Page 1 :

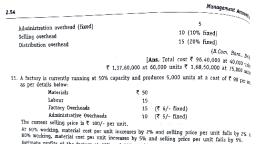

Management Accountina, , 3.80, , EXAMINATION QUESTIONS, Objective Type Questions, , I. True or False Statements, not of cost, cost control and, 1. Standard costing is a technique of, variance., of labour rate, 2. Labour mix variance is a sub-variance, , 3. Idle time variance is, , always, , reduction., , unfavourable., , always favourable., variance is equal, variance plus overhead efficiency, , 4. Overhead volume variance is, 5. Overhead expenditure, , to, , budget variance, , overhead, , for variable overhead., 6. Calendar variance arises, , only in, , of fixed overheads., time, sub-variance of labour, case, , variance., , a, 1,800 (Favourable)., variance is, Gang composition variance is, and material quantity, (Adverse), T, 1,000, is, 8. When material cost variance, F 800 (Adverse)., then material price variance will be, materal mix, , 7., , 9. Consumption of, , high, , value materials in, , larger proportion, , variance., , results is adverse, , cost., and revised standard, difference between actual cost, 10. Revision variance is the, 8. False, 9., 5. False, 6. True, 7. True,, 1. False, 2. False 3. True, 4. False,, , True, 10. False], , [Ans., , Essay Type Questions, cost' and, explain the concept of 'standard, of standard costing as, Explain briefly the significance, , 1. Define and, 2., , costing., technique of cost, , 'standard, a, , cost., between standard cost and estimated, of industries is standard, 4. Define standard costing. In what type, , 3., , Distinguish, , between historical, 5. Point out the differences, , costing and, , (B.Com. Hons. Delhi), control., , (B.Com. Hons. Delhi), (B.Com. Hons. Delhi), , costing employed?, , standard, , limitations of standard costing., 6. Discuss the advantages and, standard costing. Describe briefly its, 7. Outline the primary objects of, , (B.Com., Calicut), , costing., , uses, , (B.Com., Kerala), (B.Com., Kerala), , under each of the, , following, , heads:, , (b) As a basis of inventory valuation,, (d), As a guide in fixing selling prices., As, (B.Com. Hons., Delhi), (B.Com. Hons., Delhi), Distinguish between standard costing and budgetary control., (a), (c), , 8., , As, , measuring rod of performance,, an aid in preparing earnings budget,, a, , 9. What is 'standard costing'? Bring out clearly the relationship between standard costing and budgetary, , (B.Com. Hons.Delhi), , control., , 10. Standard costing and budgetary control are inter-telated but not independent., (B.Com. Hons. Delhi), 11. "Calculation of variances in standard costing is not an end in itself, but a means to an end." Discuss., , T.C. W.A. Inter), 12. What do you understand by the following, (a) Fficiency ratio (6) Activity ratio (c) Capacity ratio, , (B.Com. Hons., Delhi), , Practical Questions, 1. The following particulars are regarding the standard and actual production of product X., Standard quantity of material per unit, 5 kg., , Standard price per kg., , 5

Page 2 :

Standard Costing and, , Variance, , Analysis, , 3.81, 400, , Actual number of units produced, Actual quantity of materials used, , 2,200 kg., 74.80 per kg., , Price of materials, , Calculate (i) Material price variance (i) Material usage variance, , (B.Com., Madurai), , [Ans. (i), , 440 (F) (i) 7 1,000 (A)], , 2. Given that the cost standards for material consumption are 40 kg. @R 10 per kg, compute the, variance when actuals are:, , (a), (c), , 48 kg. at, 48 kg. at, , (b) 40 kg. at, , 10 per kg., 12 per kg., , (d), , 36, , kg. for, , 12 per kg., a, , total, , cost, , of 7 360., , (C.A. Inter), (Ans. MPV (a) Nil, (6) 7 80 (A), (c) T 96 (A), (d) Nil,;, , MUV (a), 3. In, , factory,, , a, , 80 (A). (b) Nil, (o) 7 80 (A), (d) R 40 (F)], , standard estimates for material for the manufacture of 1,000 units of, , product, , Z is 400, , kg. at 2.50 per kg. When 2,000 units of product are produced it is found that 825 kg of materials, (B.Com, Calcutta), are consumed at, 2.70 per kg. Calculate material variances., [Ans. MCV 7 227.50(A), MPV 165(A) MUV 62.50 (A)], , 4. Calculate the mix variance, Rate, , Material, , Quantity (kg.), , A, , 10, , 2, , B, , 15, , 3, , A, , 8, , 2.50, , B, , 17, , 2.50, , Standard, Actual, , (B.Com., Calicut), [Ans. Mix Variance, 5. The standard cost card, , for, , one, , Material 4 pieces @, , unit of, , product, , shows the, , following, , 2 (A)], , costs for material and labour., , 5.00, , Labour 10 hours @ 7 1.50, , 5,700 units of the product, , were, , manufactured, , during, , the month of March, with the, , following, , material and labour costs:, , Material, Labour, Calculate, , 6. For, , a, , -, , 23,000 pieces @ F 4.95, 56,800 hours @ 7 1.52, , (B.Com. Hons., Delhi), , variances., appropriate material and labour, , unit of product A, the, , 7, (A), [Ans. (i) MCV 150 (F); MPV T 1,150 (F); MQV R1,000, 300 (F)], LEV, 7, LRV, 1,136, 836, (A);, LCV, (A);, (ii), standard data is given below:, , Material. . . 5 kg. @7 40 per kg., Labour. . . 40 hrs. @7 1.00 per hour, , 7200, 40, , 240, Actual data, , Actual production 100 units, Materials: 490 kg. @ 7 42 each, , Labour: 3,960 hrs. @F 1.10 per hour, , 20,580, 4,356, 24,936

Page 3 :

Management Accounting, , 3.82, , Calculate:, 1. Material cost variance, 3. Material, usage variance, 5. Labour rate variance, 580 (A)., Ans. 1., , ne, , standard cost, , 2. Material, , 6. Labour efficiency, 7 356, 3. 7 400 (F), 4., , (A),, , 'material' and labour' for the, , on, , variance, , variance, Labour cost, variance, , 4., , 2. 7 980, , price, , making of, , 5. ? 396, , (A),, , a, , unit, , or à, , (A),, , certain, , 6, , (Adapted), 740 (F, , product, , are, , estimated as under:, Material 80 kg. at, 1.50 per kg., Labour 18 hrs. at 7 1.25 per hr., , 75 kg. of matenal costing? 1.75 per, of a unit, it was found that, the wage rate being 1.50 per hour., was 16 hours,, Kg. has been consumed and that the time taken, variances.(B.Com., Hons., Delhi), rour are required to calculate material and labour, LRV R 4 (A), LEV T 2.50 (F)1, MPV-T 18.75 (A), MUV T 7.50 (F),, , n completion of the production, , [Ans., , 8. From the following data, calculate material mix variance., , Standard, , Actual, , Price, , quantity, , quantity, , per unit, , X, , 50, , 45, , 14, , Y, , 40, , 35, , 12, , 40, , 11, , Material, , 30, , Z, Due to, , it, , shortage of X,, , was, , decided to reduce its, , consumption by 10 and, , increase the, , consumption, , (B.Com. Calcutta), , of Y and 2 by 6 and 4 respectively., , [Ans. MMVT 4 (A)], , (Hint. Adjust standard qunatities), 9. From the following calculate:, , (a), , Price variance,, , (b) Usage, , variance,, , (c), , Mix variance, and, , (d), , Revised usage variance:, Actual, , Standard, , Material, , Qty., , Rate, , Amt., , 20, , 5, , 3, , 15, , 3, , 60, , 10, , 6, , 60, , 6, , 120, , 15, , 5, , 75, , aty., , Rate, , Amt., , A, , 10, , 2, , B, , 20, , C, , 20, , (B.Com., Madurai), , [Ans. (a), , 20 (A), (6) 70 (F), (c) 7 10 (A), (d) s0 (F)], , 10. From the following compute : (i) Material price variance (ii) Material quantity variance (ii) Matenal, mix variance, and, , (iv), , Material cost variance., , Standard, , Material, , Quantity, , Actual, , Unit price, , Kg., , Quantity, Kg., , 10, , B, , 20, , 3, , 10, , 20, , 6, , 5, , 50, , 30, , Unit Price

Page 4 :

Standar Costing and, , Variance Analysis, , 3.83, , [Ans. (i), , 20, , (A), (i), , 70, , (F), (ii), , (A), (iv) ? 50 (F)), (M.Com. Bharathidasan), 10, , 11. Dhilips Company manufactures Product P by mixing three raw materials. For every 100 kg. of P, 125, ra. of raw materials are used. In April there was an output of 5,600 kg of P. The standard and actual, , particulars, , tor, , April, , are as, , follows:, , Standard, , Raw Material, , Actual, , Mix, , Price per Kg., , Mix, , Price per Kg., , I, , 50%, , 40, , 60%, , 42, , II, , 30%, , 20, , 20%, , 16, , III, , 20%, , 10, , 20 %, , 12, , Calculate all material variances assuming actual quantity of materials consumed was 7,000 kg, , (B.Com. Hons. Delhi), , Ans. MCV T 19,600 (A), MPV, , 5,600 (A), MUv, MMV, , 14,000 (A), , 14,000 (A),, , MYV Nil], , 12. From the following data, calculate material variances., Material, , St. aty., , St. Rate, , Actual Qty., , Actual Rate, , 1.05, , 7,500 kg., 3,300 kg., 2,400 kg., , 1.20, , Y, , 8,000 kg., 3,000 kg., 2,000 kg., , Z, , 2.15, 7 3.30, , 2.30, 3.50, , Also write a note on the relationship of various variances that you compute., , (T.C.W.A., Inter), [Ans. MCV, , 3,540 (A); MPV 2,100 (A); MOV T 1,440 (A);, MMVR 1,110 (A); MRQV 330 (A)], , 13. Birla& Co. Ltd. manufactures product P and uses a standard cost system. Standard product and cost, , specification for 1,000 kg. of product, , are as, , follows:, Price, , Qty in kg., , Material, , .50, , 2,000, , 200, , 4.00, , 800, , 200, , 1.00, , 200, , 800, , B, , Cost, , ,, , CoeD, , 3,000, , 1,200, , Input, Output, , 1,000, , Material records indicate:, Consumption in January, , 1,57,000 kg. @7, B, , 2.40, , 3,2,, , 38,000 kg@7 4.20, , 36,000 kg@7 1.10, C, Actual finished production for the month of January is 2,00,000 kg. Calculate material vanances., , (B, [Ans., , MPV-T 4,500, , (F), MUV, , Inter), 3,000 (A),, 24,000 (F)], , Com Hons Delhi I.C.W.A., 19,500, , MYV-R 22,500, , (F), MMV, (F), MCVR

Page 5 :

Management Accounting, 3.84, and 40, , 14. Pieco Ltd. is, , producing, , ndard, , a, , standard loss of productior is, , mix, , 30%., , The, , X, of material, by using 60 kg., 5, per kg., X is, , standard, , kg., , price of, , material Y. The, Der, kg., , of, of Y7 10, , and that, , The actual mixture and yield were as follows:, , X 80 kg. @ R 4.50 per kg., Y 70 kg. @ 7 8 per kg., , (C.S. Inter), (F):, , Actual yield is 115 kg., Calculate material vaiances., [Ans., , roowing, , ., , of, the particulars in respect, , are, , a, , product where, , two, , MMV, , types, , of, , Actual, , Standard, , Material, , A, , 120, , B, , 80, , Tons, , Rate, , Tons, , input, , 10.0, , Rate, , 140, , 9.50, , 60, , 9.00, , 7.50, , 0.91, , (F);, 50 (A); MYV 7 100 (F)], materials A and B are used, , MPV R 180, , (F);, , MCV ? 230, , MQV 7 50, , 200, , 200, , 18, , 20, , Less: Loss, , 182, , 180, , Net production, You, , required, , are, , to calculate:, , (b), (d), , Material Price Variance, Material Yield Variance, , (a), (c), , Material Mix Variance,, Material, , a, , 20, , certain chemical mixture, , 40% material A at, 60% material B at, following particulars, 180, 220, , kg. of, kg. of, , (A); (6), , 'AB, , 50, , (A); () * 20 (F); (d) R 30 (A), , is:, , 400 per kg., 600 per kg., , A standard loss of 10% is, , The, , Variance, , (M. Com., Madras), , [Ans. (a), 16. The standard cost of, , Usage, , anticipated in production:, , are, , available for the month of December., , material A has been used at ? 360 per, material B has been used at 7 680 per, , kg., kg., , The actual production of 'AB is 369 kg., Calculate:, , (a), (c), (e), , Material Cost Variance, Material Usage Variance, , (b), (d), , Material Price Variance, Material Mix Variance, , Material Yield Variance, , (B, , Com Hons Delhi, I.C.W.A., , Inter], , [Ans. (a) MCV F 1,200 (A), (b) MPV 7 10,400 (A), (c) MUV T 9,200 (F),, (d) MMV 7 4000 (F); MYV 7 5200 (F)]., 17. The standard cost of a certain chemical mixture is:, 35% material A at F 25 per kg., 65% material B at 7 36 per kg.

Page 6 :

dard Costing, , and Variance Analysis, , 3.85, , 5%, lo is expected in production., andard loss of, at, 27 per kg., and, 125 kg. of material A, 275 kg. of materñal B at ? 34 per kg., , A, , output, The actual, , was, , 365, , During, , a, , period, , there is used:, , kq., , Calculate:, , Material Cost Variance, , (a), (c), , (b) Material Price Variance, (d) Material Yield Variance, , Material Mix Variance, , [Ans. (a), 1R., , 372.97 (A), (b), , (B.Com. Hons., Delhi;], 165 (A), (d) 507.97 (A), , 300 (F), (c), , of product A 2 is as follows, The standard mix, Material, Kgs, , Price per kg. (F), , 45, , X, , 6.00, , 25, , Y, , 4.50, , 30, , Z, , .50, , The standard loss in production is 10% of input. There is no scrap value. Actual production for a, , month was 7,425 kgs. of A2 from 80 mixes. Actual purchases and consumption of material during, the month were :, , Kg, , Material, , Price per kg. (7), , 4,200, 1,700, , X, , 6.50, , 4.25, 9.75, , 2,600, , You are required to calculate the following varíances for presentation to the management:, , (ii) Material price, (iv) Material yield, , () Material cost vanance, , (ii), (v), , Material mix variance, Material usage variance, , [Ans. (i), , 7 4806.25, , cost variance, , (A), (ii) 7 2,325 (A): (ii), , F, , (C.S. Inter), 812.50 (A),, , (iv) F 1668.75 (A) (v) 7 2481.25 (A)], , of 6", 19. Modern Tiles Ltd. makes plastic tiles of standard size, materials:, you are required to calculate direct, , () the, () the, , variance, variance., , x, , 6", , x, , 1/8"., , From the, , following information,, , in total., , (a) price; and (6) usage., mix; and (6) yield., (0n) the usage variance analysed into (a), an output of, A standard mix of the compound required to produce, cost variance sub-divided into, , thick is as follows:, , 20,000 square feet of tiles, , Direct Materials, , Quantity (Kgs.), , Price Per Kg. (7), , 600, , 0.90, , A, , 400, , 0.65, , B, Dunng December, eight mixes, Direct Materials, , 0.40, , 500, , C, were, , processed and, 5,000, , 2,900, , B, , 4,400, , C, Actual production for December, , actual materials consumed, , Quantity (Kgs.), , A, , was, , 1/8, , 6,20,000 tiles., , were:, , Price Per Kg. (7), 0.85, , 0.60, 0.45, , (B., , Com Hons Delhi, C.S., , Inter)

Page 7 :

Management Accountina, , 3.86, 220, , [Ans. MCV T, , [Hint., , Area covered per, , tile, , Area per sq. ft, , No. of tiles, , required, , per sq. ft, , 6", , =, , 6", , =, , 12", , x, , 12", , =, , 144, , +, , 36, , x, , MPV 7 175, , (A),, , output from, , 8, , 5, MMV R 55, , (F);, (F); MYV, MYV? 450, ze, , 36", , =, , =, , (A), , 144", , =, , 4, , No. of tiles required for 20,000 sq. ft = 20,000 x 4, St., , (F),, , 80,000,, , 6,40,000 tiles., , mixes 80,000x 8, , Actual output = 6,20,000 tiles.], Z0. The standard material cost of manufacturing a product shows the following standards:, Materials, , Quantity, , A, , 40 kg., 10 kg., 50 kg., , B, , C, , Amount, , Standard Price per kg, 75, , 3,000, , 50, , 500, , 20, , 1,000, 4,500, , Material cost per unit (Total), , The standard material input mix is 100 kg. and the standard output of the finished product is, , kg. The actual results for period are, , 90, , Materials used, , 2,40,000 kg., , @80 per kg., , 40,000 kg., 2,20,000 kg., , @R 52 per kg., @7 21 per kg., , Actual output of the finished product is 4.20,000 kg., , You are required to calculate the material price, mix and yield variances., , [Ans. MCV, , (I.C.W.A. Inter), , 49,00,000 (A), MPV7 15,00,000 (A), MUv 34,00,000 (A),, MMV 19,00,000 (A), MYV R 15,00,000 (A)1, , 21. The standard cost of a product is: 10 hours per unit at, , 5 per hour, , The actual data is:, , Production 1,000 units, Hours taken:, , Production, Idle time, , 10,400 hours, , Total time, , 10,800 hours, 5.20 per hour. Calculate:, , 400 hours, , Payments made 56,160 at, (a) Labour cost variance, (c) Labour rate variance, 22. Find out, , [Ans. (a), different Labour Variances., Standard, , Output, Rate of, , payment :, , Time taken:, , (6), , (d) Idle time variance., (B.Com., Meerut), 6,160 (A), (6) F 4,000 (A), (¢) R 2,160, (A), (d) 7 2,000 (A)], , 1,000 units, 6 per unit, 50 hours, , Labour efficiency variance, , Actual, 1,200 units, , Wages paid with bonus :, , 8,000, , 40 hours., , [Ans., [Hint. St., , LCV R 800, rate per, , (A),, , LRV T, , hour 7 120,, , 3,200(A),, , LEV 7, , 2,400 (F)], 200], , Actual rate per hour

Page 8 :

Standard, , Costing and, , Variance, , 3.87, , Analysis, , A fob is scheduled to be completed in 30 weeks with a labour employment of 100 skilled operatives., A Semi-skilled operatives and 60 unskilled operatives. The standard weekly wage of each type ot, , 24., , operatives are skilled R 60, semi-skilled 36 and unskilled7 24. The work is actually completed, a labour force of 80 skilled, 50 semi-skilled and 70 unskilled operatives and the, in 32 weeks with, 20 for unskilled labour., actual weekly wage rates average 65 for skilled, 7 40 for semi-skilled and, (I.C.W.A, Inter), Analyse the variance in the labour cost due to various reasons., [Ans. LCVT 8,800 (A), LRV 10,240 (A), LEV 7 1,440 (F),, LMV 19,200 (F), LREV 17,760 (A)], and 5 boys paid at standard hourly rates, A gang of workers usualy consists of 10 men, 5 women, of 40 hours, the gang is expected, of T 1.25, 0.80 and R 0.70 respectively. In a normal working week, to produce 1,000 units of output., , rates being, certain week, the gang consisted of 13 men, 4 women and 3 boys; actual hourly, to abnormal idle time and 960 units, T 1.20 0.85 and 0.65 respectively. Two hours were lost due, of output were produced., , In, , a, , Calculate appropriate labour variances., , Ans., , LCVT 70, , (A),, , LRV 7 24, , actual labour, 25. The standard labour composition and the, , (F),, , 43.10 (A), LREV T 8 (F), , composition engaged during the, , given below:, (a) Standard number of workers in a group, (b) Standard wage rate (7 per hour), (c) Actual number of workers employed, , LEV T 94, , LITV, , (L.C.W.A. Inter), (A),LMV F 58.90 (A),, month are, , Skilled, , Semi-skilled, , Unskilled, , 30, , 10, , 10, , 5, , 3, , 2, , 15, , 12, , 24, , during the month in the group, 2, , 2.5, 6, Actual wage rate per hour (R ), the group produced 9,600 standard hours of work., During the month of 200 working hours,, Labour mix, Calculations showing Wage rate variance, Labour (revised) efficiency variance,, , (d), , Required:, , (I.C. W.A., Inter), , variance and Total labour cost variance., , [Ans. Wage, , (A); Labour efficiency (revised) variance, Labour mix variance 3,000 (F); Total labour cost variance, , rate variance 7 3,300, , following data,, with, analysis of, together, Materials, , 26. From the, , Labour, , prepare unit cost statement, variances :, , showing prime, , cost, , (A);, 2,700 (A), 2,400, , of products A and B, , Product B, , Product A, , Standard, , 600 kg. @7 5.00, , 90 kg. @ 7 3.00, , Actual, , 580 kg. @ 7 5.50, , 100 kg. @ 7 2.80, , Standard, , 80 hrs. @ 7 2.00, 92 hrs. @7 1.75, , Actual, , 16 hrs. @, , 2.80, , 14 hrs. @2.600, , (T.C.W.A., Inter), Ans. Product A :, , Standard total cost, Actual total Cost, , 314.80;, 3,160; Product B :, 3,351; product B : 7 316.40;, , Total cost variance: AR 191 (A) BR 1.60 (A), , Material: A : MPV T 290 (A) MUV T 100 (F) MCV7 190, B: MPV, 20 (F) MUV 7 30 (A) MCV 7 10, Labour: A : LRV T 23 (F) LEV, 24 (A) LCV F 1,00, B: LRV R 2.80 (F) LEV F 5.60 (F) LCV 7 8.40, , (A):, (A),, (A);, (F)]

Page 9 :

Management Accounting, , 3.88, , factory during, and, , a, of workers in, the, composition of the aang, owng, composition, The standard, O e Or the production departments,, were as below:, , was, , rate, Two workers at a standard, , Skilled, , Eml-skiled:, , Unskilled, ne, , standard, , a, , standard rate, , workers at, , a, , standard, , mOnei, , onth,, , wage rate per hou, nour, , each, 20 per hour, each, 12 per hour, each, 8 per hour, hour of the product., , four units per, output of the ganq, the gang and hourly, the actual composition of, was, , however,, Type of worker, , question,, , of, rate of ?, , Four workers at, , Four, , of 7, , or, , particular, , a, , workers, , Wage, , No. of workers, , paid, , rates, , rate, , the month in, , Dunng, , paid, , were, , under, , as, , per worker, , per hour engaged, 20, , Skilled, , 2, , Semi-skilled, , 3, , 14, 10, , Unskilled, , 12 hours when, , included, the month, which, The gang was engaged for 200 hours during, the product were, breakdown. 810 units of, was possible, due to machine, gang during the month., , required, , : (a), , variances and reconcile., 2,100, , 28., , (A),, , LRV 7 3,200, , Ans. LCV, The.following standards have been, , (A), LEV, , 1,100, , set to manufacture, , a, , (F),ITV, , 1,440, , of B at, units of C at, , compute, , the, , (b) above in sub(I.C. W.A., Inter), , LYV, , 1,740, , (F)], , 9.00, , 3 per unit, , 15.00, , 1 per unit, , 32.00, 24.00, , Direct labour 3 hrs. @8 per hour, , 56.00, , Total Standard Prime Cost, units of the product, The company manufactured and sold 6,000, were as follows:, unit., 12,500 units of A at 7 4.40 per, unit., 2.80 per, at, units, , 18,000, , output of the, , .00, , 2 units of A at 7 4 per unit, , 15, , (A),, , production, , product:, , Direct materials, 3 units, , no, , (b) to, , unit labour cost of the product;, to compute the standard, the variances in, month; and (c) analyse, vanance in labour cost during the, , You are, , total, , recorded as, , during the, , year. Direct material costs, , of B, , unit., 88,500 units of C at 7 1.20 per, of these hours the, labour hours during the year. For 2,500, direct, worked, 17,500, The Company, were paid at the standard rate., hour while for the remaining the wages, company paid at 7 12 per, Variances., Variances and Labour Rate and Efficiency, Calculate Materials Price and Usage, , (B. Com Hons Delhi), , 10,000 (A), LEV R 4,000 (F)], indicate the following for the month of April., 29. The records of Conwest Engineering Corporation, Unit cost, Standards, , [Ans., , MPV7 19,100, , (A),, , MUV, , 500, , (A),, , LRV, , Direct material, , 4 gallons @7 1.20, , 4.80, , Direct labour, , 3 hours@, , 5.40, , Factory overhead, , 1.800, , 0.60 per labour hour, Total manufacturing cost, , 1.80, , 12.00

Page 10 :

Standard Costing, , and Variance, , 3.89, , Analysis, , Month of April Activity, month of April, has been 6,500 units with, ()Production, during, the, in-progress inventories., , beginning, , no, , or, , ending, , wotk, , (i) Materials, , Purchased, , 32,000 gallons@7 1.18 per gallon, , Used in production, , 25,600 gallons, , (i) Labour:, Hours worked, , 20,000, , Average hourly wage rate, , 7 1.75, , (iv) Factory, , overhead, , :, , Total overhead cost incurred, , 12,500, , only, , Calculate material variances, labour variances and, , [Ans. MCV, , (a), (b), , factory, , overhead., , (B.Com., Hons. Delhi), , (F),, , MPV 7 512, , LRV, , (F),, , MOV 7 480, , (F),, , LCV T 100, , (F),, , 1,000 (F), LEV { 900 (A), OCV F 800 (A)], , calculate:, , following, , 30. From the, , 992, , total variance for, , Variable Overhead Cost Variance, Variable Overhead, , Efficiency, , Variance, , Budgeted, , Actual, 3,20,000, , Output (units), , 3,00,000, 30,000, , Working hours, , 75,000, , 60,000, , Overhead, , 26,000, , (M.Com., Bharathidasan), [Ans. (a) 7 60,000 (A): (b) R 20,000 (F)], 31. The following information is available from the records of a company., , Fixed overhead for June, , Production in June (units), Standard time per unit (hrs.), , Budget, , Actual, , 10,0000, , 12,000, 2,100, , 2,000, , 10, , 22,000, , Actual hours worked in June (hrs.), , Compute, , (i), , Fixed overhead cost variance, , (ii) Volume variance, (v) Efficiency variance, , ii) Expenditure variance, , (iv) Capacity variance, , (B.Com. Hons. Delhi, Adapted), , 2,000 (A), (ii) F 500 (F), (iv) 7 1,000 (F), () R 500, 1,500 (A), (i), 32. From the following prepare variance analysis of a particular department for a month:, , [Ans. (i), , Variable Overhead items:, , Material handing, , Actual, , 8,325, , Idle Time, , 850, , Re-work, Overtime premium, , 825, , Supplies, , 250, , 4,000, , 14,250, Fixed Overhead Items:, , Supervision, , 1,700, , Depreciation of plant, , 2,000, , (A)]

Page 11 :

Management Accounting, , 3.90, , 5,000, , Depreciation of equipment, , 1,150, , Rates, , 350, , Insurance, , d, , per, , 10,200, , 1.70 per standard hour, rate, budaetedActual, hours,overhead., 10,000hour, standard, capacity, standard, for fixed, level is 8,000 standard, , 650, VO Cost Variance 7, , [Ans., FO Expenditure, , following prepare overhead variance, rom, factory overhead 7 14,250., the, , Ddgeted, dard, , 200, , ror a, , month., , overhead absorption rate, production capacity 10,000 standard hours, budgeted, standard hours., Actual production level 8,000, , hour for, , factory, , overhead., , 2,750, , a, , per, , (F),, , ov 7 3,400, , (A), , 5,000, , 26,500, , 22,500, , (I.C.W.A. Inter), [Ans. Budget varia:, , produces, , 1.70, , 25,000, , Actual Overhead Expenses, Applied Overhead Expenses, , rate, , Actual, , (B.Com. Hons Delhi), , Estimated Factory 0verhead, Estimated Direct Labour Hours, , Eint-St. overhead, , Inter), , 2,200 (A, 2,00 (A, , FO Cost Variance, FO Volume Variance, , (A),, department, analysis of a particular, Variance, , overhead, , hours.(I.C.W.A., , (A),, , OBV, [Ans. OCv7 650 (A),, 34. Determine the budget and capacity variances from the following data, , 35. DCW Ltd., , ror vanable, , 25,000, , 5,000, , =, , ce 7 1,500 (A), Capacity variance, , 7 5 per hour; Actual hours 22,500, 5,000) x 5, , Capacity Variance = (4,500, , single product from, , a, , single material., , Output units, , Materials:, Total quantity, , It furnishes the, , following, , Budget, , Actual, , ,000, , 6,000, , kg. 16,000, , 13,000, , 32,000, , 27,300, , Total amount, , 2,500 (A)], +, , 5, , =4,500;, , 2,500, , (A)], , information:, , Labour:, , Total hours, , 2,400, , 2,000, , 7 3,000, , 3,000, , Total amount, Variable Overhead Expenses:, 2,400, Total hours, T2,400, Total amount, You are required to compute the following variances:, (b) Material Usage Variance, (a) Material Price Varian, (d) Labour Efficiency Variance, (c) Labour Rate Variance, (e) Overhead Efficiency Variance, Overhead Budget Variance, (g) Overhead Cost Variance, , 2,000, , 2,200, , (C.A. Inter), (Ans. (a), , 1,300 (A), (6)R 2,000 (A), (c) T 500 (A). (d) 7 250 (A)., , e), 36. From the following data, calculate overhead variances:, Hours, when working at normal capacity, Overhead hourly rate, , 200 (A), ), , T 200 (A), (9) T 400 (A)], , Dept. X, , Dept. Y, , 4,000, , 2,000, , 70.50, , 2

Page 12 :

sandard Costing, , and Veniance Analysis, , 3.91, , Hours allowed for actual production, , 4,000, 4,150, 7 2,020, , Actual details- Hours, -, , Overhead, , 1,600, 1,550, , 3,750, (B. Com Hons Delhi, Adopted, 1.C. W.A. Inter), , [Ans. Dept. X - OCV R 20 (A), OBV, , 20 (A) OVV nil Dept. Y -, , OCV, , 550 (A), , OBV 7 250 (F), OvV 7 800 (A)], , 7. The following information is available from the cost records of a company for December, 2017, Materials purchased 20,000 pieces, Materials consumed 19,000 pieces, Actual wages paid for 4,950 hour, , 88,000, 24,750, , Fixed factory overheads budgeted, Fixed factory overhead incurred, , 40,000, 44,000, , Units produced-1800, Standard rates and prices are :, Direct material rate7 4 per piece, , Standard input-10 pieces per unit, Direct labour rate-{ 4 per hour, Standard hours required to produce a unit-2.5 hours, , Overheads-R 8 per labour hour., Compute the following variances, , (a) Material price and usage;, (b) Labour rate and efficiency;, (c) Fized overheads expenditure variance;, (d) Fized overheads volume variance., , (B.Com. Hons. Delhi), 7,600 (A); MUV 7 4,000 (A): (6) LRV R 4,950 (A); LEV 7 1,800 (A);, , [Ans. (a) MPV, , (c) R 4,000 (A), (d) 7 400 (A)], , 38. (a) From the following data, calculate the following variances:, , (i) Material cost variance;, (ii) Material quantity variance;, , (ii) Material price variance;, (iv) Mateial mix variance;, , (v) Material yield variance., Materials, , Standard, , Actual, , Qty., , Price, , Qty., , A, , 60%, , 20, , 88, , 30, , B, , 40%, , 10, , 132, , 10, , Standard loss, , Price, , 10%, , Actual output : 180 units, () A company has a normal capacity of 120 machines working 8 hours per day of 25 days in a, , month. The fixed overheads are budgeted 7 1,44,000 per month. The standard time requived to, manufacture one unit of production is 4 hours., In April 2006, the company worked 24 days of 840 machine hours per day and produced 5,305, units of output. The actual fixed overheads were 7 1,42,000., , Compute:

Page 13 :

3.92, , Management Accounting, Calender, (B.Com. Hons. Delhi), variance; (iii), Ans.variance;, (a) (i) T(ii)760Capacitv, (A); (i) 7 880 (A); (ii) F 120 (F); (iv) * 440 (F); (V) 3, variance., , *EIcy, , 20(A), , F 17,280 (A); (ii) 75,760, (i) F 6,360 (F); (ti), (b), (A)], 39. (a) The standard labour cost for producing 200 metres of cloth was pre-determined as 20 si, , labour hours, * @ 5, , etres of cloth, and, 30, , d, , per hour and 30 unskilled labour, 1 hours @ ? 10 per hour., was, , unskilled labour, , Calculate, , of 30 skilled, per du, , produced with the help, , hours, , paid @?, , 12, , labour hours, , paid @7 17, , per hoa.., , (7) Labour mix variance, and (iü) Labour yield variance., ()Details o f fixed overheads, production hours and production for a, , period are:, , 10,000 hours, , Budgeted hours, , 5 hours, , Standard hours per unit of output, Standard fixed overheads per hour, Actual production, , 10, , 1,920 units, , 794,000, , Actual fixed overheads, Calculate, , (7) Fixed overhead cost variance; (ii), , (ii) Fixed overhead, (B.Com. Hons. Delhi), [Ans. (a) () LMVR 30 (A); (ii) LYv, 180 (F), , Fixed overhead, , volume variance, , (b) (i) R, 40., , Following, , data is, , expenditure variance,, , 2,000, , (F); (iü), , F 6,000, , and, , ? 4,000, , (F); (ii), , (A)], , given, , Product, , Actual, , Budget, , N, , St. Price, , Qty., , St. Price, , Qty., , 8,000, , 12, 9, , 9,000, , 11, , 6,000, , 10, , K, , 12,000, , Total, , 20,000, , 15,000, , Calculate (a) Sales Value Variance, (b) Sales Price Variance, (c) Sales Volume Variance, (d) Sales Mix, Variance, (e) Sales Quantity Variance., [Ans. (a) 45,000 (A), (6) * 3,000 (A), (©) 42,000 (A), (d) * 9,000 (F), (e) R 51,000 (A)], , 41. Budgeted and actual sales for the month of December, 2017 of two products A and B of Mess. KY, Ltd. were as follows:, , Product, , Budgeted, , Sales Price/Unit, , units, X, , 6,000, 10,000, , Actual, Units, , Actual Price/Unit, , 5.00, , 5,000, , 00, , 4.75, , 2.00, , 1,500, 7,500, , 1,750, , 2.00, .90, , Budgeted costs for products X and Y were R4.00 and 7 1.50 per unit respectively. Work out from, the above data the following variances:, , (i), (ii), (ii), , Sales value variance, Sales volume variance, Sales, , (vi) Sales mixture variance, (v) Sales quantity variance, , price variance, [Ans. () R 450 (F), (i) 7 550 (A), (ii), , 1,000(F) (iv) R 1,782 (F), (V) 7 782 (A)]

Page 14 :

Standar, , Costing and, , ariance Analysis, , 3.93, , Palculate (a) efficiency ratio and (6) activity ratio from the following data., Budgeted production, , 90 units, 10, 8 units, , Standard hours per unit, Actual production, , Actual hours worked, , 2,000, , (I.C.W.A. Inter,), [Ans. (a) 40%, (b) 39% (Approx.)], 3 From the following data, calculate "activity ratio' and efficiency ratio': A factory manufactures two, nraducts 'A' and B. Standard time to manufacture product 'A' is 2 hours and product 'B 10 hours., , The budgeted, , and actual, , production in December, , Product 'A', Product 'B, , Total actual hours worked were 660., , were as, , follows:, , Budgeted, , Actual, , Production, , production, , 125 units, , 100 units, , 24 units, 3 0 units, (B.Com. Hons. Delhi; B.Com., Calicut;), , [Ans. Activity ratio 80%, Efficiency ratio 66 9%]