Page 1 :

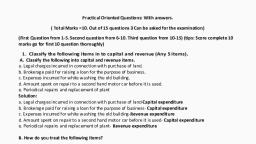

4i9, , Tons, PA plic a, ath, Denl)\, , gtions OP preparation of Comparative Statement of Profit and Loss fit and loss of, wt the following stateme ; id statement of pro ita, , of ap a g nt of profit and loss into the comparative § (NCERT cp) 182 cil 1}, pe j, , | Note | 2013-14 | 2014-15, , | No. | Rs. Rs., | 60,00,000 | 75,00,000 |, 1,50,000 | 1,20,000 |, 44,00,000 | 50,60,000 |, , 35% 40% |, , | Particulars, , | (i) Revenue from operations |, (ii) Other incomes, (iii) Expenses, , (iv) Income tax, , , , BCR Co. LTD, , - Comparative statement of profit and loss for the year ended March 31, 2014 and 2015:, , |, , Percentage, , , , , , , , , 2013-14 | 2014-15 Increase (+) |, , , , , , , , , , , , , , , , ticul Absolute Increase (+), ‘ ars é debi, es s (1 year | (2"™ year) or Decrease (—) or Decrease (—), (, (2) (3) (3)-(2)=4 100 |, (, ee oe. ah Rs. Rs. Rs. |, , , , , , “ele, "1. Revenue from operations | 60,00,000 | 75,00,000, , , , , , , , , , ‘yL Add: Other Incomes 1,50,000 | 1,20,000 (30,000), | [II Total Revenue I +1 61,50,000 | 76,20,000 14,70,000, | tv. Less: Expenses 44,00,000 | 50,60,000 6,60,000, | y. Profit before tax (I-IV) | 17,50,000 | 25,60,000 8,10,000, , , , , , , , , , , VI. Less: Income Tax |_6,12,500 10,24,000, | VII. Profit after tax (V-VI) 11,37,500 | 15,36,000, , Note: ( Percentage change is calculated by using the following formula:, , 4,11,500, 3,98,500, , , , , , , , , , | Absolute Increase OF Decrease, , a x100, Amount of 2013-14 (i.e., 1* year), , Accordingly, —, , ercentage increase or (decrease) in:, , , , , , _ 15,00,000 . ,, ~ 60,00,000, , (30,000), i -=—— —— x 100 =e, Il. Other incomes 1,50, 000 * (-) 20%, 14,70,000, a St 100 PS, 61,50,000 27, 6,60,000, =—_——x100 | =, AE B0.00D, , , , , , I. Revenue from operations, , , , , , Ill. Total revenue, , , , , , , , IV. Expenses, , , , Pnt's illuminator, , , , Il PU Accoun