Page 1 :

Class: XII, Subject: Economics, , Class Notes, Topic: Determination of Income and, Employment, , Excess Demand: Meaning, Impact and Reasons, Excess demand refers to the situation when aggregate demand (AD) is more than the, aggregate supply (AS) corresponding to full employment level of output in the economy., It is the excess of anticipated expenditure over the value of full employment output., Excess demand gives rise to an inflationary gap. Inflationary gap refers to the gap by, which actual aggregate demand exceeds the aggregate demand required to establish, full employment equilibrium., Impact of Excess Demand:, Excess demand is not a desired situation because it does not lead to any increase in level, of aggregate supply as the economy is already at full employment level., Excess demand has the following effect on output, employment and general price level:., 1. Effect on Output:, Excess demand does not affect the level of output because economy is already, at full employment level and there is no idle capacity in the economy., 2. Effect on Employment:, There will be no change in the level of employment as the economy is already, operating at full employment equilibrium and there is no involuntary unemployment., 3. Effect on General Price Level:, Excess demand leads to rise in the general price level (known as inflation) as, aggregate demand is more than aggregate supply., Reasons for Excess Demand:, Excess demand may arise due to several factors. Important, among them, are mentioned, below:

Page 2 :

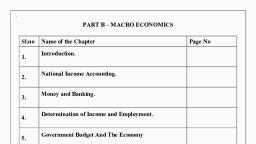

1. Rise in the Propensity to consume, 2. Reduction in taxes, 3. Increase in Government Expenditure, 4. Increase in Investment, 5. Fall in Imports, 6. Rise in Exports, 7. Deficit Financing, Measures to Rectify the Situation of Excess Demand, 1. Fiscal Policy:, Fiscal policy is the expenditure and revenue (taxation) policy of the government to, accomplish the desired objectives., The main tools of fiscal policy are:, (i) Expenditure policy (Reduce expenditure):, In a situation like that of excess demand, government should curtail its expenditure on, public works such as roads, buildings, rural electrification, irrigation works,, thereby reducing the money income of the people and their demand for goods, and services. In this way, government should reduce the budget deficit which shows, excess of expenditure over revenue., (ii) Revenue policy (increase taxes):, During inflation, government should raise rates of all taxes especially on rich people, because taxation withdraws purchasing power from the tax-payers and to that extent, reduces effective demand., 2. Monetary Policy :, Monetary policy is the policy of the central bank of a country to control money supply, and credit in the economy. Therefore, it is also called Central Bank’s Credit Control, Policy

Page 3 :

Measures of monetary policy maybe :, (a) quantitative (which influence the total volume of credit) and, (b) qualitative (which regulates flow of credit for specific uses), (a) Quantitative Measures:, (i) Bank rate (Increase bank rate):, In a situation of excess demand leading to inflation, the central bank raises bank, rate which discourages commercial banks in borrowing from the central bank., Increase in bank rate forces commercial banks to increase their own lending rate, of interest which makes credit cost her. As a result, the demand for loans falls., (ii) Open Market Operation (Sell securities):, It refers to buying and selling of government securities and bonds in the open market by, the central bank. This is done to influence the cash reserves with commercial banks. Sale, by central bank brings flow of money to it from commercial banks thereby, restricting their lending capacity., Such operations affect amount of cash reserves with the commercial banks and their, capacity to offer loans. During inflation, central bank sells government securities to, commercial banks which lose equivalent amount of cash reserve thereby affecting their, capacity to offer loans. Thus, it is an effective measure to control credit., (iii) Varying reserve ratios, (a)Cash-Reserve Ratio (Raise CRR), It is the ratio (or fraction) of bank deposits that a commercial bank is required, to keep with the central bank. When there is an inflationary situation, the, central bank raises the rate of minimum cash-reserve ratio thereby making the, banks to keep more cash reserve with RBI which in turn curtails the lending, capacity of commercial banks. RBI fixes rate of CRR according to market Conditions., b)Statutory Liquidity Ratio (Raise SLR), In addition to CRR, there is another measure called SLR according to which every

Page 4 :

bank is required to hold a certain minimum proportion of its total demand and time, deposits in liquid form like liquid assets such as government securities. When RBI, wants to contract credit or lending by banks, it increases SLR and thereby reduces credit, availability., (iv) Reverse Repo Rate (Raise it), Reverse repo rate is said to be that rate of interest at which a central bank (RBI in India), borrows money from commercial banks for a short term.During excess demand in, the economy, the reverse repo rate is increased .So the commercial banks increase their, reserves and park more surplus funds with central bank which reduces the money, supply in the economy to combat Inflation., (b) Qualitative Measures:, Margin Requirements (Increase it):, Margin requirement refers to the amount of security that banks demand from borrower of, loan., It is the difference between the amount of loan granted and the current value of security, offered for taking loan. In a situation of excess demand, the central bank raises the limit, Of margin requirements. This discourages borrowing because it makes traders get, less credit against their securities., Content Developed Absolutely From Home PS