Page 2 : 1st Edition : 2008-09, 13rd Revised Edition : 2020-21, , q ys[kk'kkL= : MkW- ,l- osG flag, q Accountancy : Dr. S. K. Singhq Prob. & Sol. in Accountancy :, Dr. S. K. Singhq Project Work in Accountancy :, Dr. Singh & Guptaq m|ferk : MkW- flag ,oa xqIrk, q Entrepreneurship : Dr. Singh & Guptaq izSfDVdy m|ferk : MkW- flag ,oa xqIrk, q O;kolkf;d v/;;u : MkW- flag ,oa xqIrk, q O;kolkf;d v/;;u : MkW- vkj- ;w- flag, , q Business Studies : Dr. Singh & Guptaq Business Studies : Dr. R.U. Singhq Project Work in Business Studies :, Dr. Singh & Guptaq vFkZ'kkL= : MkW- vuqie vxzoky, q Economics : Dr. Anupam Agrawalq Prob. & Sol. in Economics :, Dr. Anupam Agrawalq Project Work in Economics :, Dr. Anupam Agrawalq Lab Manual Mathematics :, Dr. Sharma & Goyal-, , To protect you against counterfeit/fake/duplicate books we have put a Hologram on the cover of our titles. The, hologram displays a unique 3-D multilevel, multicolor effect of our logo from different angles, a flying bird is on right, lower side which is shown as flying when the Hologram is moved, Gradient lines top right of the hologram which, move with the movement of Hologram, SBPD in switch of SBPD logo when u turn the hologram 90º then you can see, SBPD or when tilted properly illuminated under a single source of light., A fake hologram does not show above qualities of Original Hologram., , ã, , Authors, Book Code : 5065, ISBN : 978-93-83697-99-1, Price : ` 530.00, No part of this publication can be reproduced or copied in any form or by any means without permission in writing of, the Publisher. Breach of this condition is liable for legal action., Note : This publication is being sold on the condition and understanding that the information, comments and views, it contains are merely for guidance and reference and must not be taken as having the authority of, or being binding, in any way on, the author, editors, publishers and sellers, who do not owe any responsibility whatsoever for any loss,, damage or distress to any person, whether or not a purchaser of this publication, on account of any action taken or, not taken on the basis of this publication. Despite all the care taken, errors or omissions may have crept, inadvertently into this publication., All disputes are subject to the jurisdiction of competent courts in Agra., , SBPD Publications, , , 3/20B, Agra-Mathura Bye Pass Road, Near Tulsi Cinema, Agra-282 002, Phones : (0562) 2527707, 2854327, 2858183, 4042977, 4304545; Mobile : 09358177555,, 09412258082-86; e-mail :

[email protected]; visit us at : www.sbpdpublications.com

Page 3 :

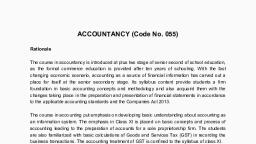

Preface, The present book 'Accountancy' has been written to meet the specific requirements of the, students of Class XII preparing for CBSE, Delhi, JAC, Ranchi and other State Boards, examinations. The book is divided into two parts, viz. Part A and Part B.., Distinctive Features :, The book has a number of distinctive features, some of which are as follows :, q Learning objectives in the form of chapter outline have been given at the beginning of, each chapter., q Systematic accounting treatment of the subject in simple language and lucid manner., q Accounting treatment in conformity with the various laws and New Companies Act,, 2013 and Accounting Standards issued by the Institute of Chartered Accountants of, India., q Treatment of Goodwill as per AS-26 (New Indian AS-38)., q Problems relating to Cash Flow Statement have been solved as per revised, AS-3 issued by ICAI., q Exhibits and diagrams have been given to explain and illustrate the material., q Questions have been arranged under (i) Useful Questions (A) Long Answer,, (B) Short Answer, (C) Very Short Answer and (D) Objective Type Questions and (ii), Practical Problems which have further been sub-classified under appropriate, headings, that too, according to the serial order of Illustrations., q Practical problems have been arranged in order of their standard so that logical, sequence and flow from simple to hard and to harder could be maintained., q Chapterwise Objective type Questions is also Provided Separately in form of Booklets., This will help Students in preparation of Board Exam as well as CA-CPT Exam., q In addition, the book contains latest model papers and board question papers., q The Chapter on redemption of debentures is fully revised pertaining to Companies, Act, 2013 with the following descriptions:, (i) Creating Debenture Redemption Reserve @ 25%/10% as per Section 71(4) of the, Companies Act, 2013, Rule 18(7b) of the Companies (Share Capital and Debentures), Rules 2014 and 2019., (ii) Investment or deposit of 15% of the face value of debentures to be redeemed towards, Debentures Redemption Investment as per Rule 18(7C) of the Companies (Share, Capital and Debentures) Rules, 2014., (iii) As per Section 53 of the Companies Act, 2013, Companies would no longer be, permitted to issue shares at discount. Hence, teachers are requested not to teach issue, of shares at discount, however they should be acquainted with the concept of issue of, shares at discount ., The authors are highly grateful to M/s SBPD Publications for the initiative and pains, taken to get the book printed and published so nicely and that, too, in a very short period of time., We are also thankful to the teachers and students who have appreciated the book and, given feed back for the improvement of the book and look forward for their Valuable, Suggestions., Authors

Page 4 :

Highlights of the Companies Act, 2013 and, Companies (Share Capital and Debentures) Rule 2014, From Accounting Point of View, 1. Law provides for uniform financial year (April to March) for all Companies (Section, 129 : Financial Year)., 2. The maximum number of partners in case of Partnership Firms would be 50 as per, Companies (Miscellaneous) Rules, 2014., 3. As per Companies (Amendment) Act, 2015, the requirement of minimum paid up, capital for Public Company and Private Company of ` 5,00,000 and ` 1,00,000, respectively has been removed., 4. Shares, other than Sweat Equity Share, cannot be issued at a discount. (Section 53, Prohibition on Issue of Shares at Discount)., 5. Rate of Maximum Interest on Calls-in-advance (increased from 6% p.a. to) 12% p.a., 6. Rate of Maximum Interest on Calls-in-arrears (increased from 5% p.a. to) 10% p.a., 7. Schedule-VI of the 1956 Companies Act has been replaced by Schedule III of the, Companies Act, 2013., 8. As per SEBI Circular No. 12 of June 17, 2014, Rule 1(C) Condition of 90% as, minimum subscription of issue size has been withdrawn. Now it requires merely, disclosure of minimum subscription in the offer document (i.e., prospectus) as, required under Section 39(1) of Companies Act, 2013., 9. (i) According to Section 39(2) of the Companies Act, 2013, the amount payable on, every security shall not be less than 5% of the nominal amount of the security or, such other percentage of amount, as may be prescribed by SEBI by making, regulations., (ii) As per SEBI, guidelines, application money on each share should not be less than, 25%/10% of the issue price of each share., 10. As per Rule 18(7) of Companies (Share Capital and Debentures) Rule, 2014, atleast, 25%/10% (Companies Rule 2019) of debentures issued must be transferred from, Surplus of Profit and Loss Statement to Debenture Redemption Reserve (DRR), before the commencement of redemption of debentures., 11. Every Company which is required to create DRR shall on or before 30th April each, year, must invest or deposit in specified securities, a sum of 15% of debentures to be, redeemed maturing during the year ending 31st March of the next year., 12. According to Accounting Standard (AS) 4 Revised the proposed dividend will not be, treated as current liability of that year.

Page 5 :

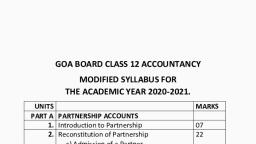

Syllabus, Central Board of Secondary Education (CBSE), Delhi, ACCOUNTANCY XII, One Paper, , 3 Hours, , Units, Part A :, Unit 1., Unit 2., Unit 3., Part B :, Unit 4., Unit 5., Part C :, , Theory : 80 Marks, Periods, , Marks, , Accounting for Not for Profit Organizations,, Partnership Firms and Companies, Financial Statements of Not-for-Profit Organizations, Accounting for Partnership Firms, Accounting for Companies, , 25, 90, 35, , 10, 30, 20, , 150, , 60, , 30, 20, , 12, 8, , 50, , 20, , 20, , 20, , Financial Statement Analysis, Analysis of Financial Statements, Cash Flow Statement, Project Work, Project work will include :, Project File, Written Test, Viva Voce, , 4 Marks, 12 Marks (One Hour), 4 Marks, OR, , Part B :, , Computerized Accounting, , Unit 4., , Computerized Accounting, , 50, , 20, , Practical Work, , 20, , 20, , Part C :, , Practical work will include :, Practical File, Practical Examination, Viva Voce, , 4 Marks, 12 Marks (One Hour), 4 Marks, , Part A : Accounting for Not for Profit Organizations, Partnership Firms and Companies, 60 Marks, Unit 1 : Financial Statements of Not-for-Profit Organisation, q Not-for-Profit Organisations : Concept, q Receipts and Payments Account : Features and Preparation., q Income and Expenditure Account : Features, Preparation of Income and Expenditure, Account and Balance Sheet from the given receipts and payments account with additional, information.

Page 6 :

(ii), Unit 2 : Accounting for Partnership Firms, q Partnership : Features, Partnership Deed., q Provisions of the Indian Partnership Act 1932 in the Absence of Partnership Deed., q Fixed v/s Fluctuating Capital Accounts. Preparation of Profit & Loss Appropriation, Account-Division of Profit among Partners, Guarantee of Profits., q Past Adjustments (relating to interest on Capital, Interest on Drawing, Salary and Profit, Sharing Ratio)., q Goodwill : Nature, Factors Affecting and Methods of Valuation-Average Profit, Super, Profit and Capitalization., Note : Interest on partner’s loan is to be treated as a charge against profits., Accounting for Partnership Firms Reconstitution and Dissolution, q Change in the Profit Sharing Ratio among the Existing Partners-Sacrificing Ratio,, Gaining Ratio, Accounting for Revaluation of Assets and Reassessment of Liabilities and, Treatment of Reserves and Accumulated Profits, Preparation of Revaluation Account and, Balance Sheet., q Admission of a Partner : Effect of Admission of a Partner on Change in the Profit Sharing, Ratio, Treatment of Goodwill (as per AS-26), Treatment for Revaluation of Assets and Reassessment of Liabilities, Treatment of Reserves and Accumulated Profits, Adjustment of, Capital Accounts and Preparation of Balance Sheet., q Retirement and Death of a Partner : Effect of Retirement/Death of a Partner on Change in, Profit Sharing Ratio, Treatment of Goodwill (as per AS-26), Treatment for Revaluation of, Assets and Re-assessment of Liabilities, Adjustment of Accumulated Profits and, Reserves, Adjustment of Capital Accounts and Preparation of Balance Sheet. Preparation, of Loan Account of the Retiring Partner., Calculation of Deceased Partner s Share of Profit till the Date of Death. Preparation of, Deceased Partner sCapital Account and his Executor sAccount., q Dissolution of a Partnership Firm : Meaning of Dissolution of Partnership and, Partnership Firm, Types of Dissolution of a Firm. Settlement of Accounts-Preparation of, Realization Account, and other Related Accounts : Capital Accounts of Partners and, Cash/Bank A/c (Excluding Piecemeal Distribution, Sale to a Company and Insolvency of, Partner(s))., Note : (i) The realised value of each asset must be given, at the time of dissolution., (ii) In case, the realisation expenses are borne by a partner, clear indication should be given, regarding the payment thereof., Unit 3 : Accounting for Companies, Accounting for Share Capital, q Share and Share Capital : Nature and Types., q Accounting for Share Capital : Issue and Allotment of Equity and Preferences Shares., Public Subscription of Shares-over Subscription and Under Subscription of Shares; Issue, at Par and at Premium, Calls in Advance and Arrears (Excluding Interest), Issue of Shares, for Consideration Other than Cash., q Concept of Private Placement and Employee Stock Option Plan (ESOP)., q Accounting Treatment of Forfeiture and Re-issue of Shares., q Disclosure of Share Capital in the Balance Sheet of a Company., Accounting for Debentures, q Debentures : Issue of Debentures at Par, At a Premium and at a Discount. Issue of, Debentures for Consideration other than Cash, Issue of Debentures with terms of, Redemption; Debentures as Collateral Security-Concept, Interest on Debentures. Writing, off Discount/Loss on Issue of Debentures., q Redemption of Debentures-Methods : Lump-sum, Draw of Lots, Creation of Debenture, Redemption Reserve., Note : Related sections of the Companies Act, 2013 will apply., Part B : Financial Statement Analysis, 20 Marks, Unit 4 : Analysis of Financial Statements, q Financial Statements of a Company : Statement of Profit and Loss and Balance Sheet in, the Prescribed Form with Major Headings and Sub-Headings (as per Schedule III to the, Companies Act, 2013)., Note : Exceptional Items, extraordinary items and profit (loss) from discontinued

Page 7 :

(iii), operations are excluded., Financial Statement Analysis : Objectives, Importance and Limitations., Tools for Financial Statement Analysis : Comparative Statements, Common Size, Statements, Cash Flow Analysis, Ratio Analysis., q Accounting Ratios : Meaning, Objectives, Classification and Computation., q Liquidity Ratios : Current Ratio and Quick Ratio., q Solvency Ratios : Debt to Equity Ratio, Total Assets to Debt Ratio, Proprietary Ratio and, Interest Coverage Ratio., q Activity Ratios : Inventory Turnover Ratio, Trade Receivables Turnover Ratio, Trade, Payables Turnover Ratio and Working Capital Turnover Ratio., q Profitability Ratios : Gross Profit Ratio, Operating Ratio, Operating Profit Ratio, Net, Profit Ratio and Return on Investment., Note : Net Profit Ratio is to be calculated on the basis profit before and after tax., Unit 5 : Cash Flow Statement, q Meaning, Objectives and Preparation (as per AS-3 (Revised) (Indirect Method only), Note : (i) Adjustments relating to depreciation and amortisation, profit or loss on sale of, assets including investments, dividend (both final and interim) and tax., (ii) Bank overdraft and cash credit to be treated as short-term borrowings., (iii) Current investments to be taken as marketable securities unless otherwise specified., Project Work, 20 Marks, Note : Kindly refer to the guidelines published by the CBSE., OR, Part B : Computerised Accounting, 20 Marks, Unit 3 :, Computerised Accounting, Overview of Computerised Accounting System., q Introduction : Application in Accounting., q Features of Computerised Accounting System., q Structure of CAS., q Software Packages : Generic, Specific, Tailored, Accounting Application of Electronic Spreadsheet., q Concept of Electronic Spreadsheet., q Features Offered by Electronic Spreadsheet., q Application in Generating Accounting Information, Bank Reconciliation Statement;, Asset Accounting; Loan Repayment of Loan Schedule, Ratio Analysis., q Data Representation Graphs, Charts and Diagrams., Using Computerised Accounting System., q Steps in installation of CAS, codification and Hierarchy of account heads, creation of, accounts., q Data : Entry, validation and verification., q Adjusting entries, preparation of balance sheet, profit and loss account with closing, entries and opening entries., q Need and security features of the system., Database Management System (DBMS), q Concept and Features of DBMS., q DBMS in Business Application., q Generating Accounting information-Payroll., q, q

Page 8 :

(iv), , Jharkhand Academic Council (JAC), Ranchi, , ACCOUNTANCY, One Paper, , 3 Hours, , Unit, Part A :, 1., 2., 3., 4., Part B :, 5., 6., 7., , Part C :, 5., 6., 7., 8., , 80 Marks, Periods Marks, , Accounting for Not-For-Profit Organisations,, Partnership Firms and Companies, Accounting for Not-for-Profit Organisations, Accounting for Partnership Firms, Reconstitution of Partnership, Accounting for Share Capital and Debenture, Financial Statement Analysis, Analysis of Financial Statements, Cash Flow Statement, Project Work, Unit 1 : Project File, 4 marks, Unit 2 : Written Test, 12 marks (one hour), Unit 3 : Viva Voce, 4 marks, OR, Computerized Accounting, Overview of Computerized Accounting System, Accounting using Data Base Management System (DBMS), Accounting Applications of Electronic Spread Sheet, Practical Work in Computerized Accounting, Unit 1 : File, 4 marks, Unit 2 : Practical Examination, 12 marks (one hour), Unit 3 : Viva Voce, 4 marks, , 22, 14, 34, 54, 124, , 10, 5, 20, 25, 60, , 33, 33, 18, , 12, 8, 20, , 84, , 40, , 12, 26, 24, 22, , 5, 8, 7, 20, , 84, , 40, , Part A : Accounting for Not-for-Profit Organizations,, Partnership Firms and Companies, (Periods 124), Unit 1 :Accounting for Not-for-Profit Organisations, (Periods 22), q Not-for-Profit Organisations : Meaning and Examples., q Receipts and Payments Account : Meaning and Concept of Fund based Accounting, q Preparation of Income and Expenditure Account and Balance Sheet from Receipt, and Payment Account with Additional Information., Unit 2 : Accounting for Partnership Firms, (Periods 14), q Nature of Partnership Firm, Partnership Deed Meaning, Importance., q Partners Capital Accounts : Fixed Vs. Fluctuating Capital, Division of Profit, among Partners, Profit and Loss Appropriation Account including Past, Adjustments.

Page 9 :

(v), Unit 3 : Reconstitution of Partnership, (Periods 34), q Changes in Profit Sharing Ratio among the Existing Partners Sacrificing Ratio, and Gaining Ratio., q Accounting for Revaluation of Assets and Liabilities and Distribution of Reserves, and Accumulated Profits., q Goodwill : Nature, Factors affecting and Methods of Valuation : Average Profit,, Super Profit and Capitalisation Methods., q Admission of a Partner : Effect of Admission of Partners, Change in Profit Sharing, Ratio, Accounting Treatment for Goodwill (as per AS -10), Revaluation of Assets, and Liabilities, Reserves (Accumulated Profit) and Adjustment of Capitals., q Retirement/Death of a Partner : Change in Profit Sharing Ratio, Accounting, Treatment of Goodwill, Revaluation of Assets and Liabilities, Adjustment of, Accumulated Profits (Reserve) and Capitals., Unit 4 : Accounting for Share Capital and Debenture, (Periods 54), q Share Capital : Meaning, Nature and Types., q Accounting for Share Capital : Issue and Allotment of Equity and Preference, Shares; Private placement of shares, meaning of employee stock option plan., Public Subscription of Shares : Over Subscription and Under Subscription; Issue, at Par, Premium and at Discount; Calls in Advance, Calls in Arrears, Issue of, Shares for Consideration other than Cash., q Forfeiture of Shares : Accounting Treatment, Re-issue of Forfeited Shares., q Presentation of Share Capital and Debenture in Company sBalance Sheet., q Issue of Debenture : At Par, at Premium, Issue of Debentures for Consideration, other than Cash., q Redemption of Debentures out of Capital Redemption Methods : Lump-sum, Payment, Draw by Lots, Purchase in the Open Market and Conversion (Excluding, Cum-interest and Ex-interest)., Part B : Financial Statement Analysis, Unit 5 : Analysis of Financial Statements, (Periods 33), q Financial Statements of a Company : Preparation of Simple Balance Sheet of a, Company in the Prescribed Form with Major Headings only., q Financial Statement Analysis : Meaning, Significance and Limitations., q Tools for Financial Statement Analysis : Comparative Statements, Common Size, Statements., Accounting Ratios : Meaning and Objectives, Types of Ratios, Liquidity Ratios : Current Ratio, Liquid Ratio, Solvency Ratios : Debt to Equity, Total Assets to Debt, Proprietary Ratio., Activity Ratios, : Inventory Turnover, Debtors Turnover, Payable, Turnover, Working Capital Turnover, Fixed Assets, Turnover., Profitability Ratio : Gross Profit, Operating Ratio, Net Profit Ratio, Return on, Investment, Earning per Share, Dividend per Share, Price, Earning Ratio.

Page 10 :

(vi), Unit 6 : Cash Flow Statement, (Periods 33), q Cash Flow Statement : Meaning and Objectives, Preparation, Adjustments, related to Depreciation, Dividend and Tax, Sale and Purchase of Non-Current, Assets (as per revised standard issued by ICAI)., Unit 7 : Project Work in Accounting, (Periods 18), (Please refer to the Guidelines published by the CBSE), OR, Part C : Computerised Accounting, (Periods 84), Unit 5 : Overview of Computerized Accounting System, (Periods 12), q Concept and Types of Computerised Accounting System (CAS), q Features of a Computerized Accounting System, q Structure of a Computerised Accounting System, Unit 6 : Accounting Using Data Base Management System (DBMS), (Periods 26), q Concept of DBMS, q Objects in DBMS : Tables, Queries, Forms, Reports, q Creating Data Tables for Accounting, q Using Queries, Forms and Reports for Generating Accounting Information., Applications of DBMS in Generating Accounting Information such as, Shareholders Records, Sales Reports, Customers' Profile, Suppliers' Profile,, Payroll, Employees' Profile, Petty Cash Register., Unit 7 : Accounting Applications of Electronic Spreadsheet, (Periods 24), q Concept of an Electronic Spreadsheet (ES), q Features offered by Electronic Spreadsheet, q Applications of Electronic Spreadsheet in generating Accounting Information,, Preparing Depreciation Schedule, Loan Repayment Schedule, Payroll Accounting, and other such Applications., Unit 8 : Practical Work in Computerised Accounting, (Periods 22), (Please refer to the Guidelines published by the CBSE), Using Computerized Accounting System, q Steps in Installation of CAS, Codification and Hierarchy of Account Heads,, Creation of Accounts., q Data : Entry, Validation and Verification., q Adjusting Entries, Preparation of Balance Sheet, Profit and Loss Account with, Closing Entries and Opening Entries., q Need and Security Features of the System., Database Management System (DBMS), q Concept and Features of DBMS., q DBMS in Business Application., q Generating Accounting Information Payroll, Part C :, q, , Practical Work, Please refer to the guidelines published by CBSE., , 20 Marks 26 Periods

Page 11 :

Contents, Chapter, , Page No., , Part A : Accounting for Not-for-Profit Organisations and, Partnership Firms, 1. Accounting for Not-for-Profit Organisations/Non -Trading Organisations, , 1—75, , [1.1 Meaning of Not-for-Profit Organisations, 1.2 Accounting Records of Not-for-Profit, Organisations, 1.3 Receipts and Payments Account, 1.4 Fund-based Accounting and Nonfund-based Accounting, 1.5 Explanation and Treatment of Some Important Items,, 1.6 Income and Expenditure Account, 1.7 Preparation of Balance Sheet, 1.8 Incidental, Trading Activities, 1.9 Fast Revision l Useful Questions l Practical Problems.], , 2. Accounting for Partnership Firms—Fundamentals, , 77—152, , [2.1 Meaning, Definition and Nature of Partnership, 2.2 Characteristics/ Features/Essential, Elements of Partnership, 2.3 Essentials of an Ideal Partnership, 2.4 Limited Liability, Partnership (LLP), 2.5 Rights of Partners, 2.6 Duties of Partners, 2.7 Partnership, Deed/Agreement, 2.8 Partnership Accounts 2.9 Guarantee of Profit to a New Partner,, 2.10 Past Adjustments/Adjustments in Closed Accounts 2.11 Final Accounts of Partnership, Firm, 2.12 Fast Revision l Useful Questions l Practical Problems.], , 3. Goodwill : Meaning, Nature, Factors Affecting and Methods, of Valuation, , 153—176, , [3.1 Meaning and Definitions of Goodwill, 3.2 Characteristics (Features) of Goodwill,, 3.3 Classification of Goodwill, 3.4 Nature of Goodwill, 3.5 Need for Valuation of Goodwill,, 3.6 Factors Affecting the Value of Goodwill, 3.7 Methods of Valuation of Goodwill, 3.8 Fast, Revision l Useful Questions l Practical Problems.], , 4. Reconstitution of Partnership—Change in Profit-Sharing, Ratio Among the Existing Partners, , 177—214, , [4.1 Meaning of Reconstitution of Partnership Firm, 4.2 Occasions/Circumstances of, Reconstitution, 4.3 Change in Profit-Sharing Ratio among Existing Partners, 4.4 Fast, Revision l Useful Questions l Practical Problems.], , 5. Admission of a Partner, , 215—304, , [5.1 Position of Incoming (New) Partner, 5.2 Need for Admission of a New Partner, 5.3 Main, Adjustments on Admission of a New Partner, 5.4 Fast Revision l Useful Questions, l Practical Problems.], , 6. Retirement of a Partner, , 305—366, , [6.1 Meaning of Retirement of a Partner, 6.2 Adjustments at the Time of Retirement of a, Partner, 6.3 Fast Revision l Useful Questions l Practical Problems.], , 7. Death of a Partner, , 367—406, , [7.1 Death of a Partner, 7.2 Effects of the Death of a Partner, 7.3 Adjustments at the Time of, Death of a Partner, 7.4 Fast Revision l Useful Questions l Practical Problems.]

Page 12 :

(ii), , Chapter, 8. Dissolution of Partnership Firm, , Page No., 407—472, , [8.1 Meaning of Dissolution of Partnership, 8.2 Meaning of Dissolution of Firm,, 8.3 Difference between Dissolution of Partnership and Dissolution of Firm, 8.4 Circumstances of Dissolution of Partnership, 8.5 Types or Modes of Dissolution of Partnership Firm,, 8.6 Settlement of Accounts on Dissolution, 8.7 Accounting Treatment on Dissolution of, Partnership Firm, 8.8 When Balance Sheet of the Firm is not given, 8.9 Fast Revision, l Useful Questions l Practical Problems.], , Part A : Company Accounts, 1. Company : General Introduction, , 1—10, , [1.1 Meaning of a Company, 1.2 Essential Features of a Company, 1.3 Nature of Company,, 1.4 Types (or Kinds) of Companies, 1.5 Important Documents of a Company l Useful, Questions.], , 2. Accounting for Share Capital : Share and Share Capital, , 11—32, , [2.1 Share Capital of a Company, 2.2 Shares, 2.3 Disclosure or Presentation of Share Capital, in Company’s Balance Sheet, l Useful Questions l Practical Problems.], , 3. Accounting for Share Capital : Issue of Shares, , 33—74, , [3.1 Issue of Shares for Cash, 3.2 Issue of Shares for Consideration other than cash,, 3.3 Preferential Allotment of Shares, 3.4 Issue of Right Shares [Section 62(1)], 3.5 Fast, Revision l Useful Questions l Practical Problems.], , 4. Forfeiture and Re-Issue of Shares, , 75—116, , [4.1 Meaning of Forfeiture of Shares, 4.2 Effect of Forfeiture of Shares, 4.3 Procedure of, Forfeiture of Shares, 4.4 Accounting Treatment on Forfeiture of Shares, 4.5 Re-Issue of, Forfeited Shares, 4.6 Surrender of Shares, 4.7 Difference between Surrender of Shares and, Forfeiture of Shares, 4.8 Fast Revision l Useful Questions l Practical Problems.], , 5. Issue of Debentures, , 117—162, , [5.1 Meaning of Debenture, 5.2 Difference between Share and Debenture, 5.3 Types of, Debentures, 5.4 Issue of Debentures, 5.5 Issue of Debentures as Collateral Security, 5.6 Different Terms of Issue and Redemption of Debentures, 5.7 Interest on Debentures and, Income-tax thereon, 5.8 Writing-off of Discount and Loss on Issue of Debentures, 5.9 Zero, Interest Bond and Deep Discount Bond, 5.10 Fast Revision l Useful Questions l Practical, Problems.], , 6. Redemption of Debentures, , 163—220, , [6.1 Meaning of Redemption of Debentures, 6.2 Sources of Funds for Redemption of, Debentures, 6.3 Methods of Redemption of Debentures, 6.4 Fast Revision l Useful, Questions l Practical Problems.], , Part B : Financial Statements Analysis, 7. Financial Statement of a Company : Balance Sheet and Statement, of Profit and Loss, , 221—256, , [7.1 Meaning of Financial Statements, 7.2 Objectives of Financial Statements, 7.3 Elements, of Financial Statements, 7.4 Nature of Financial Statements, 7.5 Types of Financial, Statements, 7.6 Contents or Components of Annual Report, 7.7 Importance of Financial

Page 13 :

(iii), , Chapter, , Page No., , Statements, 7.8 Limitations of Financial Statements, 7.9 Balance Sheet of a Company,, 7.10 Statement of Profit and Loss, 7.11 Fast Revision l Useful Questions l Practical, Problems.], , 8. Analysis of Financial Statements, , 257—266, , [8.1 Concept of Financial Analysis or Meaning of Analysis of Financial Statements,, 8.2 Meaning of Interpretation of Financial Statements, 8.3 Features of Financial, (Statement) Analysis, 8.4 Objectives or Purposes of Financial Analysis, 8.5 Importance or, Advantages of Analysis of Financial Statements, 8.6 Importance of Financial Analysis to, User Groups, 8.7 Types or Methods of Financial Analysis, 8.8 Limitations of Financial, Analysis, 8.9 Fast Revision l Useful Questions.], , 9. Tools for Financial Statement Analysis : Comparative Statements, , 267—290, , [9.1 Meaning of Tools of Financial Analysis, 9.2 Tools or Techniques or Methods of Financial, Analysis, 9.3 Comparative Statements, 9.4 Fast Revision l Useful Questions l Practical, Problems.], , 10. Common-Size Statements, , 291—312, , [10.1 Meaning of Common-size Statements, 10.2 Purpose or Objectives of Common-size, Statements, 10.3 Utility or Importance of Common-size Statements, 10.4 Types of Commonsize Statements, 10.5 Limitations of Common-size Statements, 10.6 Common-size Income, Statement, 10.7 Common-size Balance Sheet, 10.8 Trend Analysis, 10.9 Fast Revision, l Useful Questions l Practical Problems.], , 11. Accounting Ratios, , 313—396, , [11.1 Meaning of Accounting Ratios, 11.2 Objectives (or Purposes) of Accounting Ratios,, 11.3 Importance of Accounting Ratios, 11.4 Limitations of Accounting Ratios, 11.5 Steps, involved in the Analysis of Accounting Ratios, 11.6 Types or Classification of Accounting, Ratios, 11.7 Fast Revision, l Useful Questions l Practical Problems.], , 12. Cash Flow Statement, , 397—500, , [12.1 Meaning of Cash Flow Statement (C.F.S.), 12.2 Nature of Cash Flow Statement,, 12.3 Objectives of Cash Flow Statement, 12.4 Utility/Importance or Uses of Cash Flow, Statement, 12.5 Limitations of Cash Flow Statement, 12.6 Preparation of Cash Flow, Statement (As per AS-3 Revised) New Ind. A. S.-7, 12.7 Method of Preparation of Cash Flow, Statement, (As per AS-3 Revised) 12.8 Fast Revision lUseful Questions l Practical, Problems.], , Part C : Computer in Accounting, 1. Introduction to Computer and Accounting Information System (AIS), , 1—13, , 2. Overview of Computerised Accounting System (CAS), , 14—23, , 3. Database Management System (DBMS), , 24—39, , 4. Electronic Spreadsheet, , 40—60, , l Project Work, l Chapter-wise Value/Multi-Disciplinary based Questions with Answers, l Latest Model Paper, l Board Examination Papers, , 1—72, 1—32, (i), (i)

Page 14 :

LIST OF ABBREVIATIONS, A, A/c, AICPA, AS, ASB, B/d, B/E, B/F, B/P, B/R, Bros., B/S, B/R/S (B.R.S.), B.S.E.B., B.V., C, C, CBDT., C.D., C/d, C/N, COSDASYL, CPU, C/R, D.B., D.B.M., D.D., D.D., D.E.R., D/N, DDL, D.P.S., D.T.R., E, E.P.S., F.S., GAAP, G.P., G.P.R., IAS, IASC, ICAI, , Assets, Account, American Institute of Certified, Public Accounts, Accounting Standards, Accounting Standards Board, Brought down, Bills of Exchange, Brought Forward, Bills Payable, Bills Receivable, Brothers, Balance Sheet, Bank Reconciliation Statement, Bihar School Examination Board, Bill Value, Capital/Owner’s Capital, Contra Entry, Central Board of Direct Taxes, Cash Discount, Carried down, Credit Note, Conference on Data System, Languages, Central Processing Unit, Current Ratio, Data Base, Data Base Management, Doubtful Debts, Demand Draft, Debt Equity Ratio, Debit Note, Data Definition Language, Dividend Per Share, Debtors Turnover Ratio, Equity, Earning Per Share, Financial Statements, Generally Accepted Accounting, Principles, Gross Profit, Gross Profit Ratio, International Accounting, Standards, International Accounting, Standards Committee, Institute of Chartered, Accountants of India, , IICA, ICWAI, ISO, J.F., L, L.F., L.R., N.L., N.P., N.P.R., N.R., O.D., O.R., O/S, P.A.T., P.B.D.D., P.B.I.T., P.B.T., P.L. or P/L, P.N., P.P., P.R., Q.R., RAM, RBI, R.D.D., R/I, R.O.I., R.O.C.E., ROM, SEBI, S.L.M., S.N./Sl.N., S/R, SQL, T.B., T.D., T.D.S., U.S.E.B., V. No., W.D.L., , Indian Institute of Chartered, Accountants, Institute of Cost & Works, Accountants of India, International Standard, Organisation, Journal Folio, Liabilities, Ledger Folio, Liquid Ratio, Net Loss, Net Profit, Net Profit Ratio, New Reserve, Overdraft, Old Reserve/Operating Ratio, Outstanding, Profit After Tax, Provision for Bad and, Doubtful Debts, Profit Before Interest and, Tax, Profit Before Tax, Profit Loss, Promissory Note, Prepaid, Purchase Returns, Quick Ratio, Random Access Memory, Reserve Bank of India, Reserve for Doubtful Debts, Returns Inward, Return on Investment, Return on Capital Employed, Read Only Memory, Securities Exchanges Board, of India, Straight Line Method, Serial Number, Sales Returns, Structured Querry Language, Trial Balance, Trade Discount, Tax Deduction at Source, Uttarakhand School, Examination Board, Voucher Number, Written Down Value

Page 15 :

Part A : Accounting for, Not-for-Profit Organisations, and Partnership Firms, , 1, , Learning Objectives, After Studying this chapter, you would be able to understand :, , P.No., , 1.1 Meaning of Not-for Profit Organisations, l Objectives and Features of Not-for-Profit Organisations l Difference, between Not-for-Profit Organisation and Profit Earning Organisation, , 2, , 1.2 Accounting Records of Not-for-Profit Organisations, l Objectives of Accounting Records l Financial Statements or Final, Accounts of Non-Trading Organisations, , 3, , 1.3 Receipts and Payments Account, l Meaning l Difference between Receipts and Payments Account and Cash, Book l Features l Limitations l Format l Process or Steps of Preparing, Receipts and Payments Account, , 4, , 1.4 Fund-based Accounting and Non-fund-based Accounting, l Meaning l Features l Objectives l Classification l Accounting, Treatment l Non-fund based Accounting l Difference between Fund, Accounting and Non-fund Accounting, , 9, , 1.5 Explanation and Treatment of Some Important Items, , 13, , 1.6 Income and Expenditure Account, l Meaning l Features l Difference between Receipts and Payments, Account and Income and Expenditure Account l Distinction between, Income and Expenditure Account and Profit and Loss Account l Format of, Income & Expenditure Account l Preparation of Income and Expenditure, Account, , 18, , 1.7 Preparation of Balance Sheet, , 40, , 1.8 Incidental Trading Activities, , 55, , 1.9 Fast Revision, , 55, , ❑ Useful Questions, , 56, , ❑ Practical Problems, , 61, , 1

Page 16 :

SBPD Pub li ca tions Ac countancy (XII), , 1.1 Meaning of ‘Not-for-Profit’ Organisations, The primary objective of a business organisation is to earn profit. Hence, all the, business or commercial organisations are called ‘Profit-making’ Organisations. On the, other hand, there are some organisations or institutions or associations which are called, ‘non-trading’ organisations or ‘not-for-profit’ organisations. The main objective of these, organisations is to provide service to their members or beneficiaries or to the society as a, whole without any intention to seek profit., ‘Not-for-Profit’ Organisations refer to concerns or institutions which render services to the, members or society and work for the promotion of charity, religion, education, literature, art, and culture, etc. without aiming at profit. The surplus of these organisations is not, distributed among their members rather it is used for the promotion of activities of the, good of the organisation., SBPD Publications Financial Accounting (XII), Examples of Not-for-Profit Organisations :, (i) Educational Institutions :, Schools, Colleges, Universities., (ii) Religious Organisations :, Mandir, Masjid, Gurudwara and Church etc., (iii) Sports Institutions :, Sports Club, Vyayamshala., (iv) Social Institutions :, Hospital, Libraries, Charitable Trusts, Nursing Homes, etc., (v) Recreation and Cultural Organisations :, Recreation Club, Cultural Societies, Literary Society, etc., (vi) Professional Bodies or Institutions : Chamber of, Commerce, Trade Unions, Medical Council of India,, Institute of Chartered Accountants of India etc., (vii) Professional Persons : Doctors, Engineers, Lawyers, Professors, Chartered, Accountants, Actors, Singers, Players, etc., 1.1.1 Objectives of Not-for-Profit Organisations, Main objectives of a non-profit-earning organisation are as, follows :, 1. To provide service or recreations to its members or group or, the public at large., 2. To work for the welfare of the society or promotion of religion,, education, art, culture and sports etc., 1.1.2 Main Features or Characteristics of Not-for-Profit, Organisations, 1. Not-for-profit organisations are established for the welfare and, service of the society and their members., 2. They promote art, culture, religion, education, sports etc., 3. They do not operate with the objective of earning profit., 4. These organisations are set-up as charitable societies, trust or club etc., 5. The major sources of funds of these organisations are :, (a) subscriptions from their members, (b) donations, (c) contributions from outsiders, and (d) Government aid or grants., 6. These organisations are managed by a managing or executive committee elected, by their members., , 2

Page 17 :

Ac count ing for Not-for-Profit Or gani sa tions/Non-Trad ing Organisations, 7. These organisations prepare Receipts and Payments A/c,, Income and Expenditure A/c and Balance Sheet., 8. The surplus of these organisations are not distributed amongst, the members. It is added to the capital fund., 1.1.3 Difference between Not-for-Profit Organisation and Profit-Earning Organisation (Business Firm), The points of distinction between a profit-earning organisation and not-for-profit, organisation are as follows :, S.N., 1., 2., , 3., , 4., , Basis of, Difference, , Profit-Earning Organisation, , The primary motive of such an organisation is to earn profit., It is represented by owner’s capital,, accumulated reserves and surplus., Here the fund is known as ‘Owner’s, Fund’., Net Results The net result of the activities of such, of Activities an organisation is known as ‘Net Profit’, or ‘Net Loss’., Financial, The Financial Statements of such type, Statements of organisation include :, (i) Manufacturing A/c or Trading A/c,, (ii) Profit & Loss A/c,, (iii) Balance Sheet., Primary, Motive, Fund, , Not-for-Profit Organisation, The primary motive of such an entity, (organisation) is to serve people., In case of not-for-profit organisation,, there is ‘Capital Fund’ or ‘General, Fund’. It is represented by Donation,, Subscription, Surplus etc., The net result of this type of organisation is known as the ‘Surplus’ or, ‘Deficit’., Financial Statements of non-trading, organisations include :, (i) Receipts and Payments A/c,, (ii) Income and Expenditure A/c,, (iii) Balance Sheet., , 1.2 Accounting Records of Not-for-Profit Organisations, A majority of the profit organisations maintain their accounting records under the, single entry system. They usually maintain a Cash Book, Supplier’s Ledger and Members’, Register. Where the size of the organisation is large, the accounts are kept under complete, double entry system. It should be noted that a non-profit organisation, too, employs the, same accrual basis of accounting used by a business entity., Non-trading organisations or institutions are required to keep proper accounting, records and keep control over the utilisation of their fund. With this end in view they, maintain their accounts on double entry system. But their system of keeping accounts is, quite different than that of the trading concerns. Since, the objective of non-trading, institutions is not to earn profit like that of the trading concerns, they keep accounts on, ‘Cash System’ instead of ‘Mercantile System’., Under this system, ‘Cash Book’ is the most important book of accounting record. But, various institutions and professional persons keep the following books according to their, requirements :, (1) Cash Book : In this book all cash receipts and payments are duly recorded., (2) Memorandum or Waste Book : In this book all transactions of credit nature are, recorded., (3) Stock Register : In this register records of all fixed assets and consumable items, are maintained., (4) Salaries and Wages Register : This register contains the records of salaries of, staff employed by the organisation and wages paid to the workmen., (5) Members Register : This register contains full details of members of the, organisation, subscription received from them, outstanding subscription and that of, advance subscription., , 3

Page 18 :

SBPD Pub li ca tions Ac countancy (XII), (6) Other Registers : Such as Subscription Register, Donor’s Book, Fee Collection, Register etc., 1.2.1 Necessity or Objectives of Accounting Records, These organisations/institutions are required to keep proper accounting records to, fulfil the following objectives :, (1) To keep proper control over the utilisation of their funds., (2) To avoid or minimise the chances of misappropriations or embezzlement of the, funds contributed by the members, donors, Government and other bodies., (3) To facilitate preparation of financial statements at the end of the year., (4) To facilitate comparison of the financial results with that of the budget., (5) To show that the expenses are made in the light of the objective of the, institutions., (6) To arrive at the ‘Surplus’ or ‘Deficit’ at the end of the accounting year., (7) To comply with the statutory requirements and for seeking financial grants., Sequence for Preparing Accounts :, 1. Preparation of Receipts and Payments Account, 2. Fund-based Accounting, 3. Treatment of some important Items, e.g., Subscriptions, Donation, Consumable, Items etc., 4. Preparation of Income and Expenditure Account, 5. Preparation of Balance Sheet, 1.2.2 Financial Statements or Final Accounts of Non-Trading Organisations, Not-for-Profit Organisations prepare their annual accounts (that is, final accounts) at, the end of every financial year. The objectives of preparing financial statements are two fold :, 1. To apprise the members about the financial affairs of the organisation, and, 2. To submit the same to the Government departments for financial grants/aids., Usually a non-profit-organisation prepares the following statements :, Financial Accounts of Not-for-Profit Organisation, , 1. Receipts and Payments, Account, , 2. Income and Expenditure, Account, , 3. Balance Sheet., , 1.3 Receipts and Payments Account, 1.3.1 Meaning of Receipts and Payments Account, A Receipts and Payments Account is a summary of cash receipts and cash payments, relating to a given period. According to William Pickles, ‘’Receipts and Payments Account is, nothing more than a summary of the Cash Book (Cash and Bank transactions) over a, certain period, analysed and classified under suitable headings. It is the form of account, most commonly adopted by the treasurers of societies, clubs, associations, etc. when, preparing the results of the year’s working.’’, The Receipts and Payments Account is an Asset Account or Real Account., It is, in fact, a summary of the Cash Book. It is prepared at the end of the period, under consideration. All receipts (relating to past, present or future period) are shown on, the debit side and all payments (relating to past, present or future) are shown on the credit, side of this account. It should be noted that in Receipts and Payments Account both revenue, and capital items are shown. It does not give the date of transactions. Thus, both Cash Book, , 4

Page 19 :

Ac count ing for Not-for-Profit Or gani sa tions/Non-Trad ing Organisations, and ‘Receipts and Payments’ Account provide the same information but in different manner., Hence, in some respects they differ from each other., 1.3.2 Difference between Receipts and Payments Account and Cash Book, S., No., 1., 2., 3., , Basis of, Difference, Date, Entries, Period, , Receipts and Payments Account, , 5., , Entries are not made datewise., Entries are made in classified form., This account is prepared at the end of, the accounting year., Institutions This is prepared by the not-for-profit, organisations., Ledger Folio There is no column of ledger folio., , 6., , Side, , 4., , Cash Book, All entries are made datewise., Entries are made in chronological order., Cash book is recorded on daily basis., , This is prepared by all the organisations, trading and non-trading., This has a separate column for ledger, folio., Left side is receipts side and right side Left side is debit side and right side is, is payments side., credit side., , 1.3.3 Main Features of Receipts and Payments Account, (1) It is like a Cash Book ., (2) It is the summary of Cash and Bank transactions., (3) All the cash receipts (whether they are of capital nature or revenue nature) are, shown on the debit side of this account., (4) Likewise, all cash payments (whether they are of capital nature or revenue nature), are shown on the credit side of this account., (5) It starts with the opening cash and bank balances (shown on the debit side of this, account) and ends with closing balances of Cash/Bank (being shown on the credit side)., (6) The closing balance of this account indicates the cash left after meeting the, expenses. It is carried forward., (7) It does not record non-cash items (such as depreciation)., (8) It includes all receipts and payments, whether they are related to current, past or, future periods., (9) It ignores outstanding expenses or accrued incomes., , (1), (2), (3), (4), (5), , Important Points to Remember in Respect of Receipts, and Payments Account, In Receipts and Payments Account all cash transactions made in the current year, are recorded whether they relate to past year, current year or future year., Non-cash transactions (e.g., depreciation) are not recorded in this account., Credit transactions, outstanding expenses, accrued income, unaccrued income, etc. are not recorded in this account., In this account transactions are recorded with actual cash., This account shows cash balance at the end of the year., , 1.3.4 Limitations of Receipts and Payments Account, Following are the limitations of Receipts and Payments Account :, (1) It is prepared on cash basis of accounting and does not contain any non-cash items, of expenses, e.g., depreciation., (2) It does not provide information about income and expenses of the accounting, period. It only reveals the amount of income and expenses in cash., (3) It does not help in judging the financial position of the organisation as it shows, cash and bank transactions only. It does not show other assets and liabilities., (4) It does not show ‘Surplus/Deficit’., (5) It is not prepared on accrual basis., , 5

Page 20 :

SBPD Pub li ca tions Ac countancy (XII), 1.3.5 Format of Receipts and Payments Account, A specimen of Receipts and Payments Account is given below :, Receipts and Payments Account, Dr., (for the year ending ..............20.....), Receipts, To Balance b/d :, Cash in hand, Cash at Bank, To Revenue Receipts :, Subscriptions, General Donation, Entrance Fees, Sale of Newspapers/Magazines/, Periodicals, Sale of Old Sports Material, Proceeds from Charity, Proceeds from Use of Hall, Proceeds from Lectures/Entertainments, Receipts from Show/Concerts, Interest on Fixed Deposits, Interest on Investment, Locker's Rent, Sale of Scrap, Sale of Grass, Grants-in-aid from Govt., Miscellaneous Receipts, To Capital Receipts :, Specific/Purpose Donation, Legacies, Life Membership Fees, Sale of Fixed Assets, Sale of Investments, Endowment Funds, Sale of Sports Equipments, , `, , ....., ....., ....., ....., ....., ....., ....., ....., , ....., ....., ....., ....., ....., ....., ....., ....., ....., ....., ....., ....., ....., ....., ....., ....., , ....., , Payments, By Balance c/d, if any, (Bank Overdraft), By Revenue Payments :, Salaries and Wages, Rent, Rates and Taxes, Insurance, Audit Fee, Printing and Stationery, Honorarium, Postage and Courier, Advertisement, Telephone, Repairs and Renewals, Upkeep of Ground, Entertainment Expenses, Gardening, Conveyance, Bank Charges, Water and Electricity, Municipal Taxes, Newspapers/Magazines/Periodicals, Bar Expenses, Miscellaneous Expenses, By Capital Payments :, Purchase of Fixed Assets, (e.g. Furniture, Building), Purchase of Books, Investments, Fixed Deposits, Prize Fund Investment etc., By Balance c/d :, Cash in hand, Cash at Bank, , Cr., `, , ....., ....., ....., ....., ....., ....., ....., ....., ....., ....., ....., ....., ....., ....., ....., ....., ....., ....., ....., ....., ....., , ....., ....., ....., ....., ....., ....., ....., ....., , Note : Normally the total of the debit side of Receipts and Payments A/c will be more than the credit side. Hence,, to tally the total of both the sides, the difference will be shown as ‘By Balance c/d’. In case, the total of, credit side is more, then the difference will be Bank Overdraft and it should be shown as to Balance b/d on, the debit side of Receipts and Payments A/c., , 1.3.6 Process or Steps of Preparing Receipts and Payments Account, Step 1 : Show the opening balances of cash in hand and cash at bank on the debit side of, the Receipts and Payments Account. In case, there is bank overdraft in the, beginning of the year, enter the same on the credit side of this account., , 6

Page 21 :

Ac count ing for Not-for-Profit Or gani sa tions/Non-Trad ing Organisations, Step 2 : Show amounts of all receipts items or its debit side irrespective of their nature, whether capital or revenue and whether they relate to past, current and future, periods., Step 3 : Show the amounts of all payments items on its credit side irrespective of their, nature whether capital or revenue and whether they relate to past, current and, future period., Step 4 : None of the outstanding or payable expenses and depreciation and none of the, accrued or receivable income is shown in this account, the reason being that they, do not involve in-flow or out-flow of cash., Step 5 : Lastly, find out the difference between the total of debit side and that of the total, of credit side of this account and enter the difference on the credit side as, closing balance of Cash/Bank. In case, however, the total of the credit side is, more than that of the total of the debit side, show the difference on the debit side, as bank overdraft; thus, the account is closed., ILLUSTRATIONS AND PRACTICAL PROBLEMS : AT A GLANCE, Illustration No., , Details, , Practical Problem No., , 1(A), 1(B), 1(C), , Preparation of Receipts and Payments Account, , 1(A) to 2, , 2 to 4(B), 5 to 9, , Fund-based Accounting (Without Adjustment), Calculation of Income from Subscriptions, , 3(A) to 6, 7(A) to 11, , 10(A) to 10(E), 11, 12, 13, 14 to 17, , Calculation of Consumable Goods : Medicines and, Stationery, Calculation of Salary/Profit from Sale of Tennis, Balls, Calculation of Depreciation and Profit or Loss on, Sale of Asset, Preparation of Income and Expenditure Account, , 12 to 16, 17(A), 17(B), 18, 19, 20 to 23, , 18 to 22, , Preparation of Income and Expenditure Account, (With Adjustments), , 23, , Preparation of Receipts and Payments Account and, Income and Expenditure Account, B/S of Not-for-Profit Organisations, Calculation of Capital Fund, , 31, , 33, 34, , 33, , Preparation of Income and Expenditure A/c and, Ascertainment of Capital Fund, Preparation of Income and Expenditure Account, and Balance Sheet, Preparation of Income and Expenditure A/c and, Balance Sheet from Trial Balance, Miscellaneous and Boards’ Questions, , 33, , Total, , 24, 25(A), 25(B), 26, 27 to 31, 32, , 24 to 30, , —, 32, , 35 to 38, 39, 40 to 44, 44, , Illustration 1(A) (Preparation of Receipts and Payments Account), A Rotary Club has kept its accounts on cash basis and figures for the last year are, given below. Prepare Receipts and Payments Account for the year :, `, Entrance Fees received, 5,000, Subscriptions : Received during the year, 39,600, Mr. X’s Fees received during the year, 1,200, Expenses paid during the year, 54,500, Expenses unpaid this year, 2,940, , 7

Page 22 :

SBPD Pub li ca tions Ac countancy (XII), Surplus on Bar Account, Secretary’s Honorarium, Cash in hand in the beginning of the year, Locker Rent received, Investment made during the year (at cost), Solution, Dr., , 15,000, 3,000, 4,700, 1,000, 2,200, (U.S.E.B., 2009), , Receipts and Payments Account, Receipts, , To Balance b/d (Cash in hand opening), To Entrance Fees, To Subscriptions, To Mr. X’s Fees, To Locker Rent, To Surplus on Bar A/c, , Amount, `, , 4,700, 5,000, 39,600, 1,200, 1,000, 15,000, 66,500, , Cr., , Payments, , Amount, `, , By Expenses, By Secretary’s Honorarium, By Investment, By Balance c/d (Cash in hand closing), , 54,500, 3,000, 2,200, 6,800, , 66,500, , Note : Unpaid expenditure is not shown in Receipts and Payments Account but it is shown in Income &, Expenditure Account., , Illustration 1(B), Maurya Club has 300 members paying subscription ` 10 each per month. The Club, has a fixed deposit of ` 80,000 @ 10% p.a. interest in a bank. The Club rents some portion of, building @ ` 2,000 per day., From the following information, prepare Receipts and Payments Account of the Club, for the year ending 31st December, 2018 :, (i) On 1st January, 2018 Cash Balance is ` 6,300., (ii) Interest received for 9 months on Bank Fixed Deposit., (iii) 40 members have not paid subscription for the last two months., (iv) During the year building was rented for 10 days., (v) Paid for salary ` 28,000 and other expenses ` 17,000., (vi) Purchased Furniture for ` 15,000., Solution, Maurya Club, Receipts and Payments Account, Dr., (for the year ending 31st Dec., 2018), Cr., Receipts, To, To, To, To, , Balance b/d (1.1.2018), Subscriptions, Interest on Bank Fixed Deposit, Rent Received, , Amount, `, , 6,300, 35,2001, 6,0002, 20,000, , Payments, , Amount, , By Salary, By Other Expenses, By Furniture, By Balance c/d (31.12.2018) (Bal. fig.), , 67,500, Working Notes :, 1. Subscriptions Received :, Payable : 300 × ` 10 × 12, Less : Outstanding 40 × ` 10 × 2, , Subscriptions received, 9, 10, 2. Interest on Fixed Deposit : 80,000 ×, ×, = ` 6,000., 100 12, , 8, , `, , 28,000, 17,000, 15,000, 7,500, 67,500, , `, 36,000, 800, 35,200

Page 23 :

Ac count ing for Not-for-Profit Or gani sa tions/Non-Trad ing Organisations, Illustration 1(C), On the basis of following information, prepare Receipts and Payments Account in the, books of Vijay Club for the period of 31st December, 2018 :, Subscription received for the previous year, ` 40, Subscription received for the current year, ` 360, Subscription not received for the current year, ` 60, Receipts : Rent of Room ` 20; Games Fee ` 120; Cash received from Canteen ` 250., Payments : Salaries ` 200; Repairing ` 24; Printing and Stationery ` 60; Canteen, Articles ` 170; Wages of Watchman ` 136; Electricity ` 80; Rent and Taxes ` 100., Outstanding Expenditures : Repairing Exps. ` 16; Canteen Articles ` 44; Cash, Balance on January 1st, 2018 ` 36 and on 31st December, 2018 ` 56. (U.S.E.B., 2011), Solution, Dr., , Receipts and Payments Account of Vijay Club, (for the year ending 31st Dec., 2018), Receipts, , Amount, , Payments, , Cr., Amount, , `, To Balance b/d : Cash (1-1-2018), To Subscription received (2017), To Subscription received (2018), To Rent of Room, To Games Fee, To Cash received from Canteen, , 36, 40, 360, 20, 120, 250, , `, By Salaries, By Repairing, By Printing and Stationery, By Canteen Articles, By Wages of Watchman, By Electricity, By Rent and Taxes, By Balance c/d (Cash 31.12.2018), , 200, 24, 60, 170, 136, 80, 100, 56, 826, , 826, , 1.4 Fund-based Accounting and Non-fund-based Accounting, 1.4.1 Meaning and Concept of Fund-based Accounting, Fund-based accounting is a system of accounting where fund is taken as an, independent fiscal and accounting entity with a self-balancing set of accounts. In other, words,, ‘‘Fund-based Accounting is a technique of book-keeping under which separate selfbalancing set of assets, liabilities, incomes and expenses are maintained for each fund for a, specific purpose.’’, Under Fund-based Accounting, receipts and incomes relating to a particular fund is, credited to that particular fund and payments and expenses are debited to it. Examples of, such (special) funds are : Match Fund, Sports Fund, Prize Fund, Building Fund, Library, Fund etc., It should be noted that a fund sets aside cash or other assets to achieve specific, objective(s). Such funds may be invested in securities and the income earned on such, investments is added to the respective funds and not credited to Income and Expenditure, Account. Funds are used only for such specific purpose for which the same have been, contributed by the donors., The special funds are shown in Balance Sheet because these are capital receipts., However, if after adjustment of income and expenses, the balance in special or specific, fund is negative (i.e., if the amount of expenses relating to that fund is more than that of, the fund and interest on specific fund investment), it is shown on the debit side of Income, and Expenditure Account. Capital in this type of accounting is called ‘Capital Fund’., Fund-based accounting system can be adopted by the government non-profit organisations as well as by the non-government non-profit organisations. For example,, , 9

Page 24 :

SBPD Pub li ca tions Ac countancy (XII), Government Non-Profit Organisations : Central Universities, State Universities, Colleges, Schools, Government Hospitals, etc., Non-Government Non-Profit Organisations : Trust, Hospitals, Club, Private, Educational Institutions, Libraries, etc., 1.4.2 Features of Fund-based Accounting, 1. A separate set of book for each fund is maintained under fund-based accounting., Thus, fund is treated as separate entity and accounted for accordingly., 2. If the organisation receives a legally restricted fund, it has to set up a restricted, fund for it., 3. The financial resources of not-for-trading organisations include grants, aid and, contributions. These resources are used as per instructions., 4. Fund-based accounting is used by non-profit organisations., 1.4.3 Objectives of Fund-based Accounting, Following are the objectives of Fund-based Accounting : (i) To compare the actual, financial results of various activities with the budget. (ii) To assess the financial, performance of the not-for-profit entity during the year. (iii) To ensure that rules,, regulations and legal provisions are being compiled with. (iv) To assess the efficiency in, spending money on approved activities and tasks., 1.4.4 Classification of Funds, Following are the different types of funds used in Fund Accounting :, Funds, ● Revenue Funds, ● Restricted Fund, ● Unrestricted Fund, (Revenue Nature), , ● Specific or Special Funds, ● Endowment Fund, ● Fixed Asset Fund, ● Debt Fund, ● Annuity Fund (Capital Nature), (i) General Fund or Unrestricted Fund : General Fund means a fund created to, carryout the general activities. There are no restrictions on the use of the assets, of constituting General Fund. General Fund is made of annual subscriptions, general gifts, general grants etc., (ii) Restricted Fund : Restricted Fund means a fund arising from the contributions, received for carrying out those activities for which contributions are made., (iii) Fixed Asset Fund or Development Fund : It is a fund which is created out of, specific grants or general funds for acquisitions of the assets such as land and, building, furniture, etc. or for development of assets., (iv) Endowment Fund : Endowment Fund means a fund arising from a gift or, legacy with the legal condition that the principal amount will be maintained, permanently and income from such amount can be used for the various activities, of the organisation., (v) Debt or Loan Fund : Debt Fund means a fund meant for raising loan, debt or, borrowings of long-term nature., Thus, Revenue Funds essentially record normal revenue transactions whereas special, Funds record transactions of capital nature, 1., 2., 3., 4., , 10, , KEY POINTS TO REMEMBER, , Special Funds record the transactions of capital nature., Contributions and transfers are directly credited to the respective fund accounts., A statement showing changes in balances of each of specific funds is prepared., Balance sheet of each of specific funds is prepared.

Page 25 :

Ac count ing for Not-for-Profit Or gani sa tions/Non-Trad ing Organisations, 1.4.5 Accounting Treatment of Items relating to Specific Fund, Case 1 :Amount to be shown on the liabilities side of the Balance Sheet (If, expenses relating to such fund is less) : Take example of Match Fund :, Calculation of Match Fund :, `, , Opening Balance, Add : Sale of Match Tickets, Add : Donations received for Match Fund, Add : Interest on Match Fund Investments, Less : Match Expenses, Amount of Match Fund to be shown on the Liabilities side of the Balance Sheet, , ................., ................., ................., ................., ................., ................., ................., , Case 2 : If the amount of expenses relating to Specific Fund is more than the, amount of Specific Fund, In this case, the difference between the two, i.e., negative figure, being excess of, expenses over the fund amount is shown on the debit side of Income and Expenditure, Account and not in the Balance Sheet., ❏ Fund-based Accounting, Illustration 2 (Match Fund), Show how will you deal with the following items in the final accounts of Star Club :, Match Fund ` 80,000, Match Expenses ` 30,000, Sale of Match Tickets ` 32,000., Solution, There is a specific Match Fund. The accounting treatment will be made as under :, Balance Sheet (as on ...............), Liabilities, Match Fund, Add : Sale of Match, Tickets, Less : Match Expenses, , `, , Assets, , `, , `, 80,000, 32,000, 1,12,000, 30,000, , 82,000, , Illustration 3 (Match Fund), Show how would you deal with the following items in the case of a ‘Not-for-Profit, Organisation’ :, Match Fund ` 80,000, Match Fund Investments ` 80,000, Match Expenses ` 1,50,000,, Donations for Match Fund received during the year ` 26,000, Sale of Match Tickets, ` 36,000., Solution, `, Match Fund, 80,000, Add : Donations for Match Fund, 26,000, Add : Sale of Match Tickets, 36,000, 1,42,000, Less : Match Expenses, 1,50,000, To be shown in Income & Expenditure A/c as Expenses, (8,000), Since the balance of Match Fund becomes negative by ` 8,000, it will be shown on the, debit side of Income and Expenditure Account and Match Investment will be shown on, assets side of Balance Sheet., , 11

Page 26 :

SBPD Pub li ca tions Ac countancy (XII), Illustration 4(A) (Prize Fund), Show how would you deal with the following items while preparing the Income &, Expenditure Account and Balance Sheet for the year ending on 31st March, 2019, in each, of the following cases :, Case (i) : Prizes awarded ` 5,000., Case (ii) : Prizes awarded ` 5,000; Prize Fund as on 31st March, 2018 ` 40,000;, Donations for prizes received during the year 2018-19 ` 7,200., Case (iii) :Prizes awarded ` 5,000; Prize Fund as on 31st March, 2018 ` 40,000;, Donations for prizes received during the year 2018-19 ` 7,200; 9% Prize, Fund Investments as on 31st March, 2018 ` 40,000; Interest received on, Prize Fund Investments ` 2,700., Solution, Case (i), Income and Expenditure Account, Dr., (for the year ended 31st March, 2019), Cr., Expenditure, To Prizes awarded, , Income, , `, 5,000, , `, , Prizes awarded are taken to Income & Expenditure Account because there does not, exist a prize fund., Case (ii), Balance Sheet, (as on 31st March, 2019), Liabilities, Prize Fund :, Opening Balance, Add : Donations received, Less : Prizes awarded, , Case (iii), Liabilities, Prize Fund :, Opening Balance, Add : Donations received, Add : Interest on Prize Fund, Investments (` 2,700, + 900), Less : Prizes awarded, , Assets, , `, `, 40,000, 7,200, 47,200, 5,000, , `, , 42,200, , Balance Sheet, (as on 31st March, 2019), `, `, 40,000, 7,200, , 3,600, 50,800, 5,000, , Assets, 9% Prize Fund Investments, Interest accrued on 9% Prize Fund, Investments, , `, 40,000, 9001, , 45,800, , Note : (1) Total Interest on Prize Fund Investments of ` 40,000 @ 9% p.a., Less : Received during the year, , `, 3,600, 2,700, 900, , Accrued Interest, , Illustration 4(B), Present the following information for the year ended 31st March, 2018 in the, financial statements of a not-for-profit organisation :, (C.B.S.E., A.I., 2019), Particulars, Opening Balance of Match Fund, Sale of Match Tickets, Donations for Match Fund received during the year, Match Expenses, , 12, , `, , 5,00,000, 3,75,000, 1,24,000, 10,00,000

Page 27 :

Ac count ing for Not-for-Profit Or gani sa tions/Non-Trad ing Organisations, Solution, , Balance Sheet, (as on 31st March, 2018), Liabilities, , `, , `, Match Fund, 5,00,000, Add : Sale of Match Tickets 3,75,000, Add : Donation received, 1,24,000, 9,99,000, Less : Match Expenses, (Note 1), 9,99,000, , Assets, , `, , Nil, , Income and Expenditure Account, (for the year ended 31st March, 2018), , Dr., , Expenditure, To Match Expenses (Note 1), , `, 1,000, , Cr., , Income, , `, , Note : Match expenses are ` 10,00,000. Out of which ` 9,90,000 are met through match fund as per the, availability of the fund. Hence, remaining ` 1,000 are debited to Income and Expenditure A/c. It means, the balance of match fund will be nil in the Balance Sheet., , 1.4.6 Non-fund-based Accounting, Non-fund Accounting is based on matching revenue and cost principle. This system is, followed by the business concerns having earning of profit as the prime objective. Under, this system transactions are identified and recorded according to double entry system on, accrual system. Under this system (i) Profit and Loss Account is prepared to calculate, profit or loss earned during a period, and (ii) Balance Sheet is prepared to find out the, financial position of the company., Under Non-fund-based Accounting system, no separate sets of books are maintained, for each fund. In this system, all items of income and expenses of the current year are, taken to Income and Expenditure Account. As such revenue expenses are recorded on debit, side and revenue income are recorded on credit side of the Income and Expenditure Account., 1.4.7 Difference between Fund Accounting and Non-Fund Accounting, Basis of, Difference, 1. Basis, , Fund Accounting, It is based on cash., , 2. Use of Funds Funds are used for specific purposes., 3. Financial, Statements, , Non-fund Accounting, It is based on accrual concept., Funds can be used for any profit earning, purpose., , Under this system (i) Receipts and Under this system (i) Trading and Profit, Payments Account, (ii) Income and and Loss Account, and (ii) Balance Sheet, Expenditure Account, and (iii) Balance are prepared., Sheet are prepared., , 4. Entity, of Each fund is fiscal and treated as Business enterprise in treated as the, Accounting financial accounting entity., accounting entity., 5. Economic, Interest, , In fund accounting, owners have no In non-fund accounting, owners have, economic interest in the organisation. their economic interest in the form of, profit., , 1.5 Explanation and Treatment of Some Important Items, (1) Subscriptions, It is the main source of income of non-profit organisation. It is the amount paid by the, members at regular intervals. As such, subscriptions are treated as revenue receipts (that, , 13

Page 28 :

SBPD Pub li ca tions Ac countancy (XII), is income) and recorded on the credit side of Income & Expenditure Account. Care must be, taken to take credit for only those subscriptions which are relevant and, connected with current year., However, special subscriptions received should be separated from, general subscriptions. Special subscription should be shown on the, liabilities side of the Balance Sheet until they are utilised for the, special purpose, special subscriptions are meant for special purpose., Calculation of Income from Subscriptions : Amount of, subscriptions to be credited to Income & Expenditure Account may be, calculated by (i) Preparing a Statement, or (ii) Preparing Subscription, Account., ❏ Method No. 1 : By Preparing Statement, A statement may be prepared to calculate subscription., Calculation of Subscription for the year, Particulars, `, Total Subscription received during current year, (as per Cash Book or Receipts & Payments A/c), Add : Outstanding Subscriptions for Current Year, Add : Subscriptions received in advance in last year belonging to Current Year, , ........., ........., , Less : Outstanding Subscription of Previous Year received in Current Year, Less : Subscriptions received in advance in current year belonging to next year, , ........., ........., , Amount, `, ........., , Net Subscriptions to be credited to Income and Expenditure A/c, , ........., ........., ........., ........., , ❏ Method No. 2 : By Preparing Subscription Account, Dr., Subscription Account, Particulars, To Outstanding Subscriptions A/c, (Outstanding Subscriptions, in the beginning), To Income and Expenditure A/c, (Bal. fig.), To Advance Subscription A/c, (Subscriptions received in, advance at the end), , Particulars, By Advance Subscriptions A/c, (Subscriptions received in, ........., advance in the beginning), By Bank or Cash A/c, ........., (Total Subscriptions received), By Outstanding Subscription A/c, (Outstanding Subscriptions, ........., at the end), ........., `, , Cr., `, ........., ........., ........., ........., , While preparing Income and Expenditure A/c and Balance Sheet remember the, following :, (1) Regarding Revenue Income (e.g. Subscription, Rent, Interest, Sale of Old, Newspapers etc.) Adjustments :, (a) Closing outstanding subscription is added to the subscription in Income & Expenditure A/c and shown on assets side of closing B/S., (b) Opening outstanding subscription is deducted from the subscription in Income, Expenditure A/c and shown on assets side of opening B/S., (c) Closing advance subscription is deducted from the subscription in Income &, Expenditure A/c and shown on liability side of closing B/S., , 14

Page 29 :

Ac count ing for Not-for-Profit Or gani sa tions/Non-Trad ing Organisations, (d) Opening advance subscription is added to the subscription in Income &, Expenditure A/c and shown on liability side of opening B/S., (2) Regarding ‘Revenue Expenditures’ (e.g. Salary, Rent, Interest etc.), Adjustments :, (a) Closing outstanding expenses are shown on liability side of closing B/S., (b) Opening outstanding expenses are shown on liability side of opening B/S., (c) Closing prepaid expenses are shown on assets side of closing B/S., (d) Opening prepaid expenses are shown on assets side of opening B/S., (2) Donation, Donation is the amount received from any person, firm, company or any other body by, a way of gift. It is contributed in the form of cash or if it is received in kind, it is properly, valued. It appears on the debit side of the Receipts and Payments Account in the year of, receipt., Types of Donation :, (a) Special or Specific Donation : Donations received for specific purposes are, always capitalised. As such, specific donation or special donation, is treated as, liabilities and is shown on the liabilities side of the Balance Sheet. Examples of, such donations are : donation for building, donation for library, donation for, pavialion etc. Such donations are not recurring in nature., (b) General Donation : When the purpose for which the donation is to be utilised is, not mentioned, it is called general donation. It can be of two types : (i) General, donation of big amount, and (ii) General donation of small amount., General donations of big amounts and of non-recurring nature are, generally, treated, as capital receipts. These are taken to the liabilities side of the Balance Sheet. On the other, hand, general donations of small amounts (and recurring in nature) are treated as revenue, receipts or incomes. Such donations can be expected every year. Thus, the general, donations of relatively small amount are credited to Income and Expenditure Account., Whether the amount of donation is big or small it is a matter of fact. It depends on the, size and nature of the institution and above all, the and nature of circumstances of each, case., Note : If nothing is mentioned about the nature of donation, it (donation) should be treated as general, donation and is recorded in the credit side of Income and Expenditure A/c., , Adjustments regarding Donation : If additional information or instruction is given, with respect to donation, it should be followed accordingly. For instance, (i) if it is, mentioned that ‘half of donation should be capitalised’ or ‘half of donation should be, treated as income’. Then, show half of donation on the credit side of Income and, Expenditure, as income and the rest on the liabilities side of Balance Sheet as liability., (ii) If it is mentioned in the adjustments that ‘donation should be capitalised’, then even if, the amount of donation is small, it will be shown on the liabilities side of the, Balance Sheet., (3) Legacies, Legacy is an amount given to a non-trading concern as per the ‘will’ of a deceased, person. It is a kind of donation. It appears on the debit side of the Receipts and Payments, Account. Generally, legacy is of non-recurring nature. So, it is always capitalised and shown, on the liabilities side of the Balance Sheet. However, if the amount is small, it can be treated, as income., l In the absence of any clear information it should be treated as capital item., (4) Entrance Fees/Admission Fees, Fees paid by the new members at the time of joining the organisation or institution is, called ‘entrance fees or admission fees’. Since, these fees are paid only once by members, it, , 15

Page 30 :

SBPD Pub li ca tions Ac countancy (XII), is clearly of non-recurring nature. As such, it should be treated as capital receipts and be, shown on the liabilities side of the Balance Sheet., But some accountants are of the view that though each member pays the entrance, fees only once, on account of the constant change in the membership, entrance fees are, received regularly. So, they are recurring in nature. Hence, entrance fees may be treated, as income and entered on the credit side of Income and Expenditure Account., If no instruction is given, it should be treated as income., Remember : General Rules, 1. Treat ‘Donation’/‘General Donation’ as revenue receipt (i.e., income)., 2. Treat ‘Specific Donation’ as a capital receipt, i.e., liability., 3. Entrance Fees/Admission Fees are to be treated as revenue receipts, i.e., income., 4. Subscriptions received for specific purpose should be treated as capital receipts,, that is, liability., 5. Subscriptions : Revenue Receipt, i.e., Income., 6. Life Membership Fees : Capital Receipt i.e., Liability., 7. Endowment Fund : Capital Receipt i.e., Liability., 8. Government Grants-in-aid-Income., 9. Development Grants : Capital Receipt i.e., Liability., (5) Endowment Fund, Endowment Fund is a fund which provides permanent means of support for any, person or institution. It is either deposited in the bank or invested in securities, (investments). Since, the fund provides a permanent means of support, it is a receipt of, capital in nature. It is recorded on the liabilities side of Balance Sheet. Interest earned on, investment of such fund is shown as income in the Income & Expenditure Account., (6) Sale of Old Assets, (i) Sale proceeds of old assets are not shown in Income and Expenditure Account., (ii) Profit on sale of old asset is recorded on the credit side of Income and Expenditure, Account and loss on sale of old asset is entered on the debit side of Income and, Expenditure Account. (iii) In the Balance Sheet, the book value of the concerned asset, (and not the selling price of the asset sold) should be deducted from the total value of, the asset on the assets side of the Balance Sheet., (7) Life Membership Fees, It is paid only once in life by the member. It is a capital receipt. Hence, it is recorded, on the liability side of the Balance Sheet. Sometimes a part of it is transferred to, ‘Subscriptions A/c’ and the balance is transferred to Capital Fund or General Fund., However, if contrary instruction is given, it should be treated accordingly., (8) Sale of Old Newspapers/Periodicals etc., Receipts from sale of old newspapers, magazines, periodicals, journals etc. are, treated as revenue receipts or incomes. These are credited to Income and Expenditure, Account., (9) Sale of Old Sports Materials, Receipts from sale of old sports materials, such as old bats, balls, nets etc. are treated, as revenue receipts or incomes. These are recurring in nature. Hence, these are shown on, the credit side of Income and Expenditure Account., (10) Honorarium, It is the amount paid to those persons who are not employees of the organisation. It is, a revenue expenditure (since it is paid quite regularly). Hence, it is shown on the, expenditure (debit) side of the Income and Expenditure Account., , 16

Page 31 :