Page 1 :

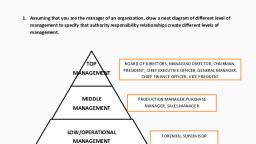

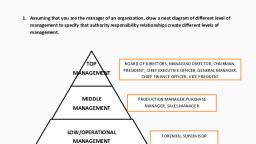

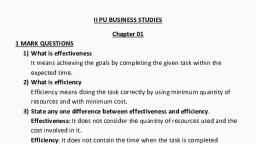

II PUC-ACCOUNTANCY-ANSWERS FOR SECTION A, B AND PRACTICAL ORIENTED, QUESTIONS, , CHAPTER-1--ACCOUNTING FOR NOT-FOR-PROFIT ORGANISATION, SECTION A: One Mark Questions, I. Fill in the blanks:, 1. Not-For-Profit Organizations are used for the welfare of the Society, 2. Not-For-Profit Organizations are not engaged in Trading or Business., 3. Receipts and Payments Account is the summary of Cash and Bank transactions., 4. Income and Expenditure account is just like a Profit and Loss A/c of a trading concern., 5. Income and Expenditure A/c is prepared on Accrual basis, 6. Subscription is a fee paid by the Members, 7. Legacies are the amounts received as per the will of the deceased person., 8. Opening balance in Receipt and Payment A/c represents Opening Cash/Bank, balance., 9. Government Grant for maintenance is treated as Revenue receipt., 10. Donation for specific purpose are always Capital Receipt, II. Multiple Choice Questions.(ANSWER IN BOLD LETTERS), 1. Not-For-Profit Organizations are formed for:, a) Profit b) Service, c) Profit & Service d) None of these, 2. Most of Not-For-Profit Organizations transactions are:, a) Cash, b) Credit, c) Cash & Credit, d) Barter, 3. Receipts and Payments Account include items of:, a) Capital Nature, b) Revenue Nature, c) Both (a) and (b) d) None of these, 4. Income and Expenditure Account include the amounts of:, a) Current year, b) Previous Year, c) Next Year, d) Both current year and previous year, 5. Capital Fund does not include:, a) Entrance fees, b) Legacies, c) Building Fund, d) Life Membership Fees, 6. Legacies are treated as:, a) Revenue Receipt, b) Capital Receipt, c) Revenue Expenditure, d) Capital Expenditure, 7. Purchase of a computer by a college is treated as, a) Capital Receipt, b) Capital Expenditure, c) Revenue Receipt, d) Revenue Expenditure, 8. In the absence of any specific instruction, where do you show the Entrance fees?, a) Debit side of Income and Expenditure Account., b) Credit side of Income and Expenditure Account., c) Liability side of the Balance Sheet., d) Added to Capital Fund on the liabilities side of B/S, 9. Special Funds are shown in:, a) Income Side, b) Expenditure Side, c) Liability Side, d) Asset Side, 10.Life Membership fees are treated as:, a) Capital Receipts, b) Capital Expenditure, c) Revenue Receipts, d) Revenue Expenditure, , 1

Page 2 :

11.Loss on the sale of fixed asset is treated as:, a) Capital Receipts b) Revenue Receipts c) Capital Expenditure d) Revenue Expenditure, III.True or False type Questions:, 1.Receipt and Payment Account is a summary of all capital receipts and payments. =False., 2.If the sports fund is maintained, sports expenses will be shown on the debit side of Income, and Expenditure Account.= False, 3.The balancing figure on credit side of Income and Expenditure Account denotes excess of, expenses over incomes.= True, 4.Scholarships granted to students out of funds provided by Government will be debited to, Income and Expenditure Account.=False, 5.Donations for specific purposes are always capitalized. =True., 6.Opening Balance Sheet is prepared when the opening balance of capital fund is not given.=, True, 7.Surplus of Income and Expenditure Account is added to Capital Fund.=True, 8.Income and Expenditure Account is equivalent to Profit and Loss Account of a trading, concern.= True, 9.Receipts and Payments Account does not differentiate between capital and revenue receipts.=, True, 10.Capital and Revenue items are recorded in Receipt and Payment Account. =True., IV. Very Short Answer Questions:, 1.Give an example for Not-For-Profit Organization., Ans: Sports Club, 2.What is the Motive of Not-For-Profit Organization?, Ans: Service, 3.Where do you show Opening Bank overdraft in Receipt and Payment Account?, Ans: Credit side of Receipts and Payments A/c., 4.Name any one final account of a Not-For-Profit Organization., Ans: Income & Expenditure A/c, 5.State any one major source of income of Not-For-Profit Organization., Ans: Subscriptions, 6.State any one books of account maintained by a Not-For-Profit Organization., Ans: Cash Book, 7.State any one feature of Receipts and Payments Account, Ans: Summary of Cash book, 8.How do you treat the prizes paid, when the prize fund in not maintained?, Ans: When there is no prize fund maintained, then prizes paid are debited to Income and, Expenditure A/c., 9.What is Capital Fund?, Ans: Capital fund is the difference between assets and liabilities of a not-for- profit organization., 10.Give an example for specific donation., Ans: Building donation, 11.How do you treat the tournament expenses, when the Tournament fund is maintained?, Ans: When Tournament Fund is maintained, then tournament expenses are deducted from it, on the liability side of balance sheet., 12.How do you treat the Life Membership Fees?, Ans: Life membership Fees are capital receipt., , 2

Page 3 :

Section B- Two Marks Questions, 1.What are Not-For-Profit Organizations?, Ans: Not-For-Profit organizations refer to those which are formed to render, social services, and are set up as charitable institution which function, without any motive of profit., 2.Give any two examples of Not-For-Profit Organizations., Ans: a- Sports Club, b. Schools & Colleges, 3.State any two features of Not-For-Profit Organizations., Ans: (i) Formed for providing service (ii)Organized as societies and charitable trusts., 4.Name any two books of accounts maintained by Not-For-Profit Organization., Ans: (i) Cash Book, (ii) Stock register, 5.Give the meaning of Receipts and Payments Account., Ans: Receipts and Payments A/c is a summary of cash and bank transactions under various, heads prepared at the end of accounting year., 6.State any two features of Receipts and Payment Account., Ans: (i)It is a summary of cash book (ii) It includes both capital & revenue items., 7.What do you mean by Income and Expenditure Account?, Ans: Income and Expenditure A/c is a summary of income & expenditure of, a not-for-profit organization for the accounting year., 8.State any two features of Income and Expenditure Account., Ans: (i) It Includes only revenue items, (ii) It Includes only current year figures., 9.Give any two examples for revenue expenditure., Ans: (i) Salary Paid, (ii) Rent paid, 10.Give any two examples for capital expenditure, Ans: (i) Sports materials purchased (ii) Furniture Purchased., 11.Give any two examples for revenue receipt., Ans: (i) Subscriptions received, (ii) Interest Received, 12. Give any two examples for capital receipt., Ans: (i) Life membership fees received (ii) Special donations received, 13.State two differences between Receipts and Payments Account and Income and, Expenditure Account., Ans: Differences between:, Receipts & Payments A/c, Income & Expenditure A/c, (i) Summary of Cash Book, (i) Summary of Income &, Expenditure, (ii)It includes both capital & revenue, (ii) It includes only revenue items, items, 14.What is Capital Fund?, Ans: Capital Fund is the difference between assets and liabilities of not-forprofit organizations as on a particular date., 15.What are Legacies?, Ans: Legacies are the amount received by a not-for-profit organization as per the, will of a deceased person., 16.What is Honorarium?, Ans: Honorarium is the amount paid to the person who is not the regular, employee of the organization, for his services., , 3

Page 4 :

17.Give the meaning of Endowment Fund., Ans: Endowment fund is a fund arising from a bequest or gift, the income of, which is devoted, for a specific purpose., 18.How do you treat tournament expenses, when separate tournament fund not, maintained?, Ans:When separate tournament fund is not maintained, then tournament expenses are debited, to income and expenditure A/c., 19. How do you treat prizes awarded, when Prize Fund is maintained?, Ans: When prize fund is maintained, prizes awarded are deducted from the fund on liabilities, side., 20.Give the meaning of incidental trading activity., Ans: Incidental trading activity means, commercial (trading) activity taken place in a not-forprofit organization to provide certain facilities to members or public in general., , CHAPTER-2--ACCOUNTING FOR PARTNERSHIP: BASIC CONCEPTS, Section A: One Mark Questions, I. Fill in the blank questions (ANSWER IN BOLD LETTERS), 1. Section 4 of Indian Partnership Act, 1932 defines Partnership,, 2. A partnership has no separate Legal entity., 3. In order to form a partnership, there should be at least 2(Two) persons., 4. Partnership is the result of Agreement between two or more persons to carry on business, and share its profits and losses., 5. It is preferred that the partners have a written agreement., 6. The agreement should be to carry on some Lawful business., 7. Each partner carrying on the business is the principal as well as Agent the, for all other partners., 8. The liability of a partner for his acts is Unlimited., 9. In the absence of Partnership Deed Interest of advance from Partner will, be charged @ 6% p.a., 10. Under Fixed Capital Method, the capitals of the partners shall remain, fixed., 11. Under Fluctuating Capital Method, the partners’ capital account balances, Fluctuate from time to time., 12. Profit and Loss Appropriation Account is merely an extension of Profit, & Loss A/c of firm., 13. Profit and Loss Appropriation Account Dr, To Interest on Partners’ Capital accounts, (Transferring int.on capital to P/L Appropriation a/c)., 14. Profit and Loss Appropriation Account Dr, To Salary to Partners account, (Transferring partners salary to P/L Appropriation a/c), 15. P/L Appropriation A/c Dr, To Partners Capital/Current a/cs., (Being Profit transferred to Partners), 16. When fixed amounts are withdrawn at the end of every month, interest on, the total amount for the year ending is calculated for 5& 12 months., 17. Under fluctuating capital method, all the transactions relating to partners, are directly recorded in the Partners Capital accounts., , 4

Page 5 :

18. Under fixed capital method, the amount of capital remains Fixed., 19. Under fixed capital method, all the transactions relating to a partner are, recorded in a separate account called Partners Current Account., 20. There is not much difference in the final accounts of a sole proprietary, concern and that of a Partnership Firm., II.Multiple Choice Questions.(ANSWERS IN BOLD LETTERS), 1.The agreement between the partner should be in:, a) Oral, b) Written, c) Oral or Written d) None of the above, 2. Partnership deeds contain:, a) Name of firm, b) Name and address of the partners, c) Profit and Loss sharing ratio, d) All of the above, 3. If any partner has advanced some money to the firm beyond the amount of, his capital, he shall be entitled to get interest on the amount at the rate of:, a) 5% p.a, b) 6% p.a, c) 8% p.a, d) None of the above., 4. Interest on capital is generally provided for in that situations when:, a) The partners contribute unequal amounts of capital but share profits, equally., b) The capital contribution is same but profit sharing is unequal, c) Both the situations above., d) None of the above, 5. When fixed amount is withdrawn on the first day of every month, interest, on total amount of the year ending will be calculated for:, a) 2 & ½ months, b) 4 & ½ months, c) 6 & ½ months, d) None of the above, 6. When varying amounts are withdrawn at different intervals, the interest is, calculated using., a) Simple Method, b) Average Method, c) Product Method d) None of the above, 7. Adjustment for correction of omission and commission can be made:, a) Profit and Loss adjustment account., b) Directly in the Capital Accounts of concerned partners, c) Both the situations above, d) None of the above, 8. In order to form a Partnership there should be at least:, a) One person b) Two persons c) Seven persons, d) None of the above, 9. The business of a partnership concern may be carried on by:, a) All the partners, b) Any of them acting for all, c) All partners or any of them acting for all d) None of the above, 10. The agreement between Partners must be to share:, a) Profits, b) Losses, c) Profits and Losses, d) None of the above, 11. The liability of a Partner for acts of the firm is:, a) Limited, b) Unlimited, c) Both the above d) None of the above., 12. The partnership Deed should be properly drafted and prepared as per the, provisions of the, a) Partnership Act b) Stamp Act, c) Companies Act, d) None of the above, , 5

Page 6 :

13. The clauses of Partnership Deed can be altered with the consent of:, a) Two Partners, b) Ten Partners, c) Twenty Partners, d) All the Partners, III. True or False Questions, 1.The agreement between partners must be in writing= False, 2.The clauses of partnership deed can be altered with the consent of all the Partners.=True, 3.If the partnership deed is silent about the profit sharing ratio, the profit and loss of the firm is, to be shared equally.=True, 4.A partner is entitled to claim interest at the rate of 10% p.a on the amount of capital, contributed by him. If there is no agreement in the firm.=False, 5.In the absence of Partnership Deed, no partner is entitled to get salary.=True, 6.Under fixed capital method the Partner’s Capital Accounts will always show a credit balance. =, True., 7.Under Fixed Capital Method the Partners Capital Accounts will always show a debit, balance.=False, 8.P & L Appropriation A/c shows how the profits are appropriated among the partners.=True, 9.When fixed amount is withdrawn during the middle of every month, interest on total amount is, calculated for 6 months.=True, 10.If there is loss, no interest on capital is to be paid to partners, even if there is a provision in, Partnership Deed.=True, 11.Accounting treatment for Partnership is similar to that of a sole Proprietorship, Business.=True, 12.There are two methods by which the capital accounts of partners can be maintained=True, 13.Profit and Loss appropriation account is merely an extension of the Profit and Loss Account, of a firm.=True, 14.Interest on partners capital is debited to Partner’s Capital Accounts.=False, 15.In case of Guarantee of profit to a partner, assurance may be given by only one, partner=True., IV.Very short answer questions:, 1.Who is a Partner?, Ans: Persons who have entered into partnership with one another are individually called, , ‘partners’, 2.What do you mean by Partnership Firm?, Ans: Section 4 of the Indian Partnership Act 1932 defines partnership as the ‘relation, , between persons who have agreed to share the profits of a business carried on by all or, any of them acting for all’., 3.State any one feature of Partnership., Ans: There must be two or more persons to constitute partnership, 4.What is the minimum number of partners in a firm?, Ans: TWO., 5.Name any one content of Partnership Deed., Ans: Names and Addresses of all partners., 6.Name any one method of maintaining capital accounts of partners., Ans: Fixed Capital Method, 7.Name any one final account of partnership firm, Ans: Profit and Loss A/c, , 6

Page 7 :

8.How do you distribute profit or loss among the partners in the absence partnership deed?, Ans: Equally, 9.Why the Profit and Loss Appropriation account is prepared?, Ans: Profit and Loss Appropriation A/c is prepared to show how the profits distributed among, the partners, after making necessary adjustments., 10.At what rate Interest on advances by Partners is to be paid as per Partnership Act?, Ans: 6% p.a, 11.When interest is charged on partners drawings?, Ans: Interest is charged on partners’ drawings when there is a provision in agreement among, the partners about it., 12. When Partners Current Accounts are prepared in partnership firms?, Ans: Partners current A/cs are prepared in partnership firms when partners capital accounts, are maintained under fixed capital method., 13.State any one special aspect of partnership accounts., Ans: Maintenance of Partners’ Capital A/cs, 14.When the Current Accounts of Partners are opened?, Ans: Current A/cs of Partners are opened in Fixed Capital Method., 15.Under fluctuating capital method, how many accounts are maintained for each partner?, Ans: One, 16.State any one feature of fluctuating capital method., Ans: Capital balance of each partner changes year after year., 17.State any one situation in which provision of payment of interest on partner’s capital is, made., Ans: If firm had earned profit and agreement had the provision of interest on, capital., 18.Find out interest at 8% p.a. on capital of Rs.50,000 for 9 months., Ans: Rs.3, 000, 19.Which is the suitable method of calculation of Interest on drawings, when fixed amount is, withdrawn every month?, Ans: Average period method., 20.Give one example for past adjustment?, Ans: Omission of interest on capital., Section B: Two marks questions:, 1.What is Partnership?, Ans: Partnership is a relation between two or more persons who join hands to set up a business, and share its profits and losses., 2.Define Partnership?, Ans: According to Sec 4 of the Indian Partnership Act-“Partnership is the relation between, persons who have agreed to share the profits of a business carried on, by all or any of them, acting for all”, 3.State any two features of Partnership., Ans: a- Two or More person’s, b- Agreement between persons., 4. What is Partnership Deed?, Ans: Partnership Deed is the written agreement on stamp paper containing terms of, partnership duly signed by all partners., 5.What are the methods of maintaining capital accounts of partners?, Ans: a- Fixed Capital Method, b- Fluctuating Capital Method, , 7

Page 8 :

6. What is fixed capital method?, Ans: Fixed Capital Method is a method of maintaining partners capital Accounts in which the, capital balances of the partners shall remain fixed. All, adjustments relating to partners are, recorded in a separate account, called partner’s current account., 7. What is fluctuating capital method?, Ans: Fluctuating Capital Method is a method of maintaining partners’ capital, Accounts in, which all adjustments relating to partners are recorded in their, Capital A/cs., 8. State any two differences between fixed and fluctuating capital methods, Ans: Differences between, Fixed Capital Method, Fluctuating Capital Method, i. Adjustments are made in partners current, i. Adjustments are made in Partners Capital, a/cs, A/cs, ii. Capital balance remains unchanged, ii. Capital balance fluctuates year by year., 9. What do you mean by Profit and Loss Appropriation Account?, Ans: Profit and Loss Appropriation A/c is the extension of P&L A/c which shows how the profits, are appropriated among the partners., 10. What is guarantee of profit to a partner?, Ans: Guarantee of profit to a partner means giving assurance of certain minimum amount by, way of his share of profits of the firm., 11. What do you mean by past adjustments?, Ans: Past Adjustments refer to making necessary rectifications for omissions or commissions, noticed after preparation of final accounts., 12. State any two final accounts of a Partnership firm., Ans: a- Profit and Loss A/c, b- Balance Sheet, 13. In the absence of partnership deed, specify the rules relating to the, followings;, a) Sharing of profit and losses, b) Interest on partners capital, Ans: a) Equally, b) Not to be allowed, 14. State the rules relating to the followings in the absence of Partnership Deed:, a) Interest on drawings, b) Interest on advances from Partners., Ans: a) Not to be charged, b) Allowed @ 6% p.a, 15. Name any two methods for calculation of Interest of drawings., Ans: a) Product Method, b) Average Period Method, 16. When the interest on drawings is generally provided to partners?, Ans: Interest on drawings is generally charged on partners when it is expressed in agreement., 17. How do you close Profit and Loss Appropriation account in Partnership?, Ans: Profit and Loss Appropriation A/c in partnership is closed by transferring its balance to, Partners Capital or Current A/cs., 18. State any two special aspects of Partnership Accounts., Ans: i. Maintenance of Partners capital A/cs, ii.Distribution of P&L among Partners, 19. Name any two contents of Partnership Deed., Ans: i. Name and address of the firm ii. Capital Contribution by Partners., , 8

Page 9 :

CHAPTER-3--ADMISSION OF A PARTNER., Section A: One mark questions:, I. Fill in the blanks:, 1. Old ratio is used to distribute accumulated profits and losses at the time of, admission of a new partner., 2. Profit or loss on revaluation is shared among the old partners in Old ratio., 3. Old ratio-New Ratio= Sacrificing Ratio., 4. Accumulated losses are transferred to the capital accounts of the old partners, at the time of admission in their Old ratio., 5. General reserve is to be transferred to Capital accounts at the time of, admission of a new partner., 6.Goodwill brought in by new partner in cash is to be distributed among old, partners in Sacrificing ratio., 7. If the amount brought by new partner is more than his share in capital, the, excess is known as Hidden goodwill, 8. Asset Account is debited for the increase in the value of an asset., 9. Unrecorded asset is to be credited to Revaluation account., 10. A and B are partners sharing profits & losses equally with capitals of, Rs.45,000 each. C is, admitted for 1/3rd share and he brings in Rs.60, 000 as his capital. Hidden Goodwill, is Rs.30, 000., 11.Due to change in profit sharing ratio, some partners will gain in future profits while others, will Loose., 12. Goodwill is an Intangible asset., 13. Goodwill account is credited for cash brought in by new partners for his, share of, goodwill., 14. New Profit Sharing ratio is required for sharing future profits and also for adjustment of, capitals., II. Multiple Choice Questions (ANSWER IN BOLD LETTERS), 1.At the time of admission of a new partner, general reserve appearing in the old balance sheet, in transferred to:, a) All partners Capital Account, b) New Partner’s Capital Account, c) Old Partners Capital Account, d) None of the above, 2. A, B and C are partners in a firm. If D is admitted as a new partner, a) Old firm if dissolved, b) Old firm and old partnership are dissolved, c) Old partnership is reconstituted, d) None of the above, 3. On the admission of a new partner, increase in the value of asset is, credited to, a) Profit and Loss Adjustment (Revaluation) Account, b) Asset Account, c) Old partners Capital Account, d) None of the above, 4. At the time of admission of a partner, undistributed profits appeared in the, balance sheet of the old firm is transferred to the capital accounts of, a) Old partners in old profit sharing ratio., b) Old partners in new profit sharing ratio., c) All the partners in new profit sharing ratio, d) None of the above., , 9

Page 10 :

5. If new Partner brings cash for his share of goodwill, goodwill is, transferred to Old Partners’ Capital Account in:, a) Sacrificing ratio, b) Old Profit sharing ratio., c) New Profit sharing ratio d) None of the above., 6. Which of the following are treated as reconstitution of a Partnership Firm?, a) Admission of a partner, b) Change in profit sharing ratio, c) Retirement of a partner d) All the above, 7. Profit or loss on revaluation is shared among the partners in the, a) Old profit sharing ratio, b) New profit sharing ratio, c) Capital ratio, d) Equal ratio, 8. Assets and Liabilities are recorded in Balance Sheet after the admission of, a partner at:, a) Original Value, b) Revalued Value, c) Realizable value, d) None of the above, 9. On the admission of a new partner, the increase in the value of an asset is, credited to, a) Revaluation Account, b) Asset Account, c) Old Partners Capital Account, d) None of the above, 10. Old Profit Sharing Ratio-New Profit Sharing Ratio is=, a) Sacrificing ratio b) Gaining ratio, c) Both the above, d) None of the above., 11.In the absence of an agreement to the contrary, it is implied that old, partners will contribute to new partner’s share of profit in the ratio of, a) Capital, b) Old profit sharing ratio, c) Sacrificing ratio, d) Equally, 12. The balance of reserves and other accumulated profits at the time of, admission of a new partner are transferred to;, a) All partners in the new ratio, b) Old partners in the new ratio, c) Old partners in the old ratio, d) Old partners in the sacrificing ratio, 13. Goodwill raised in books at the time of admission of partners will be, written off in:, a) Old profit sharing ratio, b) New profit sharing ratio, c) Sacrificing ratio, d) None of the above, 14. Revaluation Account is debited for the, a) Increase in provision for doubtful debts, b) Increase in the value of building, c) Decrease in the amount of creditors, d) Transfer of loss on revaluation, 15. A and B are partners sharing profits in the ratio of 3:1. C is admitted into, partnership for 1/4th share. The sacrificing ratio of A and B will be:, a) Equal, b) 3:1, c) 2:1, d) 3:2, III. True or False type questions, 1.Goodwill brought in cash by new partner is distributed among old partners in their Sacrificing, ratio.= True, 2.In case of admission of a partner, profit or loss on revaluation is transferred to Old Partners’, Capital Accounts.=True, , 10

Page 11 :

3.Accumulated profit is transferred to all partner’s capital accounts including new, partner.=False, 4.The debit balance of Profit and Loss Account shown in the assets side of the Balance Sheet will, be debited to Old Partners Capital Accounts.=True, 5.Increase in the value of an asset is credited to Revaluation Account=True, 6.The traditional name of ‘Revolution A/c’ is ‘Profit and Loss Adjustment A/c’= True, 7.Goodwill is an intangible asset.=True, 8.Decrease in the value of liability is debited to Revaluation Account.=False, 9.Sacrificing ratio is required to distribute the cash brought by new partner among old partners, for his share of goodwill.= True, 10.Share sacrificed=Old share-New share.= True, IV. Very Short answer type questions:, 1.What is partnership?, Ans: Partnership is the relation between two or more persons who join hands to set up a, business and share its Profits or Losses., 2.What do you mean by reconstitution of a Partnership Firm?, Ans: Reconstitution of a Partnership Firm means change in the existing agreement, relations, and composition of members., 3.State any one reason for admission of a new partner., Ans: To increase the Capital, 4.State any one right acquired by a newly admitted partner, Ans: Right to share the assets or profits of the partnership firm, 5.Why the NPSR is required at the time of admission of a partner?, Ans: NPSR is required to share the future profits or losses., 6.What is Goodwill?, Ans: Goodwill is the monetary value of goodname, reputation and wide business connections., 7.State any one factor affecting the value of goodwill., Ans: Nature of business, 8.What is normal profit?, Ans: Normal profit means normal return on capital employed., 9.State any one method of valuation of goodwill., Ans: Average profit method, 10.Give the formula for sacrificing ratio, Ans: Sacrificing Ratio = Old Ratio - New Ratio, 11.Which account is to be debited to record the increase in the value of assets?, Ans: Asset A/c., 12.What is Revaluation Account?, Ans: Revaluation A/c is an a/c prepared in connection with recording of increase or decrease, in value of assets and liabilities and to find out the P/L on revaluation., 13.Which account will be credited when there is a loss on revaluation?, Ans: Revaluation A/c, 14.Which account will be debited when the cash is brought by a new partner for his share, of goodwill?, Ans: Cash/Bank A/c, 15.What is hidden goodwill?, Ans: Hidden goodwill refers to the difference between total required capital and actual capital of, all partners., , 11

Page 12 :

Section B: Two Marks Questions, 1.When the goodwill is distributed among old partners in the sacrificing ratio?, Ans: When goodwill is brought in cash by new partner, it is distributed in, sacrificing ratio, 2.State any two methods of valuation of goodwill., Ans:, (i) Average profit method, (ii) Super Profit method, 3. State any two rights acquired by a new partner., Ans: a - Right to share the assets of the firm, b - Right to share profits of the firm, 4. What do you mean by hidden goodwill?, Ans: Hidden goodwill refers to goodwill which value is not given at the time, of admission but, has to be inferred from arrangement of capitals and, profit sharing ratio, 5.Pass the journal entry to write off the goodwill raised to the extent of full value., Ans: All Partners’ Capital A/cs Dr, xx—, To Goodwill A/c, ---xx, ( Being writing off of full value of goodwill), 6.State any two matters which need adjustments in the books of the firm at the time of, admission of a new partner., Ans: (i) Revaluation of assets and liabilities, (ii) Valuation and adjustment of goodwill, 7. What is sacrificing ratio?, Ans: Sacrificing ratio refers to the ratio in which the old partners agree to, sacrifice their, share of profit in favour of the new partner., 8.Why the sacrifice ratio is calculated?, Ans: Sacrificing ratio is calculated in order to distribute the goodwill, brought in cash by new, partner., 9.What is the need for the revaluation of assets and liabilities on the admission of a, partner?, Ans: The need for the revaluation of assets and liabilities is to ascertain true financial position, of the business., 10.State any two reasons for admitting a new partner., Ans: (i) To increase the capital (ii) To improve the managerial ability, 11. How do you close revaluation account when there is a profit?, Ans: If there is profit, revaluation a/c is closed by debiting revaluation a/c and crediting old, partners capital a/cs, 12.State any two factors which determine the goodwill of the firm., Ans: (i) Nature of the business, (ii) Location of the business, 13. What is average profit method of valuation of goodwill?, Ans: Average profit method is a method of valuating goodwill, where, average profit is, multiplied with the agreed number of years purchase, to ascertain goodwill., of last four, 14. Goodwill of the firm valued at two years purchase of the average profit, years. The total profits for last four years are Rs.40, 000., Calculate the goodwill of the firm., Ans: a- Average Profit, - Total Profit /No of years, = 40,000/ 4, = Rs.10, 000, b- Goodwill, = Average Profit x No of years purchase, = 10,000 x 2, = Rs.20,000, , 12

Page 13 :

15. Pass the journal entry for increase in the value of building on the, , Ans:, , admission of a partner., , Building A/c, Dr, To, Revaluation A/c, (Being increase in the value of building), , 16.Pass the journal entry for the decrease in the value of a liability., Ans: Liability A/c, Dr, To, Revaluation A/c, (Being decrease in the value of liability), CHAPTER-4--RETIREMENT/DEATH OF A PARTNER, (A) RETIREMENT OF A PARTNER, Section A: One Mark Questions, I. Fill in the blanks:, 1.Old ratio is used to distribute accumulated profits and losses at the time of retirement of a, partner., 2.Profit or loss on revaluation is shared among the partners in Old ratio on retirement of a, partner., 3.New ratio –Old ratio= Gaining Ratio, 4.Accumulated losses are transferred to the Capital Accounts of the partners at the time of, retirement in their Old ratio., 5.General reserve is to be transferred to All Partners’ Capital Accounts at the time of, retirement of a partner., 6.Goodwill raised to the extent of retiring partner’s share only is to be debited to continuing, partners capital accounts in Gaining ratio., 7.In the absence of any instruction, Retiring Partner’s Capital A/c is closed by transferring its, balance to Retiring Partner’s Loan A/c., 8.New ratio is used for adjustment of continuing partners’ capitals., 9.X, Y and Z are the partners sharing profits and losses in the ratio of 3:2:1. If Y retires, the, new ratio X and Z will be 3:1., 10.Share gained is calculated by deducting Old share from the New Share., 11.The ratio in which the remaining partners will share future profits after retirement is, called New ratio., 12.The balance in the retiring partner’s loan A/c is shown on the Liabilities side of the B/S, till the last installment is paid., 13.The amount paid to the Retiring Partner in excess of what is due to him is called Hidden, goodwill., 14.In the absence of any agreement as the disposal of amount due to Retiring Partner, Sec 37, of the Indian Partnership Act.1932 is applicable., 15.If goodwill already appears in the books, it will be written off by debiting All Partners’, Capital A/cs in their OPSR., II.Multiple Choice Questions:(ANSWER IN BOLD LETTERS), 1.Abhishek,Rajat and Vivek are partners sharing profits in the ratio of 5:3:2. If Vivek, retires,the New Profit Sharing Ratio between Abhishek and Rajat will be, a) 3:2, b) 5:3, c) 5:2, d) None of the above, 2. The old profit sharing ratio among Rajendra,Satish and Tejpal were 2:2:1., The New Profit Sharing Ratio after Satish’s retierement is 3:2. The, gaining ratio is, a) 3:2, b) 2:1, c) 1:1, d) 2:2, , 13

Page 14 :

3. Anand, Bahadur and Chander are partners sharing profit equally. On, Chander’s retirement, his share is acquired by Anand and Bahadur in the, ratio of 3:2. The New Profit Sharing Ratio between Anand and Bahadur, will be:, a) 8:7, b) 4:5, c) 3:2, d) 2:3, 4.In the absence of any information regarding the acquisition of share in the, profit of the retiring/decreased partner by the remaining partners, it is, assumed that they will acquire his/her share in, a) Old Profit Sharing Ratio, b) New Profit Sharing Ratio, c) Equal Ratio, d) None of the above, 5. On retirement/death of a partner, the Retiring/Deceased Partner’s Capital, Account will be credited with, a) his/her share of goodwill., b) goodwill of the firm., c) shares of goodwill of remaining partners, d) none of the above., 6. Govind, Hari and Pratap are partners, On retirement of Govind,the, goodwill already appears in the Balance Sheet at Rs.24,000. The goodwill, will be written off by debiting, a) All Parnters’ Capital Accounts in their old profit sharing ratio., b) Remaining Partners’ Capital Accounts in their new profit sharing ratio., c) Retiring Partner’s Capital Accounts from his share of goodwill., d) None of the above., 7. Chaman,Raman and Suman are partners sharing profits in the ratio of, 5:3:2.Raman retires, the new profit sharing ratio between Chaman and, Suman will be 1:1. The goodwill of the firm is valued at Rs.1,00,000., Raman’s share of goodwill will be adjusted by:, a) debiting Chaman’s Capital Account with Rs.15,000 each., b) debiting Chaman’s Capital Account and Suman’s Capital Account, with Rs.21,429 and 8,571 respectively., c) debiting only Suman’s Capital Account with Rs.30,000., d) debiting Raman’s Capital Account with Rs.30,000., 8. On retirement/death of a partner, the remaining partner(s) who have, gained due to change in profit sharing ratio should compensate the:, a) retiring partners only., b) remaining partners (who have sacrificed) as well as retiring partner., c), remaining partners only (who have sacrificed)., d), none of the above., III.True or False Type Questions:, 1.Profit or loss on revaluation is transferred to All Parnters’ Capital Accounts in case of, retirement of partner. = True, 2.Accumulated profit is transferred to Continuing Partners’ Capital Accounts. = False, 3.Adjustment of partners’ capitals of the remaining partners is to be made in the New Ratio.=, True, 4.New Share= Old share + share sacrificed.= False, 5.Share gained is computed by deducting Old share from the New Share. = True, 6.Increase in the value of asset is debited to Revaluation Account.= False, 7.Gain ratio is used to adjust the goodwill raised to the extent of retiring partner share only.=, True, 8.Full value of goodwill raised on retirement is credited to All Partners’ Capital Accounts, including retiring partner in their old ratio. = True, , 14

Page 15 :

9.Sec 37 of the Indian Partnership Act, 1932 states that the outgoing partner has an option to, receive either interest @ 6% p.a till the date of payment or such share of profits which has been, earned with his money.= True, IV. Very Short Answer Questions:, 1.What do you mean by retirement of a partner?, Ans: A partner is said to be retired from the firm, when his relation with the firm as a partner, comes to an end., 2.Give the formula for calculating Gain Ratio., Ans: Gaining Ratio=New Ratio-Old Ratio., 3.Why the Gain Ratio is required on retirement of a partner?, Ans: Gaining Ratio is required to write off goodwill created only to the extent of retiring, partner’s share., 4.Why the New Ratio is required on retirement of a partner?, Ans: New Ratio is required to share future profits/losses between remaining, partners., 5.Give the formula for calculation of new profit sharing ratio on retirement of a partner., Ans: New Profit Sharing Ratio = Old share + Acquired share, 6.What do you mean by Hidden Goodwill?, Ans: Hidden goodwill refers to the amount paid to retiring partner in excess of, actual amount, due to him., 7.Portion gained=New Share.______, Ans: Portion gained =New Share-Old Share., (B) DEATH OF A PARTNER, Section A: One Mark Questions, I.Fill in the blanks, 1. Executors account is generally prepared at the time of Death of a partner., 2. Accounting treatment at the time of retirement and death is Similar., 3. The period from date of the last Balance sheet and the date of the partner’s death is called, Intervening period., 4. Profit & Loss Suspense A/c account is debited for the transfer of share of accrued profit of, a deceased partner., 5. Accrued profit is calculated on the bases of Previous Year’s profit/Average Profit/Sales., 6. Amount payable to the Executors of the deceased partner is transferred to Executors Loan A/c, II. Multiple Choice Questions(ANSWER IN BOLD LETTERS), 1.Accrued profit is ascertained on the following ways:, a ) Average Profit, b) Previous year’s profit c) On sales, d) All of the above., 2. Amount due to deceased partner is settled in the following manner, a) Immediate full payment, b) Transferred to Loan Account, c) Partly paid in cash and the balance transferred to Loan A/c, d) All of the above., 3. Deceased partner’s share of profit in the accrued profit may be calculated, on the basis of:, a) Last years profit, b) average profits of past few years, c) Sales, d) All the above, 4. Amount payable to the Executors of the deceased partner is transferred to:, a) Executors Loan Account, b) Executors Account, c) Remaining Partners’ Capital A/cs, d) None of the above., 5. Items to be considered while calculating the amount payable to the, deceased partner is, a) His share of capital, b) His share in reserve, c) His share in accrued profit, d) All the above., , 15

Page 16 :

III. True or False type questions:, 1.Deceased partner’s claim is transferred to his Executor’s Account.= True, 2.Deceased partner’s share of profit for the intervening period may be calculated on the basis of, last year’s profit/average profit of past few years or on the basis of sales.= True, 3.Deceased partner may be paid in one lump sum of installments with interest.=True, 4.Retirement normally takes place at the end of an accounting period,where as death of a, partner may occur any time.= True, 5.Amount payable to the Executors of the deceased partner is transferred to Executors Loan, Account.= True., IV.Very short Answer Questions:, 1. Who is an ‘Executor’?, Ans: Executor is the legal representative of a deceased partner in a, partnership firm., 2. When do you prepare Executors Account?, Ans: Executors A/c is prepared at the time of death of a partner., 3.Which account is credited for the share of accrued profit of a deceased partner?, Ans: Deceased Partner’s Capital/Executors A/c., 4.What is intervening period?, Ans: The period from last balance sheet and the date of the partner’s death is the intervening, period., 5.How do you close the Executors Account?, Ans: Executors A/c is closed by transferring its balance to Executors Loan, A/c., BOOK-1---CHAPTER-5--DISSOLUTION OF PARTNERSHIP FIRM, Section B- Question for two marks:, 1.What is Dissolution of Partnership?, Ans: Dissolution of Partnership means some of the partners terminate their, connections with, the firm and remaining partners will continue the, business of the firm., 2.Give the meaning of Dissolution of a Partnership Firm., Ans: Dissolution of a Partnership Firm means dissolution of partnership, between all the, partners of a firm. All the partners cut off their connections with the firm and the business of, the firm is closed down., 3.State any two circumstances under which a Partnership Firm is dissolved., Ans: a- Consent of all partners, b- Contract between partners, c- Expiry of fixed period, d- Completion of venture (any two), 4. State any two differences between Dissolution of Partnership and Dissolution of Partnership, Firm, Ans: Differences between, Dissolution of Partnership Dissolution of Partnership Firm, a- Business is not closed, a- Business is closed, b- Assets and Liabilities revalued, b- Assets are sold and liabilities are paid off, 5. What is Realization Account?, Ans: Realization A/c is an a/c which is prepared at the time of dissolution of, a partnership, firm to ascertain the profit or loss on realization of assets, and payment of liabilities., 6. Why is Realization Account prepared?, Ans: Realization A/c is prepared to close all the ledger a/cs and to make, settlement of a/cs., 7. What is the accounting treatment for unrecorded Asset Realized on Dissolution of a Firm?, Ans: Unrecorded asset realized is debited to cash (bank) a/c and credited to realization a/c, 8. What is the accounting treatment for unrecorded Liability paid on Dissolution of a Firm?, Ans: Unrecorded liability paid is debited to realization a/c and credited to cash(bank)a/cs., 9. How do you treat PBD on Dissolution of a firm?, Ans: P.B.D is closed by transferring it to credit side of realization a/c, , 16

Page 17 :

10.Give the journal entry for an asset taken over by a partner on Dissolution of a Firm., Ans:, Partner’s Capital A/c, Dr, To Realization A/c, (Being asset taken over by partner), 11.Give the journal entry for a liability taken over by a partner on Dissolution of a Firm., Ans:, Realization A/c, Dr, To Partner’s Capital A/c, (Being liability taken over by partner), 12. Give the journal entry for transferring an asset to Realization Account., Ans:, Realization A/c, Dr, To Asset A/c, (Being transfer of Asset), 13.Write the journal entry for the transfer of an outside Liability to Realization Account., Ans:, Liability A/c, Dr, To Realization A/c, (Being transfer of Liability), 14.Give the journal entry for the payment of Partner’s Loan on Dissolution of a Firm., Ans:, Partner’s Loan A/c, Dr, To Cash/Bank) A/c, (Being Partner’s Loan Paid), 15.Give the journal entry for sale of an asset on Dissolution of a Firm., Ans:, Cash/Bank A/c, Dr, To Realization A/c, (Being Sale of Asset), 16.Give the journal entry for payment of a liability on Dissolution of a Firm., Ans:, Realization A/c, Dr, To Cash (Bank), (Being payment of liability), 17. Give the journal entry for the transfer of profit on realization., Ans:, Realization A/c, Dr, To Partners’ Capital A/cs, (Being profit transferred), 18. Give the journal entry for the transfer of loss on realization., Ans:, Partners’ capital A/cs, Dr, To Realization A/c, (Being transfer for loss), 19.Give the journal entry for realization expenses paid by the firm., Ans:, Realization A/c, Dr, To Cash (Bank) A/c, (Being realization expenses paid), 20.How do you close realization A/c on dissolution of a firm?, Ans: Realization A/c is closed by transferring its balance to partners’ capital, a/cs, 21.Give the journal entry for Realization Expenses paid by the partner on behalf of the firm., Ans:, Realization A/c, Dr, To partner’s capital A/c, (Being realization expenses paid by partner), , 17

Page 18 :

BOOK-2, 1.ACCOUNTING FOR SHARE CAPITAL, Section-A: One mark Questions, I. Fill in the blanks:, 1. A company is an Artificial Person., 2. Subscribed Capital is the part of the issued capital., 3. Call money received in advance is called Calls in advance, 4. 5 Lakh Rupees is the minimum paid up capital of a Public Company., 5. One months must elapse between two calls., 6. 7 Members is minimum number of members in a Public Company., 7. 2 Members is minimum number of members in a Private Company., 8. The amount of buy back of shares in any financial year should not exceed, 25% of the paid-up capital., 9. Minimum paid up capital of a private company is 1,00,000., 10. Profit on forfeiture of shares is transferred to Capital Reserve Account., II. Multiple Choice Questions (Answers in bold letters), 1.Equity shareholders are:, a) Creditors, b) Owners, c) Customers of the company, d) None of the above, 2.. Interest on calls in arrears in charged according to table ‘F’ at the rate of:, a) 10%, b) 6%, c) 8%, d) 11%, 3. Shares can be forfeited for:, a) Non-payment of call money, b) Failure to attend meeting, c) Failure to repay the loan to the bank., d) The pledging of shares as a security, 4. Balance of Share Forfeiture Account is shown in the Balance Sheet under the head:, a) Current Liabilities and Provisions, b) Reserves and Surplus, c) Share Capital, d) Unsecured Loans, 5. Issued capital is part of, a) Reserve capital, b) Un issued capital, c) Authorized capital, d) None of the above, 6. Maximum number of members in a private company is, a) 40, b) 200, c) 70, d) No limit, 7. More applications are received than offered to public is called, a) Less offers, b) Under subscription, c) Over subscription, d) More offers, 8. Paid up capital is part of, a) Authorized Capital, b) Reserved Capital, c) Called-up capital, d) Subscribed capital, 9. If a shareholder fails to pay call money, it is called, a) Calls unpaid, b) calls in advance, c) Calls in arrears d) None of the above, 10. Minimum number of members in a public company is, a) 20, b) 50, c) No limit, d) 7, , 18

Page 19 :

III.True or False Type Questions, 1.A company is an artificial person= True, 2.Shares of a company are generally transferable.= True, 3.Share application account is a liability account.= True, 4.Paid-up capital may exceed called-up capital = False, 5.Capital Reserves are created out of capital profits.=True, 6.The part of capital which is called-up only on winding up is called reserved capital= True, 7.Private companies invite the public to subscribe for its shares= False, 8.Forfeiture of shares is cancellation of the rights of shareholders.=True, 9.All the shares of buy-back should be fully paid-up=True, 10.The articles of the Association must authorize the company for the buy-back of shares.=True, IV.Very Short Answer Questions, 1.State any one kind of a company., Ans: Companies limited by shares., 2.What is issued capital?, Ans: Issued capital is that part of authorized capital which is actually issued to the public for, subscription, 3.What is buy-back of shares?, Ans: Buy-back of shares means purchase of its own shares by a company, 4.What is minimum paid-up capital of a private company?, Ans: Rs.1,00,000., 5.When the Reserved Capital is used?, Ans: In the event of winding-up of the company., 6.What is over subscription?, Ans: Over subscription means applications for more shares are received than the number of, shares offered to the public for subscription., 7.What is under subscription?, Ans: Under subscription means number of the shares applied for is less than the number for, which applications have been invited for subscription., 8.What is issue of shares at par?, Ans: Issue of shares at par means issuing shares at a price equal to their face, value., 9.What is issue shares at premium?, Ans: Issue of shares at a premium means issuing shares at a price more than, their face value., 10.When the shares are forfeited?, Ans: For non payment of allotment and/or call money due on shares., Section B- Two marks questions:, 1.What is a company?, Ans: A company means company which is incorporated or registered under the companies Act., It is an artificial person existed in the eyes of law., 2.State any two features of a company., Ans: (i)Limited liability, (ii) Transferability of Shares, 3.. What is ‘Prospectus’?, Ans: Prospectus is an invitation to the public that a new company has come, into existence, and it needs funds for doing business., 4.What do you mean by over subscription?, Ans: Over subscription means applications for more shares are received than the number, offered to the public for subscription., 5.What are calls in arrears?, Ans: Calls in arrears mean calls made on shares, but money not received by, the company., 6.State any two methods of issue of shares., Ans: (i) Issue of shares at Par (ii) Issue of shares at a premium, , 19

Page 20 :

7. What is issue of shares for consideration other than cash?, Ans: Issue of shares for consideration other than cash means issuing of shares for purchasing, of assets without receiving money in cash., 8.What is forfeiture of shares?, Ans: Forfeiture of shares means cancellation of membership of a shareholder, who fails to, make payment due on his shares., 9.Give the journal entry for transfer of profit on re-issue of forfeited shares., Ans: Share Forfeiture A/c, Dr, To Capital Reserve A/c, (Being profit on re-issue transferred), 10.State any two categories of share capital., Ans: a- Authorized Capital, b- Issued Capital, , CHAPTER-2--ISSUE AND REDEMPTION OF DEBENTURES, Section A- one mark questions, I. Fill in the blanks, 1. Debenture holders are the Creditors of the Company., 2. Debentures issued as collateral security will be debited to Debenture, Suspense A/c, 3. Discount of issue of debentures is a fictitious asset., 4. Coupon rate is Rate of interest at which the amount is paid by the company on its, debentures., 5. Premium on issue of debentures is a Capital Profit, 6. When all the debentures are redeemed, Debenture Redemption Reserve A/c is credited to, General Reserve A/c, 7. NBFC registered with the RBI create redemption reserve equivalent to at least 25% of the, value of outstanding debentures issued through public, issue., 8. Withdrawal from Debenture Redemption Reserve is permissible only after 10% of debentures, have been redeemed., 9. In case of conversion of the debentures into shares, Debentures’ A/c is debited and Share, Capital A/c is credited., 10.If own debentures are purchased by the company for the Investment, purpose, own, debentures will be shown as an asset in the Balance Sheet., 11. Debentures which are transferable by mere delivery are called Bearer, debentures., 12. Debentures A/c is shown under the head Non-current Liabilities/Long- Term Borrowings, in the Balance Sheet., 13. 1,000 10% debentures issued at par, 10% means Rate of interest., 14. The balance of Sinking Fund Investment A/c after realization of, investments is, transferred to Sinking Fund A/c., 15. When the debentures are redeemed out of profits, an equal amount is, transferred to, Debenture Redemption Reserve (DRR) A/c., II. Multiple Choice Questions: (Answers in bold letters), 1.Premium on Redemption of Debentures A/c is _________A/c., a) Asset, b) Income, c) Liability, d) Expense, 2.. Debentures premium cannot be used to____, a) write off the discount on issue of debentures or shares., b) write off the premium on redemption of share or debentures., c) pay dividends, d) write off the capital loss., , 20

Page 21 :

3. Loss on issue of debentures is treated as:, a) Intangible asset, b) Current Asset, c) Current Liability d) Miscellaneous expenses., 4. In the event of liquidation of the company, the debentures holders have, priority for, a) Interest, b) Principal amount, c) Both a) & b) above, d) None of the above, 5. Debentures cannot be redeemed at:, a) Premium, b) Discount, c) Par, d) More than 10% Premium., 6. Debentures cannot be redeemed out of:, a) Profits, b) Provisions, c) Capital, d) All the above, 7. A company issued 2,000, 8% debentures of Rs100 each at par value, redeemed at 10% premium 8% stands for:, a) Rate of divided, b) Rate of tax, c) Rate of interest, d) Rate of TDS, 8. Debenture holders are, a) Owners of the company, b) Lenders of the company, c) Debtors of the company, d) Trustees of the company, 9. X Company ltd, purchased machinery for Rs.20, 000, payable Rs.6,500 in, cash and the balance by issue of 12% debentures of Rs.100 each at a discount, of 10%. How many debentures would be required to issue to the vender?, a) 155 debentures of Rs.100 each, b) 150 debentures of Rs.100 each, c) 135 debentures of Rs.100 eachd) 145 debentures of Rs.100 each, 10. XYZ Company Ltd issued 5,000 6% debentures of Rs.100 each at par and, are redeemable at 10% premium. Premium on redemption will be debited at, the time of issue of debentures to, a) Loss on Issue of Debentures A/c, b) Share Discount A/c, c) Security Premium A/c, d) General Reserve A/c, 11. Methods of Redemption of Debentures are, a) By annual drawings, b) By conversion of shares or debentures, c) By purchasing own debentures in open market, d) All of the above., 12. A company cannot redeem its debentures fully:, a) Out of capital, b) Out of profits, c) Both a & B above, d) None of the above, 13. If the market price of the Debentures is more than the face value, at the time, of redemption this will be a capital loss and is transferred to:, a) Capital Reserve, b) General Reserve, c) Profit on Redemption of Debentures, d) Loss on Redemption of Debentures., , 21

Page 22 :

14. The following journal entry appears in the books of a Company., Bank A/c, Dr., 9,50,000, Loss on issue of Debentures A/c, Dr., 1,50,000, To 8% Debentures A/c, 10,00,000, To Premium on Redemption of Debentures A/c, 1,00,000, In this case, Debentures are issued at a discount of ____%, a) 15%, b) 5%, c) 10%, d) 8%, 15. Raj Company Ltd. purchased assets worth Rs.14, 40,000. It issued debentures of, Rs.100 each at a discount of 4% in full settlement of the purchase consideration., The number of debentures issued to vendors is:, a) 15,000, b) 14,400, c) 16,000, d) 15,600, IV. True or False Type Questions:, 1.Debenture is a part of loaned capital.= True, 2.Debenture holders have voting rights.= False, 3.Debentures bear fixed interest.= True, 4.Debentures cannot be issued for consideration other than cash.= False, 5.Company can buy-back its debentures=True., 6.Interest on debentures is not shown in P&L Statement.=False, 7.Debenture holders are not the members of the company.= True, 8.Premium on redemption of debentures is a liability A/c.=True, 9.Debentures cannot be issued as a collateral security.=False, 10.A company can issue irredeemable debentures.=True, 11.Redemption of debentures is made by the company in accordance with the terms of, issue.=True, 12.A company cannot purchase its own debentures in the open market.=False, 13.Profit on redemption of debentures is in the nature of a capital profit.=True, 14.Debentures cannot be issued at a discount for more than 10% of the face value.=False, 15.Loss on issue of debentures is a revenue loss.=False, II.Very Short Answer Questions., 1.What is meant by debentures?, Ans: Debentures are the acknowledgements of debt taken by the company, 2.What is Bond?, Ans: Bond is an instrument of acknowledgment of debt., 3. What is coupon rate?, Ans: Coupon rate refers to a specified rate of interest on debentures., 4. What do you mean by zero coupon rate debentures?, Ans: Zero coupon rate debentures refer to the debentures those do not carry, a specific rate of, interest., 5. What is meant by issue of debentures for consideration other than cash?, Ans: Issue of debentures for consideration other than cash means issuing, debentures to, vendors for purchasing of assets., 6.What do you mean by the issue of debentures as a collateral security?, Ans: Issue of debentures as a collateral security means issuing debentures to, the lenders, (bank) in addition to some other assets already pledged., 7.Name any one method of redemption of debentures., Ans: Payment in lump sum, 8.What do you mean by redemption of debentures?, Ans: Redemption of debentures refers to repayment of the amount of, debentures by the, company., 9.Expand D R R., Ans: DRR= Debenture Redemption Reserve, , 22

Page 23 :

10.Expand DRFI., Ans: DRFI= Debenture Redemption Fund Investment, 11.Expand AIFIs, Ans: AIFIs = All India Financial Institutions, 12.State any one type/kind of debentures., Ans: Secured Debentures., 13.Can the company purchase its own debentures?, Ans: Yes, 14. Debenture Redemption Reserve is shown under which head in the, Balance Sheet?, Ans: Reserve & Surplus, 15. Name the head under which discount on issue of debentures appears in, the Balance, Sheet of a Company., Ans: Other Non-Current Assets., CHAPTER-3--FINACIAL STATAEMENTS OF A COMPANY, I. Section A: One Mark Questions, 1.Financial statements are the basic and formal annual report., 2.Financial statements include Statement of Profit and Loss and Balance Sheet., 3.Income statement and Balance Sheet (Position Statement) are the financial statements., 4.The object of preparation of balance sheet is to ascertain the Financial status of the, enterprise, 5.Income statement is prepared to ascertain Surplus of the enterprise., 6.Share capital appears under the head Shareholders’ Fund, 7.Capital reserve is shown under Reserve & Surplus head., 8.Debit balance of statement of profit and loss shall be shown as Negative figure under surplus, head., 9.Loans which are repayable within 12 months are called as short term borrowings., 10.Fixed assets are classified as tangible and intangible assets., II. Multiple Choice Questions(ANSWER IN BOLD LETTERS), 1.Financial statements generally include:, a. Comparative Statement, b. Fund flow statement, c. Income statement and balance sheet, d. None of the above, 2. The prescribed form of Balance Sheet of the companies has been given in, the Schedule-----a) VI part I b) VI part II c) VI Part IV d) III schedule, 3. Which of the following is shown under the head “fixed assets”, a) Goodwill, b) Patents c) Trademarks, d) All of the above, 4. Current Assets does not include:, a) Short term investments, b) Buildings, c) Inventories, d) Cash and cash equivalents, 5. Current liabilities are to be paid within, months, a) 3 months, b) 6 months, c) 9 months. d) 12 months, 6. External users of financial statements does not include., a) Banks, b) Shareholders, c) Creditors, d) Government, 7. Share capital is shown as, a) Authorized capital b) Issued capital c) Subscribed capital d) All the above, 8. Financial statements are prepared based on, a) Accounting postulate, b) Accounting conventions, c) Recorded facts, d) All the above, 9. Non-current assets are, a) Expected to use in the business for long period, , 23

Page 24 :

b) Involved in entities operating cycle, c) Primarily held of trading, d) Cash and cash equivalents, III. True or False type questions:, 1.The original cost is the basis of recording transactions= True, 2.Going concern postulate assumes that the enterprise exists for a longer period of time= True, 3.The financial statement do not show current financial condition of a business.=False, 4.The stationery is valued at cost.= True, 5.Provisions are maintained for known liabilities.=True, 6.While preparing financial statements, inventories valued at market price or cost price, whichever is less.= True, 7.Cash and cash equivalents are to be disclosed in accordance to IAS-3.=True, 8.Rounding off of figures in financial statements is not mandatory.=False, 9.In the Balance Sheet of a Company, goodwill is shown under the heading of ‘Fixed Assets’=, True, 10.Proposed dividend is shown under the head ’Provisions’=True, IV. Very Short Answers Questions:, 1.Name any one type of financial statements., Ans: Balance Sheet, 2.State any one feature of financial statements, Ans: Recorded facts, 3.Name any one internal user of financial statements., Ans: Shareholders, 4.Write any one objective of financial statements., Ans: To Assist the users in their decision making, 5.State any one type of reserve., Ans: General Reserve, 6.Give an example for non-current asset., Ans: Building, 7.Where do you record the money received against share warrants?, Ans: Sharholder’s Fund, 8.Hod do you treat Credit balance of income statement under the head surplus?, Ans: It is shown in surplus under ‘Reserve & Surplus’ head., 9.Write any one feature of current assets., Ans: Involved in entity’s operating cycle, 10.How do you treat preliminary expenses?, Ans: Preliminary expenses are to be written off completely in the year in, which such expenses, are incurred first from securities premium, reserve, next from surplus., Section- B Two Marks Questions, 1.Give the meaning of financial statements., Ans: Financial Statements are the basic and formal annual reports through, which corporate, management communicates financial information to, its owners and various other external, parties., 2.Mention two types of financial statements., Ans: i. Statement of P & L, ii.Balance Sheet, 3. State any two features of financial statements, Ans: i. Recorded facts, ii. Accounting conversions followed, 4. Write any two objectives of financial statements., Ans:, i. To provide information about earning capacity of the business., ii. To provide information about economic resources and obligations of a business, 5.State any two benefits of financial statements., Ans: i. Basis for prospective investors, , 24

Page 25 :

ii. Report on the performance of the management, 6. Give any two limitations of financial statements, Ans: i. Do not reflect current situation ii. No qualitative information, 7. State any two postulates., Ans: i. Going concern postulate ii. Money measurement postulate, 8. How will you disclose the following items in the Balance Sheet of a, Company?, i) Loose Tools, ii) Proposed dividends., Ans: i. Loose Tools: Inventories(Current Assets), ii. Proposed Dividend: Short term provisions(Current Liabilities), 9. State any two differences between current liabilities and non-current liabilities., Ans: Differences between:, Current Liabilities, Non-Current Liabilities, i. Expected to be settled within 12 months, i. Expected to be settled after, 12months, ii. Held primarily for the purpose of being, ii. Held as source for long term, traded, finance., 10. Mention any two items which are shown under the head “Reserves &, Surplus”, Ans:, i. Capital Reserve, ii. Securities Premium Reserve, CHAPTER-4--FINANCIAL STATEMENT ANALYSIS, Section A: One Mark Questions:, I. Fill in the blanks:, 1. The term analysis means simplification of financial data, 2. Interpretation means explaining the meaning and significance of the data., 3. Comparative analysis is also known as Horizontal analysis., 4. Common size analysis is also known as Vertical analysis., 5. Common size statement is also known as component percentage, statement, 6. The term ‘financial analysis’ includes both ‘analysis and Interpretation., 7. Analysis in useless without Interpretation., 8. Interpretation without analysis is Difficult., 9. The statement showing the profitability and financial position for different, periods of time in a comparative form is known as comparative, statement., 10. The statement which indicates the relationship of different items of, financial statement, with a common item is called common size statement., 11. It is possible to assess the profitability, solvency and efficiency through, the technique of Ratio analysis., 12. Analysis of actual movement of cash into and out of an organization is called Cash Flow, Analysis., 13. Inter-firm comparison or comparison of the company’s position with the related, industry as whole is possible with the help of common size statement analysis., 14. Percentage of each asset to the total assets is shown in Common Size Balance Sheet., 15. Analysis and interpretation are Complimentary to each other., , II. Multiple choice questions (Answers in bold letters), 1.The financial statements of a business enterprise include:, a) Balance Sheet, b) Statement of Profit and Loss., c) Cash flow statement, d) All the above, , 25

Page 26 :

2. The most commonly used tools for financial analysis are, a) Horizontal Analysis, b) Vertical Analysis, c) Ratio Analysis, d) All the above, 3. An annual report is issued by a company to its, a) Directors, b) Auditors c) Share Holders d) None of the above, 4.Comparative statement are also known as, a) Dynamic Analysis, b) Horizontal Analysis, c) Vertical Analysis, d) External Analysis, 5. Common size statements are also known as, a) Dynamic Analysis, b) Vertical Analysis, c) Horizontal Analysis, d) External Analysis, 6. Percentage of each liability to the total liabilities is shown in, a) Common Size Balance Sheet b) Comparative Balance Sheet, c) Both the above, d) None of the above, 7. Balance Sheet provides information about financial position of the, enterprise, a) At a point in time b) Over a period of time, c) For a period of time d) None of the above, 8. Comparative Statement shows the changes during the year, a) in absolute terms, b) in relative terms, c) both the above, d) none of the above, 9. Common Size Statements are useful in comparison of, a) Intra-firm for the same or several years, b) Inter-firm over different years, c) Both (a) & (b) above, d) None of the above, 10. Financial Analysis can be undertaken by, a) Management, b) Parties outside the firm, c) Both the above, d) None of the above, III.True or False type questions;, 1.The Financial Statements of business enterprise include Cash Flow Statement.= False, 2.Comparative Statements are the form of Horizontal Analysis.=True, 3.Common Size Statements and Financial Ratios are the two tools employed in Vertical, Analysis.= True, 4.Financial Analysis is used only by the creditors.= False, 5.Financial Analysis helps an analyst to arrive at a decision.=True, 6.In a Common Size Statement, each item is expressed as a percentage of same common base.=, True, 7.The difference between the inflow and outflow of cash is the net cash flow.=True, 8.The flow of cash into the business is called positive cash flow of financial tatements.=True, 9.Financial Analysis can be undertaken by management or by parties outside thefirm.=True, 10.Financial data will be comparative only when same accounting principles are used. =True., 11.Non-monetary aspects are ignored in financial analysis.=True, 12.Financial analysis does not consider price level changes.=True, 13.Items of expenditure are shown as a percentage of the net revenue from operations in, Common Size Income Statement.= True, , 26

Page 27 :

IV.Very short answer type questions, 1.What do you mean by Financial Statement Analysis?, Ans: Financial Statement Analysis means simplification of financial data by methodical, classification given in financial statements., 2.State any one object of Financial Statement Analysis., Ans: To assess profitability and operational efficiency, 3.State any one technique of Financial Statement Analysis., Ans: Comparative Statements, 4.State any one user of Financial Analysis., Ans: Shareholders/investors/creditors(any one), 5.What is Vertical Analysis?, Ans: It is a tool of financial analysis, in which data or figures are converted into percentages of a, common base amount., 6.What is Horizontal Analysis?, Ans: It is a technique of financial analysis, in which data or figures are shown in a comparative, form of two or more years/ enterprises., 7.State any one importance of Financial Analysis., Ans: Helpful to finance manager, 8.State any one limitation of Financial Analysis., Ans: It does not consider price level charges, 9.Give the meaning of analysis., Ans: Analysis mean simplification of financial data by methodical classification, 10.Give the meaning of interpretation., Ans: Interpretation means explaining the meaning and significance of data., Section B- Two marks questions, 1.What do you mean by Financial Statement Analysis?, Ans: Financial Statement Analysis is the process of identifying the financial strengths and, weakness of the firm by properly establishing relationship between the items of financial, statements., 2.Give the meaning of Analysis and Interpretation of Financial Statements., Ans: Analysis and Interpretation of Financial Statements means simplification of data and, explaining the meaning and significance of, data., 3.List any two techniques of Financial Statement Analysis., Ans: (i) Comparative Statements (ii)Common Size Statements, 4. Distinguish between Vertical and Horizontal Analysis of Financial Data., Ans:, Vertical Analysis, Horizontal Analysis, (i) Figures are converted into % of, (i) Figures are shown in comparative, common base item, form, (ii) Figures of same year are, (ii) Figures of two years are, converted into %, compared, 5. What are Comparative Financial Statements?, Ans: Comparative Financial Statements refer to the financial statements prepared by providing, columns for the figures both the current year as well as previous year and for change during, the year both in absolute and relative terms., 6.What do you mean by Common Size Statements?, Ans: Common Size Statements refer statements in which the data or figures of financial, statements are converted into percentages of a common base, amount., 7.State any two importance of Financial Statement Analysis., Ans: (i) Helpful to financial manager, ii) Helpful to investors., , 27

Page 28 :

8. State any two objectives of Financial Statement Analysis., Ans: (i)To ascertain the relative importance of different components, (ii) To identify the reasons for change in profitability/financial position., 9.State any two users of Financial Statement Analysis., Ans: 9i) Finance Manager (ii) Top Management, 10. State any two limitations of Financial Statement Analysis., Ans: (i) Non-Monetary aspects ignored, (ii) It does not reflect the current position, 11. Give the Absolute increase and percentage increase for the following, Previous Year Rs, Current Year Rs, Revenue from operations, 60,000, 75,000, Ans:, Absolute increase [ Rs.75,000 -60,000] = Rs.15,000, % of increase = 15,000x100/60,000= 25%, 12. Give the formula for percentage change in Comparative Statement., Ans:, % change = Absolute increase or decrese, x 100, First Year figure, 13. State the importance of Comparative Statements., Ans: (i) Easy to draw meaningful conclusion because of comparative form, (ii) They indicate the trend and direction of financial position and result., 14. State the importance of Common Size Statements., Ans: (i) Establishment of significant relationship between two items., (ii) Relationship is helpful in evaluating operational activities of the business, enterprises., CHAPTER-5--ACCOUNTING RATIOS, Section A: One Mark Questions, I. Fill in the blanks, 1. Accounting Ratios are an important tool of Financial Statement Analysis, 2. A Ratio Analysis is a mathematical number calculated as a reference to relationship of two, or more numbers., 3. Ratio can be expressed as a fraction, proportion, percentage and a number of times., 4. If a ratio is compared with one variable from the statements of Profit and Loss and another, variable from the Balance Sheet, it is called Comparative Ratio, 5. Quick Ratio is also known as Acid Test Ratio, 6. Ratios are means to an end rather than the End of itself, 7. Current ratio is the proportion of current assets to current liabilities., 8. Liquidity ratios are calculated to measure the short term solvency of the business., 9. The quick assets are those assets which are quickly convertible into Cash., 10.The Profitability ratios are preliminary measures of return., 11.Ratio of gross profit to revenue from operatios is known as Gross Profit ratio., 12. Debt-Equity ratio measures the relationship between long term debt and, equity., 13. Proprietary ratio expresses relationship of proprietor’s funds to Net Assets, 14.The Inventory Turnover Ratio measures the activity of a firm’s inventory., 15.The Average Collection Period is useful in evaluating credit and collection, policies., II. Multiple Choice Questions(Answer in bold letter), 1.The following groups of ratios are primarily measures risk, a. Liquidity, Activity and Profitability, b. Liquidity, Activity and Inventory, c. Liquidity, Activity and Debt, d. Liquidity, Debt and Profitability, , 28

Page 29 :

2.The ________ratios are primarily measures return., a) Liquidity b) Activity c) Debt, d) Profitability, 3.. The_____of business firm is measured by its ability to satisfy it’s short-term, obligations as they become due:, a) Activity, b) Liquidity, c) Debt, d) Profitability, 4. _____ratios are a measure of the speed with which various accounts are, converted into revenue from operations or cash:., a) Activity, b) Liquidity, c) Debt, d) Profitability, 5. The two basic measures of liquidity are, a) Inventory Turnover and Current Ratio, b) Current Ratio and Liquid Ratio, c) Gross Profit Margin and Operating Ratio, d) Current Ratio and Average Collection Period, 6. The____is a measure of liquidity which excludes_______generally, the least liquid, asset:, a) Current ratio, trade receivable, b) Liquid ratio, trade receivable, c) Current ratio, inventory, d) Liquid ratio, inventory, 7. The____is useful in evaluating credit and collection policies, a) Average Payment Period, b) Current Ratio, c) Average Collection Period, d) Current Assets Turnover, 8. The_____measuers the activity of a firm’s inventory, a) Average Collection period, b) Inventory turnover ratio, c) Liquid ratio, d) Current ratio, 9. The ____may indicate that the firm is experiencing stock outs and lost sales., a) Average payment period, b) Inventory turnover ratio, c) Average collection period, d) Quick ratio, 10. ABC co. extends credit terms of 45 days to its customers. Its credit collection, would be considered poor, if its average collection period was., a) 30 days, b) 36 days, c) 47 days d) 37 days, 11. _________are especially interested in the average payment period, since it, provides them with a sense of the bill-paying patterns of the firm., a) Customers, b) Stockholders, c) Lenders and suppliers d) Borrowers and buyers, 12. The______ratios provide the information critical to the long run operation of the, firm., a) Liquidity, b) Activity, c) Solvency, d) Profitability, 13. Dividend payout ratio refers to proportion of earning that are distributed to the, a) Share holders, b) Debenture holders, c) Creditors, d) Lenders, 14. Trade payables turnover ratio indicates, a) Payment of Trade Payables, b) Payment to creditors, c) Payment of Bank Loan, d) Payment of Bills Payable, 15. Liquidity ratios are expressed in;, a) Pure ratio form, b) Percentage, c) Rate or Time, d) None of the above, , 29

Page 30 :

III. True or False type questions, 1.The only purpose of financial reporting is to keep the managers informed about the progress of, operations= False, 2.Analysis of data provided in the financial statements is termed as financial analysis.=True, 3.Long term borrowings are concerned about the ability of a firm to discharge its obligations to, pay interest and repay the principal amount.= True, 4.A ratio is always expressed as a quotient of one number divided by another.=False, 5.Ratios help in comparisons of a firm’s results over a number of accounting periods as well as, with other business enterprises.=True., 6.A ratio reflects quantitative and qualitative aspects of results.=False, 7.Liquidity ratios are essentially short term in nature=True., 8.Current ratio is the proportion of current assets to current liabilities.=True, 9.The quick assets are those assets which cannot be quickly converted into cash=False, 10.A higher interest coverage ratio ensures safety of interest of debts.=True., 11.The liquidity ratios are preliminary measures of return.=False, 12.Higher gross profit ratio is always a good sign=True., 13.Dividend payout ratio refers to the proportion of earning distributed to the, shareholders.=True., 14.Net profit refers to profit after tax (PAT) =True., 15.Price earnings ratio=Market price of share/Earnings per share=True., IV.Very short answer type questions:, 1.Give the meaning of Ratio Analysis., Ans: Ratio Analysis is the indispensable part of interpretation of results revealed by the, financial statements., 2.State any one objective of ratio analysis., Ans: To know areas of business which need more attention, 3.State any one use of ratio analysis., Ans: Simplify complex figures and establish relationships, 4.Mention any one limitation of ratio analysis., Ans: Ignores price level changes, 5.Mention any one type of ratio, Ans: Liquidity Ratio-Current Ratio, 6.Give one example for current assets, Ans: Cash/cash at bank/inventory(any one), 7.Give one example for current liability., Ans: Creditors/B/P/Bank Overdraft(any one), 8.What is current ratio?, Ans: Current ratio is the proportion of current assets to current liabilities, 9.What is quick ratio?, Ans: Quick ratio is the ratio of quick assets to current liabilities., 10. Name any one type of turnover ratio., Ans: Inventory Turnover Ratio, 11.Give the meaning of net profit ratio., Ans: Net Profit ratio is a profitability ratio of net profit to revenue from, operations., 12.Give the meaning of dividend payout ratio., Ans: Dividend payout ratio refers to the proportion of earnings that are distributed, to the shareholders., 13.What is activity ratio?, Ans: Activity Ratio is the ratio that indicate the speed at which activities of the, business are being performed., 14.State one significance of interest coverage ratio., Ans: It reveals the number of times interest on long term debts is covered by the, profits, available for interest, , 30

Page 31 :