Page 1 :

The Market Forces of Supply and Demand, , Wren a cold snap hits Florida, the price of orange juice rises in supermarkets, throughout the country. When the weather turns warm in New England every, summer, the price of hotel rooms in the Caribbean plummets. When a war, breaks out in the Middle East, the price of gasoline in the United States rises,, and the price of a used Cadillac falls. What do these events have in common?, They all show the workings of supply and demand., , Supply and demand are the two words economists use most often—and for, good reason. Supply and demand are the forces that make market economies, work. They determine the quantity..of.each good..produced.and_the price at, which it is sold. If you want to know how any event or policy will affect the, economy, you must think first about how it will affect supply and demand., , This chapter introduces the theory of supply and demand. It considers how, buyers and sellers behave and how they interact with one another. It shows how, supply and demand determine prices in a market economy and how prices, in, turn, allocate the economy’s scarce resources., , 63, , Scanned with CamScz

Page 2 :

64, , PART 2 HOW MARKETS WORK, , ———, , MARKETS AND COMPETITION, , market, a group of buyers and, sellers of a particular, , good or service, , competitive market, , a market in which there, are many buyers and, many sellers so that, each has a negligible, impact on the market, , price, , demand refer to the behavior of people as they interact with, , © markets, Before discussing how buyers and sellers, n by the terms market ang, , The terms supply and, one another in competitiv, behave, let’s first consider more fully what we mea, , competition,, , What Is a Market?, , A market is a group of buyers and sellers of a particular good or service. The, buyers as a group determine the demand for the product, and the sellers as a, group determine the supply of the product. ;, , Markets take many forms. Sometimes markets are highly organized, such as, the markets for many agricultural commodities. In these markets, buyers and, sellers meet at a specific time and place, where an auctioneer helps set prices, and arrange sales., , More often, markets are less organized. For example, consider the market for, ice cream in a particular town. Buyers of ice cream do not meet together at any, one time. The sellers of ice cream are in different locations and offer somewhat, different products. There is no auctioneer calling out the price of ice cream. Each, seller posts a price for an ice-cream cone, and each buyer decides how much ice, cream to buy at each store. Nonetheless, these consumers and producers of ice, cream are closely connected. The ice-cream buyers are choosing from the various, ice-cream sellers to satisfy their hunger, and the ice-cream sellers are all trying to, appeal to the same ice-cream buyers to make their businesses successful. Even, though it is not organized, the group of ice-cream buyers and ice-cream sellers, forms a market., , What Is Competition?, , The market for ice cream, like most markets in the economy, is highly competitive. Each buyer knows that there are several sellers from which to choose, and, each seller is aware that his product is similar to that offered by other sellers. As, a result, the price of ice cream and the quantity of ice cream sold are not determined by any single buyer or seller. Rather, price and quantity are determined, by all buyers and sellers as they interact in the marketplace., , Economists use the term competitive market to describe a market in which, there are so many buyers and so many sellers that each has a negligible impact, on the market price. Each seller of ice cream has limited control over the price, because other sellers are offering similar products. A seller has little reason to, charge less than the going price, and if he charges more, buyers will make theit, purchases elsewhere. Similarly, no single buyer of ice cream can influence the, price of ice cream because each buyer purchases only a small amount. ., , In this chapter, we assume that markets are perfectly competitive. To reach this, highest form of competition, a market must have two characteristics: (1) the, goods offered for sale are all exactly the same, and (2) the buyers and sellers are, so numerous that no single buyer or seller has any influence over the market, price. Because buyers and sellers in perfectly competitive markets must accept, the price the market determines, they are said to be price takers. At the market, price, buyers can buy all they want, and sellers can sell all they want. ., , There are some markets in which the assumption of perfect competition, applies perfectly. In the wheat market, for example, there are thousands of farm, , , a, , Scanned with CamScz

Page 3 :

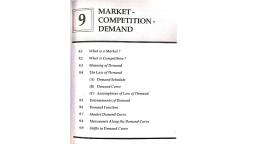

CHAPTER 4 THE MARKET FORCES OF SUPPLY AND DEMAND 65, , ers who illi, sell wheat and millions of consumers who use wheat and wheat prod, ucts. Because no single, single buyer or seller ca ence the price pat, ©, takes the price as given, y' can influence the price of wheat, each, , as doe and services, however, are sold in perfectly competitive marnl athe kets have only one seller, and this seller sets the price. Such a, fea monopol eee Your local cable television company, for instance, may, feam whi poly. ‘esidents of your town probably have only one cable company, , m Ww ich to buy this service. Some markets (covered in the study of microeconomics) fall between the extremes of perfect competition and monopoly., , Despite the diversity of market types we find in the world, assuming, perfect, competition is a useful simplification and, therefore, a natural place to start. Perfectly competitive markets are the easiest to analyze because everyone participating in the market takes the price as given by market conditions. Moreover,, because some degree of competition is present in most markets, many of the lessons that we learn by studying supply and demand under perfect competition, apply in more complicated markets as well., , Quick Quiz What is a market? * What are the characteristics of a competitive, market?, , 8 LS), DEMAND, , We begin our study of markets by examining the behavior of buyers. To focus, our thinking, let’s keep in mind a particular good—ice cream., , The Demand Curve: The Relationship between Price, and Quantity Demanded, , The quantity demanded of any good is the amount of the good that buyers are quantity demanded, willing and able to purchase. As we will see, many things determine the quan- the amount of a good, tity demanded of any good, but when analyzing how markets work, one deter- _that buyers are willing, minant plays a central role—the price of the good. If the price of ice cream rose and able to purchase, to $20 per scoop, you would buy less ice cream. You might buy frozen yogurt, instead. If the price of ice cream fell to $0.20 per scoop, you would buy more., Because the quantity demanded falls as the price rises and rises as the price falls,, we say that the quantity demanded is negatively related to the price. This relationship between price and quantity demanded is true for most goods in the economy and, in fact, is so pervasive that economists call it the law of demand:, Other things equal, when the price of a good rises, the quantity demanded of the ;, good falls, and when the price falls, the quantity demanded rises. tng a, the aise, The table in Figure 1 shows how many ice-cream cones Catherine buys each a oa ol month at different prices of ice cream. If ice cream is free, Catherine eats 12 . at Oe at, cones per month. At $0.50 per cone, Catherine buys 10 cones each month. As the P 900d rises, price rises further, she buys fewer and fewer cones. When the price reaches ~, $3.00, Catherine doesn’t buy any ice cream at all. This table is a demand sched- — demand schedule, ule, a table that shows the relationship between the price of a good and the a table that shows the, quantity demanded, holding constant everything else that influences how much relationship between, , the price of a d and, f the good want to buy. of a good an, wth paph in Figure 1 uses the numbers from the table to illustrate the law of the quantity demanded, , demand. By convention, the price of ice cream is on the vertical axis, and the, , law of demand, the claim that, other, , Scanned with CamScz

Page 4 :

66 PART 2 HOW MARKETS WORK, , 1 FIGURE, , Catherine's Demand, , Schedule and Demand Curve _ increases the quantity demanded,, , Price of Quantity of Price of, Ice-Cream Cone Cones Demanded lee-Cream Cone, , , , $3.00, $0.00 12 cones, 0.80 10, 1.00 8 on, 6, ; “4 a 1. Adecrease 9.99, vee ps, 28D 2 in price ‘|, 3.00 0 1.50, 1.00, 0.50, , ded at each price. The, The demand schedule shows the ry cneaee shows how the quantity, , demand curve, which graphs the hapa varies. Because a lower price, , demanded of the good changes a: the Cemend eurve slopes downward,, , , , , , SESS, , 0123 4 5 6 7 8 9 101112 Quantity of, ea Ice-Cream Cones, 2....increases quantity, of cones demanded., , demand curve, , @ graph of the relationship between the price, of @ good and the quantity demanded, , quantity of ice cream demanded is on the horizontal axis. The downward-sloping, line relating price and quantity demanded is called the demand curve., , Market Demand versus Individual Demand, , The demand curve in Figure 1 shows an individual's demand for a product. To, analyze how markets work, we need to determine the market demand, the sum of, all the individual demands for a particular good or service., , The table in Figure 2 shows the demand schedules for ice cream of two individuals—Catherine and Nicholas. At any price, Catherine’s demand schedule, tells us how much ice cream she buys, and Nicholas’s demand schedule tells us, how much ice cream he buys. The market demand at each price is the sum of, the two individual demands., , The graph in Figure 2 shows the demand curves that correspond to these, demand schedules. Notice that we sum the individual demand curves horizontally to obtain the market demand curve, That is, to find the total quantity, demanded at any price, we add the individual quantities found on the horizontal axis of the individual demand curves. Because we are interested in analyzing, how markets work, we will work most often with the market demand curve., The market demand curve shows how the total quantity demanded of a good, varies as the price of the good varies, while all the other factors that affect how, much consumers want to buy are held constant., , Scanned with CamScz

Page 5 :

CHAPTER 4 THE MARKET FORCES OF SUPPLY AND DEMAND: 67, , The quantity demanded in a mark, ‘et is the sum of the quantities demanded by all é, the buyers at each price. Thus, the market demand curve is found by adding hori —". 2, , , , zontally the individual demand curve:, s. At a price of $2.00, Catherine demands }, 4 ann cones, and Nicholas demands 3 ice-cream cones. The quantity Sree j, dem in the market at this price is 7 cones, fal e i, Individual Demands, Price of Ice-Cream Cone Catherine Nicholas Market, $0.00 12 + 7 = 19 cones, 0.sS0 10 6 16, 1.00 8 5 13, 1.50 6 4 10, 2.00 4 3 7, 2.50 2 2 4, 3.00 0 1 1, Catherine's Demand + Nicholas's Demand, , , , , , , , , , , , i Dn, , |, , 012345678 9101112 01234567 8 9101112 0 2 4 6 8 1012 14 16 18, Quantity of Ice-Cream Cones Quantity of Ice-Cream Cones Quantity of Ice-Cream Cones, , , , Shifts in the Demand Curve, , The demand curve for ice cream shows how much ice cream people buy at any, holding constant the many other factors beyond price that influence, ‘decisions. As a result, this demand curve need not be stable, Iter the quantity demanded at any given |, price, the demand curve shifts. For example, suppose the American Medical, Association discovered that people who regularly eat ice cream live longer,, healthier lives. The discovery would raise the demand for ice cream. At any, given price, buyers would now want to purchase a larger quantity of ice cream,, and the demand curve for ice cream would shift., , Figure 3 illustrates shifts in demand. Any change that increases the quantity, demanded at every price, such as our imaginary discovery by the American, Medical Association, shifts the demand curve to the right and is called an, , increase in demand, Any change that reduces the quantity demanded at every, price shifts the demand curve to the left and is called a decrease in demand., There are many variables that can shift the demand curve. Here are the most, , important., , given price,, consumers’ buying, over time. If something happens to a, , Scanned with CamScz