Page 1 :

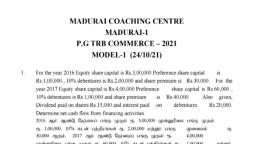

Analysis of Financial Statements ¢, , , , , , , , , , , , , , , , , , , , , y, ; | 8,10,000, V. Profit before tax 730000 1" ort i, 4,11,500 a %, VI. Income tax 6,12, 500 ease rf, iy!, 3,98,500 = 35.03%, VII. Profit after tax 11,37,500 alle ws E, Note (2): Calculation of income tax, , 35 = Rs. 6,12,500, (i) 2013-14: Income tax @ 35% on profit of Rs. 17,50,000 m7 x17,50,000, , : 40 = Rs. 10,24,000, (ii) 2014-15: Income tax @ 40% on profit of Rs. 25,60,000 = Sr rcladae apse a, , ‘ ; centage change and in calculation of i, Note to students: Follow the above procedure, in calculating percentage change an : ncome tax,, , in other questions., , Practical Oriented Questions, , 26. *Prepare comparative statement of profit and loss with 5 imaginary figures. 5 Marks, , Ans: XYZ Co. Ltd., st, Comparative Statement of Profit and Loss for the year ended 31" March 2017 and 2018, | 2017-18 | Increase (+) or, , , , , , , , , , , , , , , , , , , , , , 2016-17 (+) or (-), , Rs., , , , , , , , , Decrease (—), Rs., , Particulars Rs., , , , , , I. Revenue from operations | 10,00,000, II. Other incomes. [ 2,00,000, III. Total Revenue (I + Il) 12,00,000, IV. Less: Expenses af 9,00,000, V. Profit before tax (II— IV) | 3,00,000, VI. Less: Income tax @ 30% | 90,000 _1,35,000, , , , , , , , , , , 13,50,000, , , , , , , , , , , , t, VII. Profit after tax i 2,10,000 | 3,15,000, OR, Another alternative answer, ; ABC Ltd., , , , , , , Revenue from operations | 10,00,000 | 15,00,000 5,00,000, ——— lee ee, i Profi befrewx | 4.0n000 | 600000 2.00000) S|, W mserereare | nan) sown] en] —, , V._Proi air x LV) 420,000 140,000 st, , Student’s illuminator I PU Acco