Page 1 :

Basic Knowledge in General Banking, SL, ., 01., , 02., , 03., , 04., , 05., , Details, Chapter B: Banking Laws, What is Contract?, As per Section 2(h) of the Contract Act. 1872 ‘An agreement enforceable by law is contract., Section 2(e) of the said act provides- ‘Every promise and every set of promises, forming the, consideration for each other, is an agreement. Combining these two sections, we can safely opine, that contract is an agreement between two or more parties which is supported by consideration, and enforceable by law., Essentials of Contract:, Lawful offer and acceptance, Capacity to contract Certainty (no vagueness), Intention to create legal relationship, Free consent, Possibility of performance, Legal consideration, Legality of object, Oral/written/written/registered., Who are not capable to enter into a contract?, Minor, Drunkard, Lunatic, Insolvent, Idiot, Delirious, Senile, Section 12 contract-1872:, A person is said to be of sound mind for the purpose of making a contract if, at the time, when he makes it he is capable of understanding it and of forming a rational judgment as, to its effect upon his interests., A person who is usually of unsound mind, but occasionally of sound mind, may make a, contract when he is of sound mind., A person who is usually of sound mind, but occasionally of unsound mind, may not make, a contract when he is of unsound mind., In this connection it is noted that minor, idiot, drunkard, lunatic, senile person, insolvent,, delirious person etc. are not capable to contract and as such they cannot open bank, account., What is Indemnity? [Section 124 of Contract Act], According Section 124 of Contract Act, 1872 “A contract of indemnity is a contract wherein, one party promises to save the other from loss caused to him by the conduct of the promisor, himself or by the conduct of any other person.”, The person who promises to protect or compensate is called the indemnifier. The person to, whom the promise of indemnity is given is called the indemnity holder., , 06., , 07., , Example:, Mr. Joe is a shareholder of Alpha Ltd. lost his share certificate. Joe applies for a duplicate one., The company agrees, but on the condition that Joe compensates for the loss or damage to the, company if a third person brings the original certificate., What is Guarantee? [Section 126 of Contract Act], Section 126 of the Contract Act, 1872 defines a contract of guarantee as a contract to perform, the promise or discharge the liability of a third person in case of his default., Example:, Mr. Harry takes a loan from the bank for which Mr. Joseph has given the guarantee that if Harry, default in the payment of the said amount he will discharge the liability. Here Joseph plays the, role of surety, Harry is the principal debtor and Bank is the creditor., Parties of a Guarantee:, Surety (Guarantor), Principal Debtor (Customer), Creditor (Bank), Page | 1

Page 2 :

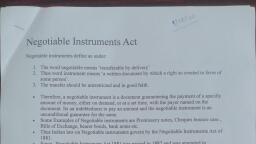

08., , Difference between Indemnity Contract and Guarantee Contract:, Indemnity, Guarantee, Basis of, Difference, 1. Definition A contract by which one party promises A contract to perform the promise,, to save the other from loss caused to or discharge the liability, of a third, him by the conduct of the promisor person in case of his default., himself, or by the conduct of any other [Section 126 of Contract Act], person. [Section 124 of Contract Act], 2. Example, A contract of Insurance is a contract of Mr. A borrows Rs. 10 lacs loan, Indemnity., from Mr. B. Mr. C has given, guarantee to Mr. B that “if Mr. A, doesn’t pay him, he will pay”., 3. Key word I will see you paid, If he doesn’t pay I will pay you, in the, contract, 4. No. of, There are two parties to the contract There are three parties to the viz., parties, viz. indemnifier (promisor) and the creditor, principal debtor and the, Indemnified (promise). In the above surety. In the above example, Mr., example, Insurer is the promissor A is the principal debtor; Mr. B is, (Indemnifier) and Insured is the the creditor and Mr. C is the, promisee (Indemnified)., surety., 5. Liability, Liability of the indemnifier to the Liability of the surety to the, of parties, indemnified, is, primary, and creditor is collateral or secondary,, independent., the primary liability being that of, the principal debtor., 6. No. of, There is only one contract in case of a In a contract of guarantee there are, contracts, contract of indemnity, i.e., between the three contracts, between principal, indemnifier and the indemnified., Debtor and Creditor; between, creditor and the surety and, between surety and principal, debtor., 7. Liability, The liability of the indemnifier arises There is usually an existing debt, emerge, only on the happening of a or duty, the performance of which, contingency., is guaranteed by the surety., 8. Liability, An indemnifier cannot sue a third party A surety, on discharging the debt, of third party for loss in his own name, because there due by the principal debtor, steps, is no privity of contract. He can do so into the shoes of the creditor. He, only if there is an assignment in his can proceed against the principal, favour., debtor in his own right, 9. Initiative, Contract, gets, formed, upon Contract gets formed upon, of contract, indemnifier`s interest, principal debtor`s interest, What do you mean by Negotiable Instruments:, According to Section 13 (a) of the Act, “Negotiable instrument means a promissory note, bill of, exchange or cheque payable either to order or to bearer, whether the word “order” or “bearer”, appear on the instrument or not.”, Thus, the term, negotiable instrument means a written document which creates a right in favor of, some person and which is freely transferable., , 09., 10., , Features of NI: Transferable (Negotiation, Delivery, Settlement of Debt) & Title, Page | 2

Page 3 :

What is Promissory notes? [Section 4], Section 4 of the Act defines, “A promissory note is an instrument in writing (note being a banknote or a currency note) containing an unconditional undertaking, signed by the maker, to pay a, certain sum of money to or to the order of a certain person, or to the bearer of the instruments.”, 11., What is Bill of Exchange? [Section 5], Section 5 of the Act defines, “A bill of exchange is an instrument in writing containing an, unconditional order, signed by the maker, directing a certain person to pay a certain sum of, money only to, or to the order of a certain person or to the bearer of the instrument”., , 17., , A bill of exchange, therefore, is a written acknowledgement of the debt, written by the creditor, and accepted by the debtor. There are usually three parties to a bill of exchange drawer, acceptor, or drawee and payee. Drawer himself may be the payee., Essential Elements of Promissory Note and Bill of Exchange:, Promissory Note, Bill of Exchange, The instrument must be in writing., It must be in writing, The instrument must be signed by the maker It must be signed by the drawer, of it, The maker of the instrument must be certain The drawer, drawee and payee must be certain, and definite, The instrument must contain a promise to It must contain an express order to pay money, pay. The promise to pay must be expressed, and money alone. The order must be, unconditional., A promissory note must be stamped It should be properly stamped., according to the stamp act., The sum of money to be paid must be certain The sum payable must also be certain., The money must be payable to a definite, person or according to his/her order., The promissory note may be payable on, demand or after a certain definite period of, time., Essential Elements of Promissory Note and Bill of Exchange:, Writing, Unconditional Promise/Order, Payable on, Signed, Stamped, Party, Sum of Money, Distinction Between Bill of Exchange and Promissory Note:, Point of Difference, Number of parties, , Payment to the, maker, Unconditional, promise, , Promissory Note, , Bill of Exchange, , In a promissory note there, are only two parties – the, maker (debtor) and the, payee (creditor)., A promissory note cannot be, made payable to the maker, himself., A promissory note contains, an unconditional promise by, the maker to pay to the, payee or his order., , In a bill of exchange, there are three, parties; drawer, drawee and payee., In a bill of exchange, the drawer and, payee or drawee and payee may be, same person., In a bill of exchange, there is an, unconditional order to the drawee to, pay according to the direction of the, drawer, , Page | 3

Page 4 :

A note is presented for A bill of exchange is payable after, payment without any prior sight must be accepted by the drawee, acceptance by the maker., or, someone else on his behalf, before it, can be presented for payment., Primary or absolute The liability of the maker of The liability of the drawer of a bill of, liability, a promissory note is primary exchange, is, secondary, and, and absolute., conditional., The maker of the promissory The maker or drawer of an accepted, Relation, note stands in immediate bill stands in immediate relations with, relation with the payee., the acceptor and not the payee., No, protest, is, needed, in, the, Foreign bill of exchange must be, Protest for, dishonour, case of a promissory note., protested for dishonour when such, protest is required to be made by the, law of the country where they are, drawn., Notice of dishonour No notice of dishonor need When a bill is dishonoured, due, to be given in the case of notice of dishonour is to be given by, promissory note., the holder to the drawer and the, intermediate indorsers., Distinction Between Promissory Note and Bill of Exchange:, Number of parties, Prior acceptance, Protest for dishonour, Payment to the maker, Primary or absolute liability, Notice of dishonour, Unconditional promise, Relation, Cheques [ Section 6]:, Section 6 of the Act defines “A cheque is a bill of exchange drawn on a specified banker, and not, expressed to be payable otherwise than on demand”., Prior acceptance, , 18., , A cheque is bill of exchange with two more qualifications, namely,, i., it is always drawn on a specified banker, and, ii., it is always payable on demand., Consequently, all cheque are bill of exchange, but all bills are not cheque. A cheque must satisfy, all the requirements of a bill of exchange; that is, it must be signed by the drawer, and must, contain an unconditional order on a specified banker to pay a certain sum of money to or to the, order of a certain person or to the bearer of the cheque. It does not require acceptance., 19., Holder [Section 8], The holder of a promissory note, bill of exchange or cheque means, any person entitled in his, own name to the possession thereof and to receive or recover the amount due thereon from the, parties thereto., , 20., , 26., , Essential requisites of a Holder, Payee or endorsee of the instrument, and1), in possession of it,, 2), or a person who is bearer thereof., What a holder can do Can complete Blank/General Endorsement into Full Endorsement, Can cross an open cheque, Can convert General Crossing into Special Crossing, Can add the words “Not Negotiable” or “A/C Payee” to the crossing., Can obtain a duplicate one of lost NI., Page | 4

Page 5 :

27., , 28., , Holder in due course [Section 9], Section 9 of the Act defines ‘holder in due course’ as any person who (i) for valuable, consideration, (ii) becomes the possessor of a negotiable instrument payable to bearer or the, indorsee or payee thereof, (iii) before the amount mentioned in the document becomes payable,, and (iv) without having sufficient cause to believe that any defect existed in the title of the, person from whom he derives his title., Essential conditions to constitute a 'Holder in due course':, 1) Who receives an instrument innocently i.e. in good faith and without negligence., 2) Who has paid value for the same., 3) Who has received the instrument before its maturity., 4) who is in possession of the instrument as a bearer or payee or endorsee., For all legal purposes, the title of the holder in due course is superior to that of the true owner., Rights and privileges of a holder in due course, 1) He obtains a better title to the instrument than that of a true owner., 2) The defective title of the previous endorsers (if any) will not adversely affect his rights., 3) He can pass on a better title to others, since, once the instrument passes through his, hands, it is purged of all defects., 4) Until the instrument is finally discharged, every party to that instrument is liable to him., 5) Even the drawer of a negotiable instrument cannot claim invalidity of the instrument, against him., 6) His claim cannot be denied on the ground that the payee has no capacity to endorse, The possessor of a Negotiable Instrument by way of Gift/Donation is Holder only not Holder in, Due Course., Payment in due course [Section 10], Payment in accordance with the apparent tenor of the instrument in good faith and without, negligence to any person in possession thereof under circumstances which do not afford, reasonable ground for believing that he is not entitled to receive payment of the amount therein, mentioned., Crossing?, When two angular parallel lines are drawn on the face of the cheque, then the cheque said to be, crossed. Thus, crossing is necessary in order to have safety. Crossed cheques must be presented, through the bank only because they are not paid at the counter. Crossing is a popular device for, protecting the drawer and payee of a cheque. Both bearer and order cheques can be crossed., Crossing prevents fraud and wrong payments., Who can cross a cheque?, The drawer of a cheque can cross it at the time of issuing it., Any holder can cross an uncrossed cheque. He can convert general crossing into special, crossing, and he can even add the words ‘Not Negotiable’ or ‘A/C payee’ to a crossing., The banker in whose favor a cheque has been crossed can again cross it in favor of, another banker, for the purpose of collection, as an agent., Specimen of General Crossing:, , 34., , 35., 36., , When crossed cheque is paid over the counter The payment will be in contravention of Payment in Due Course, The paying Banker will lose its Statutory Protection, The Paying Banker will be liable to the Drawer/True Owner of the Cheque., Special Crossing:, The name of a specific Bank is mentioned in the Special Crossing., Page | 5

Page 6 :

Specimen of Special Crossing:, , 37., , 45., 46., 47., 48., 49., , Not Negotiable Crossing [Section 130]:, “A person taking a cheque crossed generally or specially bearing in either case the words “Not, Negotiable” shall not have and shall not be capable of giving, a better title to the cheque than that, which the person from whom he took it had”., Not Negotiable Crossing can be added to either General Crossing or Special Crossing., For a Crossed Cheque bearing the words “Not Negotiable”, the Transferor will not be able to, give better Title to the Transferee., For a forged/stolen Cheque bearing “Not Negotiable” Crossing, the Holder of such a Cheque will, be compelled to give it back to the true owner of the Cheque., The object of “Not Negotiable” Crossing is to protect the Drawer or true Owner against loss or, theft in the course of transit., Example of Negotiable Crossing:, Most people believe that "Not negotiable" means that you cannot endorse a cheque in favour of, someone else. This is not correct, however, the cheque can be endorsed to someone else but all, subsequent parties accepting the cheque cannot get better rights than the person that they received, it from., For example, A buys a car from B, A writes out a cheque crossed "not negotiable". B has a right to the, funds from A's cheque (as the payee) and the fact that he has given value. He can sue A if the cheque, is dishonored., 2nd example B endorses the cheque in favour of C as deposit on a new car. If the cheque is, dishonored by A, C can sue either A or B as he has also accepted the cheque in good faith and gave, value., 3rd example C loses the cheque and it is found by D. D forges C's endorsement and endorses it over to, E for the rent on a flat. If the cheque is dishonored E can sue D but has no recourse to sue A, B or C as, it is marked "not negotiable". Even though E accepted the cheque in good faith and "for value" he, cannot get a better title than the prior endorser D who had none. Without the words "not negotiable", E could have sued A, B, or D as prior endorsers. (C can't be sued as his endorsement was forged)., If E had passed it on to F, F could sue D and E but not A, B or C., , 50., , In the case of a negotiable instrument transferee's title is not affected by any defect in the title, of transferor if it is received for consideration and in good faith. This quality of negotiable, instrument is withdrawn when it is crossed not negotiable., Difference between General and Special Crossing, , General Crossing, 1. Drawing of two parallel transverse lines is a, must., 2. Inclusion of the name of a banker is not, essential., 3. In General Crossing paying banker to honor, the cheque from any bank A/C., , Special Crossing, 1. Drawing of two parallel transverse lines, is not essential., 2. Inclusion of the name of a banker is, essential., 3. In Special Crossing paying banker to, honor the cheque only when it is, presented through the bank mentioned in, the crossing and no other bank., Page | 6

Page 7 :

4. General Crossing can be converted into a, Special Crossing., 5. In case of General Crossing the words “And, Company” or “& Company” or “Not, Negotiable” between the transverse lines to, highlight the crossing does not carry special, significance., , 51., , 4. Special Crossing can never be, converted to General Crossing., 5. In case of Special Crossing the name of, a banker may be written within two, parallel transverse lines or with the words, “And Company” or “Account Payee, Only” or “Not Negotiable” the inclusion, of these words has become customary., Difference between General and Special Crossing:, Two Transverse Line, Type of Credit Account, Example, Name of Banker, Conversion of Crossing, Negotiation [Section 14]:, When a promissory note, bill of exchange or cheque is transferred to any person, so as to, constitute that person the holder thereof, the instrument is said to be negotiated. If payable to, bearer, it is negotiated by delivery; if payable to order, it is negotiated by the indorsement of the, holder and completed by delivery., , 52., 53., 54., 55., , Form of Negotiation:, Bearer NI > By Mere Delivery, Order NI> By Endorsement and Delivery, Allonge used in Endorsement which is the paper annexed to a Negotiable Instrument., Who may negotiate [Section 51], Every sole maker, drawer, payee or endorsee, or all of several joint makers, drawers, payee or, endorsees can endorse a NI if not stated otherwise., Endorsement [Section 15], When the maker or holder of a negotiable instrument signs the same, otherwise than as such, maker, for the purpose of negotiation, on the back or face on a slip of paper annexed thereto, or, so signs for the same purpose a stamped paper intended to be completed as a negotiable, instrument, he is said to endorse the same, and is called the” Endorser”., Effect of Endorsement [Section 50], The legal effect of negotiation by endorsement and delivery is:, (i) to transfer property in the instrument from the endorser to the endorsee., (ii) to vest in the latter the right of further negotiation, and, (iii) a right to sue on the instrument in his own name against all the other parties, Who may negotiate [Section 51], Every sole maker, drawer, payee or endorsee, or all of several joint makers, drawers, payee, or endorsees, of a negotiable instrument may, if the negotiability of such instrument has not, been restricted or excluded as mentioned in section 50, endorse and negotiate the same., Essentials of a Valid Endorsement, An endorsement in order to operate as mode of negotiation must comply with the following, conditions, namely:, 1) It must be written on the instrument itself and be signed by the endorser. The simple, signature of the endorser, without additional words, is sufficient. An endorsement written, on an Allonge is deemed to be written on the instrument itself., 2) The endorsement must be of the entire instrument. A partial endorsement, that is to, say, an endorsement, which purports to transfer to the endorsee a part only of the amount, payable, or which purports to transfer the instrument to two or more endorsees severally, (i.e. separately), does not operate as a negotiation of the instrument., Page | 7

Page 8 :

3) Where a negotiable instrument is payable to the order of two or more payees or, endorsees who are not partners, all must endorse unless the one endorsee has, authority to endorse for the others., 4) Wherein a negotiable instrument payable to order, the payee or endorsee is wrongly, designated or his name is misspelt, he should sign the instrument in the same manner as, given in the instrument. Though, he may add, if he thinks fit, his proper signature., 5) Where there are two or more endorsements on an instrument, each endorsement is, deemed to have been made in the order in which it appears on the instrument, until, contrary is provided., 6) An endorsement may be made in blank or special. It may also be restrictive., , 56., , Essentials of a Valid Endorsement:, Written, Full Amount of NI, Signed, Specific Endorsee, , Signed by All Party, In Order, , Kinds of endorsement, General Endorsement/Endorsement in Blank [Section 16], , If the endorser signs his name only, the endorsement is said to be “Blank’. Cheques endorsed in, blank can be negotiated by mere delivery. Thus, a cheque, originally payable to order,, becomes payable to bearer by an endorsement in blank., Example: A cheque is payable to X or order. If it is simply signed by X on the back, it, constitutes a blank endorsement., Endorsement in Full [Section 16], , If in addition to his signature, the endorser adds a direction to pay the amount mentioned in the, instrument to, or to the order of, a specified person, the endorsement is said to be ' in full'. If in, the above illustration X adds the words "Pay to Y " or " Pay to Y or order" such, endorsement is called endorsement in full. An endorsement in blank may be converted into, an endorsement in full., According to Sec. 55" if a negotiable instrument, after having been endorsed in blank, is, endorsed in full, the amount of it cannot be claimed from the endorser in full, except by the, person to whom it has been endorsed in full or by one who derives title through such person.", Conditional Endorsement, , If the endorser of a negotiable instrument, by express words in the endorsement makes his, liability, or the right of the endorsee to receive the amount due thereon, dependent on the, happening of a specified event, although such event may never happen, such endorsement is, called a conditional endorsement (Sec. 52). Conditional endorsements do not make the, instruments non-transferable. However, such endorsements are generally not found., Restrictive Endorsement, , Sec. 50 permits restrictive endorsements which take away the negotiability of such, instruments. Such an endorsement prohibits further endorsement and is called restrictive, endorsements e.g. (a) Pay the contents to C only, (b) pay C or order for the account of B etc. The, negotiability of the instrument is not restricted by the omission of the word, or order (Sec. 51)., Sans Recourse Endorsement, , An endorser of a negotiable instrument may, by express words in the endorsement, exclude his, Page | 8

Page 9 :

liability thereon (Sec. 52). For example, if R endorses a cheque as follows:i) Pay to 'X' or order at his own risk,, ii) Pay to 'X' without recourse to me., S/He will not be liable to X or any of the subsequent endorsees if the bank dishonours the cheque, subsequently. They may sue any party prior to such endorser. But if an endorser who so, excludes his liability afterwards becomes the holder of the instrument, all intermediate, endorsers are liable to him., Facultative Endorsement, , In this case an endorser by express words increases his/her liability, or gives up some of his/her, rights under the negotiable instruments act. The endorsee must give notice of dishonour of the, instrument to the endorser, but the later may waive this duty of the endorsee by writing in the, endorsement "Notice of Dishonor waived". The endorser remains liable to the endorsee for, the nonpayment of the instrument., , 57., 58., 59., 60., 61., 62., , 63., 64., 65., , When a blank endorsement is made Full Endorsement, the amount of it can not be claimed from, the person who makes it Full Endorsement except by the person to whom it has been endorsed in, full., Conditional Endorsements do not make the instrument Non-Transferrable., Restrictive Endorsement takes away the Negotiability of Negotiable Instrument., The Negotiability of NI is not restricted by the omission of the word “ Or Order”., With San Recourse Endorsement, the endorser excludes his liability thereon. However, if such, endorser becomes the holder of the instrument subsequently, all intermediate endorsers will be, liable to him., With Facultative Endorsement, the endorser increases his liability or gives up some of his right., For Example, if Notice of Dishonor Waived is written during endorsement, the endorser will be, liable to the endorsee for the non-payment of the instrument., Liability of the Endorser [Section 35], As per Sec. 35 of N.I. Act " In the absence of a contract to the contrary, the endorser of a, Negotiable Instruments by endorsing it, engages that in due presentment it shall be accepted and, paid according to its tenor and that if it be dishonored he will compensate the holder or, subsequent indorser who is compelled to pay it for any loss or damage caused to him by such, dishonour. Every endorser after dishonour is liable as upon an instrument payable on demand.", As per See. 35 of the N.I Act every endorser is liable to every subsequent holder, in case, the instrument is dishonored., Where there are two or more endorsements on an instrument, the liability of the endorser, will be fixed in the order in which, their signatures appear on the instrument., The liability of the endorser continues even after death till the instrument is paid. The, endorsee can sue even after the death of the endorser. Supposing the endorsee dies, the, right to sue the endorsers is available to his legal representatives., The endorser is liable, only if he is served with a notice of dishonor., This liability of the endorser can be excluded by a separate contract to the contrary., The endorser can get rid of his liability by making such endorsement like ‘sans recourse’., When the instrument is paid in due course, the endorser is relieved from his liability., The endorsee can even sue after the death of endorser to his legal representatives., When the instrument is paid in due course, the endorser is relieved from his liability., The punishment for dishonor of cheque is imprisonment up to One Year Or fine up to thrice, the amount of the cheque or with Both subject to –, The cheque has been presented within validity period, The payee or HDC has served a notice in writing within 15 Days from the receipt of, Page | 9

Page 10 :

66., 67., , 68., , 69., 70., 71., 72., 73., , 74., 75., 76., 77., , information of Dishonor from the Bank., The Drawer of the cheque fails to pay within 15 Days of notice being served., In accordance with Section 138, dishonor of cheque is a criminal offence and is punishable with, monetary penalty or imprisonment up to 2 Years or Both., The Bank will not be held liable if it dishonors a cheque provided that The bank has exercised the right of set off for a delinquent loan obligation., The account is attached with Garnish Order by the Court., The Bank will be liable for the wrongful dishonor of cheque in the case of –, The account having sufficient balance covering the cheque amount., The payment of stopped payment of cheque has resulted in subsequent dishonor of other, cheques., The payment of post-dated cheque has resulted in subsequent dishonor of other cheques., The account has been closed without serving the notice to the customer and any dishonor, of cheque thereafter., If the wrongful dishonor does not result in an injury or loss of money, the customer is not, entitled to recover damages, The material alteration of Negotiable Instruments entail alteration in the important parts of the, instruments such as –, Date, The sum payable, The time of Payment, The Place of Payment etc., The paying banker is discharged from all liabilities when the Material Alteration is not Apparent, or in the case of a crossed cheque, the crossing is not Apparent., An instrument having forged signature or the drawer or other persons required for it not treated, as an instrument under NI Act 1881 and will remain inoperative., A person who receives an instrument which has been lost or by means of fraud or any other, unlawful means is not entitled to receive the amount due thereon unless he claims as holder in, due course., When the payment of Order Cheque or Bearer Cheque is made in Due Course, the Drawee, (Bank) is discharged from all liabilities., Section 31 of N.I. Act 1881 says, " The drawee of a cheque having sufficient funds of the, drawer in his hands properly applicable to the payment of such cheque must pay the cheque, when duly required so to do, and in default of such payment, must compensate the drawer for, any loss or damage caused by such default". The banker can legally return a valid cheque, without payment under the following conditions:, Countermand of payment, Notice of Customer's death, Notice of adjudication of customer as an insolvent, Insufficient fund, Standing instruction as assignment., Where a cheque crossed specially to more than one banker, except when crossed to an agent for, the purpose of collection, the banker on whom it is drawn shall refuse payment thereof., For Payment of crossed cheque out of the course, the Banker will be liable to the true owner of, the Cheque for any loss suffered by him., A Banker who receives the proceeds of a Cheque in good faith and without negligence will not, be liable to the true owner of the cheque even though the Title of Cheque proves to be a defective, one., , Chapter C: The Banking Companies Act - 1991, The Banking Companies Act – 1991 has 124 Sections., Page | 10

Page 11 :

Section – 5: Definition of different terminologies/concept, Section – 6: The Bank Companies Act, 1991 is the overriding rule, Section – 7: Form of business in which banking company may engage, Section – 7: No bank company shall be entitled to conduct direct business as a stock broker, a, stock dealer, a merchant banker, a portfolio manager and any such businesses, Section – 8: Use of the word “Bank” or any of its derivatives, Section -10: Disposal of non-banking assets, No Bank will hold any immovable property for any period exceeding seven years from the, acquisition thereof except such as is required for its own use., Section -11: Prohibition on employment of managing agents and restrictions on certain forms of, employment., Section -12: Removal of Documents, Section -13: Requirement as to minimum Paid-up Capital and its maintenance, Section -14: Regulation of paid-up capital, subscribed capital, authorized capital and voting, rights of shareholders., Subscribed capital shall not be less than one-half of the authorized capital, Paid-up capital shall not be less than one-half of the subscribed capital, The voting rights of any share-holder, except those of the Government, do not exceed, 5(five) percent of the total voting rights of all the shareholders, Section -15: Election of new directors, All banking companies except a new bank or a specialized bank may elect new directors in the, Annual General Meeting., Section –15A: Filling up the post of Chief Executive Officer, The post of Chief Executive Officer shall not be kept vacant for a consecutive period of, more than three months., If it is not filled in within three months, the Bangladesh Bank may appoint an, Administrator for the discharge of the responsibilities of Chief Executive Officer., Section -17: Vacation of the office of Director., If such failure of repayment of Loan continues for a period of two months even after, Bangladesh Bank’s Notice, the post of director shall be fallen vacant with the expiry of, the period cited in the Notice., Any person receiving a Notice from concerned bank through Bangladesh Bank may, explain his position to the Bangladesh Bank within thirty-one days from the date of, receipt of such notice with a copy of the explanation to the concerned banking company., The Bangladesh Bank shall give reply of the explanation within 15 days from the date, of receipt of the explanation and the decision of the Bangladesh Bank in this regard, shall be final., Section -18: Certain benefit of the directors, Any director of any banking company shall not accept pecuniary benefit other than honorarium, for attending the meeting of the Bank’s Board of Directors. The amount of honorarium may be, determined by the Board of Directors unanimously., Section -19: Restriction on commission, brokerage, discount etc., The Maximum amount is not exceeding two and one-half percent of the paid-up capital of the, said shares., Section -20: Prohibition of charge on unpaid capital, Section -21: Prohibition of floating charge on assets, Section -22: Restrictions regarding payment of dividend, No Bank can pay any Dividend on its shares provided that If all its capitalized expenses and other expenses have not been completely written off, If it fails to maintain paid-up capital and reserve fund as per requirements, If there is provision shortfall, Section -24: Reserve Fund, Page | 11

Page 12 :

To transfer 20% of the profit to the Reserve Fund as long as the accumulated Reserve Fund is, below its paid-up capital., Section -25: Cash Reserve Fund (6.00% Daily and 6.50% Bi-Weekly), Section -27: Restrictions on loans and advances (Against the security of its own shares), Section –27 Ka Ka: List of Defaulting Borrowers, Section -31: License of Banking Companies, Section -32: Open a branch in a new place of business or Change of the Location of an existing, Branch., Section -33: Maintenance of Liquid Assets (SLR – 13%), Section -35: Unclaimed deposits and valuable articles, All unclaimed deposits & valuable articles for 10(ten) years must be sent to Bangladesh Bank., Section -37: Power to publish information of Classified Loans by BB, Section -38: Accounts and balance sheet, Section -39: Audit of Financial Statements by CA, Section -40: Report submission, Three copies of the accounts and balance sheet along with the Auditor’s Report duly approved by, the BOD shall be sent to Bangladesh Bank by three months at the close of the period to which, they relate., Section -44: The inspection by BB, Section -46: Power of Bangladesh Bank to remove Chairman/Directors/CEO, Section -57: Punishment for certain activities relating to Bank Companies, The punishment is imprisonment of maximum two years or with penalty of taka twenty, thousand or with both., , Chapter D: Money Laundering Prevention Act-2012, Page | 12

Page 13 :

01., , Define money laundering as per MLP Act 2012., , In the simplest form, Money laundering is the act of disguising the source or true nature of, money obtained through illegal means., A definition of what constitutes the offence of money laundering under Bangladesh law is set, out in Section 2 (Tha) of the Prevention of Money Laundering Act 2002 (Act No. 7 of 2002), which is reads as follows: “Money Laundering means –, (Au) Properties acquired or earned directly or indirectly through illegal means;, (Aa) Illegal transfer, conversion, concealment of location or assistance in the above act of the, properties acquired or earned directly of indirectly through legal or illegal means;, A concise working definition was adopted by Interpol General Secretariat Assembly in 1995,, which defines money laundering as: "Any act or attempted act to conceal or disguise the, identity of illegally obtained proceeds so that they appear to have originated from legitimate, sources"., What is Money Laundering?, , Money laundering can be defined in a number of ways. But the fundamental concept of Money, laundering is the process by which proceeds from a criminal activity are disguised to conceal, their illicit origins. Most countries subscribe to the definition adopted by the United Nations, Convention against Illicit Traffic in Narcotic Drugs and Psychotropic Substances (the Vienna, Convention, 1988) and the United Nations Convention against Transnational Organized, Crime (the Palermo Convention, 2000). The definition of money laundering as per the above, UN Convention is as follows:, The conversion or transfer of property, knowing that such property is derived from, any offense, e.g. drug trafficking, or offenses or from an act of participation in such, offense or offenses, for the purpose of concealing or disguising the illicit origin of the, property or of assisting any person who is involved in the commission of such an offense, or offenses to evade the legal consequences of his actions;, The concealing or disguising of the true nature, source, location, disposition, movement,, rights with respect to, or ownership of property, knowing that such property is derived, from an offense or offenses or from an act of participation in such an offense or offenses,, , and;, The acquisition, possession or use of property, knowing at the time of receipt that such, property was derived from an offense or offenses or from an act of participation in, such offense or offenses., The Financial Action Task Force on Money Laundering (FATF), which is recognized as the, international standard setter for anti-money laundering (AML) efforts, defines the term “money, laundering” succinctly as “the processing of criminal proceeds to disguise their illegal origin, in order to legitimize the ill-gotten gains of crime.”, According to the Section 2 of the Money Laundering Prevention Act, 2012 “Money Laundering” means –, (i) knowingly move, convert, or transfer proceeds of crime or property involved in an offence, for the following purposes:, 1) concealing or disguising the illicit origin/nature, source, location, ownership or control, of the proceeds of crime; or, 2) assist any person for evading the legal consequences of his or her action who is, involved in the commission of the predicate offence;, (ii) smuggle funds or property abroad earned through legal or illegal means;, (iii) knowingly transfer or remit the proceeds of crime into or out of Bangladesh with the, intention of hiding or disguising its illegal source;, (iv) conclude or attempt to conclude financial transactions in such a manner as to avoid, , Page | 13

Page 14 :

reporting requirement under this Ordinance., (v) convert or movement or transfer property with the intention to instigate or assist the, carrying out of a predicate offence;, (vi) acquire, possess or use property, knowing that such property is the proceeds of a, predicate offence; or, (vii) perform such activities so that illegal source of the proceeds of crime may be concealed, or disguised; or, (viii) participate in, associate with, conspire to commit, attempt to commit or abet, instigate, or counsel to commit any offences mentioned above., , Stages of Money Laundering:, Despite the variety of methods employed, the laundering is not a single act but a process, accomplished in 3 basic stages which may comprise numerous transactions by the, launderers that could alert a financial institution to criminal activity –, Placement - the physical disposal of the initial proceeds derived from illegal activity., Layering - separating illicit proceeds from their source by creating complex layers of, financial transactions designed to disguise the audit trail and provide anonymity., Integration - the provision of apparent legitimacy to wealth derived criminally. If the, layering process has succeeded, integration schemes place the laundered proceeds, back into the economy in such a way that they re-enter the financial system, appearing as normal business funds., The three basic steps may occur as separate and distinct phases. They may also occur, simultaneously or, more commonly, may overlap. How the basic steps are used depends on, the available laundering mechanisms and the requirements of the criminal organizations., The table below provides some typical examples., , The 3 Stages of Money Laundering: Placement, Layering and Integration, Reporting organization” meansi) bank; (ii) financial institution; (iii) insurer; (iv) money changer; (v) any company or, institution which remits or transfers money or money value; (vi) any other institution, carrying out its business with the approval of Bangladesh Bank;, (vii) ( 1) stock dealer and stock broker, (2) portfolio manager and merchant banker,, (3) securities custodian, (4) asset manager;, (viii) (1) non-profit organization, (2) non government organization, (3) cooperative society;, (ix) real estate developer; (x) dealer in precious metals or stones; (xi) trust and company, service provider; (xii) lawyer, notary, other legal professional and accountant; (xii) any other, institution which Bangladesh Bank may, from time to time, notify with the approval of the, Government;, Responsibilities of the Reporting Organizations?, , The reporting organizations shall have the following responsibilities in the prevention of money, laundering, namely:(a) to maintain complete and correct information with regard to the identity of its customers during the, operation of their accounts;, (b) if any account of a customer is closed, to preserve previous records of transactions of such account for, at least 5(five) years from the date of such closure;, (c) to provide with the information maintained under clauses (a) and (b) to Bangladesh Bank from time to, time, on its demand;, (d) if any doubtful transaction or attempt of such transaction as defined under clause (n) of section 2 is, observed, to report the matter as ‘suspicious transaction report " to the Bangladesh Bank immediately on, its own accord., , 02., , Customer Acceptance Policy, Every bank should develop a clear Customer Acceptance Policy laying down explicit criteria for, acceptance of customers. The Customer Acceptance Policy must ensure that explicit guidelines, are in place to set-up any kind of business relationship with the bank. A concrete Customer, Acceptance Policy is very important so that inadequate understanding of a customer’s, background and purpose for utilizing a bank account or any other banking product/service may, not expose the Bank to a number of risks. The primary objectives of a Customer Acceptance, Policy are –, Page | 14

Page 15 :

1) to manage any risk that the services provided by the Bank may be exposed to;, 2) to prevent the Bank from being used, intentionally or unintentionally, for ML/TF, purposes; and, 3) to identify customers who are likely to pose a higher than average risk, Customer acceptance policy of a bank must include- No account in anonymous or fictitious name, or account only with numbers shall be opened;, No banking relationship shall be established with a Shell Bank; and, No account in the name of any person or entity listed under United Nations Security, Council Resolutions (UNSCRs) or their close alliance adopted under Chapter VII of the Carter of, UN on suspicion of involvement in terrorist or terrorist financing activities and proscribed or, enlisted by Bangladesh Government shall be opened or operated., , Customer Due Diligence, Customer Due Diligence (CDD) combines the Know Your Customer (KYC) procedure,, transaction monitoring based on the information and data or documents collected from reliable, and independent sources., The CDD obligations on banks under legislation and regulation are designed to make it more, difficult obligations to accomplish to use the banks banking to understand industry for who, money their laundering customers or are terrorist to guard financing against. the risk CDD of, committing offences under MLPA, 2012 including 'Predicate Offences' and the relevant offences, under ATA, 2009. Therefore, banks should be able to demonstrate to their supervisory authority, to put in place, implement adequate CDD measures considering the risks of money laundering, and terrorist financing. Such risk sensitive CDD measures should be based on, a) Type of customers;, b) Business relationship with the customer;, c) Type of banking products; and, d) Transaction carried out by the customer., The adoption of effective KYC standards is an essential part of banks' risk management policies., Banks with inadequate KYC program may be subject to significant risks, especially legal and, reputational risk. Sound KYC Policies and Procedures not only contribute to the bank's overall, safety and soundness, they also protect the integrity of the banking system by reducing money, laundering, terrorist financing and other unlawful activities., Banks therefore need to carry out customer due diligence for two broad reasons:, to help the organization, at the time due diligence is carried out, to be reasonably satisfied, to those customers who they say about, to know whether they are acting on behalf of, another, and that there is no legal barrier (e.g. government or international sanctions), to provide them with the product or service requested; and to enable the organization in, investigation, law enforcement by providing available information about customers in, due process., It may be appropriate for the bank to know more about the customer by being aware of the nature, of the customer's business in order to assess the extent to which his transactions and activity, undertaken with or through the bank is consistent with that business., , Enhanced CDD measures, Banks should conduct Enhanced CDD measures, when necessary, in addition to normal CDD, measures. Bank should conduct Enhanced Due Diligence (EDD) under the following, circumstances:, Page | 15

Page 16 :

Individuals or legal entities scored with high risk;, Individuals who are identified as politically exposed persons (peps), influential persons, and chief executives or top-level officials of any international organization;, Transactions identified with unusual in regards to its pattern, volume and complexity, which have no apparent economic or lawful purposes;, while establishing and maintaining business relationship and conducting transaction with, a person (including legal representative, financial institution or any other institution) of, the countries and territories that do not meet international standard in combating money, laundering and terrorism financing (such as the countries and territories enlisted as High Risk and Non- Cooperative Jurisdictions in the Financial Action Task Force’s Public, Statement)., , Enhanced CDD measures include, Obtaining additional information on the customer (occupation, volume of assets,, information available through public databases, internet, etc.) and updating more, regularly the identification data of customer and beneficial owner., Obtaining additional information on the intended nature of the business relationship., Obtaining information on the source of funds or source of wealth of the customer., Obtaining information on the reasons for intended or performed transactions., Obtaining the approval of senior management to commence or continue the business, relationship when applicable., Conducting regular monitoring of the business relationship, by increasing the number and, timing of controls applied and selecting patterns of transactions that need further, examination., Making aware the concerned bank officials about the risk level of the customer., , Customer Identification, Customer identification is an essential part of CDD measures. For the purposes of this Guidance, Notes, a customer includes:, the person or entity that maintains an account with the bank or those on whose behalf an, account is maintained (i.e. beneficial owners); the beneficiaries of transactions conducted, by professional intermediaries; and, any person or entity connected with a financial transaction who can pose a significant, reputational or other risk to the bank., , Authorities of CAMLCO, CAMLCO should be able to act on his own authority;, He/she should not take any permission or consultation from/with the MD or CEO before, submission of STR/SAR and any document or information to BFIU;, He/she shall maintain the confidentiality of STR/SAR and any document or information, required by laws and instructions by BFIU;, He/she must have access to any information of the bank;, He/she shall ensure his/her continuing competence., , Responsibilities of CAMLCO, , , , , , , , CAMLCO must ensure overall AML & CFT compliance of the bank;, Oversee the submission of STR/SAR or any document or information to BFIU in time;, Maintain the day-to-day operation of the bank’s o AML&CFT compliance;, CAMLCO shall be liable to MD , CEO or BoD for proper functioning of CCU;, CAMLCO shall review and update ML & TF risk assessment of the bank;, Ensure that corrective actions have taken by the bank to address the deficiency identified, by the BFIU or BB., , Authority and Responsibility of BAMLCO, For preventing ML, TF & PF in the branch, the BAMLCO should perform the following, Page | 16

Page 17 :

responsibilities:, Ensure that the KYC of all customers have done properly and for the new customer KYC, is being done properly;, Ensure that the UN Security Council and domestic sanction list checked properly before, opening of account and while making any international transaction;, Keep information of 'dormant accounts * and take proper measures so that any, withdrawal from these accounts shall not be allowed without compliance of BFIU's, instruction;, Ensure regular transaction monitoring to find out any unusual transaction (In case of an, automated bank, the bank should follow a triggering system against transaction profile or, other suitable threshold. In case of a traditional bank, transaction should be examined at, the end of day against transaction profile or other suitable threshold ,, Records of all transaction monitoring should be kept in the file);, Review cash transaction to find out any structuring;, Review of CTR to find out STR/SAR;, Ensure the checking of UN sanction list before making any foreign transaction;, Ensure that all the employees of the branch are well aware and capable to identify any, unusual transaction or any attempt of unusual transaction;, Compile self-assessment of the branch regularly and arrange quarterly meeting regularly;, Accumulate the training records of branch officials and take initiatives including, reporting to CCU, HR and training academy;, Ensure all the required information and document are submitted properly to CCU and any, freeze order or stop payment order are implemented properly;, Follow the media report on terrorism, terrorist financing or other offences, like, corruption, bribery, drug trafficking, gold smuggling, human trafficking, kidnapping or, other predicate offences and find out any relationship of the branch with the involved, person; if so the BAMLCO should make an STR/SAR;, Ensure that the branch is maintaining AML & CFT files properly and record keeping is, done as per the requirements of chapter 7;, Ensure that corrective actions have taken by the branch to address the deficiency, identified by the BFIU or BB., , Transaction Profile (TP), Each account must be associated with transaction profile by the customer by putting his /, her signature in the uniform TP form (as prescribed by Bangladesh Bank);, Monitor transactions and consult TP ;, Focus on high- risk customers and also transactions inconsistent with TP., , Suspicious Transaction Reporting, 1) Suspicious transaction may include:, a. transaction inconsistent with TP, b. transaction structured to avoid, c. transaction unusual for the type of business, d. transaction having no reasonable explanation, etc., 2) Identification of suspicious transaction through:, a. monitoring of transactions, b. clients contact, c. third party information etc., , Cash Transaction Reporting (CTR), Comply CTR for multiple cash transactions within one day exceeding threshold limit (10 lac or, above) on monthly basis; CTR is applicable for:, a. Cash deposit, Page | 17

Page 18 :

14., 01., 02., 03., 01., , 02., 03., 04., , 05., 06., , 07., 08., , 09., 10., , b. Cash withdrawal, Cash remittance / On-line deposit., Section 25: Responsibilities of the Reporting Organizations in Prevention of Money Laundering, The records of transaction of closed account have to be kept for at least 5(five) years, from the date of such closure., Suspicious Transaction Report is to be prepared based on doubtful transaction, Punishment for failure in providing information as per Sub-Section (1), Imprisonment (A), Fine (B), Type, Others, Tk.50 Thousand to Tk.25 Lac, Cancellation of License or, (To be Deposited into Treasury, Authorization of Carrying, of the State), our Commercial Activities, Money Laundering Prevention (Amendment) Act 2015, Section 12: “Authority" will be replaced by the word ‘Anti-Corruption Commission (ACC)’., Section 23: “Bangladesh Bank" will be replaced by the word ‘Bangladesh Financial Intelligence, Unit (BFIU)., Sub-section (1) of section 24 (Ka): The full time chief officer who will be in the ranks and status, of Deputy Governor., Component of AML & CFT Compliance Program, Component of AML & CFT Compliance Program:, Central Compliance Unit (CCU), Chief Anti-Money Laundering Compliance Officer (CAMLCO), Branch Anti-Money Laundering Compliance Officer (BAMLCO), A bank should communicate clearly to all employees on an annual basis by a statement from, the CEO or MD that clearly sets forth its policy against ML, TF & PF., AML & CFT Compliance Policy must be written, approved by the board of directors, and noted, as such in the board meeting minutes., Procedures should address its Know Your Customer (“ KYC” ) policy and identification, procedures before opening new accounts, monitoring existing accounts for unusual or suspicious, activities, information flows, reporting suspicious transactions, hiring and training employees, and a separate audit or internal control function to regularly test the program’s effectiveness., The AML & CFT policies should be reviewed regularly and updated as necessary and at least, annually based on any legal/regulatory or business/ operational changes., Customer Acceptance Policy:, No banking relationship shall be established with a Shell Bank, No account in the name of any person or entity listed under United Nations Security, Council Resolutions (UNSCRs)., Customer Due Diligence (CDD) combines the Know Your Customer (KYC) procedure,, transaction monitoring based on the information and data or documents collected from reliable, and independent sources., Banks should conduct Enhanced CDD measures, when necessary, in addition to normal CDD, measures. Bank should conduct Enhanced Due Diligence (EDD) under the following, circumstances:, Individuals or legal entities scored with high risk;, Individuals who are identified as politically exposed persons (peps), influential persons, and chief executives or top-level officials of any international organization;, Transactions identified with unusual in regards to its pattern, volume and complexity, which have no apparent economic or lawful purposes;, Central Compliance Unit (CCU) will be directly monitored by the Managing Director or the, Chief Executive Officer of the bank. The CCU will report to BFIU., The central compliance unit must be headed by a high official, who will be known as the Chief, Anti Money Laundering Compliance Officer (CAMLCO). He will report directly to CEO or MD., Page | 18

Page 19 :

11., 12., 13., , 05., , 01., , In this case, ‘High official’ will be considered as an official up to 2 (two) steps below of the, managing director/ chief executive officer. But, for a foreign bank, mentioned ‘high official’, must be a member of the Management Committee (MANCOM)., The D- CAMLCO will be at least in the rank of ‘Deputy General Manager’ or ‘Vice President’, of the bank., Authorities and Responsibilities of CAMLCO, Bangladesh Bank may recover the amount from the reporting agency or from the account of the, respective person by debiting any account maintained in any bank or financial institution or, Bangladesh Bank and in case of any unrealized or unpaid amount, Bangladesh Bank may, if, necessary, apply before the concerned court for recovery., The Bankers’ Books Evidence Act, 1891, The Law of evidence requires that the existence, condition or contents of a document can be, proved before a court only by producing the original document. So long as the original document, is available a copy cannot be produced. One of such exception is when the original is a document, of which a certified copy is permitted by any Law., , Chapter E: Liquidity Management including CRR, SLR, 01., , What is CRR?, Page | 19

Page 20 :

02., , 03., 04., , 05., , 06., , 06., 07., , 08., , According to Article 36 of the Bangladesh Bank Order 1972, every scheduled bank has to, maintain Cash Reserve Ratio in the form of cash with BB. At present, the required CRR is 6.50%, on bi-weekly average basis of the average total demand and time liabilities (ATDTL) with a, provision of minimum 6% on daily basis of the same ATDTL. Banks are required to maintain, CRR is pursuant of Monetary Policy Objectives of BB., What are the Components of CRR?, At present, banks are allowed to maintain cash reserve with local currency (Taka) only. The day, end balances of the Taka current accounts maintained with different offices of BB will be, aggregated to compute the maintained cash reserve of the day., The balance so maintained shall be un-encumbered in all aspect. The encumbered (lien against, discounting facility, etc. and capital lien in case of foreign banks) portion of the balance will be, deducted while computing both the maintained amount and excess of cash reserve., Why Banks are required to maintain CRR?, What is SLR?, According to Section 33 of the Bank Company Act 1991, every scheduled bank has to maintain, Statutory Liquidity Ratio (SLR) in cash or gold or in the form of un-encumbered approved, securities. At present, the required SLR is 13% daily for conventional banks and 5.5% daily for, Islamic Shari'ah based banks and Islamic Shari'ah based banking of conventional banks., What are the components of SLR?, The eligible components for maintaining Statutory Liquidity Reserve are Cash in tills (both local and foreign currency), Gold, Daily excess reserve (excess of Cash Reserve) maintained with BB, Balance maintained with the agent bank of BB, Un-encumbered approved securities as defined in section 5 clause 'ka' of Bank, Company Act, 1991., Credit balance in Foreign Currency Clearing Account maintained with BB., Daily excess of Cash Reserve (if any) will be calculated using the following formula:, Daily excess of Cash Reserve = (Day-end balance of un-encumbered cash maintained in Taka, current accounts with BB – Required cash reserve on Bi-weekly average basis)., Guidelines for use of Foreign Currency from Foreign Currency Clearing Account for SLR, purpose?, Banks may use foreign currency from Foreign Currency Clearing Account maintained with BB, for SLR purpose as long as there is credit balance in the account. However, no interest will be, paid on the used portion of foreign currency., Any misreporting (DB-5FC) regarding the amount of foreign currency used for SLR purpose will, attract a penalty two times of the amount of interest already credited for the misreported, amount along with reversal of the interest credited., Why Banks are required to maintain SLR?, Which items are excluded while calculating Demand and Time Liabilities?, For the purpose of maintenance of CRR and SLR, demand and time liabilities should include all, on-balance sheet liabilities excluding the items listed below:, a) Paid up capital and reserves, d) Inter-bank items;, b) Loans taken from BB, e) Repo, Special Repo and any kind of, Liquidity Support taken from BB., c) Credit Balance in Profit and Loss account, What are the purposes of CRR/SLR?, Monetary Policy Objective, Page | 20

Page 21 :

CRR and SLR may be used to regulate money supply by central bank. When central bank, increases CRR/SLR, banks have to keep more cash/gold/approved securities and it will have less, money. As a result, money supply in the economy will decrease. Similarly, when central bank, decreases CRR/SLR, banks have more money available and money supply will increase., Moreover, CRR/SLR also regulates money creation ability of banks. If CRR/SLR is increased,, the money creation ability of banks decreases and vice versa. Thus, CRR/SLR may be used to, control money supply., Solvency of Banks, CRR/SLR increases solvency of banks. CRR/SLR reserves can be used to make payment against, the liabilities by a bank in the extreme case when it is running out of fund but cannot manage it, from other sources., , 09., , 10., , Sale of Government bonds, Maintenance of SLR in approved securities ensures investment by banks in government bonds., What are the components of Demand Liabilities?, (b) Other Demand Liabilities., (a) Demand Deposits (General), i) All Current Accounts except from banks., i) Margin on L/ cs., ii) All Cash Credit Accounts (Credit ii) Margin on Guaranties., Balances), iii) Lockers Key Security Deposits., iii) Demand Portion of savings bank iv) Unclaimed Dividend/ Dividend Payable, Accounts., v) Credit Balance and adjustment account., iv) Overdue Fixed Deposits accounts., vi) Security Deposit accounts (amount, v) Call Deposits accounts other than from deposited by Supplier, banks (on Demand), of stationery and furniture etc. as security)., vi) Unclaimed balance accounts., vii) Sundry Deposits accounts., vii) Interest accrued on above accounts., viii) Any other miscellaneous deposits, viii) All other Deposits payable to public on payable on demand., demand e.g., 1. Outstanding Bills., 2. Payment Orders., 3. Telegraphic Transfers & M.T., 4. Outstanding Drafts., 5. Drafts payable Account., 6. Demand Drafts., 7. Hajj Deposits., 8. Bonus scheme Remittances Payable., 9. Branch Remittances Payable., 10. Bills Payable., 11. Certificates Payable., ix) Foreign Currency Deposit account, x) Unsold balance of NFCD account., xi) Convertible Taka account., What are the components of Time Liabilities?, (b) Other Time Liabilities, (a) Time Deposits (General), , Page | 21

Page 22 :

i) Fixed Deposits from Customers other than, from banks., ii) Special Notice Deposits other than those, from other banks., iii) Time portion of the savings bank deposits., iv) Short term Deposit accounts., v) Recurring Deposits, vi) Interest accrued on all above accounts., , i) Employees' Provident Fund Accounts., ii) Staff Pension Fund., iii) Employees' Security Deposits., iv) Staff Guarantee or Security Fund., v) Contribution towards Insurance Fund., vi) Any other miscellaneous liabilities, payable on notice or after a, specified period., vii) Margin account- Foreign Currency., viii) Liabilities towards Foreign banks/, Correspondence bank., ix) Bi-lateral trade liabilities., Chapter F: Cash management, , 01., 01., 02., 03., 04., 05., , 06., 07., , 08., 09., 10., 11., 12., 13., 14., , Type of Cash Limit:, Cash Counter Limit, Cash Transit Limit, Safe Limit, Notes Refund Regulation -2012, Altered Note means a note in which an alteration has been made in the number, signature or, value or in any other respect, Charred Note means a note which is burnt or having sign of burn partially or wholly., Damp Note means a note which is wet partly or fully, or so weak that the note(s) can be easily, broken or tom when counted or handled., Deformed and Decomposed Note means a note which has been deformed or disfigured or, vitiated or decomposed by anyway or by writing with ink or other materials on the note., Half Note means half of a note which has been divided vertically or horizontally through or near, the center. A note formed by joining one half, which is identifiable, to another half, which is not, identifiable as belonging to the note to which first mentioned half belongs, will not be accepted, as a single note but will be treated as two half notes., Mismatched note means a note formed by joining a half note of one note to a half note of another, note., Mutilated note means a note of which a portion is missing or a note which is composed of pieces,, provided that the note presented is clearly more than half a note in area and that if the note is, composed of pieces of a note joined together, each piece is, in the opinion of Prescribed Officer,, identifiable as the part of the same note., "Obliterated Note" means a note, not being a mutilated or altered or mismatched note, which has, become or has been rendered fully or partially undecipherable;, Note means a note of the Bangladesh Bank issued by the Bank and a currency note of the, Government of the People's Republic of Bangladesh issued by the Government., Number includes the letter (s) and number (s) denoting the series to which the note belongs, No Claim in respect of a note alleged to have been lost, stolen or wholly destroyed shall be, entertained., Any claim which was not made by the claimant within 12 months of the time when it might first, have been made by him, the Prescribed Officer shall not entertain the claim., Half the value of a half note shall be paid if the number of the note is identified on the half note, and the half note is entire and has not been divided and bears all the essential features of that, half., Disposal of mutilated note(s):, Area of the note, Payable value of the note of, presented of respective, respective denomination, denomination, Page | 22

Page 23 :

15., 16., 17., 01., 02., , 03., , 04., , 05., 06., , 07., , 51% - 75%, 50%, 76% - 90%, 75%, Above 90%, 100%, A claim in respect of an altered, mismatched or fully obliterated note shall be rejected., A claim in respect of a damp note and partially obliterated note shall be rejected unless the, Prescribed Officer is satisfied as to the identity and genuineness of such note, No claim in respect of charred note shall be entertained unless the unburnt area of the note(s) is, more than 50%, bearing main essential features and is worth to check its genuineness., Chapter G: Payment system, What is Clearing?, Clearing is the process of collection of proceeds of instruments of different banks by a collecting, bank through some systematic procedures with the involvement of Central Bank., What is BACH? (Bangladesh Automated Clearing House), BACH” (Bangladesh Automated Clearing House) means the overall system and facility that, supports the Exchange and settlement of payment items among Participating Banks and the, Bangladesh Bank., What are the Components of BACH?, BACPS: Bangladesh Automated Cheque Processing System “BACPS” means a facility that clears, cheques and approved payment items for Bank companies., BEFTN: Bangladesh Electronic Fund Transfer Network the Bangladesh Electronic Funds Transfer, Network (BEFTN) operates as a processing and delivery center providing for the distribution and, settlement of electronic credit and debit instruments among all participating banks., What is MICR?, Magnetic ink character recognition, or MICR, is a character recognition technology used, primarily by the banking industry to facilitate the processing and clearance of cheques and other, documents., Features of MICRFront View Instrument No. (7 Instrument Type (2 digit), digit), Routing No. (9 digit), Rear View Payee’s A/C no.& Phone No Clearing, Ins. A/c No. (13 digit), Stamp Endorsement & Sign Endorsement line print, What is PBM?, The BACPS Participating Bank Module ( PBM) provides cheque envelope validation and provides an, interface for sending and receiving cheque envelopes from and to BACPS., What are the BACPS threats?, The whole system is highly secured but some fraudulent attempts have found misusing the, BACPS system:, Reasons behind fraudulent attempt, a. Material alternation in amount both numeric and word figure, b. Material alternation in instrument no., c. Material alternation in MICR encoded line, d. Material alternation in MICR line, e. Duplicate print, What are the protective measures against BACPS threats?, a. Verifying by UV detector before present, b. Instrument print with erasable UV ink, c. Positive pay Instruction, d. New account alert, Page | 23

Page 24 :

10., , e. KYC update and monitoring Example, What is Value Date Clearing?, When an outward clearing instrument is posted in the system, the amount lay at the account as, un-cleared balance. Based on type of clearing, the instrument has a maturity date i.e. date when, the instrument is supposed to honor through clearing house. If the instrument is not return by the, drawee Bank, on the maturity date the instrument amount is accumulated with available balance, at the account level as cleared fund after running Value date clearing process in the system., What is Same Day Clearing?, Bangladesh Bank, Dhaka introduced another clearing house named “Same Day Clearing" for, quick clearing large amount instruments. This clearing house deals with instruments drawn on, Branches of different Banks and for the instrument amount Tk. 5.00 lac and above. As regards, clearing house timing for presenting instrument the detailed guidelines of ABBL is to be, followed., State the responsibilities of presenting bank under BACH., , 11., , What are the responsibilities of paying bank?, , 12., , The law has not imposed any duty on the bank to collect the cheque, dividend warrants and other, allied instruments. A bank may refuse to collect them if it feels like., The Collecting Bank acts as a holder for value provided that When the banker gives cash in exchange for a cheque drawn on another banker., When the banker credits his customer with the amount of the cheques soon as it is paid in, and allows him to draw at once against the amount., When the cheque is expressly paid to reduce the amount of an overdraft., The collecting banker would receive statutory protection under provisions of section 131 of the, Negotiable Instrument Act; only when he collects a crossed instrument in good faith and without, negligence., Basis of negligence:, If a banker is completely careless in collecting a cheque, he will be held liable under the, ground of ‘gross negligence’., Collecting a cheque crossed A/C payee other than the payee’s account., Failure to verify the correctness of endorsement., Failure to verify the existence of authority in case of per pro signatures., The duties and responsibilities of a collecting banker is protected under section 131 & 131 A of, the NI Act if he exercises reasonable diligence, care and skill in presenting and obtaining, payment of cheques, bills and drafts handed over to him for collection., Paying Banker is a banker on whom a cheque is drawn should pay the cheque when it is, presented for payment., A banker is bound to honor his customer’s cheque, to the extent of the funds available and the, existence of no legal bar for payment., If the paying banker wrongfully dishonors a cheque, he will be asked to pay damages and the, bank is bound to compensate., The paying banker should not pay mutilated cheque. He should return the cheque for the, drawer’s confirmation., Circumstances under which a cheque can be dishonored:, Countermanding, Notice of death of a customer, Notice of insolvency, Notice of insanity, Notice of assignment, Defective title, , 08., , 09., , 13., , 14., 15., , 16., , 17., 18., 19., 20., , 21., , Page | 24

Page 25 :

22., , 23., , 24., , If a paying banker pays a cheque which bears a forged signature of the payee or endorsee, he is, liable to the true owner of the cheque., The essential features of Payment in Due Course:, Apparent tenor of the instrument: The apparent tenor refers to the intention of the parties, as it is evident from the face of the instrument., Payment in good faith and without negligence: Good faith forms the basis of all banking, transactions. Negligence refers to carelessness in discharging duties. If negligence is, proved, the bankers will loss statutory protection in the following situations:, payment of a crossed cheque over the counter., Payment of a post-dated cheque before maturity., Failure to verify regularity of an endorsement., Payment must be made to person who has actual possession of the instrument and he is, entitled to receive the amount of the cheque., There should not be any doubt about payment., Bangladesh Electronic Funds Transfer Network (BEFTN), What is BEFTN?, The Bangladesh Electronic Funds Transfer Network (BEFTN) will operate as a processing and, delivery center providing for the distribution and settlement of electronic credit and debit, instruments among all participating banks. This Network will operate in a real-time batch, processing mode. All payment transactions will be calculated into a single multilateral netting, figure for each individual bank. Final settlement will take place using accounts that are, maintained with Bangladesh Bank., What are the Participants of BEFTN?, The EFT Network is a multilateral electronic clearing system in which electronic payment, instructions will be exchanged among Scheduled Banks. The system involves transmitting,, reconciling and calculating the net position of each individual participant at the end of each, processing cycle. The participants involved are:, Originator: The Originator is the entity that agrees to initiate EFT entries into the network, according to an arrangement with a receiver., Originating Bank (OB): The originating bank is the bank which receives payment instructions, from its client (the originator) and forwards the entry to the BEFTN., Bangladesh Electronic Funds Transfer Network (BEFTN): BEFTN is the central clearing, facility, operated by Bangladesh Bank that receives entries from OBs, distributes the entries to, appropriate RBs, and facilitates the settlement functions for the participating banking institutions., Receiving Bank (RB): The receiving bank is the bank that will receive EFT entries from, BEFTN and post the entries to the account of its depositors (Receivers)., Receiver: A receiver is a person/organization who has authorized an Originator to transmit an, EFT entry to the account of the receiver maintained with the Receiving Bank (RB)., , 25., 26., , Correspondent Bank: In some cases an Originator, Originating Bank or Receiving Bank may, choose to use the services of a Correspondent Bank for all or part of the process of handling EFT, entries., What are the Entries of EFT?, Debit Entries, Credit Entries, Utility bill payments, Inward Foreign remittances, Equal Monthly Installments (EMI), Domestic remittances, Page | 25

Page 26 :

27., , Government tax payments, Payroll private and government, Government license fees, Dividends/Interest/Refunds of IPO, Insurance premium, Business to business payments ( B2B), Mortgage payments, Government tax payments, Club/Association subscriptions, Customer-initiated transactions, What is RTGS?, An RTGS system is a gross settlement system of money or securities in which both processing, and final settlement of funds transfer instructions can take place continuously (i.e., in real time)., It will enable instant settlement of high value local currency transactions as well as government, securities and foreign currency-based transactions. As it is a gross settlement system, transfers, are settled individually, i.e., without netting debits against credits. An RTGS system can thus be, characterized as a fund transfer system that is able to provide continuous intraday finality for, individual transfers. In RTGS or large-value funds transfer system, the transmission and, processing of payment messages are typically automated or electronic, while settlement takes, place in central bank funds. Along with these individual interbank transactions all other Deferred, Net Settlement Batches (DNSB) such as BACPS, BEFTN or NPSB will settle their net position, through RTGS system, RTGS in turn will be linked to Bangladesh Bank core banking solution, , , , 36., 37., 38., , Page | 26