Page 1 :

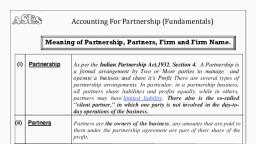

Chapter-2, , Accounting for partnership-Basic, concepts, Partnership is a form business which is owned by two or, more persons who have agreed to share the profits /Loss, of a business carried on by all or any one of them acting, for all.

Page 2 :

Features of Partnership, , 1.Number of members, Minimum-2, Maximum-100

Page 3 :

Features of Partnership, , 2.Agreement, , To form a partnership there must be an, agreement. It may be oral or written ,written, agreement is known as PARTNERSHIP DEED

Page 4 :

Features of Partnership, , 3.Always to conduct a Business, The partnership should be to carry on some, lawful business.

Page 5 :

Features of Partnership, , 4.Unlimited Liability

Page 6 :

Features of partnership, , 5.No Separate Legal, Existence, It has no separate legal existence apart from, its members. It can’t purchase property on its, own name.

Page 7 :

Features of Partnership, , 6.Sharing of Profit/Loss, The profit should be shared by the partners in, an agreed ratio.

Page 8 :

Partnership Deed, The agreement in writing, containing the terms and conditions, of partnership as agreed between partners is called, ‘partnership deed’., , Contents of Partnership Deed, 1.Name of the firm., 2.Names and addresses of all partners., 3.Nature and places of business., 4.Date of commencement of partnership.

Page 9 :

Contents of Partnership Deed, 5.Duration of partnership, if any., 6.Rules regarding operation of bank accounts., 7.Amount of capital contributed by each partner., 8.Profit sharing ratio between partners, if any., 9.Interest on partners loan to the firm, if any., 10.Interest on partner’s capital and drawings, if, any.

Page 10 :

Contents of Partnership Deed, 11.Salary, commission, if any, payable to a, partner., 12.Rights,duties and liabilities of partners., 12.Method of computation and treatment of, goodwill on reconstitution of a firm., 13.Mode of settlement of accounts at the, time of admission, retirement, death, and dissolution of firms.

Page 11 :

Rules applicable in the absence of, Partnership Deed or if the deed is, silent on any matter, 1.Profit Sharing, Partners are entitled to share profit and, losses equally

Page 12 :

Rules applicable in the absence of, Partnership Deed or if the deed is, silent on any matter, 2.Interest on Capital, No Interest on capital is payable to partners

Page 13 :

Rules applicable in the absence, of Partnership Deed or if the, deed is silent on any matter, 3.Interest on Drawings, No interest will be charged on drawings made by, partners.

Page 14 :

Rules applicable in the absence, of Partnership Deed or if the, deed is silent on any matter, 4.Remunerations like salary,commission etc., No one is entitled to get salary or commission.

Page 15 :

Rules applicable in the absence, of Partnership Deed or if the, deed is silent on any matter, 5.Interest on Partners Loan to the Firm, Partners are entitled to get interest @ 6% p.a. on loans, advanced by the partners. It should be paid even if there, is loss

Page 16 :

Appropriation of Profit and Charge Against Profit, Appropriation of Profit, It is the distribution of net profit to various heads. It is made only if there, is a profit., Example: Interest on capital,salary to partner,commission to, partners,amount transferred to reserve etc., , Charge Against Profit, It is the deduction from revenue to ascertain net profit or net, loss. It is made even if there is loss. It will be debited to profit, and loss account. Interest on loan,depreciation,salary to, staff,bad debts etc.

Page 17 :

Important Accounts in Partnership, Partners Capital account, , ➢, , Partners Current Account, , ➢, , Profit and Loss Appropriation, Account, , ➢, , Drawings Account, , ➢

Page 18 :

Partner's Capital Account, All transactions relating to the partners of a firm are, recorded in their capital accounts. This includes the amount, of money brought in as capital, withdrawal of capital, share, of profit, interest on capital,Drawings,interest on drawings,, partner’s salary, commission, etc. Partners capital account, is a personal account. Partners capital account can be, maintained in two ways:-, , 1.Fluctuating Capital Method, 2.Fixed Capital Method

Page 19 :

Partner's Capital Account, 1.Fluctuating Capital Method, Under fluctuating capital method, there is only one, account,viz. capital account for each partner is maintained., All transactions relating to partners of a firm are recorded in, their capital accounts., Features:➢ In this method only one account,i.e,partners capital A/C, ➢, , ➢, , All adjustment like interest on capital,partner's, salary,drawings,interest on drawings etc. are recorded in, capital account itself., Balance of partner's capital account will fluctuate from year, after year.

Page 20 :

1.Fluctuating Capital Method, Partner's Capital A/C (Fluctuating Method), Particulars, , Amount, , Particulars, , Amount, , To Balance b/d (If Debit balance), , xxxxx, , By Balance b/d (If Credit balance), , xxxxx, , To Drawings, , xxxxx, , By Cash (If additional capital, introduced), , xxxxx, , To interest on drawings, , xxxxx, , By Salary, , xxxxx, , To Profit and Loss Appropriation, A/C (Share of loss), , xxxxx, , By Commission, , xxxxx, , To Balance c/d (If Credit Balance), , xxxxx, , By Interest on Capital, , xxxxx, , By Profit and Loss, Appropriation(Share of Profit), , xxxxx, , xxxxxx, , xxxxxx

Page 21 :

Fixed Capital Method, , Under fixed capital method two accounts are, maintained for each partner,viz. Partner's Capital, Account and Partner's Current Account. Opening, capital balance and additional capital, introduced,capital withdrawal (if any) are recorded in, capital account. All other adjustments like interest on, capital,salary,drawings,interest on drawings etc. are, recorded in a separate account known as partners, current account., Features:➢ Two accounts are maintained for each partner., ➢, , ➢, , All adjustments are recorded in Partner's Current Account., Capital Account balance will remain unaltered unless, additional capital introduced or withdrawn.

Page 22 :

F, I, X, E, D, C, A, P, I, T, A, L, M, E, T, H, O, D

Page 23 :

Difference Between Fixed Capital Method And Fluctuating, Capital Method, Fixed Capital Method, , Fluctuating Capital Method, , Two Accounts, , One Account, , All Adjustments Recorded in Current A/C, , All Adjustments Recorded in Capital A/C Itself, , Normally No changes in Capital Account BalanceCapital Account Balance Will Change, , Both Capital and Current Account Balance in, Balance Sheet, , Only Capital Account Balance in Balance Sheet, , Capital Account Always Show Credit Balance, , Capital Account may Show Debit or Credit, Balance

Page 24 :

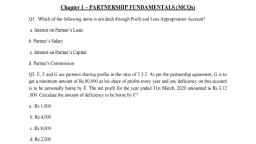

Distribution of Profit/Loss, , Profit and Loss Appropriation, Account, In Partnership distribution of profit or loss among, partners through a separate account known as Profit, and Loss appropriation account. It is an extension of, profit and loss account. It is opened with net profit/ net, loss brought forward from profit and Loss Account., TRADING, ACCOUNT, , PROFIT AND LOSS, ACCOUNT, , PROFIT AND LOSS, APPROPRIATION A/C

Page 25 :

Profit and Loss Appropriation A/C, In partnership there is an agreement between partners, with regard to salary to partners,commission,interest on, capital and interest on drawings etc.So Net Profit, reflected in profit and loss account required some, adjustments with regard salary to partner,commission,, interest on capital etc. before its distribution among, partners. These adjustments takes place in a separate, account called Profit and loss appropriation account., P&L A/C, , Net profit-Closing, Balance of profit, And loss a/c, , P&L APPROPRIATION A/C, , CAPITAL A/C, , Net profit is brought, forward(as opening, Balance) to P&L, Appropriation a/c,here, some adjustment is, required for net profit., , Divisible Profit/Loss, Is the end result of P&L, Appropriation A/C. It should, be transferred to, partners, Capital A/C in their, profit sharing ratio

Page 26 :

Profit and Loss Appropriation A/C, , It is credited with interest on drawings. It is debited, with, salary, to, partner,commission, to, partner,amount transferred to reserve (if any) etc., At the end this account should be balanced and if it, show credit balance,it means profit and should be, transferred to the credit side of partners capital, account in their profit sharing ratio and vice versa., Profit and Loss Appropriation A/c, , Particulars, , By P&L Account(Net loss), By Salary, By Commission, By Interest on Capital, By Reserve(if any), By Partners capital( B/F), (in their ratio), , Amount, xxxx, xxxx, xxxx, xxxx, xxxx, xxxx, xxxx, , Particulars, By P&L Account(Net Profit), By Interest on Drawings, , Amount, xxxx, xxxx, , xxxx

Page 27 :

Profit and Loss appropriation Account, Features:It is a nominal account., ➢ It is an extension of profit and loss account., ➢ It is prepared to show how the net profit has been, distributed among partners., ➢ It is opened with net profit or loss., ➢ It is credited with interest on drawings., ➢ It is debited with salary to partner,commission to, partner,interest on capital etc., ➢ If it show credit balance ,it means distributable, profit and should be credited to partners capital, account in their profit sharing ratio., ➢

Page 28 :

Profit and Loss Appropriation, Account, Journal Entries:Particulars, , Debit, , Credit, , For transfer of Net Profit:, xxxx, P & L Account Dr, To P & L Appropriation Account, (Net profit Transferred to P & L Appropriation A/C), , xxxx, , For Transfer of net loss( if any), , P & L Appropriation Account, To P & L Account, (Net LossTransferred to P & L Appropriation A/C), , xxxx, xxxx, , For Allowing Interest on Capital, , Interest on Capital A/C Dr, To Partners Capital A/C, (Interest on Capital allowed), , xxxx, xxxx

Page 29 :

For Closing Interest on Capital Account, , P & L Appropriation A/C Dr, To Interest on Capital A/C, , xxxx, xxxx, , (Interest on capital account is closed by transferred it to P, & L Appropriation A/C), When Salary Due, Partners Salary A/C Dr, To Partner's Capital A/C, (Salary due), , For Closing Salary Account, P & L appropriation A/C Dr, To Partner's Salary A/C, (Salary account closed by transferred it to P &L, Appropriation A/C), For Transfer to Reserve, , P & L appropriation A/C Dr, To Reserve A/C, (Amount transferred to reserve), , xxxx, xxxx, , xxxx, xxxx, , xxxx, xxxx

Page 30 :

For Charging interest on drawings, , Partner's Capital A/C Dr, To Interest on Drawings, , xxxxx, xxxxx, , Interest on drawings charged to partners capital A/C, For closing Interest on Drawings, Interest on Drawings A/C Dr, To P & L Appropriation A/C, (Interest on drawings account closed by transferred, to P & L Appropriation A/C), , xxxxx, xxxxx, , For transfer of balance in the P& L Appropriation A/C, (If Profit), , P & L Appropriation A/C Dr, To Partner's Capital A/C, (Divisible profit distributed among partners in, their ratio), , xxxxx, xxxxx, , For transfer of balance in the P& L Appropriation A/C, (If Loss), , Partner's Capital A/C, To P & L Appropriation A/C Dr, (Divisible profit distributed among partners in, their ratio), , xxxxx, xxxxx

Page 31 :

Profit and Loss appropriation Account, Profit and Loss Appropriation A/C, Particulars, , Amount, , Particulars, , Amount, , Net Loss b/d (If any), , xxxx, , Net Profit b/d (If any), , xxxx, , Salary, , xxxx, , Interest on Drawings, , xxxx, , Commission, , xxxx, , Reserve, , xxxx, , Partners Capital A/C, (In their ratio), , xxxx, , xxxxx, , xxxxx

Page 32 :

Profit and Loss appropriation Account, Items to be Debited:➢, , Net Loss b/d (P&L A/C), , ➢, , Interest on capital, , ➢, , Salary to partner, , ➢, , Commission to partner, , ➢, , Amount transferred to, reserve

Page 33 :

Profit and Loss appropriation Account, Items to be Credited:➢, , Net Profit b/d (P&L A/C), , ➢, , Interest on Drawings

Page 34 :

Some Important Calculations:-, , 1.Interest on Drawings, 2.Interest on Capital

Page 35 :

Interest on Capital, The interest on capital is paid to the, partners as a compensation for their, capital contribution to the firm. Interest on, capital is an expense to the firm and a, gain to partners individually. No interest is, allowed on partners’ capital unless it is, agreed between partners.

Page 36 :

Interest on Capital, Interest is generally calculated on the opening, capital and credited to partners capital account., It is an appropriation of profit and it should be, noted that interest on capital is payable only, out of profit. No interest on capital if there is, loss., Interest on capital=Capital of the partner x Rate, x period for which amount remained in the, business.

Page 37 :

Interest on Capital -No Addition or Withdrawal, Interest on capital=Opening capital x rate x period, for which amount remain in business., Q.Amal and Bimal entered into partnership business on 01-012017 by bringing in Rs.300000 and Rs.200000 respectively., They decided to share profit and losses equally and agreed, that the interest on capital will be provided to the partners @, 10% per annum. There was no addition or withdrawal of, capital by any partner during the year. Calculate interest on, capital of Amal for the year?, Interest on capital of Amal=300000 x 10/100 x12/12, OR, =300000 x10%, =30000

Page 38 :

Interest on Capital – When Additional capital, introduced during the accounting year., 1.On opening capital interest for full year, 2.On the additional capital interest from the, date of contribution to the end of the period, Anna and Maria are partners in a firm. Anna’s capital account showed a, balance of Rs.50,000 on 01-01-2017.During the year 2017 Anna, introduced an additional capital of Rs.10,000 on 1st August 2017.The, Interest on capital allowed @ 8% p.a. Accounts are closed on December, 31st every year. Calculate interest on capital to be allowed to Anna during, the year 2017.?, For Anna's opening capital for full year,i.e. 50,000 x8% =4,000, For Anna's additional capital from the date of contribution(1-8-2017) to, the end of the period(31-12-2017) ,i.e.10000 x 8% x 5/12 =333, Total Interest on capital of Anna = 4000 + 333, = 4333

Page 39 :

Interest on Capital – When there is, withdrawal out of capital during the year, In this case interest is calculated as follows:-, , 1.On opening capital interest is calculated for full, year (1), 2.On the amount of capital withdrawn during the, year interest for the period from the date of, withdrawal to the closing day and deduct it, from the above (1)

Page 40 :

Interest on Capital – When there is withdrawal out, of capital during the year, Q. Sneha and Varsha are partners in a firm. Their, capital accounts as on 1-04-2017 showed a balance of, Rs.2,00,000 and Rs.3,00,000 respectively. On October, 1st 2017Sneha withdraw Rs.30,000 from her capital., Interest is allowed @8% p.a. Calculate interest on, capital of Sneha for the financial year 2017-2018?, On opening capital for full year, i.e.2,00,000 x 8% =16,000 (1), Calculate interest on the amount of capital withdraw for the, period from the the date of withdraw to the closing date,, i.e 3,000 x 8% x 6/12 = 1200 (2), Interest on capital(1-2) = 16000 – 1200, = 14,800

Page 41 :

Interest on Capital – When there is both addition and, withdrawal of capital by partners during the year, , 1.On opening capital interest is calculated for full, year (1), 2.On additional capital from the date of, contribution to the end of the period (2), 3.On the amount of capital withdrawn during the, year interest for the period from the date of, withdrawal to the closing day and deducted, from the total of the interest calculated under, point(1) and point (2).

Page 42 :

Interest on Capital – When there is both addition and, withdrawal of capital by partners during the year, Tomy and George are partners in in a firm. Their capital, account balance as on 1-4-2017 showed a balance of, Rs.5,00,000 and Rs.2,00,000 respectively. On June 1 st ,Tomy, introduced additional capital of Rs.20,000.On November 1 st, Tomy withdraw Rs.30,000 from his capital. Interest on capital, is allowed @10% p.a. Calculate interest on capital, Ans., On opening capital (5,00,000) Interest on capital for whole year, i.e, 5,00,000 x 10% =50000 (1), On additional capital from the date of contribution(1-6-2017) to the closing date, (31-3-2018), i.e. 20,000 x 10% x 10/12 =1667 (2), On the amount of capital withdrawn for the period from the date of withdrawal(111-2017) to the closing day (31-3-2018), i.e. 30,000 x 10% x 5/12 = 1250 (3), Net interest on capital = (1) +(2) – (3), i.e, 50,000 + 1667 - 1250 =50417

Page 45 :

Interest on Drawings, It is the amount charged by the firm on, drawings made by partners. No interest is, charged on drawings if there is no, agreement between partners in this regard., However, if the partnership deed so, provides interest is charged at an agreed, rate, for the period the money is, outstanding during the accounting year. It is, an expense to the partner and income to, the firm., Expense to Us

Page 46 :

Interest on Drawings, Calculation of interest on drawings under different situation:Case1: Amount of withdrawal, rate of interest and date, of withdrawal are given, Interest on drawings=amount of drawings x rate x period, st, , Q.Johnson ,a partner withdraws Rs. 16,000 on 1, May 2017.Books of accounts are closed on 31 st, December every year. Calculate interest on drawings, at 6% per annum., Ans., , Interest on drawings=amount of drawings x rate x period, =16,000 x 6% x 8/12, =640

Page 47 :

Interest on Drawings, , Case: 2 Date of withdrawal is not given, amount, and rate of interest is given, If the date of drawings is not given, it may be, assumed that drawings were made evenly throughout, the year. In such a case interest should be calculated, for six months on the whole amount., Interest on drawings=amount of drawings x rate x 6/12, Q.Sachin ,a partner withdraws Rs.8,000 in a year and, interest is chargeable on the drawings at 7% per, annum. Calculate interest on drawings., Ans., Here date of drawings is not given .So interest should be, calculated for six months on the whole amount., Interest on drawings = 8,000 x 7% x 6/12, = 280

Page 48 :

Interest on Drawings, Case:3 Different amounts withdrawn at different intervals, In case date of drawings and the different amounts withdrawn, are clearly stated,the interest on drawings can be calculated, with the help of the product method, Steps in product method:Step-1 Calculate the time period between date of withdrawal, and closing date, Step-2 Multiply the time period so calculated by the respective, amount of drawings. This is called the Product., Step-3 Add up the various products, Step-4 Calculate interest for one month on the sum of, products at the rate of percentage.

Page 49 :

Interest on Drawings-Product Method, Johnson a partner in a firm, withdrew the following amounts, during the year2017., , March-1, , 6000, , June-1, , 4000, , August-1, , 5000, , November-30 2000, , The interest on drawings is to be charged 12% p.a., Assuming accounting year closes on Dec, 31.Calculate interest on drawings chargeable to the, partner?

Page 50 :

Interest on Drawings-Fixed Amount, withdrawn Every Month, If a partner withdraws fixed amount at regular intervals,the, interest on drawings can be calculated on the basis of average, period., Interest on Drawings, = Total Drawings x Rate/100 x Average Period, The calculation of average period depends upon whether the, fixed amount is withdrawn on the first day of each, month,middle of the month or at the end of each month, , Date of Withdrawal, , Average Period, , First day of every month, , 6.5 Months, , Middle of every month, , 6 Months, , End of every month, , 5.5 months

Page 51 :

Interest on Drawings-Fixed Amount, withdrawn Every Month, Q.Manoj,a partner withdraws a sum of Rs.2,000per month, from the firm. Interest on drawings is to be charged @ 8% per, annum. What is the interest that should be charged to partner, if drawings are made:(1) In the beginning of each month, (2) In the middle of each month, (3) In the end of each month, , Ans., Interest on Drawings, = Total Drawings x Rate/100 x Average, Period, , Total drawings = 2000 x 12, =24,000

Page 52 :

Interest on Drawings-Fixed amount withdrawn every Month, , Interest on Drawings, = Total Drawings x Rate/100 x Average, Period, Ans-1-First Day of the month, Interest on Drawings = 24000 x 8/100 x 6.5/12, =1040, Ans-2-Middle of the month, Interest on Drawings = 24000 x 8/100 x 6/12, =960, Ans-3-End of the month, Interest on Drawings = 24000 x 8/100 x 5.5/12, =880

Page 53 :

Interest on Drawings -Fixed Amount withdrawn in, Every Quarter, Date of Withdrawal, , Average Period, , First day of every quarter, , 7.5 Months, , Middle of every quarter, , 6 Months, , End of each quarter, , 4.5 Months

Page 54 :

Journal Entry- interest on Drawings, Interest on drawing is an income for the firm and expense to, each partner, Journal Entry-When interest on drawings, charged among partners, Partner's Capital AC Dr, xxxx, To Interest on Drawings, xxxx, (Interest on drawings charged among partner's capital, account), , Journal Entry-To close interest on drawings, account, Interest on Drawings A/C Dr, xxxx, To Profit and Loss Appropriation A/C, xxxx, (Interest on drawings account closed by transfer it, to P & L Appropriation A/C)

Page 55 :

Guarantee of Profit, to a Partner

Page 56 :

Guarantee of Profit to a Partner, Sometimes,on admission of anew partner,old, partners may give an assurance to the new partner, that,he shall be given a minimum amount of profit, irrespective the actual profit. This guaranteed, profit is to be paid only if-new partner's share of, profit as per the ratio is less than the guaranteed, amount.

Page 57 :

Guarantee of Profit to a Partner, Mohan and Krishnan are partners in a firm. They admit Sunny, as a partner with a guarantee that his share of profits shall not, be less than Rs.20,000.Profit are to be shared in the, proportion of 4:3:3.The total profit for the year 2017 were, Rs.50,000.Prepare P&L Appropriation A/C showing the division, of profit of the year 2017., Here,Guaranteed partner is Sunny, Sunny's guaranteed profit = 20,000., Profit sharing ratio between Mohan,Krishnan and Sunny = 4:3:3, Firm's profit = 50,000, Sunny's actual profit is 50,000 x 3/10 = Rs.15,000, , i.e. Sunny's actual profit(15,000) is less than his guaranteed sum, (20,000). The deficiency amount Rs.5,000 should be given to Sunny, by Mohan and Krishnan in their profit sharing ratio (4:3)

Page 58 :

Guarantee of Profit to a Partner, Profit and Loss appropriation account, , Particulars, , Amount, , Particulars, , Amount, , Mohans Capital, 20,000, Less :Share of deficiency, 2857, , 50,000, , 17,143, , Net Profit, (P & L Account), , Krishnan's Capital, 15,000, Less :Share of deficiency, 2143, , 12,857, , Sunny,s Capital, Add: Deficiency, (2857 + 2143), , 15,000, 5000, , 20,000, , 50,000, , 50,000

Page 60 :

Past Adjustments, In certain cases, after the preparation of final accounts, and partners capital account,it is found that certain items, are to be omitted or wrongly treated. Such errors and, omissions usually relates to interest on capital,interest on, drawings,wrong distribution of profit,interest on partners, loan,salaries to partners etc. All such errors or omission, to be adjusted to correct their impact in the capital, balances of partners. Instead of altering old, accounts,adjustments can be made either:I.Adjusted through prepare Profit and Loss Adjustment, Account, II.Directly adjusted in capital account of partners in, whose account is affected( Table method/Adjusted by, passing a single journal entry)

Page 61 :

Following question and solution give an idea about, past adjustments and P & L Adjustment A/C, st, ●, On march 31 2016,Capital accounts of A,B and C, after making adjustments for profits,drawings etc, were as A-Rs 8,00,000,B- Rs 6,00,000 and C, Rs.4,00,000. Subsequently it was discovered that, interest on capital and drawings had been omitted., The partners were entitled to interest on capital,, @5% per annum. The drawings during the year were, A, Rs.2,00,000,, b, Rs.1,50,000, and, CRs.90,000.Interest on drawings chargeable to the, partners was A-Rs.5,000,B- Rs 3,600 and C, Rs.2000.The net profit during the year amounted to, Rs 12,00,000 The profit sharing ratio was, 3:2:1.Record necessary adjustment entries for, rectifying the above errors and omissions., ●

Page 62 :

Past Adjustments-P & L Adjustment A/C, 1.Profit and Loss Adjustment A/C Method, , Step-1 If the item of omission is interest on capital,first, ascertain the opening capital. This is because interest on, capital is always calculated on opening capital. If capital, given is closing capital,in order to find out opening, capital,following procedures should be adopted:Closing Capital, Add:Drawings, Interest on drawings, (if any), , xxxx, xxxx, xxxx, , Less:Profit already credited xxxx, Opening Capital, xxxx

Page 63 :

In this problem opening capital is not given. So we want to, calculate opening capital to find out interest on capital., Step-1 Calculate opening Capital, Particulars, Closing Capital, Add: Drawings, Less:Profit already credited, Opening Capital, , A, 800000, 200000, 1000000, 600000, 400000, , B, C, 600000, 400000, 150000, 90000, 750000, 490000, 400000, 200000, 350000, 290000, , Interest on capital of A , 4,00,000 x 5% =20000, Interest on capital of B, 3,50,000 x 5% =17500, Interest on capital of C, 2,90,000 x 5% =14,500

Page 64 :

Past Adjustments-P & L Adjustment A/C, , Step-2 Works out the amount of omitted items which are to be, credited to partner's capital account such interest on, capital,partners salary,commission, etc. In this problem only, interest on capital(credit side items) is omitted Pass the following, journal entry to rectify the omission of interest on capital:Profit and Loss Adjustment A/C Dr, To A's Capital A/C, To B's Capital A/C, To C's Capital A/C, , 52000, , (Rectification entry to adjust interest on, capital), , 20000, 17500, 14500

Page 65 :

Past Adjustments-P & L Adjustment A/C, Step-3 Works out the amount of omitted items which are, to be debited to partner's capital account such interest on, drawings. Pass the following journal entry for the same:, A's Capital, A/C the, Dr amount, 5000, Step-2, Works out, of omitted items which are to be, B's Capiyal, A/C Dr, 3600 such interest on drawings. Pass, debited, to partner's, capital account, Capitaljournal, A/C Drentry for2000, the C's, following, the same:, To Profit and Loss Adjustment A/C, 10600, (Rectification entry to adjust interest on drawings)

Page 66 :

Past Adjustments-P & L Adjustment A/C, Step-4 Find out the balance of Profit and Loss Adjustment A/C .The, credit balance in the Profit and Loss Adjustment A/C reflects profit, and debit balance reflect loss. This is to be distributes among, partners in their profit sharing ratio:, (a)If it is a credit balance (profit), Profit and Loss Adjustment A/C Dr, xxxx, To, Partner's Capital A/C (Individually), xxxx, (Transfer of credit balance of P & L Adjustment A/C), , (b)If it is a debit balance (Loss), Partner's Capital A/C Dr (Individually), xxxx, To,Profit and Loss Adjustment A/C, xxxx, (Transfer of debit balance of P & L Adjustment A/C)

Page 67 :

Past Adjustments-P & L Adjustment A/C, Step-4 Find out the balance of Profit and Loss Adjustment A/C .The, credit balance in the Profit and Loss Adjustment A/C reflects profit, and debit balance reflect loss. In this problem debit balance is, higher. This is to be distributes among partners in their profit, sharing ratio:, (a) Loss distributed:, A's Capital A/C Dr, 5000, B's Capiyal A/C Dr, 3600, C's Capital A/C Dr, 2000, To Profit and Loss Adjustment A/C, 10600, (Rectification entry to adjust interest on drawings)

Page 68 :

Profit and Loss adjustment A/C, Particulars, , Amount, , To A's Capital, To b's Capital, To C's Capital, , Particulars, , Particulars, , Amount, , 20000By A's capital, 17500By B's Capital, 14500By C's Capital, By A's capital, By B's Capital, By C's Capital, , 5000, 3600, 2000, 20700, 13800, 6900, , 52000, , 52000, , Partners Capital Account, A, , To P&L, Adjustment A/C, 5000, To P&L Adjustment, A/C, 20700, To Balance c/d (b/f) 794300, , 820000, , B, , 3600, , C, , Particulars, , A, , B, , 800000, , 600000 400000, , 2000, , By Balance b/d, By P&L, Adjustment A/C, , 20000, , 17500, , 820000, , 617500 414500, , 13800, 600100, , 6900, 405600, , 617500, , 414500, , C, , 14500

Page 69 :

Past Adjustment, 2. Directly adjusted in capital account of partners/ Corrected, through passing a single journal entry, Due to omission or wrong treatment the capital accounts of, partners reflect wrong balances. Some partners capital, account over credited(gaining partners) and some partners, capital accounts under credited(sacrificing partners).In this, method we need to prepare only a statement to find out the, net effect of omissions or commissions. Then debit the capital, account of the partner whose account is over credited(gaining, partner) and credit the capital account of the partner whose, capital account is under credited(sacrificing partner).The, adjustment journal entry is as follows:Gaining Partner's Capital A/C Dr, xxxx, To, Sacrificing Partner's Capital A/C, xxxx, (Adjustment journal entry to rectify omissions and errors)

Page 70 :

PAST ADJUSTMENTS, Statement Showing Net Adjustment, , Particulars, , Name of the Partners(On, partners point of view), , Total ( On, firms point of, view), , X, , Y, , Z, , Interest on capital to be credited, , Cr, , Cr, , Cr, , Dr, , Interest on drawings to be debited, , Dr, , Dr, , Dr, , Cr, , Salary to be Credited, , Cr, , Cr, , Cr, , Dr, , Calculate Net effect of the total, column, , Amount(Net effect) in the total, column distributed among partners, in their ratio, [if net effect column shows debit, balance here also debit], , Net effect of the partners column, , (Dr/Cr), Dr/Cr(dep, ends on, net effect, column), , Dr/Cr, , Dr/Cr, , -, , Dr/Cr, , Dr/Cr, , Dr/Cr, , -

Page 71 :

Past adjustment -Table Method, , Q.On march 31st 2016,Capital accounts of A,B and C, after making adjustments for profits,drawings etc, were as A-Rs 8,00,000,B- Rs 6,00,000 and C, Rs.4,00,000. Subsequently it was discovered that, interest on capital and drawings had been omitted., The partners were entitled to interest on capital,, @5% per annum. The drawings during the year were, A Rs.2,00,000, b Rs.1,50,000 and C, Rs.90,000.Interest on drawings chargeable to the, partners was A -Rs.5,000,B Rs 3,600 and C, Rs.2000.The net profit during the year amounted to, Rs 12,00,000 The profit sharing ratio was, 3:2:1.Record necessary adjustment entry for, rectifying the above errors and omissions.

Page 72 :

Past Adjustment-Table Method, , Particulars, , Interest on capital to be credited, , Name of the Partners(On partners, Total ( On, point of view), firms point of, view), A, B, C, , 20000, (Cr), 5000, (Dr), , 17500, (Cr), 3600, (Dr), , 14500, (Cr), 2000, (Dr), , 52000, (Dr), 10600, (Cr), 41400, (Dr), , Amount(Net effect) in the total column, distributed among partners in their, ratio 3:2:1, , 20700, (Dr), , 13800, (Dr), , 6900, (Dr), , -, , Net effect of the partners column, , 5700, (Dr), , 100, (Cr), , 5600, (Cr), , -, , Interest on drawings to be debited, , Calculate Net effect of the total column, , A's Capital A/C Dr, 5700, To, B's Capital A/C, 100, To, C's Capital A/C, 5600, (Adjustment entry to rectify omission)

Page 73 :

Here the rectification journal entry is, , A's Capital A/C Dr, 5700, To, B's Capital A/C, 100, To, C's Capital A/C, 5600, (Adjustment entry to rectify omissions), Effect of the above journal entry is, A's Capital before rectification is 8,00,000.This balance is, incorrect. Preparation of table revealed that to get correct figure A's, capital account should be debited by Rs.5700.B's capital was Rs, 6,00,000. To correct B's capital it should be credited by Rs.100.C's, capital was Rs.4,00,000.To correct C's capital it should be credited, by Rs.5600., Capital Account Balance Before, Correction, , Correction, Required(Dr/Cr), , Capital Balance After, correction, , A-8,00,000(Credit), , 5700(Dr), , 7,94,300(Cr), , B-6,00,000(Credit), , 100(Cr), , 6,00,100(Cr), , C-4,00,000(Credit), , 5600(Cr), , 4,05,600(Cr)

Page 74 :

Q.Anil,Binil and Sunil are partners in a firm sharing profit and, losses in the ratio of 5:3:2.Their fixed capitals were, Rs.3,00,000, Rs.2,00,000 and Rs.1,00,000 respectively. For, the year 2017 interest on capital was credited to them @ 10%, per annum instead of 6% per annum, , Particulars, , Name of the Partners(On, partners point of view), Anil, Binil, Sunil, , Interest on capital over credited 12,000, 4% to be debited, (Cr), Calculate Net effect of the total, column, Amount(Net effect) in the total, 12,000, column distributed among, (Dr), partners in their ratio 5:3:2, (24,000), Net effect of the partners, column, , 0, , 8,000, (Cr), , 4,000, (Cr), , 7,200, (Dr), , 4,800, (Dr), , 800, (Cr), , 800, (Dr), , Total ( On, firms point, of view), , 24,000, (Dr), 24,000, (Dr), -, , -

Page 75 :

Journal Entry, , Sunil's Capital A/C Dr, To Binil's Capial A/C, , 800, 800, , (Adjustment journal entry to rectify the error)

Page 76 :

X,Y and Z are partners share profits in the ratio of 3:2:1.The, profit of the last three years were Rs.1,40,000,RS.84,000 and, Rs.1,06,000 respectively. These profits were by mistake shared, equally for all the three years. It is now decided to correct the, error. Give necessary journal entry for the same., , Particulars, , Profit wrongly credited to be debited (To, cancel the mistake)3,30,000 (1:1:1), , Name of the Partners(On partners point Total ( On firms, of view), point of view), X, , Y, , Z, , 1,10,000, (Dr), , 1,10,000, (Dr), , 1,10,000, (Dr), , Calculate Net effect of the total column, , Amount(Net effect) in the total column, distributed among partners in their ratio, 3,30,000 (3:2:1), , Net effect of the partners column, , 3,30,000, (Cr), 3,30,000, (Cr), , 1,65,000, (Cr), , 1,10,000, (Cr), , 55,000, (Cr), , -, , 55,000, (Cr), , 0, , 55,000, (Dr), , -

Page 77 :

Journal Entry, , Z's Capital A/C Dr, To X's Capial A/C, , 55,000, 55,000, , (Adjustment journal entry to rectify the error)