Page 1 :

www.shsph.blogspot.com, , SENIOR HIGH SCHOOL, , BUSINESS FINANCE, Module 4 - Quarter 1, , Basic Long-Term Financial, Concepts, , Department of Education • Republic of the Philippines

Page 3 : www.shsph.blogspot.com, , SENIOR HIGH SCHOOL, , BUSINESS FINANCE, Module 4 - Quarter 1, , Basic Long -Term Financial, Concepts, , This instructional material was collaboratively developed and reviewed by, educators from public and private schools, colleges, and universities. We, encourage teachers and other education stakeholders to email their, feedback, comments, and recommendations to the Department of, Education at

[email protected]., , We value your feedback and recommendations., , Department of Education ● Republic of the Philippines, III

Page 5 :

www.shsph.blogspot.com, , TABLE OF CONTENTS, , Page No., Cover page, , III, , Table of Contents, , V, , Overview, , VI, , General Instructions, , VI, , Lesson 4: Basic Long-Term Financial Concepts, , 1, , What I Need to Know?, , 1, , What I Know, , 1, , What’s In?, , 2, , What’s New?, , 3, , What is it?, , 3, , What’s New?, , 7, , What is it?, , 7, , What’s more?, , 10, , What I Have Learned?, , 14, , What I Can do?, , 14, , Assessment, , 15, , Answer Key, , 18, , Appendix, , 19, , References, , 22, , V

Page 6 :

www.shsph.blogspot.com, , OVERVIEW, , This module covers the mathematics of finance with focus on the time value of, money. The concept of interest is explained particularly the difference between simple and, compound interest. Future and present value computations are discussed using different, cash flow patterns with the use of interest factor tables. Basic time value of money, applications is illustrated including loan amortization examples and the net present value, method in assessing the financial feasibility of projects. Concept of risk-return trade-off is, also discussed in this module., As a learner, you are expected to read and analyze the lesson provided and, accomplish the activities and assessment included to achieve the learning objectives, emphasized at the start of the module., , GENERAL INSTRUCTIONS, For the learners:, To be guided in achieving the, objectives of this module, do the, following:, , For the teacher:, To facilitate and ensure the students’, learning from this module, you are, encouraged to do the following:, , 1. Read and follow instructions, carefully., 2. Write all your ANSWERS in, your Activity Book, 3. Answer the pretest before, going through the lessons., 4. Take note and record points, for clarification., 5. Compare your answers, against the key to answers, found at the end of the, module., 6. Do the activities and fully, understand each lesson., 7. Answer the self-check to, monitor what you learned in, each lesson., 8. Answer the posttest after you, have gone over all the lessons., , 1. Clearly communicate learning, competencies and objectives, 2. Motivate through applications, and connections to real life., 3. Give applications of the theory, 4. Discuss worked-out examples, 5. Give time for hands-on, unguided classroom work and, discovery, 6. Use formative assessment to, give feedback, 7. Introduce extensions or, generalizations of concepts, 8. Engage in reflection questions, 9. Encourage analysis through, higher order thinking prompts, 10. Provide alternative formats for, student work, 11. Remind learners to write their, answers in their Philosophy, Activity Notebook, , VI

Page 7 :

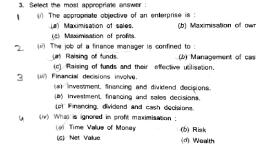

www.shsph.blogspot.com, , Lesson, , 4, , BASIC LONG-TERM, FINANCIAL CONCEPTS, , What I Need to Know, At the end of this lesson, you are expected to:, 1. distinguish simple and compound interest;, 2. solve exercises and problems in computing for time value of money, of present and future value tables;, , with the aid, , 3. prepare loan amortization tables;, 4. compute for the net present value of a project with a conventional cash- flow, pattern;, 5. describe the risk-return trade-off., , What I Know, , A. TRUE OR FALSE. On the space provided, write TRUE if the idea being expressed is, correct and FALSE if otherwise., __________1. Interest represents the time value of money., __________2. Compound interest is the product of the principal amount multiplied by the, period’s interest rate., __________3. Simple interest is the interest paid on both the principal and the amount of, interest accumulated in prior periods., __________4. Present value is the current value of a future amount of money, or series of, payments, evaluated at an appropriate discount rate., __________5. The gradual extinction of a loan over a period of time by means of a, sequence of regular payments as to principal and interest due at the end of equal intervals of, time is known as amortization., , 1

Page 8 :

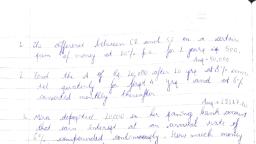

www.shsph.blogspot.com, B. SOLVE. Write your solution and explanation., Your father told you that he will entrust you with the funds for your college education., He gave you two options: a) receive the money now in the amount of, P 200 000 or b), receive P 500 000 ten years from now. The investment opportunity will provide you a 10%, rate of return. Which option would you prefer?, , What’s In, “A peso today is worth more than a peso tomorrow”. The time value of money would, tell us that a peso today is not equal to a peso in the future., The most basic finance-related formula is the computation of interest. It is computed, as follows:, 𝐈=𝐏 × 𝐑 × 𝐓, , (Equation 4.1), , where:, I = interest, P = Principal, R = Interest rate, T = Time period, As a review, try this exercise by identifying the a) principal, b) interest rate, and time, period in the examples below., 1. Your mother invested P 18 000 in government securities that yields 6% annually, for two years., 2. Your father obtained a car loan for P 800 000 with an annual rate of 15% for 5, years., 3. Your sister placed her graduation gifts amounting to P 25 000 in a special, savings account that provides an interest of 2% for 8 months., 4. Your brother borrowed from your neighbor P 7 000 to buy a new mobile phone., The neighbor charged 11% for the borrowed amount payable after three years., 5. You deposited P 5 000 from the savings of your daily allowance in a time deposit, account with your savings bank at a rate of 15% per annum. This will mature in 6, months., , 2

Page 9 :

www.shsph.blogspot.com, , What’s New, ACTIVITY 4.1 Simple and Compound Interest, A. Fill in the blanks of the table involving a simple interest., Principal, P 8 000, P 15 000, 3), P 1 000, P 4 500, , Rate, , Time, 7 months, 2), 4 months, 1 yr & 3 months, 5 and a half years, , 1), 4.8%, 4.5%, 4), 0.25%, , Interest, P 210, P 300, P 500, P 70, 5), , B. Complete the table for a compound interest involving P 40 000 loaned for a period of, 5 years with 6% interest compounded annually., , 1st year, , Principal at, the start of, the year, P 40 000, , Interest, , 40 000 x 0.06 x 1 = P 2 400.00, , Amount (at the end of, the year), P 40 000 +P 2 400 =, P 42 400.00, , 2nd year, 3rd year, 4th year, 5th year, , What is It, , In general business terms, interest is defined as the cost of using money over time., This definition is in close agreement with the definition used by economists, who prefer to, say that interest represents the time value of money., Interest is the excess of resources (usually cash) received or paid over the amount, of resources loaned or borrowed which is called the principal., If you decided to invest your money in a bank, you will ask the banker how much, interest you will get. The banker will explain that there are two types of interest that would be, used to determine the amount of interest that you are going to receive. Remember that, interest is beneficial for you when you are receiving it but not when you are paying it. So, it is, important to know which type of interest when deciding where to put your money and where, to get the money., , 3

Page 10 :

www.shsph.blogspot.com, , SIMPLE INTEREST, Simple interest is the product of the principal amount multiplied by the period’s, interest rate (a one-year rate in standard)., Example 1:, You invested P 10 000 for 3 years at 9% and the proceeds from the, investment will be collected at the end of 3 years. Using a simple interest assumption, the, calculation will be as follows:, Year, , Principal, , Interest, , Cumulative Interest, , Total, , 1, , P 10 000, , 10 000 x 0.09 = P 900, , P 900, , P 10 900, , 2, , P 10 000, , 10 000 x 0.09 = P 900, , P 1 800, , P 11 800, , 3, , P 10 000, , 10 000 x 0.09 = P 900, , P 2 700, , P 12 700, , Using the formula in Equation 4.1, simple interest can be computed., , COMPOUND INTEREST, Compound interest is the interest paid on both the principal and the amount of, interest accumulated in prior periods., Example 2:, Using example 1 where you invested P 10 000 for 3 years at 9% and the, proceeds from the investment will be collected at the end of 3 years, compound interest will, be computed as follows:, Year, , Principal, , Interest, , Cumulative, Interest, , Total, , 1, , P 10 000, , 10 000 x 0.09 = P 900, , P 900, , P 10 900, , 2, , P 10 900, , 10 900 x 0.09 = P 981, , P 1 881, , P 11 881, , 3, , P 11 881, , 11 881 x 0.09 = P 1 069.29, , P 2 950.29, , P 12 950.29, , For compound interest, use the formula, FV = 𝐏 (𝟏 + 𝒊)𝒏, , (Equation 4.2), , where:, FV = Future Value, P = Principal, i = Interest rate per compound interest period or periodic rate, n = Time period or number of compound interest periods, , Subtract the principal from the future value to get the compound interest. Hence, I c=, FV – P., , 4

Page 11 :

www.shsph.blogspot.com, , FUTURE VALUE OF MONEY, To account for time value for single lump-sum payment, we use the same formula, provided for under compound interest rates as shown on Equation 4.2., FV = 𝐏𝐕 (𝟏 + 𝒊)𝒏, , (Equation 4.3), , where, PV = Present Value, (𝟏 + 𝒊)𝒏 = Future value interest factor (FVIF)*, The future value is the value of the present value after n time periods., Example 3: Using the formula, find the future values of P 1 000 compounded at a 10%, annual interest at the end of one year, two years and five years., Solution:, , PV = P 1 000 and i = 0.10, , Year 1, , FV = P 1 000 (1 + 0.10)1 = P 1 100*, , Year 2, , FV = P 1 000 (1 + 0.10)2 = P 1 210*, , Year 5, , FV = P 1 000 (1 + 0.10)5 = P 1 610.50*, , Example 4:, Determine the compound amount on an investment at the end of 2 years if P, 20 000 is deposited at 4% compounded a) semi-annually and b) quarterly., Solution:, , a) Given: PV = P 20 000, i = 0.04/2, n = 2 x 2 = 4, 0.04 4, ), 2, , FV = 20 000(1 +, , = P 21 648*, , b) Given: PV = P 20 000, i = 0.04/4, n = 4 x 2 = 8, FV = 20 000(1 +, , 0.04 8, ), 4, , = P 21 658*, , PRESENT VALUE OF MONEY, To get the present value of a lump-sum amount, we rearrange Equation 4.2:, PV = 𝐅𝐕 (𝟏 + 𝒊)−𝒏, , (Equation 4.4), , where, (𝟏 + 𝒊)−𝒏 = Present value interest factor (PVIF)* or discount factor, Example 5:, Jack would like to buy a car two years from now using the proceeds of a 20%, investment that is compounded semi-annually. If the projected price of the car is P 1 400, 000, how much money must be invested today to earn the price of the car?, Solution:, Given: FV = P 1 400 000, i = 0.20/2, n = 2 x 2 years = 4, PV = 1 400 000(𝟏 +, , 0.20 −𝟒, ), 2, , *, , = P 956 200*, , Refer to the tables at the end of this module for FVIF and PVIF. Simply find the intersection of the relevant time in the rows, and the interest rate in the columns of the table., , 5

Page 12 :

www.shsph.blogspot.com, , ACTIVITY 4.2 Future Value and Present Value, A. DIRECTION: Complete the table to find the compound amount of P 50 000.00 invested at, 10% interest. Show your solutions., In 1 year, , In 5 years, , In 10 years, , 1. Compounded annually, 2. Compounded semi-annually, 3. Compounded quarterly, 4. Compounded monthly, 5. compounded daily, B. DIRECTION: Solve each problem., 1. Lisa receives an amount of P 20 000 deposited in her account on her 18 th, birthday. If the bank pays 6% interest monthly and no withdrawals are made, how, much should be credited in her account on his 21st birthday?, 2. James borrows P 5 000 with interest at 15% quarterly. How much should he pay, at the end of 2 years and 6 months to settle her debt?, 3. Mr. Santos invested P 15 000 in an account for each of his children. The, accounts paid 8% compounded semi-annually. Determine the balance of each, account for the following:, a. The youngest child withdrew the balance after 5 years for college, b. The second child withdrew the balance after 8 years to buy a car, c. The third child withdrew the balance after 10 years to travel, 4. A man wishes to accumulate P 10 000 in 2 years, how much should he invest, now at 15% compounded semi-annually?, 5. What is the present worth of P 5 000 for 2 years at 12% compounded quarterly?, 6. How much should be deposited now at 10% compounded monthly to have, P 10 000 in 4 years?, 7. Mr. Malakas deposited P 5 000 on the day his son was born. If the money is, worth 12% compounded quarterly, how much money will his son have on his 21 st, birthday?, 8. Your father entrusts you with the funds for your college education. He gave you, two options: a) receive the money now in the amount of P 200 000 or b) receive, P 500 000 ten years from now. An available investment opportunity to you, provides a 10% return. Which option would you prefer? Show your calculations, and explanation., 9. Five years ago, Joe invested P 35 000 compounded semi-annually at 8%. How, much is his money now?, , 6

Page 13 :

www.shsph.blogspot.com, , What’s New, , ACTIVITY 4.3 AMORTIZATION SCHEDULE, Direction: Complete the amortization table below of a loan of P 100 000 payable semiannually after 5 years at a rate of 10%. Show your solution of the first PV and the rest of, succeeding entries of columns E, B and C., Period, , Unpaid PV,, Beginning, , A, , 0, 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, , Interest based, on Effective Rate, (A x effective, rate), B, , Interest based on, stated rate, (Principal x, stated rate), C, , 4 228, , 3 000, , Amortization, (B – C), , Unpaid PV,, Ending, (A + D), , D, , E, , 84 555, 84 555, , 1 228, , What is It, ANNUITIES, An installment that requires a buyer to pay equal payments at a certain period, illustrates an annuity – a series of equal cash flow – payments in this case for a specific, number of periods., If payment is made and interest is computed at the end of each payment interval,, then it is called ordinary annuity. To get the present value interest factor for an ordinary, annuity (FVIFA) use the formula below:, PV = R, , 1−( 1+𝑖)−𝑛, , (Equation 4.5), , 𝑖, , Where,, R = regular payment, , 7

Page 14 :

www.shsph.blogspot.com, To get the future value of an ordinary annuity, use this formula:, FV = R, , ( 1+𝑖)𝑛 −1, , (Equation 4.6), , 𝑖, , Example 6: What lump sum would have to be invested at 6% compounded annually to, provide an ordinary annuity of P 10 000 per year for 4 years?, Solution: Given: R = P 10 000, i = 0.06/1, n = 1 x 4 = 4, PV = 10 000, , 1−( 1+0.06)−4, 0.06, , = P 34 651*, , Take note that 3.4651(rounded) is the present value factor of ordinary annuity for 4, years at 6% according to the present value factor table (see table 3)., If the cash flow happens at the beginning of each period, then it is called a annuity, due. The formulas to use are shown below:, PV = R(1+ i)[, FV = R(1+ i)[, , 1−( 1+𝑖)−𝑛, 𝑖, ( 1+𝑖)𝑛 −1, 𝑖, , ], , (Equation 4.7), , ], , (Equation 4.8), , Example 7:, If a supplier would allow you to pay P 50 000 annually at 10% for 3 years with, the first payment due immediately, how much would be the present value and the, future value?, Solution: Given: R = P 50 000, i = 0.10/1 , n = 1 x 3 = 3, 1−( 1+0.10)−3, , PV = 50 000(1 +0.10)[, , 0.10, , ] = P 136 775*, , Take note that 2.7355 is the present value of an annuity due for 3 years at 10%, according to the present value factor table (see table 5)., FV = 50 000(1+ 0.10)[, , ( 1+0.10)3 −1, 0.10, , ] = P 182 050*, , Take note that 3.6410 is the future value of an annuity due for 3 years at 10%, according to the future value factor table (see table 6)., If the cash flow stream lasts forever or is indefinite, then it is called a perpetuity. The, formula for present value of a perpetuity is simply, PV =, , 𝑅, , (Equation 4.9), , 𝑖, , LOAN AMORTIZATION, Most housing and car loans are amortizing loans that require the borrower to pay that, equal amount either annually, semi-annually, quarterly, or monthly., , * Refer to the tables at the end of this module for FVIF and PVIF of ordinary annuity and annuity due., , 8

Page 15 :

www.shsph.blogspot.com, Let us look at an example of a corporate loan to illustrate how a loan amortization, table is prepared. For some corporate long-term loans, principal payment is fixed, and the, interest expense is adjusted based on the declining principal balance., Example 8: On July 1, 2015, DD Company borrowed P 3 million from ASC Bank at the rate, of 10% a year. The loan is paid at the rate of P 500 000 every December 31 and, June 30 until the full amount is paid. Below is an amortization table for the loan., Amortization Table for P 3-million Loan, Date, , Payments, , Interest, , Principal, Payment, , Principal, Balance, 3 000 000, , Dec. 31, 2015, , 650 000, , 150 000, , 500 000, , 2 500 000, , June 30, 2016, , 625 000, , 125 000, , 500 000, , 2 000 000, , Dec. 31, 2016, , 600 000, , 100 000, , 500 000, , 1 500 000, , June 30, 2017, , 575 000, , 75 000, , 500 000, , 1 000 000, , Dec. 31, 2017, , 550 000, , 50 000, , 500 000, , 500 000, , June 30, 2018, , 525 000, , 25 000, , 500 000, , -, , To compute for the interest expense from June 30 to December 31, 2015:, Interest = 3 000 000 x 10% x (6 /12), = 150 000, To compute for the equal regular payment, use the formula in Equation 4.5, that is, R=, , PV, 1−( 1+i)−n, i, , or, , R=, , PV, PVIFA, , (Equation 4.10), , Example 9:, You borrowed P 50 000 from a bank to buy a mobile phone. Assuming you, need to repay the loan by equal payments at the end of every 6 months for 3 years at, 10% interest compounded semi-annually. What is your periodic payment?, Solution:, , Given: PV = P 50 000, i = 0.10/2, n = 2 x 3 = 6, R=, , 50 000, 5.0757∗, , = P 9 850.86, , * Refer to the table at the end of this module for PVIF of ordinary annuity., , 9

Page 16 :

www.shsph.blogspot.com, , ACTIVITY 4.4 LOAN AMORTIZATION, Using the problem in example 9, construct an amortization schedule by filling, up the table below. Show your solutions for column B by using the formula: I = Prt., Period, , Periodic, Payment at the, end of every 6, months, , Interest at 10%, due at the end, of every 6, months, , Amount repaid to, the Principal at, the end of every 6, months, , Outstanding, Principal at the, end of every 6, months, , A, , B, , C, , D, , 0, , P 50 000.00, , 1, 2, 3, 4, 5, 6, Total, , What’s More, NET PRESENT VALUE METHOD, One useful application of the time value of money is using the Net Present Value, Method to determine whether a project should be accepted or rejected by a company. The, basic decision rule is to accept the project if the net present value is positive and reject if it is, negative. The basic formula is:, NPV = PV of Inflows – PV of Outflows, or, NPV = PV of Future Cash Flows – Initial Investment, , (Equation 4.11), , Example 10:, A company wants to purchase an equipment that will cost P 100 000 and, estimated to be used for 5 years. Operating cash inflows from the use of equipment, would be P 50 000 while annual operating cash outflows (due to repairs and, maintenance) are estimated at P 10 000. Compute for the NPV., Solution:, PV of Future Cash Flows = 40 000, , 1−( 1+0.10)−5, 0.10, , PV of Future Cash Flows, 10, , = P 40 000 x 3.7908, = P 151 632

Page 17 :

www.shsph.blogspot.com, NPV = PV of Future Cash Flows – Initial Investment, = 151 632 – 100 000, = P 51 632, Since the NPV is positive, this means that the benefit to be derived from the project is, higher than the cost which would mean to accept the investment., , ACTIVITY 4.5 ARE YOU A RISK TAKER?, Do you have what it takes to make it? Let’s find out:, Write down the letter of the answer you select on a piece of paper for scoring! Compare your, score with your classmates., 1. You are driving to meet some friends. You’re running late. The traffic light ahead, turns yellow. You:, a. Always stop at yellow no matter what., b. Break and stop at the light. You’re late anyway, right?, c. You beat the light., 2. Your friend gives you a tip. She heard this stock is going to go through the roof in, the, next, week., You:, a. Hear this stuff all the time, know it’s not true and ignore her., b. Nod, squint your eyes, log into E*Trade and invest a few., c. Take all that money you had for a rainy day and invest., 3. You are a really cool partygoer. Your bf/gf is with you. You see this seriously cute, hottie, across, the, room., You:, a. Look at your boy/girl, order yourself another drink and continue on with, your, conversation., b. Envision a plan where if the stars aligned and you were both at the bar at the same, time, you, would, definitely, have, something, to, talk, about., [+2], c. Immediately excuse yourself and head across the room., 4. You’re with a friend in a carnival. You walk into this interesting tent. In the center is, a cobra in a cage. People are queued up to pay a hundred for a chance to grab the, five-hundred, bill, on, top, of, the, snake's, cage., You:, a. Leave., b. Stick around to see the free show., c. Exclaim, “Heck, I’ve got a hundred!” And get in line., 5. You’re sitting next to this old man on a jeepney. It’s obvious he hasn’t showered, and smelling alcohol while he naps through the trip. When he wakes up he starts, talking to you, explaining how he can help your business. You:, a. Thank him politely and inside your head you can’t wait to get off., b. Give him your business card and ask for his, knowing full well this guy is full of, crap., c. You try to find a polite way to tell him his body odor offends., , 11

Page 18 :

www.shsph.blogspot.com, 6. It’s the dreaded annual company Christmas party. The CEO is a little inebriated and, asks if anyone else would like to get up to attest to the company’s good fortune., You:, a. Put your head down in shame., b. Chuckle with most of the crowd., c. Realize this is your time to shine and head up to the front., 7. You’ve spent time researching the perfect part of town to buy a property. You think, you have all your bases covered, but investing in this property will definitely put, you and your family out there. You:, a. Decide it’s better to wait until you have more of a cushion., b. Buy the property and hope for the best., c. Are so convinced the deal is so good, you buy two. The other with money from a, 2nd mortgage on your home., 8. Today is your birthday and you are on a trip with friends to celebrate. Everyone has, been drinking and the gang decides it’s the perfect time to rent gears from the, resort and go bungee jumping. You:, a. Tell your friends you’ll greet them when they get back., b. Go ask around for a car to hire and recommendations on the best places to drink, in town., c. You are the first one tethered to the cord., Scoring:, For every answer A, award yourself 1 point, For every answer B, award yourself 2 points, For every answer C, award yourself 3 points, So, what kind of risk taker are you? Well, if you scored from, 8 – 10 Death warmed over. Check your pulse. Are you even alive? What are you doing with, your life?, 11 – 13 Nervous Nelly. Come on, it’s time for you step it up. You want to be more, adventurous. Try a little harder., 14 – 16 Risk Master General. Nice. You know how to balance risk with reward. This is, exactly where you want to be. You know how to have a good time and you will be very, successful., 17 – 19 You’re the Pusher. You like to push the envelope. That’s great! Just be careful., Scale it back from time to time. Risk is not its own reward., 20+ You have serious issues and you should seek professional help. If you haven’t crashed, and burned yet, you will soon., , 12

Page 19 :

www.shsph.blogspot.com, Questions:, 1., 2., 3., 4., , Which category did you belong?, Do you think it reflects your personality? Why?, Are your choices the same as your classmates?, Which category did most belong?, , RISK-RETURN TRADE-OFF, In finance, we assume that individuals are risk averse but have different levels of risk, aversion. Risk aversion means that individuals maximize returns for a given level of risk or, minimize risk if the returns are the same. Risk-averse individuals would require a higher, return if the risk level increases., , In general, the riskier the investment, the higher the potential return should be,, indicating a direct relationship between risk and potential return. As a business owner you, should know to balance the risk and the potential return of your investments., , Risk is defined here as the uncertainty of returns. One way to reduce risk to an, acceptable level is through diversification wherein you invest in different types of, investments with different risks and returns. This is an application of the saying:, “ Don’t, put all your eggs in one basket.”, , What I Have Learned, , ACTIVITY 4.6 DISCUSSION QUESTIONS, Answer as briefly as you can., 1., 2., 3., 4., 5., 6., 7., , Differentiate simple interest from compound interest., Explain the concept of time value of money., Differentiate between present value and future value., What is the difference between an ordinary annuity and annuity due?, What does an amortization table show?, Explain the purpose of the net present value., Explain the concept of risk-return trade-off., , 13

Page 20 :

www.shsph.blogspot.com, , What I Can Do, , ACTIVITY 4.6 BUSINESS APPLICATIONS, Solve and show your solution and explanations in a separate paper., 1. CM Company borrowed P 2 000 000 from a bank on June 30, 2015. The loan has an, annual interest rate of 10% and the principal is payable at the end of every quarter, amounting to P 25 000. The first quarterly payment will be on September 30, 2015., Prepare an amortization schedule for 2015 until the loan is fully paid on June 30,, 2017. How much interest expense is incurred in 2015 and 2016 with respect to this, loan?, 2. A firm is evaluating two projects. The firm’s cost of capital (appropriate discount rate), has been determined to be 9%, and the projects have the following initial investments, and cash flows:, Project Q, , Project Y, , P 50 000, , P 48 000, , 1, , P 20 000, , P 30 000, , 2, , 25 000, , 35 000, , 3, , 15 000, , 40 000, , 4, , 20 000, , 10 000, , Initial Investment:, Cash Flows:, , Which project should the company pursue? Why?, , 14

Page 21 :

www.shsph.blogspot.com, , Assessment, , A. DIRECTION: Fill the blanks with the correct answer. Write all your answers in a separate, answer sheet., 1. ________is the excess of resources (usually cash) received or paid over the amount, of resources loaned or borrowed., 2. ________ is the interest paid on both the principal and the amount of interest, accumulated in prior periods., 3. Future value interest factor (FVIF) is represented by the formula ____________., 4. An installment that requires a buyer to pay equal payments at a certain period is, called ___________., 5. __________means that individuals maximize returns for a given level of risk or, minimize risk if the returns are the same., 6. The basic decision rule is to accept the project if the net present value is _________., 7. If the cash flow stream lasts forever or is indefinite, then it is called ___________., 8. If payment is made and interest is computed at the end of each payment interval,, then it is called _____________., 9. One way to reduce risk to an acceptable level is through ___________ wherein you, invest in different types of investments with different risks and returns., 10. If the cash flow happens at the beginning of each period, then it is called, ___________., B. Multiple Choice, 1. In a loan amortization schedule, interest payments for each period would most, probably, a. Increase overtime c. Remain the same, b. Decrease overtime d. There are no interest payments in the schedule., 2. The formula (1 + i)n is also called, a. present value factor for lump-sum payment, b. future value factor for lump-sum payment, c. present value factor for ordinary annuity, d. future value factor for ordinary annuity, , 15

Page 22 :

www.shsph.blogspot.com, 3. An increase in the present value may be caused by, a. increase in the discount rate, b. decrease in the discount rate, c. discount rate does not affect the present value, d. none of the above, 4. Interest payments that are based on the original principal and previous interest, recognized is based on, a. present value, b. future value, , c. simple interest rate, d. compound interest rate, , 5. The time value of money suggest that a peso received today is worth _______ a, peso received in the future., a. less than, , c. the same as, , b. more than, , d. none of the above, , 6. You invest P 5 000 today at an interest rate of 10% for four years, how much would, be the future value of the investment?, a. P 3 415, , b. P 7 000, , c. P 6 500, , d. P 7 320, , 7. You are an incoming college freshman taking-up a four-year course. Suppose that, you want to purchase a car immediately after graduating which will cost you P 750, 000. How much should you invest at the end of every year in an investment fund that, earns 9% annually to have enough to buy the car upon graduation?, a. P 164 000, , b. P 531 300, , c. P 607 445, , d. P 132 828, , 8. If you invest a lump-sum amount of P 25 000 at an interest rate of 12%, compounded, monthly, how much would be your investment after 3 years?, a. P 34 000, , b. P 35 123, , c. P 39 338, , d. none of the above, , 9. An equipment with a cost of P 100 000 is expected to generate returns of, P 90, 000; P 60 000 and P 50 000 for the first, second and third year, respectively. Using a, discount rate of 12%, what is the NPV of the project?, a. P 60 121, , b. P 79 341, , c. P 83 431, , d. P 63 778, , 10. What is the present value of a 6% investment that would pay P 30 000 annually, perpetually?, a. P 500 000, , b. P 450 000, , c. P 300 000, , 16, , d. none of the above

Page 23 :

www.shsph.blogspot.com, DIRECTION: Solve the following problems., 1. You will invest P 30 000 into an investment that will earn 10% every year for 5 years., a. How much would you receive after 5 years if the 10% is a simple interest rate?, b. How much would you receive after 5 years if the 10% is a compound interest rate?, 2. ABC Company expects to receive P 1 000 five years from now and wants to know, what this money is worth today. Calculate the value today of P 1 000 discounted at, 10%., 3. Find the amount of P 5 000 ordinary annuity payable quarterly for 3 years. Money is, worth 12% converted quarterly., 4. Consider the given annuities:, A:, , P 1 000 deposited at the beginning of each month for 3 years at 12%, compounded semi-annually., , B:, , P 3 000 deposited at the beginning of each quarter for 3 years at 12%, compounded quarterly., , Calculate the amount of each annuity. Compare the two annuities., 5. A mortgage of P 80 000 is to be paid by annual payment over a period of 10 years. If, the interest rate is 15.8% effective., a) calculate the annual payment;, b) construct an amortization schedule;, c) find the total payment made;, d) find the total interest paid, 6. A project requires an initial outlay of P 100 000. The relevant inflows associated with, the project are P 60 000 in year one and P 50 000 in years two and three. The, appropriate discount rate for this project is 11%. Compute the net present value., Should the company accept the project?, , Congratulations!, You have completed your, journey in this subject. Great job!, It’s now time to go, explore, and, apply all, your learning’s here, , 17

Page 24 :

7. Perpetuity, 8. Ordinary Annuity, 9. Diversification, 10. Annuity due, , 2. Compound interest, , 3. (1 + i)n, , 4. Annuity, , 5. Risk aversion, , 18, , 7. b, 8. d, 9. d, 10. a, , 2. b, , 3. a, , 4. d, , 5. b, , Since the NPV is positive, the company should, accept the project., , 6. NPV = P 31 195.57, , d. P 84 290.11, , c. P 164 290.10, , b., , 5. a. P 16 429.01, , B: FV = P 14 617.80, , 4. A: FV = P 7 393.80, , 3. PV = P 49 770, , 2. PV = 620.10, , b) FV = P 48 315, , 1. a) FV = P 45 000, , C. Problem Solving, , 6. d, , 1. b, , B. Multiple Choice, , 6. positive, , 1. Interest, , A. Fill in the blanks, , Assessment, , Lesson 4, , Choose to receive the P 200 000 today since, P 200 000 > 192 750 (PV) of, P 500 000., , b) FV = P 518 740, , a) PV = P 192 750, , Solve, , 5. True, , 4. True, , 3. False, , 2. False, , 1. True, , True or False, , What I Know, , Lesson 4, , www.shsph.blogspot.com, , Answer Key

Page 25 :

www.shsph.blogspot.com, , APPENDIX, , Table 1 Present Value Interest Factor, , Table 2 Future Value Interest Factor, , 19

Page 26 :

www.shsph.blogspot.com, , Table 3 Present Value Interest Factor of an Ordinary Annuity, , Table 4 Future Value Interest Factor of an Ordinary Annuity, , 20

Page 27 :

www.shsph.blogspot.com, , Table 5 Present Value Interest Factor of an Annuity Due, , Table 6 Future Value Interest Factor of an Annuity Due, , 21