000

Page 8 :

13.8, , ACCOUNTING, , Cash expenses, , Debtors, , ?, , Imprest Cash, , ?, , Petty Cash expenses, , 4,000, , Solution, In the Books of Buckingham Bros, Bombay, Nagpur Branch Account, , `, To, , Opening, Assets, , Branch, , `, By, , Bank –, Remittances, received from, branch, , Stock, (24,000+16,000), , 40,000, , Cash Sales, , Debtors, , 25,000, , Cash, Debtors, , Imprest Cash, , 2,000, , To, , Goods, sent, Branch A/c, , To, , Creditors, Purchases), , To, , Bank (Sundry exp.), , To, , Bank, exp.), , cash, , 4,000 By, , To, , Net Profit transferred, to General Profit &, Loss A/c, , By, , (Petty, , to, , (Direct, , 60,000 By, , 45,000, from, , 1,20,000, , Cash, from, Debtors in transit, , 5,000, , 1,70,000, , 45,000, , Stock:, Transfer, H.O., , 30,000, , Direct Purchase, , 10,000, , Sundry Debtors, (W.N. 2), , 24,000, , Imprest, (W.N. 3), , from, , Cash, , 15,000, , 2,000, , 15,000, 2,21,000, , © The Institute of Chartered Accountants of India, , 2,21,000

Page 9 :

ACCOUNTING FOR BRANCHES INCLUDING FOREIGN, , 13.9, , Working Notes:, (1) Collections from debtors:, `, Total remittances (` 1,65,000 + ` 5,000), Less: Cash sales, , 1,70,000, , (45,000), , 1,25,000, , (2) Calculation of Sundry Debtors closing Balance:, , `, Opening Balance, , 25,000, , Add: Credit Sales, , 1,30,000, , Less: Returns, Discount, Bad debts & collections (3,000 + 2,000 +, 1,000 + 1,25,000), Closing balance, , 1,55,000, (1,31,000), 24,000, , (3) Calculation of closing balance of Imprest Cash, , `, Opening Balance, , 2,000, , Add: Transfer from H.O., , 4,000, 6,000, , Less: Expenses, , (4,000), , Closing balance, , 2,000, , Stock and Debtors method, If it is desired to exercise a more detailed control over the working of a branch,, the accounts of the branch are maintained under the Stock and Debtors Method., According to this method, the following accounts are maintained by the Head, Office:, Account, , Purpose, , 3. Branch Debtors Account, , Ascertainment of closing balance of, debtors, , 1. Branch Stock Account (or Branch Ascertainment of shortage or surplus, Trading Account), 2. Branch Profit and Loss Account, Calculation of net profit or loss, , © The Institute of Chartered Accountants of India

Page 10 :

13.10, , ACCOUNTING, , 4. Branch Expenses Account, 5. Goods sent to Branch Account, , Ascertainment of total expenses, incurred, Ascertainment of cost of goods sent to, branch, , If the branch is also allowed to purchase goods locally and to incur expenses out, of its cash collections, it would be necessary to maintain (i) a Branch Cash, Account, and (ii) an independent record of branch assets., The manner in which entries are recorded in the above method is shown below:, (a), (b), (c), , (d), (e), (f), (g), , (h), (i), (j), , (k), (l), , Transaction, , Account debited, , Cost of goods sent to Branch Stock A/c, the Branch, Remittances, expenses, , for Branch Cash A/c, , Any, assets, (e.g. Br Asset (Furniture) A/c, furniture) provided by, , Account credited, , Goods sent to Branch, A/c, (H.O.) Cash A/c, , (i) (H.O.) Cash A/c or, (ii) Creditors A/c, , H.O., (iii) (H.O.) Furniture A/c, Cost of goods returned Goods sent to Branch Branch Stock A/c, by the branch, A/c, Cash Sales, Branch, Credit Sales, Branch, Return of, debtors, , at, , the Branch Cash A/c, , Branch Stock A/c, , at, , the Branch Debtors A/c, , Branch Stock A/c, , goods, , to the Branch, , Cash paid by debtors, , by, , Branch Stock A/c, , Branch Debtors A/c, , Branch Cash A/c, , Branch Debtors A/c, , Discount & allowance Branch Expenses A/c, to debtors, bad debts, Remittances to H.O., (H.O.) Cash A/c, Expenses met by H.O., , Branch Expenses A/c, , Branch Debtors A/c, Branch Cash A/c, (H.O.) Cash A/c, , Closing Stock: Credit the Branch Stock Account with the value of closing, stock at cost. It will be carried down as opening balance (debit) for the, next accounting period. The Balance of the Branch Stock Account, (after, , © The Institute of Chartered Accountants of India

Page 11 :

ACCOUNTING FOR BRANCHES INCLUDING FOREIGN, , 13.11, , adjustment therein the value of closing stock), if in credit, will represent, the gross profit on sales and vice versa., Other Steps, (m), , Transfer Balance of Branch Stock Account to the Branch Profit and Loss, Account., , (n), , Transfer Balance of Branch Expenses Account to the debit of Branch Profit &, Loss Account., , (o), , The balance in the Branch P&L A/c will be transferred to the (H.O.) Profit &, Loss Account., , The credit balance in the Goods sent to Branch Account is afterwards transferred, to the Head Office Purchase Account or Trading Account (in case of, manufacturing concerns), it being the value of goods transferred to the Branch., Branch Trading and Profit and Loss Account (Final Accounts Method), In this method, Trading and Profit and Loss accounts are prepared considering, each branch as a separate entity. The main advantage of this method is that, it is, easy to prepare and understand. It also gives complete information of all, transactions which are ignored in the other methods. It should be noted that, Branch Trading and Profit and Loss account is merely a memorandum account, and therefore, the entries made there in do not have double entry effect., , Illustration 2, From the information given in the illustration 1, prepare Nagpur Branch Trading, and Profit and Loss Account in the books of head office., , Solution, , Buckingham Bros. Bombay, Nagpur Branch-Trading and Profit and Loss Account, for the year ending 31st December, 20X1, , `, To, To, To, To, , Opening Stock, Goods, transferred, from Head Office, Purchases, Gross Profit c/d, , `, , 40,000 By, 60,000, 45,000, 52,000, , By, , © The Institute of Chartered Accountants of India, , Sales, Cash, Credit sales, Less: Returns, Closing Stock, , 45,000, 1,30,000, 1,75,000, (3,000), , `, , 1,72,000, 25,000

Page 12 :

13.12, , To, To, To, To, To, , Expenses, Discounts, Bad Debts, Petty Cash Expenses, Net Profit transferred, to General P&L A/c, , ACCOUNTING, , 1,97,000, 30,000 By, 2,000, 1,000, 4,000, 15,000, , Gross Profit, b/d, , 1,97,000, 52,000, , 52,000, 52,000, The students may note that Gross Profit and Net Profit earned by the branch are, ascertainable in this method and also evaluating the performance of the branch is, very much easier in this method than in the ‘Debtors method’., Solving Illustration by all three methods, Given below is a simple problem, the solution whereto has been prepared in all, the three methods so as to show the distinguishing features of these methods., , Illustration 3, The Bombay Traders invoiced goods to its Delhi branch at cost. Head Office paid all, the branch expenses from its bank account, except petty cash expenses which were, met by the Branch. All the cash collected by the branch was banked on the same, day to the credit of the Head Office. The following is a summary of the transactions, entered into at the branch during the year ended December 31, 20X1., , `, Balances as on 1.1.20X1:, Stock, Debtors, Petty Cash,, , `, , 7,000 Bad Debts, , 600, , 12,600 Goods returned by customers, 200 Salaries & Wages, , 500, 6,200, , Goods sent from H.O., , 26,000 Rent & Rates, , 1,200, , Goods returned to H.O., Cash Sales, , 1,000 Sundry Expenses, 17,500 Cash received from Sundry, , 800, , Credit Sales, Allowances to customers, , 28,400 Debtors, 200 Balances as on 31.12.20X1:, , 28,500, , Discount to customers, , 1,400, , Stock, , 6,500, , Debtors, , 9,800, , Petty Cash, , © The Institute of Chartered Accountants of India, , 100

Page 13 :

ACCOUNTING FOR BRANCHES INCLUDING FOREIGN, , 13.13, , Prepare: (a) Branch Account (Debtors Method), (b) Branch Stock Account, Branch, Profit & Loss Account, Branch Debtors and Branch Expenses Account by adopting, the Stock and Debtors Method and (c) Branch Trading and Profit & Loss Account to, prove the results as disclosed by the Branch Account., , Solution, (a) Debtors Method, Delhi Branch Account, 20X1, Jan. 1, , `, To, , Balance b/d, Stock, Debtors, Petty cash, , Dec., 31, , 20X1, , `, , Dec., 31, , Cash Sales, , 12,600, , Cash from, 19,800, , Sundry, Debtors, , Goods sent, to, Branch, A/c, , To, , Bank:, , Returns, , Salaries &, , to H.O., 6,200, &, , Sundry Exp., To, , 26,000, , By, , 1,200, 800, , 8,200, , Balance, being, Profit, carried, to, (H.O.) P & L, A/c, Balance b/d, , 17,500, 28,500, , 46,000, , Goods sent, to Branch, A/c –, 1,000, , Balance c/d, Stock, , 6,500, , Debtors, , 9,800, , Petty Cash, , 100, , 16,400, , 9,400, 63,400, , To, , By, , `, , Bank, , To, , Rent, Rates, , 20X2, , By, , 7,000, 200, , Wages, , Jan. 1,, , `, , 16,400, , © The Institute of Chartered Accountants of India, , 63,400

Page 14 :

13.14, , ACCOUNTING, , (b) Stock and Debtors Method, Branch Stock Account, 20X1, , `, , Jan. 1, , To, , Stock, , Dec., 31, , To, , Goods Sent, , To, , 7,000, , to, Branch, A/c, Branch P&L, A/c, , 20X1, , `, , Dec. 31, , By, , 26,000, , Sales:, Cash, , 17,500, , Credit, 19,900, , 28,400, , Less: Return, By, , Goods sent, to Branch, A/c, Return, , By, , Balance c/d, (Stock), , (500), , 27,900, , 52,900, 20X2, Jan. 1, , To, , Balance b/d, , `, , 45,400, 1,000, , 6,500, 52,900, , 6,500, , Delhi Branch Debtors Account, 20X1, , ` 20X1, , `, , Jan. 1, , To, , Balance b/d, , 12,600 Dec. 31, , By, , Cash, , Dec. 31, , To, , Sales, , 28,400, , By, , Returns, , 500, , By, , Allowances, , 200, , By, , Discounts, , 1,400, , By, , Bad debts, , 600, , By, , Balance c/d, , 41,000, 20X2 Jan. 1, , To, , Balance b/d, , 28,500, , 9,800, 41,000, , 9,800, , Delhi Branch Expenses Account, 20X1, Dec. 31, , ` 20X1, To, , Salaries & Wages, , 6,200, , © The Institute of Chartered Accountants of India, , Dec. 31, , `, By Branch P & L, , 10,500

Page 15 :

13.15, , ACCOUNTING FOR BRANCHES INCLUDING FOREIGN, , To, , Rent & Rates, , 1,200, , To, , Sundry Expenses, , 800, , To, , Petty, expenses, 100), , Cash, (200-, , 100, , To, , Allowances, customers, , to, , 200, , To, , Discounts, , 1,400, , To, , Bad Debts, , 600, , A/c, , 10,500, , 10,500, , Delhi Branch Profit & Loss Account, 20X1, Dec. 31, , To Branch Exp. A/c, To Net Profit to, General P & L, A/c, , (c), , 10,500 Dec. 31, , `, By Gross, b/d, , Profit, , 19,900, , 9,400, 19,900, , 19,900, , Branch Trading and Profit and Loss Account, `, , To, , Stock, , To, , Goods sent, Less:, H.O., , `, 7,000, , Returns, , `, By, , 26,000, to, , Gross profit c/d, , (1,000), , Credit, 25,000, 19,900, , 17,500, 28,400, , Less:, Returns, By, , Closing Stock, , 51,900, To, , Salaries & Wages, , 6,200, , To, , Rent & Rates, , 1,200, , To, , Sundry Exp., , 800, , To, , Petty Cash Exp., , 100, , To, , Allowances, Customers, , to, , `, , Sales:, Cash, , from H.O., , To, , 20X1, , `, , (500), , 27,900, , 45,400, 6,500, 51,900, , By, , 200, , © The Institute of Chartered Accountants of India, , Gross Profit b/d, , 19,900

Page 16 :

13.16, , ACCOUNTING, , To, , Discounts, , 1,400, , To, , Bad Debts, , 600, , To, , Net Profit, , 9,400, 19,900, , 19,900, , 5.2 When goods are invoiced at selling price, It would be obvious that if Branch Account is debited with the sales price of, goods and subsequent to the debit being raised there is a change in the sale, price, the amount of debit either has to be increased or reduced on a, consideration of the quantity of unsold stock that was there at the branch at the, time the change took place. Such an adjustment will be necessary as often as the, change in sale price occurs., Moreover the amount of anticipatory profit, included in the value of unsold stock, with the branch at the close of the year will have to be eliminated before the, accounts of the branch are incorporated with that of the head office. This will be, done by creating a reserve., It may also be necessary to adjust the value of closing stock on account of the, physical losses of stock due to either pilferage or wastages which may have, occurred during the year. The last mentioned adjustments are made by debiting, the cost of the goods to Goods Lost Account and the amount of loading, (included in the lost goods), to the Branch Adjustment Account. The three, different methods that are usually adopted for maintaining accounts on this basis, are described below:, , (i), , Stock and Debtors Method, , Under this method, when goods are invoiced at selling price, one additional, account ie. ‘Branch Adjustment account’ is also prepared in addition to all the, accounts which are maintained on cost basis. (Refer para 5.1), •, , When goods are invoiced at selling price, the following points should be kept, in mind under this method:, , (i), , Journal Entries:, , (a), , ` Transaction, , Sale price of the, goods sent from, H.O. to the Branch, , Accounts debited, , Branch Stock A/c, (at selling price), , © The Institute of Chartered Accountants of India, , Accounts credited, , (i) Goods sent to, Branches A/c with, cost of the goods, sent.

Page 17 :

ACCOUNTING FOR BRANCHES INCLUDING FOREIGN, , (b), , (c), (d), (e), , (f), , Return of goods, (i), By the Branch to, H.O., (ii), Cash sales at the, Branch, Credit Sales at the, Branch, Goods returned to, Branch, by, customers, Goods lost in, (i), Transit or stolen, (ii), , 13.17, , (ii) Branch, Adjustment, A/c, (with the loading, i.e.,, Difference, between, the selling and cost, price)., Goods sent to Branch Branch Stock A/c, A/c (with the cost of, goods returned)., Branch Adjustment A/c, (with the loading), Cash/Bank A/c, , Branch Stock A/c, , Branch Debtors A/c, , Branch Stock A/c, , Branch Stock A/c, , Branch Debtors A/c, (at selling price), , Goods Lost in Transit Branch Stock A/c, A/c, or Goods Stolen A/c, (with cost of the goods), Branch Adjustment A/c, (with the loading), , (ii) Closing Stock, The balance in the Branch Stock Account at the close of the year normally should, be equal to the unsold stock at the Branch valued at sale price. But quite often, the value of stock actually held at the branch is either more or less than the, balance of the Branch Stock Account. In that event it will be necessary that the, balance in the Branch Stock Account is increased or reduced by debit or credit to, Goods Lost Account (at cost price of goods) and Branch Adjustment Account, (with the loading). The Stock Account at selling price, thus reveals loss of stock (or, surplus) and serves as a check on the branch in this respect., , © The Institute of Chartered Accountants of India

Page 18 :

13.18, , ACCOUNTING, , The discrepancy in the amount of balance in the Branch Stock Account and the, value of stock actually in hand, valued at sale price, may be the result of one or, more of the under-mentioned factors:, •, , An error in applying the percentage of loading., , •, , Goods having been sold either below or above the established selling price., , •, , A Commission to adjust returns or allowances., , •, , Physical loss of stock due to natural causes or pilferage., , •, , Errors in Stock-taking., , For example, the balance brought down in the Branch Stock Account is ` 100 in, excess of the value of stock actually held by the branch when the goods were, invoiced by the head office to the branch at 20% above cost and the discrepancy is, either due to pilferage or loss by fire, the actual loss to the firm would be ` 80, since, 20% of the invoice price would represent the element of profit. The adjusting entry, in such a case would be:, Dr.`, Goods Lost A/c, , Dr., , 80, , Branch Adjustment A/c, To Branch Stock A/c, , Dr., , 20, , Cr. `, , 100, , If on the other hand, a part of the sale proceeds has been misappropriated, then the, adjusting entry would be:, Dr., Loss by theft A/c, , Dr., , XX, , Branch Adjustment A/c, , Dr., , XX, , To Branch Stock A/c, , Cr., , XX, , Rebates and allowances allowed to customers are adjusted by debiting the, amounts of such allowances to Branch Adjustment Account and crediting Branch, Stock Account. But, if the gross amount of sale has been debited to Branch, debtors Account, this account would be credited instead of Branch Stock Account,, since the last mentioned account would have already received credit for the full, value., In the Goods Sent to Branch Account, the cost of the goods sent out to a branch, for sale is credited by debiting Branch Stock Account. Conversely, the cost of, © The Institute of Chartered Accountants of India

Page 19 :

ACCOUNTING FOR BRANCHES INCLUDING FOREIGN, , 13.19, , goods returned by the branch is debited to this account. As such the balance in, the account at the end of the year will be the cost of goods sent to the branch;, therefore, it will be transferred either to the Trading Account or to Purchases, Account of the head office., The amount of profit anticipated on sale of goods sent to the branch is credited, to the Branch Adjustment Account and conversely, the amount of profit not, realized in respect of goods returned by the branch to head office or that in, respect to stock remaining unsold with the branch at the close of the year is, debited. The balance in this account, at the end of year thus will consist of the, amount of Gross Profit earned on sale by the branch. On that account, it will be, transferred to the Branch Profit and Loss Account., , (iii) Elimination of unrealized profit in the closing stock, The balance in the Branch Stock account would be at the sale price; therefore, it, would be necessary to eliminate the element of profit included in such closing, stock. This is done by creating a reserve against unrealized profit, by debiting the, Branch Adjustment Account and crediting Stock Reserve Account with an amount, equal to the difference in the cost and selling price of unsold stock. Sometimes, instead of opening a separate account in respect of the reserve, the amount of, the difference is credited to Branch Stock Account. In that case, the credited, balance of such a reserve is also carried forward separately, along with the debit, balance in the Branch Stock Account; the difference between the two would be, the value of stock at cost. In either case, the credit balance will be deducted out, of the value of closing stock for the purpose of disclosure in the balance sheet, so, that the stock is shown at cost., An Alternative method: Where the gross profit of each branch is not required to, be ascertained separately, although the selling price is uniform, the amount of, goods sent to the branch is recorded only in two accounts namely - Branch Stock, Account and Goods Sent to Branch A/c., In this method, at the end of the year the Branch Stock Account is closed by, transfer of the balance representing the value of closing stock, at sale price, to the, Goods Sent to Branch Account. This has the effect of altogether eliminating, from the books the value of stock at the branch. The balance of Goods sent to, Branch Account is afterwards transferred to the Trading Account representing, the net sale price of goods sold at the branch. In that case, the value of closing, stock at the branch at cost will be subsequently introduced in the Trading, Account together with that of closing stock at the head office., © The Institute of Chartered Accountants of India

Page 20 :

13.20, , ACCOUNTING, , Illustration 4, Harrison of Chennai has a branch at New Delhi to which goods are sent @ 20%, above cost. The branch makes both cash and credit sales. Branch expenses are met, partly from H.O. and partly by the branch. The statement of expenses incurred by, the branch every month is sent to head office for recording., Following further details are given for the year ended 31st December, 20X1:, , `, Cost of goods sent to Branch at cost, Goods received by Branch till 31-12-20X1 at invoice price, , 2,00,000, 2,20,000, , Credit Sales for the year @ invoice price, Cash Sales for the year @ invoice price, , 1,65,000, 59,000, , Cash Remitted to head office, , 2,22,500, , Expenses paid by H.O., Bad Debts written off, , 12,000, 750, , Balances as on, Stock, Debtors, , 1-1-20X1, , 31-12-20X1, , `, , `, , 25,000 (Cost), 32,750, , 28,000 (invoice price), 26,000, , Cash in Hand, 5,000, 2,500, Show necessary ledger accounts in the books of the head office and determine the, Profit and Loss of the Branch for the year ended 31st December, 20X1., , Solution, Books of Harrison, Branch Stock Account, , `, To Balance b/d, , To Goods Sent to Branch A/c, To Branch Adjustment A/c, (Excess of sale, over invoice price), , `, , 30,000 By Branch Debtors, , 2,40,000 By Branch Bank, 2,000 By Balance c/d, , Goods in Transit, (` 2,40,000 –` 2,20,000), , 2,72,000, , © The Institute of Chartered Accountants of India, , Stock at Branch, , 1,65,000, , 59,000, , 20,000, 28,000, , 2,72,000

Page 21 :

ACCOUNTING FOR BRANCHES INCLUDING FOREIGN, , 13.21, , Branch Debtors Account, `, To Balance b/d, , `, , 32,750, , To Branch Stock, , By Bad debts written off, , 1,65,000, , By Branch, Cashcollection (bal. fig.), By Balance c/d, , 1,97,750, , 750, , 1,71,000, , 26,000, , 1,97,750, , Branch Cash Account, `, To Balance b/d, To Branch Stock, , To Bank (as per contra), To Branch Debtors, , 5,000, 59,000, , 12,000, 1,71,000, , 2,47,000, , `, By Bank Remit to H.O., By Branch profit & loss A/c, (exp. paid by H.O.), By Branch profit & loss A/c, , [Bal. fig. (exp. paid by, Branch)], By Balance c/d, , 2,22,500, 12,000, 10,000, , 2,500, , 2,47,000, , Branch Adjustment Account, `, To Stock Reserve (on closing, stock (48,000 × 1/6), To Gross Profit c/d, , 8,000, 39,000, 47,000, , `, By Stock Reserve opening, (25000 × 20%), By Goods sent to Branch A/c, By Branch Stock A/c, , 5,000, 40,000, , 2,000, , 47,000, , Branch Profit and Loss Account, `, To Branch Expenses (paid by, HO: ` 12,000 and paid by, Branch ` 10,000), To Branch Debtors-Bad debts, To Net Profit, , 22,000 By Gross Profit b/d, , `, 39,000, , 750, , 16,250, 39,000, , © The Institute of Chartered Accountants of India, , 39,000

Page 22 :

13.22, , ACCOUNTING, , Goods Sent to Branch Account, `, To Branch Adjustment A/c, , `, , 40,000 By Branch to Stock A/c, , To Purchase A/c - Transfer, , 2,00,000, 2,40,000, , 2,40,000, 2,40,000, , Debtors Method, Under this method, the principal accounts that will be maintained are:, •, , The Branch Account;, , •, , The Goods Sent to Branch Account; and, , •, , The Stock Reserve Account., , Entries in these accounts will be made in the following manner:, (a), (b), , (c), (d), (e), , (f), (g), , Transaction, , Account debited, , ‘Loading being the, difference, between, selling price and cost, of goods, Returns to H.O. at, selling price, , Goods Sent to Branch Branch A/c, A/c, , Goods sent to Branch Branch A/c, at selling price, , Account credited, , Goods Sent to Branch, A/c, , Goods Sent to Branch Branch A/c, A/c, , ‘Loading’ in respect of Branch A/c, goods returned to H.O., ‘Loading’ included in Stock Reserve A/c, the opening stock to, reduce it, , Goods Sent to Branch, A/c, Branch A/c, , ‘Loading’ included in Branch A/c, closing stock to reduce, it to cost, , Stock Reserve A/c, , Closing stock at selling Branch Stock A/c, price, , Branch A/c, , It will be observed that entries in the Branch Account in respect of goods sent to, a branch or returned by it, as well as those for the opening and closing stock, will, be at selling price. In consequence, the Branch Account is maintained at selling price., © The Institute of Chartered Accountants of India

Page 23 :

ACCOUNTING FOR BRANCHES INCLUDING FOREIGN, , 13.23, , Hence the Branch Account will not correctly show the trading profit of the Branch, unless these amounts are adjusted to cost. Such an adjustment is effected by, making contra entries in ‘Goods Sent to Branch A/c’ and ‘Stock Reserve Account’., In respect of closing stock at branch for the purpose of disclosure in the Balance, Sheet, the credit balance in the ‘Stock Reserve Account’ at the end of the year will, be deducted from the value of the closing stock, so as to reduce it to close; it will, be carried forward as a separate balance to the following year, for being, transferred to the credit of the Branch Account., , Illustration 5, Take figures from Illustration 4 and prepare branch account following debtors’ method., , Solution, Books of Harrison, New Delhi Branch Account, `, To Balance b/d, Stock, Debtors, Cash, , To Goods Sent to Branch A/c, (2,00,000 + 20% of, 2,00,000), To Bank (Exp. paid by, H.O.), To Net Profit Transferred, to H.O. Profit and Loss, A/c, To Balance, reserve, stock), , c/d (Stock, on closing, , `, , By Balance b/d, 30,000, Stock Reserve, , 32,750 By Goods Sent to Branch A/c, 5,000 By Bank-Remittance, , 2,40,000, , 5,000, , 40,000, , received from the Branch:, , 12,000, , Cash sales, , 16,250, , Debtors Collection1,63,500 2,22,500, (W.N.1), (Net of expense), , 8,000, , By Balance c/d, , 3,44,000, , © The Institute of Chartered Accountants of India, , 59,000, , Stock (including Transit), (W.N.2), Debtors, Cash, , 48,000, 26,000, , 2,500, , 3,44,000

Page 24 :

13.24, , ACCOUNTING, , Working Note:, 1. Collection from debtors = Total collection – Cash sales, = 2,22,500 – 59,000 = 1,63,500, 2. Closing stock = Stock at branch + Goods sent by H.O. – Goods received by Branch, = 28,000 +2,40,000 – 2,20,000 = 48,000, , Trading and Profit and Loss Account (Final Accounts) Method, All items of memorandum Branch Trading and Profit and Loss Account are to be, converted into cost price if the goods are invoiced to branch at selling price., Other points will remain same as already discussed in Para 5.1 for this method if, goods are invoiced at cost., , Illustration 6, Following is the information of the Jammu branch of Best New Delhi for the year, ending, 31st March, 20X2 from the following:, (1), , Goods are invoiced to the branch at cost plus 20%., , (2), , The sale price is cost plus 50%., , (3), , Other information:, , `, Stock as on 01.04.20X1(invoice price), , 2,20,000, , Goods sent during the year(invoice price), , 11,00,000, , Sales during the year, , 12,00,000, , Expenses incurred at the branch, , 45,000, , Ascertain, (i), , the profit earned by the branch during the year., , (ii), , branch stock reserve in respect of unrealized profit., , © The Institute of Chartered Accountants of India

Page 25 :

ACCOUNTING FOR BRANCHES INCLUDING FOREIGN, , 13.25, , Solution, (i), , Calculation of profit earned by the branch, In the books of Jammu Branch, Trading Account and Profit and Loss Account, , Particulars, , Amount Particulars, , `, To Opening stock, To Goods received by Head, office, To Expenses, To Net profit, (ii), , Amount, , `, , 2,20,000 By Sales, 11,00,000 By Closing stock (Refer, W.N.), 45,000, 1,95,000, , 12,00,000, 3,60,000, , ________, , 15,60,000, , 15,60,000, , Stock reserve in respect of unrealised profit, = ` 3,60,000 x (20/120) = ` 60,000, , Working Note:, `, Cost Price, , 100, , Sale Price, Calculation of closing stock at invoice, price, , 150, `, , Invoice Price, , Opening stock at invoice price, , 120, , 2,20,000, , Goods received during the year at invoice, price, , 11,00,000, , Less : Cost of goods sold at invoice price, , (9,60,000) [12,00,000 x (120/150)], , Closing stock, , 13,20,000, , 3,60,000, , Illustration 7, Sell Well who carried on a retail business opened a branch X on January 1st, 20X1, where all sales were on credit basis. All goods required by the branch were supplied, from the Head Office and were invoiced to the branch at 10% above cost., , © The Institute of Chartered Accountants of India

Page 26 :

13.26, , ACCOUNTING, , The following were the transactions:, Jan. 20X1, , Feb. 20X1, , March 20X1, , `, , `, , `, , Goods sent to Branch (Purchase Price), , 40,000, , 50,000, , 60,000, , Sales as shown by the branch monthly, report, Cash received from Debtors and remitted to, H.O., Returns to H.O. (Invoice price to, Branch), , 38,000, , 42,000, , 55,000, , 20,000, , 51,000, , 35,000, , 1,200, , 600, , 2,400, , The stock of goods held by the branch on March 31, 20X1 amounted to ` 53,400 at, invoice to branch., Record these transactions in the Head Office books, showing balances as on 31st, March, 20X1 and the branch gross profit for the three months ended on that date., All workings should form part of your solution., , Solution, Books of Sell Well, Branch Account, , `, To Goods, sent, Branch A/c, [, , 110, ×1,50,000, 100, , To Stock, (W.N.2), , to, , ], Reserve, , To Profit, (bal.), transferred, to, General Profit &, Loss A/c, , `, By Cash-collected, from debtors, , 1,06,000, , By Goods sent to, Branch-returns, , 4,200, , 4,855 By Goods sent to, Branch (W.N. 1), , 14,618, , 1,65,000, , 37,363 By Balance c/d, , 2,07,218, , © The Institute of Chartered Accountants of India, , Stock, , 53,400, , Debtors, , 29,000, , 82,400, 2,07,218

Page 27 :

ACCOUNTING FOR BRANCHES INCLUDING FOREIGN, , 13.27, , Memorandum Branch Debtors Account, , `, To Balance b/d, To Sales, , — By Cash/Bank, 1,35,000 By Balance c/d, 1,35,000, , `, 1,06,000, 29,000, 1,35,000, , Goods Sent to Branch Account, , `, To Branch A/c (Returns), To Branch A/c (Loading), (W.N.1), To Purchases A/c, , 4,200 By Branch A/c, 14,618, 1,46,182, 1,65,000, , `, 1,65,000, , 1,65,000, , Working Notes:, 1., , Loading on Goods sent to Branch = 1/11 of (` 1,65,000 – ` 4,200) = ` 14,618, , 2., , Stock Reserve = 1/11 of 53,400 = ` 4,855, , Illustration 8, Hindustan Industries Mumbai has a branch in Cochin to which office goods are, invoiced at cost plus 25%. The branch sells both for cash and on credit. Branch, Expenses are paid direct from head office, and the Branch has to remit all cash, received into the Head Office Bank Account., From the following details, relating to calendar year 20X1, prepare the accounts in, the Head Office Ledger and ascertain the Branch Profit. Branch does not maintain, any books of account, but sends weekly returns to the Head Office:, , `, Goods received from Head Office at invoice price, , 6,00,000, , Returns to Head Office at invoice price, , 12,000, , Stock at Cochin as on 1st Jan., 20X1, , 60,000, , Sales in the year -, , Cash, , 2,00,000, , Credit, , 3,60,000, , Sundry Debtors at Cochin as on 1st Jan. 20X1, Cash received from Debtors, , © The Institute of Chartered Accountants of India, , 72,000, 3,20,000

Page 28 :

13.28, , ACCOUNTING, , Discount allowed to Debtors, , 6,000, , Bad debts in the year, , 4,000, , Sales returns at Cochin Branch, , 8,000, , Rent, Rates, Taxes at Branch, Salaries, Wages, Bonus at Branch, , 18,000, 60,000, , Office Expenses, Stock at Branch on 31st Dec. 20X1 at invoice price, , 6,000, 1,20,000, , Prepare Branch accounts in books of head office by Stock and debtors method., , Solution, Books of Hindustan Industries, Mumbai, Cochin Branch Stock Account, , `, To Balance b/d, To Goods sent to Branch, A/c, To Branch Debtors A/c, (sales return), To Branch P &, (surplus), , L, , A/c, , `, , 60,000 By Bank A/c (Cash sales), 6,00,000 By Branch Debtors (Cr. sales), By Goods sent to Branch, , 8,000, (Returns to H.O.), 24,000 By Balance c/d (closing, stock), , 6,92,000, , 2,00,000, 3,60,000, , 12,000, 1,20,000, 6,92,000, , Cochin Branch Stock Adjustment Account, , `, To Goods sent to Branch A/c, (1/5 of ` 12,000) (on, returns), To Branch P & L A/c (Profit, on sale at invoice price), To Balance c/d (1/5 of `, 1,20,000), , 2,400 By Balance b/d, (1/5 of ` 60,000), 1,05,600 By Goods sent to Branch, A/c, (1/5, of, `, 6,00,000), , `, 12,000, , 1,20,000, , 24,000, 1,32,000, , © The Institute of Chartered Accountants of India, , 1,32,000

Page 29 :

13.29, , ACCOUNTING FOR BRANCHES INCLUDING FOREIGN, Goods Sent to Branch Account, , `, To Cochin, Branch, Adjustment A/c, , `, , Stock, , 1,20,000 By Cochin Branch Stock, A/c, , 6,00,000, , To Cochin Branch Stock A/c, (Returns), , 12,000 By Cochin Branch Stock, Adj. A/c, , 2,400, , To Purchases A/c, , 4,70,400, 6,02,400, , 6,02,400, , Branch Debtors Account, , `, To Balance b/d, , `, , 72,000 By Bank, , To Branch Stock A/c, , 3,20,000, , 3,60,000 By Branch P & L A/c, Discount, Bad Debts, , 6,000, 4,000, , 10,000, , By Branch Stock, (Sales Returns.), 4,32,000, , 8,000, , By Balance c/d, , 94,000, , 4,32,000, , Branch Expenses Account, , `, To Bank A/c (Rent, Rates &, Taxes), To Bank A/c (Salaries &, Wages), To Bank A/c (office exp.), , 18,000, 60,000, , `, By Branch Profit & Loss, A/c (Transfer), , 6,000, , 84,000, , 84,000, , 84,000, , Branch Profit & Loss Account for the year ending 31st Dec. 20X1, , `, To Branch Expenses A/c, (60,000+6,000+18,000), , `, , 84,000 By Branch, A/c, , Stock, , Adj., , 1,05,600, , By Branch, , stock, , A/c, , 24,000, , Discount, , © The Institute of Chartered Accountants of India

Page 30 :

13.30, , Bad debts, , ACCOUNTING, , 6,000, 4,000, , To Net Profit transferred to, Profit & Loss A/c, , 10,000, , (Sale over invoice, price), , 35,600, , 1,29,600, , 1,29,600, , Illustration 9, Arnold of Delhi, trades in Ghee and Oil. It has a branch at Lucknow. He dispatches, 25 tins of Oil @ ` 1,000 per tin and 15 tins of Ghee @ ` 1,500 per tin on 1st of, every month. The branch incurs some expenditure which is met out of its, collections; this is in addition to expenditure directly paid by Head Office., Following are the other details:, , Purchases, , Delhi, , Lucknow, , `, , `, , Ghee, , 14,75,000, , -, , Oil, , 29,32,000, , -, , 3,83,275, -, , 14,250, , 18,46,350, 27,41,250, , 3,42,750, 3,15,730, , -, , 6,47,330, , -, , 6,13,250, , Direct expenses, Expenses paid by H.O., Sales, , Ghee, Oil, , Collection during the year (including Cash, Sales), Remittance by Branch to Head Office, , (Delhi), Balance as on:, Stock :, , Ghee, Oil, , Debtors, Cash on Hand, Furniture & Fittings, Plant/Machinery, , © The Institute of Chartered Accountants of India, , 1-1-20X1, , 31-12-20X1, , 1,50,000, 3,50,000, , 3,12,500, 4,17,250, , 7,32,750, 70,520, , 55,250, , 21,500, , 19,350, , 3,07,250, , 7,73,500

Page 31 :

13.31, , ACCOUNTING FOR BRANCHES INCLUDING FOREIGN, , (Lucknow), Balance as on:, , 1-1-20X1, , 31-12-20X1, , Ghee, , 17,000, , 13,250, , Oil, , 27,000, , 44,750, , 75,750, , ?, , Cash on Hand, , 7,540, , 12,350, , Furniture & Fittings, Plant/Machinery, , 6,250, -, , 5,625, , Stock :, Debtors, , Addition to Plant/Machinery on 1-1-20X1 ` 6,02,750., Rate of Depreciation: Furniture / Fittings @ 10% and Plant / Machinery @ 15%, (already adjusted in the above figures)., The Branch Manager is entitled to 10% commission after charging such commission, whereas, the General Manager is entitled to 10% commission on overall company, profits after charging such commission. General Manager is also entitled to a salary, of ` 2,000 p.m. General expenses incurred by H.O. ` 24,000., Prepare Branch Account in the head office books and also prepare the Arnold’s, Trading and Profit and Loss A/c (excluding branch transactions)., , Solution, In the books of Arnold, Lucknow Branch Account, `, To, , Balance b/d, Opening stock:, , To, , By Bank (Remittance to, H.O.), , Ghee, , 17,000, , Debtors, Cash on hand, , 75,750, 7,540, , Oil, , Furniture & fittings, Goods sent to Branch, A/c, Ghee (15 x 1500 x 12), , `, , 27,000, , 6,250, , 2,70,000, , © The Institute of Chartered Accountants of India, , 6,13,250, , By Balance c/d, , Closing stock:, Ghee, , 13,250, , Cash on hand (W.N. 2), Furniture & fittings, , 12,350, 5,625, , Oil, Debtors (W.N. 1), , 44,750, 86,900

Page 32 :

13.32, , To, To, , To, , Oil (25 x 1000 x 12), , Bank (Expenses paid by, H.O.), Branch, Manager, commission, (` 58,335 × 1/11), Net Profit transferred, to General P & L A/c, , ACCOUNTING, , 3,00,000, , 14,250, , 5,303, 53,032, , 7,76,125, , 7,76,125, , Arnold, Trading and Profit and Loss account for the year ended 31st December, 20X1, (Excluding branch transactions), `, To Opening Stock:, , `, By Sales:, , Ghee, , 1,50,000, , Ghee, , 18,46,350, , Oil, , 3,50,000, , Oil, , 27,41,250, , To Purchases:, Ghee, , By Closing Stock:, 14,75,000, , Less: Goods sent, to Branch, (2,70,000), Oil, , 12,05,000, , Ghee, , 3,12,500, , Oil, , 4,17,250, , 29,32,000, , Less: Goods sent, to Branch, (3,00,000), , 26,32,000, , To Direct Expenses, , 3,83,275, , To Gross Profit, , 5,97,075, 53,17,350, , To Manager’s Salary, , 24,000 By Gross Profit, , To General Expenses, , 24,000 By Branch, transferred, , To Depreciation, Furniture @ 10% 2,150, , © The Institute of Chartered Accountants of India, , 53,17,350, 5,97,075, Profit, , 53,032

Page 33 :

ACCOUNTING FOR BRANCHES INCLUDING FOREIGN, , Plant & Machinery, , @ 15% (W.N.3) 1,36,500, , To General, Manager’s, Commission @ 10%, (i.e., 4,63,457 × 1/11), , To Net profit, , 13.33, , 1,38,650, , 42,132, 4,21,325, 6,50,107, , 6,50,107, , Working Notes:, (1) Debtors Account, , `, To Balance b/d, , `, , 75,750 By Cash Collections, , To Sales made during, , By Balance c/d, , 6,47,330, 86,900, , the year:, Ghee, , 3,42,750, , Oil, , 3,15,730, 7,34,230, , 7,34,230, , (2) Branch Cash Account, `, To Balance b/d, To Collections, , 7,540 By Remittance, , 6,47,330 By Exp. (Balance fig.), By Balance c/d, , 6,54,870, (3) Depreciation on Plant & Machinery, , `, 6,13,250, , 29,270, 12,350, , 6,54,870, , 3,07,250 x 15% + 6,02,750 x 15%, , 5.3 Goods invoiced at wholesale price to retail branches, Under this method, the Head Office (particularly, the manufacturing concern), supplies goods to its retail branches at wholesale price which is cost plus, wholesale profit. The profit attributable to such branches is the difference, between the sale proceeds of goods at the shops and the wholesale price of the, goods sold. For the purpose, it is assumed that the manufacturer would always be, © The Institute of Chartered Accountants of India

Page 34 :

13.34, , ACCOUNTING, , able to sell the goods on wholesale terms and thereby realizes profit equal to the, difference between the wholesale price and the cost. Many concerns, therefore,, invoice goods to such shops at wholesale price and determine profit or loss on, sale of goods on this basis. Accordingly, Branch Stock Account or the Trading, Account is debited with:, (a), , the value of opening stock at the Branch; and, , (b), , price of goods sent during the year at wholesale price., , It is credited by:, (a), , sales effected at the shop; and, , (b), , closing stock of goods valued at wholesale price., , The value of goods lost due to accident, theft etc. also is credited to the Branch, Stock Account or Trading Account calculated at the wholesale price. At this, stage, the Branch Stock or Trading Account will reveal the amount of gross profit, (or loss). It is transferred to the Branch Profit and Loss Account. On further being, debited with the expenses incurred at the shop and the wholesale price of goods, lost, the Branch Profit and Loss Account will disclose the net profit (or loss) at the, shop., Since the closing stock at the branch has to be valued at wholesale price, it would, be necessary to create a stock reserve equal to the difference between its, wholesale price and its cost (to the head office) by debiting the amount in the, Head Office Profit and Loss Account. This Stock Reserve is carried down to the next, year and then transferred to the credit of the (Head Office) Profit and Loss, Account., , Illustration 10, M/s Rahul operates a number of retail outlets to which goods are invoiced at, wholesale price which is cost plus 25%. These outlets sell the goods at the retail, price which is wholesale price plus 20%., Following is the information regarding one of the outlets for the year ended, 31.3.20X2:, , `, Stock at the outlet 1.4.20X1, Goods invoiced to the outlet during the year, Gross profit made by the outlet, , © The Institute of Chartered Accountants of India, , 30,000, 3,24,000, 60,000

Page 35 :

ACCOUNTING FOR BRANCHES INCLUDING FOREIGN, , 13.35, , Goods lost by fire, , ?, , Expenses of the outlet for the year, , 20,000, , Stock at the outlet 31.3.20X2, 36,000, You are required to prepare the following accounts in the books of Rahul Limited, for the year ended 31.3.20X2 :, (a), , Outlet Stock Account., , (b), , Outlet Profit & Loss Account., , (c), , Stock Reserve Account., , Solution, Outlet Stock Account, , `, To Balance b/d, To Goods sent to outlet, To Gross Profit c/d, , `, , 30,000 By Sales (Working Note 1), , 3,60,000, , 3,24,000 By Goods lost by fire (b.f.), , 18,000, , 60,000 By Balance c/d, 4,14,000, , 36,000, 4,14,000, , Outlet Profit & Loss Account, , `, , `, , To Expenses, , 20,000 By Gross Profit b/d, , To Goods lost by fire (W.N., 2), , 18,000, , To Profit transferred, , 22,000, 60,000, , 60,000, , 60,000, , Stock Reserve Account, , `, To HO P & L A/c – Transfer, To Balance, required), , c/d, , (Stock, , Res., , `, , 6,000 By Balance b/d, , 6,000, , 7,200 By HO P&L A/c (W.N., 3), , 7,200, , 13,200, , © The Institute of Chartered Accountants of India, , 13,200

Page 36 :

13.36, , ACCOUNTING, , Working Notes :, `, (1), , Wholesale Price, , 100+25, , = 125, , Retail Price, , 125 + 20%, , = 150, , Gross Profit at the outlet, Wholesale Price – Retail Price (150 – 125), Retail sales value = 60,000 ×, (2), , 150, 25, , 25, , = ` 3,60,000, , Goods lost by fire, Opening Stock + Goods Sent + Gross Profit – Sales – Closing Stock, 30,000 + 3,24,000 + 60,000 – 3,60,000 – 36,000 = ` 18,000, , (3), , Stock Reserve, Opening Stock, , = 30,000 × 25, , = ` 6,000, , Closing Stock, , = 36,000 × 25, , = ` 7,200, , 125, 125, , 6. ACCOUNTING FOR INDEPENDENT BRANCHES, When the size of the business is big, it is desirable that the branch maintains, complete records of its transactions. These branches are called independent, branches and each independent branch maintains comprehensive account books, for recording their transactions; therefore a separate trial balance of each branch, can be prepared. The head office maintains one ledger account for each such, branch, wherein all transactions between the head office and the branches are, recorded., Salient features of accounting system of an independent branch are as follows:, 1., , Branch maintains its entire books of account under double entry system., , 2., , Branch opens in its books a Head Office account to record all transactions, that take place between Head Office and branch. The Head Office maintains, a Branch account to record these transactions., , © The Institute of Chartered Accountants of India

Page 37 :

ACCOUNTING FOR BRANCHES INCLUDING FOREIGN, , 13.37, , 3., , Branch prepares its Trial Balance, Trading and profit and loss Account at the, end of the accounting period and sends copies of these statements to Head, Office for incorporation., , 4., , After receiving the final statements from branch, Head Office reconciles, between the two – Branch account in Head Office books and Head Office, account in Branch books., , 5., , Head office passes necessary journal entries to incorporate branch trial, balance in its books., , The Head Office Account in branch books and Branch Account in head office, books is maintained respectively., (i), , (ii), , (iii), , (iv), (v), , (vi), , Transactions, , Head office books, , Branch books, , Dispatch, of Branch A/c, Dr. Goods received from Dr., goods to branch, H.O. A/c, To Good sent to, by H.O., Branch A/c, To Head Office A/c, When goods are, Goods, sent, to Dr. Head Office A/c, Dr., Branch A/c, returned by the, To Goods received, Branch to H.O., To Branch A/c, from H.O. A/c, Branch Expenses No Entry, Expenses A/c, Dr., are paid by the, To Bank or Cash A/c, Branch, Branch Expenses, , Branch A/c, , Sales effected by, the Branch, , No Entry, , paid by H.O., To Bank or cash, Outside, No Entry, purchases, made by the, Branch, , (vii) Collection from, Cash or Bank A/c, Debtors of the, To Branch A/c, Branch recd. by, H.O., (viii) Payment by H.O. Branch A/c, for, purchase, To Bank, made by Branch, , © The Institute of Chartered Accountants of India, , Dr. Expenses A/c, , Dr., , To Head Office A/c, Purchases A/c, Dr., To Bank (or) Creditors, A/c, Cash or Debtors A/c, To Sales, , Dr. Head office A/c, To Sundry, A/c, , Debtors, , Dr., Dr., , Dr. Purchases (or) Sundry Dr., Creditors A/c, To Head Office

Page 38 :

13.38, , ACCOUNTING, , (ix), , Purchase of Asset, , (x), , Asset purchased Branch Asset A/c, by the Branch but, To Branch A/c, Asset, A/c, retained at H.O., books, Depreciation on Branch A/c, (x) above, To Branch Asset, , (xi), , by Branch, , No Entry, , Sundry Assets, , To Bank (or) Liability, , Dr., , Dr. Head office, , Dr., , Dr. Depreciation A/c, , Dr., , To Bank (or) Liability, , To Head Office A/c, , (xii) Remittance, of Branch A/c, Dr. Bank A/c, funds by H.O. to, To Bank, To Head Office, Branch, (xiii) Remittance, of Reverse entry of(xii), Reverse entry of, funds by Branch, above, above, to H.O., , Dr., , (xii), , (xiv) Transfer of goods (Recipient) Branch Dr. Supplying Branch H.O. Dr., A/c, A/c, from one Branch, to, another, To, Supplying, To Goods Received, branch, Branch A/c, from H.O. A/c, Recipient Branch, Goods Received from Dr., H.O. A/c, To Head Office A/c, , Students may find a few further practical situations and it is hoped that they can, pass entries on the basis of accounting principles explained above., The final result of these adjustments will be that so far as the Head Office is, concerned, the branch will be looked upon either as a debtor or creditor, as a, debtor if the amount of its assets is in excess of its liabilities and as a creditor if, the position is reverse., A debit balance in the Branch Account should always be equal to the net assets at, the branch. The important thing to remember, when independent sets of accounts, are maintained, is that the branch and head office books are connected with each, other only through the medium of the Branch and the Head Office Account which, are converse of each other.; also when accounts of the branch and head office are, consolidated both the Branch and Head Office Accounts will be eliminated., © The Institute of Chartered Accountants of India

Page 39 :

ACCOUNTING FOR BRANCHES INCLUDING FOREIGN, , 13.39, , 7. ADJUSTMENT AND RECONCILIATION OF, BRANCH AND HEAD OFFICE ACCOUNTS, If the branch and the head office accounts, converse of each other, do not tally,, these must be reconciled before the preparation of the final accounts of the, concern as a whole., For example if Head Office has sent goods worth ` 50,000 but the branch has, received till the closing date goods only ` 40,000, then the branch should treat `, 10,000 as goods in transit and should pass the following entry :, Goods in transit A/c, , Dr., , Cr., , Dr., , 10,000, , To Head Office A/c, , 10,000, , However, there will be no entry in Head office books being the point where the, event has been recorded in full, hence no further entries in Head office books., , 7.1 Reasons for Disagreement, Following are the possible reasons for the disagreement between Branch A/c in Head, office books and Head office A/c in Branch books on the closing date:, •, , Goods dispatched by the Head office not received by the branch. These, goods may be in transit or loss in transit., , •, , Goods returned by the branch to Head Office may have been received by, the H.O. Again, these goods may be in transit or lost in transit., , •, , Amount remitted by Head office to branch or vice versa remaining in transit on the, closing date., , •, , Receipt of income or payment or expenses relating to the Branch transacted, by the head office or vice versa, hence not recorded at the respective ends, wherein they are normally to be recorded., , The technique of reconciliation has been illustrated through the example given, below :, Head, office, Goods sent to Branch, © The Institute of Chartered Accountants of India, , Dr., , Branch, Cr., , 1,50,000, , Dr., -, , Cr.

Page 40 :

13.40, , ACCOUNTING, , Goods recd. from H.O. A/c, Branch A/c, , 1,12,000, , Head office A/c, , -, , -, , 1,40,000, , -, , -, , 78,500, , On analysis of Branch A/c in Head office books and Head office A/c in branch, books, you find:, •, , Goods valued `10,000 sent by head office has not been received by brand,, hence not recorded in the branch books., , •, , ` 15,000 remitted by the branch has not been received, hence not recorded, in the head office books., , •, , Direct collection of ` 10,500 from a customer of the branch by Head office, not informed to the branch, hence not recorded by the branch., , •, , A sum of ` 14,500 paid by branch to the suppliers of head office not, recorded at Head office., , •, , Head office expenditure allocation to the branch `12,000 not recorded in, the branch., , •, , ` 7,500 being FD interest of head office received by the branch on oral, instructions from H.O., not recorded in the head office books., Head Office, Books, , (i), , (ii), , Goods, transit, (` 10,000), , in, , Cash in Transit:, , (iii) Direct, Collection by, H.O. on behalf, of the Branch, (iv) Direct payment, , Branch Books, , Dr., , Cr., , Dr., , Cr., , `, , `, , `, , `, , -, , -, , Goods, in, Transit A/c, To, , Cash, in, Transit A/c, , 15,000, , To Branch, A/c, , Sundry, , Crs., , 10,000, , Head, office A/c, , 10,000, , (No Entry), 15,000, Head, A/c, , 14,500, , © The Institute of Chartered Accountants of India, , Office, , To Debtors, A/c, , 10,500, 10,500

Page 41 :

13.41, , ACCOUNTING FOR BRANCHES INCLUDING FOREIGN, , of ` 14,500 by, Branch on, behalf of H.O, (v), , A/c, To Branch, A/c, , 14,500, Branch, A/c, , Expenditure, Allocated, to, Branch, , (vi) Fixed Deposit, interest of `, 7,500 directly, received by the, Branch, , Branch A/c, , To Sundry, Income, , 7,500, , To, A/c, , Exp., , H.O., , 12,000, , 12,000, , 7,500, , In Branch Books, Head Office Account, `, To Sundry Debtors A/c, , `, , 10,500 By Balance b/d, , To Balance c/d, , 90,000 By Goods in transit, 1,00,500, , By Branch expenses, By Balance b/d, , 78,500, 10,000, 12,000, , 1,00,500, , 90,000, , In the Books of Head Office, Branch A/c, `, To Balance b/d, , To Sundry Income, , To Balance b/d, Important Points to be noted:, (i), , `, , 1,12,000 By Cash in Transit, , 7,500 By Sundry Creditors, , 1,19,500, , 90,000, , By Balance c/d, , 15,000, 14,500, 90,000, , 1,19,500, , the balance of Head Office A/c in Branch books and Branch A/c in Head, Office books have tallied., , © The Institute of Chartered Accountants of India

Page 42 :

13.42, , (ii), , ACCOUNTING, , Adjustment are made only at the point:, Where the recording has been omitted, and, Other than the point where action has been effected., , 7.2 Other points, (1) Inter-Branch Transactions, Inter-branch transactions are usually adjusted as if they were entered into only, with the head office. It is a very convenient method of treating such transaction, especially where the number of branches are large. Suppose Kolkata Branch, incurred an expenditure on advertisement of ` 1,000 on account of Delhi Branch,, the entries that would be made in such a case would be as follows:, Dr., , Cr., `, , In Kolkata Books:, Head Office A/c, To Cash, , In Delhi Books:, , Advertisement A/c, To H.O. A/c, In H.O. Books:, Delhi Branch A/c, , To Kolkata Branch A/c, , Dr., , 1,000, , Dr., , 1,000, , Dr., , 1,000, , 1,000, , 1,000, , 1,000, , (2) Fixed Assets, Often the accounts of fixed assets of a branch are kept in the head office books;, in such a case, at the end of the year, the amount of depreciation on the assets is, debited to the branch concerned by recording the following entry:, Branch Account, , Dr., , To Branch Asset Account, The branch will pass the following entry:, Depreciation Account, To Head Office Account, , © The Institute of Chartered Accountants of India, , Dr.

Page 43 :

ACCOUNTING FOR BRANCHES INCLUDING FOREIGN, , 13.43, , (3) Head office Expenses charged to Branch, Usually the head office devotes considerable time in attending to the affairs of, the branch; on that account, it may decide to raise a charge against the branch in, respect of the cost of such time. In such a case the amount is debited to the, branch as ‘Expenses’ and is credited to appropriate revenue head such as Salaries, Accounts, General Charges Account, Entertainment Account etc. The branch, credits the H.O. Account and debits Expenses Account., , 8. INCORPORATION OF BRANCH BALANCE IN, HEAD OFFICE BOOKS, The method that will be adopted for incorporating the trading result of the, branch with that of the head office would depend on whether it is desired to, prepare separate Profit & Loss Account and Balance Sheet of the branch and the, Head Office or consolidated statement of account of both branch and head office., In the first-mentioned case, the amount of profit or loss shown by the Profit &, Loss Account of the branch only will be transferred to Head office Account in the, branch books and a converse entry will be passed in the Head Office books by, debit to the Branch Account. This method has already been illustrated above. In, such a case, not only the Profit & Loss Account of the branch and that of the head, office would be prepared separately but also there would be separate Balance, Sheet for the branch and the head office. The branch Balance Sheet would show, the amount advanced by the head office to it, as capital. In the head office, Balance Sheet, the same amount would be shown as an advance to the branch., If however, it is desired to prepare a consolidated Profit & Loss Account and, Balance Sheet, individual balances of all the revenue accounts would be, separately transferred to the Head Office Account by debit or credit in the branch, books and the converse entries would be passed in the head office books. The, effect thereof will be similar to the amount of net profit or loss of the branch, having been transferred since it would be composed of the balances that have, been transferred. In case it is also desired that consolidated balance sheet of the, branch and the head office should be prepared, it will also be necessary to, transfer the balance of assets and liabilities of the branch to the head office. The, adjusting entries that would be passed in this respect are shown below:, (a), , Head Office Account, To Asset (individual) Account, , © The Institute of Chartered Accountants of India, , Dr.

Page 44 :

13.44, , (b), , ACCOUNTING, , (Individual) Liability Account, , Dr., , To Head Office Account, Converse entries are passed in the head office books., It is obvious that after afore-mentioned entries have been passed, the Branch, Account in the Head Office books and Head Office Account in the branch books, will be closed and it will be necessary to restart them at the beginning of the next, year., In consequence, at the beginning of the following year, the under-mentioned, entry is recorded by the branch:, Asset Account (In Detail), , Dr., , To Liability Accounts (In Detail), To H.O. Account (The difference between assets and liabilities), , Illustration 11, Messrs Ramchand & Co., Hyderabad have a branch in Delhi. The Delhi Branch deals, not only in the goods from Head Office but also buys some auxiliary goods and, deals in them. They, however, do not prepare any Profit & Loss Account but close all, accounts to the Head Office at the end of the year and open them afresh on the, basis of advice from their Head Office. The fixed assets accounts are also, maintained at the Head Office., The goods from the Head Office are invoiced at selling prices to give a profit of 20, per cent on the sale price. The goods sent from the branch to Head Office are at, cost. From the following prepare Branch Trading and Profit & Loss Account and, Branch Assets Account in the Head Office Books., Trial Balance of the Delhi Branch as on 31-12-20X1, Debit, , ` Credit, , Head office opening balance on, 1-1-20X1, Goods from H.O., , 15,000 Sales, , Purchases, , 20,000 Head Office Current A/c, , 50,000 Goods to H.O., , Opening Stock, (H.O. supplies goods at invoice, prices), , Sundry Creditors, 4,000, , © The Institute of Chartered Accountants of India, , `, 1,00,000, 3,000, 15,000, 3,000

Page 45 :

ACCOUNTING FOR BRANCHES INCLUDING FOREIGN, , Opening Stock of other goods, , 500, , Salaries, , 7,000, , Rent, , 3,000, , Office expenditure, Cash on Hand, , 2,000, 500, , Cash at Bank, , 4,000, , Sundry Debtors, , 13.45, , 15,000, 1,21,00, 0, , 1,21,000, , The Branch balances as on 1st January, 20X1, were as under: Furniture ` 5,000;, Sundry Debtors ` 9,500; Cash ` 1,000, Creditors ` 30,000. The closing stock at, branch of the head office goods at invoice price is ` 3,000 and that of purchased, goods at cost is ` 1,000. Depreciation is to be provided at 10 per cent on branch, assets., , Solution, Delhi Branch Trading and Profit & Loss Account, for the year ended 31st Dec., 20X1, `, To Opening Stock:, , By, , Head, office 3,200, Goods, (4,000 x 80%), Others, , 500, , By, By, 3,700, , To Goods, to, Branch, (50,000 x 80%), , 40,000, , To Gross Profit c/d, , 42,700, , To Purchases, , To Salaries, To Rent, , `, Sales, , 1,00,000, , Goods, from, Branch, Closing Stock :, Head, Office, goods, (3,000 x 80%), Others, , 3,000, , 2,400, , 1,000, , 3,400, , 20,000, 1,06,400, , 7,000 By, 3,000, , © The Institute of Chartered Accountants of India, , Gross profit b/d, , 1,06,400, , 42,700

Page 46 :

13.46, , To Office, Expenses, To Dep., furniture, 10%, , ACCOUNTING, , 2,000, on, @, , 500, , To Net profit, , 30,200, 42,700, , 42,700, , Branch (Fixed) Assets Account (In Head Office Books), 20X1, Jan. 1, , ` 20X1, To, , Balance b/d, , `, , 5,000 Dec., 31, , By, , Delhi Branch A/c, , By, , Balance c/d, , (Depreciation), , 5,000, , 500, 4,500, 5,000, , 20X2, Jan. 1, , To, , Balance b/d, , 4,500, , Working Notes:, Cash/Bank Account (Branch Books), `, To Balance b/d, , To Cash, Received, Debtors **, , from, , `, , `, , 1,000 By, , Salaries, , 7,000, , By, , Office Exp., , 2,000, , By, By, , Cash Balance, Bank Balance, , 500, 4,000, , 94,500 By, , By, By, , Rent, , Creditors*, 47,000, Head Office (Balancing 32,000, fig.), , 95,500, *Opening Balance + Purchases – Closing balance = Payment, ` 30,000 + ` 20,000 – ` 3,000 = ` 47,000., © The Institute of Chartered Accountants of India, , 3,000, , 95,500

Page 47 :

13.47, , ACCOUNTING FOR BRANCHES INCLUDING FOREIGN, ** Opening Balance + Sales – Closing balance = Received, ` 9,500 + ` 1,00,000 – ` 15,000 = ` 94,500, Trial Balance of Delhi Branch as on 1-1-20X1, , Debtors, Cash, , Stock, , Dr., , Cr., , `, , `, , 9,500, H.O. Goods, Others, , 1,000, , 4,000, 500, , 4,500, , Creditors, , Head Office Account, , 15,000, 30,000, , 30,000, 30,000, , Head Office Account, `, To Balance (transfer), , 15,000 By Goods, Office, 32,000, , To Cash, , To Goods sent, , `, from, , 3,000, , 50,000, , Head 50,000, , 50,000, , Credit balance in Head Office Account before this transfer will be ` 15,000 credit., Note : Furniture A/c is maintained in Head office books; it is not a part of either, opening or closing balance., , Illustration 12, Ring Bell Ltd. Delhi has a Branch at Bombay where a separate set of books is used., The following is the trial balance extracted on 31st December, 20X1., Head Office Trial Balance, , `, , `, , Share Capital (Authorised: 10,000 Equity, Shares of ` 100 each):, Issued: 8,000 Equity Shares, , © The Institute of Chartered Accountants of India, , 8,00,000

Page 48 :

13.48, , ACCOUNTING, , Profit & Loss Account - 1-1-20X1, , 25,310, , General Reserve, , 1,00,000, , Fixed Assets, , 5,30,000, , Stock, , 2,22,470, , Debtors and Creditors, , 50,500, , 21,900, , Profit for 20X1, , 52,200, , Cash Balance, , 62,730, , Branch Current Account, , 1,33,710, 9,99,410, , 9,99,410, , Branch Trial Balance, , `, Fixed Assets, , 95,000, , Profit for 20X1, , 31,700, , Stock, , 50,460, , Debtors and Creditors, , 19,100, , Cash Balance, , `, , 10,400, , 6,550, , Head Office Current Account, , 1,29,010, 1,71,110, , 1,71,110, , The difference between the balances of the Current Account in the two sets of books, is accounted for as follows:, (a), , Cash remitted by the Branch on 31st December, 20X1, but received by the, Head Office on 1st January 20X2 - ` 3,000., , (b), , Stock stolen in transit from Head Office and charged to Branch by the Head, Office, but not credited to Head Office in the Branch books as the Branch, Manager declined to admit any liability (not covered by insurance) - ` 1,700., , Give the Branch Current Account in Head Office books after incorporating Branch Trial, Balance through journal., , Solution, The Branch Current Account in the Head Office Books and Head Office Current, Account in the Branch Books do not show the same balances. Therefore, in order, © The Institute of Chartered Accountants of India

Page 49 :

13.49, , ACCOUNTING FOR BRANCHES INCLUDING FOREIGN, , to reconcile them, the following journal entries will be passed in the Head Office, books :, Journal Entries, 20X1, , Dec., 31, , Cash in Transit A/c, To Branch Current A/c, , Dr., , Cr., , `, , `, , Dr., , 3,000, , Dr., , 1,700, , (Cash sent by the Branch on 31st Dec., 20X1, but received at H.O. on 1st Jan., 20X2), Loss by theft A/c, , To Branch Current A/c, , (Stock lost in transit from H.O. to Branch), , 3,000, , 1,700, , In order to incorporate, in the H.O. books, the given Branch trial balance which, has been drawn up after preparing the Branch Profit & Loss Account, the, following journal entries will be necessary:, Journal Entries, 20X1, Dec. 31, , `, Branch Current Account, , Dr., , `, , 31,700, , To Profit & Loss Account, , 31,700, , (Branch Profit for the year), Branch Fixed Assets, , Dr., , 95,000, , Branch Stock, , Dr., , 50,460, , Branch Debtors, , Dr., , 19,100, , Branch Cash, , Dr., , 6,550, , To Branch Current Account, (Branch, Books), , assets, , brought, , into, , 1,71,110, H.O., , Branch Current A/c, To Branch Creditors, (Branch creditors brought into H.O., Books), © The Institute of Chartered Accountants of India, , Dr., , 10,400, 10,400

Page 50 :

13.50, , ACCOUNTING, , Branch Current Account, , `, To Balance b/d, , `, , 1,33,710 By Cash in transit, , 3,000, , To Profit & Loss A/c, , 31,700 By Loss of theft, , 1,700, , To Branch Creditors, , 10,400 By Sundry Branch Assets, 1,75,810, , 1,71,110, 1,75,810, , Profit and Loss Account for 20X1, , `, To Loss by Theft, To Balance c/d, , `, , 1,700 By Balance b/d, 1,07,510 By Year’s Profit :, , 25,310, H.O., , 52,200, , Branch, , 31,700, , 1,09,210, , 1,09,210, , Illustration 13, KP manufactures a range of goods which it sells to wholesale customers only from, its head office. In addition, the H.O. transfers goods to a newly opened branch at, factory cost plus 15%. The branch then sells these goods to the general public on, only cash basis., The selling price to wholesale customers is designed to give a factory profit which, amounts to 30% of the sales value. The selling price to the general public is, designed to give a gross margin (i.e., selling price less cost of goods from H.O.) of, 30% of the sales value., KP operates from rented premises and leases all other types of fixed assets. The rent, and hire charges for these are included in the overhead costs shown in the trial, balances., From the information given below, you are required to prepare for the year ended, 31st Dec., 20X1 in columnar form., (a), , A Profit & Loss account for (i) H.O. (ii) the branch (iii) the entire business., , (b), , Balance Sheet as on 31st Dec., 20X1 for the entire business., , © The Institute of Chartered Accountants of India

Page 51 :

ACCOUNTING FOR BRANCHES INCLUDING FOREIGN, , 13.51, , H.O., , `, Raw materials purchased, Direct wages, Factory overheads, , Branch, , `, , `, , `, , 35,000, 1,08,500, 39,000, , Stock on 1-1-20X1, Raw materials, , 1,800, , Finished goods, Debtors, , 13,000, 37,000, , 9,200, , Cash, , 22,000, , 1,000, , Administrative Salaries, , 13,900, , 4,000, , Salesmen Salaries, , 22,500, , 6,200, , Other administrative &, selling overheads, , 12,500, , 2,300, , Inter-unit accounts, Capital, , 5,000, , 2,000, 50,000, , Sundry Creditors, Provision for unrealized profit in, stock, Sales, , 13,000, 1,200, 2,00,000, , Goods sent to Branch, Goods received from H.O., , 65,200, , 46,000, 44,500, 3,10,200, , 3,10,200, , 67,200, , 67,200, , Notes:, (1), , On 28th Dec., 20X1 the branch remitted ` 1,500 to the H.O. and this has not, yet been recorded in the H.O. books. Also on the same date, the H.O., dispatched goods to the branch invoiced at ` 1,500 and these too have not yet, been entered into the branch books. It is the company’s policy to adjust items, in transit in the books of the recipient., , (2), , The stock of raw materials held at the H.O. on 31st Dec., 20X1 was valued at `, 2,300., , (3), , You are advised that:, •, , there were no stock losses incurred at the H.O. or at the branch., , © The Institute of Chartered Accountants of India

Page 52 :

13.52, , (4), , ACCOUNTING, , •, , it is KP’s practice to value finished goods stock at the H.O. at factory cost., , •, , there were no opening or closing stock of work-in-progress., , Branch employees are entitled to a bonus of ` 156 under a bilateral, agreement., , Solution, In the books of KP, Trading and Profit & Loss Account for the year ended 31st Dec., 20X1, , To Material, consumed, (W.N.1), To Wages, To Factory, Overheads, To Opening, stock of, finished, goods, , H.O., , Branch, , Total, , H.O., , Branch, , Total, , `, , `, , `, , `, , `, , `, , 34,500, , -, , 34,500, , 2,00,000, , 65,200, , 2,65,200, , 1,08,500, , -, , 1,08,500, , 46,000, , -, , -, , 39,000, , -, , 39,000, , By Goods, Sent to, Branch, By Closing, stock, including, transit, (W.N.2), , 15,000, , 9,560, , 24,560, , 74,760, , 2,89,760, , 19,560, , 85,560, , 13,000, , To Goods, from H.O., To Gross, Profit c/d, (W.N.3), , 9,200, , 22,200, , 46,000, 66,000, , 19,560, , 85,560, , 2,61,000, , 74,760, , 2,89,760, , To Admn., Salaries, , 13,900, , 4,000, , 17,900, , To Salesmen, Salaries, , 22,500, , 6,200, , 28,700, , 12,500, , 2,300, , 14,800, , To Other, Admn. &, selling, , By Sales, , Overheads, , © The Institute of Chartered Accountants of India, , 2,61,000, By Gross, Profit b/d, , 66,000

Page 53 :

13.53, , ACCOUNTING FOR BRANCHES INCLUDING FOREIGN, , To Stock, Reserve, , 47, , -, , 47, , -, , 156, , 156, , 17,053, , 6,904, , 23,957, , 66,000, , 19,560, , 85,560, , (W.N.4), , To Bonus to, Staff, To Net Profit, , 66,000, , 19,560, , 85,560, , Balance Sheet as on 31st Dec., 20X1, `, Capital, Profit :, , H.O., , H.O., , Branch, , Total, , H.O., , Branch, , Total, , `, , `, , `, , `, , `, , `, , 50,000, , -, , -, , -, , -, , 50,000 Fixed Assets, , 17,053, , Branch, , 6,904, , Trade, , Creditors, , Current Assets:, 23,957, , 23,957 Raw material, Finished, , 13,000, , 13,000 Goods, , Bonus, , 156, , Payable, H.O., , Account*, , 156 (Less, Res.), , 10,404, , Stock, , Reserve, (W.N.4), , 15,000, , 9,560 23,313*, , Debtors, , 37,000, , -, , 37,000, , Cash, , 23,500, , 1,000, , 24,500, , 10,560, , 87,113, , transit item), Branch A/c, , 88,204, , 2,300, , Stock, , (including, , 1,247, , 2,300, , 10,560, , 87,113, , 10,404*, 88,204, , *9,560 × 100/115 i.e., (8,313 + 15,000) = ` 23,313, ** (5,000 + 6,904) – 1500 = ` 10,404., , Working Notes:, (1), , Material Consumed, Opening raw material + Raw Material Purchased – Closing raw material, = 1,800 + 35,000 - 2,300 = 34,500, , (2), , Closing stock at head office, (a), , Calculation of total factor cost = Material consumed + Wages +, Factory overhead, , © The Institute of Chartered Accountants of India

Page 54 :