Page 1 :

www.shsph.blogspot.com, , SENIOR HIGH SCHOOL, , BUSINESS FINANCE, Module 1 - Quarter 1, , Introduction to Financial, Management, , WWW.GOOGLE.COM, , Department of Education • Republic of the Philippines

Page 3 : www.shsph.blogspot.com, , SENIOR HIGH SCHOOL, , BUSINESS FINANCE, Module 1 - Quarter 1, , Introduction to Financial, Management, , This instructional material was collaboratively developed and reviewed by, educators from public and private schools, colleges, and universities. We, encourage teachers and other education stakeholders to email their, feedback, comments, and recommendations to the Department of, Education at

[email protected]., , We value your feedback and recommendations., , Department of Education ● Republic of the Philippines, II

Page 5 :

www.shsph.blogspot.com, , TABLE OF CONTENTS, , Page No., Cover page, , II, , Table of Contents, , IV, , Overview, , V, , General Instructions, , V, , Lesson 1: Introduction to Financial Management, , 1, , What I Need to Know?, , 1, , What I Know, , 1, , What’s In, , 2, , What’s New?, , 3, , What is it?, , 3, , What’s More?, , 9, , What I Have Learned?, , 10, , What Can I Do?, , 11, , Assessment, , 12, , Additional Activities, , 12, , Answer Key, , 13, , References, , 14, , IV

Page 6 :

www.shsph.blogspot.com, , OVERVIEW, , This module created to train learners to familiarize with Business Finance, with the fundamental principles, tools, and techniques of the financial operation, involved in the management of business enterprises. In answering the pre-test,, self-check exercises and post-tests, remind students to use separate sheets., Business Finance is a specialized subject of Accounting, Business and, Management strand, which introduces the basic concepts of corporate finance and, personal finance. The lessons have been designed to give learners the opportunity, to explore the content and performance standards set for Business Finance. It will, prepare learners in applying such learnings in real life situation., , GENERAL INSTRUCTIONS, For the teacher:, To facilitate and ensure the students’, learning from this module, you are, encouraged to do the following:, , For the learners:, To be guided in achieving the, objectives of this module, do the, following:, , 1. Clearly communicate learning, competencies and objectives, 2. Motivate through applications, and connections to real life., 3. Give applications of the theory, 4. Discuss worked-out examples, 5. Give time for hands-on, unguided classroom work and, discovery, 6. Use formative assessment to, give feedback, 7. Introduce extensions or, generalizations of concepts, 8. Engage in reflection questions, 9. Encourage analysis through, higher order thinking prompts, 10. Provide alternative formats for, student work, 11. Remind learners to write their, answers in their Philosophy, Activity Notebook, , 1. Read and follow instructions, carefully., 2. Write all your ANSWERS in, your Activity Book, 3. Answer the pretest before, going through the lessons., 4. Take note and record points, for clarification., 5. Compare your answers, against the key to answers, found at the end of the, module., 6. Do the activities and fully, understand each lesson., 7. Answer the self-check to, monitor what you learned in, each lesson., 8. Answer the posttest after you, have gone over all the lessons., , V

Page 7 :

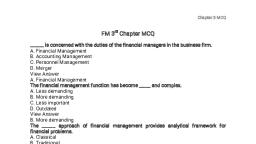

www.shsph.blogspot.com, , Lesson, , 1, , INTRODUCTION TO FINANCIAL MANAGEMENT, , What I Need to Know, After going through this module, you are going to:, 1. Define Finance, 2. Describe who are responsible for financial management within an, organization, 3. Describe the primary activities of the financial manager, 4. Describe how the financial manager helps in achieving the goal of the, organization, 5. Describe the role of financial institutions and markets, , What I Know, Let us determine how much you already know about the definition of finance, the, activities of the financial manager, and financial institutions and markets. Take, this test., Direction: Read each question carefully, choose the letter with the correct answer, and write your answer on the space before each number., _____1. It is a financial intermediary handling individual savings. It receives, premium payments placed in loans or investments to accumulate funds to cover, future benefits., A. life insurance company, C. savings bank, B. commercial bank, D. credit union, _____2. Which of the following is not a financial institution?, A. A pension fund, C. A commercial bank, B. A newspaper publisher, D. An insurance company, _____3. It is a set up so that employees of corporations or governments can receive, income after retirement., A. life insurance company, C. Savings bank, B. Pension fund, D. credit union, , 1

Page 8 :

www.shsph.blogspot.com, _____4. It is a type of financial intermediary that pools savings of individuals and, makes them available to business and government users. Funds obtained through, the sale of shares., A. Mutual Funds, C. Savings and loans, B. Commercial banks, D. Credit Union, _____5. Most businesses raise money by selling their securities in a., A. direct placement, C. public offering, B. stock exchange, D. private placement, _____ 6. Which of the following is not a service provided by financial institutions., A. Buying the businesses of customers, B. Investing customers’ savings in stocks and bonds, C. Paying savers’ interest on deposit, D. Lending money to customers, _____7. By definition, the money market involves the buying and selling of., A. funds that mature in more than one year., B. flows of funds., C. stocks and bonds., D. short-term funds., _____8. It creates financial relationship between suppliers and users of short-term, funds., A. financial market, C. stock market, B. money market, D. capital market, _____9. Firms that require funds from external sources can obtain them from, A. financial markets., C. financial institutions., B. private placement., D. All the above., _____10. The science and art of managing money., A. Financial Management, C. Management, B. Finance, D. Personal Finance, , What’s In, As a senior high student taking this subject and read this module, you will, learn to become financial literate in all aspect in life. If you are thinking that only, working individuals, entrepreneurs, businesses make financial decisions, then you, will be benefiting more from this subject than the rest. Perhaps, your first lesson is, to know that you do make financial decisions on a daily basis. Finance is every day;, I want to challenge you to get your notebook and answer these questions and give, your honest answer. How much is your monthly allowance or everyday allowance?, List all your expenses when you come in school. How much is your expense? How, much is your extra money? On the other hand, do you experience short of cash? In, addition, why? All of these questions will teach you how to manage your finances., , 2

Page 9 :

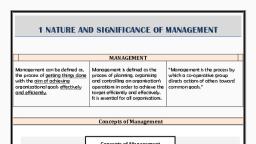

www.shsph.blogspot.com, , What’s New, Activity 1.1, Direction: Write the hierarchy of positions according to common organizational, structure of a company., , What is it?, Read and understand the information very well then find out how much you, can remember and how much you learned by doing the activity and assessment., What is Finance and Financial Management?, Finance is always of great importance, be it in a business or in one's, everyday life. It is important to manage risks in business, it is equally important to, manage risks in life as well. Risk is nothing but an uncertain event that might, damage your assets and when it is financial risks, it creates loss of Finance. Some, books define Finance as the science and art of managing money. (Gitman &, Zutter, 2012), Financial Management deals with that decisions that are supposed to, maximize the value of shareholder’s wealth (Cayanan). These decisions will, ultimately affect the markets perception of the company and influence the share, price. The goal of Financial Management is to maximize the value of shares of, stocks. Managers of a corporation are responsible for making the decisions for the, company that would lead towards shareholder’s wealth maximization., Organizational structure of the company is important especially in the, financial aspect of the business and the particular set of people, each play a role in, the decision making of the company. See diagram below., 3

Page 10 :

www.shsph.blogspot.com, Board of Directors, , President, , Vice President, for Marketing, , Vice President, for Finance, , Vice President, for Production, , Vice President, for, Administration, , From the diagram presented, emphasized that each line is working for the, interest of the person on the line above them. Since the managers of the company, are making decisions for the interest of the board of directors and the board of, directors do the same for the interest of the shareholders, it follows the goal of, each individual in a corporate organization should have an objective of, shareholders wealth maximization., , The roles of each position identified., , 1. Shareholders: The shareholders elect the Board of Directors (BOD). Each, share held is equal to one voting right. Since the shareholders elect the, BOD, their responsibility is to carry out the objectives of the, shareholders. Otherwise, they would not be elected in that position. Ask, the learners again, what objective of the shareholders is, just to refresh., 2. Board of Directors: The board of directors is the highest policy making body in a, corporation. The board’s primary responsibility is to ensure that the corporation, is operating to serve the best interest of the stockholders. The following are, among the responsibilities of the board of directors:, a. Setting policies on investments, capital structure and dividend policies., b. Approving company’s strategies, goals and budgets., c. Appointing and removing members of the top management including the, president., d. Determining top management’s compensation., e. Approving the information and other disclosures reported in the financial, statements (Cayanan, 2015), 3. President (Chief Executive Officer): The roles of a president in a, , corporation may vary from one company to another., Among the, responsibilities of a president are the following:, a. Approving the information and other disclosures reported in the financial, statements. Overseeing the operations of a company and ensuring that the, strategies as approved by the board are implemented as planned., , 4

Page 11 :

www.shsph.blogspot.com, b. Performing all areas of management: planning, organizing, staffing, directing, and controlling., c. Representing the company in professional, social, and civic activities., 4. VP for Marketing: The following are among the responsibilities:, a. Formulating marketing strategies and plans. Directing and coordinating, company sales., b. Performing market and competitor analysis., c. Analyzing and evaluating the effectiveness and cost of marketing methods, applied., d. Conducting or directing research that will allow the company identify new, marketing opportunities, e.g. variants of the existing products/services, already offered in the market., e. Promoting good relationships with customers and distributors. (Cayanan,, 2015), 5. VP for Production: The following are among the responsibilities:, a. Ensuring production meets customer demands., b. Identifying production technology/process that minimizes production cost, and make the company cost competitive., c. Coming up with a production plan that maximizes the utilization of the, company’s production facilities., d. Identifying adequate and cheap raw material suppliers. (Cayanan, 2015), 6. VP for Administration: The following are among the responsibilities:, a. Coordinating the functions of administration, finance, and marketing, departments., b. Assisting other departments in hiring employees., c. Providing assistance in payroll preparation, payment of vendors, and, collection of receivables., d. Determining the location and the maximum amount of office space needed, by the company. Identifying means, processes, or systems that will minimize, the operating costs of the company. (Cayanan, 2015), The role of the VP for Finance/Financial Manager is to determine the, appropriate capital structure of the company. Capital structure refers to how, much of your total assets financed by debt and how much is financed by equity., To be able to acquire assets, our funds must have come somewhere. If it has, bought using cash from our pockets, it has financed by equity. On the other hand,, if we used money from our borrowings, the asset bought has financed by debt., What are the functions of Financial Managers?, 1. Financing decisions- include making decisions as to how to finance long-term, investments and working capital-which deals with the day-to-day operations of the, company., 2. Investing Decisions- To minimize the probability of failure, long-term, investments have supported by a capital budgeting analysis., , 5

Page 12 :

www.shsph.blogspot.com, 3. Operating Decisions – deal with the daily operations of the company especially, on how to finance working capital accounts such as accounts receivable and, inventories., 4. Dividend Policies – Dividend is a part of profits that are available for, distribution, to equity shareholders. The Finance manager must decide whether the, firm should distribute all the profits or retain them or distribute a portion and, retain the balance., OVERVIEW OF THE FINANCIAL SYSTEM, , SAVERS, -Households, -Individuals, -Corporations/Companies, -Government Agencies, , Financial, Intermediaries, -Banks, -Insurance Companies, -Stock Exchange, -Stock brokerage firms, -Mutual Funds, -, , Users of Funds, (Borrowers/Investors), -Households, -Individuals, -Corporations/Companies, -Government Agencies, , The financial system links the savers and the users of funds. Savings can, come from households, individuals, companies, government agencies, or any other, entity whose cash inflows are greater than their cash outflows. The financial, system through financial intermediaries provides a mechanism by which these, savings can be channeled to users of funds, borrowers, and investors., Some of the financial instruments issued by users of funds such as the, shares of stocks and corporate bonds of publicly listed companies and the debt, securities issued by the National Government has traded., , Differentiate the Financial instruments, financial institutions and, financial markets, 1. Financial institutions are companies in the financial sector that provide a, broad range of business and services including banking, insurance, and, investment management., Identify examples of financial institutions/Intermediaries:, a. Commercial Banks - Individuals deposit funds at commercial banks,, which use the deposited funds to provide commercial loans to firms and personal, loans to individuals, and purchase debt securities issued by firms or government, agencies., b. Insurance Companies - Individuals purchase insurance (life, property, and casualty, and health) protection with insurance premiums. The insurance, companies pool these payments and invest the proceeds in various securities until, the funds needed to pay off claims by policyholders. Because they often own large, blocks of a firm’s stocks or bonds, they frequently attempt to influence the, management of the firm to improve the firm’s performance, and ultimately, the, performance of the securities they own., 6

Page 13 :

www.shsph.blogspot.com, c. Mutual Funds - Mutual funds owned by investment companies that, enable small investors to enjoy the benefits of investing in a diversified portfolio of, securities purchased on their behalf by professional investment managers. When, mutual funds use money from investors to invest in newly issued debt or equity, securities, they finance new investment by firms. Conversely, when they invest in, debt or equity securities already held by investors, they are transferring ownership, of the securities among investors., d. Pension Funds - Financial institutions that receive payments from, employees and invest the proceeds on their behalf., Other financial institutions include pension funds like Government Service, Insurance System (GSIS) and Social Security System (SSS), unit investment trust, fund (UITF), investment banks, and credit unions, among others., 2. Financial Instruments-is a real or a virtual document representing a legal, agreement involving some sort of monetary value. These can be debt securities like, corporate bonds or equity like shares of stock. When a financial instrument issued,, it gives rise to a financial asset on one hand and a financial liability or equity, instrument on the other., a. A Financial Asset is any asset that is:, • Cash, • An equity instrument of another entity, • A contractual right to receive cash or another financial asset from another, entity., • A contractual right to exchange instruments with another entity under, conditions that are potentially favorable. (IAS 32.11), • Examples: Notes Receivable, Loans Receivable, Investment in Stocks,, Investment in Bonds, b. A Financial Liability is any liability that is a contractual obligation:, • To deliver cash or other financial instrument to another entity., • To exchange financial instruments with another entity under conditions, that are potentially unfavorable. (IAS 32), • Examples: Notes Payable, Loans Payable, Bonds Payable, c. An Equity Instrument is any contract that evidences a residual interest in the, assets of an entity after deducting all liabilities. (IAS 32), • Examples: Ordinary Share Capital, Preference Share Capital, • Identify common examples of Debt and Equity Instruments., d. Debt Instruments generally have fixed returns due to fixed interest rates., Examples of debt instruments are as follows:, • Treasury Bonds and Treasury Bills issued by the Philippine, government. These bonds and bills have usually low interest rates and have very, low risk of default since the government assures that these has been paid., 7

Page 14 :

www.shsph.blogspot.com, • Corporate Bonds issued by publicly listed companies. These bonds, usually have higher interest rates than Treasury bonds. However, these bonds are, not risk free. If the company issued the bonds goes bankrupt, the holder of the, bonds will no longer receive any return from their investment and even their, principal investment has wiped out., , e. Equity Instruments generally have varied returns based on the, performance of the issuing company. Returns from equity instruments, come, from, either, dividends, or, stock, price, appreciation., The following are types of equity instruments:, •Preferred Stock has priority over a common stock in terms of claims over, the assets of a company. This means that if a company has liquidated and its, assets have to be distributed, no asset be distributed to common stockholders, unless all the claims of the preferred stockholders has given. Moreover, preferred, stockholders have also priority over common stockholders in cash dividend, declaration. Dividends to preferred stockholders are usually in a fixed rate. No cash, dividends given to common stockholders unless all the dividends due to preferred, stockholders paid first. (Cayanan, 2015), • Holders of Common Stock on the other hand are the real owners of the, company. If the company’s growth is encouraging, the common stockholders will, benefit on the growth. Moreover, during a profitable period for which a company, may decide to declare higher dividends, preferred stock will receive a fixed dividend, rate while common stockholders receive all the excess., 3. Financial Market - refers to a marketplace, where creation and trading of, financial assets, such as shares, debentures, bonds, derivatives, currencies, etc., take place., Classify Financial Markets into comparative groups:, - Primary vs. Secondary Markets • To raise money, users of funds will go to, a primary market to issue new securities (either debt or equity) through a, public offering or a private placement., • The sale of new securities to the public referred to as a public offering and, the first offering of stock named an initial public offering. The sale of new, securities to one investor or a group of investors (institutional investors) is, referred to as a private placement., • However, suppliers of funds or the holders of the securities may decide to, sell the securities that have purchased. The sale of previously owned, securities takes place in secondary markets., • The Philippine Stock Exchange (PSE) is both a primary and secondary, market., , 8

Page 15 :

www.shsph.blogspot.com, Money Markets vs. Capital Markets •Money markets are a venue wherein, securities with short-term maturities (1 year or less) are sold. They have created, because some individuals, businesses, governments, and financial institutions, have temporarily idle funds that they wish to invest in a relatively safe, interestbearing asset. At the same time, other individuals, businesses, governments, and, financial institutions find themselves in need of seasonal or temporary financing., • On the other hand, securities with longer-term maturities sold in Capital, markets. The key capital market securities are bonds (long-term debt) and both, common stock and preferred stock (equity, or ownership)., The role of Financial Managers: make financing decisions that require, funding from investors in the financial markets., , What’s more?, How do we measure wealth maximization?, For example, Assume that Mr. Y bought 10 shares of Globe Telecom at PHP2, 510, each on September 9, 2010. This brings his investments to PHP25, 100. What, happens to the value of his investment if the price goes up to PHP2, 600 per share, or it goes down to PHP2, 300 per share?, , Explanation: An increase of the share price to PHP2, 600 per share means that, people are willing to buy the shares for that amount. If the learners were to sell, their shares at this point, it will result to a profit of PHP90 per share or PHP900 on, their whole investment. Hence, the value of their investment increased from PHP25,, 100 to PHP26, 000. Therefore, there is an increase in shareholder’s wealth., On the other hand, a decrease in the share price to PHP2, 300 per share, means that people are only willing to buy shares for PHP2, 300. If the learners were, to sell their investment at this point, they will receive PHP23, 000 which would, result to a loss of PHP2, 100. The decrease in value of their investment leads to a, decrease in shareholder’s wealth., Activity 1.2, Direction: Read the problem and answer it correctly. Follow the format above when, you answer., 1. ABC Company bought 10 shares of Jollibee Corporation at PHP2, 000 each on, January 9, 2012. This brings his investments to PHP20, 000. What happens to the, value of his investment if the price goes up to PHP2, 520 per share or it goes down, to PHP1, 500 per share?, 9

Page 17 :

www.shsph.blogspot.com, , What I Can Do, , Activity 1.4, Direction: Write three examples of each circle and describe it briefly., For example: Financial Instruments: My answer is cash-It is used for, exchange of something you want to buy (describe your answer on each circle), , Financial, Institution, , Financial, Instruments, , 11, , Financial, Market

Page 18 :

www.shsph.blogspot.com, , Assessment, , Directions: Write T if the statement is True and F if the statement is False., Write your answer on the space provided, ______1. High cash flow is generally associated with a higher share price whereas, higher risk tends to result in a lower share price., ______2. The wealth of corporate owners has measured by the share price of the, stock., ______3. When considering each financial decision alternative or possible action in, terms of its impact on the share price of the firm's stock, financial, managers should accept only those actions that expected to maximize, shareholder value., ______4. Stockholders expect to earn higher rates of return on investments of lower, risk and lower rates of return on investments of higher risk., ______5. Financial markets are intermediaries that channel the savings of, individuals, businesses, and government into loans or investments., ______6. Commercial banks obtain most of their funds from borrowing in the, capital markets., ______7. The money market involves trading of securities with maturities of one, year or less while the capital market involves the buying and selling of, securities with maturities for more than one year., ______8. Primary and secondary markets are markets for short-term and long-term, securities, respectively., ______9. A mutual fund is a type of financial intermediary that obtains funds, through the sale of shares and uses the proceeds to acquire bonds and, stocks issued by various business and governmental units., ______10. Credit unions are the largest type of financial intermediary handling, individual savings., , Additional Activities, Direction: Summarize the roles of individual/position (Organizational structure), involve in the decision making of the company., ___________________________________________________________________________, __________________________________________________________________________________, __________________________________________________________________________________, __________________________________________________________________________________, __________________________________________________________________________________, __________________________________________________________________________________, __________________________________________________________________________________, __________________________________________________________________________________, __________________________________________________________________________________, __________________________________________________________________________________, __________________________________________________________________________________, __________________________________________________________________________________, 12

Page 19 :

www.shsph.blogspot.com, , Answer Key, , It’s now time to go on to the next, adventure…Good luck!, , 13, , Assessment, , 1. T, 2. T, 3. T, 4. F, 5. F, 6. F, 7. T, 8. F, 9. T, 10. F, , What I Know, , 1. b, 2. b, 3. b, 4. a, 5. b, 6. a, 7. a, 8. b, 9. d, 10. b, , Congratulations!, You have completed your journey in this, lesson. You did a great job!