Page 1 :

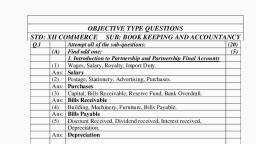

RECONSTITUTION OF PARTNERSHIP:, , GSU MEAN Toor ay oy, ed ANAT SY, , Goce sees, , , , Meaning of Retirement, , When a partner leaves or retires from the firm due to any reason, it is known as retirement of, a partner. On retirement or death of a partner, the old partnership comes to an end and a new, partnership comes into existence between the remaining partners. However the firm continues., , Retirement involves a few preconditions that have been clearly laid down by Section 32(1) of the, Indian Partnership Act, 1932. It states that a partner may retire:, , © with the consent of all the partners, @ in accordance with an express agreement amongst the partners, , @ by issuing a notice in writing to all the partners stating the intention to retire (this occurs in, cases where partnership is at will), , Adjustments Required, , Following are the various matters that need adjustment at the time of retirement:, , (i) Determination of new profit-sharing ratio., , (ii) Determination of gaining ratio., , (iii) Treatment of goodwill., , (iv) Revaluation of assets and Reassessment of liabilities., , (v) Adjustment of reserves and accumulated profits or losses., , (vi) Determination of the amount payable to the retiring partner or ,to the executors of a deceased, , partner., New Profit-sharing Ratio a ., , The new profit-sharing ratio is the ratio in which the continuing partners will share profit. The, share of each remaining partner will be the sum total of his old share of profit in the firm and, the portion of the retiring partner's share of the profit acquired., Itis determined as:, , New share = Old share + Acquired share, , The new profit sharing ratio may be calculated as follows in the following circumstances:, , Case 1: WI information is given about remaining partners’ new share, new ratio will be, : nen no in, , : : i ng them. :, the same as old ratio amo ; Pi as, Case 2: WI iri artner’s share is acquired by remaining partners in a specified ratio, the, e 4: When retiring p:, , i isting share to arrive at their new share in the fir, iC is al gS! f ay ‘m., i S| a d to their exis, acquired share is dde, , Saining Ratio, Gaining Ratio refers to the ratio in, Partner's share of profit. 1t is calcula, Gaining Ratio, ¢ Partnership: Retirement and Death of a Partner | 53, no, , vhich the remaining partners gain the retiring or deceased, M, , ated as:, = New share - Old Share, , Reconstitutia

Page 2 :

Pe, , Calculation of Gaining Ratio under different cases:, , Case I: No Agreement amongst Partners for New Profit-sharing Ratio, : No Ag, , In case the partners have no express agreement, they continue to share it in their olq, , * . - ‘ Pro, sharing ratio. Thus the gaining ratio is automatically their old profit-sharing ratio. fs |, , : G |, Case II: Agreement amongst Partners for New Profit-sharing Ratio 4, , When there is an agreement to share the retiring partner’s share amongst the Temaininy, partners, the gaining ratio is governed by such an agreement. 8, , Case III: Acquisition of Retiring Partner’s Share only by One Partner, , When the retiring partner's share is gained entirely by one partner, then only gaining Partne, E, provides for the share of goodwill of the retiring partner., , , , , , , , , , , , , , , , , , Difference between Sacrificing Ratio and Gaining Ratio, S.No. | Basis Sacrificing Ratio Gaining Ratio, 43 Definition It is the proportion in which the old| It is the proportion in which the oij j, partners sacrifice their share in favour | partners acquire the outgoing (retired o,, of a new partner. deceased) partner’s share., 2. Time of Calculation Generally, it is calculated at the time of | Generally, it is calculated at the time of | |, admission of a new partner. retirement or death of a partner. ;, 3. Purpose It is calculated to know how the old| It is calculated to know how the E, partners shall share the goodwill] remaining partners shall contribute, brought in by the new partner. towards the share of goodwill of the, retiring partner., 4. Formula Sacrificing Ratio = Old Share — New| Gaining Ratio = New Share — Old Share, Share, 5. Effect on Share The old partners’ share decreases. The remaining partners’ — share, of Profit of Old/ increases., Remaining Partners, 6. Effect on Capital] Old partners’ capital accounts are| Remaining partners’ capital accounts) |, Accounts credited for the share of goodwill in the | are debited for the share of goodwill in, sacrificing ratio. the gaining ratio., , , , , , , , , , , , ie mg Treatment of Goodwill, , , , When a partner retires, the continuing partners gain his share of profit. They thus have ! |, compensate the retiring partner for his share in the goodwill in the gaining ratio. Similarly whe", there is death of a partner, the continuing partners should bear the share of the goodwill due |, the heirs of the deceased partner. ;, , , , The accounting adjustments adopted to treat goodwill in the accounts depends directly 07 the, fact whether goodwill already appears in the books or not., , Case I: When goodwill does not appear in the books of accounts:, , The share of goodwill of the retiring partner is credited to his capital account and continu, partners’ capital accounts will be debited with share of goodwill of the retiring partner in gain!, ratio., In this case, following entry is passed:, Continuing Partners’ Capital/Current A/cs Dr. (In gaining ratio), , To Retiring Partner’s Capital/Current A/c, (Being goodwill adjusted in partners’ capitals), , pw, i i : pe fit, Note: If any of the remaining partners has also sacrificed a part of his share in profits a with, on retirement or death of a partner, his capital/current account will also be credi, his proportion of sacrifice (i.e., Share of sacrifice x Firm’s goodwill)., , , , pec ge

Page 3 :

Case II: When goodwill exists in the accounting books:, When goodwill account already appears in books, write off the existing goodwill by debiting all, the partners’ capital accounts (in case of fluctuating capitals) or current accounts (in case of fixed, , capitals) in their old profit-sharing ratio and crediting the goodwill account., , All Partners’ Capital/ Current A/es, , Dr. (in old ratio), To Goodwill A/c(existing value of goodwill), , Late it the outgoing partner's capital/current account with his share of goodwill and debit, the gaining partners) capitaVcurrent account in gaining ratio,, Remaining Partmers* Capital/ Current Aes, To Outgoing Parmer’s CapitalCurrent Ae, (Being goodwill adjusted on ap, Hidden Goodwill, , , , Dr. (in gaining ratio), , , , (goodwill share), ariner’s retirement), , Ifthe firm has agreed to settle the account of retiring Pp, then amount paid to him in excess of his, For example A, B and, , artner by paying him alump-sum amount,, adjusted capital shall be treated as his share of goodwill., C are partners. A retires, his capital account after m, reserves and profit on revaluation exists at $60,000, B and C h, , full setdement of his claim. It implies that 30,000 (%90,000 —, the firm. This will be treated by debiting, ratio and crediting A’s Capital A/c., , aking adjustment for, ave agreed to pay him %90,000 in, %60,000) is A’s share of goodwill of, %30,000 in B and C’s Capital Accounts in their gaining, , When Goodwill Account is Opened (Raised), , Case I: Goodwill is raised at its Full value and written off:, , (i) Goodwill A/c Dr. (Value of Goodwill), , To All partners’ Capital A/cs (in old profit sharing ratio), , (Being goodwill raised at its current value), (4) Continuing Partners’ Capital A/c, , To Goodwill A/c, , (Being Goodwill Account written off in new profit-sharing ratio), , Dr. (in new profit sharing ratio), , Case II: Goodwill is raised to the extent of Retiring partner’s share and is written off:, , @ Goodwill Afe Dr. (Goodwill share of, , retiring partner), = Pe + Canina ; in old profit sharing rati, To Retiring partners’ Capital A/cs (in old profit sharing ratio), (Being goodwill raised with the share of retiring partner in goodwill), BN Fai 3 Dr, (in gaining ratio), (ii) Gaining Partners’ Capital A/c Gn gaining, ‘To Goodwill A/c, (Being Goodwill Account written off in gaining ratio), Revaluation of Assets and Reassessment of Liabilities: eee, Generally wy iner retives'frem'n partnership firm, the assets and liabilities ave revalued, ally when a partner retires : rw aartner pets his (aie shave of the fan’, or adiused on th e ite of retirement so that the retiring partner gets Nis thin shave of the firm's, ste e date j evra , Ace Prati g, asec ; ye cots and liabilities of the firm are revalued, Revaluation Account vatit and, Losin: pened ne assets care ‘ reared inn the same wity sts ts prepared in the ease ot admission of, a aes eeament ite ies is that in case of retirement, any profit or loss on revaluation, y Partner, The only difference ts 0, , 's divided Wl riners (including the retiring ee een a of admission, on Ble epar , . i loss on revaluation,, , ofa new ‘ aes the } riner does nol share such profit or lo; ul, artner, the new partne ?, , R titution of Partnership: Retirement and Death of a Partner | 55, ‘aranstt

Page 4 :

= Memorandum Revaluation Account: ts, i assi assessment of liabili;, ffect to revaluation of assets and re abilities, , ets and liabilities, Mena ee Accoun,, 7 issi ri partner. It should be remem], , is prepared in the same manner as in case of admission of a partneé bereq, , is prepared in the same mat as, , i +s transferred to Capital Accounts of, that first part of Memorandum Revaluation Account is rar fer ped tc ae ae all the, er in their old profit-sharing ratio, while Part of, , ae Welidl i arin : ‘, partners including outgomg pa oan fs -tners in their new, this account is transferred to the Capital Accounts of the conunuing partne Profit., , sharing ratio. ., m Treatment of Accumulated (Undistributed) Profits/Losses and Reserves:, are any undistributed profits or reserves, the same need, to be divided amongst all the partners 11 their old profit- I uring ratio. Aecuiaiulatee profits and, reserves belong to all partners, hence, they should be cr dited to all paves copra accounts in, their old profit-sharing ratio. Alternatively, only the reuring partner's share a be rane, to his capital account if the other partners continue to share profits in their old ratio and want, to still show reserves in the Balance Sheet., , The following entry will be made for distributing accumulated profits or reserves., , When the partners decide to give ¢, without affecting existing amounts of, , , , , , Upon retirement of a partner, if there, , , , Profit and Loss Ac (credit balance) Dr., General Reserve Ve Dr., ‘To All Partmers’ Capital/Current A/cs, , (Being accumulated profits distributed among partners in their old profit-sharing ratio upon, retirement of a partner.), , For distributing accumulated losses and fictitious assets:, , If there is a debit balance of Profit and Loss Account and deferred revenue expenditure in the, , Balance Sheet on the date of retirement of a partner, it must be written off by all the partners in, old profit-sharing ratio., , All Partners’ Capital/Current A/cs Dr., To Profit and Loss A/c (debit balance), To Advertisement Suspense A/c, , , , (Being accumulated losses and fictitious assets distributed amongst partners in their old profit, sharing ratio upon retirement of a partner), , For distributing surplus of specific funds:, Workmen's Compensation Reserve A/c Dr. (Excess of Reserve over, Actual Liability), , Dr. (Excess of Reserve ove, Difference between Book, value and market value °, Investment), , Investment Fluctuation Reserve A/c, , ‘To All Partners’ Capital A/es (or Current A/cs), , (Being amounts in excess ofactual requirement in specilic reserves divided amongst partnersit, their old profit-sharing ratio upon retirement), g Final Payment to the Retiring Partner, , The final amount payable to the retiring partner is determined by taking into accounts the, following items:, , 1. Opening balance of capital account and current account of the retiring partner,, , 2. Retiring partner's share in revaluation profit,

Page 5 :

3, Retiring partner’s share in reserves and accumulated profits., 4, Retiring partner's share of profit till the date of retirement., 5, Retiring partner's share of goodwill., , Salary and/or interest on, , >, , capital due to retiring partner., The above mentioned items increase, , the amount payable to the retiring partner., items decrease the amount payable t, , o the retiring partner., 1. Drawings and interest on drawings., , The following, , 9, Retiring partner's share in the accumulated losses,, , , , , , 3. Retiring partner’s share of revaluation loss., Methods of Payment, , Case I: Full setlement of account in one single (lumpsum) payment., Retiring Partner's Capital A/c, To Cash/Bank A/c, , (Being retiring partner's w!, , Dr., , hole claim settled at the time of retirement), Case II: Part payment of dues and balance transferred to loan account, Retiring Partner’s Capital A/c Dr., To Retiring Partner’s Loan A/c, , To Bank A/c, , (Being retiring partner’s claim partly settled through cash and the rest, transferred to the loan account at the time of retirement), , Case III: Entire balance transferred to loan account and paid later in instalments., Reuring Partner’s Capital A/c Dr., , To Retiring Partner’s Loan A/c, , (Being retiring partner’s whole claim transferred to the corresponding loan account at the time, of retirement), , Note: If the question does not specify the treatment of settlement of retiring parmers’ account,, the final payment due to him is transferred to his Loan Account., , Retirement of a Partner During the Accounting Year, , Sometimes, retirement of a partner may take place during accounting year. In that case, the, , retiring Betiner is entitled to his share in the profit of the current year up to the date of his, 8g, , retirement. = : ., , If retiring partner's share in profit has to be calculated on the basis of last year’s profit, then, , it will fei iarices ap to the date of partner's retirement from the date of last Balance Sheet., , a 2, Following points must be remembered:, , ; ray, and there is no change in the profit sharing, : satset ring an accounting yeay ar . s, Ifa partner retires during an ac oe is credited through the Profit and Loss Suspense, , , , ratio of continuing partners, then the pi, Account., Following Journal entry will be passed:, Profit and Loss Suspense A/c, Capital A/e + aeal of » profit-sharing ratio of, unting year, and there ts achange tthe dae ha ‘i ee u ‘, , . . 2 na 7 4 i i Alu ors al a SCOURS, Ifa partner retires during an eit credited through the continuing Partners’ Capital Accor, continuing partners, then profit, , in their gaining ratio., , Di,, , ‘To Retiring Partner's, , , , oe 2 2d Mane ab a Dastnae ERT