Page 2 :

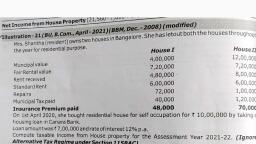

PROBLEM 4, From the particulars given below compute ARV in each case separately :, Practical Income Tax, Rental Value, SC, MRV, FRV, 60,000, 48,000, Real Rent, 75,000, 36,000, 96,000, 60,000, 45,000, Standard Rent, 69,000, 1,16,000, 54,000, Not applicable, 40,000, 1,20,000, SOLUTION, 72,000, 42,000, 1,15,000, Computation of Annual Rental Value, Case (a) Rent Control Act is not applicable, MRV, FRV, 75,000 whichever is higher is ERV, 75,000 or Real Rent 69,000, 60,000, 75,000, ERV, Whichever is higher is ARV, Case (b) Rent Control Act is applicable, 75,000, MRV, 48,000, 60,000, 60,000, 72,000, 60,000, 60,000, 60,000, FRV, ephen, Whichever is higher or, Standard Rent, Whichever is less is ERV, HRU, FRV, Real Rent of 54,000 is less than ERV, as such ERV is ARV, J.R., とRV, Acks, Case (c) Rent Control Act is applicable, MRV, 36,000, 45,000, 45,000, 42,000, 42,000, 40,000, 42,000, FRV, Whichever is higher, Standard Rent, Whichever is less is ERV, Or Real Rent, Whichever is higher Annual Rental Value, ARV(oi, tow, Case (d) Rent Control Act is applicable, MRV, bum by, 96,000, 1,16,000, 1,16,000, 1,15,000, 1,15,000, 1,20,000, 1,20,000, FRV, Whichever is higher, Standard Rent, Whichever is less is ERV, de Deau up, 3., or Real Rent, Whichever is higher is Annual Rental Value, NAV, PROBLEM 5, Compute the annual rental value for the previous year 2018-19 from partieuturs given below :, MRV, Standard Rent, Unrealised rent, Date of completion, 7 84,000 p.a., 7 87,000 p.a., 4,000, 31-07-2018, FRV, * 90,000 p.a., 7 8,000 p.m., Real Rent, Date of letting: 01-10-2018

Page 3 :

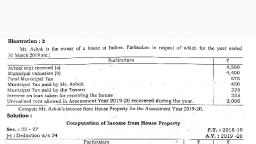

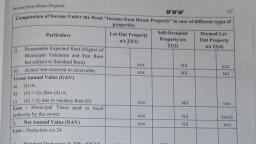

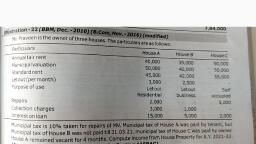

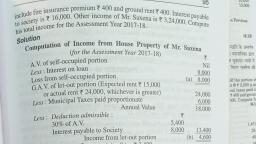

2I77, Income from House Property, PROBLEM 10, Compute the income from house property of Mr. Anil and Mr. Sunil from the following informaton, for the year ending 31st March, 2019:, (a) Mr. Anil and Mr. Sunil are brothers and they have inherited equally the house property from, their father., (b) Rent realisable from the property is 27,000 per annum.., (c) Municipal Taxes (to be borne by the landlord) are ? 9,000 per annum., (d) The property is on a leasehold plot of land and the annual lease rent is 3,000., (e) Rent collector is paid ? 100 per month., () Property was mortgaged for taking a lọan of 50,000 at 10% per annum for the purpose, of partnership businęss of Mr. Anil and Mr. Sunil. The loan was taken on 1st October,, 2016., (g) One of the Flats in the Building fetching monthly rent of 500 was vacant for two months., (C.A. Inter), SOLUTION, Calculation of Income from House Property, Rental Value of the property [27,000 - vacancy 1,000], Less : Municipal Taxes, Net Annual Value, 26,000, 9,000, 17,000, Less: Deductions u/s 24:, Standard Deduction 30% of NAV, 5,100, Income from House Property, 11,900

Page 4 :

07,000 X 8/12, 58,000, Whichever is less is ERV, Or Real Rent for 8 months, Less : Unrealised rent, Whichever is higher, Less : Loss due to vacancy, 58,000, 64,000, 4,000, 60,000, 60,000, 16,000, 44,000, Whichever is higher is ARV, PROBLEM 6, Mr. D. owns a house at Vijay Nagar and submits the following particulars :, Rent received, 1,75,000, 1,60,000, 1,70,000, 1,72,000, Standard Rent, Municipal Valuation, Fair Rental Value, Municipal Taxes, 12% of municipal rental value +2% of municipal taxes as Sanitation Surcharge, Compute net annual value., ŠOLUTION, Computation of Net Annual Value, As actual rent received is more than all the, rental values hence actual rent is ARV, 1,75,000, Less : Municipal Taxes 12% of 7 1,70,000, Surcharge for sanitation 2% of 20,400, 20,400, 408, 20,808, Net Annual Value, 1,54,192, PROBLEM 7, Compute the income from house property from information given below :