Page 3 :

“Anything that is generally acceptable as a means of, exchange and at the same time, acts as a measure and a, store of value”, , - Prof Crowtherr, , “Money is what, money does”, - Prof. Walker -

Page 4 :

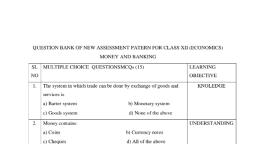

How did people exchange goods, and services before the invention, of money......?

Page 8 :

Medium of Exchange (hn-\n-a-b- am-[y-aw-), To facilitate transactions,, money acts as a common, medium acceptable to both, parties.

Page 9 :

Unit of Account /Measure of value, (aq-ey-¯n-sâ A-f-hptImÂ-), Money is used to measure the value of, goods and services. When the value is, expressed in the form of money, it is, called price., ങ്ങ

Page 10 :

A Store of value (aq-ey- -tiJ-cw-), All goods can not be preserved for, a long time. So we can store wealth, in the form of money. Then it, becomes an asset.., ങ്ങ

Page 11 :

A standard of differed payments, (hn-fw-_n-X- A-S-hp-I-Ä-¡p- am-\-Z-WvUw), Deferred payments mean, those payments which are to, be made in the future.

Page 13 :

Know these.., Now digital transactions are increasing, The world moving towards cashless system, When digital information is using for transactions., It is the electronic representation of money., Now, India govt promoting digitalization of, transaction (cashless transactions), Eg: e-wallets, Jan Dhan Accounts

Page 14 :

Demand for money & Supply of money, Demand for money, It is the desire of people to hold, money in hand., Money mainly used for transactions., The volume of transaction., determine the demand for money

Page 15 :

Transaction depends upon the level of, income, , Level of Income, , DD form money &, Volume of transaction

Page 16 :

The DD for money and interest, rate inversely related., If interest rate is high, the DD, for money is low, If the interest rate is low the, DD for money will be high., , Opportunity, cost of holding, money is, interest rate

Page 17 :

Supply of money, The total stock of money in, circulation at a particular, time. That may be in, , The controller of, money supply is, central bank., , , , , In India central banks, is Reserve Bank of, India (RBI), , Cash &, Deposits

Page 18 :

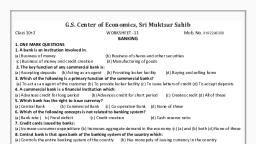

Central Bank, Central bank is the apex monitory, authority in a country., In India, central bank is RBI, RBI established on 1935

Page 19 :

Functions of central bank, Controls the Money supply., Measures used to control, Bank rate, Open market operation (OMO), Reserve ratios etc, , Banker to the government, Issues currency, Custodian of foreign exchange, It act as bankers bank, Lender of last resort etc

Page 20 :

Commercial Bank, The bank which accept deposit from public and lend, money is known as commercial banks, Functions of commercial Bank, Primary functions, Accepting, deposits, Lending money, , Secondary Functions;, Remittance of funds, Collection of dividends, Execution of orders, Purchase & Sale of bonds, Prepare tax returns, Giving locker facility, travellers cheque,, ATM & mobile banking facilities,, , Developmental, functions., Low interest, loans, Self, employment, programmes, Infrastructure

Page 21 :

Commercial Bank, The bank which accept deposit from public and lend money is known as commercial, banks. The difference between borrowing rate and lending rate is spread

Page 22 :

Supply of money, Supply of money is the total stock of money in, circulation at a particular time. That may be in, , Currency, coins&, , Deposits, In India controller of money supply is RBI.

Page 23 :

RBI's measures of money supply, (Since 1977), , M1 = CU+DD, M2 = M1+savings deposits with post office savings, banks, M3 = M1+Net time deposits of commercial banks, M4 = M3 + Total deposits with post office savings org., , , , , , M1 & M2 are called narrow money, M3 & M4 are called broad money, M3 - is called aggregate monetary resources., It is most commonly used measure of money supply.

Page 24 :

Credit creation, It is a process by which, commercial banks create credit, in financial system., "Multiple, expansion of, deposits is called, credit creation"

Page 25 :

Know these…., People deposits money in, bank for interest, Bank lends money for, interest, Bank keeps a portion of, deposit as Reserve (Cash, Reserve Ratio), , Asset of bank, reserve + loan, , liability of bank, Deposits

Page 27 :

Monitory policy, It is the measures taken by central bank or, monitory authority to regulate money supply., Eg:- During inflation RBI contracts money, supply. But, during the deflation RBI, expands money supply

Page 28 :

Policy Tools To Control Money Supply, Quantitative Tools, Cash Reserve Ratio, Bank Rate, Open Market, operations, , Qualitative Tools, Margin Requirements, Moral suasion

Page 29 :

Quantitative Tools, 1. Cash Reserve Ratio (CRR), It is a percentage of the total deposits which commercial, banks have to hold as reserves. During inflation, CRR is, increased and during deflation CRR reduced, , 2. Bank rate, It is the interest charged on the loans of commercial banks, by RBI. This is raised or lowered in appropriate situations.

Page 30 :

3. Open Market Operations(OMO), OMO involves buying and selling of, securities by the RBI., Two types of OMO, a) Outright transactions, They are permanent transactions, which is not reversed., a) Repo (repurchase agreement), transactions., Here transactions are reversible at, later date for a particular price., , Know these…, Repo rate:It is the rate at which RBI, lends commercial banks., , Reverse repo rate: It is the rate at which, commercial bank deposit, their excess cash with RBI

Page 31 :

Qualitative Tools, Margin Requirements, It refers to the difference between the market value of, securities and the amount that can be borrowed against the, securities., Moral suasion, RBI persuade commercial banks to make necessary change in, lending, thereby money supply. It is moral suasion

Page 32 :

Demand for Money, (Detailed explanation)

Page 33 :

Transaction demand

Page 35 :

Speculative demand

Page 38 :

Liquidity trap, It is a situation in which the Speculative demand for, money becomes perfectly elastic when the rate of, interest reaches the lowest level.