Page 2 :

Sulalitha - Accountancy, , 1, , Chapter-1, , Accountancy for Not-For-Profit Organisation, , SECTION-A:, 1., , ONE MARK QUESTIONS, , Donations for specific purposes are always capitalized. State True/False., , Ans: True., 2., , Not-for-profit-organisations are used for the welfare of the ____________ ., , Ans: society., 3., , Not-for-profit organisations are formed for _______________ ., a) profit, , b) service, , c) profit and service, , d) None of these, , Ans: b) service., 4., , Give an example for Not-for-profit-organisation?, , Ans: i) Charitable Institutions, ii) Hospitals, Public Libraries., 5., , Give an example for specific donation?, , Ans: Donation for buildings., 6., , Receipt and payment A/c is a summary of _________ book., , Ans: Cash, 7., , _______________ are the amounts received as per the will of the deceased, person., , Ans: Legacies, 8., , Life membership fees is treated as ________________ ., , Ans: Capital receipt, 9., , Name any one final a/c of Not-for-profit -organisation., , Ans: Income and Expenditure A/c, 10., , Capital and Revenue items are recorded in receipt and payment A/c. State, True/False., , Ans: True, 11., , Government grant is treated as ________________ receipt., , Ans: Revenue.

Page 3 :

2, , Sulalitha - Accountancy, , SECTION-D, 1., , Following is the Balance sheet of Shri Ramakrishna Education Society, Udupi, for the year ending 31.3.2019., (June-2016), Balance Sheet as on 31.03.2019, Liabilities, Capital Fund, Affiliation fees dues, Building Fund, Salary Outstanding, , Amount, (`), 54,000, 2,000, 40,000, 4,000, , Assets, , Amount, (`), , Furniture, , 40,000, , Investments, , 26,000, , Sports Equipments, , 15,000, , Subscriptions Outstanding, , 3,000, , Cash at Bank, , 6,000, , Books, , 10,000, , Total 1,00,000, Dr., , Total 1,00,000, , Receipts and payments for the year ending 31.3.2020, Receipts, To Balance b/d, , Amount, (`), 6,000, , Payments, , Cr., Amount, (`), , By Affiliation fees, , 2,000, , To Subscriptions, , 25,000, , By Salaries, , 42,000, , To Govt. Bonds, , 75,000, , By Boards, Maps and Charts, , 8,000, , To Building grants, , 20,000, , By Furniture, , 5,000, , By Repairs and Painting, , 4,000, , By Books, By Postage, , 1,000, , By Tournament expenses, , 5,000, , By Printing and Stationary, , 6,500, , By Union Day function expenses, , 8,500, , By Balance c/d, Total 1,36,000, , 35,000, , 19,000, Total 1,36,000, , Adjustments:, a) Salary payable ` 3,000., b) Subscriptions received in advance during the year ` 500., c) Subscriptions due for the current year ` 1,200., d) Depreciate furniture by ` 2,900 books by ` 6,000 and sports equipments by ` 2,500., Prepare:, i)Income and Expenditure A/c for the year ending 31.3.2020., ii)Balance sheet as on that date.

Page 4 :

Sulalitha - Accountancy, , 3, , Shri Ramakrishna Education Society, Udupi., , Ans:, Dr., , Income and Expenditure A/c for the year ending 31.3.2020, Expenditure, , Amount, (`), , To Affiliation fees, , 2,000, , (–) P.Y. (O/s), , –2,000, , To Salaries, , 42,000, , (–) P.Y. (O/s), , –4,000, , 0000, , Income, , +3,000, , 25,000, , (–) P.Y. (O/s), , –3,000, 22,000, , (+) C.Y. (O/s), , 6,000, , (+) Furniture, , 2,900, , (+) Sports Equipment, , 2,500, , 41,000, , (–) Received in advance, , –500, , 22,700, , By Govt. grants, , 75,000, , By Interest received, , 10,000, , 11,400, , To Repairs and Painting, , 4,000, , To Postage, , 1,000, , To Tournament expenses, , 5,000, , To Printing and Stationary, , 6,500, , To Union day function exp., , 8,500, , To Surpulus, , 1,200, 23,200, , To Depreciation:, Books, , Amount, (`), , By Subscriptions, , 38,000, (+) C.Y. (O/s), , Cr., , 30,300, 1,07,700, , 1,07,700, , Balance Sheet as on 31.03.2020, Liabilities, , Amount, (`), , Subscription received, , Furniture, , in advance, , 500, , Salary O/s, , 3,000, , Building fund, (+) Grants, , 40,000, +20,000, , (+) Surplus, , 60,000, , 54,000, +30,300, , (+) Additions, , 84,300, , Amount, (`), 40,000, 5,000, 45,000, , (–) Depreciation, , Capital Fund :, Opening, , Assets, , –2,900, , Investments, , 26,000, , Sports equipments, , 15,000, , (–) Depreciation, , –2,500, , Subscriptions O/s, , 42,100, , 12,500, 1,200

Page 5 :

4, , Sulalitha - Accountancy, , Cash @ Bank, , 19,000, , Books, , 10,000, , (+) Additions, , 35,000, 45,000, , (–) Depreciation, , 6,000, , Boards, Maps and Charts, , 8,000, , 1,47,800, , 2., , 39,000, , 1,47,800, , Following is the Balance sheet and Receipts and Payments A/c of Ganesh, Education Trust, Udupi., (March, 2016), Balance Sheet as on 31.03.2014, Liabilities, , Amount, (`), , O/s Office Expenses, , 5,000, , Bank Loan, Capital Fund, , Assets, Cash in hand, , 15,000, , 35,000, , Furniture, , 25,000, , 1,20,000, , Buildings, , 70,000, , Sports Materials, , 20,000, , Library Books, , 30,000, , Total 1,60,000, , Dr., , Amount, (`), , Total 1,60,000, , Receipts and payments for the year ending 31.3.2015, Receipts, , Amount, (`), , Payments, , Cr., Amount, (`), , To Balance b/d, , 15,000, , By Office Expenses, , To Subscriptions, , 50,000, , By Postage, , 100, , To Entrance fees, , 8,000, , By Printing, , 500, , To Donations, , 12,000, , To Interest, , 5,000, , 22,000, , By Salary, , 25,000, , By Purchase of Books, , 10,000, , By Bank Loan paid, , 5,000, , By Subscriptions to Newspapers, By Balance c/d, Total, , 90,000, , Adjustments:, i) Subscriptions outstanding ` 5,000., ii) Subscriptions received in advance ` 5,000., iii) Salary prepaid ` 3,000, , 600, 26,800, , Total, , 90,000

Page 6 :

Sulalitha - Accountancy, , 5, , iv) Capitalise 50% of entrance fees and 50% of donations., v) Depreciate building by 10% p.a., Prepare:, a) Income and Expenditure A/c for the year ending 31.3.2015., b) Balance sheet as on 31.03.2015., Ganesh Education Trust, Udupi., , Ans:, Dr., , Income and Expenditure A/c for the year ending 31.3.2015, Expenditure, To Office expenses, (–) O/s expenses (P.Y.), , Amount, (`), 22,000, 5,000, , To Printing & Stationary, To Salary, (–) Prepaid, , By Subscriptions, 17,000, , To Postage, , 22,000, 100, , 50,000, 5,000, 55,000, , received in advance, , 5,000, , 50,000, , By Entrance fees, , 4,000, , 50, 100, By Donation, , 6,000, , 8,000 , , building by 10% p.a., , 7,000, , 10, 100, , 12,000 , , To subscription to newpapers, To Surplus (Bal), , Amount, (`), , (–) Subscription, , To Depreciation on, , 70,000 , , (+) O/s (C.Y.), , 500, , 25,000, 3,000, , Income, , Cr., , 600, , 50, 100, , By Interest, , 5,000, , 17,800, 65,000, , 65,000, , Balance Sheet as on 31.03.2015, Liabilities, , Amount, (`), , Bank Loan, 35,000, (–) Repaid, 5,000, 30,000, Subscription received, in advance, 5,000, Capital fund, Opening Bal., 1,20,000, (+) Entrance fees, 6,000, (+) Surplus, 17,800 1,47,800, Total 1,82,800, , Assets, Cash in hand, Furniture, Building, (–) Depreciation, Sports materials, Library books, (+) Purchases, Prepaid Salary, O/s Subscription, , Amount, (`), 26,800, 25,000, 70,000, 7,000, 30,000, 10,000, , 63,000, 20,000, 40,000, 3,000, 5,000, , Total 1,82,800

Page 7 :

6, , Sulalitha - Accountancy, , 3., , From the following Receipts and Payments account and Balance Sheet of, Union Club, prepare Income and Expenditure account for the year ended, 31.3.2018 and Balance sheet as on that date. (March, 2019), Balance Sheet as on 31.03.2017, Liabilities, , Amount, (`), , Outstanding Salary, , 1,000, , Capital Fund, , 39,900, , Assets, , Amount, (`), , Cash in hand, , 3,500, , Books, , 6,200, , O/S subscription, , 3,600, , Furniture, , 2,600, , Building, Total, , Dr., , 25,000, , 40,900, , Total, , Receipts and payments for the year ended 31.3.2018, Receipts, , Amount, (`), , To Balance b/d, , 3,500, , Payments, , 40,900, , Cr., Amount, (`), , By General expeses, , 900, , To Subscriptions, , 75,000, , To Entrance fees, , 2,000, , By Postage, , 1,300, , To Rent from use of Hall, , 7,000, , By Electricity charges, , 7,800, , To Donation, , 10,000, , To Sale of Newspaper, , 400, , To Life Membership fees, , 7,300, , By Salary, , 16,000, , By Furniture, , 26,500, , By Books, , 13,000, , By Newspaper, , 600, , By Meeting expenses, , 7,200, , By T.V. set, , 16,000, , By Balance c/d, , 15,900, , Total 1,05,200, , Total 1,05,200, , Additional Information:, a), , Subscription outstanding on 31st March, 2018 - Rs. 10,000., , b), , Salary outstanding on 31st March, 2018 - Rs. 1,000., , c), , Depreciation furniture and Books at 10% each (only on opening balances)., , d), , Donation to be capitalised., , e), , Electricity charged paid in advance - Rs. 650.

Page 8 :

Sulalitha - Accountancy, , 7, , Union Club, , Ans:, Dr., , Income and Expenditure A/c for the year ending 31.3.2018, Expenditure, , Amount, (`), , To General expenses, To Salary, (–) O/s (P.Y.), , 900, 16,000, 1,000, 1,000, , To Postage, To Electricity charges, (–) paid in advance, , By Subscriptions, (–) O/s (P.Y.), (+) O/s (C.Y.), , 16,000, 1,300, , 7,800, 650, , To News paper, , Amount, (`), 75,000, 3,600, 71,400, , 15,000, (+) O/s (C.Y.), , Income, , Cr., , 10,000, , 81,400, , By Entrace fees, , 2,000, , By Rent from use of Hall, , 7,000, , By Sale of Newspaper, , 400, , 7,150, 600, , To meeting expenses, , 7,200, , To Depreciation, Furniture (on op. bal), 10, 2,600 , 100, 10, Books 6,200 , 100, To Surplus (Bal), , 260, , 620, , 880, 56,770, , Total, , 90,800, , Total, , 90,800, , Balance Sheet as on 31.03.2018, Liabilities, , Amount, (`), , O/s Salary (31.3.2018), , 1,000, , Capital Fund:, , Assets, , Amount, (`), , Cash in hand, Books, , Opening balance, , 39,900, , (+) Additions, , (+) Surplus, , 56,770, , (+) Donation, , 10,000, , (–) Depreciation, , (+) Life membership, , 73,000 1,13,970, , Furniture, , 15,900, 6,200, 13,000, 19,200, , (+) Purchase, , 620, , 18,580, , 2,600, 26,500, 29,100, , (–) Depreciation, , 260, , 28,840, , Building, , 25,000, , T.V. Set, , 16,000, , O/s Subscription (31.3.2018), , 10,000, , Electricity charges, (paid in advance), Total 1,14,970, , 650, Total 1,14,970

Page 9 :

8, , Sulalitha - Accountancy, , 4., , The following are the Balance Sheet and Receipts and Payments of Mandar, Education Society, Bagalkot., Balance Sheet as on 31.03.2018, Liabilities, , Amount, (`), , Capital fund, , 72,800, , Audit Fees O/s, , 5,000, , Total, , Dr., , Assets, , Amount, (`), , 5% Govt. Bonds, , 62,000, , Furniture, , 6,500, , Maps and Charts, , 3,200, , Cash in Hand, , 4,100, , Subscriptions O/s, , 2,000, , 77,800, , Total, , Receipts and payments for the year ended 31.3.2019, Receipts, , Amount, (`), , To Balance b/d, , 4,100, , To Subscription, , 41,000, , To Donations, , 5,000, , To Interest on, , Payments, , 1,700, , By Autid fees, , 5,000, , By Rent, , 3,600, , By Maps and Charts, , 6,800, , By Salary, , 2,100, , By Balance c/d, 51,800, , Adjustments:, a), , Audit fees Rs. 2,500 till due., , b), , Charge Rs. 500 as depreciation on furniture., , c), , Hall of the donation is to be considered as revenue., , d), , Outstanding Interest on Govt. Bonds Rs. 1,400., Prepare:, i) Income and Expenditure A/c and, ii) New Balance Sheet as on 31.3.2019., , 500, 16,000, , By Functions, , Total, , Cr., Amount, (`), , By Stationary and Postage, , donations, , 77,800, , 17,800, Total, , 51,800

Page 10 :

Sulalitha - Accountancy, , 9, , Mandar Education Society, , Ans:, Dr., , Income and Expenditure A/c for the year ending 31.3.2019, Expenditure, , Amount, (`), , Income, , To Audit Fees, , 5,000, , By Subscriptions, , (–) O/s (P.Y.), , 5,000, , (–) O/s (P.Y.), , 0000, , By Donations 5,000 , , (+) O/s (C.Y.), , 2,500, , To Rent, To Stationery & Postage, To Salary, , Amount, (`), 41,000, 2,000, , 2,500, , 1, 2, By Interest on Govt. bonds, , 3,600, , (+) 62,000 , , 500, , 5, 100, , = (3,100 – 1,700), , Cr., , 39,000, 2,500, , 1,700, 1,400, , 3,100, , Total, , 44,600, , 16,000, , To Functions, , 2,100, , To Depreciation on Furniture, To Surplus (Balance), , 500, 19,400, , Total, , 44,600, , Balance Sheet as on 31.03.2019, Liabilities, , Amount, (`), , Audit Fees O/s, , 2,500, , Capital Fund, Opening Balance, (+) Donations, (+) Surplus, , 72,800, 2,500, 19,400, , 94,700, , Assets, 5% Govt. Bonds, , Amount, (`), 62,000, , (+) Interest, , 1,400, , Furniture, , 6,500, , (–) Depreciation, , 500, , Maps and Charts, , 3200, , (+) Additions, , 6,800, , Cash in hand, Total, 5., , 97,200, , 63,400, 6,000, 10,000, 17,800, , Total, , 97,200, , Following are the Balance Sheet and Receipt and Payment of Sree Sports,, Club, Bengaluru., Balance Sheet as on 31.03.2018, Liabilities, , Amount, (`), 2,000, 32,500, , Outstanding Salary, Capital fund, , Total, , 34,500, , Assets, Cash balance, O/s Subscription, Sports materials, Furniture, , Amount, (`), 7,300, 1,200, 16,000, 10,000, Total, 34,500

Page 11 :

10, , Sulalitha - Accountancy, , Dr., , Receipts and payments for the year ended 31.3.2019, Receipts, , Amount, (`), , To Balance b/d, , 7,300, , To Subscriptions, , 38,000, , To Entrance fees, , 2,000, , To Sale of Old news papers, , 200, , To Sale of old, , Payments, , Cr., Amount, (`), , By Salary, , 10,000, , By Purchase of sports, materials, , 6,000, , By Investments, , 20,000, , By Fixed deposits, , 10,000, , sports materials, , 1,200, , By Postage, , 300, , To Rent, , 7,000, , By General expenses, , 400, , Total, , By Lighting charges, , 1,300, , By Balance c/d, , 7,700, , 55,700, , Total, , 55,700, , Adjustments:, a), , Subscription outstanding for the year 2019 is Rs. 3,000., , b), , Subscription received is advance for the year 2020 - Rs. 1,000., , c), , Depreciation on Sports materials by Rs. 5,000., , d), , Capitalize entrance fees., , e), , Outstanding lighting charges Rs. 300., Prepare:, i), , Income and Expenditure A/c., , ii) Balance sheet as on 31.3.2019., , Sree Sports Club, Bengaluru., , Ans:, Dr., , Income and Expenditure A/c for the year ending 31.3.2019, Expenditure, To Salary, (–) O/s (P.Y.), , Amount, (`), 10,000, 2,000, , By Subscriptions, 8,000, , To Postage, , 300, , To General Expenses, , 400, , To Lighting Charges, (+) O/s, , Income, , (–) O/s (P.Y.), , To Depreciation on, , (+) O/s (C.Y.), , 1,600, , (–) Received in advance, , 5,000, , By Sale of old newpapers, , 31,900, Total, , 38,000, 1,200, 3,000, 39,800, , sports materials, To Surplus, , Amount, (`), , 36,800, , 1,300, 300, , Cr., , 47,200, , 1,000, , 38,800, 200, , By Sale of old sports materials, , 1,200, , By Rent, , 7,000, Total, , 47,200

Page 12 :

Sulalitha - Accountancy, , 11, , Balance Sheet as on 31.03.2019, Amount, Assets, (`), , Liabilities, Subscriptions received, , 1,000, , in advance, , Cahs Balance, Sports materials, , O/s Lighting charges, , 300, , Amount, (`), 7,700, 16,000, , (+) Purchases, , Capital Fund, , 6,000, 22,000, , Opening balance, , 32,500, , (+) Entrance fees, , 2,000, , (+) Surplus, , 31,900, , (–) Depreciation, 66,400, , 5,000, , Investments, , 20,000, , Fixed Deposits, , 10,000, , O/s Subscription, , 3,000, , Furniture, Total, 6., , 17,000, , 10,000, , 67,700, , Total, , 67,700, , Following are the Balance Sheet and Receipts and Payments of Hassan Sports, Club, Hassan., Balance Sheet as on 31-03-2017, Liabilities, , Amount, (`), , Capital Fund, , 61,000, , Assets, , Amount, (`), , Buildings, , 64,000, , Subscription for 2017-18, , 1,000, , O/S Subscriptions, , 1,600, , O/s office expenses, , 4,000, , Outstanding Rent, , 400, , Bank Loan, , 20,000, , Furniture, , 12,000, , Cash at Hand, Total, Dr., , 86,000, , 8,000, Total, , Receipt and Payment Account for the year ended 31-03-2018, Receipts, , Amount, (`), , To Balance B/d, To Subscriptons:, , 8,000, , Payments, , 86,000, Cr., Amount, (`), , By Office Expenses, , 2016-17, , 1,600, , 2016-17, , 4,000, , 2017-18, , 17,600, , 2017-18, , 6,000, , 2018-19, , 2,800, , By subscription to, Newspapers & Journals, , 2,000, 4,000, , To Entrance Fees, , 4,000, , By Refreshment Expenses, , To Rent, , 4,000, , By Investments, , To Income from Drama, , 6,000, , By Bank Loan, , 8,000, , By Salary, , 4,000, , By Balance c/d, , 6,000, , To Sale of newspapers, , 400, Total, , 44,400, , 10,000, , Total, , 44,400

Page 13 :

12, , Sulalitha - Accountancy, , Adjustments:, i) Subscriptions outstanding Rs. 1,000, ii) Salary outstanding Rs. 400., iii) Interest payable Rs. 2,400, iv) Depreciation on Building Rs. 5,000, v) Entrance Fees is to be capitalised., Prepare:, a) Income and Expenditure A/c, b) Balance Sheet as on 31.03.2018., , Hassan Sports Club, Hasan., , Ans:, Dr., , Income and Expenditure Account for the year ending 31st March, 2018, Expenditure, , Amount, (`), , To Office expenses (2017-18), , 6,000, , To Subscriptions to, , Income, By Subscriptions, , Amount, (`), 17,600, , (2017-18), , newspapers and journals, , 2,000, , (+) Subscriptions 2017-18 1,000, , To Refreshment expenses, , 4,000, , (+) O/s, , 1,000, , By Rent, , 4,000, , To Salary, , Cr., , 4,400, , 19,600, , 4,800, , (–) O/s Rent, , To Interest payable, , 2,400, , By Income from Drama, , 6,000, , To Depreciation on building, , 5,000, , By Sale of Newspapers, , 400, , To Surplus, , 5,400, , (+) O/s, , 400, , Total, , 400, , 29,600, , Total, , 3,600, , 29,600, , Balance Sheet as on March 31, 2018, Liabilities, , Amount, (`), , Capital Fund, , Assets, Buildings, , Opening Balance, , 61,000, , (+) Entrance fees, , 4,000, , (+) Surplus, , 5,400, , Bank loan, , 20,000, , (–) Repaid, , 8,000, , Salary O/s, , (–) Depreciation, Furniture, 70,400, 12,000, , Amount, (`), 64,000, 5,000, , 59,000, 12,000, , Cash in hand, , 6,000, , Investments, , 10,000, , O/s subscriptions, , 1,000, , 400, , Interest payable, , 2,400, , Subscription received, in advance (2018-19), , 2,800, Total, , 88,000, , Total, , 88,000

Page 14 :

Sulalitha - Accountancy, , 7., , 13, , From the following Receipt and Payment Account and information given, below, prepare Income and Expenditure Account and the Balance Sheet of, Adult Literacy Organisation as on March 31, 2018., , Dr., , Receipt and Payment Account for the year ending on 31.03.2018, Receipts, , Amount, (`), , To Balance b/d, , 19,550, , To subscriptions, 2017-18, , 27,700, , 2018-19, , 500, , To Sale of old newspaper, , 28,200, 800, , To Govt. grant, To Sale of Furniture, , By General Expenses, , 3,200, , By News papers, , 1,850, , By Electricity, , 3,000, , By Fixed deposit with bank, , 18,000, , (on 30-06-2017) @10% p.a., By Books, , 7,000, , 3,700, , By Salary, , 3,600, , By Rent, , 6,500, , 900, , Fixed Deposits, Total, , Amount, (`), , 12,000, , (book value Rs. 5,000), To Interest received on, , Payments, , Cr., , By Postage charges, , 300, , By Furniture (purchased), , 10,500, , By Balance c/d, , 11,200, , 65,150, , Total, , 65,150, , Additional Information:, i), , Subscription outstanding on 31-03-2018 Rs. 1,500, , ii), , On March 31, 2018 Salary outstanding Rs. 600, , iii), , On April 1, 2017, Organisation owned Furniture Rs. 12,000, Books Rs. 5,000, Adult Literacy Organisation, , Ans:, , Opening Balance Sheet as on 1.4.2017, Liabilities, , Amount, (`), , Capital Fund, , Assets, , Amount, (`), , Furniture, , (Balancing figure), , 36,550, , 12,000, , Books, , 5,000, , Cash/Bank, Total, , 19,550, , 36,550, , Total, , 36,550, , Adult Literacy Organisation, Dr., , Income and Expenditure Account for the year ending 31st March, 2018 Cr., Expenditure, , Amount, (`), , Income, , Amount, (`), , To General Expenses, , 3,200, , By Subscriptions (2917-18)27,700, , To Newspaper, , 1,850, , (+) O/s (C.Y.), , 1,500, , 29,200

Page 15 :

14, , Sulalitha - Accountancy, , To Electricity, , 3,000, , To Salary, , 3,600, , (+) O/S, , 600, , To Rent, To Postage Charges, , 800, , By Govt. grant, 4,200, , By Interest received, , 6,500, , on Fixed deposit, , 300, , To Loss on sale of old furniture, , By Sale of old newspapers, , 1,300, , (+) O/s Interest, , 12,000, 900, 450, , 1,350, , Total, , 43,350, , 10, 9, , , , 900 , 18,000 , 100 12, , , , (Rs. 5,000–Rs. 3,700), To Surplus, , 23,000, Total, , 43,350, , Balance Sheet as on March 31, 2018, Liabilities, , Amount, (`), , Capital Fund, , 36,550, , (+) Surplus, , 23,000, , Subscriptions recd., , Assets, Furniture, , 59,550, , 12,000, , (–) Book value sold, , 500, , in advance for 2018-19, 600, , 31.03.2018, , 5,000, 7,000, , (+) purchases, , Salary outstanding on, , Amount, (`), , 10,500, , Books, , 5,000, , (+) purchases, , 7,000, , 11,200, , Fixed Deposit, , 18,000, 450, , O/s Subscription on 31.3.2018, , 8., , 12,000, , Cash, O/s Interest on F.D., Total, , 17,500, , 60,650, , Total, , 1,500, 60,650, , Receipt and Payment account of Shankar Sports Club, is given below for the, year ended March 31, 2018., Receipts, , Amount, (`), , Payments, , To Cash in hand, , 2,600, , By Rent, , To Entrance fees, , 3,200, , By Usages, , To Donation for Building, , 23,000, , Amount, (`), 18,000, 7,000, , By Billiard Table, , 14,000, 10,000, , To Locker rent, , 1,200, , By Furniture, , To Life membership fees, , 7,000, , By Interest, , 2,000, , To Profit from Entertainment, , 3,000, , By Postage, , 1,000, , To Subscription, , 40,000, , By Salary, , 24,000, , By Cash in hand, Total, , 80,000, , 4,000, Total, , 80,000

Page 16 :

Sulalitha - Accountancy, , 15, , Prepare Income and Expenditure Account and Balance sheet with the help of the, following information :, Subscription outstanding on March 31, 2017 is Rs. 1,200 and Rs. 2,300 on March 31,, 2018, opening stock of postage stamps's is Rs. 300 and Closing stock is Rs. 200, Rent, Rs. 1,500 related 2016-17 and Rs. 1,500 is still unpaid on April 1, 2017 the club owned, furniture Rs. 15,000, furniture value at Rs. 22,500 on March 31, 2018. The club took, a loan of Rs. 20,000 @ 10% p.a. during the year 2016-17., Shankar Sports Club, , Ans:, , Opening Balance Sheet as on 1.4.2017 (31st March, 2017), Liabilities, , Amount, (`), , Rent unpaid, , 1,500, , Loan @ 10% p.a., , 20,000, , Assets, , Amount, (`), , Cash in hand, , 2,600, , Subscriptions O/s (31.3.2017), , 1,200, , Stock of postage, stamps, , 300, , Furniture, , 15,000, , Capital fund (deficiency), Total, , Dr., , 2,400, , 21,500, , Total, , Income and Expenditure Account for the year ending 31.3.2018, Expenditure, To Rent, (–) O/s (P.Y.), , Amount, (`), 18,000, 1,500, 16,500, , (+) O.S. (C.Y.), , 1,500, , 18,000, , To Usages, , 7,000, , To Interest, , 2,000, , To Postage, (+) Op. stock, , 1,000, 300, , 200, , To salary, , Cr., Amount, (`), , By Entrance fees, , 3,200, , By Locker rent, , 1,200, , By Profit from Entertainment, , 3,000, , By Subscription, , 40,000, , (–) O/s (P.Y.), , 1,200, 38,800, , (+) O/s (C.Y.), , 2,300, , 41,100, , By deficit (Excess of, , 1,300, (–) Cl. stock, , Income, , 21,500, , expenditure over Income), , 600, , 1,100, 24,000, , To Depn. on Furniture, (15,000+10,000+22,500), , 2,500, Total, , 54,600, , Total, , 54,600

Page 17 :

16, , Sulalitha - Accountancy, , Balance Sheet as on 31st March, 2018, Liabilities, , Amount, (`), , Assets, , Loan @ 10% p.a., , 20,000, , Cah in hand (31.3.2018), , Donation for building, , 23,000, , Furniture, , Rent unpaid (31.3.2018), , 1,500, , Amount, (`), 4,000, 22,500, , O/s Subscription (C.Y.), , 2,300, , Closing stock of postage stamps, Billiard Table, , 200, 14,000, , Capital fund (Dr. balance) 2,400, (+) Deficit, , 6,100, 8,500, , Total, , 9., , (–) Life membership fees 7,000, , 1,500, , Total, , 44,500, , 44,500, , Sun Club, Dharwad was started from 1.4.2015. Its receipts and payments, account for the year ending 31.3.2016 was as follows., (March, 2017), Receipts, , Amount, (`), , Payments, , Amount, (`), , To Subscription, , 70,000, , By Salry, , 26,500, , To Interest, , 11,000, , By Tournament expenses, , 20,000, , To Tournament fund, , 30,000, , By Telephone charges, , To Games fees, , 25,000, , By Games expenses, , 10,000, , To Life membership fees, , 40,000, , By Sports material, , 20,000, , 6,500, , To Donation, , 2,00,000, , By Buildings, , 2,00,000, , To Entrance fees, , 1,00,000, , By Furniture, , 30,000, , By Office expenses, , 10,000, , By Investments, , 1,00,000, , By Balance c/d, Total 4,76,000, , 53,000, Total 4,76,000, , Adjustments:, a) Outstanding salaries - Rs. 2,000., b) Donations and entrance fees are capitalised., c) Sports materials on 31.3.2016 were valued at Rs. 8,500., d) Depriciate building and furniture by 10%., e) O/s subscription Rs. 5,000 and subscription received in advance Rs. 3,000., Prepare :, i) Income and Expenditure Account., ii) Balance sheet.

Page 18 :

Sulalitha - Accountancy, , 17, , Sun Club, Dharwad, Dr., , Income and Expenditure Account for the year ending 31st March, 2016 Cr., Expenditure, , Amount, (`), , To Salary, , 26,500, , (+) O/s, , 2,000, , To Telephone charges, , Income, By subscription, , 28,500, , (+) O/s (C.Y.), , 6,500, , Amount, (`), 70,000, 5,000, 75,000, , To Games expenses, , 10,000, , (–) received in advance, , To Office expenses, , 10,000, , By Interest, , 11,000, , By Games fees, , 25,000, , To Depreciation @ 10%, , 10, 100, , 20,000, , 10, 100, , 3,000, , Building - 2,00,000 , Furniture - 30,000 , Sports materials, , 3,000, , 72,000, , 11,500, , (20,000 – 8,500), To Surplus, , 18,500, Total 1,08,000, , Total 1,08,000, , Balance Sheet as on 31.3.2016, Liabilities, , Amount, (`), , Capital Fund, Opening Balance, , -, , Assets, , Amount, (`), , Sports material, , 20,000, , (–) Depreciation, , 11,500, , (+) Surplus, , 18,500, , Building, , (+) Life membership, , 40,000, , (–) Depreciation, , 20,000, 30,000, , (+) Donation, , 2,00,000, , Furniture, , (+) Entrance fees, , 1,00,000 3,58,500, , (–) Depreciation, , Tournament fund, , 30,000, , (–) Tournament exp., , 20,000, , O/s Subscription, 10,000, , Cash in hand, , O/s Salaries, , 2,000, , Investments, , Subscriptions recd. in adv., , 3,000, , Total 3,73,000, , 8,500, , 2,00,000, , 3,000, , 1,80,000, , 27,000, 5,000, 53,000, 1,00,000, , Total 3,73,000

Page 19 :

18, , Sulalitha - Accountancy, , Chapter-2, , Accountancy for Partnership: Basic Concepts, , SECTION-A : ONE MARK QUESTIONS, 1., , Section _________ of Indian Partnership Act, 1932 difines Partnership., , Ans: 4., 2., , A partnership has no separate __________ entity., , Ans: Legal, 3., , Partnership is the result of _________ betwen two or more persons to do, business and share, , Ans: Agreement., 4., , In order to form a partnership there should be at least ___________ persons., , Ans: 2, 5., , The agreement should be to carry on some __________ business., , Ans: Lawfull., 6., , The liability of a partner for his acts is ____________ ., , Ans: Unlimited., 7., , Under ____________ method, the capitals of the partners shall remain fixed., , Ans: Fixed capital., 8., , Profit and Loss Appropriation Account is merely an extension of ____________, account of firm., , Ans: P & L A/c, 9., , The agreement between the partner should be in :, a) oral, , b) written, , c) oral or written, , d) None of the above., , Ans: c) Oral or written, 10., , Partnership deed contains:, a) Name of firm, , b) Name and address of the partners, , c) Profit and loss sharing ratio, , d) All of the above, , Ans: d) All of the above.

Page 20 :

Sulalitha - Accountancy, , 11., , 19, , When varying amounts are withdrawn at different intervals, the interest is, calculated using ________________ ., a) Simple method, , b) Average method, , c) Product method, , d) None of the above, , Ans: c) Product method., 12., , In order to form a partnership there should be atleast :, a) one person, , b) two persons, , c) seven persons, , d) None of the above, , Ans: b) Two persons., 13., , The business of a partnership concern may be carried on by :, a) All the partners, , b) Any of them acting for all, , c) All the partners or any of them acting for all. d) None of the above., Ans: c) All the partners or any of them acting for all., 14., , The agreement between partners must be to share:, a) Profits, , b) Losses, , c) Profit and Losses, , d) None of the above, , Ans: c) Profits and losses, 15., , The liability of a partner for acts of the firm is :, a) Limited, , b) Unlimited, , c) Both of the above, , d) None of the above, , Ans: b) Unlimited, 16., , The agreement between partners must be in writing: True/False., , Ans: False, 17., , If the partnership deed is silent about the profit sharing ratio, the profit and, loss of the firm is to be shared equally. True/False, , Ans: True, 18., , In the observe of partnership deed, no partner is entitled to get salary or, commission. True/False., , Ans: True, 19., , P/L Appropriation A/c shows how the profits are appropriated among the, partners: True/ False., , Ans: True., 20., , Interest on partners capital is debited to partner's capital account: True/, False., , Ans: False., 21., , State any one feature of partnership firm., , Ans: i) Two or more persons;, 22., , ii) Agreement or any one., , What is the minimum number of partners in the firm ?, , Ans: The minimum number of partners in partnership firm is two.

Page 21 :

20, , Sulalitha - Accountancy, , 23., , Name any one contents of partnership deed., , Ans: i) Name of the firm ;, 24., , Name any one method of maintaining capital accounts of partners., , Ans: i) Fixed capital method, 25., , ii) Nature of business or any oen., , ii) Fluctuating capital method, , Why the profit and loss appropriation account is prepared?, , Ans: P and L appropriation account is prepared to show how net profit is distributed, among the partner., , SECTION-B: TWO MARK QUESTIONS, 1., , What is partnership ?, , Ans: The partnership is an association of two or more persons who agree to carry on a, legal business jointly and share the profits or losses from that business in an agreed, ratio., 2., , Define partnership?, , Ans: Under section A of Indian partnership Act, 1932 defines partnership as, "the relation, beteen persons who have agreed to share the profits and losses of a business carried, on by all or any of them acting for all.", 3., , State any two features of partnership., , Ans: i) Two or more persons, ii) An agreement, iii) Sharing of profit (any two), 4., , What is partnership deed?, , Ans: When the partnership agreement is written and signed by all the partners and is, duly stamped according to the stamp act. It is called, 'partnership deed.', 5., , Name any two contents of the partnership deed?, , Ans: i) Name of the firm, ii) Profit and loss sharing ratio, iii) Capital contribution by partners., 6., , (any two.), , What are the methods of maintaining capital account of partners?, , Ans: i) Fixed capital method, ii) Fluctuating capital method, 7., , What is fixed capital method?, , Ans: Fixed capital method is the method under which the capitals of the partners shall, remain fixed (same) year after year. It will change only when additonal capital is, introduced or a part of capital is withdrawn., 8., , What is fluctuating capital method?, , Ans: Fluctuating capital method is a method under which the capitals of the partners, fluctuate (change) from year to year under this method only one account i.e., capital, account is maintained for each partner.

Page 22 :

Sulalitha - Accountancy, , 9., , 21, , Name any two methods for calculation of Interest on drawings?, , Ans: i) Average period method; ii) Product method, 10., , What do you mean by profit and loss appropriation account?, , Ans: P & L appropriation account is a special account that a firm prepares to show the, distribution of profits and losses among the partners., , PROBLEMS on Preparation of P & L Appropriation Account (6 Marks), Proforma of P & L Appropriation A/c, Dr., , Profit and Loss Appropriation A/c, , Particulars, , Amount, (`), , Particulars, , Cr., Amount, (`), , To Profit and Loss A/c, (Net loss b/d), , xxx, , By Profit and Loss A/c, (Net profit c/d), , xxx, , To Interest on Capital A/c, , xxx, , By Interest on Drawings A/c, , xxx, , To Partner's Salary/Commission A/c, , xxx, , By Partner's Capital/current A/c, , xxx, , To Partner's Capital /Current A/c, , xxx, , (Distribution of losses), , (Distribution of Profits), xxxx, , 1., , xxxx, , Mithun and Nithin are equal partners with captals of Rs. 1,80,000 and Rs., 1,40,000 rspectively on 01-04-2012. The partnership deed provided for, interest on capital at 5% per annum. Interest on drawings being: Mithun Rs., 540 and Nithin Rs. 360 and annual commission of Rs. 8,000 to Mithun. During, the year Mithun withdrew Rs. 18,000 and Nithin Rs. 12,000 for their private, use., The profit before adjustment of interest on capital, interest on drawings and, Mithun's commission was Rs. 42,100 for the year., Prepare the profit and loss appropriation account for the year ending 31st, March, 2013., , Soln:, Dr. Profit and Loss Appropriation A/c for the year ended 31st March, 2013 Cr., Particulars, , Amount, (`), , To Interest on Capital A/c, Mithun 1,80,000 , Nithin 1,40,000 , , 5, 100, , 5, 100, , Particulars, By Profit and Loss A/c (Profit), , 9,000, 7,000, , Amount, (`), 42,100

Page 23 :

22, , Sulalitha - Accountancy, , To Mithun's commission A/c, To Partner's capital A/c, , 8,000, 19,000, , (Net profit transferred), Mithun 19,000 , Nithin 19,000 , , 1, 2, , 1, 2, , Mithun, , 540, , Nithin, , 360, , 900, , Total, , 43,000, , 9,500, 9,500, Total, , 2., , By Interest on drawings A/c, , 43,000, , Uma and Suma started a partnership business on 1st April, 2013 with capitals, of Rs. 1,00,000 and Rs. 60,000 respectively. They agreed to share the profits, and losses in their capital ratio. It was agreed to allow interest on capitals at, 10% per annum. Suma is allowed monthly salary of Rs. 750 and Uma an annual, commission of Rs. 7,000. During the year Uma withdrew Rs. 12,000 and Suma, Rs. 16,000 and respective interest on drawings amounted to Rs. 600 and Rs., 800. The profit of the firm for the year ending before charging the above, adjustments Rs. 38,600., Show the P and L Appropriation A/c for the year ending 31st March, 2014., , Soln:, Dr. Profit and Loss Appropriation A/c for the year ended 31st March, 2013 Cr., Particulars, , Amount, (`), , To Interest on Capital A/c, Uma 1,00,000 , Suma 60,000 , , 10, 100, , Particulars, , Amount, (`), , By Profit and Loss A/c (Profit), , 38,600, , 10,000, , 10, 100, , 60,000, , By Interest on drawings A/c, , To Suma's Salary A/c (750 12), , 9,000, , Uma, , 600, , To Uma's commission A/c, , 7,000, , Suma, , 800, , 1400, , To Partner's capital A/c, , 8,000, , Total, , 40,000, , (Net profit transferred), Uma 8,000 , , 5, 8, , 5,000, , Suma 8,000 , , 3, 8, , 3,000, Total, , 40,000

Page 24 :

Sulalitha - Accountancy, , 3., , 23, , Vinay and Vidya are partners sharing profits and losses in the ratio of 6:4., Their capitals on 1.04.2012 is Rs. 2,00,000 and Rs. 1,00,000 respectively. They, made profit for the year ended Rs. 89,400 before making the following, adjustments., a) Interest on capital at 8% p.a., b) Allowed Salary Rs. 1,000 p.m. to each partner., c) Their drawings during the year Rs. 20,000 and Rs. 15,000 respectively., d) Interest on drawings amounted to Rs. 2,000 and Rs. 1,800 respectively., Prepare profit and loss appropriation account for the year ended, 31st March, 2013., , Soln., Dr. Profit and Loss Appropriation A/c for the year ended 31st March, 2013 Cr., Particulars, , Amount, (`), , To Interest on Capital A/c, , Particulars, , Amount, (`), , By Profit and Loss A/c (Profit), , Vinay - 2,00,000 , , 8, =16,000, 100, , Vidya - 1,00,000 , , 8, = 8,000, 100, , 24,000, , Vinay, , 2,000, , To Salary to Vinay (1000 12), , 12,000, , Vidya, , 1,800, , To Salary to Vidhya (1000 12), , 12,000, , To Partner's capital A/c, , 45,200, , 89,400, , By Interest on drawings A/c, , (Net profit transferred), Vinay - 45,200 , , 6, = 27,120, 10, , Vidhya - 45,200 , , 4, = 18,080, 10, Total, , 4., , 93,200, , Total, , 93,200, , Arun and Varun are the partners sharing profits and losses in the ratio of, 2:1. Their opening capital being Rs. 80,000 and Rs. 50,000 respectively. They, earned a profit of Rs. 20,000 before allowing the followings:, i) Interest on capital @ 8% P.A., ii) Interest on drawings: Arun Rs. 2,000, Varun Rs. 2,500, iii) Salary to Arun Rs. 3,000 p.a., iv) Commission to Varun Rs. 2,000 p.a.

Page 25 :

24, , Sulalitha - Accountancy, , Dr., , Profit and Loss Appropriation Account, Particulars, , Amount, (`), , To Partner's Capital A/c, , 8, = 6,400, 100, 8, Varun - 50,000 , = 4,000, 100, To Salary to Arun, , Particulars, , Amount, (`), , By Profit and Loss A/c (Profit), , Arun - 80,000 , , To Commission to Varun, , Cr., , 20,000, , By Interest on drawings A/c, 10,400, , Arun, , 2,000, , 3,000, , Varun, , 2,500, , 4,500, , Total, , 24,500, , 2,000, , To Partner's capital A/c, (Net profit transferred), , 2, = 6,067, 3, 1, Varun - 9,100 = 3,033, 3, Total, Arun - 9,100 , , 5., , 9,100, 24,500, , X and Y are partners commenced partnership business on 01-04-2019, sharing, profits and losses in 3:2 ratio with capitals of Rs. 1,00,000 and 80,000, respectively. They earned profits of Rs. 75,000 for the year before allowings., a), b), c), d), , Interest on capitals @ 10% p.a., Interest on drawings: X- Rs. 1,000 and Y Rs. 800., Commission payable to X Rs. 2,000 per month., Salary payable to Y Rs. 3,000 per month., , Prepare P and L Appropriation A/c for the year ending 31-03-2020., Soln., Dr., , Profit and Loss Appropriation A/c for the year ended 31.03.2020, Particulars, , Amount, (`), , To Interest on Capital A/c, 10, X - 1,00,000 , = 10,000, 100, 10, Y - 80,000 , = 8,000, 100, To Commission to X-(2000 12), To Salary to Y (3000 12), , Total, , Particulars, , Cr., Amount, (`), , By Profit and Loss A/c (Profit), , 75,000, , By Interest on drawings A/c, 18,000, , X-, , 1,000, , 24,000, , Y-, , 800, , 36,000, , By Loss transferred to, Partner's capital a/c, 3, X - 1200 = 720, 5, 2, Y - 1200 = 480, 5, , 78,000, , 1,800, 1,200, , Total, , 78,000

Page 26 :

Sulalitha - Accountancy, , 6., , 25, , Sachin and Pratham, Rs. 1,00,000 and Rs., profits and losses in, earned the profits of, , commenced business in partnership with capital and, 80,000 respectively on 01-04-2018 agreeing to share, the ratio of 3:2 for the year ending 31-03-2019. They, Rs. 36,000 before allowing:, , a), , Interest on capital at 5% p.a., , b), , Interest on drawings: Sachin Rs. 600 and Pratham Rs. 1,000., , c), , Yearly Salary of Pratham Rs. 10,000., , d) Their drawings during year Sachin Rs. 16,000 and Pratham Rs. 20,000., Prepare P and L Appropriation A/c., Soln., Dr., , Profit and Loss Appropriation A/c for the year ended 31.03.2019, Particulars, , Amount, (`), , To Interest on Capital A/c, Sachin -, , 1,00,000 , , Pratham - 80,000 , , 5, =, 100, , 5,000, , 5, 100, , 4,000, , =, , To Pratham's Salary, , Particulars, , Cr., Amount, (`), , By Profit and Loss A/c (Profit), , 36,000, , By Interest on drawings A/c, 9,000, , Sachin -, , 10,000, , Pratham, , 600, 1,000, , 1,600, , Total, , 37,600, , To Net profit to Partner's, Capital A/c, Sachin - 18,600 , , 3, = 11,160, 5, , Pratham - 18,600 , , 2, = 7,440, 5, Total, , 18,600, 37,600, , DIFFERENT METHODS of calculating Interest on partner's drawings, I Direct Method or Specific Period Method/ Average Period Method, 1., , Prema is a partner in a firm. She withdrew Rs. 3,000 in the beginning (first), of each month for 12 months. The books of the firm are closed on March,, 31st every year., Calculate interest on drawings if the rate of interest is 10% p.a., , Soln: Calculation of interest on drawings of Prema:, Interest on drawing = Total drawings Rate ×, Total drawings, , =, , 3000 12 = Rs. 36,000, , Average period, 12

Page 27 :

26, , Sulalitha - Accountancy, , Average period, , =, , , Interest on drawings , , , , , , , Longest period Shortest period, 2, 12 1, 1, 6 months, 2, 2, 61, 10, 36000 , 2, 100, 12, 1, 13, 36000 , , 12, 10, 2, 1, 13, 1, 36000 , , , 10, 2, 12, 1, 13, 36000 , , 10, 24, 13, 36000 , 240, , Interest on drawings = Rs. 1,950., , 2., , Mr. Mahohar withdrew Rs. 2,000 in the middle of each month. The, partnership deed provider for charging the interest on drawings @ Rs. 12%, p.a. Calculate interest on Manohar's drawings for the year ending 31st, December, 2017., , Soln: Calculation on Interest on Drawings of Mr. Manohar., Interest on drawing, , = Total drawings Rate ×, , Average period, 12, , Total drawings, , =, , 2000 12 = Rs. 24,000, , Average period, , =, , Longest period Shortest period, 2, , , , 11 12 12, 12, , 6 months, 2, 2, , Interest on drawings 24000 12 6, 100, 12, Rs.1,440, , 3., , Hemanth withdrew Rs. 2,500 at the end of each month. The partnership deed, provids for charging interest on drawings @ 12% p.a. Calculate interest of, Hemanth's drawings for the year ending 31st December, 2018., , Soln: Calculation of interest on drawings of Hemanth., Interest on drawing =, , Total drawings Rate ×, , Average period, 12, , Total drawings, , =, , 2500 12 months = Rs. 30,000, , Average period, , =, , Longest period Shortest period, 2, , , , 11 0, 1, 5 months, 2, 2

Page 28 :

Sulalitha - Accountancy, , 27, , 51, 12, 2, 100, 12, 12, 11, 30000 , , 12, 100, 2, 12, 11, 1, 30000 , , , 100, 12, 12, , Interest on drawings 30000 , , Interest on drawings of Hemanth = Rs. 1,650, , II Problems under Product Method:, 4., , Sahana and Saniya are partners in a firm. Sohana's drawings for the year, 2018-19 are given as under :, Rs. 4,000 on 01.06.2018, Rs. 6,000 on 30.09.2018, Rs. 2,000 on 31.11.2018, Rs. 3,000 on 01.01.2019, Calculate the interest on drawings at 8% p.a. for the year ending on 31.03.2019, under product method., , Soln: Calculation of interest on drawings (under Product Method):, Date (1), , Amount (2), , Period (3), , Product (4), 23, , 01.06.2018, , 4,000, , 10, , 40,000, , 30.09.2018, , 6,000, , 06, , 36,000, , 30.11.2018, , 2,000, , 04, , 8,000, , 01.01.2019, , 3,000, , 03, , 9,000, , Total product, Interest on Drawings, , 93,000, , Total product Rate , , 1, 12, , 8, 1, , 100, 12, Interest on drawings of Sahana = Rs. 620, 93,000 , , 5., , Radha and Ravi are the partners in a firm. Radha's drawings for the year, 2015-16 are given as under :, Rs. 5,000 on 01.04.2015, Rs. 8,000 on 30.06.2015, Rs. 3,000 on 01.12.2015, Rs. 2,000 on 31.03.2016, Calculte the interest on Radha's drawings at 10% p.a. for the year ending, 31.03.2016 under product method.

Page 29 :

28, , Sulalitha - Accountancy, , Soln: Calculation of Interest on Radha's drawing under product method., Date, (1), , Amount, (2), , Period in, months (3), , Product (4), 23, , 01.04.2015, , 5,000, , 12, , 60,000, , 30.06.2015, , 8,000, , 09, , 72,000, , 01.12.2015, , 3,000, , 04, , 12,000, , 31.03.2016, , 2,000, , 00, , 00000, , Total product, Interest on Drawings, , 1,44,000, , Total product Rate , , 1, 12, , 10, 1, , 100, 12, Interest on drawings of Radha = Rs. 1,200., 1,44,000 , , 6., , Yashasvi and Tapasvi are partners in a firm. During the year ended on 31st, March, 2020. Yashasvi makes the drawings as under:, Date of drawings, , Amount (in Rs.), , 01.08.2019, , 5,000, , 31.10.2019, , 8,000, , 31.12.2019, , 10,000, , 31.03.2020, , 15,000, , Partnership Deed provided that partners are to be charged interest on, drawings @ 12% p.a. Calculate the interest on drawings of Yashasvi under, product method., Soln: Calculation of Interest on Yashasvi's drawings under product method:, Date, (1), , Amount, (2), , Period in, months (3), , Product (4), 23, , 01.08.2019, , 5,000, , 8, , 40,000, , 31.10.2019, , 8,000, , 6, , 40,000, , 31.12.2019, , 10,000, , 3, , 30,000, , 31.03.2020, , 15,000, , 0, , 00000, , Total product, Interest on Drawings, , 1,10,000, , Total product Rate , , 12, 1, , 100, 12, Interest on drawings of Yashasvi = Rs. 1,100., 1,10,000 , , 1, 12

Page 30 :

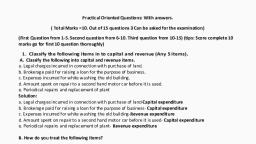

Sulalitha - Accountancy, , 29, , PRACTICAL ORIENTED QUESTIONS, 1., , How do you treat the following in the absence of partnership deed., a) Profit Sharing Ratio, b) Interest on Capital, c) Interest on Drawings, d) Interest on Partner's Loans and Advances, e) Partner's Salary/Commission., , Ans: a) Equal share, b) No Interest on Capital, c) No Interest on Drawings, d) 6% Interest on Loans and Advances, e) No any Salary/Commission to any partner., 2., , Write two partner's capital A/c under fluctuating capital system with 5, imaginary figures :, , Ans:, , Partner's Capital Accounts (Under Fluctuating Capital System), , Dr., , Cr., Particulars, To Drawings A/c, To Int. on Drawings, To Balance c/d, , Ram, (`), , Rahim, (`), , 10,000, , 10,000, , 1,000, , 1,000, , 1,29,000 1,19,000, , Particulars, , Ram, (`), , Rahim, (`), , 1,00,000, , 1,00,000, , By Int. on Capital A/c, , 10,000, , 10,000, , By Ram's Salary A/c, , 10,000, , –––_, , By P & L Appro. A/c, , 20,000, , 20,000, , By Balance b/d, , 1,40,000 1,30,000, , 1,40,000 1,30,000, By Balance b/d, , 3., , 1,29,000 1,19,000, , Prepare two partner's current a/c under fixed capital system with 5 imaginary, figures., Partner's Current Account, , Ans:, Dr., Particulars, To Drawings A/c, To Int. on Drawings, To Balance c/d, , Giri, (`), , Hari, (`), , 10,000, , 10,000, , 1,000, , 1,000, , 29,000, , 29,000, , 40,000, , 30,000, , Giri, (`), , Cr., Hari, (`), , By Int. on Capital A/c, , 10,000, , 10,000, , By Giri's Commission, , 10,000, , –––_, , By P & L Appro. A/c, , 20,000, , 20,000, , 40,000, , 30,000, , 29,000, , 29,000, , Particulars, , By Balance b/d

Page 31 :

30, , Sulalitha - Accountancy, , 4., , Prepare P and L Appropriation A/c of the firm with 5 imaginary figures., , Ans:, Dr., , Profit and Loss Appropriation Account, Particulars, , Amount, (`), , Cr., , Particulars, , Amount, (`), , To Int. on Capital A/c, , By Profit and Loss A/c (N/P b/d), , Sahana - 1,00,000 10 = 10,000, , By Int. on Drawings, , 100, , Saniya - 1,00,000 , , 10, = 10,000, 100, , 20,000, , Sahana, , 1,000, , To Sahana's Salary A/c, , 10,000, , Saniya, , 1,000, , To Saniya's Commission A/c, , 10,000, , 98,000, , 2,000, , To Partner's capital A/c, Sahana - 60,000 , Saniya - 60,000 , , 1 = 8,000, 2, , 1 = 8,000, 60,000, 2, Total 1,00,000, , * * *, , Total 1,00,000

Page 32 :

Sulalitha - Accountancy, , 31, , Chapter-3, , Reconstitution of a Partnership Firm, Admission of a Partner, SECTION-A:, 1., , ONE MARK QUESTIONS, , _________ ratio is used to distribute accumulated profits and losses at the, time of admission of a new partner., , Ans: Old Ratio, 2., , Goodwill brought in by new partner in cash is to be distributed among old, partners in _______ ratio., , Ans: Sacrifice Ration., 3., , ___________ account is debited for the increase in the value of an asset., , Ans: Revaluation Account., 4., , Goodwill is an _________ asset., , Ans: Intangible Asset., 5., , At the time of admission of a new partner, general reserve oppearing in the, old balance sheet is transferred to :, a) All Partners Capital Account, b) New Partner's Capital Account, c) Old Partners Capital Account, d) None of the above, , Ans: c) Old Partners Capital Account., 6., , In the absence of an agreement to the contrary, it is implied that old partners, will contribute to new partner's share of profit in the ratio of :, a) Capital, , b) Old profit sharing ratio, , c) Sacrificing ratio d) Equally, , Ans: d) Equally, 7., , Goodwill raised in books at the time of admission of partner will be written, off in :, a) Old profit sharing ratio, b) New profit sharing ratio, c) Sacrificing ratio, d) None of the above, , Ans: b) New profit sharing ratio., 8., , Increase n the value of an asset is credited to Revaluation account. T/F., , Ans: True., 9., , The traditional name of 'Revaluation A/c' is 'Profit and Loss Adjustment A/c'., T/F., , Ans: True., 10., , Accumulated profit is transferred to all partner's capital accounts including, new partner. T/F, , Ans: False.

Page 33 :

32, , Sulalitha - Accountancy, , Adjustment of Capital, Sometime, at the time of admission, the partners agree that their capitals should also be, adjusted so as to be in proportionate to their profit sharing ratio. (This is done on the basis, of new partners capital and his share). On capital adjustment, if there is excess (surplus), in the capital account, the partner will withdraw the excess amount of capital and if there, is deficit (shortage), the partner will bring in the necessary amount to cover the shortage., Journal Entry: (When adjustments are made in cash), 1), , If there is deficit (shortage) :, Cash (or Bank) A/c, , Dr., , To Concerned Partner's Capital A/c, 2), , xxx, , ___, , ___, , xxx, , xxx, , ___, , ___, , xxx, , If there is surplus:, Concerned Partner's Capital A/c, , Dr., , To Cash (or Bank) A/c, , SECTION-D : 12 Marks Questions, 1., , A and B are partners sharing profits and losses in the ratio of 2 : 1. Their, Balance Sheet as on 31.3.2020 was as follows :, Balance Sheet as on 31.03.2020, Liabilities, , Amount, (`), , Assets, , Amount, (`), , Creditors, , 20,000, , Cash in hand, , Bills Payable, , 10,000, , Stock, , 15,000, , Reserve Fund, , 12,000, , Debtors, , 20,000, , Machinery, , 30,000, , Capitals:, , 5,000, , A, , 60,000, , Buildings, , 60,000, , B, , 40,000, , Investments, , 12,000, , Total 1,42,000, , Total 1,42,000, , On 01.04.2020, 'C' is admitted into partnership on the following conditions:, a) 'C' should bring in cash Rs. 25,000 as his capital and Rs. 15,000 goodwill for his, 1/5th share in future profits., b) Appreciate buildings at 20% and stock is revalued at Rs. 12,000, c) Provision for doubtful debts (PDD) maintained at 5% on debtors., d) Outstanding salary Rs. 2,000., Prepare : i) Revaluation Account., ii) Partner's Capital Account, and, iii) New Balance sheet of the firm.

Page 34 :

Sulalitha - Accountancy, , 33, , Soln.:, Dr., , Revaluation Account, Particulars, , Amount, (`), , To Stock (15,000 – 12,000), , Cr., Particulars, , 3,000, , Buildings, , PDD - 10 20,000 , , , , 1,000, , 20, , 60,000 , , 100, , , , O/s Salary, , 2,000, , Partner's Capital A/c, , 6,000, , 5, , , , A - 6,000 , , 2, = 4,000, 3, , B - 6,000 , , 1, = 2,000, 3, Total, , Dr., , Amount, (`), 12,000, , 12,000, , Total, , 12,000, , Partners Capital A/cs, , Particulars, , A, (` ), , To 'A's Capital A/c, , ––, , B, (`), ––, , C, (`), 10,000, , 2, , 15,000 , 5, , , To 'B's Capital A/c, , 5,000, , 1, , 15,000 , 3, , , , Cr., , Particulars, By Balance b/d, , A, (` ), , B, (`), , C, (`), , 60,000, , 40,000, , ––, , By Revaluation A/c, , 4,000, , 2,000, , ––, , By Reserve Fund, , 8,000, , 4,000, , ––, , (Rs. 12,000 in 2:1 OR), , To Balance c/d, , 82,000, , 51,000, , 25,000, , By Cash A/c (or Bank), (25,000 + 15,000), By 'C's Capital A/c, , ––, 10,000, , –– 40,000, 5,000, , ––, , (Rs. 15,000 in 2:1 SR), Total, , 82,000 51,000, , Dr., , 40,000, , Total, , 82,000, , 51,000 40,000, , By Balance b/d, , 82,000, , 51,000 25,000, , Cash/Bank Account, Particulars, , Amount, (`), , To Balance b/d, , 5,000, , To C's Capital A/c, , Cr., Particulars, , Amount, (`), , By Balance c/d, , 45,000, , 40,000, , (25,000 + 15,000), Total, To Balance b/d, , 45,000, 45,000, , Total, , 45,000

Page 35 :

34, , Sulalitha - Accountancy, , New Balance Sheet as on 1.4.2018, Liabilities, , Amount, (`), , Assets, , Creditors, , 20,000, , Cash in Hand, , Bills payable, , 10,000, , (5,000 + 25,000 + 15,000), , Capitals:, , Stock, 82,000, , Less: Depreciation, , B, , 51,000, , (or written off), , C, , 25,000, , Debtors, , 2,000, , 45,000, , 15,000, , A, , Outstanding Salary, , Amount, (`), , 3,000, , 20,000, , Less: PDD, , 1,000, , Machinery, , 19,000, 30,000, , Buildings, , 60,000, , Add: Appreciation, , 12,000, , Investment, , 72,000, 12,000, , Total 1,90,000, , 2., , 12,000, , Total 1,90,000, , Suresh and Shankar are partners in a firm sharing profits and losses in the, ratio of 1 : 1. Their balance sheet as on 31.03.2017 was as follows:, Balance Sheet as on 31.03.2017, Liabilities, , Amount, (`), , Assets, , Amount, (`), , Creditors, , 40,000, , Cash at Bank, , 30,000, , Bills Payable, , 45,000, , Stock, , 25,000, , Reserve Fund, , 15,000, , Debtors, , Capitals:, , Less: PDD, , 40,000, 2,000, , 38,000, , Suresh, , 60,000, , Furniture, , 10,000, , Shankar, , 40,000 1,00,000, , Machinery, , 15,000, , Buildings, , 92,000, , Patents, , 20,000, , Profit and Loss A/c, , 30,000, Total 2,30,000, , Total 2,30,000, , On 01.04.2017, they admitted Jagadish as a new partner for 1/4th share in the future, profits on the following terms., a) Jagadish should bring in cash Rs. 50,000 as his capital and Rs. 25,000 towards, Goodwill., b) Depreciate Machinery by 10%.

Page 36 :

Sulalitha - Accountancy, , 35, , c) Increase provision for doubtful debts by Rs. 4000., d) Buildings are revalued at Rs. 1,20,500., Prepare : i) Revaluation Account., ii) Partner's Capital Account, and, iii) New Balance sheet of the firm., Soln.:, Dr., , Revaluation Account, Particulars, , Amount, (`), , 10, , , , Cr., Particulars, , To Machinery 10 15,000 , , , , 1,500, , By Buildings, , To Provision for Doubtful Debts (PDD), , 4,000, , (1,20,500 – 92,000), , Amount, (`), 28,500, , To Profit transferred to, 1, Suresh - , 2, , 11,500, , 1, Shankar - , 2, , 11,500, , 23,000, , Total, , 28,500, , Dr., Particulars, , Suresh Shankar Jagadish, , (`), ––, , Particulars, , (`), ––, , 1, , 25,000 , 2, , , 12,500 By Balance b/d, , 12,500 By Reserve Fund, , 1, , 25,000 , 2, , , , Cr., Suresh Shankar Jagadish, , (` ), , By Revaluation A/c, , To Shankar Cap. A/c, , To Balance c/d, , 28,500, , Partners Capital A/cs, (` ), , To Suresh Cap. A/c, , Total, , (`), , (`), , 60,000 40,000, , ––, , 11,500 11,500, , ––, , 7,500, , 7,500, , ––, , 15,000 15,000, , ––, , (Rs. 15,000 in 1:1), 1,06,500, , 86,500, , 50,000 By Profit & Loss A/c, (30,000 in 1:1, By Bank A/c, , ––, , ––, , 75,000, , 12,500 12,500, , ––, , (50,000 + 25,000), By Jagadish Cap. A/c, (Rs. 25,000 1:1 SR), Total, , 1,06,500, , 86,500, , 75,000 Total, By Balance b/d, , 1,06,500, , 86,500, , 75,000, , 1,06,500 86,500, , 50,000

Page 37 :

36, , Sulalitha - Accountancy, , Balance Sheet of Suresh, Shankar and Jagadish as on 1.4.2017, Liabilities, , Amount, (`), , Assets, , Creditors, , 40,000, , Cash at Bank, , Bills payable, , 45,000, , (30,000 + 50,000 + 25,000), , Capitals:, , Amount, (`), 1,05,000, , (Opening bal. + Capital + Goodwill), , Suresh, , 1,06,500, , Stock, , Shankar, , 86,500, , Debtors, , Jagadish, , 50,000, , Less: PDD, , 25,000, 40,000, 6,000, , 34,000, , (2,000 + 4,000), Furniture, , 10,000, , Machinery, , 15,000, , Less: Depreciation, , 1,500, , Buildings, , 92,000, , Add: Appreciation, , 28,500, , Patents, , 1,20,500, 20,000, , Total 3,28,000, , 3., , 13,500, , Total 3,28,000, , Rajesh and Rakesh are partners in a firm sharing profits and losses in the, ratio of 3:2. Their balance sheet as on 31.03.2018 stood as follows :, Balance Sheet as on 31.03.2018, Liabilities, , Amount, (`), , Creditors, , 41,500, , General reserve, , 4,000, , Capitals Accounts :, , Assets, , Amount, (`), , Cash at Bank, , 22,500, , Bills Receivable, Debtors, , 3,000, 18,000, , Rajesh, , 30,000, , Less: PDD, , Rakesh, , 16,000, , Stock, , 20,000, , Buildings, , 25,000, , Machinery, , 4,000, , Total, , 91,500, , 1,000, , Total, , 17,000, , 91,500

Page 38 :

Sulalitha - Accountancy, , 37, , On 01.04.2018, they admit Shyam as a new partner and offered him 1/5th share in, the future profits on the following terms:, a) He has to bring Rs. 10,000 as his capital and Rs. 5,000 towards goodwill., b) Appreciate buildings by 20%., c) Maintain 5% PDD on debtors., d) Provide for outstanding repair bills Rs. 1,000., Prepare: i) Revaluation Account, ii) Partner's Capital Accounts and, iii) New Balance Sheet of the firm., Soln.:, Dr., , Revaluation Account, Particulars, , Amount, (`), , To Provision for, , 1,000, , Cr., Particulars, , Buildings, , O/s Repair bills, , 20, , 25,000 , , 100, , , , To Profit transferred to:, , PDD, , 3, , Rajesh - 5 , , 2, , Dr., Particulars, To Rajesh Cap. A/c, , 5,000, , 100, , , 5, , 18,000 , 1,000 , 100, , , , 2,460, , Rakesh - 5 , , , Amount, (`), , 2,460, , 4,100, , Total, , 5,100, , Total, , 5,100, , Combined Partners Capital A/cs, Rajesh Rakesh Shyam Particulars, (` ), (`), (`), ––, , ––, , Cr., Rajesh Rakesh Shyam, (` ), (`), (`), , 3,000, , By Balance b/d, , 30,000, , 16,000, , ––, , 2,000, , By Revaluation, , 2,460, , 1,640, , ––, , 2,400, , 1,600, , ––, , 3, , 5 5,000 , , , , To Rakesh Cap. A/c, 3, , 5,000 , 5, , , To Balance c/d, , (Profit), 37,860 21,240 10,000, , General Reserve, (Rs. 4,000 in 3:2 OR), By Bank A.c, (1,000 + 5,000), By Shyam's Cap. A/c, (Rs. 5,000 in 3:2 SR), , Total, , 37,860 21,240 15,000, , Total, By Balance b/c, , ––, 3,000, , –– 15,000, 2,000, , ––, , 37,860 21,240 15,000, 37,860, , 21,240 10,000

Page 39 :

38, , Sulalitha - Accountancy, , New Balance Sheet as on 1.4.2018, Liabilities, , Amount, (`), , Creditors, , 41,500, , Capital Accounts:, , Assets, , Amount, (`), , Cash at Bank, , 37,500, , (22,500 + 10,000 + 5,000), , Rajesh, , 37,860, , Bills Receivable, , Rakesh, , 21,240, , Debtors, , Shyam, , 10,000, , Less: PDD, , Provision for O/s repair bills, , 1,000, , 3,000, 18,000, 900, , Stock, , 20,000, , Buildings, , 25,000, , Add: Appreciation, , 5,000, , Machinery, , 30,000, 4,000, , Total 1,11,600, , 4., , 17,100, , Total 1,11,600, , Sachin and Dravid are partners in a firm sharing profits and losses in the, ratio of 3:2. Their balance sheet is given below:, Balance Sheet as on 31.03.2017, Liabilities, , Amount, (`), , Assets, , Amount, (`), , Creditors, , 18,000, , Cash in hand, , 2,000, , Bills payable, , 12,000, , Cash at Bank, , 18,000, , Reserve Fund, , 3,000, , Sundry Debtors, , 25,000, , 20,000, , 2,000, , 23,000, , Capitals:, , Less: PDD, , Sachin - 50,000, , Stock, , 10,000, , Furniture, , 25,000, , Buildings, , 50,000, , Dravid - 50,000, , 1,00,000, , P & L Account, Total 1,33,000, , 5,000, Total 1,33,000, , On 01.04.2017, they admit Ashwin as a new partner into partnership on the following, terms :, a) He brings in Rs. 40,000 as capital and Rs. 18,000 towards goodwill for 1/4th share, in future profits.

Page 40 :

Sulalitha - Accountancy, , 39, , b) Depreciate furniture by 10% and buildings are revalued at Rs. 45,000, c) PDD is increased to Rs. 3,500, d) Prepaid insurance Rs. 2,000, Prepare: i), , Revaluation Account, , ii) Partner's Capital Accounts and, iii) New Balance Sheet as on 01.04.2017., Soln.:, Dr., , Revaluation Account, Particulars, , Amount, (`), , To Furniture, , 2,500, , 10, , 25,000 , , 100, , , , 5,000, , Dr., , 4,200, 2,800, , 7,000, , Total, , 9,000, , Partners Capital A/cs, Sachin Dravid Ashwin Particulars, (` ), (`), (`), 4,200, , 2,800, , ––, , ––, , ––, , ––, , 3, , 18000 , 5, , , , Cr., Sachin Dravid Ashwin, (` ), (`), (`), , By Balance b/d, , 50,000, , 50,000, , ----, , By Reserve fund, (3,000 in 3 : 2), , 1,800, , 1,200, , ----, , By Bank A/c, , ––, , –– 58,000, , (40,000 + 18,000), ––, , –––, , –––, , 2, , 18,000 , 5, , , Total, , 3, , Sachin 5 , , , 9,000, , To Profit & Loss A/c, (5,000 in 3 : 2), , To Balance c/, , 2,000, , 1,500, Total, , To Dravid Cap. A/c, , By Prepaid Insurance, , Dravid 5 , , , To PDD (3,500 – 2,000), , To Sachin's Cap. A/c, , Amount, (`), , 2, , (50,000 – 45,000), , To Revaluation, , Particulars, , By Loss transferred to :, , To Buildings, , Particulars, , Cr., , By Ashwin's Cap. A/c 10,800, , 7,200, , ––, , (18,000 in 3 : 2 SR), 55,400, , 53,600, , 40,000, , 62,600 58,400, , 58,000, , Total, , 62,600, , 58,400 58,000, , To Balance c/d, , 55,400, , 53,600 40,000

Page 41 :

40, , Sulalitha - Accountancy, , New Balance Sheet as on 1.4.2017, Liabilities, , Amount, (`), , Assets, , Amount, (`), , Creditors, , 18,000, , Cash at hand, , 60,000, , Bills payable, , 12,000, , Cash at Bank, , 18,000, , Sundry debtors, Capitals:, , Less:PDD (2,000+1,500), , Sachin, , 55,400, , Stock, , Dravid, , 53,600, , Furniture, , Ashwin, , 40,000 1,49,000, , Less: Depreciation, , 25,000, 3,500, , 10,000, 25,000, , Buildings, , 2,500, , 22,500, , 50,000, , Less: Depreciation, , 5,000, , Prepaid Insurance, Total 1,79,000, , 5., , 21,500, , 45,000, 2,000, , Total 1,79,000, , Surekha and Sunita are partners in a firm. Their Balance Sheet as on, 31.03.2017 was as follows :, Balance Sheet as on 31.03.2017, Liabilities, Creditors, , Amount, (`), 1,50,000, , General Reserve, , 50,000, , Assets, , Amount, (`), , Cash at Bank, , 50,000, , Stock, , 50,000, , Furniture, Capitals:, , 1,20,000, , Debtors, , Surekha, , 1,20,000, , Sunita, , 50,000, , 40,000, , Buildings, , 1,00,000, , Investments, , Total 4,00,000, , 40,000, Total 4,00,000, , On 01.04.2017, Kavita is admitted into the partnership on the following terms., a) She brings in Rs. 60,000 as capital and Rs. 20,000 towards Goodwill for 1/4th share, in the future profits., b) Depreciate furniture by 10% and appreciate building by Rs. 22,000., c) Investments are to be revalued at Rs. 50,000, d) Provide Rs. 2,000 for outstanding salary., Prepare: i), , Revaluation Account, , ii) Partner's Capital Accounts and, iii) New Balance Sheet of the firm.

Page 42 :

Sulalitha - Accountancy, , 41, , Soln.:, Dr., , Revaluation Account, Particulars, , Amount, (`), , To Furniture, , 12,000, , 10, , 1,20,000 , , 100, , , , To Salary outstanding, , 2,000, , Cr., Particulars, , Amount, (`), , By Buildings A/c, , 22,000, , By Investments, , 10,000, , (50,000 – 40,000), , To Profits transferred to, Surekha 1 , 2, , 9,000, , , , 1 , , Sunita , 2, , 9,000, , 18,000, , Total, , 32,000, , Dr., , Total, , 32,000, , Partners Capital A/cs, , Particulars, To Surekha's, 1, , Surekha, (` ), , Sunita, (`), , ––, , Cr., , Kavita Particulars, (`), , Surekha, (` ), , Sunita Kavita, (`), (`), , ––, , 10,000 By Balance b/d, , 1,20,000, , 80,000, , ––, , ––, , ––, , 10,000 By Revaluation A/c, , 9,000, , 9,000, , ––, , 10,000, , 10,000, , –– By General Reserve, , 25,000, , 25,000, , ––, , , , Cap. A/c 20,000, 2, , To Sunita's Cap. A/c, 1, , 20,000 , 2, , , To Bank A/c, (Goodwill amt., , (Rs. 50,000 in 1:1), , withdrawn), , By Bank A/c, , To Balance c/d, , 1,54,000 1,14,000, , ––, , –– 80,000, , 60,000 (60,000 + 20,000), By Kavitha's Cap. A/c, , 10,000, , 10,000, , ––, , (Rs. 20,000 in 1:1 SR), Total, , 1,64,0001,24,000 80,000 Total, To Balance c/d, , 1,64,000 1,24,000 80,000, 1,54,000 1,14,600 60,000

Page 43 :

42, , Sulalitha - Accountancy, , New Balance Sheet as on 1.4.2017, Liabilities, , Amount, (`), , Creditors, , 1,50,000, , Capitals:, , Assets, Cash at Bank, , 1,10,000, , (50,000 + 60,000+20,000–20,000), , Surekha, , 1,54,000, , Stock, , Sunitha, , 1,14,000, , Furniture, , Kavitha, , 60,000, , O/S Salary, , 2,000, , 50,000, 1,20,000, , Less: Depreciation, , 12,000, , Debtors, , 1,08,000, 40,000, , Buildings, , 1,00,000, , Add: Appreciation, , 22,000, , Investments, , 40,000, , Add: Appreciation, , 10,000, , Total 4,80,000, 6., , Amount, (`), , 1,22,000, , 50,000, , Total 4,80,000, , Raja and Rani are partners in a firm sharing profits and losses in the ratio of, 3:2. Their Balance Sheet as on 31.03.2018 was as follows :, Balance Sheet as on 31.03.2018, Liabilities, , Amount, (`), , Assets, , Amount, (`), , Creditors, , 40,000, , Cash, , Bills Payable, , 20,000, , Machinery, , 60,000, , General Reserve, , 25,000, , Stock, , 25,000, , Capitals Accounts :, , Debtors, , 5,000, , 23,000, , Raja, , 60,000, , Less: PDD, , Rani, , 40,000 1,00,000, , Buildings, , 50,000, , Investments, , 20,000, , P and L Account, Total 1,85,000, , 3,000, , 20,000, , 5,000, Total 1,85,000, , On 01.04.2018, they admitted Mantri as a partner and offer him 1/5th share in the, future profits on the following terms:, a) Mantri has to bring in Rs. 30,000 as his capital and Rs. 10,000 towards goodwill., Goodwill is to be withdrawn by the old partners.

Page 44 :

Sulalitha - Accountancy, , 43, , b) Depreciate Machinery by 5%., c) Appreciate buildings by 10%., d) PDD is reduced to Rs. 2,000 and investments are to be revalued at Rs. 25,000., Prepare: i), , Revaluation Account, , ii) Partner's Capital Account and, iii) New Balance Sheet of the firm., Soln.:, Dr., , Revaluation Account, Particulars, , Amount, (`), , To Machinery, , 3,000, , Cr., Particulars, , Amount, (`), , By Buildings, , 5,000, , 10, , 60,000 , , 100, , , 10, , 50,000 , , 100, , , To Profit transferred to:, , By PDD (3,000 – 2,000), , 1,000, , By Investments, , 5,000, , 3, , Raja - 5 , , , 4,800, , 2, , Rani - 5 , , , Dr., , 3,200, , 8,000, , Total, , 11,000, , Raja, (` ), , Rani, (`), , To P/L A/c, , 3,000, , 2,000, , (Rs. 5,000 in 3:2), , To Cash A/c, , ––, , ––, , Total, , –– By Balance b/c, , 6,000 By General Reserve, , 11,000, , Cr., Raja, (` ), , Rani Manthri, (`), (`), , 60,000 40,000, 4,800, , ––, , 3,200, , ––, , 15,000 10,000, , ––, , (Rs. 25,000 in 3:2), ––, , ––, , 6,000, , 4,000 By Cash A/c, , By Manthri's Cap. A/c, 76,800, , ––, , ––, , 40,000, , 6,000, , 4,000, , ––, , 85,800 57,200, , 40,000, , 76,800 51,200, , 30,000, , (30,000 + 10,000), , 2, , 5 10,000 , , , , To Balance c/d, , Manthri Particulars, (`), , By Revaluation A/c, , 3, , 10,000 , 5, , , To Rani's Cap. A/c, , Total, , Partners Capital A/c, , Particulars, , To Raja's Cap. A/c, , (25,000 – 20,000), , 51,200, , 85,800 57,200, , 30,000 (Rs. 10,000 in 3:2 SR), 40,000 Total, By Balance b/d

Page 45 :

44, , Sulalitha - Accountancy, , New Balance Sheet as on 1.4.2018, Liabilities, , Amount, (`), , Assets, , Creditors, , 40,000, , Cash, , Bills Payable, , 20,000, , (5,000+30,000+10,000–10,000), , Capital, , 35,000, , Machinery, , 60,000, , Raja, , 76,800, , Less: Depreciation, , Rani, , 51,200, , Stock, , Manthri, , 30,000, , Debtors, , 3,000, , 57,000, 25,000, , 23,000, , Less: PDD, , 2,000, , Buildings, , 21,000, , 50,000, , Add: Appreciation, Investments, Less: Appreciation, Total 2,18,000, , 7., , Amount, (`), , 5,000, , 55,000, , 20,000, 5,000, , 25,000, , Total 2,18,000, , A and B are partners in a firm sharing profits and losses in the ratio of 6:4., Their balance sheet as on 31.03.2017 was as follows :, Balance Sheet as on 31.03.2017, Liabilities, Creditors, , Amount, (`), 20,000, , Assets, , Amount, (`), , Cash in hand, , Bills payable, , 6,000, , Debtors, , Reserve Fund, , 4,000, , Less: PDD, , 5,000, 20,000, 2,000, , 18,000, , Capitals:, , Stock, , 17,000, , A - 40,000, , Buildings, , 30,000, , Furniture, , 30,000, , B - 30,000, , 70,000, Total 1,00,000, , Total 1,00,000, , On 01.04.2017, 'C' is admitted into the partnership on the following terms:, a) He brings Rs. 25,000 as capital and Rs. 8,000 towards goodwill for 1/6th share in, the future profits., b) Depreciate furniture at 10% and appreciate buildings by 20%., c) Provision for doubtful debts is no longer necessary.

Page 46 :

Sulalitha - Accountancy, , 45, , d) Provide Rs. 1,000 for repair charges., e) Goodwill is to be withdrawn by the old partners., Prepare: i), , Revaluation Account, , ii) Partner's Capital Account and, iii) New Balance Sheet of the firm after admission., Soln.:, Dr., , Revaluation Account, Particulars, , Amount, (`), , To Furniture, , 3,000, , 10, , 100 30,000 , , , , Cr., Particulars, , Amount, (`), , By Buildings, , 6,000, , 20, , 100 30,000 , , , , To Provision for repair, charges, , 4,000, , By PDD, , 2,000, , To Profit transferred to, 6 , , A - 10 , , , 2,400, , 4 , , B - 10 , , , 1,600, , 4,000, , Total, , 8,000, , Dr., Particulars, To 'A's Cap. A/c, , Total, , 8,000, , Partners Capital A/c, A, (` ), , B, (`), , Cr., , C, (`), , Particulars, , A, (` ), , B, (`), , C, (`), , 40,000, , 30,000, , ––, , ––, , ––, , 4,800, , By Balance b/c, , ––, , ––, , 3,200, , By Revaluation A/c, , 2,400, , 1,600, , ––, , 4,800, , 3,200, , ––, , By Reserve Fund, , 2,400, , 1,600, , ––, , 6, , 10,000 , , 10, , , To B's Cap. A/c, 4, , 10 10,000 , , , , To Cash A/c (Goodwill, amount withdrawn), To Balancd c/d, Total, , By Cash A/c, 44,800, , 33,200, , 25,000, , 49,600 36,400, , 33,000, , By C's Capital A/c, (Rs. 8,000 in 6:4 SR), , ––, 4,800, , –– 33,000, 3,200, , ––, , Total, , 49,600, , 36,400 33,000, , By Balance b/d, , 44,800, , 33,200 25,000

Page 47 :

46, , Sulalitha - Accountancy, , New Balance Sheet as on 1.4.2017, Liabilities, , Amount, (`), , Creditors, , 20,000, , Bills Payable, , 6,000, , Capitals:, , Assets, Cash in Hand, Debtors, , 20,000, , Stock, , 17,000, , 44,800, , Buildings, , B, , 33,200, , Add: Appreciation, , C, , 25,000, , Furniture, , 1,000, , 30,000, 6,000, , 36,000, , 30,000, , Less: Depreciation, , Total 1,30,000, , 8., , 30,000, , (5,000+25,000+8,000–8,000), , A, , Provision for repair charges, , Amount, (`), , 3,000, , 27,000, , Total 1,30,000, , Anil and Sunil are partners in a firm sharing profits in the ratio of 2:1. Their, balance sheet as on 31.03.2016 was as follows:, Balance Sheet as on 31.03.2016, Liabilities, , Amount, (`), , Bills Payable, , 16,000, , Assets, , Amount, (`), , Cash, , 4,000, , Sundry Creditors, , 5,000, , Sundry Debtors, , 30,000, , Reserve Fund, , 9,000, , Stock, , 32,000, , Capitals:, , Furniture, , 8,000, , Anil, , 60,000, , Buildings, , 56,000, , Sunil, , 50,000, , Motor Car, , 10,000, , Total 1,40,000, , Total 1,40,000, , On 01.04.2016, they admitted Vimal for 1/4 th share in future profits under the, following terms., a) He should bring cash for capital Rs. 40,000 and Rs. 30,000 for goodwill., b) Half of the goodwill amount withdrawn by the old partners., c) Buildings are revalued at Rs. 66,000 and make a provisiion for legal, charges Rs. 700., d) Stock and Motor Car be depreciated by 10% cash., e) Provide for doubtful debts at 5% on debtors., Prepare: i), , Revaluation Account, , ii) Partner's Capital Account and, iii) New Balance Sheet of the firm.

Page 48 :

Sulalitha - Accountancy, , 47, , Soln.:, Dr., , Revaluation Account, Particulars, , Amount, (`), , To Provision for legal charges, 10, , 700, , , , To Stock 100 32,000 , , , , Cr., Particulars, , Amount, (`), , By Buildings A/c, , 10,000, , (66,000 – 56,000), , 10, , , , To Motor Car 100 10,000 , , , , 1,000, , To Provision for doubtful, , 1500, , 5, , , , debts (PDD) 100 30,000 , , , To Profit transferred to :, 2, , Anil 3 , , , 2,400, , 1 , , Sunil 3 , , , 1,200, , 3,600, , Total, , 10,000, , Dr., , Total, , 10,000, , Partners' Capital A/c, , Particulars, To Anil's Cap. A/c, , Vimal Particulars, (`), , Cr., , Anil, (` ), , Sunil, (`), , Anil, (` ), , Sunil Vimal, (`), (`), , ––, , ––, , 20,000 By Balance b/d, , ––, , ––, , 10,000 By Revaluation A/c, , 2,400, , 1,200, , ––, , 10,000, , 5,000, , –– By General Reserve, , 6,000, , 3,000, , ––, , 60,000 50,000, , ––, , 2, , 3 30,000 , , , , To Sunil's Cap. A/c, 1, , 30,000 , 3, , , , To Cash A/c, 1, , ( 2 of Goodwill amt., withdrawn), , (Rs. 9,000 in 2:1), By Cash A/c, , To Balance c/d, , 78,400, , 59,200, , ––, , –– 70,000, , 40,000 (40,000 + 30,000), By Vimal's Cap. A/c, , 20,000 10,000, , ––, , (Rs. 30,000 in 2:1 SR), Total, , 88,400 64,200 70,000 Total, To Balance b/d, , 88,400 64,200 70,000, 78,400 59,200 40,000

Page 49 :

48, , Sulalitha - Accountancy, , Dr., , Cash Account, Particulars, , Amount, (`), , To Balance b/d, , 4,000, , To Vimal's Capital, , 70,000, , (40,000 + 30,000), , Cr., Particulars, , Amount, (`), , By Anil's Capital A/c, , 10,000, , 1, , 20,000 , 2, , , , By Sunil's Capital, , 5,000, , 1, , 2 10,000 , , , , By Balance c/d, Total, To Balance b/d, , 74,000, , 59,000, Total, , 74,000, , 59,000, , New Balance Sheet as on 1.4.2016, Liabilities, , Amount, (`), , Bills Payable, , 16,000, , Sundry Creditors, , 5,000, , Capitals:, , Assets, , Cash at Bank, , Anil, , 78,400, , Less: PDD, , Sunil, , 59,200, , Stock, , Vimal, , 40,000, , Less: Depreciation, , 700, , 30,000, 1,500, , 28,500, , 32,000, 3,200, , Furniture, , 28,800, 8,000, , Buildings, , 56,000, , Add: Appreciation, , 10,000, , Motor car, , 10,000, , Less: Depreciation, Total 1,99,300, , 1,10,000, , (4,000 + 40,000 + 30,000 – 15,000), Sundry Debtors, , Provision for legal charges, , Amount, (`), , 1,000, , 66,000, , 9,000, , Total 1,99,300

Page 50 :

Sulalitha - Accountancy, , 9., , 49, , Purari and Purohit are equal partners. Their Balance Sheet as on 31.03.2017, was as follows :, Balance Sheet as on 31.03.2017, Liabilities, , Amount, (`), , Bills Payable, Sundry Creditors, , Assets, , 6,600, , Cash, , 1,800, , 12,800, , Stock, , 23,600, , Capitals:, , Sundry debtors, , Pujari - 40,000, , Less: PDD, , Purohit - 30,000, , 70,000, , Total, , Amount, (`), , 25,000, 5,000, , 20,000, , Furniture, , 4,000, , Buildings, , 40,000, , 89,400, , Total, , 89,400, , On 01.04.2017, they admit Pandit as a new partner and offered him 1/4th share in the, profit on the following terms:, a) He should bring in Rs. 30,000 as capital and Rs. 18,000 towards goodwill., b) Half of the goodwill should be withdrawn by the old partners., c) Stock and furniture to be depreciated by 10% each., d) PDD is reduced by Rs. 3,000., Prepare: i), , Revaluation Account, , ii) Partner's Capital Account and, iii) New Balance Sheet of the firm., Soln.:, Dr., , Revaluation Account, Particulars, , Amount, (`), , 10, , , To Furniture , 23,600 , 100, , 10, , 2,360, , , , 4,000 , By Furniture , 100, , , Cr., Particulars, , Amount, (`), , By PDD, , 3,000, , 400, , To Profit transferred to:, Pujari - 1 , 2, , 120, , Purohit - 1 , 2, , 120, , 240, , Total, , 3,000, , , , Total, , 3,000

Page 51 :

50, , Sulalitha - Accountancy, , Note on PDD:, PDD appearing in Balance Sheet Rs. 5,000, It is decreased by Rs. 3,000 (Adj. d), Therefore, balance PDD is 5,000 – 3,000 = Rs. 2,000, Treatment:, i), ii), , Take decrease in PDD of Rs. 3,000 on the credit side of Revaluation A/c., Deduct Balance PDD of Rs. 2,000 from debtors of Rs. 25,000 in the Balance Sheet., , Dr., , Partners' Capital A/c, , Particulars, , Puraji, (` ), , To Pujari's Cap. A/c, , ––, , Purohit, (`), , Pandit, (`), , ––, , 9,000, , 1, , 18,000 , 2, , , ––, , ––, , 9,000, , 1, , 2 18,000 , , , , Pujari Purohit Pandit, (` ), (`), (`), , By Balance b/d, , 40,000, , 30,000, , ––, , 120, , 120, , ––, , By Cash A/c, , ––, , –– 48,000, , (30,000 + 18,000), , To Cash, (Half of the goodwill, amount withdrawn), , Total, , Particulars, , By Revaluation A/c, , To Purohit Cap. A/c, , To Balance c/d, , Cr., , 4,500, , 4,500, , ––, , 44,620 34,620, , 30,000, , 49,120 39,120 30,000, , By Pandit Capital A/c, (Rs. 18,000 in 1:1 SR), , 9,000, , 9,000, , ––, , 1, , , , Purohit - 18,000 2 , , , , Total, , 49,120 39,120 30,000, , To Balance b/d, , 44,620 34,620 30,000, , New Balance Sheet as on 1.4.2017, Liabilities, Bills Payable, Sundry Creditors, , Amount, (`), 6,600, 12,800, , Assets, Cash, , 40,800, , (1,800+30,000+18,000–9,000), Stock, , Capital Accounts:, , Amount, (`), , Less: Depreciation, , 23,600, 2,360, , Pujari, , 44,620, , Sundry Debtors, , Purohit, , 34,620, , Less: PDD (5,000 – 3,000) 2,000, , Pandit, , 30,000, , Furniture, Less: Depreciation, Buildings, , Total 1,28,640, , 21,240, , 25,000, 23,000, , 4,000, 400, , 3,600, 40,000, , Total 1,28,640

Page 52 :

Sulalitha - Accountancy, , 10., , 51, , Sharat and Bharat are sharing profits and losses in the ratio 2 : 1. Their, Balance Sheet as on 31.03.2018 was as follows :, Balance Sheet as on 31.03.2018, Liabilities, , Amount, (`), , Creditors, , 12,000, , Assets, Cash in Hand, , Bills Payable, , 8,000, , Debtors, , Reserve Fund, , 9,000, , Stock, , Capitals:, Sharat, , 20,000, , Bharat, , 20,000, , 40,000, , Total, , 69,000, , Amount, (`), 10,000, 5,000, 10,000, , Furniture, , 4,000, , Buildings, , 40,000, , Total, , 69,000, , They admitted Kamat into partnership giving him1/4th share in the future profits on, the following terms :, a) The new partner should bring Rs. 25,000 as his capital., b) The goodwill of the firm is valued at Rs. 24,000., c) Value of buildings is to be appreciated by Rs. 7,000 and furniture to be appreciated, by Rs. 1,000., d) Stock is valued at 10% less than the book value and there is an oustanding printing, bill for Rs. 400., Prepare: i) Revaluation Account, ii) Partner's Capital Account and, iii) Balance Sheet of the new firm., Soln.:, Dr., , Revaluation Account, Particulars, , Amount, (`), , To Stock, , Cr., Particulars, , Amount, (`), , 1,000, , Buildings, , 7,000, , 400, , Furniture, , 1,000, , 10, , 100 10,000 , , , , To Outstanding Printing bill, To Profit transferred to, 2, , Sharat - , 3, , 4,400, , 1, Bharat - , 3, , 2,200, , 6,600, , Total, , 8,000, , , , Total, , 8,000

Page 53 :

52, , Sulalitha - Accountancy, , Dr., , Partners' Capital A/c, , Particulars, , Sharat, (` ), , To Sharat's Cap. A/c, , Cr., , Bharat Kamat Particulars, (`), (`), , Sharat Bharat Kamat, (` ), (`), (`), , ––, , ––, , 4,000, , By Balance b/d, , 20,000 20,000, , ––, , ––, , ––, , 2,000, , By Revaluation A/c, , 4,400, , 2,200, , ––, , 34,400, , 27,200, , 19,000, , By Reserve Fund, , 6,000, , 3,000, , ––, , 2, , 6000 , 3, , , , To Bharat's Cap. A/c, 1, , 3 6000 , , , , To Balance c/d, , (Rs. 9,000 in 2:1 OR), By Cash A/c, , ––, , By Kamaths Cap. A/c, , 4,000, , –– 25,000, 2,000, , ––, , (Rs. 6,000 in 2:1 SR), Total, , Note:, , 34,400 27,200 25,000, , Total, , 34,400 27,200 25,000, , To Balance c/d, , 34,400 27,200 19,000, , 1, , Kamath's share of goodwill = 4 24,000 6,000, Sacrifice ratio of Sharat and Bharath = 2 : 1 (i.e., old ratio itself.), 2, , , , 1, , , , Credit to Sharat = 3 6000 = 4,000, , , Credit to Bharat = 3 6000 = 2,000, , , New Balance Sheet as on 31.3.2017, Liabilities, Creditors, Bills Payable, , Amount, (`), 12,000, 8,000, , Assets, Cash (10,000 + 25,000), , 35,000, , Debtors, Stock, , Capitals:, , Amount, (`), , 5,000, 10,000, , Less: Depreciation, , 1,000, , Sharat, , 34,400, , Furniture, , 4,000, , Bharat, , 27,200, , Add: Appreciation, , 1,000, , Kamat, , 19,000, , Buildings, , Outstanding Printing Bill, Total, , 400, 1,01,000, , Add: Appreciation, Total, , 9,000, , 5,000, , 40,000, 7,000, , 47,000, 1,01,000

Page 54 :

Sulalitha - Accountancy, , 11., , 53, , Vani and Sandhya are partners sharing profits and lossesin the proportion, of 3/5 and 2/5. Their Balance Sheet as on 31.03.2018 was as follows :, Balance Sheet as on 31.03.2018, Liabilities, , Amount, (`), , Assets, , Amount, (`), , Creditors, , 77,500, , Cash at Bank, , 21,500, , Reserve Fund, , 20,000, , Stock, , 39,000, , P and L Account, , 5,000, , Capitals:, , Debtors, , 60,000, , Less: PDD, , 3,000, , 57,000, , Vani, , 60,000, , Furniture, , 10,000, , Sandhya, , 30,000, , Buildings, , 40,000, , Machinery, , 25,000, , Total 1,92,500, , Total 1,92,500, , On 01.04.2018, Chaya is admitted into partnership on the following terms., a) She should bring Rs. 40,000 as capital for 1/6th share and Goodwill of the firm is, valued at Rs. 30,000., b) Depreciate furniture by 10%., c) Appreciate buildings by 20%, d) PDD is increased by Rs. 3,000., e) An amount of Rs. 2,000 due to a creditor is not likely to be claimed and, hence to be written off., Prepare: i) Revaluation Account, ii) Partner's Capital Account and, iii) New Balance Sheet of the firm., Soln.:, Dr., , Revaluation Account, Particulars, , Amount, (`), , To Furniture A/c, , 1,000, , 10, , 10,000 , , 100, , , 3,000, , To Profit transferred to, 2, , Particulars, , Amount, (`), , By Buildings, , 8,000, , 20, , 40,000 , , 100, , , To PDD, , Vani - , 5, , Cr., , By Creditors, , 2,000, , (written off), 3,600, , 2, , Sandhya - 5 , , , 2,400, , 6,600, , Total, , 10,000, , Total, , 10,000

Page 55 :