Page 1 :

Accounting for Not-for-Profit Organisation, LEARNING OBJECTIVES, After studying this chapter,, you will be able to;, • Identiy the need for, and, nature of accounting records, relating to not-for-profit, organisations;, • List the principal financial, statements prepared by notfor-profit organisations;, • Prepare the Receipt, and, Payment Account and Income, and Expenditure Account;, • Prepare Income and, Expenditure Account and, Balance Sheet from a given, Receipt and Payment, Account;, • Explain treatment of certain, peculiar items of Receipts, and Payments such as, subscriptions from members,, special funds, legacies, sale, of old fixed assets, etc., , 1, , T, , here are certain organisations which are set up, for providing service to its members and the, public in general. Such organisations include clubs,, charitable institutions, schools, religious, organisations, trade unions, welfare societies and, societies for the promotion of art and culture. These, organisations have service as the main objective and, not the profit as is the case of organisations in, business. Normally, these organisations do not, undertake any business activity, and are managed, by trustees who are fully accountable to their, members and the society for the utilization of the, funds raised for meeting the objectives of the, organisation. Hence, they also have to maintain, proper accounts and prepare the financial statement, which take the form of Receipt and Payment, Account; Income and Expenditure Account; and, Balance Sheet. at the end of for every accounting, period (normally a financial year)., This is also a legal requirement and helps them, to keep track of their income and expenditure, the, nature of which is different from those of the business, organisations. In this chapter we shall learn about, the accounting aspects relating to not-for-profit, organisation., 1.1 Meaning and Characteristics of Not-for-Profit, Organisation, Not-for -Profit Organisations r efer to the, organisations that are for used for the welfare of the, society and are set up as charitable institutions, , 2018-19

Page 2 :

2, , Accountancy – Not-for-Profit Organisation and Partnership Accounts, , which function without any profit motive. Their main aim is to provide service to a, specific group or the public at large. Normally, they do not manufacture, purchase or, sell goods and may not have credit transactions. Hence they need not maintain, many books of account (as the trading concerns do) and Trading and Profit and Loss, Account. The funds raised by such organisations are credited to capital fund or, general fund. The major sources of their income usually are subscriptions from their, members donations, grants-in-aid, income from investments, etc. The main objective, of keeping records in such organisations is to meet the statutory requirement and, help them in exercising control over utilisation of their funds. They also have to prepare, the financial statements at the end of each accounting period (usually a financial, year) and ascertain their income and expenditure and the financial position, and, submit them to the statutory authority called Registrar of Societies., The main characteristics of such organisations are:, 1. Such organisations are formed for providing service to a specific group or, public at large such as education, health care, recreation, sports and so on, without any consideration of caste, creed and colour. Its sole aim is to provide, service either free of cost or at nominal cost, and not to earn profit., 2. These are organised as charitable trusts/societies and subscribers to, such organisation are called members., 3. Their affairs are usually managed by a managing/executive committee, elected by its members., 4. The main sources of income of such organisations are: (i) subscriptions, from members, (ii) donations, (iii) legacies, (iv) grant-in-aid, (v) income, from investments, etc., 5. The funds raised by such organisations through various sources are, credited to capital fund or general fund., 6. The surplus generated in the form of excess of income over expenditure, is not distributed amongst the members. It is simply added in the, capital fund., 7. The Not-for-Profit Organisations earn their reputation on the basis of, their contributions to the welfare of the society rather than on the, customers’ or owners’ satisfaction., 8. The accounting information provided by such organisations is meant for, the present and potential contributors and to meet the statutory requirement., 1.2 Accounting Records of Not-for-Profit Organisations, As stated earlier, normally such organisations are not engaged in any trading, or business activities. The main sources of their income are subscriptions from, members, donations, financial assistance from government and income from, investments. Most of their transactions are in cash or through the bank. These, , 2018-19

Page 3 :

Accounting for Not-for-Profit Organisation, , 3, , institutions are required by law to keep proper accounting records and keep, proper control over the utilization of their funds. This is why they usually keep, a cash book in which all receipts and payments are duly recorded. They also, maintain a ledger containing the accounts of all incomes, expenses, assets, and liabilities which facilitates the preparation of financial statements at the, end of the accounting period. In addition, they are required to maintain a stock, register to keep complete record of all fixed assets and the consumables., They do not maintain any capital account. Instead they maintain capital, fund which is also called general fund that goes on accumulating due to, surpluses generated, life membership fee, donation, legacies, etc. received, from year to year. In fact, a proper system of accounting is desirable to avoid, or minimise the chances of misappropriations or embezzlement of the funds, contributed by the members and other donors., Final Accounts or Financial Statements: The Not-for-Profit Organisations are also, required to prepare financial statements at the end of the each accounting period., Although these organisations are non-profit making entities and they are not required, to make Trading and Profit & Loss Account but it is necessary to know whether the, income during the year was sufficient to meet the expenses or not. Not only that, they have to provide the necessary financial information to members, donors, and, contributors and also to the Registrar of Societies. For this purpose, they have to, prepare their final accounts at the end of the accounting period and the general, principles of accounting are fully applicable in their preparation as stated earlier,, the final accounts of a ‘not-for-profit organisation’ consist of the following:, (i) Receipt and Payment Account, (ii) Income and Expenditure Account, and, (iii) Balance Sheet., The Receipt and Payment Account is the summary of cash and bank, transactions which helps in the preparation of Income and Expenditure Account, and the Balance Sheet. Besides, it is a legal requirement as the Receipts and, Payments Account has also to be submitted to the Registrar of Societies along, with the Income and Expenditure Account, and the Balance Sheet., Income and Expenditure Account is akin to Profit and Loss Account. The, Not-for-Profit Organisations usually prepare the Income and Expenditure, Account and a Balance Sheet with the help of Receipt and Payment Account., However, this does not imply that they do not make a trial balance. In order to, check the accuracy of the ledger accounts, they also prepare a trial balance, which facilitates the preparation of accurate Receipt and Payment Account as, well as the Income and Expenditure Account and the Balance Sheet., In fact, if an organisation has followed the double entry system they must, prepare a trial balance for checking the accuracy of the ledger accounts and it, will also facilitate the preparation of Receipt and Payment account. Income, and Expenditure Account and the Balance Sheet., , 2018-19

Page 4 :

4, , Accountancy – Not-for-Profit Organisation and Partnership Accounts, , 1.3 Receipt and Payment Account, It is prepared at the end of the accounting year on the basis of cash receipts and, cash payments recorded in the cash book. It is a summary of cash and bank, transactions under various heads. For example, subscriptions received from the, members on different dates which appear on the debit side of the cash book, shall, be shown on the receipts side of the Receipt and Payment Account as one item, with its total amount. Similarly, salary, rent, electricity charges paid from time to, time as recorded on the credit side of the cash book but the total salary paid, total, rent paid, total electricity charges paid during the year appear on the payment, side of the Receipt and Payment Account. Thus, Receipt and Payment Account, gives summarised picture of various receipts and payments, irrespective of whether, they pertain to the current period, previous period or succeeding period or whether, they are of capital or revenue nature. It may be noted that this account does not, show any non cash item like depreciation. The opening balance in Receipt and, Payment Account represents cash in hand/cash at bank which is shown on its, receipts side and the closing balance of this account represents cash in hand and, bank balance as at the end of the year, which appear on the credit side of the, Receipt and Payment Account. However, if it is bank overdraft at the end it shall, be shown on its debit side as the last item. Let us look at the cash book of Golden, Cricket Club given in the example to show how the total amount of each item of, receipt and payment has been worked out., Example 1, Golden Cricket Club, Cash Book (Columnar), , Dr., Date, , Receipts, , 2014, April 1 Balance b/d, April 10 Subscriptions, April 10 Entrance fees, May 20 Life membership, fees, June 12 Locker rent, July 23 Life membership, fees, Aug. 20 Donation for, building, Sept. 13 Subscriptions, (2013-14), Sept. 13 Subscription, , L.F., , Bank, Office Date, Amount Amount, (Rs.), (Rs.) 2014, , Payments, , 2014, 35,000 20,000 April 15 Insurance premium, 1,20,000, May 12 Printing and, stationery, 13,000, May 20 Postage and, 12,000, courier fees, June 16 Telephone, 42,000, expenses, 8,000, July 10 Wages and salaries, July 15 Rates and Taxes, 60,000, July 30 Govt. securities, Aug. 13 Printing and, 30,000, stationery, Aug. 15 Postage and, 45,000, courier service, Sept. 10 Lighting, , 2018-19, , Cr., L.F., , Bank, Office, Amount Amount, (Rs.), (Rs.), 15,000, 10,750, 430, 810, 22,000, 17,000, 1,00,000, 15,000, 480, 12,250

Page 5 :

Accounting for Not-for-Profit Organisation, Sept. 14 Entrance fees, Nov. 9 Subscription, , 10,000, 35,000, , Nov. 9, , Subscription, (2015-16), , 10,000, , Subscription, , 25,000, , Interest on, government, securities, , 18,000, , 2015, Feb. 07, Mar. 28, , 5, Sept 13 Telephone expenses, Oct. 1 Wages and salaries, Oct. 18 Printing and, stationery, Oct. 31 Govt. securities, Dec. 31 Wages and Salaries, 2015, Jan. 21 Courier charges, Feb. 2 Telephone, expenses, Mar. 10 Postage and, Courier fees, Mar. 27 Lighting, Mar. 27 Wages and Salaries, Mar. 31 Balance c/d, , 4,21,000 62,000, , Item wise Aggregation of various Receipts, Subscriptions (2014–2015), April 10, 2014, Sept. 13, 2014, Nov. 9, 2014, Feb. 7, 2015, Total, , Amount (Rs.), 1,20,000, 45,000, 35,000, 25,000, 2,25,000, , Subscriptions (2013–14), Date, , Amount (Rs.), , Sept. 13, 2014, , 30,000, , Total, , 30,000, , Subscription (2015–16), Date, , Amount (Rs), , Nov. 9, 2014, , 10,000, , Total, , 10,000, , Entrance Fees, Date, , 1,00,000, 22,000, 240, 960, 850, 14,000, 22,000, 70,000 23,400, 4,21,000 62,000, , Part A, , Date, , 830, 10,000 12,000, 13,000, , Amount (Rs), , April 10, 2014, Sept.14, 2014, , 13,000, 10,000, , Total, , 23,000, , 2018-19

Page 6 :

6, , Accountancy – Not-for-Profit Organisation and Partnership Accounts, , Locker Rent, Date, , Amount (Rs), , June 12, 2014, , 42,000, , Total, , 42,000, , Life Membership fee, Date, , Amount (Rs), , May 20, 2014, July 23, 2014, , 12,000, 8,000, , Total, , 20,000, , Donation for Buildings, Date, , Amount (Rs), , Aug. 20, 2014, , 60,000, , Total, , 60,000, , Interest on Government securities, Date, , Amount (Rs), , March 28, 2015, , 18,000, , Total, , 18,000, , Part B, Item wise Aggregation of various Payments, Insurance Premium, Date, , Amount (Rs), , April 15, 2014, , 15,000, , Total, , 15,000, , Printing and Stationery, Date, , Amount (Rs.), , May 12, 2014, Aug. 13, 2014, Oct. 18, 2014, , 10,750, 15,000, 13,000, , Total, , 38,750, , Lighting, Date, , Amount (Rs.), , Sept. 10, 2014, March 27, 2015, , 12,250, 14,000, , Total, , 26,250, , 2018-19

Page 7 :

Accounting for Not-for-Profit Organisation, , 7, , Telephone Expenses, Date, , Amount (Rs.), , June 16, 2014, , 810, , Sept. 13, 2014, , 830, , Feb. 2, 2015, , 960, , Total, , 2,600, , Rates and Taxes, Date, , Amount (Rs.), , July 15, 2014, , 17,000, , Total, , 17,000, , Government Securities, Date, , Amount (Rs.), , July 30, 2014, , 1,00,000, , Oct. 31, 2014, , 1,00,000, , Total, , 2,00,000, , Wages and Salaries, Date, , Amount (Rs.), , July 10, 2014, , 22,000, , Oct. 1, 2014, , 22,000, , Dec. 31, 2014, , 22,000, , March 30, 2015, , 22,000, , Total, , 88,000, , Postage and Courier Service, Date, , Amount (Rs.), , May 20, 2014, , 430, , Aug. 15, 2014, , 480, , Jan. 21, 2015, , 240, , March 10, 2015, , 850, , Total, , 2,000, , The above data can also be shown in the form of the respective accounts in, the ledger. A detailed illustrative list of items of receipts and payments is given, in figure 1., , 2018-19

Page 8 :

8, , Accountancy – Not-for-Profit Organisation and Partnership Accounts, Figure 1, Receipts, , Payments, , 1. Donations, (a) General, (b) Specific purpose, 2. Entrance Fees, 3. Legacies, 4. Sale of Investments, 5. Sale of Fixed Assets, 6. Subscriptions from Members, 7. Life Membership Fees, 8. Sale of old Newspapers, 9. Sale of Old Sports Material, 10. Interest on Fixed Deposits, 11. Interest/ Dividend on Investments, 12. Proceed from Charity Shows, 13. Sale of Scrap, 14. Grant-in-aid, 15. Interest/Dividend on Specific, Fund Investments, 16. Miscellaneous Receipts., , 1., 2., 3., 4., 5., 6., 7., 8., 9., 10., 11., 12., 13., 14., 15., 16., 17., 18., 19., , Purchase of Fixed Assets, Purchase of Sports Material, Investment in Securities, Printing and Stationery, Postage and Courier Charges, Advertisements, Wages and Salary, Honorarium, Telephone Charges, Electricity and Water Charges, Repairs and Renewals, Upkeep of Play Ground, Conveyance Charges, Subscription for Periodicals, Audit Fees, Entertainment Expenses, Municipal Taxes, Charity, Insurance, , Receipt and Payment Account is given below:, Receipt and Payment Account for the year ending ————Receipts, Balance b/d, Cash in Hand, Cash at Bank, Subscriptions, General Donations, Sale of newspaper/, periodicals/waste paper, Sale of old sports materials, Interest on fixed deposits, Interest/Dividend on general, investments, Locker Rent, Sale of scraps, Proceeds from charity show, Miscellaneous receipts, Grant-in-aid, Legacies, Specific Donations, Sale of Investments, Sale of Fixed Assets, , Amount, (Rs.), xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, , Payments, Balance b/d (Bank overdraft), Wages and Salaries, Rent, Rates and Taxes, Insurance, Printing and Stationery, Postage and courier, Advertisement, Sundry expenses, Telephone charges, Entertainment expenses, Audit fees, Honorarium, Repair and Renewals, Upkeep of ground, Conveyance, Newspapers and Periodicals, Purchases of Assets, Purchase of Investments, Balance c/d, , 2018-19, , Amount, (Rs.), xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx

Page 9 :

Accounting for Not-for-Profit Organisation, Life membership fees, Entrance fees, Receipts on account of, specific purpose funds, Interest on specific funds', investments, Balance b/d (Bank Overdraft)*, , 9, xxx, xxx, xxx, , Cash in hand, Cash at Bank*, , xxx, xxx, , xxx, xxx, xxxxx, , xxxxx, , Fig. 1.1: Format of Receipt and Payment Account, , *, , There will be either of the two amounts i.e., each at bank or bank overdraft, not both., , It may be noted that the receipts side of the Receipt and Payment Account gives a, list of revenue receipts (for past, current and future periods) as well as capital receipts., Similarly, the payments side of the Receipts and Payments Account lists the Revenue, Payments (for past, current and future periods) as well as Capital Payments., 1.3.1 Salient Features, 1. It is a summary of the cash book. Its form is identical with that of simple, cash book (without discount and bank columns) with debit and credit, sides. Receipts are recorded on the debit side while payments are entered, on the credit side., 2. It shows the total amounts of all receipts and payments irrespective of, the period to which they pertain . For example, in the Receipt and Payment, account for the year ending on March 31, 2016, we record the total, subscriptions received during 2015–16 including the amounts related, to the years 2014–2015 and 2016-2017. Similarly, taxes paid during, 2015–16 even if they relate to the years 2014–15 and 2016–2017., 3. It includes all receipts and payments whether they are of capital nature, or of revenue nature., 4. No distinction is made in receipts/payments made in cash or through, bank. With the exception of the opening and closing balances, the total, amount of each receipt and payment is shown in this account., 5. No non-cash items such as depreciation outstanding expenses accrued, income, etc. are shown in this account., 6. It begins with opening balance of cash in hand and cash at bank (or, bank overdraft) and closes with the year end balance of cash in hand/, cash at bank or bank overdraft. In fact, the closing balance in this, account (difference between the total amount of receipts and payments), which is usually a debit balance reflects cash in hand and cash at bank, unless there is a bank overdraft., , 2018-19

Page 10 :

10, , Accountancy – Not-for-Profit Organisation and Partnership Accounts, , 1.3.2 Steps in the Preparation of Receipt and Payment Account, 1. Take the opening balances of cash in hand and cash at bank and enter, them on the debit side. In case there is bank overdraft at the begining of, the year, enter the same on the credit side of this account., 2. Show the total amounts of all receipts on its debit side irrespective of, their nature (whether capital or revenue) and whether they pertain to, past, current and future periods., 3. Show the total amounts of all payments on its credit side irrespective of, their nature (whether capital or revenue) and whether they pertain to, past, current and future periods., 4. None of the receivable income and payable expense is to be entered in, this account as they do not involve inflow or outflow of cash., 5. Find out the difference between the total of debit side and the total of, credit side of the account and enter the same on the credit side as the, closing balance of cash/bank. In case, however, the total of the credit, side is more than that of the total of the debit side, show the difference on, the debit as bank overdraft and close the account., From the following information based on the data assimilated from the cash, book given in example 1, at page 4, the Receipt and Payment Account of Golden, Cricket Club for the year ended on March 31, 2015 will be prepared as follows:, Summary of Cash Book, Details, , Amount, (Rs.), , Cash in hand as on April 1, 2014, Cash at bank as on April 1, 2014, Subscription:, Rs., 2013-14, 30,000, 2014-15, 2,25,000, 2015-16, 10,000, Donation for Building, Entrance fees, Life membership fee, Printing and Stationery, Lighting, Rates and Taxes, Telephone charges, Postage and courier, Wages and Salaries, Insurance Premium, Interest on government securities, Locker rent, Purchase of government securities, Cash in hand as on March 31, 2015, Cash at bank as on March 31, 2015, , 2018-19, , 20,000, 35,000, , 2,65,000, 60,000, 23,000, 20,000, 38,750, 26,250, 17,000, 2,600, 2,000, 88,000, 15,000, 18,000, 42,000, 2,00,000, 23,400, 70,000

Page 11 :

Accounting for Not-for-Profit Organisation, , 11, , Receipt and Payment Account for the year ending March 31, 2015, Dr., Receipts, Cash in hand as on, April 1, 2014, Cash at bank as on, April 1, 2014, Subscription:, 2013–14, 30,000, 2014–15, 2,25,000, 2015–16, 10,000, Donation for building, Entrance fees, Life membership fee, Interest on investment in, Government securities, Locker rent, , Cr., Amount, (Rs.), 20,000, 35,000, , 2,65,000, 60,000, 23,000, 20,000, 18,000, , Payments, Printing and Stationery, Lighting, Rates and Taxes, Telephone charges, Postage and Courier, Wages and Salaries, Insurance Premium, Purchase of govt. securities, Cash in hand as on, March 31, 2015, Cash at bank as on, March 31, 2015, , Amount, (Rs.), 38,750, 26,250, 17,000, 2,600, 2,000, 88,000, 15,000, 2,00,000, 23,400, 70,000, , 42,000, 4,83,000, , 4,83,000, , Illustration 1, From the following particulars relating to Silver Point, prepare a Receipt and, Payment account for the year ending March 31, 2017., Particulars, Opening cash balance, Opening bank balance, Subscriptions collected for:, 2015-16, Rs. 500, 2016-17, Rs. 7,600, 2017-18, Rs. 900, Sale of refreshments, Entrance fees received, , Amount, (Rs.), 1,000, 7,200, , 9,000, 1,000, 1,000, , Particulars, Sale of old sports materials, Donation received for pavilion, Rent paid, Sports materials purchases, Purchase of refreshments, Expenses for maintenance, of tennis court, Salary paid, Tournament expenses, Furniture purchased, Office expenses, Closing cash in hand, , 2018-19, , Amount, (Rs.), 1,200, 4,600, 3,000, 4,800, 600, 2,000, 2,500, 2,400, 1,500, 1,200, 400

Page 12 :

12, , Accountancy – Not-for-Profit Organisation and Partnership Accounts, , Solution, Books of Silver Point, Receipt and Payment Account, for the year ending March 31, 2017, Dr., , Receipts, Balance b/d, Cash, Bank, Subscriptions, 2015-16, 500, 2016-17, 7,600, 2017-18, 900, Sale of refreshments, Entrance fees, Sale of old sports materials, Donation for pavilion, , Cr., , Amount, (Rs.), 1,000, 7,200, , 9,000, 1,000, 1,000, 1,200, 4,600, , Payments, Rent, Sports materials purchased, Purchase of refreshments, Maintenance expenses for, tennis court, Salary, Tournament expenses, Furniture purchased, Office expenses, Balance c/d, Cash, Bank (balancing figure), , 25,000, , Amount, (Rs.), 3,000, 4,800, 600, 2,000, 2,500, 2,400, 1,500, 1,200, 400, 6,600, 25,000, , 1.4 Income and Expenditure Account, It is the summary of income and expenditure for the accounting year. It is just, like a profit and loss account prepared on accrual basis in case of the business, organisations. It includes only revenue items and the balance at the end, represents surplus or deficit. The Income and Expenditure Account serves, the same purpose as the profit and loss account of a business organisation, does. All the revenue items relating to the current period are shown in this, account, the expenses and losses on the expenditure side and incomes and, gains on the income side of the account. It shows the net operating result in, the form of surplus (i.e. excess of income over expenditure) or deficit (i.e. excess, of expenditure over income), which is transferred to the capital fund shown in, the balance sheet., The Income and Expenditure Account is prepared on accrual basis with the, help of Receipts and Payments Account along with additional information, regarding outstanding and prepaid expenses and depreciation etc. Hence, many, items appearing in the Receipts and Payments need to be adjusted. For example,, as shown in Example 1, (Page No. 10) subscription amount of Rs.2, 65,000 received, during the year 2014-15 appearing on the receipts side of the Receipt and Payment, Account includes receipts for the periods other than the current period. But the, subscription amount of Rs. 2,25,000 pertaining to the current year only will be, shown as income in Income and Expenditure Account for the year 2014-15., , 2018-19

Page 13 :

Accounting for Not-for-Profit Organisation, , 13, , 1.4.1 Steps in the Preparation of Income and Expenditure Account, Following steps may be helpful in preparing an Income and Expenditure Account, from a given Receipt and Payment Account:, 1. Persue the Receipt and Payment Account thoroughly., 2. Exclude the opening and closing balances of cash and bank as they, are not an income., 3. Exclude the capital receipts and capital payments as these are to be, shown in the Balance Sheet., 4. Consider only the revenue receipts to be shown on the income side of, Income and Expenditure Account. Some of these need to be adjusted by, excluding the amounts relating to the preceding and the succeeding, periods and including the amounts relating to the current year not yet, received., 5. Take the revenue expenses to the expenditure side of the Income and, Expenditure Account with due adjustments as per the additional, information provided relating to the amounts received in advance and, those not yet received., 6. Consider the following items not appearing in the Receipt and Payment, Account that need to be taken into account for determining the surplus/, deficit for the current year :, (a) Depreciation of fixed assets., (b) Provision for doubtful debts, if required., (c) Profit or loss on sale of fixed assets., Now you will observe how the income and expenditure account is prepared, from the receipts and payments account given in example 1, on page 10., Income and Expenditure Account, for the year ending on March 31, 2015, Dr., , Expenditure, Printing and Stationery, Lighting, Rates and Taxes, Telephone charges, Postage and courier charges, Wages and Salaries, Insurance Premium, Surplus (Excess of income, over expenditure), , Cr., , Amount, (Rs.), 38,750, 26,250, 17,000, 2,600, 2,000, 88,000, 15,000, 1,18,400, , Income, Subscriptions, Entrance fees, Interest on investment, in government securities, Locker rent, , 3,08,000, , 2018-19, , Amount, (Rs.), 2,25,000, 23,000, 18,000, 42,000, , 3,08,000

Page 14 :

14, , Accountancy – Not-for-Profit Organisation and Partnership Accounts, , Note that1. Opening and closing cash/bank balances have been excluded., 2. Payment for purchase of Government securities being capital expenditure has, been excluded., 3. Amount of subscriptions received for the year 2013-14 and 2015-16 have been excluded., 4. Life membership fee is an item of capital receipt and so excluded., 5. Donation for building is a receipt for a specific purpose and so excluded., , Illustration 2, From the Receipt and Payment Account given below, prepare the Income and, Expenditure Account of Clean Delhi Club for the year ended March 31, 2017., Receipt and Payment Account for the year ending March 31, 2017, Dr., , Cr., , Receipts, Balance b/d, (Cash in hand), Subscriptions, Entrance Fees, Donations, Rent of hall, Sale of investments, , Amount, (Rs.), 3,200, 22,500, 1,250, 2,500, 750, 3,000, , Payments, Salary, Rent, Electricity, Taxes, Printing and Stationery, Sundry expenses, Books purchased, Govt. bonds purchased, Fixed deposit with bank, (on 31.03.2017), Balance c/d, Cash in hand, 400, Cash at bank, 1,500, , 33,200, , Amount, (Rs.), 1,500, 800, 3,500, 1,700, 380, 920, 7,500, 10,000, 5,000, , 1,900, 33,200, , Solution, Books of Clean Delhi Club, Income and Expenditure Account for the year ending March 31, 2017, Dr., , Expenditure, Salary, Rent, Electricity, Taxes, Printing & Stationery, Sundray Expenses, Surplus, (excess of income over, expenditure), , Cr., , Amount, (Rs.), 1,500, 800, 3,500, 1,700, 380, 920, 18,200, , Income, Subscriptions, Entrance fees, Donation, Rent of hall, , 27,000, , 2018-19, , Amount, (Rs.), 22,500, 1,250, 2,500, 750, , 27,000

Page 15 :

Accounting for Not-for-Profit Organisation, , 15, , Illustration 3, From the following Receipt and Payment Account for the year ending March 31,, 2015 of Negi's Club, prepare Income and Expenditure Account for the same, period:, Receipt and Payment Account for the year ending March 31, 2015, Dr., , Cr., , Expenditure, , Amount, (Rs.), , Balance c/d Bank, Subscriptions, 2013, 1,500, 2014, 10,000, 2015, 500, Donation, Hall rent, Interest on bank deposits, Entrance fees, , 25,000, , 12,000, 2,000, 300, 450, 1,000, , Income, Purchase of furniture (1.7.14), Salaries, Telephone expenses, Electricity charges, Postage and Stationery, Purchase of books, Entertainment expenses, Purchase of 5% government, papers (1.7.14), Miscellaneous expenses, Balance c/d:, Cash, Bank, , 40,750, , Amount, (Rs.), 5,000, 2,000, 300, 600, 150, 2,500, 900, 8,000, 600, 300, 20,400, 40,750, , The following additional information is available:, (i) Salaries outstanding – Rs. 1,500;, (ii) Entertainment expenses outstanding – Rs. 500;, (iii) Bank interest receivable – Rs. 150;, (iv) Subscriptions accrued – Rs. 400;, (v) 50 per cent of entrance fees is to be capitalised;, (vi) Furniture is to be depreciated at 10 per cent per annum., Solution, Books of Negi's Club, Income and Expenditure Account for the year ending 31.3.2015, Dr., , Cr., , Expenditure, Salaries, Add: Outstanding, Telephone expenses, Electricity charges, Postage and Stationery, , Amount, (Rs.), 2,000, 1,500, , 3,500, 300, 600, 150, , Income, Subscriptions, Donation, Entrance Fees (50% of Rs. 1,000), Bank interest, 450, Add: Outstanding interest 150, , 2018-19, , Amount, (Rs.), 10,400, 2,000, 500, 600

Page 16 :

16, , Accountancy – Not-for-Profit Organisation and Partnership Accounts, , Entertainment expenses, Add: Outstanding, expenses, Miscellaneous expenses, Depreciation on furniture, Surplus, (Excess of Income over, Expenditure), , 900, 500, , 1,400, , Interest on investment, Hall rent, , 200, 300, , 600, 375, 7,075, , 14,000, , 14,000, , 1.4.2 Distinction between Income and Expenditure Account and Receipt, and Payment Account, Based upon discussion made in regard to the Receipts and Payments Account, and the Income and Expenditure Account we make the distinction between, Income and Expenditure Account and Receipts and Payments Account in the, tabular form:, Basis of distinction, Account, , Income and Expenditure, , Receipt and Payment, Account, , Nature, , It is like as profit and loss, account., , It is the summary of the cash, book., , Nature of Items, , It records income and, expenditure of revenue, nature only., , It records receipts and, payments of revenue as well as, capital nature., , Period, , Income and expenditure, items relate only to the, current period., , Receipts and payments may, also relate to preceding and, succeeding periods., , Debit side, , Debit side of this account, records expenses and losses., , Debit side of this account, records the receipts., , Credit side, , Credit side of this account, records income and gains., , Credit side of this account, records the payments., , Depreciation, , Includes depreciation., , Does not includes, depreciation., , Opening Balance, , There is no opening balance., , Balance in the beginning, represents cash in hand /cash, at bank or overdraft at, the beginning., , Closing Balance, , Balance at the end represents excess of income, over expenditure or viceversa., , Balance at the end represents, cash in hand at the end and, bank balance (or bank, overdraft)., , 2018-19

Page 17 :

Accounting for Not-for-Profit Organisation, , 17, , 1.5 Balance Sheet, ‘Not-for-Profit’ Organisations prepare Balance Sheet for ascertaining the financial, position of the organisation. The preparation of their Balance Sheet is on the same, pattern as that of the business entities. It shows assets and liabilities as at the end, of the year. Assets are shown on the right hand side and the liabilities on the left, hand side. However, there will be a Capital Fund or General Fund in place of the, Capital and the surplus or deficit as per Income and Expenditure Account which, is either added to/deducted from the capital fund, as the case may be. It is also, a common practice to add some of the capitalised items like legacies, entrance, fees and life membership fees directly in the capital fund., Besides the Capital or General Fund, there may be other funds created for, specific purposes or to meet the requirements of the contributors/donors such, as building fund, sports fund, etc. Such funds are shown separately in the, liabilities side of the balance sheet., Some times it becomes necessary to prepare Balance Sheet as at the beginning, of the year in order to find out the opening balance of the capital/general fund., 1.5.1 Preparation of Balance Sheet, The following procedure is adopted to prepare the Balance Sheet:, 1. Take the Capital/General Fund as per the opening balance sheet and, add surplus from the Income and Expenditure Account. Further, add, entrance fees, legacies, life membership fees, etc. received during the year., 2. Take all the fixed assets (not sold/discarded/or destroyed during the, year) with additions (from the Receipts and Payments account) after, charging depreciation (as per Income and Expenditure account) and show, them on the assets side., 3. Compare items on the receipts side of the Receipts and Payments Account, with income side of the Income and Expenditure Account. This is to, ascertain the amounts of: (a) subscriptions due but not yet received:, (b) incomes received in advance; (c) sale of fixed assets made during the, year; (d) items to be capitalised (i.e. taken directly to the Balance Sheet), e.g. legacies, interest on specific fund investment and so on., 4. Similarly compare, items on the payments side of the Receipt and, Payment Account with expenditure side of the Income and, Expenditure Account. This is to ascertain the amounts if: (a), outstanding expenses; (b) prepaid expenses; (c) purchase of a fixed, asset during the year; (d) depreciation on fixed assets; (e) stock of, consumable items like stationery in hand; (f) Closing balance of cash, in hand and cash at bank as, and so on., A proforma Balance Sheet is given for the proper understanding of preparing, the balance sheet., , 2018-19

Page 18 :

18, , Accountancy – Not-for-Profit Organisation and Partnership Accounts, Balance Sheet of as on ..............., , Liabilities, , Amount, (Rs.), , Capital fund:, Opening Balance, Add: Surplus, OR, Less: Deficit, Add: Capitalised Income of the, Current Year on account of:, Legacies, Entrance Fees, Life Membership Fees, Closing Balance, Special Fund/Donations:, Previous Balance (If any ), Add: Receipts for the item, during the period, Add: Income earned on, fund/Donations’, Investments, Less: Expenses paid out of, fund/Donations, Net Balance, Creditors for Purchases, and/or supplies, Bank Overdraft, Outstanding Expenses:, Income received in Advance, , ......, , ......, ......, ......, ......, ......, , Assets, , Cash in hand and /or Cash, at Bank, Outstanding Incomes, Prepaid Expenses, Stock of Consumable Items:, Previous Balance, Add: Purchases in the current, period, Less: Value consumed during, the period, Previous Balance, Add: Purchases in the current, period, Less: Book Value of the Asset, sold/disposed off, Closing Balance, , Amount, (Rs.), ......, ......, ......, , ......, ......, , ......, , ......, ......, ......, ......, ......, , ......, , Fig. 1.2: Proforma Balance Sheet, , Illustration 4, From the following Receipt and Payment Account and additional information, relating to Excellent Cricket Club, prepare Income and Expenditure Account, for the year ended March 31, 2015 and Balance Sheet as on date., Dr., , Receipts, Balance b/d (Cash in Hand), Member’s subscriptions, Member’s admission fee, Sale of old sports materials, Hire of ground, Subscription for tournament, Life membership fee, Donations, , Cr., , Amount, (Rs.), 18,000, 2,50,000, 15,000, 2,500, 28,000, 60,000, 20,000, 6,00,000, , Payments, Balance b/d (bank overdraft), Upkeep of field and pavilion, Tournament expenses, Rates and Insurance, Telephone, Postage and Courier charges, Printing and Stationery, Miscellaneous expenses, , 2018-19, , Amount, (Rs.), 16,000, 1,15,000, 40,000, 10,000, 3,500, 4,000, 26,000, 4,400

Page 19 :

Accounting for Not-for-Profit Organisation, , 19, Secretary’s honorarium, Grass seeds, Investments, Purchase of sports materials, Balance c/d, , 9,93,500, , 30,000, 2,600, 6,00,000, 68,000, 74,000, 9,93,500, , Assets at the beginning of the year were:, Rs., 5,00,000, 18,000, 85,000, 11,000, 28,000, , Play ground, Cash in hand, Stock of sports materials, Printing and Stationery, Subscriptions receivable, , Donations and Surplus on account of tournament are to be kept in Reserve for a, permanent pavilion. Subscriptions due on March 31, 2015 were Rs. 42,000. Write-off fifty, per cent of sports materials and thirty per cent of printing and stationery., , Solution, Books of Excellent Cricket Club, Income and Expenditure Account for the year ending on March 31, 2015, Dr., , Expenditure, , Cr., , Amount, (Rs.), , Upkeep of field and pavilion, Rates and Insurance, Telephone, Postage and Courier charges, Printing & stationery, 26,000, Add: Opening stock, 11,000, Available for use, 37,000, , 1,15,000, 10,000, 3,500, 4,000, , Less: Closing stock, 25,900, Stationery consumed, Miscellaneous expenses, Secretary’s honorarium, Grass seeds, Sports materials consumed:, Opening stock, 85,000, Add: Purchases, 68,000, 1,53,000, Less: Closing stock, 76,500, Surplus, (Excess of income over, expenditure), , 11,100, 4,400, 30,000, 2,600, , Income, Subscriptions, Add: Outstanding, (closing), Less: Outstanding, (opening), Admission fees, , Amount, (Rs.), 2,50,000, 42,000, 2,92,000, 28,000, , Sale of old sports material, Rent of hall, , 2,64,000, 15,000, 2,500, 28,000, , 76,500, 52,400, , 3,09,500, , 3,09,500, , Note: Since the opening balance of the capital fund is not given, the same has been, ascertained by preparing opening balance sheet., , 2018-19

Page 20 :

20, , Accountancy – Not-for-Profit Organisation and Partnership Accounts, Balance Sheet of Excellent Cricket Club as on March 31, 2015, , Liabilities, , Amount, (Rs.), , Capital Fund, Add: Surplus, , 6,26,000, 52,400, 6,78,400, Add: Life membership, fee, 20,000, Pavilion Fund:, Surplus from Tournament, (Rs.60,000-40,000) 20,000, Donation, 6,00,000, , 6,98,400, , Assets, , Amount, (Rs.), , Cash in hand, Outstanding subscriptions, Stock of sports materials, Stock of printing, and stationery, Investments, Play ground, , 74,000, 42,000, 76,500, 25,900, 6,00,000, 5,00,000, , 6,20,000, 13,18,400, , 13,18,400, , Balance Sheet of Excellent Cricket Club as on March 31, 2014, Liabilities, Bank overdraft, Capital/General fund, (balancing figure), , Amount, (Rs.), 16,000, 6,26,000, , Assets, Cash in hand, Outstanding subscription, Stock of sports materials, Printing and Stationery, Play ground, , 6,42,000, , Amount, (Rs.), 18,000, 28,000, 85,000, 11,000, 5,00,000, 6,42,000, , Test your Understanding – I, State with reasons whether the following statements are TRUE or FALSE:, (i) Receipt and Payment Account is a summary of all capital receipts and payments., (ii) If there appears a sports fund, the expenses incurred on sports activities will, be shown on the debit side of Income and Expenditure Account., (iii) The balancing figure on credit side of Income and Expenditure Account denotes, excess of expenses over incomes., (iv) Scholarships granted to students out of funds provided by government will be, debited to Income and Expenditure Account., (v) Receipt and Payment Account records the receipts and payments of revenue, nature only., (vi) Donations for specific purposes are always capitalized., (vii) Opening balance sheet is prepared when the opening balance of capital fund is, not given., (viii) Surplus of Income and Expenditure Account is deducted from the capital/, general fund., (ix) Receipt and Payment Account is equivalent to profit and loss account., (x) Receipt and Payment Account does not differentiate between capital and, revenue receipts., , 2018-19

Page 21 :

Accounting for Not-for-Profit Organisation, , 21, , 1.6 Some Peculiar Items, Final accounts of the Not-for-Profit organisations are prepared on the similar, pattern as that of a business orgnisation. However, a few items of income and, expenses of such orgnisations are somewhat different in nature and need special, attention in their treatment in final accounts. They are peculiar to these, orgnisations. Some of the common peculiar items are explained as under:, Subscriptions: Subscription is a membership fee paid by the member on annual, basis. This is the main source of income of such orgnisations. Subscription paid, by the members is shown as receipt in the Receipt and Payment Account and as, income in the Income and Expenditure Account. It may be noted that Receipt, and Payment Account shows the total amount of subscription actually received, during the year while the amount shown in Income and Expenditure Account is, confined to the figure related to the current period only irrespective of the fact, whether it has been received or not. For example, a club received Rs. 20,000 as, subscriptions during the year 2016-17 of which Rs.3,000 relate to year, 2015-16 and Rs.2,000 to 2017-18, and at the end of the year 2016-17 Rs.6,000, are still receivable. In this case, the Receipt and Payment Account will show, Rs.20,000 as receipt from subscriptions. But the Income and Expenditure, Account will show Rs. 21,000 as income from subscriptions for the year, 2016-17, the calculation of which is given as below:, Subscriptions received in 2016-17, Less: Subscriptions for the year 2015-16, Less: Subscription for the year 2017-18, Add: Subscriptions outstanding for the year 2016-17, Income from subscriptions for the year 2016-17, , Rs., 20,000, 3,000, 17,000, 2,000, 15,000, 6,000, 21,000, , The above amount of subscriptions to be shown as income can also be, ascertained by preparing the subscription account as follows:, Subscription Account, Dr., , Cr., , Date Particulars, Balance b/d, (outstanding at the, beginning), Income and Expenditure, Account (balancing figure), Balance c/d, (received in advance), , J.F., , Amount, (Rs.), , Date Particulars, , 3,000, , 21,000, 2,000, 26,000, , 2018-19, , Balance b/d, (received in advance, during previous year), Cash (subscription, received), Balance c/d, (outstanding at the end), , J.F. A m o u n t, (Rs.), Nil, , 20,000, 6,000, 26,000

Page 22 :

22, , Accountancy – Not-for-Profit Organisation and Partnership Accounts, , Illustration 5, As per Receipt and Payment Account for the year ended on March 31, 2017, the, subscriptions received were Rs. 2,50,000. Additional Information given is as, follows:, 1. Subscriptions Outstanding on 1.4.2016 Rs. 50,000, 2. Subscriptions Outstanding on 31.3.2017 Rs.35,000, 3. Subscriptions Received in Advance as on 1.4.2016 Rs.25,000, 4. Subscriptions Received in Advance as on 31.3.2017 Rs.30,000, Ascertain the amount of income from subscriptions for the year 2016–17, and show how relevant items of subscriptions appear in opening and closing, balance sheets., Solution, Details, , Amount, (Rs.), , Subscriptions Received as per Receipt and Payment account, Add: Subscriptions outstanding on 31.3.2017, Add: Subscriptions received in advance on 1.4.2016, , 2,50,000, 35,000, 25,000, , Less: Subscriptions outstanding on 1.4.2016, , 3,10,000, 50,000, , Less: Subscriptions received in advance on 31.3.2017, , 2,60,000, 30,000, , Income from subscription for the year 2016–17, , 2,30,000, , Alternately, income received from subscriptions can be calculated by, preparing a Subscriptions account as under., Subscription Account, Dr., , Cr., , Date Particulars, Balance b/d (outstanding), Income and, Expenditure Account, (balancing figure), Balance c/d (advance), , J.F. Amount Date Particulars, (Rs.), 50,000, 2,30,000, 30,000, 3,10,000, , Balance b/d (advance), Receipts and Payments A/c, Balance c/d (outstanding), , J.F., , Amount, (Rs.), 25,000, 2,50,000, 35,000, , 3,10,000, , Relevant items of subscription can be shown in the opening and closing, balance sheet as under:, , 2018-19

Page 23 :

Accounting for Not-for-Profit Organisation, , 23, , Balance Sheet as on March 31, 2014, Liabilities, , Amount, (Rs.), , Subscriptions received in advance, , 25,000, , Assets, , Amount, (Rs.), , Subscription outstanding, , 50,000, , *Relevant data only, Balance Sheet as on March 31, 2015, Liabilities, , Amount, (Rs.), , Subscriptions received in advance, , 30,000, , Assets, , Amount, (Rs.), , Subscriptions outstanding, , 35,000, , *Relevant data only, , Illustration 6, Extracts of Receipt and Payment Account for the year ended March 31, 2017, are given below:, Receipt, Subscriptions, , (Rs.), , 2015-16, 2016-17, 2017-18, , 2,500, 26,750, 1,000, 30,250, , Additional Information:, Total number of members: 230., Annual membership fee: Rs. 125., Subscriptions outstandings on April 1, 2016: Rs. 2,750., Prepare a statement showing all relevant items of subscriptions viz., income, advance,, outstandings, etc., , Solution, Amount of subscription due for the year 2016-17 irrespective of cash, Rs. 28,750 (i.e. Rs. 125 × Rs. 230)., Details, , Amount, (Rs.), , Subscriptions received as per Receipts and Payments Account, Add: Subscriptions outstanding on March 31, 2016, Add: Subscriptions received in advance on April 1, 2016, , 30,250, 2,250, NIL, , Less: Subscriptions outstanding on April 1, 2016, , 32,500, 2,750, , Less: Subscriptions received in advance on March 31, 2017, , 29,750, 1,000, , Income from Subscription for the year 2016-17. (125×230), , 28,750, , Note: The amount of subscriptions outstanding as on 01-04-2014 has been ascertained, as follows:, , 2018-19

Page 24 :

24, , Accountancy – Not-for-Profit Organisation and Partnership Accounts, Details, , (Rs.), , (Rs.), , (i) Outstanding as on 01.04.2016, Received for 2015–16, (ii) Due for 2016–17 (125×230), Received for 2016–17, , 2,750, 2,500, 28,750, 26,750, , 250, 2,000, 2,250, , Outstanding as on 31-3-2017, , Illustration 7, From the following extract of Receipt and Payment Account and the additional, information, compute the amount of income from subscriptions and show as, how they would appear in the Income and Expenditure Account for the year, ending March 31, 2015 and the Balance Sheet., Receipt and Payment Account for the year ending March 31, 2015, Receipts, Amount Payments, Amount, (Rs.), (Rs.), Subscriptions:, 2013-14, 2014-15, 2015-16, , 7,000, 30,000, 5,000, , 42,000, , Additional Information:, 1. Subscriptions outstanding March 31, 2014, 2. Total Subscriptions outstanding March 31, 2015, 3. Subscriptions received in advance, as on March 31, 2014, , Rs., 8,500, 18,500, 4,000, , Solution, Income and Expenditure Account, for the year ending on March 31, 2015, Expenditure, , Amount, (Rs.), , Income, Subscriptions, Received for 2014-15, Add: Outstanding for 2014-15, Add: Received in advance for, 2014-15, , Amount, (Rs.), 30,000, 17,000, 4,000, 51,000, , Note: Total amount of subscriptions outstanding as on 31-3-2015 are Rs. 18,500. This,, includes Rs. 1,500 (Rs. 8,500 – Rs. 7,000) for subscriptions still outstanding for, 2013–14. Hence, the subscriptions outstanding for 2014–15 are Rs. 17,000, (Rs. 18,500 – Rs. 1,500)., , 2018-19

Page 25 :

Accounting for Not-for-Profit Organisation, , 25, , Balance Sheet (Relevant Data) as on March 31, 2015, Liabilities, , Amount, (Rs.), , Subscription Received in, Advance for 2014-15, 5,000, , Assets, Subscription Outstanding:, 2013-14, 1,500, 2014-15, 1,7000, , Amount, (Rs.), , 18,500, , *Relevant data only, Do it Yourself, 1. Subscriptions received by the health club during the year 2015 were as under:, Rs., 2014, 3,000, 2015, 96,000, 2016, 2,000, 1,01,000, Rs., Subscriptions Outstanding as on 31.12.14, 5,000, Subscriptions Outstanding as on 31.12.15, 12,000, Subscriptions received in advance in 2014 for 2015, 5,000, Calculate the amount of subscriptions to be shown on the income side of Income, and Expenditure A/c., 2. During the year 2015, subscriptions received by a sports club were Rs. 80,000., These included Rs. 3,000 for the year 2014 and Rs.6,000 for the year 2016., On March 31, 2016 the amount of subscriptions due but not received was, Rs.12,000. Calculate the amount of subscriptions to be shown in Income, and Expenditure Account as income from subscription., 3. Subscriptions received during the year ended December 31, 2015 by Royal, Club were as under:, Rs., 2014, 3,000, 2015, 93,000, 2016, 2,000, 98,000, , The club has 500 members each paying @ Rs.200 as annual subscription., Subscriptions outstanding as on March 31, 2016 are Rs. 6,000. Calculate, the amount of subscriptions to be shown as income in the Income and, Expenditure Account for the year ended March 31, 2016 and show the, relevant data in the Balance Sheet as on date., , Donations: It is a sort of gift in cash or property received from some person or, organisation. It appears on the receipts side of the Receipts and Payments, Account. Donation can be for specific purposes or for general purposes., (i) Specific Donations: If donation received is to be utilised to achieve specified, purpose, it is called Specific Donation. The specific purpose can be an, , 2018-19

Page 26 :

26, , Accountancy – Not-for-Profit Organisation and Partnership Accounts, , extension of the existing building, construction of new computer, laboratory, creation of a book bank, etc. Such donation is to be capitalised, and shown on the liabilities side of the Balance Sheet irrespective of the, fact whether the amount is big or small. The intention is to utilise the, amount for the specified purpose only., (ii) General Donations: Such donations are to be utilised to promote the, general purpose of the organisation. These are treated as revenue receipts, as it is a regular source of income hence, it is taken to the income side of, the Income and Expenditure Account of the current year., Legacies: It is the amount received as per the will of a deceased person. It appears, on the receipts side of the Receipt and Payment Account and is directly added to, capital fund/general fund in the balance sheet, because it is not of recurring, nature. However, legacies of a small amount may be treated as income and shown, on the income side of the Income and Expenditure Account., Life Membership Fees: Some members prefer to pay lump sum amount as life, membership fee instead of paying periodic subscription. Such amount is treated, as capital receipt and credited directly to the capital/general fund., Entrance Fees: Entrance fee also known as admission fee is paid only once by, the member at the time of becoming a member. In case of organisations like clubs, and some charitable institutions, is limited and the amount of entrance fees is, quite high. Hence, it is treated as non-recurring item and credited directly to, capital/general fund. However, for some organisations like educational institutions,, the entrance fees is a regular income and the amount involved may also be small., In their case, it is customary to treat this item as a revenue receipt. However, if, there is specific instruction, it is advisable to treat the entire amount as capital, receipt and the relevant amount should be directly added to capital/general fund., Sale of old asset: Receipts from the sale of an old asset appear in the Receipts, and Payments Account of the year in which it is sold. But any gain or loss on the, sale of asset is taken to the Income and Expenditure Account of the year. For, example, if an item furniture with a book value of Rs. 800 is sold for Rs. 700,, this amount of Rs. 700 will be shown as receipt in Receipts and Payments, Account and Rs. 100 on the expenditure side of the Income and Expenditure, Account as a loss on sale of old asset and while showing furniture in the balance, sheet Rs. 800 will be deducted from its total book value., Sale of Periodicals: It is an item of recurring nature and shown as the income, side of the Income and Expenditure Account., Sale of Sports Materials: Sale of sports materials (used materials like old balls,, bats, nets, etc) is the regular feature with any Sports Club. It is usually shown, as an income in the Income and Expenditure Account., , 2018-19

Page 27 :

Accounting for Not-for-Profit Organisation, , 27, , Payments of Honorarium: It is the amount paid to the person who is not the, regular employee of the institution. Payment to an artist for giving performance, at the club is an example of honorarium. This payment of honorarium is shown, on the expenditure side of the Income and Expenditure Account., Endowment Fund: It is a fund arising from a bequest or gift, the income of, which is devoted for a specific purpose. Hence, it is a capital receipt and shown, on the Liabilities side of the Balance Sheet as an item of a specific purpose fund., Government Grant: Schools, colleges, public hospitals, etc. depend upon, government grant for their activities. The recurring grants in the form of, maintenance grant is treated as revenue receipt (i.e. income of the current year), and credited to Income and Expenditure account. However, grants such as, building grant are treated as capital receipt and transferred to the building fund, account. It may be noted that some Not-for-Profit organisations receive cash, subsidy from the government or government agencies. This subsidy is also, treated as revenue income for the year in which it is received., Special Funds, The Not-for-Profit Organisations office create special funds for certain purposes/, activities such as 'prize funds', 'match fund' and 'sports fund', etc. Such funds, are invested in securities and the income earned on such investments is added, to the respective fund, not credited to Income and Expenditure Account., Similarly, the expenses incurred on such specific purposes are also deducted, from the special fund. For example, a club may maintain a special fund for, sports activities. In such a situation, the interest income on sports fund, investments is added to the sports fund and all expenses on sports deducted, therefrom. The special funds are shown in balance sheet. However, if, after, adjustment of income and expenses the balance in specific or special fund is, negative, it is transferred to the debit side of the Income and Expenditure, Account or adjusted as per prescribed directions. (see Illustrations 8 and 9.), Illustration 8, Show how you would deal with the following items in the financial statements of, a Club:, Details, , Debit, Amount, (Rs.), , Prize Fund, Prize Fund Investments, Income from Prize Fund Investments, Prizes awarded, , 2018-19, , Credit, Amount, (Rs.), 80,000, , 80,000, 8,000, 6,000

Page 28 :

28, , Accountancy – Not-for-Profit Organisation and Partnership Accounts, , Solution, Balance Sheet as on……….., Liabilities, , Amount, (Rs.), , Prize fund, 80,000, Add: Income from, 8,000, Investments, 88,000, Less: Prizes Awarded 6,000, , Assets, , Amount, (Rs.), , Prize Fund Investments, , 80,000, , 82,000, , Illustration 9, (a) Show the following information in financial statements of a ‘ Not-for-Profit’, Organisation:, Details, , Amount, (Rs.), , Match Expenses, Match Fund, Donation for Match Fund, Sale of Match tickets, , 16,000, 8,000, 5,000, 7,000, , (b) What will be the effect, if match expenses go up by Rs. 6,000 other things, remaining the same?, Solution, (a), Balance Sheet as on………..*, Liabilities, Match fund, 8,000, Add: Donation, 5,000, (Specific), Add: Sale of Match, 7,000, Tickets, 20,000, Less: Match Expenses 16,000, , Amount, (Rs.), , Assets, , Amount, (Rs.), , 4,000, 4,000, , * Only relevant data., (b), If match expenses go up by Rs. 6,000, the net balance of the match fund, becomes negative i.e. Debit exceeds the Credit, and the resultant debit balance, of Rs. 2,000 shall be charged to the Income and Expenditure Account of that, year., , 2018-19

Page 29 :

Accounting for Not-for-Profit Organisation, , 29, , Test your Understanding – II, How would you treat the following items in the case of a ‘not-for-profit’ organisation?, 1. Tournament Fund Rs. 40,000. Tournament Expenses Rs. 14,000. Receipts, from Tournament Rs. 16,000., 2. Table Tennis match expenses Rs. 4,000., 3. Prize Fund Rs. 22,000. Interest on Prize fund Investments Rs. 3,000. Prizes, given Rs. 5,000. Prize fund Investments Rs. 18,000., 4. Receipts from Charity Show Rs. 7,000. Expenses on Charity Show Rs. 3,000., , Illustration 10, Extract of a Receipt and Payment Account for the year ended on March 31,, 2015:, Payments:, Stationery Rs. 23,000, Additional Information:, Details, Stock of stationery, Creditors for stationery, , April 1, 2014, 4,000, 9,000, , March 31, 2015, 3,000, 2,500, , Solution, Details, , Amount, (Rs.), , Payment made for the purchase of stationery as per, Receipts and Payments account, Less: Creditors in the beginning, , 23,000, 9,000, , Payment made for the year 2014-15, Add: Payment not yet made (i.e. creditors at the end), , 14,000, 2,500, , Stationery Purchased for the year 2014-15, Add: Stock in the beginning, , 16,500, 4,000, , Stationery Available for consumption during 2014-15, Less: Stock at the end, , 20,500, 3,000, , Stationery Consumed during 2014-15 to be taken to the, Expenditure side of the Income and Expenditure account, , 17,500, , Stationery: Normally expenses incurred on stationary, a consumable items are, charged to Income and Expenditure Account. But in case stock of stationery, (opening and/or closing) is given, the approach would be make necessary, adjustments in purchases of stationery and work out cost of stationery consumed, and show that amount in Income and Expenditure Account and its stock in the, , 2018-19

Page 30 :

30, , Accountancy – Not-for-Profit Organisation and Partnership Accounts, , balance sheet. For example, the Receipt and Payment Account shows a payment, for stationery amounting to Rs. 40,000 and there is an opening and closing, stationery amounting to Rs. 12,000 and Rs. 15,000. The amount of expense on, stationery will be worked out as follows:, Stationery, Purchases, Add: Opening stock, , 40,000, 12,000, , Less: Closing stock, , 52,000, 15,000, 37,000, , In case stationery is also purchased on credit, the amount of its consumption, will be worked out as given in Illustration 12., Do it Yourself, 1. Find out the cost of medicines consumed during 2014-15 from the following, information:, Details, , Amount, (Rs.), , Payment for purchase of medicines, Creditors for medicines purchased:, On 1.4.2014, On 31.3.2015, Stock of Medicines:, On 1.4.2014, On 31.3.2015, Advance to suppliers of medicines:, On 1.4.2014, On 31.3.2015, , 3,70,000, 25,000, 17,000, 62,000, 54,000, 11,500, 18,200, , 2. What amount of sports material will be posted to Income and Expenditure, Account for the year ended March 31, 2016 as expenditure? :, Amount, (Rs.), Stock of sports materials as on April 1, 2014, Creditors for sports material as on April 1, 2014, Stock of sports material as on March 31, 2016, Amount paid for sports material during the year 2015-16, Advance paid for sports material as on March 31, 2016, Creditors for sports material as on March 31, 2016, , 2018-19, , 7,500, 2,000, 6,200, 17,000, 3,500, 1,200

Page 31 :

Accounting for Not-for-Profit Organisation, , 31, , Illustration 11, Following is the Receipt and Payment Account of an Entertainment Club for the, period April 1, 2016 to March 31, 2017., Receipt and Payment Account for the year ending March 31, 2017, Receipts, Balance b/d, Cash, 27,500, Bank, 60,000, Member’s subscriptions:, 2015-2016, 12,500, 2016-2017, 1,00,000, 2017-2018, 10,000, Sale of furniture, (book value: Rs. 8,000), Sale of food stuffs, Sale of old periodicals, and newspapers, Hire of ground used, for marriage, Donation for sports fund, Locker Rent, , Amount, (Rs.), , 87,500, , 1,22,500, 10,000, 1,00,000, 3,200, , Payments, , Amount, (Rs.), , Salaries, Electric bill, Food stuff for restaurant, Telephone bill, Subscription for periodicals, Printing and stationery, Sports expenses, Secretary’s honorarium, 8% Investments (31.3.2017), Balance c/d:, Cash, 21,500, Bank, 45,000, , 24,000, 21,000, 60,000, 35,000, 14,500, 13,000, 50,000, 30,000, 1,00,000, , 66,500, , 48,750, 25,000, 17,050, 4,14,000, , 4,14,000, , Additional Information, 1. The club had 225 members, each paying an annual subscription of Rs. 500., Subscription outstanding as on 31 March 2016 Rs. 15,000., 2. Telephone bill outstanding for the year 2016-2017 is Rs. 2,000., 3. Locker Rent Rs. 3,050 outstanding for the year 2015-16 and Rs. 1,500 for, 2016-17., 4. Salary outstanding for the year 2016-17 Rs. 4,000., 5. Opening Stock of Printing and stationery Rs. 2,000 and closing stock of printing, and stationery is Rs. 3,000 for the year 2016-17., 6. On 1st April 2016 other balances were as under:, Rs., 1,00,000, 6,50,000, 15,000, , Furniture, Building, Sports fund, , 7. Depreciation Furniture and Building @ 12.5% and 5% respectively assuming that, it is on reducing balance for the year ending March 31,2017, Prepare Income and Expenditure account and Balance Sheet as on, that date., , 2018-19

Page 32 :

32, , Accountancy – Not-for-Profit Organisation and Partnership Accounts, , Solution, Book of Entertainment Club, Income and Expenditure Account, for the year ending on March 31, 2017, Expenditure, Salary, 24,000, Add: Outstanding, 4,000, Electric Bill, Telephone Bill, 35,000, Add: Outstanding, 2,000, Subscription for periodicals, Printing and Stationery 13,000, Add: Opening Stock, 2,000, 15,000, Less: Closing stock, 3,000, Secretary's honorarium, Sports Expenses, 50,000, Less: Opening Balance, of sports fund, 15,000, 35,000, Less: Donation for, Sports, 25,000, Depreciation On:, Furniture, 11,500, Building, 32,500, Surplus (Excess of Income over, Expenditure), , Amount, (Rs.), 28,000, 21,000, 37,000, 14,500, , 12,000, 30,000, , Income, Subscriptions, 1,00,000, Add: Outstanding, 12,500, Sale of old periodicals, Profit on sale of furniture, Hire of ground for marriage, Locker rent, 17,050, Less: Opening o/s, 3,050, 14,000, Add: Closing o/s, 1,500, Sale of Food Stuff, 1,00,000, Cost of food Consumed 60,000, , Amount, (Rs.), 1,12,500, 3,200, 2,000, 48,750, , 15,500, , 40,000, , 10,000, , 44,000, 25,450, , 2,21,950, , 2018-19, , 2,21,950

Page 33 :

Accounting for Not-for-Profit Organisation, , 33, , Balance Sheet of Entertainment Club as on March 31, 2016, Liabilities, , Amount, (Rs.), , Sports fund, Capital/General Fund, (Balancing figure), , 15,000, 8,42,550, , Assets, , Amount, (Rs.), , Cash in hand, Cash at bank, Outstanding subscription, Outstanding locker Rent, Printing & Stationery, Furniture, Buildings, , 8,57,550, , 27,500, 60,000, 15,000, 3,050, 2,000, 1,00,000, 6,50,000, 8,57,550, , Balance Sheet of Entertainment Club as on March 31, 2017, Liabilities, Subscriptions received in, advanced, Outstanding Telephone Bill, Salary Outstanding, Capital/General Fund 8,42,550, Add: Surplus, 25,450, , Amount, (Rs.), 10,000, 2,000, 4,000, , Assets, , Amount, (Rs.), , Cash in hand, Cash at bank, Outstanding subscriptions, , 21,500, 45,000, 15,000, , (2015 Rs 2500 and 2016 Rs 12500), , 8,68,000, , Outstanding locker Rent, Printing and Stationery, Furniture, 1,00,000, Less: Sales, 8,000, 92,000, Less: Depreciation, 11,500, Building, Less: Depreciation, Investment, , 8,84,000, , 2018-19, , 6,50,000, 32,500, , 1,500, 3,000, , 80,500, 6,17,500, 1,00,000, , 8,84,000

Page 34 :

34, , Accountancy – Not-for-Profit Organisation and Partnership Accounts, , Illustration 12, Prepare Income and Expenditure Account and Balance Sheet for the year ended, March 31, 2015 from the following information., Receipt and Payment Account for the year ending March 31, 2015, Receipts, Balance b/d, Subscriptions:, 2013-14, 7,200, 2014-15, 3,37,600, 2015-16, 12,000, Entrance fees, Locker rent, Revenue from refreshment, Income from investments, , Amount, (Rs.), 41,000, , 3,56,800, 16,000, 58,000, 48,000, 56,000, , Payments, Salaries and Wages:, 2013-14, 4,800, 2014-15, 83,200, Sundry expenses, Freehold land, Stationery, Rates, Refreshment expenses, Telephone charges, Investments, Audit fee, Balance c/d, , 5,75,800, , Amount, (Rs.), , 88,000, 37,000, 60,000, 16,000, 24,000, 37,500, 4,000, 2,50,000, 6,000, 53,300, 5,75,800, , The following additional information is provided to you:, 1. There are 1800 members each paying an annual subscription of, Rs. 200, Rs. 8,000 were in arrears for 2013-14 as on April 1, 2014., 2. On March 31, 2015 the rates were prepaid to June 2015; the charge, paid every year being Rs. 24,000., 3. There was an outstanding telephone bill for Rs. 1,400 on March 31, 2015., 4. Outstanding sundry expenses as on March 31, 2014 totaled Rs. 2,800., 5. Stock of stationery as on March 31, 2014 was Rs. 2000; on March 31, 2015, it, was Rs. 3,600., 6. On March 31, 2014 Building stood at Rs. 4,00,000 and it was subject to, depreciation @ 2.5% p. a., 7. Investment on March 31, 2014 stood at Rs. 8,00,000., 8. On March 31, 2015, income accrued on investments purchased during, the year amounted to Rs. 1,500., , 2018-19

Page 35 :

Accounting for Not-for-Profit Organisation, , 35, , Solution, Income and Expenditure Account, for the year ending on March 31, 2015, Dr., , Cr., , Expenditure, , Amount, (Rs.), , Salaries and Wages, Sundry Expenses, 37,000, Less: Outstanding on, 31.3.2014, 2,800, Stationery : (consumed), Opening stock, 2,000, Add: Purchases, 16,000, Less: Closing stock, 3,600, Rates, 24,000, Less: Paid for 2015-16, 6,000, Add: Prepaid in 2014-15 6,000, Telephone charges, 4,000, Add: Outstanding, 1,400, audit fee, Surplus Depreciation on building, (excess of Income over, expenditure), , 83,200, , 34,200, , 14,400, , 24,000, 5,400, 6,000, 10,000, , Income, Subscriptions, Entrance fees, Locker rent, Income from refreshment:, Revenue from, 48,000, refreshment, Less: Refreshment, 37,500, expenses, Income from, 56,000, investments, Add: Accrued income, 1,500, on current year, investment, , Amount, (Rs.), 3,60,000, 16,000, 58,000, , 10,500, , 57,500, , 3,24,800, 5,02,000, , 5,02,000, , Balance Sheet as on March 31, 2015, Liabilities, Outstanding Telephone, Expenses, Subscription received in, Advance, General Fund, 12,49,400, Add: Surplus, 3,24,800, , Amount, (Rs.), 1,400, 12,000, 15,74,200, , Assets, , Amount, (Rs.), , Cash and Bank Balance, 53,300, Subscription in Arrears, 23,200, Stock of Stationery, 3,600, Rates Prepaid, 6,000, Accrued Interest on investment:, 1,500, Investments, 8,00,000, Additions, 2,50,000 10,50,000, Building, 4,00,000, Less: Depreciation, 10,000, 3,90,000, Land, 60,000, , 15,87,600, , 2018-19, , 15,87,600

Page 36 :

36, , Accountancy – Not-for-Profit Organisation and Partnership Accounts, Balance Sheet as on March 31, 2014, , Liabilities, , Amount, (Rs.), , Outstanding Sundry Expenses, Outstanding Salary and Wages, General Fund, (Balancing figure), , 2,800, 4,800, 12,49,400, , Assets, , Amount, (Rs.), , Cash and Bank balance, Subscription in arrears, Stock of stationery, Rates prepaid, Investments, Building, , 12,57,000, , 41,000, 8,000, 2,000, 6,000, 8,00,000, 4,00,000, 12,57,000, , Working Note :, Subscription Account, Dr., , Cr., , Date Particulars, , J.F., , Opening Balance or, Balance b/d (Arrears, for 2013-14), Income and Expenditure, (1800×200), Balance, c/d (Advance for, 2015-16), , Amount, (Rs.), , Date Particulars, , 8,000, , Receipt and Payment, Balance c/d, , J.F., , Amount, (Rs.), 3,56,800, 23,200, , 3,60,000, 12,000, , 3,80,000, , 3,80,000, , Illustration 13, Following is the Receipt and Payment Account of Friendship Club in respect of, the Year on 31.3.2016., Receipt and Payment Account for the year ending March 31, 2016., Receipts, Opening cash in hand, Subscription:, 2014-15, 15,000, 2015-16, 20,000, 2016-17, 5,000, Profit from sports, Interest on 8% govt. securities, , Amount, (Rs.), 10,000, , 40,000, 17,800, 5,000, , Payment, Salaries, Stationery, Rates and Taxes, Telephone charges, 8% govt. securities at par, Sundry expenses, Courier service charges, Closing cash in hand, , 72,800, , 2018-19, , Amount, (Rs.), 20,000, 4,500, 1,500, 7,500, 25,000, 500, 300, 13,500, 72,800

Page 37 :

Accounting for Not-for-Profit Organisation, , 37, , Additional Information :, 1. There are 500 members, each paying an annual subscription of Rs. 50, Rs. 17,500, being in arrears for 2014-15 at the beginning of 2015-16. During 2014-15,, subscriptions were paid in advance by 40 members for 2015-16., 2. Stock of stationery on March 31, 2015, was Rs. 1,500 and on March 31, 2016, Rs. 2,000., 3. On March 31, 2016, the rates and taxes were prepaid to the following January 31,, the annual charge being Rs. 1,500., 4. A quarter’s charge for telephone is outstanding, the amount accrued being, Rs.1,500. There is no change in quarterly charge., 5. Sundry expenses accruing at 31.3.2015 were Rs. 250 and at March 31, 2016 Rs. 300., 6. On March 31, 2015 Building stood in the books at Rs. 2,00,000 and it is required, to write off depreciation @ 10% p.a., 7. Value of 8% Government Securities on March 31, 2015 was Rs. 75,000 which were, purchased at that date at Par. Additional Government Securities worth Rs. 25,000, are purchased on March 31, 2016., You are required to prepare:, (a) An Income and Expenditure Account for the year ended on 31.3.2016, (b) A Balance Sheet on that date., , Solution, Books of Friendship Club, Balance Sheet as on March 31, 2015, Liabilities, , Amount, (Rs.), , Outstanding Expenses:, Telephone charges, 3,000, Sundry Expenses, 250, Subscription received in, Advance, General Fund, (balancing figure), , 3,250, 2,000, 3,00,000, , Assets, , Amount, (Rs.), , Building, Investment in 8% Govt., Securities, Stock of stationery, Prepaid Rates and Taxes, Subscription outstanding, Cash in hand, , 3,05,250, , 2,00,000, 75,000, 1,500, 1,250, 17,500, 10,000, 3,05,250, , Income and Expenditure Account, for the year ending on March 31, 2015, Expenditure, Salaries, Stationery (paid), Add: Opening stock, Less: Closing stock, Stationery consumed, Rates and Taxes, , Amount, (Rs.), 20,000, 4,500, 1,500, 6,000, 2,000, 4,000, 1,500, , Income, Profit on Sports, Interest on 8% Govt., Securities Received, Add: Receivable, Total Subscription, Received during, the current year, , 2018-19, , Amount, (Rs.), 17,800, 5,000, 1,000, 40,000, , 6,000

Page 38 :

38, , Accountancy – Not-for-Profit Organisation and Partnership Accounts, , Less: Closing Prepaid, Add: Opening Prepaid, Telephone charges paid, Add: Outstanding, (Current Year), Less: Outstanding, (Previous year), Sundry expenses paid, Add: Outstanding, (Current Year), Less: Outstanding, (Previous year), Depreciation on building, Courier charges, , 1,250, 250, 1,250, 7,500, 1,500, 9,000, 3,000, , 1,500, , 6,000, , 500, 300, 800, 250, , 550, 20,000, 300, , Add: Opening, 2,000, Subscription in advance, Add: Outstanding at, 5,500, the end of the, Current Year, (2,500+3,000)=, 47,500, Less: Subscription, 5,000, received in, 42,500, Advance(Closing), Less: Outstanding, 17,500, at the start of, the Current Year, Deficit: (Excess of Expenditure, over to Income), , 52,350, , 25,000*, 3,550, , 52,350, , • Verification: 500 × 50 = 25000., Balance Sheet of Friendship Club as on March 31, 2016, Liabilities, Outstanding Expenses:, Telephone charges, 1,500, Sundry Expenses, 300, Subscription received in, Advance, General Fund, 3,00,000, Less: Deficit, 3,550, , Amount, (Rs.), , 1,800, 5,000, , 2,96,450, , Assets, Building :, 2,00000, Less: depreciation, 20,000, Investment in 8%, 75,000, Govt. Securities:, Add: Purchases, 25,000, Stock of stationery, Interest on 8%, Govt. securities Receivable, Prepaid Rates and Taxes, Subscription outstanding, (Rs.17,500-Rs. 5,000), +Rs. 3,000= Rs.5,500, Cash in hand, , 3,03,250, , Amount, (Rs.), 1,80,000, , 1,00,000, 2,000, 1,000, 1,250, 5,500, , 13,500, 3,03,250, , 1.7 Income and Expenditure Account based on Trial Balance, In case of not-for-profit organisations, normally the Income and Expenditure, Account and Balance Sheet is prepared based on the Receipts and Payments, Account and the additional information given. But, sometimes, the trial, balance along with some additional information is given for this purpose., See Illustration 14., , 2018-19

Page 39 :

Accounting for Not-for-Profit Organisation, , 39, , Illustration 14, From the trial balance and other information given below for a school, prepare, Income and Expenditure Account for the year ended on 31.3.2017 and a Balance, Sheet as on that date:, Debit Balance, , Amount, (Rs.), , Building, Furniture, Library books, Investment @12%, Salaries, Stationery, General expenses, Sports expenses, Cash at bank, Cash in hand, , 6,25,000, 1,00,000, 1,50,000, 5,00,000, 5,00,000, 40,000, 18,000, 15,000, 50,000, 2,000, , Credit Balance, Admission fees, Tuition fees received, Creditors for supplies, Rent for the school hall, Miscellaneous receipts, Government grant, General fund, Donation for library books, Sale of old furniture, , 20,00,000, , Amount, (Rs.), 12,500, 5,00,000, 15,000, 10,000, 30,000, 3,50,000, 10,00,000, 62,500, 20,000, 20,00,000, , Additional Information:, (i) Tution fee yet to be received for the year are Rs. 25,000., (ii) Salaries yet to be paid amount to Rs.30,000., (iii) Furniture costing Rs. 40000 was purchased on October 1, 2016., (iv) The book value of the furniture sold was Rs. 50,000 on April 1, 2016, (v) Depreciation is to be charged @ 10% p.a. on furniture, 15% p.a. on Library books,, and 5% p.a. on building., , Solution, , Expenditure, , Income and Expenditure Account, for the year ending on March 31, 2017, Amount Income, (Rs.), , Loss on sale of old furniture, (50,000 –20,000), Salaries, 5,00,000, Add: outstanding, 30,000, Stationery, General expenses, Depreciation:, Furniture, 3,000, Building, 31,250, Library books, 22,500, Sports expenses, Surplus (excess of income, over expenditure), , 30,000, 5,30,000, 40,000, 18,000, , Admission fees, Tuition fees, 5,00,000, Add: Outstanding, 25,000, Rent for the school hall, Miscellaneous receipts, Government grant, Interest accrued on, investments, , Amount, (Rs.), 12,500, 5,25,000, 10,000, 30,000, 3,50,000, 60,000, , 56,750, 15,000, 2,97,750, 9,87,500, , 2018-19, , 9,87,500

Page 40 :

40, , Accountancy – Not-for-Profit Organisation and Partnership Accounts, , Working Notes:, 1. As admission fee is a regular income of a school, so it has been taken as a revenue, income of the school., 2. Depreciation on furniture has been computed as following on the assumption, that furniture was sold on April 1, 2016., Amount, (Rs.), Book Value on March 31, 2017, 1,00,000, Less: Book Value of Sold furniture, (50,000), 50,000, Depreciation on furniture of Rs. 10,000 for one year, Depreciation on furniture of Rs. 40,000 for 6 months, , 1,000, 2,000, 3,000, , Total depreciation, Balance Sheet as on March 31, 2017, Liabilities, Creditors for Supplies, Outstanding Salaries, Donation for Library Books, General fund, 10,00,000, Add: Surplus, 2,97,750, , Amount, (Rs.), 15,000, 30,000, 62,500, , Assets, Buildings, Less: Depreciation, Furniture, Less: Sold, , 12,97,750, , Amount, (Rs.), 6,25,000, 31,250, 1,00,000, 50,000, 50,000, 3,000, , Less: Depreciation, Accrued fees, Library books, 1,50,000, Less: Depreciation, 22,500, Investments @ 12%, Interest accrued, Cash at bank, Cash in hand, 14,05,250, , 5,93,750, , 47,000, 25,000, 1,27,500, 5,00,000, 60,000, 50,000, 2,000, 14,05,250, , 1.8 Incidental Trading Activity, Sometimes, trading activities such as chemist Shop, hospital, canteen, beauty, parlour etc. also take place in such organisations to provide certain facilities to, members or public in general. In such a situation, trading account has to be, prepared to ascertain the results of such incidental activity. The profit from such, commercial (trading) activities is applied to fulfill the main objectives for which, the organisation was set up, and so it is transferred to the Income and, Expenditure Account. It is pertinent to note the following procedure:, 1. Prepare trading account to determine profit (or Loss) due to incidental, commercial (trading) activity. All costs and revenues directly and exclusively, , 2018-19

Page 41 :

Accounting for Not-for-Profit Organisation, , 41, , related to such activity are recorded in the trading account. Balance of, trading account is transferred to the Income and Expenditure Account., 2. Income and Expenditure Account records, in addition to trading Profit, (or loss), all other incomes and expenses not recorded in the Trading, Account. Surplus or deficit revealed by the Income and Expenditure, Account is transferred to capital/general fund., Illustration 15, Following balances have been extracted from the books of Pleasant Club for the, year ended on March 31, 2016:, Details, , Amount, (Rs.), , Capital Fund as on March 31, 2016, Furniture as on March 31, 2016, Additions of furniture during the year, Billiard Table and other accessories as on March 31, 2016, China glass and cutlery and Linen as on March 31, 2016, Restaurant receipts during the year, Restaurant stock as on March 31, 2016, Receipts from billiard Room during the year, Subscription received during the year, Interest on deposit received during the year, Honorarium paid to Secretary, Purchases for restaurant, Rent and Rates, Wages (restaurant Rs. 1,25,000), Repairs and Renewals, Lighting, Fuel, Sundry expenses, Cash in hand as on March 31, 2016, Bank balance as on March 31, 2016, Bank deposit @10% as on March 31, 2016, , 2,05,000, 21,000, 23,500, 22,250, 6,250, 9,68,000, 9,750, 86,000, 88,750, 6,000, 80,000, 5,59,500, 87,250, 2,30,750, 44,750, 44,250, 33,500, 8,000, 4,375, 36,875, 1,00,000, , Payment for purchases included Rs.7,500 for the year ended on March 31,, 2016. Restaurant stock as on March 31, 2017 were Rs. 11,250. Amount of, subscription received included Rs. 12,000 for the previous year and Rs. 3,000 for, the next year. Subscription outstanding as on March 31, 2017 were Rs. 12,500., Depreciation should be provided as per following rate Structure:, (a) Furniture @ 10 %; (b) Billiard Table and other accessories@ 12%;, (c) glass and cutlery @ 20%., Cost of boarding expenses of the staff is estimated at Rs. 68,750 of which, Rs. 50,000 is to be charged to restaurant., , 2018-19

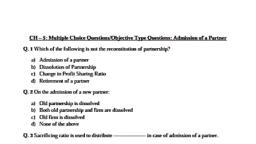

Page 42 :