Page 1 :

GOA BOARD CLASS 12 ACCOUNTANCY, MODIFIED SYLLABUS FOR, THE ACADEMIC YEAR 2020-2021., UNITS, PART A PARTNERSHIP ACCOUNTS, 1. Introduction to Partnership, 2. Reconstitution of Partnership, a) Admission of a Partner, b) Retirement of a Partner, c) Death of a Partner, 3. Dissolution of Partnership, TOTAL, PART B COMPANY ACCOUNTS, 1. Accounting for Shares and Debentures, 2. Financial Statements of a Company, a) Preparation of P & L Statement, b) Preparation of Balance sheet, TOTAL, TOTAL OF PART A + PART B, , MARKS, 07, 22, , 11, 40, 12, 14, 14, 40, 80

Page 2 :

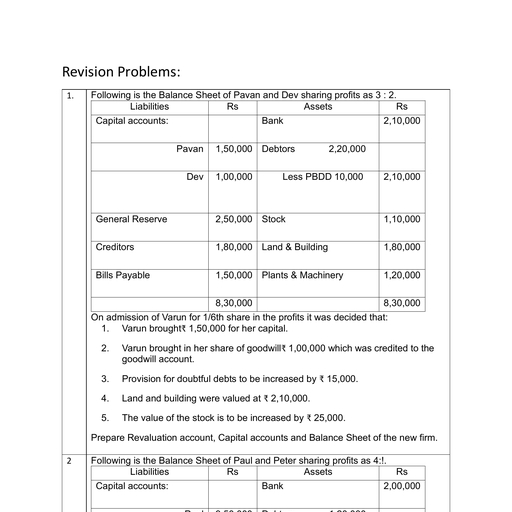

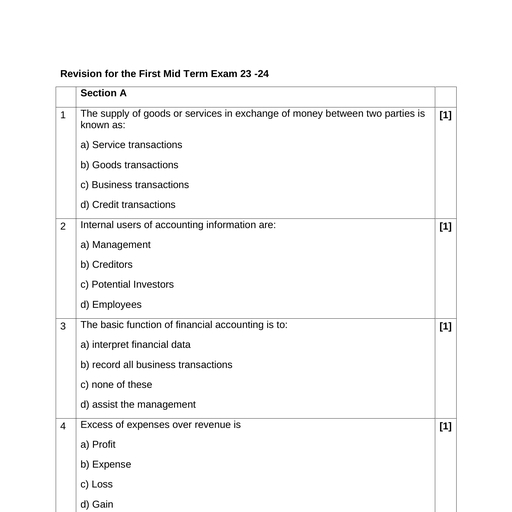

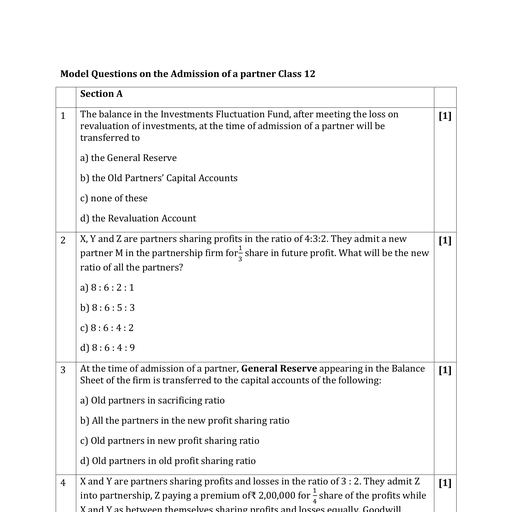

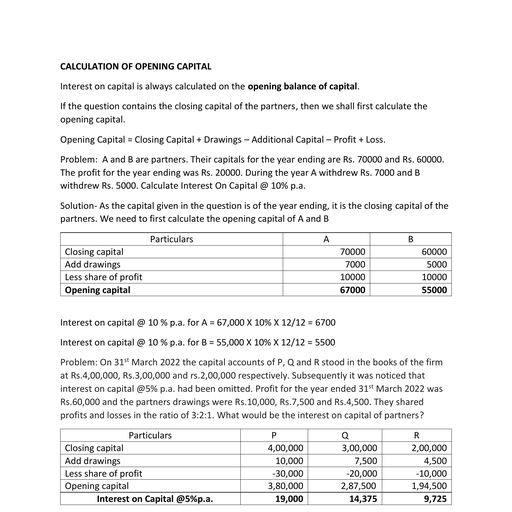

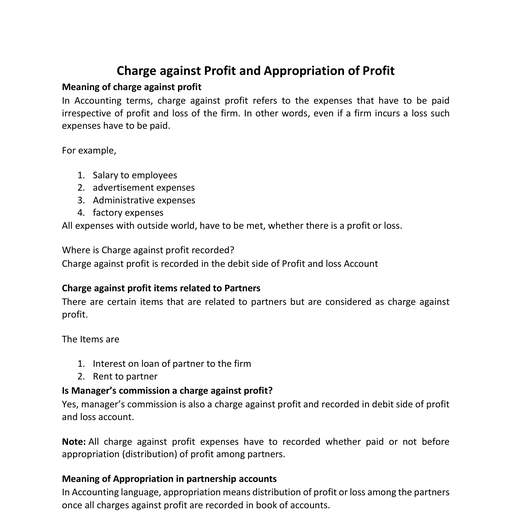

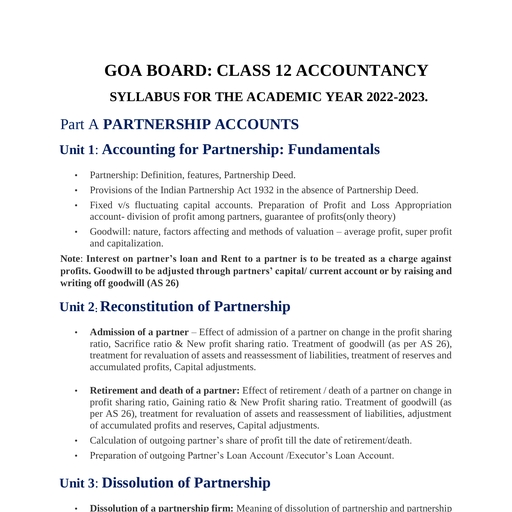

Part A PARTNERSHIP ACCOUNTS, Unit 1: Accounting for Partnership: Fundamentals, , , Partnership: Definition, features, Partnership Deed., Provisions of the Indian Partnership Act 1932 in the absence of partnership deed., Fixed v/s fluctuating capital accounts. Preparation of Profit and Loss Appropriation, account- division of profit among partners, guarantee of profits(only theory), Goodwill: nature, factors affecting and methods of valuation – average profit, super profit, and capitalization., Note: Interest on partner’s loan and Rent to a partner is to be treated as a charge against, profits. Goodwill to be adjusted through partners’ capital/ current account or by raising, and writing off goodwill (AS 26), , Unit 2:Reconstitution of Partnership, , , Admission of a partner – effect of admission of a partner on change in the profit sharing, ratio, Sacrifice ratio & New profit sharing ratio. Treatment of goodwill (as per AS 26),, treatment for revaluation of assets and reassessment of liabilities, treatment of reserves, and accumulated profits, Capital adjustments., , , , Retirement and death of a partner: effect of retirement / death of a partner on change, in profit sharing ratio, Gaining ratio & New Profit sharing ratio. Treatment of goodwill, (as per AS 26), treatment for revaluation of assets and reassessment of liabilities,, adjustment of accumulated profits and reserves, Capital adjustments., Calculation of deceased partner’s share of profit till the date of death., Preparation of Retiring Partner’s Loan Account /Executor’s Loan Account., , , , , Unit 3: Dissolutionof Partnership, , , Dissolution of a partnership firm: meaning of dissolution of partnership and, partnership firm, types of dissolution of a firm. Settlement of accounts – preparation of, realization account, and other related accounts: capital accounts of partners and cash/bank, a/c (excluding piecemeal distribution, sale to a company and insolvency of partners).

Page 3 :

Part B ACCOUNTING FOR COMPANIES, Unit 1. Accounting for shares and Debentures, Accounting for Share Capital, , , Share and share capital: nature and types., , , , Accounting for share capital: issue and allotment of equity and preferences shares. Public subscription, of shares – over subscription and under subscription of shares; issue at par and at premium, calls in, advance and arrears (excluding interest), issue of shares for consideration other than cash., , , , Accounting treatment of forfeiture and reissue of shares., , , , Disclosure of share capital in the Balance Sheet of a company., , Accounting for Debentures, , , Meaning of Debentures; nature and types, Distinction between Shares & Debentures, , , , Issue of debentures at par, at a premium and at a discount. Issue of debentures for consideration other, than cash; debentures as collateral security concept,, , Note: Related sections of the Companies Act, 2013 will apply., , Unit 2. Financial Statement of a Company, Financial statement of a Company: Meaning; Nature; Objectives; Importance/Significance and Limitations, a) Preparation of Statement of Profit and Lossin prescribed form with major headings and sub, headings., b) Preparation of Balance Sheet in prescribed form with major headings and sub headings., , *********************************************************************************