Page 1 :

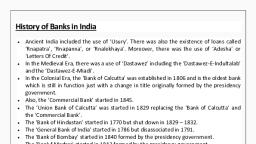

Module -1: E-Banking Business Models, , 2 Models of Electronic Payments ...., Payment and Settlement Systems..., , -ms-ottice : Packages for Institutional Automation, , 1, , NG BUSINESS MODELS, , INTRODUCTION, , Information Technology (IT) is 48 integral part of functioning ‘of most of the organisations and, most of the professionals in this digital age. In case ‘of banking which deals with money, has, now increasingly become digital and IT pays @ very important role. The raid growth in IT and, , its rapid adoption by banks in India have empowered banks to use IT extensively to offer newer, , products and services to customers apart from automating infernal processes and information, , systems. The dependence on IT is such that you cannot think of the banking business without IT, , or you may say that tt is impossible to perform banking business without IT. There has been, massive use of technology across many areas ‘of banking business in India, both from the asset, ‘and the liability side of a bank's balance sheet. The technology has spread across the Indian, banking in a very big way. Delivery channels have immensely increased the choices offered to, the customers to conduct transactions with ease and convenience, Various wholesale and retail, payment and settlement systems have enabled faster means ‘of moving the money to settle funds, among banks and customers, facilitating higher turnover of all financial transactions using iT., Developments in IT have also steered in a whole set of challenges, issues and risks to deal with, ‘as most of the data is automated and thus available in digital form., , E-banking has many names like Electronic banking, virtual banking, online banking, or internet, banking. It is simply the use of electronic and telecommunications network for delivering, various banking products ‘and services. Through e-banking, a customer can access his account, and conduct many transactions using his computer ‘or mobile phone and obviously Internet, connection., , TYPES OF E-BANKING, , Banks offer various types of services through electronic banking platforms. These are of three, types:, Level 1 — This is the basic level of service that banks offer through their websites. Through this, , service, the bank offers information about its products and services to customers. Further, some, banks may receive and reply to queries through e-mail too., , Level 2 — In this level, banks allow their customers to submit instructions or applications for, different services, check their account balance, etc. However, banks do not permit their, customers to do any fund-based transactions on their accounts.

Page 2 :

Businesses, , Customers, tL, 2., , 33, , Oe, , 7 Information Technology in Banking and Insurance - IT (S, a 4, , Level 3 — In the third level. banks allow their customers to operate their aceg transfer, bill payments, and purchase and redeem securities, etc., , Most traditional banks offer e-banking services a5 20 additional method of proyi, Further, many new banks deliver banking services primarily through the int, electronic delivery channels. Also, some banks are ‘internet only” banks without, , branch anywhere in the country. For example: Digi Bank., Therefore, banking websites are of two types:, 1. Informational W, products and services to customers., 2. Transactional Websites - These websites allow customers to conduct trans, bank’s website. Further, these transactions can range from a simple retail aceo, inquiry to a large business-to-business funds transfer., , IMPORTANCE OF E-BANKING, , Let us look at the importance of electronic banking for banks, individual custop, businesses separately., , Banks, , 1. > Lesser transaction costs — electronic transactions are the cheapest modes of transa, , 2. A reduced margin for human error — since the information is relayed electronically, f, no room for human error, , 3. Lesser paperwork — digital records reduce paperwork and make the process e&, , handle. Also, it is environment-friendly., , 4. Reduced fixed costs — A lesser need for, , g services are customer-friendly, banks exy, , branches which translates into a lower fixe, , More loyal customers — since e-bankin:, higher loyalty from its customers., , w, , Convenience — a customer can access his account and transact from anywhere 24x7;, , Lower cost per transaction — since the customer does not have to visit the branch fc, transaction, it saves him both time and money., No geographical barriers — In traditional banking systems, geographical distance, pee certain banking transactions. However, with e-banking, geographical ban, reduce, , é, , Account reviews — Business owners and designated staff members can access the, , quickly using an online banking interface. This allows them to review the account ac, , , , , , , , , , , , , , , , , , , , , , , , , , , ‘ebsites — These websites offer general information about the a, , a a ————, , 3, , E-Banking Business Models, , 2., , ity. It allows the automation of, , Better productivity — Electronic banking improves producti, enhance the productivity of the, , regular monthly payments and a host of other features to, business., Lower costs — Usually, costs in banking. relationships are based on the resources utilized If, a certain business requires more assistance with wire transfers, deposits, etc., then the bank, charges it higher fees. With online banking, these expenses are minimized., , Lesser errors — Electronic banking helps reduce errors in regular banking transactions. Bad, handwriting, mistaken information, etc. can cause errors which can prove costly. Also,, easy review of the account activity enhances the accuracy of financial transactions., Reduced fraud — Electronic banking provides a digital footprint for all employees who, have the right to modify banking activities. Therefore, the business has better visibility into, its transactions making it difficult for any fraudsters to play mischief., , E-banking in India, , In India, since 1997, when the ICICI Bi, new-generation banks offer the same to, , ank first offered internet banking services, today, most, their customers. In fact, all major banks provide e, banking services to their customers., , Popular services under e-banking in India :, , ATMs (Automated Teller Machines), Telephone Banking, , Electronic Clearing Cards, , Smart Cards, , EFT (Electronic Funds Transfer) System, ECS (Electronic Clearing Services), Mobile Banking, , Internet Banking, , Telebanking, , Door-step Banking, , Everything has two sides - pros and cons and e-bankin;, , ADVANTAGES OF E-BANKING, , g is not an exception to it., , Higher Interest Rates and Lower Charges, , banks offer higher interest rates and lower charges for services, to their, , Generally online, ct that the banks have to bear reduced costs, , customers. This is possible partly due to the fac, when serving online customers.

Page 3 :

“Y in Banking and Insurance +4 (&, , , , pfomoton Trobe, , , , 5, , , , , js obviously better than thar a aoe, , , , , , 4 ‘, panking experiere® O action. i, Therefore, the — ‘undling the same eansacl :, physical branch ‘Traditional banks have several constraints like operating hours, the physical location of the, 2 and Alerts " bank branch, holidays, ete. You don’t have to wonder if it's a holiday with online banking,, 2 wilt get more notifica ra Net CG ‘or what time is it to perform a transaction,, Esher pronty basi am 9, Additional Benefits, a investment options chan a Apart from being flexible, some banks go out of theit way to satisfy their customers By net, Speed penalizing on withdrawals on the certificate of deposits, letting customers. maintain, 3 to transfer funds ~ you can do that with, eenatat wvith no minimum balance, etc. Morcover, banks generally offer more offers and, discounts on credit and debit cards used by customers who have online accounts., , , , You don’t have t0 eee mouse. Funds from one account will, $ seconds. Anything that requires quick pa} 10, Better Customer Service, , your finger oF, ina matter of, , 4 Banking websites and apps come with cus, , and often have a dedicated “Frequently Asked Question’, , answering common customer queries,, hem if you need more help. This not, , , , , , tomized web pages to solve customer queries, (FAQs) section that helps in, , , , , transactions without all the, , , , , , , , , , , 4. Convenience, , You can conveniently ae aan! E-banking is extremely convenient You can chat with a customer service agent or call t, , the queue on Se (WiFi ‘or 4G data). You can access the website only saves the time of the customers but also that of the bank employees who can shift, , decent internet © having to visit the bank, if your banking needs don’t j their focus to more important things., , assistance of any staff member. VANTA\ F. Ki, , 5. Security, your account activities. 1. Difficult for Beginners, New customers often face difficulty in trying to get the hang of e-banking. Initially,, and are often hesitant to explore all the options, , With internet banking, you can always monitor, , i i also helps you i, i serves as a history of all the transactions but you, 4 Tal clam aces fire any severe aumage cn bs Gone 10 Yo%S Saag, , fed with encryption software that ensures complete, , customers are scared of losing their money, and features that are available on the website or on the app., stick to traditional banking if timely assistance isn’t provided., , New users often give up and, , , , , , , , , , , , , , , , , , , , , = oan Alerts related to passwords and digital signatures ar° sent periodically to >. Trust and Responsibility, security of the account. Fake websites and phishing sites are common in this age of technology. There is trust, 6. Easy Access between the bank and their customers — you know your money is safe with the bank —, f - line accounts by simp] a because they take responsibility for your money. Real banks are permanent and reliable, Costoeers can exjay cory acces with cline accounts by Sine 9 ERIE while some websites are not., , 3. Inconvenience, If your account gets locked or hacked, you will be unable to perform any banking, , transactions and even there are chances of financial loss., ‘Also, a few online banks don’t allow cash deposits. To deposit cash, you will be required, to email a cheque and transfer money from another account or bank., , credentials. In addition to that, customers can also, Since the internet remains the medium of connection, users can also, accounts in different banks from a single device., 7. Quick and Efficient, , , , have to rush through anything — you, , , , There's no waiting nor do you ee, banking transactions with pati and it will ni, ae a driving down isis ea a it ae 4. Inability to Handle Complex Transactions, 8.24X7X 365 While you can easily pay bills and transfer funds, you can’t perform complex transaction, : online., When a large sum of money is involved, it is advisable to visit a real bank and sort it o, , in-person rather than doing it online.

Page 4 :

Ee—", , in Banking and Insurance - I] (5. yp », , verification (like buying a ho., , Ieformation TechnolO®, , i transactions aso need ¢ a, , Some Sts pen psalms PNY, , : ‘ know meaning of certain Financial |, , Sometime it becomes a and your paieoyoTuogss Sota i, mn Se by a grasp ic terms, , see ares ca Oe mmenatrs. be, , ted and established, there are times when a, Sur, mo a kf actual and/or identity theft. It’s aoe Ac, Ives ized acess 1 you ReCOUD via a stolen or hacked log-in credentials,, , ¥ decent qnnection or there are bugs in the software, or oi, If you don’ aa: ae are bound to crash and you will undoubleanete, , 8. Unknown Service Agent, When you need assistance during ¢-|, unknown customer service agent, whom, , banking, your concern Is generally ass, you don’t know and even the agent, , you., 9. Complicated Websites, Some websites look like a page straight from a super complex scientific ex, Written in a secret code language with bizarre fonts and colors. Definitely, some:, things done in seconds. But some, , are simple and you can get all the ; ’, complicated and confusing. With pop-ups, errors, links, and interlinks,, probably amon pages, it ges rally difficult to understand, , 10. Internet connection and Literacy Must, E-hanking is nt for everyone. Iliterate and the elderly cannot use online bankit, cosh individual access their accounts if they don’t have an internet connection:, , E-BANKING BUSINESS MODELS, , Various E-banking Business Models are discussed herewith, they are Home B, , (Cesporate) Banking. Online Banking, Internet Banking, Mobile Banking and SMS Bank, , HOME BANKING, , Home banking is the practice of conducting banking transactions from home u, , vo cates. Home banking gracally refers 1o ether banking over the telephoned, ing started, , internet (ie. online banking). The first experiments with internet banking, , , , , , , , , , , , , , , , , , , , , , , , E-Banking Business Models ?, , 1980s, but it did not become popular until the mid-1990s when home internet access was, widespread. Today, a variety of internet banks exist with few physical branches., , The increasing popularity of home banking has fundamentally changed the character of the, banking industry. Many people are able to manage their banking requirements so that they, seldom have need of a physical branch. Online-only banks have profited from this shift in the, industry. The absence of brick and mortar locations allows many online banks to offer, favourable interest rates, lower service charges, and many other incentives for those willing to, , bank online., Online banking has become nearly synonymous with home banking as most prefer to bank via, the internet instead of over the telephone. Online banks (or banks with online options) allow, access for the majority of daily, traditional transactions, including deposits, checking account, services, and some basic financial products like savings accounts. ‘Online banking is generally, , available for both individuals and small businesses., of passbook, cash transactions, cheque (paper cheque), , Additional services, such as printing, often still occur at physical branch locations., , deposits, personal and mortgage loans,, including fixed rate Loan and floating rate Loan. All Loans are, en as mortgage or hypothecation;, back a loan with a predetermined, , Loans may come in many forms,, debt instrument, which collateral of specified property giv', , exception being personal loan. A borrower is obliged to pay, , set of payments (EMI) over a set time period., With the increased shift to online banking, new security threats have arisen. All information,, such as customer account information, balances, recent transactions, and more, which is stored, on a computer, or on other electronic device, or in the cloud, is vulnerable to hacking and theft., Many commercial banks with online arms have put into place cybersecurity measures to prevent, such dangerous theft from occurring. Cybersecurity has become essential as the world is more, dependent on computers than ever before., Three major ways that cyber thieves obtain sensitive consumer financial data are: backdoor, attacks, in which criminals exploit alternate methods of accessing a system (or don't require, usual authentication methods), denial-of-service attacks, which block a rightful user from, including more commonly known bugs and, , entering a system: and direct-access attacks,, viruses. Bugs and viruses gain access to @ system and copy its information and/or modify parts, or all of it., Characteristics of Home Banking, ystems safe and, , e Safe - Secure computer networks of bank are at work 24 X7 to keep your ®, , secure., e Convenient — 24 X 7 account access from wherever you are:, , e Accessible — Account information can be accessed via any operating system., , Features of Home Banking:, e 24X7 Account Access

Page 5 :

banks to connected to your account and deter fraud with mo oa, Me ae aa ‘of bank can be sent by email, text message, or both. With, arr alert options, you'll always know what's happening with your account., , by making the switch to eStatements and el-erters 4, secure acre youressnly stent cocoon eis trou Hous Bankine, Generated asa PDF tobe saved to your computer of printed, Find past statement and letters in your history., , ‘Alert when there's a new statement for you to view., , Office (Corporate) Banking _, , Home or Personal of Retail internet banking is for use by individual customers, r, internet banking is for corporates or companies. Corporate banking, also known as by, banking, refers to the aspect of banking that deals with corporate customers. The term Ce, Internet Banking was originally used in the United States. In corporate internet bankin, will be at least 2 users, with maker checker concept for doing transactions. In ret, Banking, the limit is usually less (may be some € 20 lakh per day or so), while in co, e-Banking limit is set by the company. :, Corporate e-banking gives you freedom to operate your business at any geogt |, from wherever you desire. Freedom to take urgent financial decisions from any St, , , , , , , , , , , , , Freedom to empower your, framework laid down by you. Freedom. from branch dependency., The corporate e-banking segment of, small- to mid-sized local businesses wil, billions in sales and offices across the country. They give loans that enable businesses to grow, and hire people, contributing to, products and services to corporations a1, , , , E-Banking Business Models, , people to conduct business the modern way yet within the, , banks typically serves a diverse clientele, ranging from, ‘th a few million in revenues to large companies with, , the expansion of the economy. Banks offer the following, nd other financial institutions:, , ments: Get Real Time Account Balances, link multiple Current, Accounts for a single view, download account statements and subscribe for statements by, , e-mail., , Fund Transfer: Transfer funds to registered and ad hoc beneficiaries using, RTGS/NEFT/IMPS. Make salary payments and group retirement plans are typically, offered by specialized affiliates of a bank., vendor payments and execute ‘bulk transfers., Tax Payments: Pay Direct and Indirect Taxes including Goods and Services Tax (GST),, Income Tax, Corporate Tax, Tax Deducted at Source (TDS), TDS on sale of property,, , Dividend Distribution Tax, Wealth Tax and State Taxes., , Update Aadhaar and GSTIN: Update your GST identification, Aadhaar details in your account number conveniently., , Cheque Book Services: Request for cheque books, initiate stop payments and check the, status of your cheques at the click of a button., , Positive Pay: Safeguard cheques issued from your, , to the beneficiary., , Cash Management Services (CMS): Used by companies for managing their working, capital and currency conversion requirements. Access a wide range of collections and, payments services. Bulk uploads and host-to-host transactions are added advantages., , Treasury: Avail of Pre-trade, At-trade and Post-trade services in an integrated and, , seamless manner., Bill Payments: Pay electricity bills, utility bills and make e-commerce payments., , Trade Services: Access @ host of trade services including issuance of Bank Guarantees,, trade MIS, Letter of Credit, credit financing and remittances., , Fixed Deposits: Open Fixed Deposits for time periods of your choice., , Loans and other credit products: These are typically the biggest areas of business within, corporate banking and, at the same time it is one of the biggest sources of profit and risk, for a bank., , Equipment lending:, of equipment used by compan!, and information technology., , Account details and State, , Number (GSTIN) and, , bank account before giving the cheque, , Commercial banks structure customized loans and leases for a range, ies in diverse sectors such as manufacturing, transportation,