Page 1 :

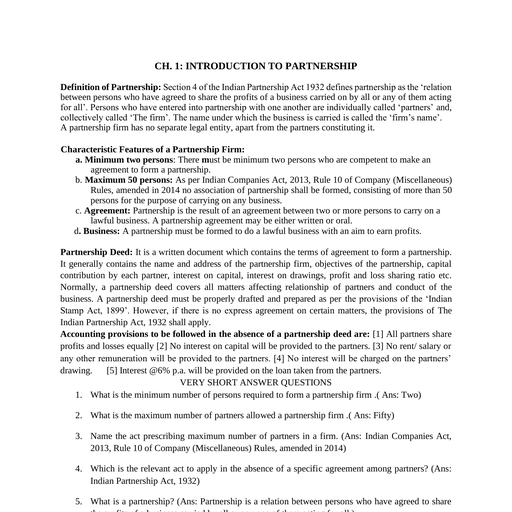

ACCOUNTANCY, CLASS 12, Model First Term Examination Year 2021-2022, Time Allowed: 1 hour and 30 minutes, General Instructions:, All questions are compulsory., Select the most appropriate answer., All questions carry one mark each., A simple calculator may be used., , Maximum Marks: 40, , 1. How does a Fixed capital account differ from a fluctuating capital account?, a) Fixed capital account neither show positive or negative accounts, b) Fixed capital account can never show a negative balance, c) Fixed capital account can show only negative account, d) Fixed capital account can show both, 2. Why sometimes partners transfer some amount of profit to reserve?, a) To pay less amount to the partners, b) To pay the interest on loan, c) To keep a fund for dissolution, d) To strengthen the financial position, 3. Vidit and Seema were partners in a firm sharing profits and losses in the ratio of 3 : 2., Their capitals were ₹1,20,000 and ₹2,40,000, respectively. They were entitled to interest on, capitals @ 10% p.a. The firm earned a profit of ₹18,000 during the year. The interest paid on, Vidit’s capital will be:, a) ₹6,000, b) ₹10,800, c) ₹7,200, d) ₹12,000, 4. Calculate interest on the drawing if Partner withdrew Rs. 6,000 at the end of each, quarter. Rate of interest on drawings is 10% p.a. and the accounting period is 1st January to, 31st December., a) Rs.900, b) Rs. 1,800, c) Rs. 975, d) Rs. 950, 5. What is the nature of rent paid to a partner?, a) Nominal Account, b) Representative Person’s Personal Account, c) Artificial Personal Account, d) Real Account, 6. Profit and Loss Appropriation Account is prepared ________.

Page 2 :

a) After calculating Net Profit, b) After calculating Gross Profit, c) Before calculating Net Profit, d) Before calculating Gross Profit, 7. Ram and Rohit started business on 1st April 2020 with capitals of Rs. 2,50,000 and, Rs.1,50,000 respectively. On the 1st of October 2020, they decided that their capitals should, be Rs.2,00,000 each. The necessary adjustments in the capitals were made by introducing or, withdrawing cash. Interest on capital is allowed at 8% p.a. Calculate the interest on Rohit’s, Capital on March 31, 2021., a) ₹12,000, b) ₹14,050, c) ₹12,050, d) ₹14,000, 8. When partners accounts are fixed where the drawings will be recorded?, a) Neither in Current account nor in Capital account, c) Both Current account and Capital account, b) Capital account, d) Current account, , 9. Which of the following statement is correct?, a) Goodwill is a current asset, b) Goodwill is an intangible asset, c) Goodwill is a wasting asset, d) Goodwill is a fictitious asset, 10. Goodwill can be sold only when:, a) Entire business is sold, b) At the time of Merger, c) New partner is admitted, d) Business earning profits, , 11. A and B are partners in a firm sharing profits in the ratio of 5 : 3. They admit C as a new, partner for 1/7th share. New Ratio will be 4 : 2 : 1. Sacrificing ratio will be:, a) 3 : 5, b) 4 : 2, c) 3 : 2, d) 5 : 3, 12. Premium brought by the new partner will be shared by the existing partners in…, a) Sacrificing Ratio, b) Old Ratio, c) New Ratio

Page 3 :

d) Gain Ratio, 13. X and Y are partners sharing profits in the ratio of 3 : 2. Mr. Z is admitted for the 1/4th, share in profits which he acquires equally from X and Y. The new ratio will be:, a) 3 : 3 : 2, b) 19 : 11 : 10, c) 9 : 6 : 5, d) None of these, 14. A and B are partners in a firm sharing profits and losses in the ratio of 3:2 A new partner, C is admitted. A surrender 1/5th of his share and B 2/5th of his share in favour of C. For, purpose of C’s admission, goodwill of the firm is valued at Rs.75,000 and C brings his share, of goodwill in cash which is retained in the firm’s books. Journal entry when premium, brought by C is ….., a) No Journal Entry in this case, b), Bank A/c, , Dr., , 2,100, , To Goodwill, A/c, , 2,100, , c), Bank, A/c, , Dr., , 75,000, , To, Cash, A/c, , 75,000, , d), Bank, A/c, To, Goodwill, A/c, , Dr., , 21,000, 21,000, , 15. L and M are partners in a firm sharing profits in the ratio 7:3 and N is admitted as a new

Page 4 :

partner For 3/7th share which he acquires 2/7 from L and 1/7 from M. N brings in ₹40,000 as, capital and ₹15,000 as his share of goodwill. How much amount will be credited to L:, a) ₹20,000, b) ₹25,000, c) ₹15,000, d) ₹10,000, 16. New profit and loss sharing ratio means ……, a) Two partners (including new) share future profit and losses, b) All partners (including new) share future profit and losses in this new ratio, c) All partners (excluding old) share future profit and losses, d) Partners will share future profits equally, , 17. General Reserve at the time of admission of a partner is transferred to:, a) Cash Account, b) Revaluation Account, c) Old Partners' Capital Accounts, d) Capital Accounts of all partners, including new partner, 18. Kamal and Rahul are the partners in a firm sharing profits and losses in the ratio of 7:3., They admit Kaushal as a partner for 1/5th share. Kaushal acquires his share from Kamal and, Rahul in the ratio of 3:2. The goodwill of the firm has been valued at Rs.25000. Kaushal paid, Rs.10000 privately to Kamal and Rahul as his share of goodwill. What should be the journal, entry?, a) No entry will be passed, b) Rahul A/c ... Dr., Kamal A/c ... Dr., To Kaushal A/c, c) Kamal A/c ... Dr., Cash A/c ... Dr., To Goodwill A/c, d) Rahul A/c ... Dr., Loan A/c ... Dr., To Cash A/c, , 19. According to section 31(1) of ________ new partner can be admitted only with the, consent of all, existing partners, a) Cooperative Societies Act, 1912, b) Partnership Act, 1932, c) Companies Act 1956, d) Hindu Joint Family Act, 1956, 20. Which of the following is not an example of Reconstitution of a partnership firm?, a) Change in Existing profit and loss sharing ratio

Page 5 :

b) Purchase of Assets for the business, c) Admission of a new partner, d) Retirement/Death of a partner, 21. Paul, Peter and James were partners sharing profits and losses in the ratio of 4 : 3 : 1., Peter retires and gives his share of profit to Paul for ₹3,600 and to James for ₹3,000. The, gaining ratio of Paul and James will be:, a) 4 : 1, b) 2 : 1, c) 4 : 5, d) 6 : 5, 22. Srishti, Nitya and Anand were partners in a firm sharing profits and losses in the ratio of, 3 : 2 :1. Srishti retired from the firm selling her share of profits to Nitya and Anand in the, ratio of 2 : 1. The new profit sharing ratio between Nitya and Anand will be:, a) 2 : 1, b) 17 : 11, c) 3 : 2, d) 19 : 11, 23. Debts which were earlier write off as bad debts, now recovered will be recorded in:, a) Cr. Side of partner’s capital A/c, b) Dr. Side of revaluation account, c) Cr. Side of revaluation account, d) Dr. Side of partner’s capital A/c, 24. Increase in the value of assets at the time of retirement of a partner is:, a) Credited to profit and loss account, b) Credited to Revaluation Account, c) Debited to Revaluation Account, d) Debited to Profit and Loss Account, 25. A partner which was retired is not liable for any debts incurred by the firm ________ his, retirement., a) During, b) Before, c) After, d) All after, during and before, 26. Remaining partners after a partner retires contribute to retiring partner in…………., a) New ratio of continuing partners, b) Both Sacrificing ratio and New ratio of continuing partners, c) Sacrificing ratio, d) Gaining Ratio

Page 6 :

27. X, Y and Z are partners sharing profits and losses in the ratio of 8: 7: 5. Partner Z retires, and his share was taken equally by X and Y. Find the new profit and loss sharing ratio of, remaining partners., a) 21 : 19, b) 8 : 7, c) 7 : 5, d) 19 : 21, 28. Which account is prepared to transfer amount due to a deceased partner shown by his, Capital, Account?, a) Continuing Partners Account, b) Partner's Executor’s Account, c) Retired Partners Account, d) Retired partners loan Account, 29. Decrease in liability at the time of retirement of a partner is:, a) Debited to Profit and Loss Account, b) Credited to Profit and Loss Account, c) Credited to Revaluation Account, d) Debited to Revaluation Account, 30. R, S and T are partners sharing profit in the ratio of 7:5:4. T died on 30th June 2020., Profit for the year was ₹24000 for the year 2020-2021. How many shares in profits for the, death period will be transferred to T’s account?, a) Debited Rs. 1500, b) Debited Rs.6000, c) Credited Rs.1500, d) Credited Rs.6000, 31. According to Indian Partnership Act 1932 Dissolution of firm means:, a) Dissolution of Partnership between all the partners, c) Dissolution of partnership between the main partners, b) End of the personal relationship among the partners, d) Change in the ratio of partners, 32. Goodwill given in the Balance Sheet, will be shown in the ________ at the time of, Dissolution of partnership firm., a) Will not be shown in any account, b) Debit side of Realisation A/c, c) Credit side of Partners capital A/c, d) Debit side of Partners capital A/c, 33. At the time of dissolution of the firm, the assets and liabilities appearing in the Balance, Sheet are transferred to:, a) Bank Accounts, b) Partners' Capital Accounts

Page 7 :

c) Realisation Account, d) Revaluation Account, 34. Rohan, Mohan and Sohan were partners sharing profits equally. At the time of, dissolution of the partnership firm, Rohan’s loan to the firm will be:, a) Credited to Rohan's Capital Account, b) Debited to Realisation Account, c) Credited to Realisation Account, d) Credited to Bank Account, 35. On dissolution of a firm, when the realised value of stock is not given, it should be taken, at ________., a) Book Value, b) Market Value, c) Book Value or Market Value whichever is lower, d) Zero Value, 36. At the time of dissolution, there was an unrecorded asset i.e. Laptop, the market price of, which was ₹24,000. This laptop was taken by a partner (Mohan) at 50% of the market price., Give journal entry for the same., a), Mohan's Capital A/c Dr., To Realisation A/c, , 12,000, 12,000, , b), Bank A/c Dr., To Office equipment, A/c, , 12,000, 12,000, , c), Mohan's Capital A/c Dr., To Bank A/c, , 12,000, 12,000, , d), Realisation A/c, Dr., To Mohan's Capital A/c, , 12,000, 12,000, , 37) On dissolution of a firm, all ________ liabilities are transferred to the ________ side of, Realisation account., a) Internal, Debit, b) External, Credit, c) Capitals of the partner, Credit

Page 8 :

d) Internal, Credit, 38) Expenses on dissolution paid by a partner must be debited to……, a) Revaluation account, b) Realisation account, c) Partner’s Capital account, d) Bank account, 39) What should be the journal entry when partner Mr.A takes over loan payable to Mrs. A, ₹20,000 together with interest of Rs.400, a) Realisation A/c, , Dr., , 20,400, , To A's Capital A/c, b) Bank A/c, , 20,400, Dr., , 20,400, , To A's Capital A/c, c) Realisation A/c, , 20,400, Dr., , 20,400, , To Bank A/c, d) Loan A/c, , 20,400, Dr., , 20,400, , To A's Capital A/c, , 20,400, , 40) Creditor’s paid Rs.42000 in full settlement of Rs 45000. The Journal entry should be:, a) Realisation A/c, , Dr., , 3,000, , To Bank A/c, b) Realisation A/c, , 3,000, Dr., , 42,000, , To Bank A/c, c) Realisation A/c, , 42,000, Dr., , 45,000, , To Bank A/c, d) Realisation A/c, To Bank A/c, , 45,000, Dr., , 48,000, 48,000

Page 9 :

Answer Key, 1) b) Fixed capital account can never show a negative balance (K), 2) d)To strengthen the financial position (K), 3) a) 6,000 (U), 4) a) Rs.900 (U), 5) a) Nominal Account (K), 6) a) After calculating Net Profit (U), 7) d) ₹14,000 (U), 8) d) Current account, 9) b) Goodwill is an intangible asset (K), 10) a) Entire business is sold (U), 11) a) 3 : 5 (U), 12) a) Sacrificing Ratio (K), 13) b) 19 : 11 : 10 (U), 14) d) Bank Dr 21,000, To, Goodwill 21,000 (A), 15) d) ₹10,000 (A), 16) b) All partners r(including new) share future profit and losses in this new ratio (K), 17) c) Old Partners' Capital Accounts (U), 18) a) No entry will be passed (U), 19) b) Partnership Act, 1932 (K), 20) b) Purchase of Assets for the business (U), 21) d) 6 : 5 (U), 22) a) 2 : 1 (A), 23) c) Cr. Side of revaluation account (U), 24) b) Credited to Revaluation Account (U), 25) c) After (U), 26) d) Gaining Ratio (K), 27) a) 21 : 19 (A), 28) b) Partner's Executor’s Account (K), 29) c) Credited to Revaluation Account (U), 30) c) Credited Rs.1500 (A), 31) a) Dissolution of Partnership between all the partners (K), 32) b) Debit side of Realisation A/c (K), 33) c) Realisation Account (K), 34) d) Credited to Bank Account (U), 35) c) Nil or zero (K), 36) a) Mohan’s Capital Dr 12,000, To, Realisation 12,000 (A), 37) b) External, Credit (K), 38) b) Realisation (K), 39) a) Realisation account Dr 20,400, To, A’s capital account 20,400 (A), 40) a) Realisation account Dr 42,000, To, Bank 42,000 (A)