Page 1 :

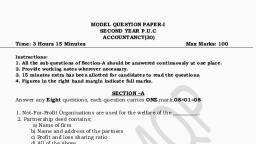

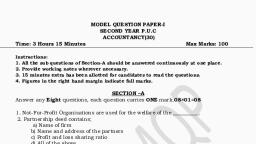

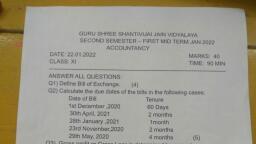

oP ae), MODEL QUESTION a n, 2020-21 for reduced enna rC Yea Aas [Now, , FIRST YEAR P.U.C, ACCOUNTANCY, , \, , Time: 3 Hours 15 Minutes M, lax Marks: 100, , Instructions:, 1. All the sub questions of Section-A should be answered continuously at one place., , 2, Provide working notes wherever necessary., 3. 15 minutes extra has been allotted for candidates to read the questions., , 4. Figures in the right hand margin indicate full marks., Section —A, 08x01=08, , Answer any Eight questions, each question carries ONE mark., , 1. Business Organization involves events., 2. Accounting is the process of recording and classifying business financial transactions.(State T/F), , 3. According to which concept the owner of the business is considered creditor of the business:, , a. Money measurement concept, , b. Dual Aspect concept ., , c. Separate entity concept ‘, d. Going concern concept, , 4. Expand GAAP, 5. Capital account balance is a, , Give an example for, ce, eet ode jae, or Market price whichever is lower, , , , 9. Give the meaning of Incomplete Records., 10. What is Statement of affairs?, Section —B, 05x02=10, , Answer any FIVE questions, each question carries TWO marks., 11. Give any two examples of revenues., 12. What is Double entry system of accounting?, 13. What do you mean by compound voucher?, 14. State the rules of debit and credit of capital., 15. Name any two methods of preparing the trial balance. ‘i, 16. What do you mean by rectification of errors? ee, 17. Give two examples of Capital Expenditure.

Page 2 :

section -C 04x06=24, , 1X marks., Answer any FOUR questions, each question carries s, , 19. Prepare Accounting Equation on the basis of the following:, a. Harish started business with cash %2,00,000, b. Purchased goods from Naman for cash %1,40,000, ¢. Sold goods to Bhanu costing 710,000, , 20. Prepare petty cash book form the following information., The imprest amount is Z 1,000., , , , , , , , , , , , , , , , Date Particulars z, 2020, Jan. 01 | Paid cartage 50, Jan.02 Bus fare 60, Jan.06 | Postage 110, Jan.10 | Refreshments to customers 80, Jan.12 | Courier charges 30, Jan.15 Pen pencil and rubber 115, Jan.18 Telegram charges 50, Jan.22 Miscellaneous expenses 70, Jan.26 Fax charges 65, Jan.31 Auto charges 90, 21. Prepare a trial balance from the following particulars as on 31-03-2020:Capital % 25,000, Bills Payable = 1,850, Bills Receivable = 4,400, Stock on1.4.2019 = 8500, Furniture = 2,600,, Purchases ®, = 8,950,, «Sales = 22,500, Discount Received = 970, Carriage = 300, Cash at Bank & 25,570, 22. From the following balances obtained from the records of Mr. Shankar, ., the year ending lst March 2020. : Prepare the Trading Account for, Opening Stock 2,00,000, Purchases for the year 20,00,000, Sales for the year 35,00,000, Carriage inwards 10,000, , Closing stock is valued 5,00,000

Page 3 :

23. Prepare a Balance Sheet of Mr. Narahari as on 3 1-3-2020., z, , Capital 56,000, Drawings 10,000, Land & Building 30,000, Machinery 20,000, Bills receivable 5,000, Cash in hand 5,000, Sundry creditors 10,000, Closing stock 11,000, Bank loan 10,000, Net Profit 5,000, , 24. From the following information, find out Closing Debtors., , Debtors on 01/04/2020, Cash Received from Debtors, Discount allowed, Bad debts, Returns from customers, Credit sales, 25. From the following information, calculate the amount paid to, , Sundry Creditors as on 01/04/2019 he, , Discount earned, , Returns outwards, , Bills accepted, , Credit purchases, , Sundry Creditors as on 31/03/2020, Section —D, , Answer any FOUR questions, each question carries TWELVE marks. — di, , 26. Briefly explain the following basic accounting terms:, , nm, , , , 27. Briefly explain the following concepts:, , Creditors:, , a) Entity ) Transaction c) Capital d) Revenues e) Voucher Goods, , z, 20,000, 70,000, 5,000, , 2,000, 3,000

Page 4 :

Jan,10 Gave charity = 500, : Jan.15 Paid Electricity bill = 750, “ Jan,18 — Bought office furniture Rs 3,000, i Jan,20 Drew cash from Bank for personal use, = Jan,22__ Bought Postage stamps = 100, © Jan,25 Drew cash for personal use % 1,000, - Jan,28 Commission received in advance € 400, 29. Record the following transactions in two column cash book of Sagar and balance it:, Date Particulars zg, 2020, Feb.01 | Bank balance 50,000, Cash balance 10,000, Feb.02 | Paid insurance premium by cheque 8,000, Feb.05 | Cash sales 25,000, Feb.08 | Cash purchases 18,000, Feb.10 | Cash deposited in to the bank 19,000, Feb.12 | Telephone bill paid by cheque 2,500, Feb.15 | Withdrawn cash from the bank for personal use 5,000, Feb.16 | Cash withdrawn from bank for office use 10,000, Feb.18 | Received cheque from Anand 10,500, Feb.22 | cartage paid in cash 1,500, Feb.28 | cheque received from Kumar 5,000

Page 5 :

—E—E, , 31, Frem the following ‘Trail Balance,, , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , sass tie Balen ghee aoa 4nd profit and loxn Account for the your ending, 2 Name of the Account Debit Credit, Capital —, Drawin BS I 785 30,000, = and Sales 500 is ton, Ss (on 1-4-2019) 1.200, Returns 280 aah, Wages 800, Buildings 22,000, Freight charges 2,000, Trade expenses 200, Advertisement 240, Interest 650, Taxes and Insurance 430, Debtors and Creditors 6,500 1,200 iad, Bills receivable and bills payable 1,500 700 i, Cash at bank 1,200 ‘ Perse, Cash in hand 1901) Se eens cigs, | Salaries a Sica, Sal Total P x, bck on 31-3-2020 was valued at ® 10,000., (2. Insurance prepared to the extent of & 100., 3. Outstanding salaries & 200., 4. Depreciate buildings by 5%,, sae 5. Provide PDD at 5% on debtors., 32. Mr. Aniket Kept his books under incom lete records. He rovides you the followin information., - Particulars 01-04-2019 ee, zg, Cash 10,000 16,000, Bank Overdraft 20,000 14,000, Bills Receivable 16,000 20,000 fee, Debtors 30,000 40, sd, Stock, , , , 24,000 sel, 20,000 Bs, , , , ¥