Page 1 :

Accounting For Partnership (Fundamentals), Meaning of Partnership, Partners, Firm and Firm Name., (i), , Partnership, , As per the Indian Partnership Act,1932. Section 4. A Partnership is, a formal arrangement by Two or More parties to manage and, operate a business and share it’s Profit There are several types of, partnership arrangements. In particular, in a partnership business,, all partners share liabilities and profits equally, while in others,, partners may have limited liability. There also is the so-called, "silent partner," in which one party is not involved in the day-today operations of the business., , (ii), , Partners, , Partners are the owners of the business, any amounts that are paid to, them under the partnership agreement are part of their share of the, profit., , (iii), , Firm, , (iv), , Firm Name, , Persons who have entered into Partnership with one another are, collectively Called Firm., , Firm name” means a name of the firm or unit of the firm which, identifies the firm or a unit of the firm and allows to distinguish it, from other firms and units of firms., , How a Partnership Works : → In a broad sense, a partnership can be any endeavor, undertaken jointly by multiple parties. The parties may be governments, non-profits, enterprises, businesses, or private individuals. The goals of a partnership also vary widely., , Features of Partnership., (i), , Two or More, Persons, , (ii), , Agreement, , At least two persons must pool resources to start a partnership firm., The Partnership Act, 1932 does not specify any maximum limit on, the number of partners., A partnership comes into being through an agreement between, persons who are competent to enter into a contract (e.g. Minors,, lunatics, insolvents etc. not eligible). The agreement may be oral,, written or implied., , Topic :- Fundamentals of Partnership Firm, , CLASS 12TH., , Aditya Saxena 8178650210

Page 2 :

A+ Accountancy, (iii), , Lawful, Business, , The partners can take up only legally blessed activities. Any illegal, activity carried out by partners does not enjoy the legal sanction., , (iv), , Registration, , Under the Act, registration of a firm is not compulsory. (In most, states in India, registration is voluntary). However, if the firm is not, registered, certain legal benefits cannot be obtained., , (v), , Profit Sharing, , The partnership agreement must specify the manner of sharing, profits and losses among partners., , (vi), , Agency, Relationship, , Generally speaking, every partner is considered to be an agent of, the firm as well as other partners. Partners have an agency, relationship among themselves. The business can be carried out, jointly run by one nominated partner on behalf of all., , (vii) Unlimited, Liability, , All partners are jointly and severally responsible for all activities, carried out by the partnership. In other words in all cases where the, assets of the firm are not sufficient to meet the obligations of, creditors of the firm, the private assets of the partners can also be, attached., , (viii) Not a Separate The firm does not have a personality of its own. The business gets, Legal Entity, terminated in case of death, bankruptcy or lunacy of any one of the, , partners., , Topic :- Fundamentals of Partnership Firm, , CLASS 12TH., , Aditya Saxena 8178650210

Page 3 :

A+ Accountancy, Partnership Deed., Meaning, Contents of, Partnership, Deed, , Partnership Deed is the written agreement containing the terms and, conditions under which the Partnership will sustain or exist., • Name of the FIRM and the Nature of the Business, • Commencement and tenure of the Business, • Amount of Capital to be contribute by each Partner., • Ratio for Sharing the profit and loss of the Business amongst Partners, • Arrangement in respect of Drawings by partners and limits, • Interest to be credited on the capital account of Partners, • Interest is to be charged on Drawings of Partners, • Remuneration to partners and the basis of determining such, remuneration Example:- Commission as a Percentage of the Firm’s, Turnover., • Process of settings disputes that may arises among the partners, • Procedure of Maintaining Books of Accounts, • Audit of the Books of Accounts, • Manner of the Valuation of Goodwill is Case of Admission Of a, Partner, Retirement/Death of a Partner., • Procedure for settlement of, Retirement/Death of a Partner., , Partner’s, , Claims, , in, , Case, , of, , • Procedure for Dissolution of Partnership., Notes, , • When Partnership Deed is not registered a partnership Firm is allowed, to carry on business subject to certain disabilities., • It is not mandatory to have written agreement in all cases. Further,, even in cases where there is Partnership Deed, It is not Compulsory to, have it registered., , Topic :- Fundamentals of Partnership Firm, , CLASS 12TH., , Aditya Saxena 8178650210

Page 4 :

A+ Accountancy, DIFFERENCE BETWEEN, PARTNERSHIP AND LIMITED LIABILITY PARTNERSHIP ., , Basis, Meaning, , Partnership, Partnership, refers, to, an, arrangement wherein two or more, person agree to carry on a business, and share profits & losses, mutually., , Limited Liability Partnership, Limited Liability Partnership is a form, of business operation which combines, the features of a partnership and a body, corporate, , Governed By, , Indian Partnership Act, 1932, , Limited Liability Partnership Act, 2008, , Registration, Charter, document, Liability, Contractual, capacity, Legal Status, Maximum, partners, Audit of, accounts, Perpetual, Succession, , Optional, Partnership Deed, , Mandatory, LLP Agreement, , Unlimited, It cannot enter into contract in its, name., Partners are collectively known as, firm, so there is no separate legal, entity., 100 partners, Not mandatory, No, , Limited to capital contribution, except, in case of fraud., It can sue and be sued in its name., It has a separate legal status., No Limit, Mandatory, only if turnover and capital, contribution overreaches 40 lakhs and, 25 lakhs respectively., Yes, , Powers of Partners., • Buying and Selling of the Goods., • Borrow and Receiving payments on behalf of the firm and getting valid receipts., • Endorsing Bills of Exchange and Promissory notes in the name of the firm., Topic :- Fundamentals of Partnership Firm, , CLASS 12TH., , Aditya Saxena 8178650210

Page 5 :

A+ Accountancy, Treatment of Remuneration, Interest on capital, Loan, Drawings Profit Sharing Ratio., Governing Statute ;- The Law governing Partnership in India is Indian Partnership Act,1932, When Partnership Deed is Silent:- If any situation and circumstance is not covered by, Partnership Deed, The Provision of the Indian Partnership Act, 1932 will apply., If Partnership Deed is Silent, , Provision of the Indian Partnership Act 1932, , Partners Remuneration, , No Remuneration will be allowed, , Interest on Partner’s Capital, , No Interest on Capital will be allowed, , Interest on Partner’s Drawing, , No Interest on Drawing will be charged, , Interest on Loan given by Partner to the, Firm, , Maximum 6% p.a. can be allowed on loan, , Profit sharing Ratio, , Profit and Losses will be shared equally., , Important Provisions of the Indian Partnership Act,1932, (i) If all The partners agree, a minor may be admitted for the benefits of partnership Section 30., (ii) A person may be admitted as a partner either with the consent of all the existing partners or, in accordance with an express agreement among the partners (Section 31), (iii) A Partner may retire from the firm either with the consent of all the other partner or in, accordance with an express agreement among the partners ( Section 32 ), (iv) Registration of the firm is optional and not compulsory (Section 69 )., (v) Unless otherwise agreed by the partners in the Partnership Deed, a firm is dissolved on the, Death of a Partner. (Section 35 ), , Topic :- Fundamentals of Partnership Firm, , CLASS 12TH., , Aditya Saxena 8178650210

Page 6 :

A+ Accountancy, Q1- A,B and C are partners in a firm they do not have a Partnership Deed., (i) A, Who has contribute more capital that other partners, demands interest on capital at, 10%p.a. But B and C do not agree with him., (ii) B has Devoted full time to the run the business and demands a salary Rs.5,000p.m A and C, do not agree with him., (iii) C demands Interest on the loan of Rs 50,000 advanced by him at the market rate of Interest, which is 12%p.a., (iv) A has drawn Rs.10,000 from the Firm for personal use. B and C demand that interest, should be charged at 10%p.a., (v) Net profit before taking into account any of the above claims amounted Rs.50,000 at the End, of the year of the business. A demands share of profit in the capital ratio. How will the, disputes be settled ?, Q2- Following differences have arisen among P,Q,R. State who is correct in each case., (i) P used Rs.20,000 belonging to the firm and made a profit of Rs.5,000. Q and R want the, amount to be given to the firm., (ii) Q used Rs.5,000 belonging to the firm suffered loss of Rs.1,000. He wants the firm to bear, the loss?, (iii) P and Q want to purchase goods from Aditya Ltd., R does not agree ?, (iv) Q and R want to admit C as a Partner, P does not agree ?, Q3- Jaspal and Rosy were Partners with Capital Contribution of Rs 10,00,000 and Rs 5,00,000, respectively. They do not have a Partnership deed. Jaspal wants that profit of the firm should, be shared in capital ratio. Rosy convinced Jaspal that profits of the firm should be Shared, Equally. Explain How rosy would have convinced jaspal for share equally., , Topic :- Fundamentals of Partnership Firm, , CLASS 12TH., , Aditya Saxena 8178650210

Page 7 :

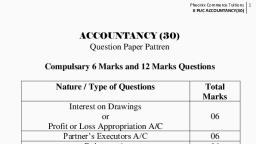

A+ Accountancy, Profit and Loss Appropriation Account., 1-Meaning of Profit and Loss Appropriation Account-, , Profit and Loss Appropriation Account is a nominal account prepared for the purpose of, distributing profits/losses among the partners after making all the adjustments relating to, Interest on Capitals, Interest on Drawings, Salary/commission to partners and transfer to, Reserve. Profit and Loss Account of the firm will show profit earned and loss suffered by the, firm to distribute the above Profit properly to the partners, The Profit and Loss Appropriation, Account is used., 2. Features of Profit and Loss Appropriation Account., (a) It is Extension of Profit and Loss Account., (b) It is applicable only for Partnership Firm, and not Sole Proprietary concerns., (c) It provides details of how Net Profit for the period has been Distributed to the Partners, (d) The entries in Profit and Loss Appropriation Accounts are governed by Partnership Deed., (Note- Interest on Partners Loan, Rent for use of Partners Premises, If any, etc are debited to, Profit and Loss Appropriation Account itself. Is only transferred to Profit and Loss, Appropriation Account.), Dr., , Profit and Loss Appropriation Account, , Particular, To Interest on Capital, , Amount, XXX, , To Partners Salary, , XXX, , To Partners Remuneration, , XXX, , To Reserve ( Amount T/f), To Profits transferred in PSR, A, ______, B, ______, , XXX, , TOTAL, , XXX, , Topic :- Fundamentals of Partnership Firm, , Cr., , Particular, By Profit and Loss( Profit), , Amount, XXX, , By Interest on Drawings, , XXX, , TOTAL, , XXX, , XXX, , CLASS 12TH., , Aditya Saxena 8178650210

Page 8 :

A+ Accountancy, Partners Capital Accounts, A partnership capital account is a distinct account that shows the equity in a partnership that, is owned by specific partners. This account typically exists as an item that is shown in a, business's financial and accounting records rather than as an actual bank account, although this, depends on business practices, It is at the rate agreed in the Partnership Deed, Methods of Accounting, Partners Capital Account may be Accounted under any of the following methods., (i) Fluctuating Capital Method., (ii) Fixed Capital Method., Aspects, , Fluctuating Capital Method, , Fixed Capital Method, , Definition, , Fluctuating capital account is that, form of capital account where the, capital of the partners keep on, fluctuating, , Fixed capital account is that form of, capital account where the business, maintains two different accounts, which are related to the different kinds, of transactions that take place in the, capital of the partners, , Number of, Accounts, , Only one account that is capital, account, , Fixed capital account has two, accounts which are capital account, and current account, , Partnership, Deed, , No need to be mentioned in, partnership deed, , Needs to be mentioned specifically in, partnership deed, , Capital, Account, status, , This type of capital account fluctuates This type of capital account remains, constant, , Topic :- Fundamentals of Partnership Firm, , CLASS 12TH., , Aditya Saxena 8178650210

Page 9 :

A+ Accountancy, Format of Partners Capital Account., Dr, , PARTNERS CAPITAL A/C, , Particular, To Cash/Bank, (withdrew of Capital), To Balance C/d, , A, Xxx, , B, Xxx, , xxx, xxx, , Dr., , Cr, , Particular, A, By Balance b/d, Xxx, By Cash/Bank/Assets xxx, (Capital Contribution), , B, Xxx, xxx, , xxx, , xxx, , xxx, xxx, Partners Current A/C, , Particular, To Balance b/d, To Drawings, To Profit and Loss, - Share of loss, To Profit and Loss, Appropriation A/C, (Interest on Drawing), To Balance C/d, , A, Xxx, Xxx, Xxx, , B, Xxx, Xxx, Xxx, , Xxx, , Xxx, , Xxx, Xxx, , Xxx, Xxx, , Particular, By Balance b/d, By Profit and loss, Appropriation A/C, - Remuneration, - Interest on, Capital, - Share of Profit, , Cr., A, Xxx, Xxx, , B, Xxx, Xxx, , Xxx, , Xxx, , (Note- If Capital Account are maintained on fluctuating basis, all the above entries will be made, in one single Capital Account only. There will be not be any Current Accont), , Interest on Partner’s Capital, Type, 1- Opening, Capital, 2- Additional, Capital, , Computation of Interest on Capital (IOC), IOC = Opening Capital x Rate of Interest (%), IOC = Additional Capital x Rate of Interest x Period of use, , Q4- Ramesh and Naresh are partners in a Firm. Their Capital as on 1st April of a Financial, year were Rs.3,00,000 and Rs. 1,20,000 respectively. They share of profit equally. On 1 st July,, They decided that their Capital should be Rs.2,00,000 each. The necessary adjustment in the, capital was made by introducing or withdrawing cash. Interest on Capital is allowed @ 8% p.a., Compute interest on Capital at Both Partners for the year end., Topic :- Fundamentals of Partnership Firm, , CLASS 12TH., , Aditya Saxena 8178650210

Page 10 :

A+ Accountancy, Interest on Capital in case of Insufficient Profit and Loss, Subject to contract between the partners, interest on capital is to be provided out of profits, only. In case of insufficient profits (i.e. net profit less than the amount of interest on capital),, the amount of profit is distributed:In profit sharing ratio., Interest on Capital, Deed is Silent, , Deed Provides for IOC, , Deed Provides for IOC and, Specifically states charge, Charge against profit, , No Deed, , Deed Provide for IOC, , No IOC, In case of Loss, , In case of Profit, , NO IOC, , Full IOC even if there, Is loss, , Sufficient Profit, , Insufficient Profit, , Full IOC, , Profit Distributed in, Capital Ratio, , Interest on Partner’s Drawings., Partnership and partners are considered separate from each other. Since, drawings is a type of, loan provided to the partner, the partner has to pay interest on the amount withdrawn from, the firm , which is known as interest on drawings. Interest on Drawings is the gain for the, business. It is recorded on Credit side of Profit and Loss appropriation, , Topic :- Fundamentals of Partnership Firm, , CLASS 12TH., , Aditya Saxena 8178650210

Page 11 :

A+ Accountancy, Account. Partners Drawings A/c. and Interest on Drawings is closed by transferring to debit, side of Capital or Current A/c, , Interest on Drawings, , Amount withdrew From Capital, , Amount withdrew From Profit, , ( Permanent Nature ), , (Non - Permanent Nature), , No Interest on Drawing will be, , Interest on Drawing will be, , Charged, , Charged, , (Note- If nothing is Specified About the nature of Drawings always assume that, Drawings out of Capital), , Interest on Drawings, , Date of Drawings not Given, , p.a., , Date of Drawings Given, , p.a., , Amount of Each, , Amount of Each, , Drawing and Time, , Drawing and Time, , Interval Is Same, , Interval Is not Same, , IOD= Drawings x Rate x 6/12, IOD= Drawings x Rate, Direct, Method, Topic :- Fundamentals of Partnership Firm, , Product, , Short Cut, , Direct, , Product, , Method, , Method, , Method, , Method, , CLASS 12TH., , Aditya Saxena 8178650210

Page 12 :

A+ Accountancy, Short cut Method:➔ Interest on Drawing = Total Drawing x Rate (%) x Average time period., , ➔ Average Period =, , Time between First Drawing +, and End of the year, , Time Between Last Drawing, and End of the year, , 2, , Q5-Compute Interest on Partners Drawings in the following situation, If Interest on Drawing, rate is 10%p.a., Case 1- Rs. 10,000 withdrawn per month, throughout the year at (a) beginning of each month, (b) middle of each month (c) end of each month., Case 2- Rs. 24,000 withdrawn per quarter, throughout, at –(a) beginning of each quarter (b), middle of each quarter (c) end of each quarter., Case 3- Drawing during the entire year Rs. 2,50,000 (details of withdraw not available), Case 4- Drawing during the entire year Rs. 2,50,000 (details of withdraw not available),and, interest is to be calculated without reference of time factor ( i.e. Interest on drawings at, 10% and not 10%p.a.), Q6- Compute Interest on Partners Drawings in the following situation, If Interest on Drawing rate, is 6%p.a.( Financial year of the firm end 31ST December)., Date of Withdraw, , Feb 1, , May 1, , June 30, , Oct 31, , Amount withdraw, , 20,000, , 50,000, , 40,000, , 60,000, , Topic :- Fundamentals of Partnership Firm, , CLASS 12TH., , Aditya Saxena 8178650210

Page 13 :

A+ Accountancy, PAST ADJUSTMENTS, , Sometimes few errors and omissions in recording of transaction or the preparation of financial, statements are found after the final accounts have been prepared and profits distributed among, partners., Journal entry for adjustment is;, Gaining partners capital/ current A/c, , ___Dr., , To Secrificing Partners capital/ current A/c, , Q7- Yash and Simran were partners in the firm sharing profit equally. Their Fixed Capitals were, ` 1,00,000 and `.50,000 respectively. The partnership Deed Provided for Interest on, Capital at 10%p.a. For the year ended 31st March 2016, the profits of the firm were, distributed without providing Interest on Capital. Pass necessary adjustment entry to, rectify the error., Q8- Vinit and Sourav are partners in a Firm sharing profit and losses in the ratio of 3:2, following the Balance sheet of the firm as at 31 st March 2018., Liabilities, , Amount, , Capital A/c, Vinit, , 60,000, , Sourav, , 20,000, , Assets, , Amount, , Sundry Assets, , 80,000, , 80,000, 80,000, , 80,000, , Profit ` 30,000 for the year ended 31st March 2018. was divided between the partners, without allowing Interest on Capital @ 12%p.a. and Salary to Vinit Rs.1,000per month., During the year Vinit and Sourav withdrew Rs. 10,000 and `.20,000 ., Q9- On 31st March 2014, balances in capital account of Eleen, Monu and Ahmad after making, adjustments for profit and Drawings were ` 1,60,000, `.1,20,000 and ` 80,000 respectively., Topic :- Fundamentals of Partnership Firm, , CLASS 12TH., , Aditya Saxena 8178650210

Page 14 :

A+ Accountancy, Subsequently, it was discovered that the interest on Capital and Drawings had been, omitted., (i) The Profit for the year ended 31st March 2014 was `. 40,000, (ii) During the year Eleen and Monu each withdrew a total sum if ` 24,000 in equal installment, in the beginning of each month and Ahmad withdrew a total sum, , `48,000 in equal, , installment at the end of the each month., (iii) The Interest on Drawing was to be Charged @ 5%p.a. and Interest on Capital was to be, allowed @ 10%p.a., (iv) The Profit sharing ratio among the partners 2:1:1., When Adjustment Journal Entries ( in place of a Single Adjustments Entry ) are, passed:, , In place of a single journal Adjustment entry, Journal entries may be required to be passed for, each adjustment separately. In this situation, analytical table to determine the net effect of all, the adjustments is not prepared instead Journal entries passed for each error or omission by, debiting or crediting Profit and Loss Adjustment A/c. After passing the entries the adjustment, of errors and omission, Profit and Loss Adjustment Account is closed by debiting or crediting, with corresponding credit or Debit to the Partners Current A/c, if fixed capital method is, followed or Partners Capital A/c if Fluctuating Capital Method is Followed, Journal Entries, , Items which are to be Credited to the partners, capital or Current A/c, , Profit and Loss adjustment A/C __Dr, To Partners Capital/Current A/c., , Items which are to be Debit to the partners, capital or Current A/c, , Partners Capital/Current A/c., ___Dr, To Profit and Loss adjustment A/C, , Net profit/loss due to above adjustments, Topic :- Fundamentals of Partnership Firm, , Profit., CLASS 12TH., , Aditya Saxena 8178650210

Page 15 :

A+ Accountancy, Profit and Loss adjustment A/C __Dr, To Partners Capital/Current A/c., Loss., Partners Capital/Current A/c., ___Dr, To Profit and Loss adjustment A/C, Q10- P,Q and R partners in a firm, Their Capital Account Rs.3,00,000, Rs1,50,000 and Rs., 1,50,000 respectively on 1st April 2017. As per the Provisions of the Deed, (i) R was to be allowed a remuneration of Rs.36,000p.a., (ii) Interest on Capital 5%, (iii) Profit were to be distributed in the Ratio 2;2;1. Ignoring the above terms, Net profit, for the year is Rs. 1,80,000 was distributed among three partners equally. Pass the, Journal Entries to rectify the above errors., , GUARANTEE OF PROFITS, Guarantee means the surety of a particular amount of profits by one or more partners and in some, cases by the firm, where the burden of guarantee is borne by the party providing such a, guarantee. In other words, it is a minimum fixed amount for the partner who is given such a, guarantee. If the actual share in profits is less than the guaranteed amount then the deficit amount, shall be borne either by the firm or by any partner as the case may be. There are many, ‘Adjustments’ which a firm will do in such a case. If the actual share in profits is more than the, minimum guarantee amount then the firm will provide the actual profits to the partner., 1. Guarantee by the Firm or by All the Partners of the Firm In this case, firstly the firm enters the guaranteed amount to the partner in the Profit an Loss, Appropriation Account. Then, it distributes the remaining profit among the remaining partners in their, remaining ratio., Journal Entries, (I) Distributing the Profit if there is No Guarantee, Agreement:, Topic :- Fundamentals of Partnership Firm, , Profit and Loss Appropriation A/c, To All Partners Capital A/c, , CLASS 12TH., , --- Dr, , Aditya Saxena 8178650210

Page 16 :

A+ Accountancy, (II) Charging Deficiency to Guaranteeing, Partners, , Guaranteeing Partners Capital A/c ---Dr, To Guaranteed Partner Capital A/c., , Q11- A,B,C are the partners in a firm sharing profit and loss in the ratio of 4:2:1. It is provided that, C’s Share in Profit would not less than `.37,500. The Profit for the year ended 31st March 2018, is ` 1,57,500. Pass the journal entries in the books of firm and prepare Profit and Loss, Appropriation Account., 2. Guarantee of Profit by one or more of the Existing Partners, , When one or more of the Existing Partners guarantee a minimum profit, The Adjustment is made, through the partners Capital Account. The Following Steps are be followed:, Step 1→ Distribute the Profit among the Partners as per Their Profit Sharing Ratio., Step 2 → If share of Profit of the Guaranteed partner is less than the minimum guaranteed profit, the difference is deducted from the share of profit of the partner who has guaranteed, and added to the share of Profit of the Guaranteed Partner., Q12- Anwar, Biswas and Divya are partners In a Firm. Their Capitals are `. 8,00,000 and, `.6,00,000 and `.4,00,000 respectively. On 1st April 2013, they shared profit and losses in the, ratio of 3:2:1 respectively. Partners are entitled to Interest on Capital @ 6%p.a. and Salary, to Biswas and Divya @ ` 4,000 per month and `. 6,000 per quarter respectively as per the, provision of Partnership Deed. Bishwas’s Share of Profit Including Interest on Capital, excluding Salary is guaranteed at a minimum of `.82,000 p.a. Any deficiency arising on that, account shall be met by Divya. Profit for the Year ended 31st March 2014 is `.3,12,000, Prepare Profit and Loss Appropriation Account. For the year ended 31st March 2014., , Topic :- Fundamentals of Partnership Firm, , CLASS 12TH., , Aditya Saxena 8178650210

Page 17 :

A+ Accountancy, , Practice Questions, Q1- In the absence of Partnership Deed, what are the rules relation to :, (a) Salaries of partners, (b) Interest on partners’ capitals, (c) Interest on partners’ loan, (d) Division of profit, and (e) Interest on partners’ drawings, , Q2- You are required to settle the dispute between Harshad and Dhiman. Also prepare Profit, and Loss Appropriation Account., Harshad and Dhiman are in partnership since 1st April, 2018. No partnership agreement, was made. They contributed ₹ 4,00,000 and ₹ 1,00,000 respectively as capital. In addition,, Harshad advanced an amount of ₹ 1,00,000 to the firm on 1st October, 2018. Due to long, illness, Harshad could not participate in business activities from 1st August, 2018 to 30th, September, 2018. Profit for the year ended 31st March, 2019 was ₹ 1,80,000. Dispute has, arisen between Harshad and Dhiman., Harshad Claims :, (i) He should be given interest @ 10% per annum on capital and loan;, (ii) Profit should be distributed in the ratio of capital;, Dhiman Claims :, (i) Profit should be distributed equally;, (ii) He should be allowed ₹ 2,000 p.m. as remuneration for the period he managed the, business in the absence of Harshad;, (iii) Interest on Capital and loan should be allowed @ 6% p.a., Q3- A and B are partners in a firm sharing profits in the ratio of 3 : 2. They had advanced to, the firm a sum of ₹ 30,000 as a loan in their profit-sharing ratio on 1st October, 2017. The, Partnership Deed is silent on interest on loans from partners. Compute interest payable by, the firm to the partners, assuming the firm closes its books every year on 31st March., Q4- The firm XYZ earned a profit of Rs. 2,75,000 during the year ending on 31st March, 2009., 10% of this profit was to be transferred to general reserve. Pass necessary journal entry, for the same., , Topic :- Fundamentals of Partnership Firm, , CLASS 12TH., , Aditya Saxena 8178650210

Page 18 :

A+ Accountancy, Q5- Singh and Gupta decided to start a partnership firm to manufacture low cost jute bags as, plastic bags were creating many environmental problems. They contributed capitals of Rs., 1,00,000 and Rs. 50,000 on 1st April, 2012 for this. Singh expressed his willingness to, admit Shakti as a partner without capital, who is specially abled but a very creative and, intelligent friend of his. Gupta agreed to this. The terms of partnership were as follows, 1-Singh, Gupta and Shakti will share profits in the ratio of 2 : 2 : 1., 2- Interest on capital will be provided @ 6% per annum, .Due to shortage of capital, Singh contributed Rs. 25,000 on 30th September, 2012 and, Gupta contributed Rs. 10,000 on 1st January, 2013 as additional capital. The profit of the, firm for the year ended 31st March, 2013 was Rs. 1,68,900. Prepare profit and loss, appropriation account for the year ending 31st March, 2013., Q6- Lalan and Balan were partners in a firm sharing profits in the ratio of 3 : 2. Their fixed, capitals on 1st April, 2010 were Lalan Rs. 1,00,000 and Balan Rs. 2,00,000. They agreed, to allow interest on capital @ 12% per annum and charge on drawings @ 15% per, annum. The firm earned a profit, before all above adjustments, of Rs. 30,000 for the year, ended 31st March, 2011. The drawings of Lalan and Balan during the year were Rs. 3,000, and Rs. 5,000 respectively. Showing your calculation clearly, prepare profit and loss, appropriation account of Lalan and Balan. The interest on capital will be allowed even if, the firm incurs loss., Q7- Ram and Rahim started business with Capital of Rs.50,000 and Rs.30,000 on 1 st January, 2021. Rahim is entitled to a salary of Rs.400 per month. Interest is allowed on Capitals, and is charged on drawings @ 6%p.a. profits are to be distributed equally after above, noted adjustments. During the year Ram withdrew Rs.8,000 and Rahim withdrew, Rs.10,000. The Profit for the year before allowing for the terms of the Partnership Deed, came to Rs.30,000 Prepare Capital and Current A/c’s of the partners., Q8- Good, Better, and Best are in Partnership Sharing Profit and Losses in the Ratio 3:2:4, Their capital Account balances as on 31st March 2021 are as follows:, Good, 1,70,000, (Cr.), Better, 1,10,000, (Cr.), Best, 1,22,000, (Cr.), Topic :- Fundamentals of Partnership Firm, , CLASS 12TH., , Aditya Saxena 8178650210

Page 19 :

A+ Accountancy, Following Information Provided:-, , 1, 2, 3, 4, 5, , 6, 7, , Rs.22,240 is to transferred to General Reserve., Good, Better, and Best are paid monthly salary in cash i.e. Rs 2,400, Rs.1,600 and, Rs.1,800, Interest on Capital @ 6% and Interest on Drawings @ 8%., Good and Best entitled to commission @ 8% and 10% respectively of the net profit, before making any appropriation., During the year Good withdrew Rs.2,000 at the beginning of every month. and, Better Rs.1,750 at the end of every month and Best withdrew Rs.1,250 at the middle, of every month., Firm’s Accountant Salary is Rs.2,000 per month. and commission of 12% of net, profit after charging such commission., Better is entitled to Commission @ 15% of the net profit before charging Interest on, Drawing but after making all other appropriations, Prepare Profit and Loss Appropriation Account., , Q9- Radha, Mary and Fatima are partners sharing profits in the ratio of 5:4:1. Fatima is given, a guarantee that her share of profit, in any year will not be less than ₹ 5,000. The profits, for the year ending March 31, 2017 amounted to ₹ 35,000. Shortfall if any, in the profits, guaranteed to Fatima is to be borne by Radha and Mary in the ratio of 3:2. Record, necessary journal entry to show distributioin of profit among the partner., , Q10- Mohan, Neeraj and Peeyush are partners in a firm. They contributed Rs. 75,000 each as, capital three years ago. At that time, Peeyush agreed to look after the business as Mohan, and Neeraj were busy. The profits for the past three years were Rs. 45,000, Rs. 30,000 and, Rs. 60,000 respectively. While going through the books of accounts, Mohan noticed that, profit had been distributed in 1 : 1 : 2 ratio. When he enquired from Peeyush about this,, Peeyush answered that since he looked after the business he should get more profit. Mohan, disagreed and it was decided to distributed profits equally with respectively effect for the, last three years.(i) You are required to make necessary corrections in the books of, accounts of Mohan, Neeraj and Peeyush by passing an adjustment entry., , Topic :- Fundamentals of Partnership Firm, , CLASS 12TH., , Aditya Saxena 8178650210