Page 1 :

PUC 1ST YEAR, BUSINESS STUDIES NOTES, , CHAPTER 4 - BUSINESS SERVICES, Meaning of Business Services: Business services are those services which are, used by business enterprises for the conduct of their activities., Example: Banking, Insurance, Transportation, Warehousing and communication, services., Meaning of Services: Services are all those economic activities that are, intangible and imply an interaction to be realized between the service provider, and the consumer., Nature/ Feature of Services:, 1. Intangibility: Services are intangible i.e they cannot be touched. They can, only be experienced by customers. Example: Doctor’s treatment., 2. Inconsistency: The 2nd important characteristic of services is, inconsistency. Since there is no standard tangible product, services have to, be performed exclusively each time. Different customers have different, demands and expectations. Service providers need to have an opportunity, to alter their offer to closely meet the requirements of the customers., Example: Mobile services., 3. Inseparability: Production and consumption of services takes place, simultaneously and seem to be inseparable., 4. Inventory Loss: Services have little or no tangible components to be, stored, service providers cannot store the service itself., 5. Involvement: One of the most important characteristics of services is the, participation of the customer in the service delivery process., Difference between Services and Goods:, Basis, Nature, Type, Intangibility, , 1|Page, , Services, An activity or process,, e.g., watching a movie, in a cinema hall, Heterogeneous, Intangible e.g., doctor, treatment, , Goods, A physical object., E.g., video cassette of, movie, Homogenous, Tangible e.g., medicine

Page 2 :

Inconsistency, , Inseparability, , Inventory, , Involvement, , Different customers, having different, demands, e.g., mobile services, Simultaneous, production and, consumption. E.g.,, eating ice-cream in a, restaurant., Cannot be kept in, stock. E.g., experience, of a train journey, Participation of, customers at the time, of services in a fast, food joint, , Different customers, getting standardised, demands fulfilled, e.g., mobile phones, Separation of, production and, consumption., E.g., purchasing ice, cream from a store, Can be kept in stock., E.g., train journey, ticket, Involvement at the time, of delivery not, possible. E.g.,, manufacturing a, vehicle, , Types of Services:, 1. Business services: Business services are those services which are used by, business enterprises for the conduct of their activities. For e.g., banking,, insurance, transportation, warehousing and communication services., 2. Social Services: Social services provide voluntarily to achieve certain, goals. These social goals may be to improve the standard of living for, weaker sections of society, to provide health care and hygienic conditions, in slum areas. For e.g., health care and education services provided by, certain Non-government organisation (NGOs) and government agencies., 3. Personal services: Personal services are those services which are, experienced differently by different customers. These services cannot be, consistent in nature. They will differ depending upon the service provider., For e.g., tourism, restaurants., Business Services:, 1., 2., 3., 4., , Banking, Insurance, Communication Services, Transportation, , 2|Page

Page 3 :

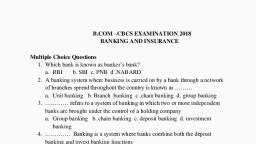

Banking: “Banking means accepting, for the purpose of lending and investment,, of deposits of money from the public, repayable on demand or otherwise and, withdraw able by cheques, draft, order or otherwise.”, Type of Banks:, 1., 2., 3., 4., , Commercial Banks, Cooperative Banks, Specialised Banks, Central Bank, , 1. Commercial Banks: Commercial banks are institutions dealing in money., These are governed by Indian Banking Regulation Act 1949 and according, to it, banking means accepting deposits of money from the public for the, purpose of lending or investment. Basically, they lend funds for, commercial activities., There are two types of commercial banks:, 1. Public Sector Banks: Public sector banks are those in which the, government has a major stake and they usually need to emphasise, on social objectives than on profitability., Example: SBI, PNB., 2. Private Sector Banks: Private sector banks are owned, managed, and controlled by private promoters and they are free to operate, as per market forces., Example: HDFC Bank, ICICI Bank., 2. Cooperative Banks: Cooperative Banks are governed by the provisions of, State Cooperative Societies Act and meant essentially for providing cheap, credit to their members. It is an important source of rural credit i.e., agricultural financing in India., 3. Specialised Banks: Specialised banks are foreign exchange banks,, industrial banks, development banks, export-import banks. They provide, financial aid to foreign trade and industries., 4. Central Bank: The Central Bank of any country supervises, controls and, regulates the activities of all the commercial banks of that country. It also, acts as a government banker. It controls and coordinates currency and, credit policies of any country. The Reserve Bank of India (RBI) is the, central bank of our country., , 3|Page

Page 4 :

Functions of Commercial Banks: The important functions of commercial, banks are:, I., , Basic or primary functions., 1. Acceptance of deposits: Deposits are the basis of the loan operations, since banks are both borrowers and lenders of money. As borrowers, they pay interest and as lenders they grant loans and get interest., 2. Lending of Funds: Lending of funds in the form of loans and, advances is the second important function of commercial banks., These advances can be made in the form of overdrafts, cash credits,, discounting trade bills, term loans, and consumer credits. The, advances are given to trade, industry, transport and other business, activities., , II., , Agency or general utility services., 1. Cheque Facility: Banks provide cheque facility to the customers, (Bank account holders). Customers use cheques for the withdrawal, of deposits from the bank. Cheques are also used to make payment, to others. Banks also render a very important service to their, customers by collecting their cheques (given by others)., There are 2 types of cheques mainly:, • Bearer cheques: which are en-cashable immediately at bank, counters., • Crossed cheques: which are to be deposited only in the, payees account., 2. Remittance of funds: Another salient function of commercial, banks of providing the facility of fund transfer from one place to, another. Banks use bank drafts, pay orders, mail transfer, NEFT,, internet banking facilities to transfer funds., 3. Allied services: In addition to above functions, banks also provide, allied services such as bill payments, locker facilities, underwriting, services. They also render other personal services like payment of, insurance premium, collection of dividend etc., , 4|Page

Page 5 :

E-Banking (Electronic services): The latest wave in information technology, is internet banking. E-Banking is Electronic banking or Banking using the, electronic media., E-banking is a service provided by many banks that allows, a customer to, conduct banking transactions, such as managing savings, checking accounts, or paying bills over the internet using a personal computer (PC) or mobile, phone., The range of services offered by e-banking are: (EFT) Electronic Funds, Transfer, (ATM) Automated Teller Machines, (EDI) Electronic Data, Interchange and credit cards Electronic or Digital cash., Benefits of e-banking: e-banking to customers:, 1. E-banking provides 24 hours, 365 days a year services to the customers of, the bank., 2. E-banking facilitates digital payments and promotes transparency in, financial statements., 3. It enable customers to make some of the permitted transactions through, mobile telephone., 4. It inculcates a sense of financial discipline by recording each and every, transaction., 5. It provide greater customer satisfaction by offering unlimited access to the, bank. For example: it enables a customer to avoid travelling with cash., Benefits towards Bank:, 1. E-banking provides competitive advantage to the bank., 2. E-banking provides unlimited network to the bank., 3. Load on branches can be considerably reduced., , 5|Page

Page 6 :

Insurance: Insurance is a contract under which one party (insurer or insurance, company) agrees in return for a consideration (i.e Insurance premium) to pay an, agreed amount of money to another party (insured) to make a loss, damage or, injury to something of value in which the insured has a pecuniary interest as a, result of uncertain event., 6|Page

Page 7 :

Functions of Insurance:, 1. Providing certainty: Insurance provides certainty of payment for the risk, of loss. There are uncertainties of happenings of time and amount of loss., Insurance removes these uncertainties and the assured receives payment of, loss. The insurer charges premium for providing the certainty., 2. Protection: The second main function of insurance is to provide protection, from probable chances of loss., 3. Risk sharing: On the happening of a risk event, the loss is shared by all, the persons exposed to it. The share is obtained from every insured member, by way of premiums., 4. Assist in capital formation: The accumulated funds of the insurer, received by way of premium payments made by the insured are invested in, various income generating schemes., Principles of Insurance:, 1. Utmost good faith: A contract of insurance is a contract of uberrimae fidei, i.e., a contract found on utmost good faith. Both the insurer and the insured, show good faith towards each other. It is the duty of the insured to disclose, all material facts relating to the subject matter insured and the insurer’s, duty is to make clear all the terms and conditions of the insurance contract., 2. Insurable Interest: The insured must have an insurable interest in the, subject matter of insurance. Insurable interest means monetary interest in, the subject matter of insurance contract. That is, the insured should gain by, the existence or safety and lost by the destruction of the subject matter of, insurance., 3. Indemnity: All insurance contracts of fire or marine insurance are, contracts of indemnity. Insurer undertakes to compensate the insured for, the loss caused to him/her due to damage or destruction of property insured., This principle is not applicable to life insurance., 4. Proximate Cause: According to this principle, compensation is given only, for such losses as are caused by the perils which are stated in the policy., When the loss is the result of two or more causes, only the proximate (or, nearest or direct) cause stated in the policy should be taken into, consideration while paying compensation., 5. Subrogation: According to this principle, after the insured is compensated, for the loss or damage to the property insured by him, the right of, ownership of such property passes on to the insurer., 7|Page

Page 8 :

6. Contribution: According to this principle, in case of double insurance, the, insurers are to share the losses in proportion to the amount assured by each, of them. In other words, in case of loss, each insurer is bound to contribute, to make good the actual amount of the loss in proportion to the policy, amount., 7. Mitigation: This principle states that it is the duty of the insured to take, reasonable steps to minimise the loss or damage to the insured property., Suppose, goods kept in a store house catch fire, then the owner of the goods, should try to recover the goods and save them from fire to minimise the, loss or damage., Types of Insurance:, , Life Insurance: A life insurance policy was introduced as a protection against, the uncertainty of life., For example: disability insurance, health/medical insurance, annuity insurance, and life insurance., 8|Page

Page 9 :

Life insurance may be defined as a contract in which the insurer in, consideration of a certain premium, either in a lump sum or by other periodical, payments, agrees to pay to the assured, or to the person for whose benefit the, policy is taken., The insurance company undertakes to insure the life of a person in, exchange for a sum of money called premium. This premium may be paid in one, lump sum, or periodically i.e., monthly, quarterly, half yearly or yearly., Life insurance is an agreement or contract which contains all the terms, and condition is put in writing and such document is called the policy. At the, same time the company promises to pay a certain sum of money either on the, death of the person or on his attaining a certain age. The person whose life is, insured is called the assured. The insurance company is the insurer., The main elements of a life insurance contract are:, 1. The life insurance contract must have all the essentials of a valid, contract., 2. The contract of life insurance is a contract of utmost good faith. The, assured should be honest and truthful in giving information to the, insurance company., 3. In life insurance, the insured must have insurable interest in the life, assured. Without insurable interest the contract of insurance is void., 4. Life insurance contract is not a contract of indemnity. The life of a, human being cannot be compensated and only a specified sum of, money is paid., Types of Life insurance Policy:, 1. Whole Life Policy: In this kind of policy, the premium will be payable for, a fixed period or for the whole life of the assured. The amount becomes, payable only after the death of the assured. The sum becomes payable only, to the beneficiaries or heir of the deceased., 2. Endowment Life Assurance Policy: It is a policy taken out for a fixed, period, say 10 years. 20 years and so on. It matures after this fixed period., The insurer (insurance company) undertakes to pay a specified sum when, the insured attains a particular age or on his death whichever is earlier. The, sum is payable to his legal heir/nominee named herein in case of death of, the assured., 3. Joint Life Policy: This policy is taken up by two or more persons. The, premium is paid jointly or by either of them in instalments or in lump sum., , 9|Page

Page 10 :

The assured sum or policy money is payable upon the death of any one, person to the other survivor or survivors., 4. Annuity Policy: Under this policy, the assured sum or policy money is, payable after the assured attains a certain age in monthly, quarterly, half, yearly or annual instalments. The premium is paid in instalments over a, certain period or single premium may be paid by the assured., 5. Children’s Endowment Policy: This policy is taken by a person for, his/her children to meet the expenses of their education or marriage. The, agreement states that a certain sum will be paid by the insurer when the, children attain a particular age., Fire Insurance: Fire insurance is a contract whereby the insurer, in consideration, of the premium paid, undertakes to make good any loss or damage caused by fire, during a specified period up to the amount specified in the policy., A claim for loss by fire must satisfy the two following conditions:, 1. There must be actual loss., 2. Fire must be accidental and non-intentional., The main elements of a fire insurance contract are:, 1. In fire insurance, the insured must have insurable interest in the subject, matter of the insurance., 2. Similar to the life insurance contract, the contract of fire insurance is a, contract of utmost good faith i.e uberrimae fidei., 3. The contract of fire insurance is a contract of strict indemnity, 4. The insurer is liable to compensate only when fire is the proximate cause, of damage or loss., Marine Insurance: A marine insurance contract is an agreement whereby the, insurer undertakes to indemnify the insured against marine losses. Marine, insurance provides protection against loss by marine perils or perils of the sea., Marine insurance are of 3 types:, 1. Ship or hull insurance: Since the ship is exposed to many dangers at sea,, the insurance policy is for indemnifying the insured for losses caused by, damage to the ship., 2. Cargo insurance: The cargo or goods while being transported by ship is, subject to many risks. These may be at port i.e., risk of theft, lost goods etc., 3. Freight Insurance: If the cargo does not reach the destination due to the, damage or loss in transit, the shipping company is not paid freight charges., 10 | P a g e

Page 11 :

Freight insurance is for reimbursing the loss of freight to the shipping, company i.e., the insured., The main elements of a marine insurance contract are:, 1. Unlike life insurance, the contract of marine insurance is a contract, of indemnity., 2. Similar to life and fire insurance, the contract of marine insurance is, a contract of utmost good faith., 3. Insurable interest must exist at the time of loss but not necessary at, the time when the policy was taken., 4. The principle of causa proxima will apply to it. The insurance, company will be liable to pay only if that particular or nearest cause, is covered by the policy., Difference between Life, Fire and Marine Insurance:, Basis of, difference, Subject Matter, , Life Insurance, , Fire Insurance, , The subject matter The subject matter, of insurance is, is any physical, human life, property or assets, , Marine Insurance, The subject matter, is a ship, cargo or, freight., , Element, , Life Insurance has Fire insurance has, the elements of, only the element, Marine insurance, protection and, of protection and has only the element, investment or, not the element of, of protection., both., investment., , Insurable interest, , Insurable interest, Insurable interest, must be present at, on the subject, Insurable interest, the time of, matter must be, must be present at, effecting the, present both at the the time when the, policy but need, time of effecting claim falls due or at, not be necessary, policy as well as, the time of loss, at the time when, when the claim, only., the claim falls, falls due., due., , 11 | P a g e

Page 12 :

Duration, , Life insurance, policy usually, exceeds a year, and is taken for, longer periods, ranging from 5 to, 30 years or whole, life, , Indemnity, , Fire insurance is a, contract of, Life insurance is, indemnity. The, Marine insurance is, not based on the, insured can claim, a contract of, principle of, only the actual, indemnity. The, indemnity. The, amount of loss, insured can claim, sum assured is, from the insurer. the market value of, paid either on the, The loss due to, the ship and cost of, happening of, the fire is, goods destroyed at, certain event or on, indemnified, sea and the loss will, maturity of the, subject to the, be indemnified., policy., maximum limit of, the policy amount, , Loss measurement, , Loss is not, measurable, , Fire insurance, Marine insurance, policy usually, policy is for one or, does not exceed a periods of voyage or, year, mixed., , Loss is, measurable, , Life insurance, Fire insurance, Surrender value or, policy has a, does not have any, paid up value, surrender value or surrender value or, paid up value, paid up value., , Loss is measurable, Marine insurance, does not have any, surrender value or, paid up value., , Policy amount, , One can insure for, any amount in life, insurance, , In fire insurance,, the amount of the, policy cannot be, more than the, value of the, subject matter, , In marine insurance, the amount of the, policy can be the, market value of the, ship or cargo., , Contingency of, risk, , There is an, element of, certainty. The, event i.e., death of, maturity or policy, is bound to, happen. Therefore, a claim will be, present., , The event i.e.,, destruction by, fire may not, happen. There is, an element of, uncertainity and, there may be no, claim, , The event i.e., loss, at sea may not occur, and there may be no, claim. There is an, element of, uncertainty., , 12 | P a g e

Page 13 :

Communication Services: Communication services are helpful to the business, for establishing links with the outside world viz., suppliers, customers,, competitors etc. Communication services help business concerns to exchange, information with others., The main services which help business can be classified into postal and, telecom., 1. Postal Services: Indian post and telegraph department provides, various postal services across India. For providing these services the, whole country has been divided into 22 postal circles. These circles, manage the day-to-day functioning of the various head post offices,, sub-post offices and branch post offices., It is broadly categorised into:, ➢ Financial facilities: These facilities are provided, through the post office’s savings schemes like Public, Provident Fund (PPF), Kisan vikas Patra (KVP), and, National Saving Certificates (NSC)., ➢ Mail Facilities: It consist of parcel facilities that is, trans-mission of articles from one place to another,, registration facility to provide security of the, transmitted articles; Insurance facility provide, insurance cover for all risks in the course of, transmission by post., Postal department also offers allied facilities, of the following types:, • Greeting post – A range of delightful, greeting cards for every occasion., • Media post – An innovative and effective, vehicle for Indian corporate to advertise, their brand., • Direct post – is for direct advertising., • International Money transfer – through, collaboration with Western Union, financial services, USA., • Passport facilities – A unique partnership, with ministry of external affairs for, facilitating passport application., • Speed Post: It links with 97 major, countries across the globe., 13 | P a g e

Page 14 :

• E-bill post – is to collect bill payment, across the counter for BSNL and Bharti, Airtel., 2. Telecom Services: Telecommunication services which help the, economic and social development of the country and help doing, business across the continents are called telecom services., The various types of telecom services:, 1. Cellular mobile services: These are all types of mobile telecom, services including voice and non-voice messages, data services., They can also provide direct inter connectivity., 2. Fixed line services: These are all types of fixed services including, voice and non-voice messages and data services to establish linkages, for long distance traffic., 3. Cable services: These are linkages and switched services within a, licensed area of operation to operate media services, which are, essentially one way entertainment related services., 4. VSAT services: VSAT (Very Small Aperture Terminal) is a, satellite-based communications service. It provides innovative, services such as telemedicine, newspapers online, market rates and, E-education, even in the most remote areas of our country., 5. DTH services: DTH (Direct to home) is also a satellite based media, services provided by cellular companies. They provide bouquet of, multiple channels., Transportation: Transport services include services by all modes of, transportation. i.e., rail, road, air and sea for the carriage of goods and, international movement of passengers., The services of different modes of transport play an important role in the, performance of business activities. Transportation removes the hindrance of place, i.e., it makes goods available to the consumer from the place of production. There, is a need to develop our transportation system to keep pace with the requirements, of our economy., Warehousing: Warehousing is a form of business service in which warehouses, act as a storage service provider and a logistical service provider., , 14 | P a g e

Page 15 :

They help to maintain quality, value and usefulness of goods. Through, warehouses, goods are made available at the right quantity, at the right place, in, the right time, in the right physical form at the right cost., Types of Warehouses:, 1. Private warehouses: Private warehouse are operated, owned or, leased by a company handling their own goods, such as retail chain, stores or multi-brand multi-product companies., 2. Public warehouses: Public warehouses can be used for storage of, goods by traders, manufactures or any member of the public after, the payment of a storage fee or charges. The government regulates, the operation of these warehouses., 3. Bonded warehouses: Bonded warehouses are licensed by the, government to accept imported goods prior to payment of tax and, customs duty. Thus, they provide storage facility for imported, goods., 4. Government warehouses: These warehouses are fully owned and, managed by the government. For example: Food Corporation Of, India, Central Warehousing Corporation., 5. Cooperative warehouses: Some marketing cooperative societies or, agricultural cooperative societies have set up their own warehouses, for members of their cooperative society. Their intention is to help, their members., Functions of warehousing:, 1. Consolidation: In this function the warehouse receives and consolidates,, materials/goods from different production plants and dispatches the same, to a particular customer on a single transportation shipment., 2. Break the bulk: The warehouse performs the function of dividing the bulk, quantity of goods received from the production plants into smaller, quantities. Then, they are transported to the customers according to the, requirements., 3. Stock piling: The next function of warehousing is the seasonal storage of, goods. They are made available to business depending on customers, demand., 4. Value added services: Certain value added services such as grading,, packaging and labelling are also provided by the warehouses. They also, help in dividing goods into smaller lots., 15 | P a g e

Page 16 :

5. Price stabilisation: By adjusting the supply of goods with the demand, situation, warehousing performs the function of stabilising prices., 6. Financing: Warehouse owners advance money to the owners on security, of goods., *********, , 16 | P a g e