Page 2 :

HAND BOOK, SECOND PUC, , ACCOUNTANCY, (NEW SYLLABUS), , Book 1: Not-For-Profit Organisation and Partnership Accounts, Book 2: Company Accounts and Analysis of Financial Statements, , 2020-2021, MYSURU DISTRICT P U COMMERCE FORUM (R), Vidyavardhaka composite pre-university college, Sheshadri Iyer Road, Near Private Bus Stand, Mysuru

Page 4 :

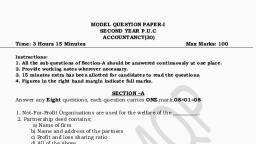

INDEX, PARTICULARS, Book 1, , Book 2, , Blue, Print &, Model, Question, Papers, , PAGE NO., , 1, , Accounting for Not-for-Profit, Organisations, , 01-16, , 2, , Accounting for Partnership- Basic, Concepts, , 17-28, , 3, , Reconstitution of Partnership FirmAdmission of a Partner, , 29-52, , 4, , Reconstitution of Partnership FirmRetirement/Death of a Partner, , 53-81, , 5, , Dissolution of Partnership Firm, , 81-94, , 1, , Accounting for Share Capital, , 2, , Financial Statements of a Company, , 111-119, , Blue Print, , 120-120, , 95-110, , MQP 1, , 121-128, , MQP 2, , 130-135

Page 5 :

Accountancy II PUC, , BOOK - 1, CHAPTER -1, , Mysuru District P U Commerce Forum, , Accounting for Not-For - Profit Organisation, Section A: One Marks Questions, , I. Fill in the Blanks:, 1. Not-For-Profit organisations are used for the welfare of the Society, 2. Not-For-Profit organisations are not engaged in Trading or Business, 3. Receipts and Payments Account is the summary of Cash and Bank transactions., 4. Income and Expenditure account is just like a Profit and Loss Account of a trading concern., 5. Income and Expenditure A/c is prepared on Accrual basis., 6. Subscription is a fee paid by the Members, 7. Legacies are the amounts received as per the will of the deceased person., 8. Opening balance in Receipt and Payment A/c represents Cash balance, 9. Government Grants for maintenance is treated as Revenue receipt., 10. Donation for specific purpose are always Capitalised, , II. Multiple choice questions:, , 1. Not-For-Profit organisations are formed for:, (a) Profit, (b) Service, (c) Profit & Service, (d) None of these, 2. Most of Not-For-Profit organisation transactions are :, (b) Credit, (a) Cash, (c) Cash & Credit, (d) None of these, 3. Receipt and Payment Account include items of :, (a) Capital Nature, (b) Revenue Nature, (d) None of these, (c) Both (a) & (b), 4. Income and Expenditure Account includes the amounts of :, (a) Current year, (b) Previous year, (c) Next year, (d) Both Current year and Previous year, 5. Capital Fund does not include:, (a) Entrances fees, (c) Building fund, , 6. Legacies are treated as:, (a) Revenue Receipt, (c) Revenue Expenditure, , (b) Legacies, (d) Life Membership fees, , (b) Capital Receipt, , (d) Capital Expenditure, 1|Page

Page 6 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , 7. Purchase of a computer by a college is treated as:, (a) Capital Receipts, (b) Capital Expenditure, (c) Revenue Receipt, (d) Revenue Expenditure, , 8. In the absence of any specific instruction, where do you show the Entrance Fee?, (a) Debit side of the Income and Expenditure Account, , (b) Credit side of the Income and Expenditure Account, (c) Liability side of the Balance sheet, (d) Added to capital Fund on the liabilities side of B/S, , 9. Special Funds are shown in :, (a) Income side, (c) Liability side, 10. Life membership fees are treated as:, (a) Capital Receipts, (c) Capital Expenditure, 11. Loss on sale of fixed asset is treated as:, (a) Capital Receipts, (c) Capital Expenditure, , III., , (b) Expenditure side, (d) Asset side, (b) Revenue Receipt, (d) Revenue Expenditure, (b) Revenue Receipt, , (d) Revenue Expenditure, , True or False type questions:, , 1. Receipt and Payment Account is a summary of all capital receipts and payments. False, 2. If the sports fund is maintained, sports expenses will be shown on the debit side of Income and, Expenditure Account. False, 3. The balancing figure on credit side of Income and Expenditure Account denotes excess of, expenses over incomes. True, 4. Scholarship granted to students out of funds provided by Government will be debited to Income, and Expenditure Account. False, 5. Donations for specific purpose are always capitalised. True, 6. Opening Balance Sheet is prepared when the Opening Balance of capital fund is not given., True, 7. Surplus of Income and Expenditure Account is added to Capital Fund. True, 8. Income and Expenditure Account is equivalent to Profit and Loss Account of a trading concern., True, 9. Receipt and payment Account does not differentiate between capital and revenue receipts., True, 10. Capital and Revenue items are recorded in Receipt and Payment Account. True, , IV., , Very short answer questions:, , 1. Give an example for Not-For-profit organisation., Ans: 1. Charitable institutions. 2. Govt. hospitals., , 3. Public libraries., , 2. What is the Motive of Not-For-profit organisation?, Ans: Service, 2|Page

Page 7 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , 3. Where do you show Opening Bank overdraft in Receipt and Payment Account?, Ans: Credit side, 4. Name any one final account of a Not-For-profit organisation., Ans: 1. Income and Expenditure Account, 2. Balance Sheet., 5. State any one major source of income of Not-For-profit organisation., Ans: 1. Subscription from members, 2. Donations, 6. State any one book of account maintained by a Not-For-profit organisation., Ans: 1. Cash book, 2. Ledger., , 7. State any one feature of Receipt and Payment Account., Ans: 1. It is a summary of the cash book., (Write any one relevant feature), 8. How do you treat the prizes paid, when the prize fund is not maintained?, Ans: Revenue Expenditure., 9. What is Capial fund?, Ans: Capital Fund = Assets – Liabilities (of a not for profit organisation), 10. Give an example for specific donation., Ans: 1. Donations for Building, , 2. Donations for Book bank., , 11. How do you treat the Life Membership Fees?, Ans: Capital Receipt., , Section B : Two Marks Questions, , 1. What are Not-For-Profit organisation?, Ans: Not for profit organisation refers to the organisation that is formed for the welfare of the, society. Their main aim is to provide services to the members or the public at large without, any profit motive., 2. Give any two examples of Not-For-Profit organisation., Ans: 1. Charitable Institutions, 2. Govt Hospital, 3. Public libraries., 4. Sports clubs, 3. State any two features of Not-For-Profit organisation., Ans: 1. They are formed for providing services such as education, sports, etc., 2. They are organised as charitable trust / societies., 3. Their affairs are usually managed by a managing committee., 4. Name any two books of accounts maintained by Not-For-Profit organisation., Ans: 1. Cash Book, 2. Ledger, 3. Stock Register., 5. Give the meaning of Receipt and Payment Account., Ans: It is the summary of cash and bank transactions. It is prepared by Not for profit, organisation at the end of the year form the cash book., 6., , State any two features of Receipt and Payment Account., Ans: 1. It is a real account, 2. It includes both capital and revenue items., 3. It is a summary of cash book., , 3|Page

Page 8 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , 7. What do you mean by Income and Expenditure Account?, Ans: It is the summary of the Income and Expenditure for the accounting year. It is prepared, by Not- For-Profit organisation to ascertain the surplus or deficit of the organisation., , 8. State any two features of Income and Expenditure Account., Ans: 1. It is a nominal account., 2. It is like a profit and loss account of business firms., 3. It includes only revenue items., 9. Give any two examples of Revenue Expenditure., Ans: a. Depreciation, b. Salary paid, , c. Rent paid, , 10. Give any two examples of Capital Expenditure., Ans: a. Cost of construction of building., b. Purchase of Machinery., c. Furniture purchased, 11. Give any two examples of Revenue Receipts., Ans: a. Subscriptions received., b. Rent received., 12. Give any two examples of Capital Receipts., Ans: a. Long-term loan borrowed., b. Sale of fixed assets., , c. Sale of old newspaper, c. Legacies received, , 13. State any two differences between Receipt and Payment Account and Income and Expenditure, Account., Receipt and Payment Account, Income and Expenditure Account., (a) It is a summary of the cash book., (a) It is a summary of Income and, Expenditure, (b) It includes both capital and revenue, (b) It includes only revenue items., items., 14. What is Capital Fund?, Ans: Capital Fund is the difference between assets and liabilities of a Not for profit, organisation. It consists of surplus and certain capitalised receipts such as Legacies, Life, membership fee, Entrance fee, etc., 15. What are Legacies?, Ans: Legacies are the amount received as per the will of a deceased person. It is treated as, capital receipt and is directly added to capital fund in the balance sheet., 16. What is Honorarium?, Ans: It is the amount paid to the person who is not the regular employee of the organisation,, for his service., Example: Payment to an artist for giving performance at the club., 17. Give the meaning of Endowment Fund., Ans: Endowment fund is a fund arising from a bequest or gift, the income of which is devoted, for specific purpose. It is a capital receipt and shown on the liability side of the Balance sheet., 4|Page

Page 9 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , 18. How do you treat tournament expenses, when separate tournament fund is not maintained?, Ans: when separate tournament fund is not maintained, then tournament expenses are debited, to income and expenditure account., 19. How do you treat prizes awarded, when Prize Fund is maintained?, Ans: Prizes awarded are deducted from Prizes Fund on the liability side of the Balance sheet., , Section E : Five Marks Questions, Practical oriented Questions:, I., , II., , Classify the following into Revenue and Capital items:, Answers, 1. X-ray plant purchased by a hospital, 2. Interest received, 3. Sale of old sports materials, 4. Donation received for Swimming pool, 5. Honorarium paid, 6. Installation charges of new machinery, 7. Subscription to newspaper, 8. Life membership fees, 9. Subscriptions received from members, 10. Amount paid for up keep of grounds, 11. Cost of purchase of assets, 12. Rent received, 13. Donations for buildings, 14. Government grant for maintenance, 15. Cost of installation of lights and fans, 16. Sale of old tennis balls, 17. Legacies received, 18. Match expenses met out of Match Fund, 19. Prizes awarded to students on the college day, 20. Laboratory expenses of science department of a college, , Capital Item, Revenue Item, Revenue Item, Capital Item, Revenue Item, Capital Item, Revenue Item, Capital Item, Revenue Item, Revenue Item, Capital Item, Revenue Item, Capital Item, Revenue Item, Capital Item, Revenue Item, Capital Item, Capital Item, Revenue Item, Revenue Item, , Prepare Receipts and Payment Account of a Not-For-Profit Organisation with 5 imaginary, figures., , Receipt and Payment Account, Dr., For the year ended 31.03.2018, Receipts, ₹, Payments, To Balance b/d, 10,000 By Salaries, To Subscriptions, 10,000 By Furniture, To Donations, 10,000 By Rent, By Balance c/d, 30,000, 15,000, To Balance b/d, , Cr., ₹, 5,000, 5,000, 5,000, 15,000, 30,000, , 5|Page

Page 10 :

Accountancy II PUC, , I., , Mysuru District P U Commerce Forum, , Section D: 12 Marks Questions, Preparation of Income and Expenditure Account and Balance Sheet when, Opening Balance Sheet is given in the problem, , 1. Followings are the Balance Sheet and Receipts and Payments Account of Sharada, Education Society, Mangaluru., Balance Sheet as on 31-03-2017, ₹, ₹, Liabilities, Assets, Capital fund, 36,400 Cash in hand, 2,050, Audit fees, 2,500 Maps and charts, 1,600, 5% Govt. Bonds, 31,000, Subscriptions outstanding, 1,000, Furniture, 3,250, 38,900, 38,900, Receipts and Payments A/C for the year ending 31-03-2018, Cr., ₹, ₹, Receipts, Payments, To Balance b/ d, 2,050 By Audit fees, 2,500, To Subscriptions, 20,500 By Rent, 1,800, To Donation, 2,500 By Maps and charts, 3,400, To Interest on Govt., 850 By Stationery and postage, 250, Bonds, By Salary, 8,000, By Functions, 1,050, By Balance c/ d, 8,900, 25,900, 25,900, , Dr., , Adjustments:, 1) Audit fees ₹ 2,500 still due, 2) Charge ₹ 250 as depreciation on furniture., 3) Half of the donation is to be Considered as revenue., 4) Outstanding Subscriptions ₹2,000 and subscriptions received in advance ₹1,500., 5) Salary prepaid ₹ 2,500, Prepare: i) Income and Expenditure Account and, ii) Balance Sheet as on 31-03-2018., , 6|Page

Page 11 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , Solution:, , Income and Expenditure Account, Dr., For the year ending 31-03-2018, ₹, Expenditure, Incomes, To Audit Fees, 2,500, By Subscriptions, Less: O/s Audit fees, Previous year, Add: O/s Audit Fees., Current year, , 2,500, Nil, , 2,500, , To Rent, To Stationary & postage, To Salary, To Functions, To Depreciation on Furniture, To Surplus (Excess income, , 2,500, , Cr., , 20,500, Less: O/s Subscription of 1,000, Previous year, 19,500, Add: O/s Subscription, 2,000, Current year, 21,500, , 1,800 Less: Subscription Received, In Advance, 1,500, 250, 8,000 By Donation (2,500x50/100), 1,050 By Interest on Govt Bonds 850, 250 Add: O/s Interest on Govt bonds 700, (31,000x2/100 = 1,550 -850), 8,950, , over the expenditure), , 22,800, , ₹, , 20,000, 1,250, 1,550, 22,800, , Balance Sheet As on 31-03-2018, , Liabilities, Capital Fund, 36,400, Add: Surplus, 8,950, 45,350, Add Donation, 1,250, (2,500x50/100), , O/S Audit Fees, Subscription received in, Advance, , ₹, , Assets, Cash in Hand, Maps & Charts, Add: Purchase, , 46,600 5% Govt Bonds, , Add: O/s Interest, , 2,500 Furniture, , Less: Depreciation, , 1,600, 3,400, 31,000, 700, 3,250, , 1,500 O/s Subscription current year, 50,600, , 250, , ₹, 8,900, 5,000, 31,700, 3,000, 2,000, 50,600, , 2. Followings are the Balance Sheet and Receipt & Payment Account of Golden Sports Club,, Vijayapura., Balance Sheet as on 31-03-2017, Liabilities, ₹, Assets, ₹, Outstanding salary, 7,000 Cash in hand, 15,500, Pre-received Subscriptions, 4,000 Sports Materials, 35,000, Capital Fund, 1,50,500 Furniture, 21,000, Land and Buildings, 90,000, 1,61,500, 1,61,500, , 7|Page

Page 12 :

Accountancy II PUC, , Dr., , Mysuru District P U Commerce Forum, , Receipts and payment A/c for the year ending 31-03-2018, , Receipts, To Balance b/ d, To Subscriptions, To Entrance Fees, To Sale of old newspaper, To Sports Fees, , ₹, 15,500, 52,000, 6,000, 3,000, 9,500, , 86,000, , Payments, By Salary, By Sports materials (1-102017), By Investments, By Postage, By Electricity charges, By Up- keep of grounds, By Balance c/ d, , Cr., ₹, 25,000, 18,000, 15,000, 400, 1,600, 6,500, 19,500, 86,000, , Adjustments:, a) Outstanding subscriptions for 2018 ₹ l,000, b) Outstanding salary as on 31-03-2018 ₹ 5,000, c) Half of the Entrance fees are to be capitalized., d) Depreciate sports materials @ 20% per annum, Prepare: i) Income and Expenditure account for the year ending 31-03-2018 and, ii) Balance Sheet as on that date, Solution:, Income and Expenditure Account, Dr., For the year ending 31-03-2018, Cr., ₹, ₹, Expenditure, Incomes, To Salary, 25,000, By Subscriptions, 52,000, Add: Pre-received Sub., 4,000, Less: O/s Salary, 7,000, Previous year 18,000, Previous year, 56,000, Add: O/s Salary, 5,000 23,000, Add: O/s Subscription, 1,000, Current year, Current year, 57,000, To Postage, 400 By Entrance fees, 3,000, (6,000x1/2)), To Electricity Charges, 250, 3,000, To Up-keep of ground, 6,500 By Sale of old newspaper, By Sports Fees, 9,500, To Depreciation of sports, Materials, 1) 35,000 x 20/100 =, 7,000, 2) 18,000 x 20/100 x 6/12 = 1,800, 8,800, To Surplus (Excess income, over the expenditure), , 32,200, 72,500, , 72,500, 8|Page

Page 13 :

Accountancy II PUC, , Balance Sheet As on 31-03-2018, , Mysuru District P U Commerce Forum, , ₹, Liabilities, Assets, Capital Fund, 1,50,500, Cash in Hand, Add: Surplus, 32,200, Sport Materials, 1,82,700, Add: Purchase, Add: Entrance Fees, 3,000 1,85,700, (6,000x1/2), , O/S Salary, , Less: Depreciation, , 5,000 Furniture, Land & Buildings, Investments, O/s Subscriptions, , 35,000, 18,000, 53,000, 8,800, , 1,90,700, , ₹, 19,500, , 44,200, 21,000, 90,000, 15,000, 1,000, 1,90,700, , 3. Followings are the Balance Sheet and Receipt and Payment Account of Malnad Sports, Club, Chikkamagaluru, Balance Sheet as on 31-03-2017, Dr., Cr., Liabilities, ₹, Assets, ₹, Outstanding salary, 3,200 Cash at Bank, 52,400, Pre-received Subscriptions, 4,000 Outstanding Subscription, 4,800, Outstanding Rent, 800 Investment, 21,000, Capital Fund, 1,30,800 Sports Materials, 43,600, Furniture, 32,800, 1,38,800, 1,38,800, , Dr., , Receipts and payment A/c for the year ending 31-03-2018, Receipts, , To Balance b/d, To Subscriptions:, 2016-17, 2017-18, 2018-19, To Donations, To Entrance Fees, To Interest, To Sale of old sports, , ₹, , Payments, , 52,400 By Rent:, 4,800, 90,200, 4,200, 32,400, 65,200, 2,800, 2,000, 2,54,000, , 2016-17, 2017-18, By Salary 2016-17, 2017-18, 2018-19, By Printing, By General Expenses, By Furniture (31-03-2018), By Sports Materials, By Balance c/d, , Cr., ₹, , 800, 8,800, 3,200, 46,400, 2,400, 15,200, 10,800, 48,000, 57,600, 60,800, 2,54,000, 9|Page

Page 14 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , Adjustments:, a. Subscriptions outstanding ₹ 5,600., b. Printing unpaid ₹ 1,000., c. Interest accrued ₹ 800., d. Depreciate furniture by 10% and sports materials by 10%., e. Capitalize 50% of donations., Prepare: (i) Income and Expenditure account and (ii) Balance Sheet as on 31-03-2018., Solution:, Income and Expenditure Account, Dr., For the year ending 31-03-2018, Cr., ₹, ₹, Expenditure, Incomes, To Rent, 8,800 By Subscriptions, 90,200, To Salaries, 46,400, Add: O/s Subscription of 5,600, To Printing, 15,200, Current year, 95,800, Add: Subscription Received, Add: Printing unpaid 1,000 16,200, To General Expenses, 10,800, in Advance 2016-17 4,000, 99,800, To Depreciation on Furniture, 1) 32,800x10/100, 3,280 By Donation (32,400x50/100) 16,200, By Entrance Fees, 65,200, To Depreciation on Sports, By Interest, 2,800, Materials, Add: Interest Accrued, 800, 3,600, 1) 43,600x10/100 =, 4,360, 2) 57,600x10/100x6/12 =2,880, 2,000, 7,240 By Sale of old sports, Materials, To Surplus (Excess of income, over the expenditure), 94,080, 1,86,800, 1,86,800, Note: Furniture purchased on end of the Accounting period, hence depreciation is nil, Balance Sheet As on 31-03-2018, , Liabilities, Capital Fund, 1,30,800, Add: Surplus, 94,080, Add: Donation, , (32,400x50/100), , ₹, , 16,200 2,41,080, , Printing unpaid, Subscription Received in, Advance (2018-19), , 1,000, 4,200, , 2,46,280, , Assets, Cash in Bank, Investments, Sports Materials, , ₹, 60,800, 5,200, , 43,600, Add: Purchased, 57,600, 1,01,200, Less: Depreciation, 7,240, 93,960, Furniture, 32,800, Add: Purchased, 48,000, 80,800, Less: Depreciation, 3,280 77,520, O/s Standing subscription, 5,600, Interest accrued, 800, Prepaid Salary, 2,400, 2,46,280, 10 | P a g e

Page 15 :

Accountancy II PUC, , II., , Mysuru District P U Commerce Forum, , Preparation of Income and Expenditure Account and Balance Sheet when, Opening Balance Sheet is not Given, , 4. From the following Receipt and Payment Account and information given below,, prepare Income and Expenditure Account and the Balance Sheet of Adult Literacy, Orgnisation as on March 31, 2018, Receipt and Payment A/C for the year ending 31-03-2017, Dr., Cr., Receipts, Payments, ₹, ₹, , To Cash in Hand (1-1-2017), To Subscriptions, To Donation, To Sale of furniture, (Book value 6,000), To Entrance Fees, To Life Membership Fees, To Interest on, Investments (5% P.A.), , Additional information:, , 6,800, 60,200, 3,000, 4,000, , 800, 7,000, 5,000, 86,800, , By Salaries, By Traveling Expenses, By Stationery, By Rent, By Repairs, By Books purchased, By Building purchased, By Cash in hand, (31-12-2017), , Particulars, As on 01-01-2017, l) Subscriptions received in advance, 1,000, 2) Outstanding subscriptions, 2,000, 3) Stock of stationery, 1,200, 4) Books, 13,500, 5) Furniture, 16,000, 6) Outstanding rent, 1,000, 7) Investments, 1,00,000, , Solution:, , 24,000, 6,000, 2,300, 16,000, 700, 6,000, 30,000, 1,800, , 86,800, , As on 31-12-2017, 3,200, 3,700, 800, 16,500, 8,000, 2,000, 1,00,000, , Balance Sheet as on 1-01-2017, , Liabilities, Pre-received Subscriptions, Outstanding Rent, Capital Fund, (Balancing Figure), , ₹, 1,000, 1,000, 1,37,500, , 1,39,500, , Assets, Cash in hand, Outstanding Subscription, Stock of Stationery, Books, Furniture, Investment, , ₹, 6,800, 2,000, 1,200, 13,500, 16,000, 1,00,000, 1,39,500, 11 | P a g e

Page 16 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , Income and Expenditure Account, Dr., For the year ending 31-12-2017, Cr., ₹, ₹, Expenditure, Incomes, To Salaries, 24,000 By Subscriptions, 60,200, To Travelling expenses, 6,000, Less: O/s Subscription, 2,000, To Stationery, 2,300, Previous year, 58,200, Purchased, Add: O/s Subscription of 3,700, Add: Opening stock 1,200, Current year, 61,900, Add: Subscription received, of stationery 3,500, Less: Closing stock of 800, 2,700, In Advance (2017), 1,000, Stationery, 62,900, Less: Subscription received 3,200 59,700, To Rent, 16,000, In advance (2018), Less: O/s Rent of P/y 1,000, 15,000, 3,000, Add: O/s Rent of C/y, 2,000 17,000 By Donation, Entrance, Fees, 800, To Repairs, 700, 5,000, To Loss on Sale of Furniture, 2,000 By Interest on Investment, (6,000 - 4,000), To Depreciation on Books, 3,000, To Depreciation on Furniture, 2,000, To Surplus (Excess income, over the expenditure), 11,100, 68,500, 68,500, Balance Sheet As on 31-03-2018, , ₹, Liabilities, Assets, Capital Fund, 1,37,500, Cash in Hand, Add: Surplus, 11,100, Stock of Stationery, 1,48,600, Buildings, Add: Life Membership Fees 7,000 1,55,600 Books, O/S Rent, 2,000 Furniture, Subscription received in, Investment, Advance, 3,200 O/s Subscription, 1,60,800, Working Note: 1, Depreciation on Books, Opening stock of Books 13,500, Add: Book Purchased, 6,000, 19,500, Less: Closing stock of 16,500, Books, , Depreciation on books = 3,000, , ₹, 1,800, 800, 30,000, 16,500, 8,000, 1,00,000, 3,700, 1,60,800, , Depreciation on Furniture, Opening stock of Furniture, 16,000, Less: Furniture Sold, 6,000, 10,000, Less: Closing stock of, 8000, Furniture, , Depreciation on Furniture, , = 2,000, 12 | P a g e

Page 17 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , 5. From the following Receipt and Payment Account of a club, prepare Income and, Expenditure Account for the year ended March 31, 2018 and the Balance Sheet as on that, date., Receipt and Payment A/C for the year ending 31-03-2017, Dr., Cr., Receipts, , ₹, , To Balance b/ d, To Subscription:, 2016-17, 2,000, 2017-18, 70,000, 2018-19, 3,000, To Sale of old books, (costing ₹ 2,300), To Rent from use of Hall, To Sale of Newspapers, To Profit from, entertainment, , Payments, , 3,500 By General Expenses, By Salary, By Postage, By Electricity charges, 75,000 By Furniture, 2,000 By Books, By Newspapers, 17,000 By Meeting expenses, 400 By T.V. set bought, By Balance c/d, 7,300, 1,05,200, , ₹, , 900, 16,000, 1,300, 7,800, 26,500, 13,000, 600, 7,200, 16,000, 15,900, 1,05,200, , Additional information:, a) The club has 100 members each paying an annual subscription of ₹ 900., Subscriptions outstanding on March 31, 2017 were ₹ 3,600., b) On March 31, 2018 salary outstanding amounted to ₹ 1,000, Salary paid included ₹, 1,000 for the year 2016-17, c) On April 1, 2018, the club owned the Land and Buildings ₹ 25,000, Furniture ₹ 2,600, and Books ₹ 6,200, Solution:, Liabilities, O/s Salary, Capital Fund, (Balancing Figure), , Balance Sheet as on 1-04-2017, ₹, Assets, 1,000 Cash at Hand, 39,900 O/s Subscription, Land & Buildings, Furniture, Books, 21,500, , ₹, 3,500, 3,600, 25,000, 2,600, 6,200, 21,500, , 13 | P a g e

Page 18 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , Income and Expenditure Account, Dr., For the year ending 31-03-2018, ₹, Expenditure, Incomes, To General Expenses, 900 By Subscriptions, 70,000, To Salary, 16,000, Less: O/s Subscription of P/y 3,600, 66,400, Less: O/s Salary, 1,000, Previous year 15,000, Add: O/s Subscription of P/y2,000, Add: O/s Salary, 1,000 16,000, Received in current Year 68,400, Current year, , To Postage, To Electricity Charges, To News papers, To Meeting expenses, To Loss on Sale of old Books, (2,300 – 2000), To Surplus (Excess income, over the expenditure), , 1,300, 7,800, 600, 7,200, , Add: O/s Subscription of, Current Year (W.N), , Cr., ₹, , 20,000, 88,400, , Add: O/s Subscription of p/y, , Still in current year (W.N)1,600, , By Rent from Use of Hall, 300 By Sale of newspaper, By profit from entertainment, 80,600, 1,14,700, , 90,000, 17,000, 400, 7,300, 1,14,700, , Balance Sheet As on 31-03-2018, , ₹, Liabilities, Assets, Capital Fund, 39,900, Cash in Hand, Add: Surplus, 80,600 1,20,500 Furniture, Subscription Received in, 3,000 Add: Purchase, Advance, Books, O/S Salary, 1,000 Add: Purchase, , 2,600, 26,500, 6,200, 13,000, 19,200, 2,300, , ₹, 15,900, 29,100, , Less: Sale of old books, 16,900, T.V. Set, 16,900, O/s Subscription C/y 20,000, Add: O/s Subscription of P/y 1,600 21,600, 1,24,500, 1,24,500, Working Note:, , Calculation of O/s Subscription of Current Year, Total Subscription Receivable 100 x 900 =, 90,000, Less: Subscription received in Current year 70,000, Outstanding subscription in current year 20,000, , O/s Subscription of Previous year, still O/s in Current year, O/s in Previous year, 3,600, Less: Previous year O/s, Received in Current year 2,000, Balance of o/s in current year 1,600, , 14 | P a g e

Page 19 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , 6. Receipt and Payment Account of Shankar Sports Club is given below Prepare Income, and Expenditure Account for the year ending 31-03-2018, , Dr., , Receipt and Payment A/C for the year ending 31-03-2018, Receipts, , To Cash in Hand, To Entrance fees, To Donation for Buildings, To Locker Rent, To Life Membership Fees, To Profit from, entertainments, To Subscriptions, , ₹, , Payments, , By Rent, By Wages, By Billiard table, By Furniture, By Interest, By Postage, 3,000 By Salary, 40,000 By Cash in hand, 80,000, 2,600, 3,200, 23,000, 1,200, 7,000, , Cr., ₹, , 18,000, 7,000, 14,000, 10,000, 2,000, 1,000, 24,000, 4,000, 80,000, , Additional information:, (a) Subscription outstanding on March 31, 2017 is ₹1,200 and ₹ 2,300 on March 31, 2018., Opening stock of postage stamps is ₹ 300 and closing stock is ₹ 200., (b) Rent ₹1,500 related to 2016-17 and ₹ 1,500 is still unpaid., (c) On April 1, 2017, the club owned furniture ₹ 15,000 and Furniture valued at ₹ 22,500, on March 31, 2018., (d) The club took a loan of ₹ 20,000 @10 p.a. for the year 2016-17., , Solution:, Liabilities, Rent Unpaid, Loan @10% P.a., , Balance Sheet as on 1-04-2017, ₹, Assets, 1,500 Cash at Hand, 20,000 Outstanding Subscription, Stock of postage Stamp, Furniture, Capital Fund (Deficit), (Balancing Figure), 21,500, , ₹, 2,600, 1,200, 300, 15,000, 2,400, 21,500, , 15 | P a g e

Page 20 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , Income and Expenditure Account, Dr., For the year ending 31-03-2018, ₹, Expenditure, Incomes, To Rent, 18,000, By Subscriptions, Less: O/s Rent of P/Y, , 40,000, Less: O/s Subscription of 1,200, Previous year, 38,800, Add: O/s Subscription of 2,300, , 1,500, , 16,500, Add: O/s Rent of C/y 1,500 18,000, Current Year, To Wages, 7,000, To Interest, 2,000 By Entrance fees, By Locker Rent, To Postage(Purchased), 300, By Profit from Entertainment, Add: Purchase of postage 1,000, By Deficit (Excess of expenditure, 1,300, Over income), Less: Closing stock of 200, 1,100, , Cr., ₹, , 41,100, 3,200, 1,200, 3,000, 6,100, , Postage, , To Salary, To Depreciation on Furniture, , 24,000, 2,500, 54,600, , 54,600, , Balance Sheet As on 31-03-2018, , Liabilities, Loan (10% P.A.), Donation for Building, O/S Rent, , ₹, 20,000, 23,000, 1,500, , Assets, Cash in Hand, Billiard table, Furniture, Postage of stamps, O/s Subscription, Capital Fund (Debit Balance) 2,400, Add: Deficit of current year 6,100, 8,500, Less: Life Membership fees 7,000, , ₹, 4,000, 14,000, 22,500, 200, 2,300, , 1,500, 44,500, , 44,500, Note: When Deficit Capital Fund along with deficit in income & Expenditure A/c, it should be, shown in Balance sheet Assets Side., , Working Note: 1, Depreciation on Furniture, Opening stock of Furniture, 15,000, Add: Furniture (purchased), 10,000, 25,000, Less: Closing stock of, 22,500, Furniture, , Depreciation on Furniture = 2,500, ***END***, 16 | P a g e

Page 21 :

Accountancy II PUC, , BOOK-1, CHAPTER – 2, , Mysuru District P U Commerce Forum, , ACCOUNTING FOR PARTNERSHIP: BASIC CONCEPTS, Section A : One mark questions :, I. Fill in the blank questions:, 1. Section 4 of Indian Partnership Act, 1932 defines Partnership, 2. A partnership has no separate Legal entity., 3. In order to form a partnership, there should be at least 2 persons., 4. Partnership is the result of Agreement between two or more persons to do business and share, its profits and losses., 5. It is preferred that the partners have a Written agreement, 6. The agreement should be to carry on some Lawful business., 7. Each partner carrying on the business is the principal as well as the for all other partners agent, 8. The liability of a partner for his acts is unlimited, 9. In the absence of partnership Deed interest on advance from Partner will be charged @ 6%, percentage per annum., 10. Under fixed capital method, the capitals of the partners shall remain fixed., 11. Under fluctuating Capital Method, the partners capital account balances Change from time to, time., 12. Profit and Loss Appropriation Account is merely an extension of Profit/Loss Account of firm., 13. Profit and loss Appropriation Account………………………….Dr, To Interest on capital Account., (Transferring interest on capital to P/L appropriation A/c), , xxx, ---, , --xxx, , 14. Profit/Loss Appropriation Account………………………….Dr, To Salary to Partners account, (Transferring partner’s salary to P/L Appropriation A/c)., , xxx, ---, , --xxx, , 15. Profit/Loss Appropriation A/c………………………………….Dr, To partners’ Capital/Current A/c., (Profit shared & transferred), , xxx, ---, , --xxx, , 16. When fixed amounts is withdrawn at the end of every month, interest on the total amount for, the year ending is calculated for 5½ months., 17. Under fluctuating capital method, all the transactions relating to partners are directly recorded, in the partners capital accounts, 18. Under fixed capital method, the amount of capital remains same fixed, 19. Under fixed capital method, all the transactions relating to a partner are recorded in a separate, account called partners current Account., 17 | P a g e

Page 22 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , 20. There is not much difference in the final accounts of a sole proprietary concern and that of a, partnership firm, , II. Multiple Choice Questions:, 1. The agreement between the partner should be in :, a)Oral, b)Written, c) Oral or Written, 2., , Partnership deed contains :, a) Name of firm, c) Profit and loss sharing ratio, , d) None of the above, , b) Name and address of the part, , d) All of the above, , 3., , If any partner has advanced some money to the firm beyond the amount of his capital, he shall, be entitled to get interest on the amount at the rate of :, a) 5% p.a., b) 6% p.a., c) 8% p.a, d) None of the above, , 4., , Interest on capital is generally provided for in that situations when:, a) The partners contribute unequal amounts of capital but share profits equally., b) The capital contribution is same but profit sharing is unequal, , c) both the situations above., d) None of the above., , 5., , When fixed amount is withdrawn on the first day of every month, interest on total amount for, the year ending will be calculated for:, a) 2 &1/2 months, b) 4 &1/2 months, c) 6 &1/2 months, d) None of the above, , 6., , When varying amounts are withdrawn at different intervals, the interest is calculated using:, a) Simple Method, b) Average Method, c) Product Method, d) None of the above, , 7., , Adjustment for correction of omission and commission can be made:, a) Profit and loss Adjustment account, b) Directly in the Capital Accounts of concerned partners, c) Both the situations above., d) None of the above, , 8., , In order to form a Partnership there should be at least:, b) Two persons, a) One person, c) Seven persons, d) None of the above, , 9. The business of a partnership concern may be carried on by:, a) All the partners, b) Any of them acting for all, c) All Partners or any of them acting for all, d) None of the above, 10. The agreement between Partners must be to share:, a) Profits, b) Losses, c) Profits and losses, , d) None of the above, 18 | P a g e

Page 23 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , 11. The liability of a Partner for acts of the firm is:, a) Limited, b) Unlimited, c) Both the above., d) None of the above, , 12. The partnership Deed should be properly drafted and prepared as per the provisions of the:, a) Partnership Act., b) Stamp Act, c) Companies Act, d) None of the above, 13. The clauses of Partnership Deed can be altered with the consent of:, a) Two Partners, b) Ten Partners, c) Twenty Partners, d) All the Partners, III. True or False Questions:, 1. The agreement between partners must be in writing. False., 2. The clauses of partnership deed can be altered with the consent of all the Partners. True, 3. If the partnership deed is silent about the profit sharing ratio, the profit and loss of the firm is, to be shared equally. True, 4. A partner is entitled to claim interest at the rate of 10% p.a. on the amount of capital contributed, by him, if there is no agreement in the firm. False, 5. In the absence of Partnership Deed, no partner is entitled to get salary. True, 6. Under fixed capital method the Partner's Capital Accounts will always show a credit balance., True, 7. P/L Appropriation A/c shows how the profits are appropriated among the partners. True, 8. When fixed amount is withdrawn during the middle of every month, interest on total amount, is calculated for 6 months: True, 9. lf there is loss, no interest on capital is to be paid to partners, even if there is a provision in, Partnership Deed: True, 10. Accounting treatment for Partnership is similar to that of a sole Proprietorship Business: True, 11. There are two methods by which the capital accounts of partners can be ' maintained: True, 12. Profit and Loss appropriation account is merely an extension of the Profit and Loss Account of, a firm: True, 13. Interest on partners’ capital is debited to Partners' Capital Accounts: False, 14. In case of Guarantee of profit to a partner, assurance may be given by only one partner: True, , IV. Very Short Answer Questions:, , 1. Who is a Partner?, Ans. The persons who have entered into partnership with one another are individually called, partner, 2. What do you mean by Partnership Firm?, Ans. The persons who have entered into partnership with one another are collectively called, partnership firm, 19 | P a g e

Page 24 :

Accountancy II PUC, , 3. State any one features of Partnership., Ans.1) Agreement, 2) Two are persons, , Mysuru District P U Commerce Forum, , 4. What is the minimum number of partners in a firm?, Ans. 2 partners, 5. Name any one contents of Partnership Deed., Ans. a) Name and address of the firm or, , b) Name and address of partners, , 6. Name any one method of maintaining capital accounts of Partners., Ans. Fixed capital system., 7. Name any one final accounts of partnership firm., Ans. Profit/Loss account, & Balance sheet etc., 8. How do you distribute profit or loss among the partners in the absence of partnership deed?, Ans. Equally, 9. Why the Profit and Loss Appropriation account is prepared?, Ans. Profit and Loss Appropriation a/c is prepared to appropriate profits among partners, 10. At what rate Interest on advances by Partners is to be paid as per Partnership Act?, Ans. 6% P.a., 11. When interest is charged on partners drawings?, Ans. Interest on drawings in charged when there is a provision in agreement among the, partners about it., 12. When Partners Current Accounts are prepared in partnership firms?, Ans. Partners’ Capital accounts are maintained under fixed capital system., 13. State any one special aspect of partnership accounts., Ans. Maintenance of partners’ capital accounts under, 14. When the Current Accounts of Partners are opened?, Ans. Current accounts are opened when the firm decides to follow fixed capital system, 15. Under fluctuating capital method, how many accounts are maintained for each partner?, Ans. Only one account i.e. capital Accounts, 16. State any one feature of fluctuating capital method., Ans. Capital balance changes year after year for each partner, 17. State any one situation in which provision of payment of interest on capital to partner is, made., Ans. 1) where the capital contribution is same but profit sharing is unequal, 18. Find out Interest at 8% p.a. on capital of Rs.50,000 for 9 months., Ans. Interest = 50,000 X 8/100 X 9/12 = ₹ 3,000, 19. Which is the suitable method for calculation of Interest on drawings, when fixed amount is, withdrawn every month?, Ans: Average period method or short cut method, 20. Give one example for past adjustment?, Ans. Omission of interest on partners’ capital, 20 | P a g e

Page 25 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , Section B: Two Marks questions:, , 1. What is Partnership?, Ans. when two or more persons join hands to set up business and share its profits and, losses is called partnership., 2. Define Partnership?, Ans: According to section 4 Indian partnership act, “partnership is the relation between, persons who have agreed to share the profits of a business carried on by all or any of them, acting for all”, 3. State any two features of Partnership., Ans: a) Agreement, b) Two or more persons, 4. What is Partnership Deed?, Ans: Partnership deed is the written agreement containing terms of partnership and stamped, as per stamp Act and signed by all the partners., 5. What are the methods of maintaining capital account of partners?, a) Fixed capital method and, b) Fluctuating capital method, 6. What is fixed capital method?, Ans: Fixed capital method is followed to have capital balances same year after year. So, capital accounts and current Accounts are prepared to separate adjustments from capital, 7. What is fluctuating capital method?, Ans: Fluctuating Capital method is followed to have all adjustments in only one A/c as, partners capital A/C. So, the balances would change year after year, 8. State any two differences between fixed and fluctuating capital methods., Ans:, Key points, Fixed, Fluctuating, 1. Accounts involved, a) Capital A/c b) Current A/c, Capital A/c, 2. Adjustments, Adjustments are recorded in, Adjustments & balances are, current A/c, taken together, 9. What do you mean by Profit and Loss Appropriation Account?, Ans: Profit/Loss appropriation Account is merely an extension of Profit/Loss account of, the partnership firm. It shows how the profit appropriated among the partners, 10. What is guarantee of profit to a partner?, Ans: Partner will be admitted sometimes with a guarantee of certain minimum. Amount by, way of his share of profits of the firm such a situation is called as guarantee of profit., 11. What do you mean by past adjustments?, Ans: past adjustments are the adjustments to be made in respect of Omission or errors in the, recording of transactions / preparation of final accounts of partnership firm., 12. State any two final accounts of a Partnership firm., Ans: a) Profit and loss Account, b) Balance sheet, 21 | P a g e

Page 26 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , 13. In the absences of partnership deed, specify the rules relating to the followings:, a. Sharing of profit and losses, b. Interest on partners’ capital, Ans: a) Sharing of profits and losses – Equally, b) Interest on partners’ capital – Not to be allowed, 14. State the rules relating to the followings in the absence of Partnership Deed:, a. Interest on drawings, b. Interest on advances from Partners., Ans: a) Interest on drawings – Not to be charged, b) Interests on advances from partners – at 6% p.a., , 15. Name any two methods for calculation of Interest on drawings., Ans: 1) Product method, 2) Average period method, 16. When the Interest on drawings is generally provided to partners?, Ans: Interest is provided as per the terms of the partnership deed., 17. How do you close Profit and Loss Appropriation Account in Partnership?, Ans: By transferring the profit or loss on appropriation to partners capital Accounts, 18. State any two special aspects of Partnership Accounts., Ans: 1) Maintenance of partner’s capital account, 2) Distribution of profit and loss among the partners, 19. Name any two contents of Partnership Deed., Ans. 1) Name & address of partners, , 2) Date of commencement of the business, , SECTION C: SIX MARKS QUESTIONS:, Problems on Preparation of P & L Appropriation A/c, , 1. Sachin and Pratham started business in partnership on 01.04.2015 with a capital of ₹ 1,00,000 and, ₹ 80,000 respectively agreeing to Share profits and losses in the ratio of 3:2. For the year ending, 31.03.2016, they earned the profits of ₹ 36,000 before allowing:, i), Interest on capital at 5% p.a., ii) Interest on drawings: Sachin ₹ 600 and Pratham ₹ 1 ,000, iii) Yearly salary of Pratham ₹ 6,000 and commission to Sachin ₹4000., Iv] Their drawings during the year: Sachin ₹ 16,000 and Pratham ₹ 20,000., Prepare Profit and Loss Appropriation Account., Solution:, Profit and Loss Appropriation Account., Dr., For the year ended 31-03-2016, Cr., , Particulars, , To Interest on Capital, Sachin(1,00,000x 5/100) 5,000, Pratham(80,000 x 5/100) 4,000, To Pratham’s Salary, To Sachin’s Commission, To Partners’ Capital A/c, Sachin - 18,600X 3/5, 11,160, Pratham – 18,600X 2/5, 7,440, , ₹, , Particulars, , ₹, , By profit & loss A/c (Net profit b/d) 36,000, By Int. on drawings, 9,000, Sachin, 600, 6,000, Pratham, 1,000 1,600, 4,000, 18,600, 37,600, , 37,600, 22 | P a g e

Page 27 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , 2. Shiva and Basava are partners sharing profits in the ratio of 2: 1 with capitals of ₹ 25,000 and ₹, 15,000 respectively. Interest on capital is agreed @ 6% p.a. Basava is to be allowed an annual salary, of ₹ 1,500. During the year 2015-16, they earned. The profits of ₹ 10,000. Interest on drawings, being; Shiva ₹ 1,500 and Basava ₹ 1000. Prepare Profit and Loss Appropriation Account., Solution:, Dr., , Profit and Loss Appropriation Account., For the year ended 31-03-2016, , Particulars, , ₹, , To Interest on Capital, Shiva (25,000 x 6/100), Basava (15000 x 6/100), , 15,00, 900, , To Basava’s salary, To Partners’ Capital A/c, Shiva - 8,600X 2/3, Basava – 8,600X 1/3, , 5,733, 2,867, , Particulars, , By profit & loss A/c (Net profit b/d), By Int. on drawings, 2,400, Shiva, 1,500, Basava, 1,000, 1,500, , ₹, , Cr., , 10,000, , 2,500, , 8,600, 12,500, , 12,500, , 3. X & Y are Partners commenced Partnership business on 1.1.2016 sharing profits & losses in 3:2, ratio with capitals of ₹ 1,00,000 and ₹ 80,000 respectively. They earned profits of ₹ 15,000 for, the year before allowing:, a) Interest on Capitals@ 10% p.a., b) Interest on drawings: X ₹ 1,000 & Y ₹ 800, c) Commission payable to X ₹ 2000, d) Salary payable to Y ₹ 3000, Prepare P & L Appropriate A/c for the year ending 31.12.2017., , Solution:, , Particulars, To Interest on Capital, X (1,00,000 x 10/100), Y (80,000 x 10/100), To X’s Commission A/c, To Y’s Salary A/c, , Profit and Loss Appropriation Account., For the year ended 31-03-2017, , ₹, , 10,000, 8,000, , Particulars, , ₹, , By profit & loss A/c (Net profit b/d) 15,000, By Int. on drawings, 18,000, X, 1,000, Y, 800, 1,800, 2,000, 3,000 Partners’ Capital A/c (Loss), X - 6,200 X 3/5, 3,720, Y – 6,200 X 2/5, 2,480 6,200, 23,000, 23,000, 23 | P a g e

Page 28 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , PROBLEMS ON CALCULATION OF INTEREST ON DRAWINGS, , 1. Yasashviand Tapashvi are partners in a firm: During the year ended on 31st March 2016, Yasashvi, makes the drawings as under:, Date of Drawings, , ₹, , 01.08.2015, 5,000, 31.12.2015, 10,000, 31.03.2016, 15,000, Partnership Deed provided that partners are to be charged interest on drawings @ 12% p.a. Calculate, the interest on drawings of Yasashvi under Product Method., Solution:, Calculation of Interest on drawings, Date of Drawings, ₹, No. of O/s Months, Product, 01-08-2015, 5,000, 8, 40,000, 31-12-2015, 10,000, 3, 30,000, 31-03-2016, 15,000, 0, 0, Total, 70,000, Interest on Drawings = Total Product x Rate x, , 1, , 12, 12, , 1, , Yashasvi’s Interest on drawings = ₹ 70,000 X100 X 12 = ₹ 700., , 2. Sahana and Saniya are partners in firm. Sahana's drawings for the year 2016-17 are given as, under:, ₹ 4,000 on 01.06.2016, ₹ 6,000 on 30.09.2016, ₹ 2,000 on 30.11.2016, ₹ 3,000 on 01.01.2017, Calculate interest on Sahan's drawings at 8% p.a. for the year ending on 31.03.2017, under, product method., Solution:, Date of Drawings, 01-06-2016, 30-09-2016, 30-11-2016, 01-01-2017, , Calculation of Interest on drawings, ₹, No. of O/s Months, 4,000, 10, 6,000, 6, 2,000, 4, 3,000, 3, Total, , Interest on Drawings = Total Product x Rate x, Sahana’s Interest on drawings = ₹.93,000, , 1, , 12, 8, 1, 𝑋𝑋 100 𝑋𝑋 12, , Product, 40,000, 36,000, 8,000, 9,000, 93,000, , = Rs.620, , 3. Murthy and Patil are partners in a firm sharing profits and losses in the ratio of 3:2. Murthy, withdraw ₹ 4,000 quarterly at the beginning of each quarter. Calculate the interest on drawings at, 9% p.a. for the year ending 31.03.2017, under product method., 24 | P a g e

Page 29 :

Accountancy II PUC, , Solution:, Date of Drawings, 01-04-2016, 01-07-2016, 01-10-2016, 01-01-2017, , Mysuru District P U Commerce Forum, , Calculation of Interest on drawings, ₹, No. of O/s Months, 4,000, 12, 4,000, 09, 4,000, 06, 4,000, 03, Total, , Interest on Drawings = Total Product x Rate x, , 1, , 12, , 9, , Murthy’s Interest on drawings = ₹ 1,20,000 𝑋𝑋 100 𝑋𝑋, , 1, 12, , Product, 48,000, 36,000, 24,000, 12,000, 1,20,000, , = ₹ 900, , 4. Calculate interest on drawings of Mr. Kamalakar @10% p.a if he withdrew ₹ 1,000 per month by, the short cut method:, (i) At the beginning of each month, (ii) At the end of each month., Solution : (i) At the beginning of each month :, , Interest on Drawings = Total Drawings x, Average period =, , 12+1, 2, , 𝟏𝟏𝟏𝟏, , =, , 𝟐𝟐, , 10, , Interest on drawings = ₹ 12,000 𝑋𝑋 100 𝑋𝑋, (ii) At the End of each month :, , 5., , 11+0, 2, , 𝟏𝟏𝟏𝟏, , =, , 𝟐𝟐, , 10, , Interest on drawings = ₹ 12,000 𝑋𝑋 100 𝑋𝑋, , 100, , 1, , x Average Period x 12, , Total drawings = ₹ 1,000 X 12 =12,000, , 13, 2, , Interest on Drawings = Total Drawings x, Average period =, , 𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅, 1, , 𝑋𝑋 12 = ₹ 650, 𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅, 100, , 1, , x Average Period x 12, , Total drawings = ₹ 1,000 X 12 =12,000, , 11, 2, , 1, , 𝑋𝑋 12 = ₹ 550, , Calculate interest on drawings of Purohit @10%p.a. if he withdrew ₹ 48,000 in year evenly., (i) At beginning of each quarter., (ii) At end of each quarter., Solution :, , (i) At beginning of each quarter:, , Interest on Drawings = Total Drawings x, Average period =, , 12+3, 2, , 𝟏𝟏𝟏𝟏, , =, , 𝟐𝟐, , 10, , Interest on drawings = ₹ 48,000 𝑋𝑋 100 𝑋𝑋, (ii) At the End of each Quarter:, 9+0, 2, , =, , 𝟗𝟗, 𝟐𝟐, , 100, , 1, , x Average Period x 12, , Total drawings = ₹ 48,000, , 15, 2, , Interest on Drawings = Total Drawings x, Average period =, , 𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅, 1, , 𝑋𝑋 12 = ₹ 3,000, 𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅, 100, , 1, , x Average Period x 12, , Total drawings = ₹ 48,000, , 10, , 9, , 1, , Interest on drawings = ₹ 48,000 𝑋𝑋 100 𝑋𝑋 2 𝑋𝑋 12 = ₹ 1,800, , 25 | P a g e

Page 30 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , PROBLEMS ON GUARANTEE OF A PROFIT, , 1. Sachin and Rahul were partners in a firm sharing profits and losses in the ratio of 3:2. They admit, Dhoni for 1/6th share in profits and guaranteed that his share of profits will not be less than ₹, 25,000. Total profits of the firm were ₹ 90,000. Calculate share of profits for each partner when the, Guarantee is given by a firm. Prepare Profit and Loss Appropriation Account., Solution:, Profit and Loss Appropriation Account., For the year ended ………………, Particulars, ₹, Particulars, ₹, To Sachin’s Capital, 45,000, By Profit & loss A/c, 90,000, (-) Deficiency Share, 6,000, 39,000, (Net profit b/d), To Rahul’s Capital, (-) Deficiency Share, , 30,000, 4,000, , To Dhoni’s Capital, (+) Deficiency Share, , 15,000, 10,000, , Working Note:, , 26,000, 25,000, 90,000, , Minimum Guarantee of profit to Dhoni, Less: Share in profit as per profit sharing ratio, (90,000X1/6), Deficiency in profit, Deficiency born by Sachin & Rahul in the ratio of 3:2, Sachin: 10,000X3/5 = 6,000, Rahul: 10,0000X2/5 = 4,000, , 90,000, ₹, 25,000, 15,000, 10,000, 10,000, , Calculation of Capital As per, New Ratio, New Ratio= 3:2:1, Total profit = ₹ 90,000, , Sachin = ₹ 90,000X3/6 =₹ 45,000, Rahul = ₹ 90,000X2/6 =₹ 30,000, Dhoni = ₹ 90,000X1/6 =₹ 15,000, , 2. Roja and Usha were partners in a firm sharing profits and losses in the ratio of 3:2. They admit Sahana, for 1/6th share in profits and guaranteed that his share of profits will not be less then ₹ 25,000. Total, profits of the firm were ₹ 90,000. Calculate share of profits for each partner when the Guarantee is given, by Roja. Prepare Profit and Loss Appropriation Account., , Solution:, Particulars, To Roja’s Capital, (-) Deficiency Share, , Profit and Loss Appropriation Account., For the year ended ………………, ₹, Particulars, 45,000, By Profit & loss A/c, (Net profit b/d), 10,000, 35,000, , To Usha’s Capital, To Sahana’s Capital, (+) Deficiency Share, Total, , ₹, 90,000, , 30,000, 15,000, 10,000, , 25,000, 90,000, , Total, , 90,000, , 26 | P a g e

Page 31 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , Working Note:, , Minimum Guarantee of profit to Dhoni, Less: Share in profit as per profit sharing ratio, (90,000X1/6), Deficiency in profit, Deficiency born by Roja, , ₹, 25,000, 15,000, 10,000, 10,000, , SECTION – E, PRACTICAL ORIENTED QUESTIONS, 1. How do you treat the following in the absence of Partnership Deed?, a) Profit Sharing Ratio, - Equal, b) Interest on Capital, , - Not Allowed, , c) Interest on Drawings, , - Not Charged, , d) Interest on advances from partners, , - Allowed At 6% p.a., , e) Remuneration to partners for firm’s work, , - No Remuneration, , 2. Write two partners current accounts under fixed capital system with 5 imaginary figures., Dr., , Particulars, To Drawings, To Interest on Drawings, To Balance c/d, , Partners Current Account, A (₹), B (₹), Particulars, 10,000 10,000 By Interest on Capital A/c, 1,000, 1,000 “ Salary A/c, 19,000, 9,000 “ P & L Appropriation A/c, 30,000 20,000, By Balance b/d, , A (₹), 10,000, 10,000, 10,000, 30,000, 19,000, , Cr., B (₹), 10,000, 10,000, 20,000, 9,000, , 3. Write two partners’ capital accounts under fluctuating capital system with 5 imaginary figures., Dr., , Particulars, To Drawings, To Interest on Drawings, To Balance c/d, , Partners Capital Account, Cr., A (₹), B (₹), Particulars, A (₹), B (₹), 10,000, 10,000 By Balance b/d, 1,00,000 1,00,000, 1,000, 1,000 By Interest on Capital A/c, 10,000 10,000, 10,000, “ Salary A/c, 119,000 1,09,000 “ P & L Appropriation A/c 10,000 10,000, 1,30,000 1,20,000, 1,30,000 1,20,000, By Balance b/d, 1,19,000 1,09,000, 27 | P a g e

Page 32 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , 4. Write Profit and Loss Appropriation Account of a firm with 5 imaginary figures., Profit and Loss Appropriation Account, Dr., For the year ended 31.03.2018, Particulars, ₹, Particulars, To Interest on Capital A/c, By Profit & Loss A/c, - Rama, 5000, [Net Profit b/d], - Krishna, 5000, 10,000 By Interest on Drawings A/c, To Salary to Rama A/c, 10,000, - Rama, 2500, To Commission to Krishna A/c 10,000, - Krishna, 2500, To Partners Capital A/c, -Rama, 10000, -Krishna, 10000, 20,000, 50,000, , Cr., ₹, 45,000, , 5,000, , 50,000, , ***END***, , 28 | P a g e

Page 33 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , BOOK - 1, CHAPTER -3, RECONSTITUTION OF A PARTNERSHIP FIRM ADMISSION OF A PARTNER, Section A: One Mark Questions, , I. Fill In The Blanks:, 1. Old Ratio is used to distribute accumulated profits and losses at the time of admission of a new, partner., 2. Profit or loss on revaluation is shared among the old partners in Old Ratio ratio, 3. Old ratio - New ratio = Sacrifice Ratio, 4. Accumulated losses are transferred to the capital accounts of the old partners at the time of, admission in their Old Ratio ratio., 5. General reserve is to be transferred to Capital accounts at the time of admission of a new, partner., 6. Goodwill brought in by new partner in cash is to be distributed among old partners in Sacrifice, Ratio, 7. If the amount brought by new partner is more than his share in capital, the excess is known as, Goodwill, 8. Asset Account is debited for the increase in the value of an asset., 9. Unrecorded asset is to be credited to Revaluation account., 10. A and B are partners sharing profits & losses equally with capitals of ₹ 45,000 each. C is, admitted for 1/3rd share and he brings in ₹ 60,000 as his capital. Hidden Goodwill is ₹ 30,000, (60,000x3 = 1,80,000) (45,000x3 = 1,50,000) Hidden Goodwill = 1,80,000-1,45,000 = 30,000, 11. Due to change in profit sharing ratio, some partners will gain in future profits while others will, loose, 12. Goodwill is an Intangible asset., 13. Goodwill account is credited for cash brought in by new partner for his share of goodwill., 14. New Profit Sharing Ratio ratio is required for sharing future profits and also for adjustment of, capitals., , II. Multiple Choice Questions:, , 1. At the time of admission of a new partner, general reserve appearing in the old balance sheet is, transferred to:, a) All Partners Capital Account, b) New Partner's Capital Account, c) Old Partners Capital Account, d) None of the above, , 2. A, B and C are partners in a firm. If D is admitted as a new partner:, a) Old firm is dissolved, b) Old firm and old partnership are dissolved, , c) Old partnership is reconstituted, d) None of the above, , 29 | P a g e

Page 34 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , 3. On the admission of a new partner, increase in the value of asset is credited to:, a) Profit and Loss Adjustment (Revaluation) Account, b) Asset Account, c) Old Partners Capital Account, d) None of the above, , 4. At the time of admission of a partner, undistributed profits appeared in the balance sheet of the, old firm is transferred to the capital accounts of:, a) Old partners in old profit sharing ratio, b) Old partners in new profit sharing ratio, c) All the partners in new profit sharing ratio, d) None of the above, 5. If new partner brings cash for his share of goodwill, goodwill is transferred to Old Partners' Capital, Account in:, a) Sacrificing ratio, b) Old profit sharing ratio, c) New profit sharing ratio, d) None of the above, 6. Which of the following are treated as reconstitution of a Partnership Firm?, a) Admission of a partner, b) Change in profit sharing ratio, c) Retirement of a partner, d) All the above, 7. Profit or Loss on revaluation is shared among the partners in the:, a) Old profit sharing ratio, b) New profit sharing ratio, c) Capital ratio, d) Equal ratio, 8. Assets and Liabilities are recorded in Balance Sheet after the admission of a partner at:, a) Original value, b) Revalued value, c) Realisable value, d) None of the above, 9. On the admission of a new partner, the increase in the value of an asset is credited to:, a) Revaluation Account, b) Asset Account, c) Old partners' Capital Account, d) None of the above, 10. Old Profit Sharing Ratio - New Profit Sharing Ratio is _________________, a) Sacrificing ratio, b) Gaining ratio, c) Both the above, d) None of the above, 11. In the absence of an agreement to the contrary, it is implied that old partners will contribute to, new partner's share of profit in the ratio of:, a) Capital, b) Old profit sharing ratio, c) Sacrificing ratio, d) Equally, 12. The balance of reserves and other accumulated profits at the time of admission of a new partner, are transferred to:, a) All partners in the new ratio, c) Old partners in the old ratio, b) Old partners in the new ratio, d) Old partners in the sacrificing ratio, 30 | P a g e

Page 35 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , 13. Goodwill raised in books at the time of admission of partner will be written off in:, a) Old profit-sharing ratio, b) New profit-sharing ratio, c) Sacrificing ratio, d) None of the above, 14. Revaluation Account is debited for the:, a) Increase in provision for doubtful debts, b) Increase in the value of building, c) Decrease in the amount of creditors, d) Transfer of loss on revaluation, , 15. A and B are partners sharing profits in the ratio of 3:1. C is admitted into partnership for 1 /4th, share. The sacrificing ratio of A and B will be:, a) Equal, b) 3:1, c) 2:1, d) 3:2, , III. True or False Type Questions:, , 1. Goodwill brought in cash by new partner is distributed among old partner in their Sacrificing, ratio. (True), 2. In case of admission of a partner, profit or loss on revaluation is transferred to Old Partners', Capital Accounts. (True), 3. Accumulated profit is transferred to all partners' capital Accounts including new partner., (False), 4. The debit balance of Profit and Loss Account shown in the assets side of the Balance Sheet, will be debited to Old Partners Capital Accounts. (True), , 5. Increase in the value of an asset is credited to Revaluation Account. (True), 6. The traditional name of 'Revaluation A/c' is 'Profit and Loss Adjustment A/c’. (True), 7. Goodwill is an intangible asset. (True), 8. Decrease in the value of liability is debited to Revaluation Account. (False), 9. Sacrifice ratio is required to distribute the cash brought by new partner among old partners for, their share of goodwill. (True), 10. Share sacrificed = Old share - New share. (True), , IV. Very Short Answer Type:, 1. What is Partnership?, Ans: According to section 4 of Indian partnership Act of 1932, partnership is defined as, “The, relationship between the persons who have agreed to share profit of business carried on by all, or any one of them acting for all”., 2. What do you mean by reconstitution of a Partnership Firm?, Ans: Reconstitution of partnership firm means any change in the existing agreement, (partnership agreement), 31 | P a g e

Page 36 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , 3. State any one reason for admission of a new partner., Ans: (a) Increase in capital, (b) Improves managerial ability, (c) Increases goodwill of firm, 4. State any one right acquired by a newly admitted partner., Ans: (a) Right to share the assets of the partnership firm, , 5. Why the NPSR is required at the time of admission of a partner?, Ans: To share the future profits of the firm by all partners. Therefore, NPSR is required at the, time of admission of partner., 6. What is Goodwill?, Ans: Goodwill refers to the reputation of a firm in respect of profit expected in future over and, above the normal profit., 7. State any one factor affecting the value of goodwill., Ans: Nature of business: Firm having stable demand is able to earn more profit with help of, goodwill., 8. What is normal profit?, Ans: Normal profit is minimum compensation that a firm receives for operating., 9. State any one method of valuation of goodwill., Ans: (a) Average profit method, (b) Super profit method, (c) Capitalization method, 10. Give the formula for sacrifice ratio, Ans: SR = OR – NR, (Sacrifice ratio) = Old ratio – New ratio, 11. Which account is to be debited to record the increase in the value of an asset?, Ans: Assets A/c needs to be debited, Asset A/c…………………………………………….Dr, xxx, --To Revaluation A/c, --xxx, (Being increased assets transferred to Revaluation A/c), 12. What is Revaluation Account?, Ans: The gain or loss on revaluation of each asset and liability is transferred to an account called, revolution account., 13. What account will be credited when there is a loss on revaluation?, Ans: Revaluation A/c is credited when there is loss on revaluation., 14. What account will be debited when the cash is brought by a new partner for his share of, goodwill?, Ans: Bank A/c needs to be debited, Bank A/c……………………………………………..Dr, xxx, --To Goodwill Ac, --xxx, 32 | P a g e

Page 37 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , 15. What is hidden goodwill?, Ans: Hidden goodwill is the excess of desired total capital of the firm over the actual combined, capital of all partners., , Section B: Two Marks Questions:, 1. When the goodwill is distributed among old partners in the sacrificing ratio?, Ans: Goodwill is distributed among old partners in the sacrifice ratio, when the goodwill is, brought in cash by new partner, 2. State any two methods of valuation of goodwill., Ans: (a) Average Profit Method, (b) Super Profit Method, 3. State any two rights acquired by a new partner., Ans: (a) Right to share the assets of partnership firm, (b) Right to share profit of partnership firm, 4. What do you mean by hidden goodwill?, Ans: Sometimes the value of goodwill is not given at time of admission of a new partner. In, such a situation, it has to be inferred from the arrangement of the capital and profit sharing ratio., 5. Pass the journal entry to write off the goodwill raised to the extent of full value., Ans: New partner’s capital A/c ………………………….. Dr., xxx, ---To Old Partner’s Capital A/c, ---xxx, [Being goodwill raised in books and written off], 6. State any two matters which need adjustments in the books of the firm at the time of admission, of a new partner., Ans: Matters which need adjustments in books of the firm at time of admission of new partner, are:, Goodwill, Revaluation of assets and liabilities, Capital of old partners, Reserves ad other accumulated profits or losses., 7. What is sacrifice ratio?, Ans: The ratio in which existing partners contribute to share of profit payable to the new/, incoming partner is called sacrifice ratio., (Sacrifice ratio = Old ratio – New ratio), OR, Sacrifice ratio is ratio in which old partner surrender their part of share of profit to new partner, on account of admission of partner., 8. Why the sacrifice ratio is calculated?, Ans: Sacrifice ratio is calculated to distribute the goodwill brought in cash by new partner., 33 | P a g e

Page 38 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , 9. What is the need for the revaluation of assets and liabilities on the admission of a partner?, Ans: It is always desirable to ascertain whether the assets of firm shown in books at current, value. In case the asset and liabilities may be overstated or understated there may also be some, unrecorded assets and liabilities., 10. State any two reasons for admitting a new partner., Ans: (a) Increase in capital, (b) Improves managerial ability, (c) Increases goodwill of firm, 11., , How do you close revaluation account when there is a profit?, Ans: If there is profit in revaluation A/c it shows credit balance and the balance or profit in, transferred to capital A/c of old partners using old ratio., , 12., , State any two factors which determine the goodwill of the firm., Nature of business: Firm having stable demand is able to earn more profit with help of, goodwill., Location: Business must be centrally located at a place having heavy consumer traffic., , 13., , What is average profit method of valuation of goodwill?, Ans: Under this method goodwill will be calculated on the basis of average profit of past few, years and also considering multiplying factor., Average profit =, , 𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇 𝑝𝑝𝑝𝑝𝑝𝑝𝑝𝑝𝑝𝑝𝑝𝑝 𝑜𝑜𝑜𝑜 𝑔𝑔𝑔𝑔𝑔𝑔𝑔𝑔𝑔𝑔 𝑛𝑛𝑛𝑛.𝑜𝑜𝑜𝑜 𝑦𝑦𝑦𝑦𝑦𝑦𝑦𝑦𝑦𝑦, 𝑁𝑁𝑁𝑁.𝑜𝑜𝑜𝑜 𝑦𝑦𝑦𝑦𝑦𝑦𝑦𝑦𝑦𝑦, , 14., , Goodwill of the firm valued at two years purchase of the average profit of last four years. The, total profits for last four years is ₹. 40,000. Calculate the goodwill of the firm., Ans: Goodwill = Average profit × No. of year purchase, 𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇 𝑝𝑝𝑝𝑝𝑝𝑝𝑝𝑝𝑝𝑝𝑝𝑝 40,000, Average profit =, =, = 10,000, 𝑁𝑁𝑁𝑁.𝑜𝑜𝑜𝑜 𝑦𝑦𝑦𝑦𝑦𝑦𝑦𝑦, 4, Goodwill = 10,000 × 2 = Rs. 20,000, , 15., , Pass the journal entry for increase in the value of building on the admission of a partner., Ans: Building A/c………………………………….Dr, xxx, --To Revaluation A/c, --xxx, [Being increase in value of building], , 16., , Pass the journal entry for the decrease in the value of a liability., Ans: Liability A/c, Dr, To Revaluation A/c, [Being decrease in value of liability], , xxx, ---, , --xxx, , 34 | P a g e

Page 39 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , PROBLEM ON CALCULATION OF NPSR AND SR, , Problems on calculation of New profit sharing Ratio:, 1. Anil and Vishal are partners sharing profits in the ratio of 3:2. They admitted Sumit as a new, partner for 1/5th share in future profits of the firm. Calculate new profit sharing ratio of Anil,, Vishal and Sumit., , Solution:, , Hint :, NPSR = Remaining share× Old Ratio, New Ratio = ?, 4 3 12, Anil = × =, New Partner Share = 1/5, 5 5 25, Old Ratio = 3:2, 4 2, 8, Vishal = × =, Remaining share = 1 – New partner share, 5 5 25, 1, 1 5, 5, = 1−, Sumit = × =, 5, 5 5 25, 4, 12 8 5, Remaining share =, New ratio =, : :, 5, 24 25 25, NPSR = New partner sharing ratio, New Ratio =12 : 8 : 5, , 2. ‘A’ and ‘B’ are partners in a firm sharing profits and losses in ratio of 3:2. They admit ‘C’ into, the partnership for 1/6th share in the profits. Calculate the new profit sharing ratio., , Solution:, Hint :, New Ratio = ?, New Partner Share = 1/6, Old Ratio = 3:2, Remaining share = 1 – New partner share, 1, = 1−, 6, 5, Remaining share =, 6, NPSR = New partner sharing ratio, , NPSR = Remaining share×Old Ratio, 5 3 15, ‘A’ = × =, 6 5 30, 5 2 10, ‘B’ = × =, 6 5 30, 5, 1 5, ‘C’ = × =, 6 5 30, 15 10 5, NR =, OR New Ratio 3 : 2 : 1, :, :, 30 30 30, , 3. ‘A’, ‘B’ and ‘C’ are partners sharing profits and losses in the proportion of 2/8th, 3/8th and 3/8th., They admit ‘d’ for 1/4th share, calculate the new profit sharing ratio of all partners., , 35 | P a g e

Page 40 :

Accountancy II PUC, , Solution:, , Mysuru District P U Commerce Forum, , Hint :, New Ratio = ?, , NPSR = Remaining share×Old Ratio, 3 2, 6, A= × =, 1, 4 8 32, New Partner Share =, 4, 3 3 9, B= × =, Old Ratio = 2:3:3, 4 8 32, Remaining share = 1 – New partner share, 3 3, 9, C= × =, 1, 4 8 32, = 1−, 4, 1 8, 8, D= × =, 3, 4 8 32, Remaining share =, 4, 6 9 9 8, New Ratio =, OR, :, :, :, NPSR = New partner sharing ratio, 32 32 32 32, New Ratio = 6 : 9 : 9 : 8, , 4. Veena and Vani are partners sharing profits in the ratio of 3:2. They admit Rani as a new partner, for 1/5th share in future profits of the firm, which she gets equally from Veena and Vani. Calculate, new profit sharing ratio of Veena, Vani and Rani., , Solution:, Sacrifice ratio = Acquired share × New partner share, 1 1, 1, Veena = × =, 5 2 10, 1 1, 1, Vani = × =, 1, 5 2 10, New partner share, 5, 1 1, SR =, :, 1, 10 10, Acquired Share = 1: 1 or, :, 2, 3 × 2 − 1× 1 6 − 1 5, 3 1, New Ratio of Veena = −, =, =, 1, 10, 10, 4 10, 10, 2, 2 4, 2 × 2 − 1× 1, 3, New ratio of Vani = −, =, =, NR=Old Ratio–Sacrifice Ratio, 4 10, 10, 10, Sacrifice Ratio = ?, 1 2, 2, New Ratio of Rani = × =, 4 2 10, New Ratio = 5 : 3 : 2, N R = New Ratio, Hint :, New Ratio = ?, Old Ratio = 3: 2, , 5. Amar and Akbar are partners, sharing profits and looses in ratio of 6:4. They admit Antony into, partnership giving him 6/20th share, which he obtains 4/20th from Amar and 2/20th from Akbar., Calculate the new profit sharing ratio., 36 | P a g e

Page 41 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , Solution:, , 6, 4, 6 × 2 − 4 ×1 8, =, =, −, 10 10, 20, 20, 4, 2, 4 × 2 − 2 ×1, 6, New ratio of Akabar =, =, =, −, 10, 10, 20, 20, 6, New partner share, 6 1 6, New Ratio of Antony =, × =, 20, 20 1 20, 4 2, 5 10, 20, Sacrifice Ratio =, :, New Ratio = 8 : 6 : 6 (÷ 2), 20 20, 2 2, 4, OR, New Ratio = Old Ratio – Sacrifice Ratio, 1, 2, 4:3:3, LCM = 5×2×2, 6. Saraswathi and Laxmi are partners in a firm sharing profits in ratio of 4 :1. They admit Parvati, as a new partner for 1/4th share in future profits, which she acquired wholly from Saraswati., Calculate the new profit sharing ratio of the all partners., New Ratio of Amar =, , Hint :, New Ratio = ?, Old Ratio = 6:4, , Solution:, , Hint :, New Ratio = ?, Old Ratio = 4:1, New Partners Share = 1/4, 1, Sacrifice Ratio = : 0, 4, , New Ratio = Old Ratio – Sacrifice Ratio, 4 1 4 × 4 − 1 × 5 11, Saraswathi = − =, =, 20, 20, 5 4, 1, 1 4 4, Laxmi = − 0 = × =, 5, 5 4 20, 1 5, 5, Parvathi = × =, 4 5 20, New Ratio = 11 : 4 : 5, , 2 5, 4, 5, 2, LCM = 5×2×2= 20, 7. Raga and Tala are partners sharing profits and losses in ratio of 7:3. They admit Shruti into the, partnership. Raga surrenders 1/2nd of his share and Tala 1/4th of her share in favour of Shruti., Calcualte new profit sharing ratio of Raga, Tala and Shruti., , Solution:, , Hint :, New Ratio = ?, Old Ratio = 7:3, Surrender Share =, , 1 1, 2 1, : , LCM= :, 2 4, 4 4, , 5 10, 40, 2 2, 8, 2 1, 4, 1, 2, LCM = 5×2×2×2 = 40, , Sacrifice Ratio = Surrender Share × Old Ratio, 2 7, 14, Raga = ×, =, 4 10 40, 3, 1 3, Tala =, =, Sacrifice Ratio =, ×, 40, 4 10, 14 3, :, 40 40, New Ratio = Old Ratio – Sacrifice Ratio, 7 14 28 − 14 14, Raga =, =, =, −, 40, 40, 10 40, 3 3 × 4 − 3 ×1 9, 3, Tala =, −, =, =, 40, 40, 10 40, 14 3 17, Shruthi =, +, =, 40 40 40, NR = 14 : 9 : 17, 37 | P a g e

Page 42 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , 8. Pradeep and Sandeep are partners sharing profits and losses in the ratio of 5:3. They admit, Pramod into the partnership and offer him 1/6th of the share which he acquired in ratio of 3:1, from old partners. Calculate the new profit sharing ratio., , Solution:, , Sacrifice Ratio = New partner share × Acquired share, 1 3, 3, Pradeep = × =, 6 4 24, 1 1, 1, 3 1, Sandeep = × =, Sacrifice Ratio =, :, 6 4 24, 24 24, New Ratio = Old Ratio – Sacrifice Ratio, 5 3, 5 × 3 − 1 12, =, =, Pradeep = −, 2 8, 24, 8 24, 24, 24, 2 4, 12, 3 1, 9 −1, 8, 2 2, 6, Sandeep = −, =, =, 8 24, 24, 24, 1, 3, LCM = 2×2×2×3 = 24 Pramod = 1 × 4 = 4, 6 4 24, 12 8 4, NR =, or (÷4), :, :, 24 24 24, New Ratio = 3 : 2 : 1, , Hint :, New Ratio = ?, Old Ratio = 5:3, New Partners Share = 1/6, Acquired Ratio = 3:1, , Problems on Sacrifice Ratio:, 1. Mohan and Madan are partners sharing profits and losses in ratio of 4:3. They admit Murali into, partnership. The new profit sharing ratio is agreed at 7:4:3 respectively. Find out the sacrifice ratio, of old partners., , Solution:, , Hint :, Sacrifice Ratio = ?, Old Ratio = 4:3, New Ratio : 7:4:3, 7 7, 14, 1, 2, LCM = 7×2 = 14, , Sacrifice Ratio = Old Ratio – New Ratio, 4 7 4× 2 − 7 1, Mohan = −, =, =, 7 14, 14, 14, 3 4, 3× 2 − 4 2, Madan = −, =, =, 7 14, 14, 14, 1 2, =, :, 14 14, OR, Sacrifice Ratio = 1 : 2, , 2. Dinesh and Mahesh are partners sharing profits and losses I ratio of 3:2. They admit Ramesh into, business and new ratio was agreed to be 5:4:3. Calculate the sacrifice ratio., 38 | P a g e

Page 43 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , Solution:, , Hint :, Sacrifice Ratio = ?, Old Ratio = 3:2, New Ratio : 5:4:3, , Sacrifice Ratio = Old Ratio – New Ratio, 3 5, 3 × 12 − 5 × 5, 1, Dinesh = −, =, =, 5 12, 60, 60, 2 × 12 − 4 × 5, 4, 2 4, Mahesh = −, =, =, 60, 60, 5 12, Sacrifice Ratio = 11 : 4, , 2 5, 12, 2 5, 6, 5, 3, LCM = 2×2×3×5=60, 3. Anil and Sunil are partners in firm sharing profits and losses in the ratio of 3:2. They admit Ashok, as new partner for 1/4th share. The new profit sharing ratio between Anil and Sunil will be 2:1., Calculate the Sacrifice Ratio., , Solution:, , Hint :, Sacrifice Ratio = ?, Old Ratio = 3:2, New Partners Share = 1/4, Remaining partners share 2:1, Remaining share = 1 – New Partner, Share, 1 3, = 1− =, 4 4, 2 5, 4, 5, 2, LCM = 2×2×5=20, , New Ratio = Remaining share X Remaining, partners share, 3 2, 6, Anil = × =, 4 3 12, 3 1, 3, × =, Sunil = 4 3 12, 1 3, 3, × =, New Ratio = 3 : 2 : 1, Ashok = 4 3 12, Sacrifice Ratio = Old Ratio – New Ratio, 3 2 3× 4 − 2 × 5, 2, Anil = − =, =, 5 4, 20, 20, 2 1 2 × 4 − 1× 5 3, Sunil = − =, =, 20, 5 4, 20, Sacrifice Ratio = 2:3, , 4. ‘X’ and ‘Y’ are partners in a firm sharing profits and losses in ratio of 3:2. They admit ‘Z’ into, partnership ‘X’ agrees to surrender 1/2nd of his share and ‘Y’ agrees to surrender 1/4th of his share, in favour of ‘Z’. Calculate sacrifice ratio., , Solution:, , Hint :, Sacrifice Ratio = ?, Old Ratio = 3:2, Surrender Share : =, , 2 1, 1 1, : LCM= :, 4 4, 2 4, , Sacrifice Ratio = Old Ratio X Surrender share, 6, 3 2, X= × =, 5 4 20, 2 1, 2, Y= × =, 5 4 20, = 6 :2, (÷2), OR, Sacrifice Ratio = 3 : 1, 39 | P a g e

Page 44 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , 5. Ram and Rahim are partners sharing profits and losses equally. They admit Charlin into, partnership. Ram agrees to surrender 1/3rd of his share and Rahim agrees to surrender 1/4th of his, share to Charlin. Calculate the sacrifice ratio., , Solution:, , Hint :, Sacrifice Ratio = ?, Old Ratio = 1:1, , 1 1, :, 3 4, 1 3, 4 3, 1 4, = ×, :, × = :, 4 3 12 12, 3 4, , Surrender Share LCM =, , Section D:, , Sacrifice Ratio = Old Ratio X Surrender share, 1 4, 4, Ram = ×, =, 2 12 24, 1 3, 3, Rahim = ×, =, 2 12 24, Sacrifice Ratio = 4 : 3, , 12 Marks Questions, , 1. 'A' and 'B' are partners sharing profits and losses in the ratio of 2:1.Their Balance Sheet, as on 31.3.2018 was as follows:, Balance Sheet as on 31.03.2018, Liabilities, ₹, Assets, ₹, Creditors, 20,000 Cash in Hand, 5,000, Bills Payable, 10,000 Stock, 15,000, Reserve Fund, 12,000 Debtors, 20,000, Capitals, Machinery, 30,000, A, 60,000, 60,000 Buildings, B, 12,000, 40,000 Investments, 1,42,000, 1,42,000, Adjustments:, On 01.04.2018, 'C' is admitted into partnership on the following conditions:, a) 'C' should bring in cash ₹ 25,000 as his capital and ₹15,000 towards goodwill (As, per AS -26), b) Appreciate buildings at 20% and stock is revalued at ₹ 12,000., c) Provision for doubtful debts maintained at 5% on debtors., d) Outstanding salary ₹ 2,000., Prepare: i) Revaluation Account., ii) Partners' Capital Accounts &, iii) New Balance Sheet of the firm., , 40 | P a g e

Page 45 :

Accountancy II PUC, , Solution:, Dr., Particulars, To Depreciation on stock, , Revaluation Account, ₹, 3,000, , (15,000-12,000), , To provision for doubtful, Debts (20,000 x 5/100), To Outstanding Salary, To Partners capital A/c, , 1,000, , Mysuru District P U Commerce Forum, , Cr., , Particulars, By Appreciation on Buildings, , ₹, 12,000, , (60,000 x 20/100), , 2,000, , (Profit on Revaluation), , A 6,000 x 2/3 = 4,000, B 6,000 x 1/3 = 2,000, , To Balance c/d, , (Closing Capital), , 12,000, , Partners’ Capital Account, , Dr., Particulars, , To A’s Capital A/c, (15,000 x 2/3), To B’s Capital A/c, (15,000 x 1/3), , 6,000, 12,000, , A, , -, , B, , -, , C, Particulars, 10,000 By Balance b/d, By Cash A/c, 5,000 (25,000+15,000), , 82,000 51,000 25,000, , A, B, 60,000 40,000, -, , Cr., , C, 40,000, , By C’s Capital A/c 10,000, , 5,000, , -, , 8,000, , 4,000, , -, , (15,000 x 2:1), By Reserve Fund, (12,000 x 2:1), , By Revaluation A/c 4,000, , 82,000 51,000 40,000, , By Balance b/d, , 2,000, 82,000 51,000 40,000, 82,000 51,000 25,000, , Balance Sheet as on 01.04.2018, Liabilities, Creditors, Bills Payable, , O/s Salary, Capitals, A, B, C, , 82,000, 51,000, 25,000, , ₹, 20,000, 10,000, 2,000, , 1,58,000, , Assets, Cash in Hand, (5,000+25,000+15,000), Stock, 15,000, Less: Depreciation, 3,000, Debtors, 20,000, Less: PDD, , 1000, , Add: appreciation, , 60,000, 12,000, , Machinery, Buildings, Investments, , 1,90,000, , ₹, 45,000, 12,000, 19,000, 30,000, 72,000, 12,000, 1,90,000, 41 | P a g e

Page 46 :

Accountancy II PUC, , Mysuru District P U Commerce Forum, , 2. Arati and Bharati are partners in a firm sharing profits and losses in the ratio of 3:2., Their Balance Sheet as on 31.03.2017 stood as follows:, Balance Sheet as on 31.03.2018, Liabilities, Bills Payable, Creditors, , ₹, 14,000, 16,000, , Capitals, Arati, Bharati, , 50,000, 25,000, , Assets, Cash in Hand, Buildings, Patents, Machinery, Debtors, 20,000, Less: Provisions 600, Stock, , 1,05,000, , ₹, 15,000, 25,000, 6,000, 35,000, 19,400, 4,600, 1,05,000, , Adjustments:, On 01.04.2017, Jayanti is admitted into the partnership on the following terms:, a. Jayanti brings in cash ₹ 20,000 as capital and 10,000 towards Goodwill., Goodwill is withdrawn by old partners. (As perAS-26), b. Buildings are appreciated by ₹ 5,000 & machinery is depreciated by 20%., c. Provision for doubtful debts is increased by ₹ 1,000., d. The new profit-sharing ratio between the partners is 5:3:2., Prepare: i) Revaluation Account, ii) Partners' Capital Accounts &, iii) Balance Sheet of the firm after admission., Solution:, Dr., , Particulars, To Depreciation on, Machinery, (35,000x20/100), To provision for doubtful, Debts (Increased), , Revaluation Account, ₹, 7,000, 1,000, , 8,000, , Particulars, By Appreciation on Buildings, , Cr., , ₹, 5,000, , To Partners capital A/c, (Loss on Revaluation), , Arati, 3,000 x 3/5 = 1,800, Bharati 3,000 x 2/5 = 1,200, , 3,000, 8,000, , 42 | P a g e

Page 47 :

Accountancy II PUC, , Dr., Particulars, , To Arati’s Capital A/c, , Mysuru District P U Commerce Forum, , Partners’ Capital Account, Arati, , -, , (20,000 x 1/2), , (20,000 x 1/2), To Cash A/c, , (Goodwill Withdrawn), , To Revaluation A/c, , To Balance c/d, (Closing Capital), , -, , -, , To Bharati’s Capital A/c, , Particulars, 5,000 By Balance b/d, By Cash A/c, 5,000 (20,000+10,000), , Bharati Jayanti, , -, , 5,000, , 5,000, , Arati, , Bharati Jayanti, , 50,000 25,000, 5,000, , By jayanti’s, Capital A/c, , -, , Cr., , 5,000, , (10,000 x1:1 S.R), , 1,800 1,200, 48,200 23,800 20,000, 55,000 30,000 30,000, , By Balance b/d, , 30,000, -, , 55,000 30,000 30,000, 48,200 23,800 20,000, , Balance Sheet as on 01.04.2018, Liabilities, Bills Payable, Creditors, Capitals, Arati, Bharati, Jayanti, , ₹, 14,000, 16,000, , Assets, Cash in Hand, (15,000+20,000), Buildings, , Add: Appreciation, , 48,200, 23,800, 20,000, , 92,000, , Patents, Machinery, , Less: Depreciation, , Debtors, , ₹, 35,000, 25,000, 5,000, 35,000, , 7,000, , 20,000, Less:PDD(600+1000) 1,600, Stock, , 1,22,000, , 30,000, , 6,000, , 28,000, 18,400, 4,600, 1,22,000, , Working Note:, Calculation of Sacrifice Ratio, Old Ratio: 3:2, New Ratio: 5:3:2, Sacrifice Ratio = Old Ratio – New Ratio, 3, , 5, , Arati’s Sacrifice Ratio = 5 − 10 =, 2, , 3, , 30−25, , Bharati’s Sacrifice Ratio = 5 − 10 =, , =, , 5, , 50, 50, 20−15, 5, 50, 𝟓𝟓, , = 50, 𝟓𝟓, , Sacrifice Ratio of Arati & Bharati = 𝟓𝟓𝟓𝟓 : 𝟓𝟓𝟓𝟓 𝒐𝒐𝒐𝒐 𝟏𝟏: 𝟏𝟏, , 43 | P a g e

Page 48 :