Page 1 :

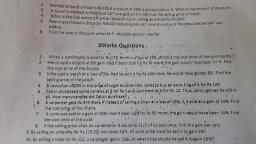

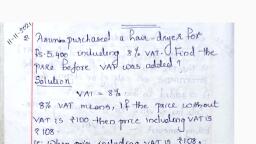

VALUE ADDED TAX (VAT), (QUESTIONS), TYPE 1: BASIC, The cost of a TV set at a showroom was Rs.36500. The sales tax charged was 8%. Find the bill amount., (Ans: Rs.39240) (R.S. Aggarwal Ex-1), The list price of a refrigerator is Rs.14650. If 6% is charged as sales tax, find the cost of the refrigerator., (Ans: Rs.15529) (R.S. Aggarwal Q.No-1), George bought a V.C.R. at the list price of Rs.18500. If the rate of VAT was 8%, find the amount he had to pay for purchasing the V.C.R., (Ans: Rs.19980) (R.D. Sharma Ex-1), The price of a pair of shoes is Rs.450. If Amit paid Rs.45 as VAT for it, find the rate of VAT., (Ans: 10%) (R.D. Sharma Ex-8), Swarna paid Rs.20 as VAT on a pair of shoes worth Rs.250. Find the rate of VAT., (Ans: 8%) (R.D. Sharma Q.No-5), Amit purchases a motorcycle, having marked price Rs.46000 at a discount of 5%. If VAT is charged at the rate of 10%, find the amount Amit has paid to purchase the motorcycle., (Ans: Rs.48070) (R.D. Sharma Ex-10), The list price of a refrigerator is Rs.9700. If a value added tax of 6% is to be charged on it, how much one has to pay to buy the refrigerator?, (Ans: Rs.10282) (R.D. Sharma Q.No-1), Rani purchases a pair of shoes whose sale price is Rs.175. If she pays VAT at the rate of 7%, how much amount does she pay as VAT? Also, find the net value of the pair of shoes., (Ans: Rs.12.25 & Rs.187.25) (R.D. Sharma Q.No-4), Sunita purchases a bicycle for Rs.660. She has paid a VAT of 10%. Find the list price of the bicycle?, (Ans: Rs.600) (R.D. Sharma Q.No-16), The sales price of a television, inclusive of VAT, is Rs.13500. If VAT is charged at the rate of 8% of the list price, find the list price of the television., (Ans: Rs.12500) (R.D. Sharma Q.No-17), TYPE 2: If price including VAT is Rs x. Then, Find out (i) Original price/list price/basic price/printed price/sale price, if VAT is given., (ii) VAT if Original price/list price/basic price/printed price/sale price is given., Raman bought an air cooler for Rs.5400 including VAT at 8%. Find the original price of the air cooler., (Ans: Rs.5000) (R.S. Aggarwal Ex-2), Tanvy bought a watch for Rs.1980 including VAT at 10%. Find the original price of the watch., (Ans: Rs.1800) (R.S. Aggarwal Q.No-3), Mohit bought a shirt for Rs.1337.50 including VAT at 7%. Find the original price of the shirt., (Ans: Rs.1250) (R.S. Aggarwal Q.No-4), Mohini purchased a computer for Rs.37960 including VAT at 4%. What is the original price of the computer?, (Ans: Rs.36500) (R.S. Aggarwal Q.No-6), Sajal purchased some car parts for Rs.20776 including VAT at 12%. What is the original cost of these spare parts?, (Ans: Rs.18550) (R.S. Aggarwal Q.No-7), Karuna bought 10 g of gold for Rs.15756 including VAT at 1%. What is the rate of gold per 10 g?, (Ans: Rs.15600) (R.S. Aggarwal Q.No-5), The price of a T.V. set inclusive of VAT is Rs.13530. If the rate of VAT is 10%, find its basic price., (Ans: Rs.12300) (R.D. Sharma Ex-2), A refrigerator is available for Rs.13750 including VAT. If the rate of VAT is 10%, find the original cost of furniture., (Ans: Rs.12500) (R.D. Sharma Q.No-8), The cost of furniture inclusive of VAT is Rs.7150. If the rate of VAT is 10%, find the original cost of furniture., (Ans: Rs.6500) (R.D. Sharma Q.No-7), Aman bought a shirt for Rs.374.50 which includes 7% VAT. Find the list price of the shirt., (Ans: Rs.350) (R.D. Sharma Q.No-3), Vikram bought a watch for Rs.825. If this amount includes 10% VAT on the list price, what was the list price of the watch?, (Ans: Rs.750) (R.D. Sharma Q.No-2), Ajit buys a motorcycle for Rs.17600 including value added tax. If the rate of VAT is 10%, what is the sale price of the motorcycle?, (Ans: Rs.16000) (R.D. Sharma Q.No-12), Rajeeta purchased a set of cosmetics. She paid Rs.165 for it including VAT. If the rate of VAT is 10%, find the sale price of the set., (Ans: Rs.150) (R.D. Sharma Q.No-15), A colour TV is available for Rs.26880 inclusive of VAT. If the original cost of the TV is Rs.24000, find the rate of VAT., (Ans: 12%) (R.S. Aggarwal Ex-3), The sale price of a TV set including VAT is Rs.27000. If the VAT is charged at 8% of the list price, what is the list price of the TV set?, (Ans: Rs.25000) (R.S. Aggarwal Q.No.8), Rohit purchased a pair of shoes for Rs.882 inclusive of VAT. If the original cost be Rs.840, find the rate of VAT., (Ans: 5%) (R.S. Aggarwal Q.No.9), Malti bought a VCR for Rs.19980 including VAT. If the original price of VCR be Rs.18500, find the rate of VAT., (Ans: 8%) (R.S. Aggarwal Q.No.10), The value of a car including VAT is Rs.382500. If the basic price of the car be Rs.340000, find the rate of VAT on cars., (Ans: 12 %) (R.S. Aggarwal Q.No.11), David purchased a pair of shoes for Rs.441 including value added tax. If the sales price of the shoes is Rs.420, find the rate of value added tax., (Ans: 5%) (R.D. Sharma Ex- 5), A colour TV is available for Rs.13440 inclusive of VAT. If the original cost of TV is Rs.12000, find the rate of VAT., (Ans: 12%) (R.D. Sharma Q.No-9), Manoj buys a leather coat costing Rs.900 at Rs.990 after paying the VAT. Calculate the rate of VAT charged on the coat., (Ans: 10%) (R.D. Sharma Q.No-13), TYPE 3: Reduction Required in the list price so that customer need to pay amount (inclusive of tax) = list price, Reena goes to a shop to buy a radio, costing Rs.2568. The rate of value added tax is 7%. She tells the shopkeeper to reduce the price of the radio to such an extent that she has to pay Rs.2568, inclusive of value added tax. Find the reduction needed in the price of the radio., (Ans: Rs.168) (R.D. Sharma Ex-4) (R.D. Sharma Q.No-10), Nisha goes to a shop to buy a box costing Rs.981. The rate of the VAT is 9%. She tells the shopkeeper to allow a discount on the price of the box to such an extent that she pays Rs.981 inclusive of VAT. Find the discount in the price of the box., (Ans: Rs.81) (R.D. Sharma Ex-9), List price of a cooler is Rs.2563. The rate of VAT is 10%. The customer requests the shopkeeper to allow a discount in the price of the cooler to such an extent that the price remains Rs.2563 inclusive of VAT. Find the discount in the price of the cooler., (Ans: Rs.233) (R.D. Sharma Q.No-20), TYPE 4: DISCOUNT, Sarita buys goods worth Rs.5500. She gets a rebate of 5% on it. After getting the rebate if VAT at the rate of 5% is charged, find the amount she will have to pay for the goods., (Ans: Rs.5486.25) (R.D. Sharma Q.No-6), Shikha purchased a car with a marked price of Rs.210000 at a discount of 5%. If VAT is charged at the rate of 10%, find the amount Shikha had paid for purchasing the car., (Ans: Rs.219450) (R.D. Sharma Q.No-18), List price of a washing machine is Rs.9000. if the dealer allows a discount of 5% on the cash payment, how much money will a customer pay to the dealer in cash, if the rate of VAT is 10%?, (Ans: Rs.9405) (R.D. Sharma Q.No-21), TYPE 5: FIND THE NET/FINAL PRICE OF ARTICLE (AFTER TAX), IF PRODUCT IS MORE THAN ONE, Rakesh goes to a departmental store and purchases the following articles:, Biscuits and bakery products costing Rs.50, VAT @ 5%., Medicines costing Rs.90, VAT @ 10%., Clothes costing Rs.400, VAT @1%, and, Cosmetics costing Rs.150, VAT @ 10%, Calculate the total amount to be paid by Rakesh to the store., (Ans: Rs.720.50) (R.D. Sharma Q.No-14), Shruti bought a set of cosmetic items for Rs.345 including 15% value added tax and a purse for Rs.110 including 10% VAT. What per cent is the VAT charged on the whole transaction?, (Ans: 13.75%) (R.D. Sharma Q.No-19)