Page 1 :

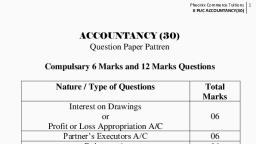

BOOK-KEEPING, &, ACCOUNTANCY, , 212.00

Page 2 :

The Coordination Committee formed by GR No. Abhyas - 2116/(Pra.Kra.43/16) SD - 4, Dated 25.4.2016 has given approval to prescribe this textbook in its meeting held on, 30.01.2020 and it has been decided to implement it from the educational year 2020-21., , Book - Keeping, and, Accountancy, STANDARD XII, , 2020, , Maharashtra State Bureau of Textbook Production, and Curriculum Research, Pune - 411 004, , Download DIKSHA App on your smartphone. If you scan the Q.R.Code, on this page of your textbook, you will be able to access full text and the, audio-visual study material relevant to each lesson provided as teaching, and learning aids.

Page 6 :

PREFACE, We are happy in introducing the text book for Std. XII based on revised syllabus, from the academic year 2020-21., The Std. XI syllabus covers topics related to Sole Proprietorship firm and basic, accounting concepts. The syllabus for Std. XII covers topics related to Partnership Firm,, Not for Profit Organization, Accounting of Company Accounts-Issue of Shares, Financial, Statement Analysis, Bills of Exchange and Computer in Accounting., Due care has been taken to present the subject matter in a simple manner so that the, students can easily understand the relating accounting concepts and contents. Similarly, the students who do not have a commerce background but are going to pursue further, education in commerce the text book will be of great help to understand the subject in, a lucid manner. Various practical problems based on skill and application are included, in the textbook. The exercises given at the end of each topic contains different types of, questions to test conceptual clarity and accuracy and encourage the students to cultivate, the skills and applications required for their future education. Also to make learning, interesting additional information and activities for the students are given at the end of, every chapter and also in QR code on the title page., We would like to bring to your notice that the illustrations and exercise problems, are designed comprehensively. While setting the question paper one is expected to, modify the questions according to the marking scheme., We are thankful to the subject committee members, study group members, translators,, reviewers, quality reviewers and all those who have taken efforts in designing this text, book., We hope the text book will be well received by the academicians and students., , Pune, Date : 21 February 2020, Bharatiya Saur : 2 Phalguna 1941, , ( Vivek Gosavi ), Director, Maharashtra State Bureau of Textbook, Production and Curriculum Research, Pune.

Page 7 :

Book-keeping and Accountancy, Competency Statement, Standard XIIth, Unit, No., , 1, , 2, , 3, , 4, , Topic, , Competency Statements, , Students are able to, • understand the meaning of Partnership., • know the important features of Partneship, • understand the meaning of The Indian Partnership Act, 1932., • understand the importance of Partnership Deed., • understand the provisions applicable in absence of Partnership Deed, Introduction to, • know how to maintain Capital Accounts of Partners, Partnership, • understand the meaning of Partnership Final Account, • know the need and importance of Final Accounts, • know the effects of adjustments in Final Accounts, • know the meaning of Trading Account, Profit and Loss Account and, Balancesheet, • know how to find out financial results of the business, Students are able to, • understand the meaning and features of Not for Profit Concerns, • know the meaning of Receipts and Payments Account, • understand the meaning of Income and Expenditure Account and its, Accounts of Not For, difference from Profit and Loss Account, Profit Concerns, • understand the difference between Profit and Not for profit, Organisations, • learn to acquire the skills for preparing Income and Expenditure, Account and Balancesheet of Not for profit concern, Students are able to, •• understand the meaning and different ways of reconstitution, •• to understand the meaning and need of admission of partner, •• to learn the adjustments required on admission of a Partner, Reconstitution of, •• to calculate the new profit sharing ratio and sacrifice ratio, Partnership, •• to know the methods of valuation of goodwill and treatment of, (Admission of Partner), goodwill, •• to learn the accounting treatment of accumulated profits/ losses, •• to make necessary adjustment for revaluation of assets and liabilities, •• to learn to adjust the capitals according to new profit sharing ratio, Students are able to, • understand the meaning of retirement of partners in partnership, business, • learn to calculate various ratios connected to retirement of, partnership, Reconstitution of, •, understand the treatment of goodwill, Partnership, • know the effect of reserves, accumulated profit/ loss, (Retirement of partner) • learn the effect of revaluation of assets and liabilities, • understand the adjustments to be made for remaining partners, capital, • to know the various modes of final payment to be made to retiring, partners

Page 8 :

5, , Students are able to, learn how to calculate various ratios, Reconstitution of, know how to calculate share of profit up to the date of death of a, Partnership (Death of a, partner, Partner), • learn how to calculate share of goodwill of deceased partner, • know how to calculate amount due to deceased partner’s executor, • understand how to settle the account of an executor, , •, •, , Dissolution of, Partnership Firm, , Students are able to, understand the meaning and reasons of dissolution of partnership, firm, • know the effects of dissolution of partnership firm, • learn various accounting treatment for settlement of accounts, • learn accounting procedure under simple dissolution and insolvency, of partner, , Bills of Exchange, , Students are able to, • know the meaning of bill of exchange, • understand the different concepts used in bills of exchange, • Prepare a draft of bill of exchange and know the various types of, bills of exchange, • understand retaining, sending bill for collection, discounting,, endorsing, honour, renewal and retiring of the bill, • learn various accounting treatment of bills of exchange, , •, 6, , 7, , 8, , Company Accounts Issue of shares, , 9, , Analysis of Financial, Statements, , 10, , Computer in, Accounting, , Students are able to, learn the types of shares and share capital, understand the concept of public subsription and private placement, know the concept of under and over valuation of shares and, accounting of shares issued at par, at premium and at discount, • know the different accounting treatment for under and over, subscription of shares as well as calls in arrears and calls in advance, , •, •, •, , Students are able to, • understand the meaning, objectives and limitations of financial, statement analysis, • learn various tools for financial statements analysis, • understand objectives and classification of Accounting ratios and, Ratio Analysis, Students are able to, • understand the computarized Accounting and its components, • understand features, importance and limitations of computarised, accounting system, • learn application of computerised accounting statements, • learn various accounting packages

Page 9 :

INDEX, , Sr., No., , Chapter, , Page, No., , 1., , Introduction to Partnership and Partnership Final Accounts, , 1, , 2., , Accounts of ‘Not for Profit’ Concerns, , 63, , 3., , Reconstitution of Partnership (Admission of Partner), , 125, , 4., , Reconstitution of Partnership (Retirement of Partner), , 168, , 5., , Reconstitution of Partnership (Death of Partner), , 187, , 6., , Dissolution of Partnership Firm, , 206, , 7., , Bills of Exchange, , 251, , 8., , Company Accounts - Issue of Shares, , 309, , 9., , Analysis of Financial Statements, , 344, , 10., , Computer In Accounting, , 381, , Answer-Key, , 392

Page 10 :

1, , Introduction to Partnership and, Partnership Final Accounts, , Content, 1.1 Meaning and Definition of Partnership, 1.2 The Indian Partnership act 1932., 1.3 Methods of Capital Account, Competency Statements, o, , The students will be able to:, , , , Understand meaning of Partnership, , , , Know the important features of Partnership, , , , Understand the meaning of "The Indian Partnership Act, 1932.", , , , Know the importance of Partnership Deed., , , , Understand the provisions applicable in absence of Partnership Deed., , , , Know how to maintain Capital Accounts of Partner., , Introduction :, The sole proprietorship has its limitations such as limited capital, limited managerial ability,, unlimited liability, no stability, absence of specialization etc. Hence when a business is to be set up, on a scale which needs more capital and involves more risk, two or more persons come together to, run it. They agree to share the capital, the management, the risk & profits of business, such mutual, relationship based on an agreement amongst these persons is termed as "Partnership". The persons, who have entered into the partnership are individually known as "Partners" and collectively as a, "Firm"., 1.1 Meaning and Definition of Partnership :, Partnership is an organization where there is an, association of two or more persons coming together, to carry on a business with a view to share Profit or, Losses of a firm., Definition :, Indian Partnership Act 1932 Section 4 defines, the partnership as, "It is the relation between persons, who have agreed to share the profits of a business carried on by all or anyone of them acting for all.", According to Prof. Handy, "Partnership is the relation existing between persons competent to, make contract, who agree to carry on a lawful business in common with a view to earn private gain., , 1

Page 11 :

Features of Partnership Firm, , Dissolution, Principal, & Agent, Joint, Ownership, &, Management, , Agreement, , Features of, Partnership, Firm, , Lawful, Business, , Registration, Sharing, of Profits &, Losses, , Unlimited, Liabilities, , 1), , 2), 3), , 4), , 5), , 6), , 7), , 8), , Principal, & Agent, , Agreement :- Partnership is a result of agreement between partners. It could be written or oral., A written agreement is preferred so that it can be used as a proof in the court of law & such, written agreement is known as “Partnership Deed.”, Number of Partners :- Minimum two partners are needed to start partnership firm and the, maximum number of partners are fifty according to companies Act 2013 (Amended in 2014), Lawful business :- Business undertaken by partnership should be lawful. It cannot undertake, business which is not allowed by state. The definition of Partnership also does not permit any, illegal business., Sharing of Profit and losses :- The purpose of partnership is to earn maximum profits. Partners, have to share profits & losses according to the ratio given in the agreement. If the agreement is, silent about the ratio then profit and loss sharing will be equal., Unlimited Liability :- The liability of partners is unlimited joint and several that is, partners, are liable till the last rupee in their pocket. If assets of business is not sufficient to pay liabilities,, then personal property of partners can be used. If anyone of the partner is declared in solvent, then his liability will be borne by the solvent partner., Registrations :- Registration of partnership firm is compulsory only in the state of Maharashtra, with effect from 1st April 2005. According to Indian Partnership Act, 1932, registration of, partnership firm is optional it means a firm may or may not be registered. Registration of firm, merely certifies its existence and it is a process of entering the name of Partnership Firm in the, register of Registrar., Joint Ownership & Management :- Each partner is joint owner of the property of the firm,, so no partner can use property for personal use. All partners have equal rights in managing the, firm. So all partners are jointly responsible for the management of firm., Principal and Agent :- Each partner works in two fold capacities i.e. principal and Agent. A, partner acts as a principal of the firm with outsiders and with other partners he acts as an agent., 2

Page 12 :

9), , Dissolution :- A partnership firm can be dissolved through agreement between the partner. If a, partner wants to close the firm he can dissolve the firm by giving fourteen days notice. The firm, can also be dissolved if a partner dies or retires, becomes insolvent or insane., , PARTNERSHIP DEED, The, document, containing, the, partnership agreement among partners is, called Partnership Deed. It contains the terms, and conditions which are agreed upon by all the, partners. An agreement may be written or oral, but when it's written, it's called a deed., The Partnership Act doesn't make it, compulsory to have a written agreement., However, in case of dispute among the, partners, it is always in the best course to have, a written agreement duly signed (by all the, respective partners) and registered under the, Act. Partnership Deed contains the rules and, regulation framed for the internal Management, of the firm. It is also an Article of Partnership., , Partnership Deed, , Contents of the Partnership Deed, 1) Name and address of the firm and its main, business., 2) Name and address of all partners and, duration of the partnership., 3) Capital contribution of all the partners, 4) Ratio in which profits (and losses) are to, be shared., 5) Rights, duties and liabilities of the partners., 6) Provisions related to admission, retirement,, death etc. of a partner., 7) Rate of interest on capital, loan, drawings, etc., 8) Salaries, commission, etc. if payable to any partners., 9) Settlement of accounts on dissolution of the firm., 10) Method of settlement of disputes among the partners., 11) Any other matter relating to the conduct of business., Importance of Partnership Deed, Partnership deed is a very important document because it is the written agreement which, contains all the terms and conditions of the partnership business. It forms the basis of mutual, relationship among the partner. Moreover, partnership deed regulates the rights, duties and liabilities, of all the partners as well as of firm. So by having partnership deed partners disputes in future may, be avoided., , 3

Page 13 :

Hence it is always in favour, to have a written agreement i.e. partnership deed duly signed by, all the partners and registered under the Indian Partnership Act 1932., 1.2, , Provision of the Indian Partnership act 1932:, , At the time of formation of partnership firm, a document is prepared called as partnership deed, and all terms and conditions are mentioned into the deed, but if the partnership deed is silent about, any point then this issue is solved as per the provisions in Partnership Act 1932 section no 12 and 17, are made applicable to determine the following issues., 1) Distribution of profit : If the partnership deed is silent about the profit sharing ratio,, then the profit and losses are distributed among the partners is equal ratio., 2) Interest on drawings : As per the provision of Indian Partnership Act 1932, if the date of, drawing is not given then average of six month's interest is charged on drawings., 3) Interest on partner's loan : If the partner provides additional amount to the business as, loan, but rate of interest on loan is not given then 6% p.a. interest is allowed., 4) Interest on capital : If the partnership deed is silent about interest on capital then interest, is not allowed., 5) Salary or commission to Partners : As per the provision made in the Indian Partnership, Act 1932 no salary, commission, allowance or any remuneration is to be given to any of, the partners for any extra work done for the firm, However, if any provision is made in, partnership deed, then partners are entitled to get commission or salary as per the agreement., 6) Admission of a new partner : As per the provisions of the Indian Partnership Act 1932,, no outside person can be admitted into the firm as a partner without the consent of other, partners., 1.3 Methods of Capital Accounts, Amount in cash or kind brought in by the partner to manage business activities is termed as, Capital. Partners maintain and operate some methods of the Capital Accounts. The two methods of, Capital Accounts are discussed below., , Methods of, Capital Account, , Fixed Capital, Method, , Fluctuating Capital, Method, , , , , , , , , , Capital Account, , Current Account, , 4, , Capital Account

Page 14 :

Fixed Capital Method:, In this method amount of capital of a partner remains the same at the end of that financial year., There is no addition or subtraction from capital during the year. When this method is adopted partner's, open a new account in name of partner's Current Account and all the related to capital adjustments, are solved through Partner's Current Account. For example, Drawings. Interest on Drawings, Interest, on Capital, Partner's Salary, Commission, Brokerage, Share of Profit and Losses are recorded in to, Current Account., Proforma of Fixed Capital Method, Partner's Capital Account, Dr., Cr., Particulars, , To Balance c/d, , Total, , X, Y, Amount Amount, (`), (`), XXX, , XXX, , Particulars, , XXX, , By Balance b/d, By Cash/Bank A/c, [Additional capital], By Assets A/c, [Capital in kind], , XXX, By Balance b/d, , X, Y, Amount Amount, (`), (`), XXX, XXX, , XXX, XXX, , XXX, , XXX, , XXX, XXX, , XXX, XXX, , Journal Entries, 1) When additional capital is introduced by a partners, Cash / Bank A/c ..................... Dr., , To Partners Capital A/c, (Being additional capital introduced into the business), 2), , When capital amount is brought in by a Partner in form of Assets, Assets A/c .................. Dr., , To Partners Capital A/c, (Being additional capital brought in kind), Partner's Current Accounts:, When fixed capital method is adopted by the partnership firm, a new separate account is, opened i.e. 'Partner's Current Account'. In this account all adjustments related to capital are recorded., Partner's Current Account may show debit or credit balance., 1) Drawings made by the partner in the current accounting year, 2) Goods or any assets taken over by the partner., 3) Interest on partners capital allowed by the firm., 4) Interest on partners drawings charged by the firm., 5) Salary, Commission etc. payable to the partner., 6) Distribution of Profit or Loss of the firm., , 5

Page 15 :

Partner's Current Account:, Dr. , , Cr., , Particulars, , X, Y, Particulars, X, Y, Amount Amount, Amount Amount, (`), (`), (`), ( `), To Balance b/d (Dr. Bal), XXX, XXX By Balance b/d (Cr. Bal), XXX, XXX, To Drawing A/c, XXX, XXX By Interest on Capital A/c, XXX, XXX, To Interest on Drawing, XXX, XXX By Salaries A/c, XXX, XXX, To Profit and Loss A/c, XXX, XXX By Commission A/c, XXX, XXX, (Share in loss), By Profit and Loss A/c, XXX, XXX, To Balance c/d, XXX, XXX (Share in Net profit), By Balance c/d, XXX, XXX, XXX, XXX, XXX, XXX, To Balance b/d, XXX, XXX By Balance b/d, XXX, XXX, 1) Interest allowed on partner's capital, a) Interest on Capital A/c.............................................................Dr., XXX, To Partners Capital A/c/ Current Account , XXX, , (Being interest due on capital), b) Profit and Loss A/C.................................................................Dr, XXX , , To interest on Capital A/C XXX, , (Being interest on Capital transferred to profit and loss account), 2), , Salary or Commission allowed to partners, a) Salary or Commission in Partner A/c......................................Dr., XXX, , To Partners Current A/c / Capital Account ..................... XXX, , (Being Salary or Commission due for payment), b) Profit and Loss A/C.................................................................Dr, XXX, , To Salaries/ Commission A/C.......................................... ./ZXXX, , (Being Salary/ Commission transferred to Profit and Loss A/C), 3), , Cash or Goods taken over by the partners for their personal use., a) Drawing A/c.............................................................................Dr., XXX, , To Cash or Goods A/C XXX, , (Being cash or goods withdrawn for personal use), b) Partners Current A/c / Capital A/c...........................................Dr, XXX, , To Drawing A/c XXX, , (Being balance on account transferred to current A/c), 4), , Interest charged on drawing of the partners, a) Partners Current A/c / Capital A/c...........................................Dr., XXX, , To Interest on Drawing account XXX, , (Being interest charged on Drawing), b) Interest on Drawings A/C........................................................ Dr, XXX, , To Profit and Loss A/C XXX, , (Being interest on Drawings transferred to profit and loss account), 6

Page 16 :

5), , Transfer of Net Profit, Profit and loss A/c ...........................................................................Dr., XXX, , To Partners Current A/c / Capital A/c , XXX, (Being profit transferred to Partner's Current / Capital Account), 6), , Distribution of Net loss :, Partners Current A/c / Capital A/c...................................................Dr., XXX, , To Profit and Loss A/c , XXX, (Being loss adjusted to Partners Current / Capital Account), Effects in Profit and Loss Account, Dr., , Cr., Particulars, , Amount Amount, Particulars, Amount Amount, (`), (`), (`), ( `), To Interest on Capital, XXX By Interest on Drawings, XXX, To Salary to Partner, XXX, To Commission to Partner, XXX, XXX, XXX, Fluctuating capital method :, In this method, amount of capital balance changes every year. It is called as fluctuating capital, method. In this method the partner's current account is not opened. Hence all adjustments are solved, through Capital Account. Following are the general adjustment related to capital., 1) Initial or Opening Balance of capital, 2) Additional Capital brought in by the partners in Cash or in kind., 3) Salary / Commission payable to partner, 4) Interest payable on capital balance to partner, 5) Drawings made during the year and interest payable on drawings by the partner, 6) Withdrawal of part of the capital by the partner, 7) Division and transfer of net disposable profit or net adjustable loss of the firm., Proforma of Fluctuating Capital Method., Capital Account, Dr. , Cr., Particulars, , To Balance b/d (Dr. Bal), To Drawing A/c, To Interest on Drawing, To Profit and Loss A/c, (Share in loss), To Balance c/d, , X, X, Particulars, Amount Amount, (`), (`), XXX, XXX By Balance b/d (Cr.Bal), XXX, XXX By Cash A/c, XXX, XXX [Addition made], XXX, XXX By Interest on capital A/c, By Salaries A/c, XXX, XXX By Profit and Loss, (Net Profit), XXX, XXX, By Balance b/d, 7, , X, X, Amount Amount, (`), ( `), XXX, XXX, XXX, XXX, XXX, XXX, XXX, , XXX, XXX, XXX, , XXX, XXX, , XXX, XXX

Page 17 :

Examples, 1), , Anand and Bharat are partners sharing profits and losses in the ratio 2 : 3. On 1.4.2019 the, capital balance are Anand ` 60,000 and Bharat ` 30,000 their drawings are ` 12,000 and, ` 10,000 respectively. As per the agreement partners are allowed 10% interest on capital and, interest on Drawings is to be charged at 12% p.a. Anand gets salary of ` 2,500 per month and, Bharat is entitled to get commission @ 3% on net sales which is ` 5,00,000. The firm's profit is, ` 60,000. Prepare partners capital account for the year ended 31st March 2019 under :, 1) Fixed Capital Method 2) Fluctuating Capital Method, , Solution : 1) Fixed Capital Method, Dr. , Particulars, To Balance c/d, , Partner's Capital A/cs , , Amount Amount, Particulars, (`), (`), 60,000, 30,000 By Balance b/d, 60,000, , 30,000, , Dr. Partner's Current A/cs, Particulars, To Drawing A/c, To Interest in Drawing, To Balance c/d, , Amount Amount, (`), (`), 60,000, 30,000, 60,000, 60,000, , By Balance b/d, , , , Amount Amount Particulars, (`), (`), 12,000, 10,000 By Interest on capital A/c, 720, 600 By Salaries A/c, 47,280, 43,400 By Commission A/c, By Profit and Loss A/c, 60,000, 54,000, , Cr., , 30,000, 30,000, Cr., , Amount Amount, (`), (`), 6,000, 3,000, 30,000, 15,000, 24,000, 36,000, 60,000, 54,000, , 2) Fluctuating Capital Method, Dr. , Partner's Capital A/cs , , Cr., , Particulars, , Amount Amount, Particulars, Amount Amount, (`), (`), (`), (`), To Drawing A/c, 12,000, 10,000 By Balance b/d, 60,000, 30,000, To Interest in Drawing A/c, 720, 600 By Interest on capital A/c, 6,000, 3,000, To Balance c/d, 1,07,280, 73,400 By Salaries A/c, 30,000, By Commission A/c, 15,000, By Profit and Loss A/c, 24,000, 36,000, 1,20,000, 1), , Interest on Capital, Anand 60,000 ×, , Bharat, , 30,000 ×, , 84,000, , 1,20,000, , 10, 100, , = ` 6,000, , 10, 100, , = ` 3,000, 8, , 84,000

Page 18 :

2), , Interest on Drawings, , 3), , Anand = 2500 x 12 = ` 30,000, , 4), , Commission to Anand = 5,00,000 ×, , 5), , Distribution of Profit ` 60,000 2:3, 2, Anand = 60,000 × = ` 24,000 , 5, 3, Bharat = 60,000 × = ` 36,000 , 5, Karan and Kiran are partners in M/s Mehta Enterprises. They have started business of ready, made garments on 1st April 2019 on which date they contribute ` 5,00,000 each as their initial, capitals. Karan has withdrawn ` 20,000 and Kiran has withdrawn ` 15,000 for their personal, use. Interest on capital is allowed @ 12% and interest on drawing is charged @ 3% p.a. Karan, is entitled to get salary, ` 1800 per month, Kiran is allowed to get commission @ 5% on net, sales. During the year net sales is ` 2,50,000 and net profit earned during the year is ` 60,000., Prepare partners capital accounts under i) Fixed capital Method ii) Fluctuating Capital Method, , 6, 12, Anand 12,000, × 100 × 12 = ` 720, , 6, 12, Bharat 10,000, × 100 × 12 = ` 600, , (Interest on Drawing always to be taken for 6 months In case date on Drawings in not mentioned), , 2), , 3, = `15,000 , 100, , Solution :, In the books of M/s Mehta Enterprises, 1), Fixed Capital Method, Dr. , Particulars, To Balance c/d, , Partner's Capital A/cs , , Kiran, Kiran, Particulars, (`), (`), 5,00,000 5,00,000 By Cash/Bank A/c, , Kiran, Kiran, (`), (`), 5,00,000 5,00,000, , 5,00,000 5,00,000, , 5,00,000 5,00,000, , Dr. Partner's Current Accounts , Particulars, To Drawing A/c, To Interest on Drawing, To Balance c/d, , Cr., , Kiran, (`), 20,000, 300, 91,300, , Kiran, Particulars, (`), 15,000 By Interest on Capital A/c, 225 By Salaries A/c, 87,275 By Commission A/c, By Profit and Loss A/c, , 1,11,600 1,02,500, , Kiran, (`), 60,000, 21,600, 30,000, , Cr., Kiran, 60,000, 12,500, 30,000, , 1,11,600 1,02,500, , 9

Page 19 :

2) Fluctuating Capital Method, Dr. , Partner's Capital Accounts , Particulars, To Drawing A/c, To Interest on Drawing, To Balance c/d, , Kiran, (`), 20,000, 300, , Kiran, Particulars, (`), 15,000 By Cash/Bank A/c, 225 By Interest on capital A/c, By Salaries A/c, 5,91,300 5,87,275 By Commission A/c, By Profit and Loss A/c, , Kiran, Kiran, (`), (`), 5,00,000 5,00,000, 60,000, 60,000, 21,600, 12,500, 30,000, 30,000, , 6,11,600 6,02,500, , 6,11,600 6,02,500, 5,91,300 5,87,275, , By Balance b/d, 1), , Interest on capital is calculated as follows :, Karan :, , , Kiran :, , 2), , Cr., , On Opening balance i.e. ` 5,00,000 for 1 year , 12, = ` 60,000, 100, On Opening balance i.e. ` 5,00,000 for 1 year , , 12% p.a. interest = ` 5,00,000 ×1years, , 12% p.a. interest = 5,00,000 ×1years ×, , 12, = ` 60,000, 100, , Interest on Drawing is charged @3% , , 3, 2, ×, = ` 300, Karan : 20,000% ×, 12 100, , 3, 2, Kiran :, 15,000 ×, ×, = ` 225 , 12 100, 5, 3) Commission paid to Karan = 2,50,000 ×, = ` 12,500, 100, 4), , Profit of ` 60,000 is distributed equally between Karan and Kiran, , , , 1, Karan = 60,000 × 2 = ` 30,000, , 1, Kiran = 60,000, × 2 = ` 30,000, 3), , Mr. Amey and Mr. Ashish are partners in a partnership firm titled as M/s. Anand Enterprises, sharing profit and losses in the ratio 3 : 2 respectively. On 1st April 2018 their capital balance, were: Mr. Amey ` 1,00,000 and Mr. Ashish ` 50,000. Their drawing during the year were :, Mr. Amey : ` 20,000 and Mr. Ashish ` 25,000. As per partnership deed 10% p.a. interest is, allowed on capital and 12% p.a. interest is charged on drawing Mr. Amey gets salary ` 3000, p.m. and Mr. Ashish is entitled to get commission @ 5% on net sales which is ` 4,00,000. The, divisible profit is ` 90,000. Prepare partners capital Accounts for the year ending 31st March, 2019 under, 1) Fixed capital method 2) Fluctuating Capital Method., , 10

Page 20 :

1), , In the books of M/s. Anand Enterprises, Under Fixed Capital Method, , Dr. Partner's Capital Accounts, , , , Cr., , Particulars, , Amey, Ashish, Particulars, Raj, Ravi, Amt. (`) Amt. (`), Amt. (`) Amt. (`), To Balance c/d, 1,00,000, 50,000 By Balance b/d, 1,00,000, 50,000, 1,00,000, 50,000, 1,00,000, 50,000, Dr. , Partner's Current Accounts , Cr., Particulars, , Amey, Ravi, Particulars, Amey, Ashish, Amt. (`) Amt. (`), Amt. (`) Amt. (`), To Drawing A/c, 20,000, 25,000 By Interest on Capital A/c, 10,000, 5,000, To Interest on Drawing A/c, 1,200, 1,500 By Salaries A/c, 36,000, To Balance c/d, 78,800, 34,500 By Commission A/c, 20,000, By Profit and Loss A/c, 54,000, 36,000, 1,00,000, , 61,000, By Balance b/d, , 1,00,000, 78,800, , 2) Under Fluctuating Capital Method, Dr. , Partner's Capital Accounts , Particulars, , Amey, Ashish, Particulars, Amt. (`) Amt. (`), To Drawing A/c, 20,000, 25,000 By Cash/Bank A/c, To Interest on Drawing A/c, 1,200, 1,500 By Interest on capital A/c, By Salaries A/c, To Balance c/d, 1,78,800, 84,500 By Commission A/c, By Profit and Loss A/c, 2,00,000 1,11,000, By Balance b/d, 1), , Cr., , Amey, Ashish, Amt. (`) Amt. (`), 1,00,000, 50,000, 10,000, 5,000, 36,000, --------------20,000, 54,000, 36,000, 2,00,000 1,11,000, 1,78,800, 84,500, , Interest on capital : , 10, Mr. Amey = 1,00,000 ×1 Year × 100 = ` 10,000 , Mr. Ashish, , 2), , 61,000, 34,500, , 10, = 50000 ×1 Year × 100, , = ` 5,000, , Interest on Drawings :, , Interest on Drawing is calculated for the average. Period of 6 months as date of drawing is not, given. , 12, 6, Mr. Amey = 20,000 × 12 × 100 = ` 1200, , 12, 6, Mr. Ashish = 25,000 × 12 × 100 = ` 1500, , 11

Page 21 :

3), , Distribution of profit , Mr. Amey, Mr. Ashish, , 4), , 3, = 5 × 90,000, 2, = 5 × 90,000, , = ` 54,000 , = ` 36,000, , Sun and Moon were partners with capital of ` 10,00,000 and ` 5,00,000 respectively. They, agree to share profits in the ratio 3 : 2. Show how the following transactions will be recorded, in the capital accounts of the partners in both the cases when i) Capitals are fluctuatin and, ii) Capitals are fixed. They also introduced additional capital of ` 2,25,000 and ` 1,50,000, Particulars, , Sun, (`), 5%, 22,500, 1,350, 15,000, 7,500, 45,000, , Interest on Capital, Drawing A/c (during 2016), Interest on Drawings, Salaries, Commission, Share in Loss for the year 2016, Solution :, Dr. , Particulars, To Drawing A/c, To Interest on Drawing, To Profit & Loss A/c, (Loss), To Balance c/d, , Moon, (`), 5%, 15,000, 900, 5,250, 30,000, , Partner's Capital Accounts , , Sun, (`), 22,500, 1350, 45,000, , Moon, Particulars, (`), 15,000 By Balance b/d, 900 By Cash/Bank A/c, 30,000 By Interest on Capital A/c, , By Salaries A/c, 12,34,275 6,38,050 By Commission A/c, 13,03,125 6,83,950, , Cr., Sun, Moon, (`), (`), 10,00,000 5,00,000, 2,25,000 1,50,000, 55,625 28,750, 15,000, 7,500, , 5,200, , 13,03,125 6,83,950, , Dr. , Partner's Capital Accounts , Particulars, Sun, Moon, Particulars, (`), (`), To Balance c/d, 12,25,000 6,50,000 By Balance b/d, By Bank, (Additional Capital), 12,25,000 6,50,000, , 12, , Cr., Sun, Moon, (`), (`), 10,00,000 5,00,000, 2,25,000 1,50,000, 12,25,000 6,50,000

Page 22 :

Partner's Current Accounts, Dr. , C r., Particulars, Son, Moon, Particulars, Son, Moon, (`), (`), (`), (`), To Drawing, 22,500, 15,000 By Interest on capital, 55,625, 28,750, To Interest on Drawing, 1350, 900 By Partner's Salaries A/c, 15,000, To Profit & Loss A/c, 45,000, 30,000 By Commission A/c, 7,500, 5,250, To Balance c/d, 9,275, By Balance b/d, 11,900, 78,125, 45,900, 78,125, 45,900, Calculation of Interest on Capitals, Sun: 5% on ` 10,00,000 for one year will be, 10,00,000 × 5, = ` 50,000, =, 100, , 5% of ` 2,25,000 for 6 months will be, 2,25,000 × 5, 5, 6, =, 100 × 12 × 100 × 12 = ` 5,625, , Total will be 50,000 + 5,625 = 55,625, Moon: 5% on 5,00,000 for one year will be, 5,00,000 × 5, = ` 25,000, 100, , 5% of ` 1,50,000 for 6 months will be, 1,50,000 × 5 × 6, =, = ` 3,750, 100 × 12, , Total will be 25,000 + 3,750 = ` 28,750, Note :, 1. Current Account balance may appear in either side i.e. Debit or Credit side, 2. In the absence of any instruction the Capital Account should be prepared by Fluctuating, capital methods, 3. Interest on loan of partners is treated as liability so it is credited to partners current account. But when there is no current account and partners are maintaining Fluctuating, capital method than interest on loan of partner is credited to Pratners Capital A/c, , 13

Page 23 :

Partnership Final Accounts, Contents 2.1 Introduction and necessity of preparation of Final Accounts. 2.2 Preparation of Trading Account,, Profit and Loss Account and Balance Sheet with following adjustments., a) Closing Stock, b) Outstanding expenses, c) Prepaid expenses, d) Income received in advance, e) Income receivable, f) Bad debts, g) Provision for doubtful debts, h), Reserve for discount on Debtors and Creditors, i), Depreciation, j), Interest on capital, drawings and loan., k) Interest on Investments and loans given, 1) Goods destroyed by fire/accident (Insured & Uninsured), m) Goods stolen, n) Goods distributed as free samples, o) Goods withdrawn by partners, p) Unrecorded purchases and sales, q) Capital expenditure included in revenue expenses and vice versa, r) Bills Receivable dishonoured, s) Bills Payable dishonoured, t), Deferred expenses, u) Capital receipts included in revenue receipts and vice versa, v) Commission to working partners on the basis of Gross Profit, Net Profit/Sales etc., Competency Statements The students will be able to :, •, Understand the meaning of Final Accounts., •, Know the need and importance of Final Accounts., •, Know the effects of adjustments in Final Accounts., •, Know the meaning of Trading Account, Profit and Loss Account and Balance Sheet., •, Know how to find out financial results of the business., 2.1 Introduction :, As per the sole proprietary concern we will also prepare the Final Account of partnership firm,, the income statement and position statement. Final Account is the last stage of accounting procedure., Generally following steps are followed in the accounting., , 14

Page 24 :

Various Steps in Accounting :, Preparation of Journal/Subsidiary Books., Preparation of Ledger., Preparation of Trial Balance considering adjustments., Preparation of Final Accounts which consist of, , a) Trading A/c b) Profit and Loss A/c c) Balance Sheet, As per Income Tax Act, 1961 financial year starts on 1st April and ends on 31st March every, year., Necessity of Preparation of Final Accounts :, Final account is prepared for the following various purposes., 1. To find out the Gross Profit or Gross Loss incurred during the year., 2. To find out the Net Profit or Net Loss of the business., 3. To know the financial position of the business at the end of every year., 4. To find out the amount of debtors and creditors., 5. To prepare various accounts for future planning., 6. To find the sources and application of fund., 7. To find out the value of goodwill for the purpose of reconstruction of firm., 8. To calculate various taxes of firm like income tax, etc., 2.2 Preparation of Partnership Final Accounts:, Trial Balance and adjustments are important in preparation of Final Account. The list of debit, and credit balances of all ledger account is called as "Trial Balance". The Final Account is prepared, at the end of every financial year., Trading Account shows the Gross Profit or Gross Loss and Profit and Loss Account shows the, Net Profit or Net Loss of the firm. The Balance Sheet shows the financial position of the business in, the form of assets and liabilities at the end of year., Trading Account :, Trading Account is a Nominal Account. Trading Account is opened in the trading organization, for the purpose to find out the Gross Profit or Gross Loss incurred during the year. In the debit side, of this account all direct expenses are recorded and in the credit side of account all direct incomes of, the firm's are recorded. If the trading account's credit side is more than debit side then account shows, the Gross Profit and vice versa. The Gross Profit or Loss is transferred to Profit and Loss Account., J. R. Batliboi :, “The Trading Account indicates the results of buying and selling of goods while preparing this, account, the general establishment charges are ignored and only the transactions related to goods, are included.”, 15

Page 25 :

Trading Account for the year ended..., Dr. , Particulars, To Opening Stock, To Purchases, Less : Return Outward, To Carriage Inward, To Freight, To Dock Charges, To Custom Duty, To Wages Productive, Manufacturing Wages, To Wages & Salaries, To Import Duty, To Coal/Coke/Gas/, Motive Power/Oil/, Water /Grease, To Royalty on, Purchase/Production, To Primary Packing, Charges, To Factory Lighting &, Heating, To Factory Rent & Rates, To Factory Insurance, To Works Manager's Salary, To Gross Profit c/d, , Particulars, Amt. (`) Amt. (`), xxx, By Sales, xxx, Less : Return Inward, xxx, xxx, xxx, By Goods lost by fire, xxx, xxx, xxx, xxx, xxx, xxx, xxx, , By Goods lost by theft, By Goods distributed, as free samples, By Goods lost in Accident, By Goods withdrawn by, Partners, By Closing Stock, By Gross Loss c/d, , Cr., Amt. (`) Amt. (`), xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, , xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, , xxx, xxx, In the case of combined term of wages and salaries following treatment should be given :, a) When the item Wages and Salaries is given in which Wages are appearing first, it should be, transferred to Trading A/c debit side., b) When the item Salaries and Wages is given in which Salaries appear first, it should be transferred, to Profit and Loss A/c – Debit side., Profit and Loss Account :, Profit and Loss Account is the type of Nominal Account. Profit and Loss account is a main, account of income statement. It is prepared to ascertain the Net Profit earned or Net Loss suffered by, a business concern during the accounting year. All indirect expenses are to be recorded to the debit, side where as all indirect incomes are to be recorded to the credit side of this account. The credit, balance on this account shows Net Profit which is to be transferred to Capital Accounts credit side, or added in capital. The debit balance of this account shows, Net Loss which is to be transferred to, Capital Account debit side or deducted from Capital., , 16

Page 26 :

R.N. Carter, "A Profit and Loss Account is an Account into which all gains and losses, are considered in order to ascertain the excess of gain over the losses or vice versa.”, Pro-forma of Profit and Loss Account for year ended, Dr. , Cr., Particulars, Amt. Amt., Particulars, Amt. Amt., `, , To Salaries, To Salaries & Wages, To Rent & Rates, To Insurance, To Electricity/Lighting, To Telephone, Postage, To Printing & Stationery, To Travelling Expenses of Salesman, To Depreciation on Assets, To Loading Charges, To Audit Fees, To Entertainmen Exp., To Repairs / Renewals / Maintenance, To Interest on Loan, To Sundry/Miscellaneous Expenses, To Conveyance, To Loss by Fire, To Loss by Theft, To Loss in Accident, To Goods distributed as free sample, To Commission Allowed/ Given, To Discount allowed, To Allowances, To Advertisement, To Carriage Outward, To Sale Charges, To Bad Debts, To Export Duty, To Taxes, To General Expenses, To Trade Expenses, To Legal Charges, To Professional Charges, To Bank Charges, To Solicitor's Fees, To Secondary Packing Charges, To Loss on sale of Fixed Assets, To Net Profit transferred to, Partners' Capital A/c/ Current A/c, , `, , xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, 17, , `, , By Gross Profit b/d, By Commission Received, By Discount Received/ Earned, By Interest Received, By Dividend Received, By Rent Received, By Sundry/Miscellaneous Receipts, By Profit on Sale of Asset, By Net Loss transferred, to Partners' Capital A/c /, Current A/c, , `, , xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, , xxx

Page 27 :

Balance Sheet :, Balance Sheet is a statement showing financial position of the firm on a particular day. All, liabilities are recorded to its left hand side where as all Assets are recorded to its right hand side. The, Balance Sheet is not an account but a statement showing the financial position of a firms, as on a, given date in the form of Assets and liabilities., A., , Palmer defines Balance Sheet as :, "The Balance Sheet is, a statement on a particular date showing on one side the traders property, and possessions and on the other side the liabilities"., Proforma of Balance Sheet is given below, Balance Sheet as on ......., , Liabilities, Capital Accounts :, A, B, C, Partners Current A/c, (Credit Balance), General Reserve, Profit & Loss A/c, Loan on Mortgage, Bank Loan, Loan from Partners, Bills Payable, Bank Overdraft, Sundry Creditors, Add/Less : Any other, adjustment, Less : Provision for, Discount on Creditors, Outstanding Expenses, Income received in, Advance, Provision for Taxes, , Amt. `, xxx, xxx, xxx, xxx, , Amt. `, , xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, , xxx, xxx, , xxx, xxx, xxx, xxx, xxx, , Assets, Goodwill, Land and Building, Less : Depreciation, Plant & Machinery, Less : Depreciation, Furniture & Fixtures, Less : Depreciation, Equipment, Less : Depreciation, Delivery/Motor Van, Less : Depreciation, Leasehold / Freehold, Premises, Less : Depreciation, Patents, Less : Depreciation, Loose Tools, Less : Depreciation, Investments, Stores & Spare Parts, Less : Depreciation, Prepaid Expenses, Outstanding Incomes, Loans and Advances, Closing Stock, Sundry Debtors, + Any adjustments, Less : Bad Debts(New), Less : Provision for Discount, on Debtors, Insurance Claim Receivable, Bills Receivable, Cash in Hand, Cash at Bank, Partners Current A/c, (Credit Balance), 18, , Amt. `, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, , Amt. `, , xxx, xxx, xxx, xxx, xxx, xxx, xxx, xxx, , xxx, , xxx, xxx, xxx, xxx, xxx, , xxx, xxx, xxx, xxx, xxx, xxx, xxx, , xxx, xxx, xxx, , xxx, xxx, xxx, xxx, xxx, xxx

Page 28 :

Notes :, 1), 2), 3), , Every item in the Trial Balance must be shown only one time and in just one part of the, Final Accounts, excluding silent/ hidden adjustments., Every adjustment must have two effects in Final Accounts i.e. debit and credit., We have already studied this topic in XI standard as “Final Account of Proprietary, Concern.” Most of the theory part, explanation of journal entries, and effects of journal, entries are similar. To avoid repetition common explanation is not given in the XII standard. But explanation and Journal Entries of new adjustments are given. For common, references / explanation teachers and students can refer textbook of standard XI. First, topic in this book i.e Introduction to Partnership is also correlated with Partnership Final, Account. Students can refer topic no.1., , Adjustments :, 1., 2., , 3., 4., 5., 6., , 7., , 8., , 9., , Adjustment, Closing Stock, Outstanding Expenses, , 1st Effect, Balance Sheet Asset side, Add to the particular, Expenses on the debit side of, Trading/Profit and Loss A/c, Prepaid Expenses, Deduct from the particular, expenses on the debit side of, Trading/Profit and Loss A/c, Income received in advance Deduct from the particular, (Pre-received Income), income on the credit side of, Profit and Loss A/c, Income receivable, Add to the particular income, on the credit side of Profit and, Loss A/c, Bad debts (Additional or Show to the debit side of Profit, New Bad debts), and Loss A/c (add to old bad, debts if any), Provision for Doubtful, Debts (Reserve for Doubtful, debts, new R.D.D.), Reserve for discount on, Debtors, Depreciation, , 10. i) Interest on capital, , Show to the debit side of, Profit and Loss A/c, , 2nd Effect, Trading A/c credit side, Balance Sheet Liability, Side, Balance Sheet Asset Side, Balance, Side, , Sheet, , Liability, , Balance Sheet Asset Side, Deduct, from, Sundry, Debtors in Balance Sheet, Asset Side, , Deduct, from, Sundry, Debtors in Balance Sheet, Asset Side, Show to the debit side of, Deduct, from, Sundry, Profit and Loss A/c (Add to Debtors, discount allowed), Balance Sheet Asset Side, Show on the debit side of the Less from the particular, Profit and Loss A/c, asset in Balance Sheet, Asset Side, Show to the Debit Side of Profit Partners, Capital/Current, and Loss A/c, A/c Credit Side or add to, Capitals/ Current Account, , 19

Page 29 :

ii) Interest on Drawings, , iii) Interest on loan taken, , 11., 12., , 13., 14., 15., 16., , 17., , 18., , 19., 20., , Show to the Debit Side of, partners Capital/Current A/c, or less from Capital/ Current, Account, Show to the Debit Side of, Profit and Loss A/c, , Show to the Credit Side of, Profit and Loss A/c, , Add to loan taken in the, Balance Sheet Liability, Side, Interest on investment, Show to the Credit Side of Balance Sheet Asset Side, Profit and Loss A/c, and on loan given, i) Insured goods destroyed Trading A/c Credit Side (gross 1. Balance Sheet Asset, by fire/accident, amount), Side (Claim amount), 2. Profit and Loss A/c Debit, side (Amount of Loss), ii) Uninsured goods, Profit and Loss A/c Debit Side Show to the Credit Side of, destroyed by fire/, Trading A/c, accident, Goods stolen, Profit and Loss A/c Debit Side Show to the Credit Side of, Trading A/c, Goods distributed as free, Profit and Loss A/c Debit Side Show to the Credit Side of, samples, (Add in Advertisement if any) Trading A/c, Goods withdrawn by, Show to the Credit Side of Partners Capital/Current, Trading A/c or deduct from A/c Debit Side, Partners for personal use, Purchases A/c, i) Unrecorded Purchases, Add to Purchases on the Debit Add to Creditors on the, Side of Trading A/c, Liability Side of Balance, Sheet, ii) Unrecorded Sales, Add to Debtors on the Asset, Add to Sales on the credit, Side of Trading A/c, Side of the Balance Sheet, i) Capital, Expenditure Deduct from that particular, Add to that particular asset, included in Revenue Revenue Expenses on the Debit in Balance Sheet Asset Side, Expenditure, Side of Trading or Profit and, Loss A/c, ii) Revenue, Expenditure Add to that particular Revenue Deducted, from, that, included, in, Capital Expenditure, particular Asset in Balance, Expenditure, Sheet, Bills Receivable dishonored Add the amount of bill Deduct the amount of bill, dishonored to Sundry Debtors dishonored from Bills, in the Balance Sheet Asset Side Receivable., Bills Payable Dishonored, Add the amount of bill Deduct the amount of bill, dishonored to Sundry Creditors dishonored from Bills, in the Balance Sheet, Payable, Deferred, Expenses, of Advertisement Expenses, Remaining amount of, Advertisement paid for 5 related to current year debited Advertisement is shown, on asset side of the, years, to Profit and Loss A/c, Balance Sheet as prepaid, Advertisement, 20

Page 30 :

21. Revenue Receipts included, in Capital Receipts e.g. sale, of goods included in sale of, Furniture, 22. Commission to partners, as percentage of Gross, Profit/sales., , Add to sales on the credit side Less to Furniture on the, of Trading A/c., Asset Side of the Balance, Sheet, Show to the Debit Side of, Profit and Loss A/c, , Show to the Credit Side of, Partners Capital/Current, A/c or Add to Partners, Capital A/c., , Hidden Adjustment Given in Trial Balance, Sr., No., 1., , Adjustment Given in, Trial Balance, Salaries/Rent Paid, (For 10 months), , 2., , Insurance premium paid, for 1 year ending 30th, June, 2019 (Accounting, year ends on 31st March, 2019), Advertisement expenses, (for 4 years), , 3., , 4., , Rent received, (for 11 months), , 5., , 10% Loan (Borrowed on, 1st Jan. 2018)(Accounting, year ends on 31st March, 2018), 16% Investment, (Purchased on 1st Jan., 2019) (Accounting year, ends on 31st March 2019), 10% Government Bonds, , 6., , 7., , Trading and Profit and, Balance Sheet, Loss A/c, Add the amount of Salaries/ Show separately the amount, Rent for 2 months to Salaries/ of Salaries/Rent for 2 months, Rent respectively, on the Liabilities Side of the, Balance Sheet, Deduct the proportionate Show separately the amount, amount of Insurance Premium of prepaid insurance on the, for 3 months from insurance Assets Side of the Balance, on the Debit Side of Profit Sheet, and Loss A/c, Show 1/4th amount of Show the remaining i.e. 3/4th, Advertisement expenses on of Advertisement expenses, the Debit Side of Profit and (not written off) on the Assets, Loss A/c, Side of the Balance Sheet, Add the proportionate amount Show the same amount on the, of Rent for one month to Rent Assets Side of the Balance, received on Credit Side of Sheet, Profit and Loss A/c, Show the amount of Interest Add the amount of Interest, Receivable on investment for Receivable on investment on, 3 months on the Credit Side of the Assets Side of the Balance, the Profit and Loss A/c, Sheet, Show the amount of Interest Add the amount of Interest, Receivable on Investment for Receivable on Investment on, 3 months on the Credit Side the Assets Side of the Balance, of the Profit and Loss A/c, Sheet, Show the amount of Interest Add the amount of Interest, Receivable on the Credit Side Receivable to Government, of Profit and Loss Account, Bonds on the Assets Side of, the Balance Sheet or show, seperately in Balance Sheet, Asset Side., , 21

Page 31 :

Important Points :, 1) Each item from Trial Balance will be included only once in the Final Accounts i.e. either in, Trading or in Profit & Loss A/c or in Balance Sheet or in working section., 2) Each adjustment has two effects for the similar amount., 3) Debit balances of Trial Balance will appear on the debit side of Trading Account or Profit &, Loss A/c or on the asset side of the Balance Sheet., 4) Credit balances of Trial Balance will appear on the credit side of Trading Account or Profit &, Loss A/c or Capital Account or on the Liabilities Side of the Balance Sheet., 5) If Salaries and Wages are given as separate items, Wages are shown on the debit side of Trading, Account while salaries are shown on the debit side of Profit and Loss A/c. If the item is “Wages, and Salaries”, it is shown on the debit side of Trading A/c and if the items is “Salaries &, Wages”, it is shown on the debit side of Profit & Loss A/c., 6) If the Trial Balance contains only “Trade Expenses”, the item will be shown on the debit side, of Profit & Loss A/c. If the Trial Balance contains “Trade Expenses” and also other items like, “Sundry Expenses” or “Office Expenses” or “General Expenses” or “Miscellaneous Expenses”,, the item “Trade Expenses” is shown on the debit side of Trading A/c while the other items of, expenses are shown on the debit side of Profit &Loss A/c., 7) The adjustment for Bad Debts and Provision for Bad and Doubtful Debts should be effected, after other adjustments for Debtors are given effect to. Such adjustments can be unrecorded, sales, drawings included in Debtors, drawings treated as sales, etc., 8) Reserve for Discount on Debtors should be given effect after the adjustments for Bad Debts and, Provision for Bad and Doubtful Debts., 9) Reserve for Discount on Creditors should be given effect after making all the other adjustments, concerning Creditors., 10) Hidden / Self-explanatory adjustments are to be given effect even if there is no special instruction, in the problem in this respect., 11) Closing Stock should be taken at “Cost or Market Price, whichever is less.", 12) If a manager or a partner is allowed commission at a certain percentage on Net Profit, such, commission should be calculated in the following manner depending upon how the commission, is quoted :, a) If it is on Net Profit before charging such commission : , Commission Amount =, , Rate of Commission × Net Profit, 100, , b), , If it is on Net Profit after charging such commission : , Rate of Commission × Net Profit, Commission Amount =, 100+ Rate of Commission, 13) When the date of drawings are not given Interest on drawings should be calculated on average, basis or for six months , Drawings × Rate × 6, 100 12, 14) If a partner introduces capital in the middle of the accounting year, then interest on capital, should be calculated on proportionate time period only. (This complication is not expected at, your Std. XII level)., 22

Page 32 :

Treatment of some important Items appearing in Trial Balance only :, i) Any outstanding expenses, , Liability Side of Balance Sheet, , ii) Any Prepaid Expenses, , Asset Side of Balance Sheet, , iii) Any outstanding income, , Asset Side of Balance Sheet, , iv) Income Received in Advance, , Liability Side of Balance Sheet, , v) Depreciation, , Debit Side of Profit & Loss A/c, , vi) Loss on Sale of any Asset, , Debit Side of Profit & Loss A/c, , vii) Goods withdrawn by partner, , Debit Side of Capital/Current A/c, , viii) General Reserve / Reserve Fund, , Liability Side of Balance Sheet, , ix) Deposit from Public, , Liability Side of Balance Sheet, , x) Goods distributed as free samples, , Debit side of Profit & Loss A/C, , xi) Suspense Account:, a) If it is on Debit Side, , Show the same figure on Asset Side, , b) If it is on Credit Side, , Show the same figure on Liability Side, , xii) Bank for Collection of Bills, , Asset Side of Balance Sheet, , Steps for solving problem :, 1) Prepare the necessary accounts, including the working notes., 2) Place some mark on Trial Balance items for external as well as internal adjustments., 3) Go through Trial Balance items and give only one accounting effect sequentially., 4) Go through Adjustments and give two accounting effects., 5) Close Ledgers in the working notes, except capital., 6) Find Gross Profit, Net Profit and transfer it to individual capital accounts., 7) Find the closing balance in capital and transfer it to Balance Sheet., 8) Tally the Balance Sheet., , 23

Page 33 :

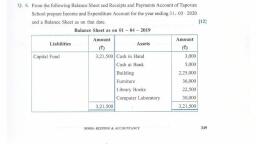

Illustrations, 1., , Daya and Kshama are Partners sharing Profits and Losses in the ratio of 1:1 from the, following Trial Balance and additional information prepare Trading and Profit and Loss, account for the year ended 31st March 2019 and Balance Sheet as on that date., Trial Balance as on 31st March, 2019, , Debit Balance, Stock (1/4/2018), Bills Receivable, Wages and salaries, Sundry Debtors, Bad debts, Purchases, Motor car, Machinery, Audit Fees, Sales Return, Discount, Building, Cash at Bank, 10% Investment, Advertisement(Paid for 9 months), Royalties, , Amt. `, 65,000, 28,000, 9,000, 1,32,500, 1,000, 1,48,000, 68,000, 1,14,800, 1,200, 2,000, 2,300, 75,000, 12,000, 20,000, 4,500, 3,000, 6,86.300, , Credit Balance, General Reserve, Capital:, Daya, Kshama, Creditors, R.D.D., Sales, Outstanding Wages, Purchases Returns, Discount, , Amt. `, 14,500, 1,60,000, 1,20,000, 98,000, 1,800, 2,85,500, 700, 4,000, 1800, , 6,86.300, , Adjustment and Additional Information :, (1) Closing Stock ` 40,000., (2) Depreciate Building and Machinery @ 5% and 3% respectively., (3) Bills Receivable included dishonoured bill of ` 3000., (4) Goods worth ` 1000 taken by Daya for personal use was not entered in the books of accounts., (5) Write off ` 1800 as Bad debts and maintain R.D.D. at 5% on Sundry Debtors., (6) Goods of ` 6000 were sold but no entry was made in the books of accounts., , 24

Page 34 :

IN THE BOOKS OF DAYA AND KSHAMA, , Trading, Profit and Loss Account for the year Ended 31st March 2019, Dr. , Particulars, To Opening Stock, To Purchases, Less - Purchases Return, To Royalties, To wages and Salaries, To Gross Profit c/d, , Amt, , Amt, , `, , `, , Particulars, , 65,000 By Sales, 1,48,000, Add :Unrecorded Sales, 4,000 1,44,000, 3,000 Less : Sales Return, 9,000 By Goods take over by, Daya for Personal Use, 1,09,500 By Closing Stock, 3,30,500, , To Advertisement, Add : o/s for 3 months, To Audit fees, To Depreciation on :, Building, Machinery, To Bad debts (old), Add : New Bad Debts, Add : New R.D.D., Less : R.D.D.(old), To Discount, To Net Profit, (Transferred to Capital A/c's), Daya, Kshama, , 4,500, 1,500, , 3,750, 3,444, 1,000, 1,800, 6,985, 9,785, 1,800, , 44,311, 44,310, , 6,000 By Gross Profit b/d, 1,200 By Interest Accrued on, Investment, By Discount, 7,194, , Cr., , Amt, , Amt, , `, , `, , 2,85,500, 6,000, 2,91,500, 2,000 2,89,500, 1,000, 40,000, 3,30,500, 1,09,500, 2,000, 1,800, , 7,985, 2,300, , 88,621, 1,13,300, , 25, , 1,13,300

Page 35 :

Balance Sheet as on 31st March, 2019, Liabilities, , Amt., , Amt., , `, , `, , Assets, , Capital : Daya, 1,60,000, Building, Add : Net Profit, 44,311, Less : Depreciation 5%, Less: (Goods taken over by, 1,000 2,03,311 Machinery, Daya for personal use), Capital Kshama, Add : Net Profit, General Reserve, O/s Advertisement Exp., (3 months), Creditors, Outstanding Wages, , 1,20,000, 44,310 1,64,310, 14,500, 1,500, 98,000, 700, , Less : Depreciation 3%, Bills Receivable, Less : Bills Receivable, Dishonoured, Motor Car, Cash at Bank, Closing Stock, Sundry Debtors, Add : Bills Receivable, Dishonoured, Add : Unrecorded Sales, Less : Bad debts (New), Less : R.D.D. 5% (New), 10% Investment, Add : Interest Accrued, , 4,82,321, , Amt., , Amt., , `, , `, , 75,000, 3,750, 1,14,800, , 71,250, , 3,444 1,11,356, 28,000, 3,000, 25,000, 68,000, 12,000, 40,000, 1,32,500, 3,000, 1,35,500, 6,000, 1,41,500, 1,800, 1,39,700, 6,985 1,32,715, 20,000, 2,000, 22,000, 4,82,321, , Working Notes :, (1) Adjustment No. 3, 5 and 6 are co-related with sundry Debtors. So, while calculating R.D.D., 5% on sundry Debtors, Amount of dishonour of Bills ` 3,000) and goods sold but not recorded, (` 6000) will be added into the sundry Debtors, then new Bad Debts will be deducted and then, Less R.D.D (New) 5% 6985 after 5% R.D.D should be calculated., 1st effect Sundry Debtors, , Add : Bills dishonoured, , Add : Unrecorded sales, , , Less Bad debts (New), , , Less R.D.D (New) 5%, , , `, , 1,32,500, 3,000, 6,000, 1,41,500, 1,800, 1,39,700, 6,985, 1,32,715, 26, , (Shown on Assets side of Balance Sheet)

Page 36 :

`, 2nd Effect To Bad debts (Old) , 1,000, Add Bad debts (New) , 1,800, Add New R.D.D , 6,985, , , 9,785, Less R.D.D. (Old) , 1,800, , ` 7,985, , 2., , - (Shown on Debit side of Profit and, Loss A/C), , From the following Trial Balance and Adjustments given below you are required to prepare, Trading and Profit and Loss Account for the year ended 31st March, 2019 and Balance, Sheet as on that date in the books of Shilpa and Katrina., Trial Balance as on 31st March, 2019, , Particulars, Land and Building, Furniture, Sundry Debtors, Stock (1/4/2018), Bad Debts, Printing and Stationary, Wages, Salaries, Carriage Inward, Sales Return, Drawings :, Shilpa, Katrina, Discount, Advance Given to Shaharukh, Cash in hand, Cash at Bank, Interest, Commision, Royalties, Purchases, , Debit `, 37,800, 17,250, 40,000, 65,000, 400, 4,000, 3,000, 5,000, 4,000, 2,000, , Particulars, Capital, Shilpa, Katrina, Bills payable, Bank Over draft, Purchases Return, Sundry Creditors, Bank Loan, Interest received, R.D.D, Sales, , 2,000, 3,000, 2,030, 10,000, 20,000, 8,000, 1,000, 2,000, 2,000, 50,000, 2,78,480, , Credit `, 45,000, 45,000, 17,500, 10,000, 1,480, 22,000, 15,000, 1,500, 1,000, 1,20,000, , 2,78,480, , Adjustments, (1) The Stock in Hand was valued at ` 58,000 on 31st March, 2019., (2) Outstanding Expenses : Royalties ` 1,500 and Wages ` 800., , 27

Page 37 :

(3) Salaries paid in advance to staff ` 2,000., (4) Create a provision for Bad Debts ` 1,000 and Reserve for Doubtful Debts 3% on Sundry, Debtors., (5) Depreciate Land and Building by 5% and Furniture by 10%., , Dr. , , IN THE BOOKS OF SHILPA AND KATRINA, Trading and Profit and Loss Account for the year ended 31st March 2019, , Particulars, , Cr., Amount Amount, `, , To Opening Stock, To Purchase, Less : Purchases Return, To Wages, Add : O/s Wages, To Royalties, Add : O/s Royalties, To Carriage Inward, To Gross Profit c/d, , To Salaries, Less : Advance Salary, To Bad debts (Old), Add : Bad Debts (New), Add : R.D.D. (New), Less - R.D.D. (Old), To Depreciation :, Land and Building, Furniture, To Printing And Stationary, To Discount, To Interest, To Commission, To Net Profit, (Transfered to Capital A/c), Shilpa, Katrina, , Particulars, , `, , `, , 65,000 By Sales, 50,000, Less : Sales Return, 1,480 4,88,520 By Closing Stock, 3,000, 800, 3,800, 2,000, 1,500, 3,500, 4,000, 51,180, 1,76,000, 5,000, 2,000, 400, 1,000, 1,170, 2,570, 1,000, 1,890, 1,725, , 17,732, 17,733, , Amount Amount, , By Gross Profit b/d, 3,000 By Interest Received, , `, , 1,20,000, 2,000 1,18,000, 58,000, , 1,76,000, 51,180, 1,500, , 1,570, , 3,615, 4,000, 2,030, 1,000, 2,000, , 35,465, 52,680, 28, , 52,680

Page 38 :

Balance Sheet as on 31st March, 2019, Liabilities, Capital :, Shilpa, Add : Net Profit, Less : Drawings, Katrina, Add : Net Profit, Less : Drawings, Bills Payable, Outstanding Expenses :, Wages, Royalties, Bank Overdraft, Sundry Creditors, Bank Loan, , Assets, , Amount Amount, `, , `, , 45,000, 17,732, 62,732, 2,000, 45,000, 17,733, 62,733, 3,000, , 800, 1500, , Land and Building, Less : 5%Depreciation, Furniture, Less :10% Depreciation, 60,732 Sundry Debtors, Less : Bad debts, Less : R.D.D. 3%, 59,733 Cash in Hand, 17,500 Cash at Bank, Closing Stock, Advance Salary, 2,300 Advance to Shaharukh, 10,000, 22,000, 15,000, 1,87,265, , 3., , Amount Amount, `, , `, , 37,800, 1,890, 17,250, 1,725, 40,000, 1,000, 39,000, 1,170, , 35,910, 15,525, , 37,830, 20,000, 8,000, 58,000, 2,000, 10,000, , 1,87,265, , Rucha and Juili are partners sharing Profits and Losses in their Capital Ratio. From the, following Trial Balance and adjustments you are required to prepare Final Accounts., Trial Balance as on 31st March, 2019, , Particulars, Purchases, Trade Expenses, Salaries, Wages and Salaries, Advertisement (2 Years), Sales Returns, Freehold Property, Office Rent, Motor Van, Stock (1/4/2018), General Expenses, Sundry Debtors, Coal, Gas, Fuel, Carriage Inward, Carriage Outward, Plant and Machinery, , Debit `, 48,000, 3,000, 4,500, 2,800, 4,000, 8,000, 23,000, 5,000, 40,000, 89,500, 2,500, 62,000, 1,000, 800, 1,300, 13,800, , Particulars, Capital A/c, Rucha, Juili, Sundry Creditors, Sales, R.D.D., Bills Payable, Purchases Return, , 3,09,200, , Credit `, 80,000, 40,000, 22,000, 1,48,000, 1,200, 12,000, 6,000, , 3,09,200, 29

Page 39 :

Adjustments :, (1) Closing Stock is valued at ` 88,000 (Cost Price) and ` 90,000 (Market Price), (2) Rucha and Juili withdrawn from business ` 3000 and ` 2000 respectively for their personal use., (3) Depreciate Motor Van by 5% and Plant and Machinery by 7%., (4) Reserve for Doubtful Debts on Debtors @ 5% is to be created., (5) Outstanding Wages ` 800., (6) Goods of ` 6000 were purchased on credit but no entry was found in the Books of Account., IN THE BOOKS OF RUCHA AND JUILI, Trading and Profit and Loss Account for the year ended 31st March 2019, , Balance Sheet as on 31st March, 2019, Dr. , Cr., Particulars, Particulars, Amount Amount, Amount Amount, `, , To Opening Stock, To Purchases, Add : Unrecorded, Purchases, Less : Purchases Return, To Wages and Salaries, Add : Outstanding Wages, To Trade Expenses, To Coal, Gas Fuel, To Carriage Inward, To Gross Profit c/d, , To Salaries, To Depreciation, Motor Van, Plant and Machinery, To R.D.D. (New), Less : R.D.D. (Old), To Advertisement, Less : Prepaid Advt., To Office Rent, To General Expenses, To Carriage Outword, To Net Profit (Transferred, to Capital A/c's), Rucha, Juili, , 48,000, 6,000, 54,000, 6,000, 2,800, 800, , `, , `, , 89,500 By Sales, Add : Unrecorded, Sales, , 48,000, 3,600, 3,000, 1,000, 800, 93,100, 2,39,000, , Less : Sales Return, By Closing Stock, By Goods withdrawn, by Partners :, Rucha, Juili, , 4,500 By Gross Profit b/d, 2,000, 966, 3,400, 1,200, 4,000, 2,000, , 48,423, 24,211, , `, , 1,48,000, 6,000, 1,54,000, 8,000 1,46,000, 88,000, , 3,000, 2,000, , 5,000, , 2,39,000, 93,100, , 2,966, 2,200, 2,000, 5,000, 2,500, 1,300, , 72,634, 93,100, 30, , 93,100

Page 40 :

Balance Sheet as on 31st March, 2019, Liabilities, Capitals :, Rucha, Juili, Outstanding Wages, Sundry Creditors, Add : Unrecorded, Purchases, Bills Payable, , Amount Amount, `, , To Drawings, To Balance c/d, , Assets, , Motor Van, 1,25,423, Less : Depreciation 5%, 62,211 1,87,634 Plant and Machinery, 800 Less : Depreciation 7%, 22,000, Debtors, 6,000 28,000 Add: Unrecorded Sales, 12,000 Less : R.D.D. 5%, Closing Stock, Prepaid Advertisement, Freehold Property, 2,28,434, Partners Capital Account, , Dr., Particulars, , `, , Rucha, , Juili, , `, , `, , 3,000, 1,25,423, 1,28,423, , Particulars, , 2,000 By Balance b/d, 62,211 By Profit and Loss A/c, 64,211, By Balance b/d, , Amount Amount, `, , 40,000, 2,000, 13,800, 966, 62,000, 6,000, 68,000, 3,400, , `, , 38,000, 12,834, , 64,500, 88,000, 2,000, 23,000, 2,28,434, Cr., , Rucha, , Juili, , `, , `, , 80,000, 48,423, 1,28,423, 1,25,423, , 40,000, 24,211, 64,211, 62,211, , Working Notes :, (2) Advertisement Expenses are paid for 2 Years , so expenses of one year ` 2000 are prepaid., Prepaid Expenses (Advertisement) is treated as an Asset. The amount of prepaid should be, deducted from total amount of Advertisement in Profit and Loss Account., , 31

Page 41 :

4., , From the following Trial Balance of Mr. Piyush and Mr. Arun. You are required to prepare, Trading and Profit and Loss Account and Balance Sheet as on the date:, Trial Balance as on 31st March, 2019, , Particulars, Stock (1/4/2018), Purchases Salaries, Salaries, Wages, Carriage, Royalties, Freight, Printing and Stationery, Sundry Debtors, Furniture, Lease hold property, Investment, Travelling Expenses, Advertisement (For 3 years), Bad Debts, Discount Allowed, Cash in Hand, Cash at Bank, Fixed Deposits, , Debit `, 30,800, 80,000, 5,000, 7,500, 3,000, 2,500, 700, 1,050, 43,000, 20,200, 25,000, 15,000, 3,450, 30,000, 500, 1,800, 7,000, 20,000, 15,000, , Particulars, Capital Account, Piyush, Arun, Sundry Creditors, Interest received on Fixed Deposit, Bank Overdraft, Sales, , 3,11,500, , Credit `, 80,000, 80,000, 20500, 1000, 10,000, 1,20,000, , 3,11,500, , Adjustments :, (1) Stock on hand on 31st March, 2019 was Cost Price ` 40,000 and Market price ` 35,000., (2) Interest on Fixed Deposit ` 1200 is still receivable., (3) Provide R.D.D. at 2.5% on Sundry Debtors., (4) Depreciate Furniture by 5%., (5) Goods of ` 8000 destroyed by fire and insurance company admited a claim of 6000 only., , 32

Page 42 :

IN THE BOOKS OF MR. PIYUSH AND MR. ARUN., Trading and Profit and Loss Account for the year Ended 31st March 2019, Dr. , , Particulars, , Amount Amount, `, , To Opening Stock, To Purchases, To Wages, To Carriage, To Royalties, To Freight, To Gross Profit c/d, , Particulars, , `, , Amount Amount, `, , 30,800 By Sales, 80,000 By Goods destroyed by Fire, 7,500, 3,000 By Closing Stock, 2,500, 700, 38,500, , 500, 1,075, , 1,800 By Gross Profit b/d, 5,000 By Interest on Fixed Deposit, 1,050, Add : Interest Receivable, 1,575, 2,000, 1,010, , `, , 1,20,000, 8000, 35,000, , 1,63,000, To Discount, To Salaries, To Printing and Stationery, To Bad Debts, Add : R.D.D. (New), To Loss by Fire, To Depreciation on, Furniture, To Travelling Expenses, To Advertisement, Less : Prepaid Advt., To Net Profit, (Transfered to Capital A/c's), Piyush, Arun, , Cr., , 1,63,000, 38,500, 1,000, 1,200, , 2200, , 3,450, 30,000, 20,000, , 7,408, 7,407, , 10,000, , 14,815, 40,700, , 33, , 40,700

Page 43 :

Liabilities, Capital Account:, Piyush, Add : Net profit, Arun, Add : Net Profit, Sundry Creditors, Bank Overdraft, , 5., , Balance Sheet as on 31st March, 2019, Assets, Amount ` Amount `, Amount `, Leasehold Property, 80,000, Investment, 7,408, 87,408 Fixed Deposit, 15,000, 80,000, Add : Interest Receivable, 1,200, 7407, 87,407 Furniture, 20,200, 20,500 Less : Depreciation 5%, 1010, 10,000 Sundry Debtors, 43,000, Less : R.D.D. 2.5%, 1075, Insurance Claim, Prepaid Advertisement, Cash in Hand, Cash at Bank, Closing Stock, 2,05,315, , Amount `, 25,000, 15,000, 16,200, 19,190, 41,925, 600, 20,000, 7,000, 20,000, 35,000, 2,05,315, , M/s Sudarshan Traders is a Partnership Firm in which, Ram and Krushna are partners, sharing Profits and Losses in the ratio 3:2. From the following Trial Balance prepare Final, Account for the year 2018-19:, Trial Balance as on 31st March, 2019, Particulars, Debit `, Credit `, Opening Stock, 36,000, Capital A/C :, Ram, 1,60,000, Krushna, 80,000, Current A/C :, Ram, 8,000, Krushna, 4,000, Purchases, 1,00,000, Sales, 2,08,000, Sundry Debtors, 1,73,500, Sundry Creditors, 41,800, Bills Receivable, 47,000, Bills Payable, 21,000, Commission, 2,800, Wages, 1,760, Salaries, 3,000, Furniture, 25,000, Plant and Machinary, 63,000, R.D.D., 1,000, Investment, 10,500, Loans and Advances Given, 35,240, Insurance, 2,500, Bad debts, 500, 12% Govt. Bonds (Purchased on 1.1.2019), 15,000, 5,19,800, 5,19,800, 34

Page 44 :

Adjustments :, (1) Stock on hand on 31 March 2019 was valued at ` 38000., (2) Ram is allowed a Salary of ` 6000 and Krushna is allowed Commission at 3% on net sales., (3) Interest on Partner's Capital is to be provided @ 5% p.a., (4) Provide depreciation on Plant and Machinery 5%., (5) ` 3000 from our customer is not recoverable., (6) Prepaid Insurance ` 500., , Trading and Profit and Loss Account for the year ended 31st March 2019, Dr. , Cr., Particulars, , Amount Amount, `, , To Opening Stock, To Purchases, To Wages, To Gross Profit c/d, , To Commission, To Salaries, To Insurance, Less : Prepaid, To Ram's Salary, To Commission to Krushna, To Depreciation on :, Plant and Machinery, To Bad debts (Old), To R.D.D. (New), Less : R.D.D. (Old), To Interest on Capital, (Pratners Current A/C), Ram, Krushna, Net Profit (Transfered, Partners to Current Account), Ram, Krushna, , `, , Particulars, , 36,000 By Sales, 1,00,000 By Closing Stock, 1760, 1,08,240, 2,46,000, , 2,500, 500, , 2,800 By Gross Profit b/d, 3,000 By Interest on Govt, Bonds Receivable, 2,000, 6,000, 6,240, , Amount Amount, `, , `, , 2,08,000, 38000, , 2,46,000, 1,08,240, 450, , 3,150, 500, 3,000, 3,500, 1,000, , 2,500, , 8,000, 4,000, , 12,000, , 35,500, 35,500, , 71,000, 1,08,690, , 35, , 1,08,690

Page 45 :

Balance Sheet as on 31st March, 2019, Liabilities, , Amount Amount, `, , Capital :, Ram, Krushna, Current A/c :, Ram, Krushna, Creditors, Bills Payable, , Assets, , `, , Amount Amount, `, , Sundry Debtors, 1,60,000, Less-Bad debts, 80,000 2,40,000 Bills Receivable, Plant and Machinery, 57,500, Less : Depreciation, 41,740, 99,240 Furniture, 41,800 Investment, 21,000 Loan and Advances, Closing Stock, Prepaid Insurance, 12% Govt. Bonds, Add : Interest Receivable, 4,02,040, , `, , 1,73,500, 3,000 1,70,500, 47,000, 63,000, 3,150, 59,850, 25,000, 10,500, 35,240, 38,000, 500, 15,000, 450, 15,450, 4,02,040, , Dr. , Partners Current Account , Cr., Particulars, Ram Krushna, Particulars, Ram, Krushna, Amt. ` Amt. `, Amt. ` Amt. `, To Balance b/d, 4,000 By Balance b/d, 8,000, By Profit and Loss A/c, 6,000, (Ram's Salary), By Profit and Loss A/c, 6,240, (Commision), To Balance c/d, 57,500, 41,740 By Profit and Loss A/c, 8,000, 4,000, (Interest on capital), By Profit and Loss A/c, 35,500, 35,000, 57,500, 45,740, 57,500, 45,740, By Balance b/d, 57,500, 41,740, Working Notes :, (1) In this problem Current Account is given. So total Amount of fixed capital of Ram (`1,60,000), and Krishna (` 80,000) = ` 2,40,000 should be directly shown on the liability side of Balance, Sheet. Effect of adjustment related with capital. i.e. 5% interest on capital, 3% commission on, net sales, partners should be reflected on current account which is separately prepared. Closing, Balances of Current Account of partners will be shown on liability side of Balance sheet., (2) Amount of Debtor ( 3000) which is not recoverable is to be treated as Bad debts (New) and it, should be deducted from debtors on Assets side of Balance Sheet., (3) 12% Govt. Bonds - are purchased on 1.1.2019, So Interest receivable is only for 3 months (i.e., 1.1.2019 To 31.3.2019) @ 12% p.a. on 15000. Which is treated as income., 15,000, 3, 12, 100 ×, × 12 =, ` 1,800, 100, ` 1,800 is for 12 months, we have to consider Interest for 3 months only., , 36

Page 46 :

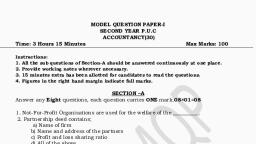

1,800, 3, 100 × 12 = ` 450, Interest on Govt Bonds @ 12% for 3 months is ` 450, 6., , From the following Trial Balance of Shreyas and Mrunal and adjustments you are required, to prepare Trading and Profit and Loss Account for the year ended 31st March, 2019 and, Balance Sheet as on that date:, Trial Balance as on 31st March, 2019 Particulars, Particulars, Capital Accounts :, Sheyas, Mrunal, Purchases, Sales, Bills Receivable, Bills Payable, Commission, Salaries, Insurance (9 months), Prepaid Rent, Sundry Creditors, Sundry Debtors, Postage, Freehold Premises, Furniture, Bad debts, Cash in Hand, Cash at Bank, Carriage Inward, Carriage Outward, Stock (1/4/2018), Returns, Wages, Outstanding Wages, , Debit `, , Credit `, 35,000, 20,000, , 37,800, 66,700, 8,000, 6,500, 2,400, 6,000, 9,000, 3,000, 48,900, 25,000, 1,700, 17,300, 20,000, 500, 4,500, 16,000, 800, 1,700, 22,500, 1,200, 3,100, Total, , 1,80,500, , 1800, 1600, 1,80,500, , Adjustments :, (1) Closing Stock ` 30.000, (2) Outstanding Expenses - Salary ` 1200 and Commission ` 400., (3) Depreciate Furniture @ 10%, (4) Provide for further Bad debts i ` 1200., (5) Goods of ` 5000 destroyed by fire and insurance company admited a claim of ` 2000 only., (6) Shreyas and Mrunal are sharing profits and losses in the ratio 2:1, 37

Page 47 :

Dr., , , THE BOOKS OF SHREYAS AND MRUNAL., Trading and Profit and Loss Account for the year ended 31st March 2019, , Particulars, To Opening Stock, To Purchases, Less : Returns, To Carriage Inward, To Wages, To Gross Profit c/d, To Insurance, Add : Outstanding, (3 months), To Salaries, Add : Outstanding, To Commission, Add : Outstanding, To Depreciation on Furniture, To Bad debts, Add : Bad Debts (New), To Loss by fire, To Postage, To Carriage Outward, To Net Profit (Transferred to, Capital Accounts), Shreyas, Mrunal, , Cr., Amount, `, , 37,800, 1,800, , 9,000, 3,000, 6,000, 1,200, 2,400, 400, , Amount, `, , Particulars, , 22,500 By Sales, Less : Returns, 36,000 By Goods destroyed, 800 by Fire, 3,100, 38,100 By Closing Stock, 1,00,500, 12,000 By Gross Profit b/d, , Amount Amount, `, , 66,700, 1200, , `, , 65,500, 5,000, , 30,000, 1,00,500, 38,100, , 7,200, 2,800, 2,000, , 500, 1,200, , 4,000, 2,000, , 1,700, 3,000, 1,700, 1,700, , 6,000, 38,100, , 38, , 38,100

Page 48 :

Balance Sheet as on 31st March, 2019, Liabilities, Capital Account :, Shreyas, Add : Net Profit, Mrunal, Add : Net Profit, Sundry Creditors, Bills Payable, Outstanding Expenses, Salaries, Commission, Outstanding Insurance, Outstanding Wages, 7., , Assets, , Amount Amount, `, , `, , 35,000, 4,000, 20,000, 2,000, , 1,200, 400, , 39,000, 22,000, 48,900, 6,500, , 1,600, 3,000, 1,600, 1,22,600, , Furniture, Less : Depreciation10%, Sundry Debtors, Less : Bad debts, Bills Receivable, Freehold Premises, Cash in Hand, Cash at Bank, Closing Stock, Insurance Claim, Prepaid Rent, , Amount Amount, `, , `, , 20,000, 2,000, 25,000, 1,200, , 18,000, 23,800, 8000, 17,300, 4500, 16,000, 30,000, 2,000, 3,000, 1,22,600, , Sapre and Atre are partners sharing Profits and Losses equally. From the following Trial, Balance and Adjustments, prepare Trading and Profit and Loss Account for the year ended, 31st March, 2019 and Balance Sheet as on that date., Trial Balance as on 31st March, 2019, Debit Balance, , Sundry Debtors, Purchases, Returns, Opening Stock, Land and Building, Carriage, Rent, Rates & Taxes, Drawings :, Sapre, Atre, Salaries, Bad debts, Machinery, (Additions on 1st Oct, 2018,, ` 10,000), Advertisement, Provident Fund Investment, , Credit Balance, , Amount, `, , 40,000, 65,000, 800, 18,000, 10,000, 1,200, 1,000, 3,000, 2,000, 3,200, 1,000, 25,000, , Sales, Sundry Creditors, Sundry Income, Capital :, Sapre, Atre, Provident Fund, Returns, Commission Pre Received, R.D.D, , 4,000, 18,500, 1,92,700, , Amount, `, , 85,000, 23,000, 2,000, 35,000, 35,000, 10,000, 1,500, 800, 400, , 1,92,700, 39

Page 49 :

Adjustments :, 1) Closing Stock is valued at ` 23,000., 2) Depreciate Land and Building @ 5% and Machinery @10%., 3) Create Provision for Bad and Doubtful Debts at 5% on Sundry debtors and write off ` 1000 for, Bad-debts., 4) Goods worth ` 3000 were sold, but no entry was found in the books of account., 5) Outstanding carriage ` 500., 6) Goods worth ` 8000 were purchased on 31st March, 2019 and included in the closing stock but, not recorded in the Books of Account., IN THE BOOKS OF SAPRE & ATRE, TRADING AND PROFIT & LOSS ACCOUNT, For the year ended 31st March, 2019, Dr. , Cr., Particulars, To Opening Stock, To Purchases, Add : Unrecorded, Purchases, Less : Returns, To Carriage, Add : Outstanding, To Gross Profit c/d, , To Salaries, To Rent, Rates & Taxes, To Depreciation, Land & Building, Plant & Machinery, To Bad debts (Old), Add : Bad-debts(New), Add : New R.D.D., Less - R.D.D (Old), To Advertisement, To Net Profit Transferred, to Capital Accounts :, Sapre, Atre, , Amt `, 65,000, 8,000, 73,000, 1,500, 1,200, 500, , Particulars, Amt `, 18,000 By Sales, Add : Unrecorded, Sales, Less : Returns, , 3,300, 3,300, , 88,000, 800, , Amt `, , 87,200, , 71,500, By Closing Stock, 1,700, 19,000, 1,10,200, 3,200 By Gross Profit b/d, 1,000, By Sundry Income, , 500, 2,000, 1,000, 1,000, 2,100, 4,100, 400, , Amt `, 85,000, 3,000, , 23,000, , 1,10,200, 19,000, 2,000, , 2,500, , 3,700, 4,000, , 6,600, 21,000, 40, , 21,000

Page 50 :

BALANCE SHEET, As on 31st March, 2019, Liabilities, , `, , Capital : Sapre, Add : Net Profit, Less : Drawings, Capital : Atre, Add : Net Profit, Less : Drawings, Providend Fund, Outstanding Expenses :, Carriage, Creditors, Add : Unrecorded, Purchases, Commission Received in, advance, , Assets, , Amount Amount, , Amount Amount, , `, , 35,000, 3,300, 38,300, 3,000, 35,000, 3,300, 38,300, 2,000, , `, , 35,300, , 36,300, 10,000, 500, , 23,000, 8,000, , Land & Building, Less : Depreciation5%, Plant & Machinery, Less:Depreciation10%, Sundry Debtors, Add : Unrecorded, Sales, Less : Bad debts (Now), Less : R.D.D. 5%, Closing Stock, Providend Fund, Investment, , 10,000, 500, 25,000, 2,000, 40,000, 3,000, 43,000, 1,000, 42,000, 2,100, , `, , 9,500, 23,000, , 39,900, 23,000, 18,500, , 31,000, , 800, 1,13,900, , 1,13,900, , Working Notes :, 1) While calculating Depreciation on Machinery, we have to consider the date of purchase of, additional Machine, which is purchased on 1st Oct 2018. (Additional Machine Purchased, `10,000) So 25,000, , 15,000, On ` 15,000, Dep. @ 10% for , 12 months, , , 10,000, On 10,000, Dep. @ 10% for, 6 months only, , , , 1,500 500 , 1, 1, 6, 10, = ` 1,500 , × 100 ×, = ` 500, 15,000 ×, 1,000, 12, 100, So Depreciation is 1,500 + 500 = ` 2,000, , 41

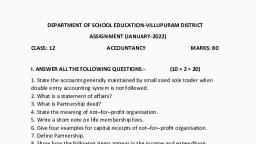

Page 51 :