Page 1 :

p, r, , 7, , _s, , Macro Economic Poli, , 6.1, 6.2, 6.3, 6.4, , 6.5, 6.6, , 6.7, , , , , , , , , , , , Fiscal Policy, , Introduction, Objectives and Instruments, Fiscal Policy during Inflation and Deflation, , Contra Cyclical Fiscal Policy and Discretionary, Fiscal Policy _, Limitations of Fiscal Policy, , Striking Balance between Inflation and Growth, through Monetary and Fiscal Policies, , Questions

Page 2 :

vipul’s™ Central Ban| i, , , , Ps Rs objectives of macroeconomic policy cy, on. The 1, , si full employment and ensuring a high level g, (2) Maintaining a stable price level and, (3) hccekerating the rate of economic growth., , , , Monetary and fiscal policies are used by governments to, achieve these objectives. The operation and effectiveness of the, two policies can be analysed as follows: :, , (@ MONETARY POLICY:, , Monetary policy is concerned with money supply, credit, creation by banks and rate of interest. It is formulated and, implemented by the Central bank. In India,, Bank of India is mainly responsible for, monetary policy. Till the Great Depression o, Was mainly used to ensure economic stabi, money supply and credit creation,, , for e.g. the Reserve, implementing the, f 1930s, this policy, lity. By controlling, Stability was ensured in the |, 0s monetary Policy was not |

Page 3 :

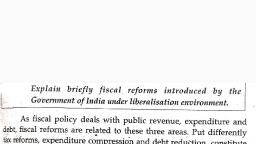

’ lic revenue, public expenditure and public ,, govemment mainly uses the budget policy to bring :, -gesirable changes in the economy, Through taxation, the, , ent mobilises resources to meet its ever increasing, expenditure. At the same time taxes reduce private spending., When the government incurs public expenditure, it leads to more, employment, higher level of output - and income. Along with, taxation and public expenditure, public debt also serves as a, useful weapon to the government to mobilise more resources and, also to bring about economic stability. Thus, through fiscal policy, economic growth and development can be accelerated., , , , OBJECTIVES AND INSTRUMENTS:, , Fiscal policy is pursued by modern governments to achieve |, certain objectives. The objectives differ from country to country, depending upon their own economic condition and priorities., However, the main objectives are:, {) To achieve optimum allocation of resources: |, @ To increase effective demand and thereby to achieve full |, , employment and maintain it., , } 9 To ensure price stability., , ® I bring about greater equality in the, 4nd wealth,, , , , , , distribution of it

Page 4 :

; taxation the government cay, mi iatbh, consumption, rac and, oh produ ents impose both direct ang, . of resources. Govern, allocatio re equity. generally a progressive, Ergatied wares To ensure, ere d. Under this system, taxes are, system of taxation is followed. © :, - Jevied on the principle of ability to pay. Hence the rich are, iy 8 more than the poor. By giving suitable tax incentives, production of mass ‘consumption goods is encouraged., Consumption of certain goods is encouraged by reducing the, tax rate while the consumption of harmful goods is, discouraged by hiking the tax rate in every budget. Resource, allocation to the various sectors and to the various regions is, F ad eniepied by tax incentives. Economic equality, stability,, ting economic growth and employment generation, can be enhanced through taxation., , , , , , , , , , , , , , , , , , 2) Public Expendi, , goverment ture: The expenditure incurred by the, aspects of " have a profound influence on various, incurred rc my. Various types of expenditure are, “z by the gove, , mment in the process of discharging its |, Of the major items of expenditure of the, _ : administrative expenses, defence, ture, rendlture incurred for the development of, ee port, communication, subsidies

Page 5 :

- infrastructure, the productive capacity of the economy can be, , , , In the case of developing counties, if public, is used to strengthen social and economic, , enhanced significantly. By spending on social welfare, __ programmes like education, health facilities, sanitation etc., and also by focussing on social security measures like old age, pension, unemployment allowance etc. the government can, reduce inequalities in the distribution of income and wealth., By providing subsidies, the production of essential goods can, be encouraged. If the public expenditure is unproductive,, than the economy will suffer from adverse consequences like, inflation, misallocation of resources, shortages, greater, inequality etc. Thus the effects of public expenditure as a, fiscal weapon depends upon the way it is incurred by the, government., , (3) Public Debt: When the expenditure of the government, , exceeds its revenue, it resorts to public debt. It is also helpful, to the government to finance a war or to meet unexpected, expenditure due to natural calamities etc. Apart from a source, , Of revenue to the government, it is also useful to the, , b, , 80vernment to control inflation. The government borrows, oe both internal and external sources. The funds thus, Mobilised should be used for productive purposes like, , lopment of infrastructure, industrial sector, agriculture 4, , a