Page 1 :

DSM Ta lay, AGUS Tas, , , , gn Meaning of Dissolution of Partnership Firm, , According to Section 39 of the Indian Partnership Act, 1932, “Dissolution of the firm means, a} dissolution of partnetsiip Among all the partners in the firm”. In such an event, all assets of the firm, are realised, i.e., sold and liabilities are paid. The surplus balance is paid to the partners in settlement of, " their accounts and short fall is met from their private estates., , Unlike dissolution of partnership which means only change in existing relationship between the, partners and the firm continues. Dissolution of firm means the firm is dissolved, i.e., wind up., u Types of Dissolution of a Firm, , The Indian Partnership Act, 1932 states ways of dissolution of a partnership firm. A partnership, firm stands dissolved in the following ways:, , , , , , , 1. Dissolution by Agreement (Section 40), @) Voluntary dissolution through mutual agreement amongst partners., Gi) Consensual dissolution according to the partnership agreement or a contract., 2. Compulsory Dissolution (Section 41), (i) When the business of the firm is declared illegal., (i) When all the partners except one decide to retire from the firm., (ii) When all the partners or all except one partner are declared insolvent., , 3. Dissolution upon Contingency, if the partnership deed so provides (Section 42), , (i) When the firm is constituted for a fixed term, on the expiry of that term., (i) When the firm is constituted to carry out one or more projects/ventures, on the completion, thereof., (ii) When a partner of the firm dies., (iv) When a partner of the firm is declared insolvent., , 4. Dissolution by Notice (Section 43), In case of partnership at will, the firm may be, to the other partners., , 5. Dissolution by Order of Court (Section 44), (i) When a partner has hecome mentally disturbed or has unsound mind,, (ii) When a partner has hecome permanently incapable of performing his duties., , dissolved if any one partner gives a notice in writing, , nsferred whole of his interest in the firm toa third partys, , , , (ili) When a partner has 0”, (iv) When a partner deliberately commits breach of agreements relating to the management of, the firm., , Dissolution of a Partnership Firm | 91

Page 2 :

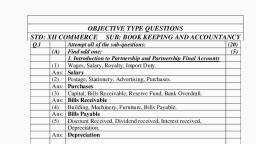

(vi) When the court is satisfied that th, , a Se, , eared 3 rovides, Section 48 of the Indian Partnership Act, 1932 prov!, ts between the partne Hy, (a) Payment of Losses: [Section 48 (a)] Losses shall be paid first out of profits, next out of, ‘ sary, by the partners individually in their profit-sharing ratio,, , Distribution of Assets: [Section 48 (b)] Assets of the firm are first to be applied in, , accoun, , (v) When the court is, , ttlement of Accounts, , , , satisfied that dh, , the, , , , and lastly, if nec, , , , e dissolution of the firm is just and equitable,, , =, , firm cannot be carried on except at a loss,, , following rules for the Settlem,, EN Gy, , Capital, , , , , , , , , , , , , , , , , , Db) ji Paying, si the debts of the firm to the third parties; next in paying to each partner rateably what is dye, to him from the firm for advances as distinguished from capital; in paying to each Partner, rateably what is due to him on account of capital, and the residue to be divided among the, partners in the proportion in which they were entitled to share profits., Distinction between Dissolution of Partnership and Dissolution of Firm, S.No. | Basis of Difference | Dissolution of Partnership Dissolution of Firm, 1, Change in economic | The economic relations of partnership | The economic relations among all the, relation among different partners are changed. | partners come to end., 2. | Termination of The business of the firm is not] The business of the firm is closed., business terminated., 3. Assets and Assets and liabilities are revalued and| Assets are sold and realised and, Liabilities new balance sheet is drawn. liabilities are paid off., 4. Closure of books of | It does not require the closing of books | All books of accounts are closed., accounts because the business is not terminated., 5. Implication It does not imply dissolution of the firm. | It implies dissolution of the partnership, and the firm., , , , , , , , , , , , , , m Settlement of Firm’s Debts and Private Debts: (Section 49), Firm’s debts are the debts incurred by the firm whereas private debts are incurred by partnels, under their individual capacity., , @ Firm’s assets are first utilized for settlement of firm’s debt and the surplus (if any) is applied, towards payment of partner’s private debts to the extent of, @ Private debts of the partners are first, if any thereafter, is used to pay off th, m Realisation Account, Realisation Account is opened on dissoluti, This account is a nominal account. The, of assets and payment of liabilities,, , his share in profits of the firm., paid out of private, , Property of the partners and the surplus, e firm’s debts,, , me, ion of firm to close down the books of accounts of the aa, Purpose of this account is to show the profit or loss on realisat, , Format of Realisation Account, , , , , , , , , , , , , , , , , , Dr Realisation Account 5, Particulars (®) | Particulars, To Sundry Assets, , , , By Sundry Liabilities, [excluding credit balance of P&L A/c,, Reserves (not representing assets),, Partners’ Capltal/Current Accounts,, Loan from Partner], , By Provision on any asset, , (excluding Cash/Bank balance,, fictitious assets, debit balance of P&L, Alc, debitbalance of Partners’ Capital/, Current Accounts,Loan to Partner), To Bank/Cash A/c, (i) (amount paid for discharging, , liabilities) {euch 8s Provision for Doubtful Debts,, (ii) (amount paid for unrecorded byt Tovision for Depreciation etc.), liabilities) ¥ Investment Fluctuation Reserve, , , , , , , , (iii) (expenses on realisation), , 92, , , , , , Accountancy—XIl: Term-2

Page 3 :

[To Partner's Capital ne al By Bank/Cash A/c, sai a partner A ,, ee Serena pad i“ him or (i) ae received on realisation of, oran' assets,, tion/commission payable to ., oe (ii) (amount received from unrecorded, assets, To Partners’ Capital pied liga (iii) ‘ana! Teceived from bad debts, it ofit on realisation, , (for transferring pr ) recovered), , By Partner's Capital A/c, (asset taken over by a partner), , By Partners’ Capital A/es (for transferring, loss on realisation), , , , , , , , , , LL, , a Distinction between Realisation and Revaluation Account, , , , , , , , , , , , , , , , , , S.No. | Basis of Difference | Realisation Account Revaluation Account, , 1. | Time of preparation | This account is Prepared at the time of | This account is prepared at the time of, dissolution of firm. Reconstitution of the firm., , 2. | Object This account is prepared to find out the | This account is prepared to find out the, Profit or loss on realisation of assets | profit or loss on revaluation of assets, and payment of liabilities. and liabilities., , 3. | Value of Assets Assets and liabilities are shown in this | The amount of increase or decrease in, , and Liabilities account at their book value. the value of assets and liabilities are, shown in this account., , 4. | Expenses Usually dissolution expenses are | No expenses are shown in this account., shown in this account., , , , , , , , , , u Unrecorded Assets and Liabilities, , These refer to those assets and liabilities that do not appear in the books of accounts at all but, they do exist otherwise because they being written off or omitted to have been recorded.At the ume of, dissolution, for unrecorded assets and liabilities, the accounting entries passed will be as follows:, , , , , , Unrecorded Assets Unrecorded Liabilities, , When the assets are sold for cash: When the liabilities are settled:, , Cash/Bank A/c Dr. Realisation A/c Dr., To Realisation A/c To Cash/Bank A/c, , When an asset is taken over by a partner: When a partner agrees to pay offa liability:, Concerned Partner's Capital A/c Dr. Realisation A/c Dr., To Realisation Alc To Concerned Partner's Capital A/c, , " Treatment of Reserves and Accumulated Profits, The undistributed profits and losses and reserves are always transferred to partners’ capital accounts, eir profit sharing ratio and not to the realisation account., , , , , , , , , , in th, , For distribution of reserves or accumulated profits, , General Reserve Dr., Reserve Fund Dr., Profit and Loss A/c Dr., , To Partners’ Capital A/es (in profit-sharing ratlo), (Being Undistributed profits and reserves transforred to partners’ capital accounts), , For distribution of accumulated losses, Partners! Capital A/cs i, , To Profit and Loss A/c ' ', (Being Undistributed losses transferred to partners capltal accounts), , Dissolution of A Partnership Firm | 93, , , , Pe

Page 4 :

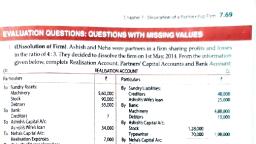

~y, , ing dissolution, 4. When a partner receives remuneration for undertaking Work but Missa, expenses are borne by the firm: n, (i) For payment of remuneration ik, Realisation A/c, To Concerned Partner's Capital A/c, (Being the remuneration due to the partner), (ii) For payment of realisation expenses wie, Realisation A/c, To Cash/Bank A/c, Being dissolution expenses paid), 5. When Realisation expenses are to be borne by one partner (A) and paid by another, A's Capital A/c Dr., To B's Capital A/c, (Being realisation expenses to be borne by A, but paid by B), , Note: When the question is silent about the treatment of realisation expenses, it is assumed tha, the firm has borne and paid the expenses., , @ Partners’ Capital Accounts, After the transfer of undistributed profits, profit or loss on realisation, balance of current account,, assets and liabilities taken over by a partner, etc. to the partners’ capital accounts, how much amounti, , due to or from partners, will be calculated. A partner owing money to the firm will pay and a partner, owing money from the firm will receive. For this purpose, the following entries will be passed:, , (a) If capital account shows debit balance:, Cash/Bank A/c, To Partner's Capital A/c, (For deficit amount of capital brought in cash), (b) If capital account shows credit balance:, Partners’ Capital A/c, To Cash/Bank A/c, , (For final payment made to a artner) |, Note: After making the above entry,, account will be closed., , Partner,, , Dr., , Dr., , A k, the capital accounts of each partner as well as cash and ba", , @ Determination of Missing Figure of Sundry Assets by Preparing Memorandum Balance heel:, , Sometimes, the partners capitals and other liabilities are given in th tion but not the oe, of sundry assets. However, the realised value of sundry assets js gi eeuesnoe. first of allo!, S18 given. In such a case, fir’ he, , Balance Sheet should be Prepared in proper form for calculating missing figure of sundry asses, , ‘ The, , 3 . 1€s are put on the liabjjie: . e Sheet. © |, balancing figure on assets side represents the aniouae of aid: Vlabilities side of the SS is know", as Memorandum Balance Sheet, ry assets. Such a Balance Sh, , , , , , , , @ Closing the Books of a Firm at the ti, , ime of Dissoluti, * + ion:, On the dissolution of the partnership, , firm, the ‘., » He following accounting records are made:, , (1) For closing the accounts, (i) For transferring the assets;, Realisation A/c, , To Assets A/c (Individually) Dr., , 96 | Accountancy—XII: Term-2

Page 5 :

(ii), , (iii), , (iv), , (v), , (vi), , For transferring outside liabilities:, Outside Liabilities A/c, To Re, , For transferring accumulated profits and Reserves:, , , , sation A/c (Individually), , General Reserve A/c, Profit and Loss A/c, , Workmen Compensation Reserve Alc, , To Partners’ Capital A/cs (in profit-sharing ratio), For transferring accumulated losses:, Partners’ Capital A/cs (in profit-sharing ratio), , To Profit and Loss A/c, , To Advertisement Suspense A/c, For transferring the provisions against Assets, Provision for Doubtful Debts A/c, Provision for Depreciation A/c, Investment Fluctuation Reserve A/c, Provision for Discount on Debtors A/c, , To Realisation A/c, For Provision which has debit balance:, Realisation A/c, , To Provision for Discount on Creditors A/c, , (2) For realising assets, , @, , For sale of assets/unrecorded assets in cash:, Bank/Cash A/c, To Realisation A/c, , Dr., , Dr., , Dr., , Dr., , Dr., , Dr., Dr., , Dr., , (ii) For an asset/unrecorded asset taken over by a partner:, , (ii) For an asset/unrecorded asset taken over by outside creditors:, , Partner’s Capital A/c, To Realisation A/c, , Dr., , , , [Excess of Reserve over actual, Liability], , The value of asset taken away by creditor should be deducted from the claim of creditor and, rest of the payment is made to him. The entry is made only for cash payment., , (8) For discharging liabilities, , @), , For payment of liabilities /unrecorded liabilities:, Realisation A/c, To Bank/Cash A/c, , Dr, , (ii) Fora liability/unrecorded liability taken over by a partner:, , Realisation Alc, To Partner's Capital A/c, , Dr, , Dissolution of A Partnership Firm | 97