Page 1 :

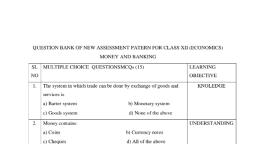

Money, Contingent Function, Distribution of national income: - salaries, wages, rent, interest etc. are, paid in the form or in the value of money is known as distribution of, National income., Maximum satisfaction to the consumer: - The satisfaction derived by a, consumer through the utilization of good is measured in terms of money., The consumer will pay the amount of the good only when he will get the, satisfaction to the value which he is paying., Maximum profit in the producer: - The producer measure the profit, earned in terms of money and not in goods., Contingent Function, Basis of credit: - Credit is given or taken in terms of money and not in, goods. For example: Loan sanction by the bank and money lenders., Liquidity: - The currency and notes have maximum liquidity than goods,, coins, debit notes, gold etc., Demand of money, Demand of money is referred to the liquidity preference of individual. That, is the choice of holding the money in liquid form or cash and to earn, interest through fix deposit., Transaction motive: - The primary motive for holding money is for, transaction purpose or to meet day to day expenses., Speculative motive: - The other motive for holding money is in the form, of money over a certain period of time. Example : Money invested as fix, deposit earns interest as profits. This is termed as speculative motive., Supply of Money, Money supply refers to the stock of money held by the banks and public at a, particular point of time as a means of payment and store of wealth., Components of money supply: a., b., c., d., e., f., , Currency held by the public, Demand deposit of bank, Time deposit of bank, Saving account deposits, Deposits in post office, Other deposits of RBI

Page 2 :

Measure of money supply in India, M1 = Currency notes and coins with public (c) + Demand Deposit with, commercial banks (DD) + other deposits with RBI ( DD), M2 = M1 + Post office saving deposits., M3 = M1 + Time deposit with commercial banks, M4 = M3 + Total post office deposits or M1 + M2 + M3, High Powered money, It is referred to as money base on which overall money supply depends i.e., the amount of money issued by the Central Bank (RBI)., High Powered Money (H) = currency in circulation + Currency deposits of, commercial Banks with RBI +, Other Deposits Of RBI