Page 1 :

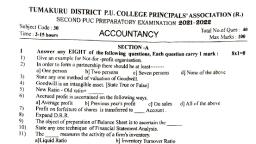

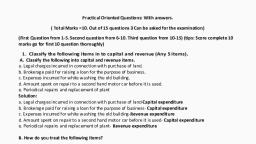

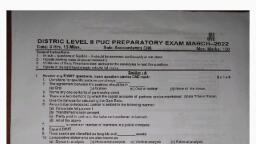

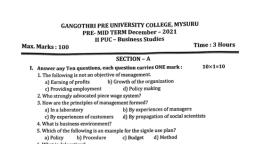

www.inyatrust.com, , 30, , -14-, , (NS), , -14-, , illlllillilllllllil ill, , (English Version), , lnstructions, , : 1., 2., 3., 4., , All the sub questions of Section, continuously at one place., , -, , A should be answered, , Provide working notes wherever necessary., , 15, , minutes exfra has been attotted, the questions., Figures, , in, , the, , right, , hand, , SECTION, , for, , 4), 5), 6), 7), 8), 9), 10), , to, , read, , margin indicate full marks., , -A, , Answer any eight questions. Each question carries 1 mark, , 1), 2), 3), , candidates, , :, , (8 x 1 = 8), , Donations for specific purposes are always capitalized. State True/False., , The liability of a partner for acts of the firm is, A, B and C are partners in a firm. lf 'D' is admitted as a new partner, a) old firm is dissolved, b) old firm and old partnership is dissolved, c) old partnership is re-constituted, d) None of the above, X, Y and Z are partners sharing profits in the ratio of 5 : 3 : 2. lf 'Z' retires,, the new profit sharing ratio between X and Y will be -, , -., , When can shares be forfeited?, Can the company purchase its own debentures in open market., , Give an example for current asset., , The most commonly used tools for financial analysis are, a) Horizontal analysis b) Vertical analysis, c) Ratio analysis d) All the above, Expand EPS., , What is cash flow statement?, , Use E-Papers, Save Trees, Above line hide when print out-InyaTrust.com, , :

Page 2 :

www.inyatrust.com, , _1F._, , tiilil lIIilffiil, , 30 (NS), , lil ltt, , SECTION.- B, , AnSWeranyfiVeqUeStionS.Eachquestioncarries2marks, , I,, , 11), 12), , |, st, , l,, , State the two methods by which the capital accounts of partners are, maintained, tqil tlcalt tg\l ., II, , ,, , I, , Write any two features of receipts and payments account., , ,Ul, , M), 15), 16), 17), 18), , What are the two main rights acquired by a newly admitted partner in the, PartnershiP firm?, , for the pavment of unrecorded liabilities on the, , HJ$ Jffirj:l'J;l,r".ntry, Name any two categories of share capital., Mention two types of financial statements., Name'any two users of financial statement analysis., Mention any two cash ftow activities classified as per AS-3., , SECTION. C, Answer any four questions. Each question carries 6 marks, , 19), , :, , (4 x 6 = 241, , Radha and Raman are partners in a firm. Radha's drawings for the year, 2018-19 are given as under:, , < 5,000 on 01 .04.2018, , t, , 3,000 on 01 .12.2018, , < 2,000 on 31.03.2019, Calculate interest on Radha's drawings at 10% p.a. for the year ending, 31.03.2019 under product method., , 20), , Rashi, Raksha and Rahul are partners sharing profits in the ratio of, 4 : 3 : 2. Rashi retires. Raksha and Rahul decided to share profits in, future in the ratio of 5 : 3. Calculate the gaining ratio of Raksha and, Rahul., , Use E-Papers, Save Trees, Above line hide when print out-InyaTrust.com

Page 3 :

www.inyatrust.com, , 3e!, , (r{s}, , -1, , 6-, , ililllr$ffififf[ril$it, , 21) Arun, Varun and Tarun are partners sharing profits and losses, Their Balance sheet as on 31.03.2019 was as follows, , ., , Balance sheet as on 31.03.2019, , ', , Cieditors, 19,000 Fixed assets, General reserve, 6,000 Stock, Capitals :, Debtors, Arun, 25,000, Cash in hand, Varun, 25,000, Tarr;n, 25,000 75,000, 1,00,000, , 53,000, 18,000, 15,000, 14,000, , 1,00,000, , Arun died on 01.08.2019. His executors claims the foilowing., , a), h), c), d), e), , Capital, , Share of General reserve, Share of commission. Annuat commission, , $hare of Goodwill. Goodwill of the firm, , r, , t 7,200, , 18,000, , Share of profit upto the date of death-his share, , r 12,000, , Prepare Arun's Capital Account., , ?-:;j, , }-iindusthan co., Ltd., issued 20,000, 10% debentures, payab,ie as follows, , of, , r10, , :, , t 2 on application, t 4 cn atlotment, r 4 on first ancl final call., Ail ihe debentures were subscribed and the money duly received., Fass the necessary iournal entries in the books of the company., , Use E-Papers, Save Trees, Above line hide when print out-InyaTrust.com, , equally.

Page 4 :

www.inyatrust.com, , -tt-, , 3m, , {r'{Si, tifiil;llil llll II;tfit, 23) From the following information, prepare statement of profit and ir:ss fcr, the year ended 31.03.2019 as per schedule - lll of the Companies, , Act, 2013., , Padiculars, Revenue from operations, , r, 8,00,000, 50,000, , Other lncome, , consumed, , 2,00,000, , Employeebenefitexpenses, , 1,00,000, , Cost of materials, , Depreciation and, , Amortization, , Tax, 24), , 30%, , Calculate Current ratio and Quick ratio from the following lnformaiion, , Particulars, lnventories, Trade receivables, Advance tax, Cash and Cash equivalents, Trade payables, Short term borrowings (bank, , 25), , 50,000, , :, , {, 50,000, 50,000, 4,000, 30,000, 1,00,000, , overdraft), , 4,000, , From the following information, calculate the cash flows frr:m final":cing, activities., , Particulars 31.03.2018 31.03.2019, Share capital 10,00,000 15,00,000, , Debentures, Bank, , 2,00,000, , Loan, , 1,00,000, , a), , Dividend proposed and paid during the year, , b), , Dividend tax paid, , { 15,000, , Use E-Papers, Save Trees, Above line hide when print out-InyaTrust.com, , { 1,50,000

Page 5 :

: www.inyatrust.com, --, , 30 (NS), , -1, , 8-, , filllilIlil, , SECTION, , -, , D, , Answer any four questions. Each question carries 12 marks, , 26), , ilfi Itil ilt, , :, , (4 x 12 = 48), , From the following Balance Sheet and Receipt and Payment account of, Unity Club, Prepare lncome and Expenditure account for the year ended, 31.03.2Q19 and the Balance sheet as on that date., Balance Sheet as on 31.03.2018, Liabilities, Assets, , 100 Cash in hand, 27,600 Building, , Outstanding Rent, Capital fund, , ', , Outstanding subscription, , t, 2,200, 20,000, 500, , Furniture, , 3,000, , Books, , 2,000, , 27,700, , 27,700, , Receipt and payment a/c for the year ended 31.03.2019, Dr., , Cr., , Receipts, , To Balance b/d, , 2,200 By Rent, , To Subscriptions, , 32,500 By Lecturer's fee, 3,250 By Printing and Stationery, , 2,500, , To Donation, , 2,500 By Books (31.03.2019), , 8,400, , To Prof:it from entertainment, , 7,250 By Furniture (01 .10.2018), , 9,900, , To lnterest, , 1, , Additional lnformation, , a), b), c), d), e), , t, , 3,900, , To Life Membership fee, , ,100 By Balance c/d, , 48,800, , I, , 6,600, , 48,900, , :, , Subscription outstanding on, , 31, , .03.2019 < 750, , Rent outstanding on 31.03.2019 < 5OO, Donation to be capitalized., Depreciate furniture at, , 10o/o, , 17,500, , p.a. (including purchase), , Depreciate books at 10% p.a., , Use E-Papers, Save Trees, Above line hide when print out-InyaTrust.com

Page 6 :

www.inyatrust.com, , -1, , 30 (NS), , 9-, , iltllt ilfil IIIi I l;I III, , 27), i, I, , Sheetal and Sharath were partners in a firm sharing profits in the, proportions of 3/4th and 1/4th. Their Balance sheet on 31 .03.2019 was as, follows, , :, , I, , Balance Sheet of Sheetal and Sharath as on 31.03.2019, , I, , Assets, r, Liabilities r, Creditors 46,000 Cash at bank 30,000, Reserve fund 4,000 Bills receivables 4,000, Capital a/c's, , Sheetal, Sharath, , Debtors, , :, , 30,000 Stock, 16,000 Furniture, , 16,000, , 20,000, 1,000, , Land and Building 25,000, 96,000, , 96,000, , On 01.04.2019 Renu was admitted into partnership on the, terms, , a), , following, , :, , Renu pays < 15,000 as her capital for 1/5th share and, , t, , 8,000 for, , goodwill., , b), , Half of the goodwill is to be withdrawn by Sheetal and Sharath', , c), , Stock be reduced by 10%, , d), , 5% provision for doubtful debts be created on sundry, , e), , Land and Building be appreciat ed by 20%, , 0, , An item of < 1,800 included in creditors is not likely to be claimed, and hence should be written back., Prepare, , :, , i), , Revaluation a/c, , ii), , Partners caPital accounts, , iii), , Balance Sheet of the new firm., , Use E-Papers, Save Trees, Above line hide when print out-InyaTrust.com, , debtorsr, , i

Page 7 :

www.inyatrust.com, , =, , 30 (NS), , 28), , -20-, , lillfi illiiltfi ilirllr, , Anup and Sumit are equal partners in a firm. They decided to dissolve the, partnership on 31.03.2019; when their Balance sheet was as under :, Balance Sheet of Anup and Sumit as on 31.03.201g, , Assets, 30,000 Cash at bank, 40,000 Sundry debtors, 10,000 Machinery, t, , Liabilities, Creditors, Loan, Reserve, Capitals :, , fund, , r, 14,000, 12,OOO, , 47,000, Stock, 42,000, Land and Building 60,000, 1,20,000, 25,000, 2,00,000, 2,00,000, , Anup 60,000, Sumit 60,000, , Furniture, , The Assets were realised as follows, , :, , Building < 72,OOO, Furniture < 22,SOO, Land and, , Stock, Machinery, Sundry, , debtors, , The creditors were paid, realisation amounted to, Prepare:, , a), b), c), , t, , < 40,500, , { 48,000, < 10,500, , 25,500, , t 2,500, , in full settlement. Expenses, , of, , Realisation account., Partners capital accounts, Bank account., , 29) Arushi Computers Ltd., issued 10,000 equity shares of < 100 each, at a, premium of, , t, , 10 per share, payable as follows, , On application, On allotment, , r, , :, , t 30, 50 (including premium), , On first and final call < 30, , All the shares were subscribed and the money duly received except the, first and final call on 500 shares. The Directors forfelted these shares and, re-issued them as fully paid at { B0 per share., Pass the necessary journal entries in the books of the company., , Use E-Papers, Save Trees, Above line hide when print out-InyaTrust.com

Page 8 :

www.inyatrust.com, , fiilIl rfiil lllil, , 30), , -21tfi, , 30 (NS), , llt, , Give the journal entries for issue of debentures for the following cases in, the books of Alpha Company Ltd.,, , a), , 10,000, 12% Debentures of <100 each issued at par but redeemable, at premium of 5%, , b), , 10,000, 12% debentures of E100 each issued at a discount of 10%, but redeemable at par., , c), , 10,000, 12% debentures of t100 each issued at a premium of 5%, but redeemable at par., , d), , 10,000, 12% debentures, , of, , <1OO each issued, , at par, and, , redeemable at par., , 31), , From the following information, prepare comparative Balance sheet of, Particulars, , 31.3.2018 31.3.2019, , t{, l. Equity and Liabilities, , :, , Equity share capital, , 5,00,000, , 8,00,000, , Reserves and Surplus, , 1,50,000, , 2,50,000, , Long term borrowings, , 2,00,000, , 1,50,000, , Trade payables, , 1,00,000, , 2,00,000, , 50,000, , 1,00,000, , Other current Liabilities, , 10,00,000 15,00,000, , Total, ll. Assets, Fixed assets, , 3,00,000, , 5,00,000, , Non-current investments, , 1,50,000, , 2,00,000, , lnventories, , 2,50,000, , 3,50,000, , Trade receivables, , 2,00,000, , 2,50,000, , Cash at bank, , 1,00,000, , 2,oo;ooo, , 10,00,000 15,00,000, , Total, , Use E-Papers, Save Trees, Above line hide when print out-InyaTrust.com

Page 9 :

www.inyatrust.com, F-, , -zz-, , 30 (NS), , 32), , tiilfirfiillfi ilirfir, , From the following particulars, calculate, , a), b), c), d), e), 0, , Net assets turnover ratio, , Fixed assets turnover ratio, Working capital turnover ratio, Gross profit ratio, Net profit ratip, Operating ratio, , assets, Current assets, Current liabilities, Revenue from operations, Fixed, , Cost of revenue from, , 16,00,000, , 4,00,000, 2,00,000, 20,00,000, , operations, , profit, Operating expenses, , 4,00,000, , Net, , SECTION, , -, , 8,00,000, 1,00,000, , E, , (Practical Oriented Questions), Answer any two questions. Each question carries 5 marks, , 33), , (2 x 5 = 10), , Classify the following into capital and revenue items., , a), b), c), d), e), 34), , :, , Legacies, Purchase of computer, Subscription, Honorarium, Purchase of stationery., , Prepare Executors loan account with imaginary figures showing the, repayment in two annual equal instalments along with interest., , 35), , Write the proforma of cash flows from operating activities under direct, method., , Use E-Papers, Save Trees, Above line hide when print out-InyaTrust.com