Page 3 :

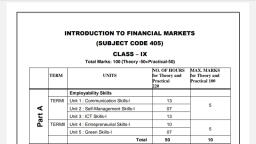

Contents, FINANCIAL MARKET MANAGEMENT – XI, CHAPTER 1: Markets and Financial Instruments..............................................9, 1.1, , What is Investment? .................................................................................. 9, , 1.2, , What are various options available for investment? ...................................... 10, , 1.3, , What is meant by a Stock Exchange? ......................................................... 12, , 1.4, , What is a Depository? .............................................................................. 13, , 1.5, , What is meant by ‗Securities‘? .................................................................. 14, , 1.6, , Regulator ............................................................................................... 15, , 1.7, , Participants ............................................................................................ 16, Points to Remember……………………………………………………………………………………………….17, , CHAPTER 2: Primary and Secondary Market..................................................18, 2.1, , What is the role of the ‗Primary Market‘? .................................................... 18, , 2.2, , Issue of Shares ....................................................................................... 18, , 2.3, , What is meant by Issue price? .................................................................. 19, , 2.4, , What is an Initial Public Offer (IPO)? .......................................................... 20, , 2.5, , What is a Prospectus? .............................................................................. 22, , 2.6, , What is meant by ‗Listing of Securities‘? ..................................................... 23, , 2.7, , What is SEBI‘s Role in an Issue? ................................................................ 23, , 2.8, , Foreign Capital Issuance .......................................................................... 24, , 2.9, , Introduction ............................................................................................ 25, , 2.10 Stock Exchange ....................................................................................... 25, 2.11 Depository………………………………………………………………………………………………………………26, 2.11.1 How is a depository similar to a bank?...............................................26, 2.11.2 Which are the depositories in India?..................................................26, 2.12 Stock Trading ......................................................................................... 28, 2.13 What precautions must one take before investing in the stock markets? ......... 31, 2.14 Products in the Secondary Markets ............................................................ 33, 2.15 Equity Investment ................................................................................... 34, 2.16 Debt Investment ..................................................................................... 36, 2.17 Miscellaneous………………………………………………………………………………………………………….38, 2.17.1 Corporate Actions……………………………………………………………………………………….38, 2.17.2 Index…………………………………………………………………………………………………………..40, 2.17.3 Clearing & Settlement and Redressal………………………………………………………..40, 2.17.4 What is a Book-closure/Record date?.................................................41, 2.17.5 What recourses are available to investor/client for redressing his, grievances?..............................................................................................42, , 3

Page 4 :

2.17.6 What is Arbitration?.........................................................................42, 2.17.7 What is an Investor Protection Fund?................................................42, 2.17.8 What is SEBI SCORES?...................................................................42, Points to Remember…………………………………………………………………………………..43, CHAPTER 3: Financial Statement Analysis......................................................44, 3.1, , CONCEPTS & MODES OF ANALYSIS………………………………………………………………………44, 3.1.1What is Simple Interest? ................................................................... 44, 3.1.2 What is Compound Interest?............................................................. 44, 3.1.3 What is meant by the Time Value of Money? ....................................... 46, 3.1.4 How to go about systematically analyzing a company? ......................... 49, , 3.2, , RATIO Analysis........................................................................................ 58, 3.2.1 Liquidity ratios: ............................................................................... 58, 3.2.2 Leverage/Capital structure Ratios: .................................................... 60, 3.2.3 Profitability ratios: ........................................................................... 61, 3.2.4 Illustration: .................................................................................... 62, Points to Remember……….…………………………………………………………………………….64, , CHAPTER 4: Mutual Funds Products and Features..........................................65, 4.1, , Introduction: ....................................................................................... ….65, , 4.2, , Mutual Funds: Structure In India.................................................................67, , 4.3, , Who Manages Investor‘s Money?.................................................................68, , 4.4, , Who is a Custodian?.................................................................………………....69, , 4.5, , What is the Role of the AMC?......................................................................69, , 4.6, , What is an NFO?.......................................................................................70, , 4.7, , What is the role of a registrar and transfer agents?.......................................70, , 4.8, , What is the procedure for investing in an NFO?............................................70, , 4.9, , What are the investor‘s rights & obligations?................................................71, , 4.10 What are the different schemes offered by Mutual Funds? .......................... 72, 4.11 Category wise funds .............................................................................. 73, 4.12 What are open ended and close ended funds? ........................................... 73, 4.13 What are Equity Oriented Funds? ............................................................ 74, 4.13.1 Introduction ......................................................................... 74, 4.14, , 4.13.2 Equity Fund Definition ............................................................. 74, What is an Index Fund?............................................................................75, , 4.15, , What are diversified large cap funds? ........................................................76, , 4.16, , What are midcap funds?...........................................................................77, , 4.17, , What are Sectoral Funds?.........................................................................77, , 4.18, , Other Equity Schemes :...........................................................................77, 4.18.1 Arbitrage Funds ............................................................................77, , 4

Page 5 :

4.18.2 Multicap Funds .............................................................................77, 4.18.3 Quant Funds .................................................................................77, 4.18.4 International Equities Fund .............................................................78, 4.18.5 Growth Schemes............................................................................78, 4.18.6 ELSS ...........................................................................................79, 4.18.7 Fund of Funds ...............................................................................79, 4.19, , What is the importance of basic offer documents (SID and SAI)? ............ 80, , 4.20, , What is the key information document ................................................ 80, , 4.21, , What is NAV? .................................................................................. 81, , 4.22, , What are expenses incurred in relation to a scheme .............................. 83, , 4.23, , What is Expense Ratio? ..................................................................... 84, , 4.24, , What is Portfolio Turnover?................................................................ 84, , 4.25, , How does AUM affect portfolio turnover? ............................................. 85, , 4.26, , How to analyse cash level in portfolios? ............................................... 86, , 4.27, , What are exit loads? ......................................................................... 86, Points to Remember………………………………………………………………………………………….86, , CHAPTER 5: ETFs, Debt and Liquid Funds.....................................................89, 5.1, , Introduction to Exchange Traded Funds ........................................... ……89, , 5.2, , Salient Features ............................................................................... 89, , 5.3, , What are REITS ............................................................................... 91, , 5.4, , Why Gold ETF .................................................................................. 91, , 5.5, , Working .......................................................................................... 92, 3.5.1 During New Fund Offer (NFO) .................................................... 92, 3.5.2 On an ongoing basis ................................................................. 92, , 5.6, , Sovereign Gold Bonds ....................................................................... 93, 5.6.1Product Details of Sovereign Gold Bonds ...................................... 93, , 5.7, , Market Making by APS ...................................................................... 96, , 5.8, , Creation units, Port Folio deposit and cash component .......................... 96, (an example), , 5.9, , Salient Features ................................................................................ 98, , 5.10, , What is Interest Rate Risk? ............................................................... 99, , 5.11, , What is Credit Risk? ........................................................................100, , 5.12, , How is a Debt Instrument Priced? ......................................................101, , 5.13, , Debt Mutual Fund Schemes ..............................................................105, 5.13.1Fixed Maturity Plans ...............................................................105, , 5

Page 6 :

5.13.2 Capital Protection Funds .........................................................105, 5.13.3 Gilt Funds ............................................................................105, 5.13.4 Balanced Funds .....................................................................105, 5.13.5 MIPs ....................................................................................105, 5.13.6 Child Benefit Plans ................................................................106, 5.14, , Salient features ..............................................................................106, , 5.15, , Valuation of securities......................................................................107, , 5.16, , Floating rate scheme .......................................................................108, , 5.17, , What is portfolio churning in liquid funds? ..........................................108, , 5.18, , Stress testing of assets ...................................................................108, Points to Remember………………………………………………………………………………………..109, , CHAPTER 6: Taxation and Regulation...........................................................111, 6.1, , Capital gains taxation ......................................................................111, , 6.2, , Indexation benefit ...........................................................................112, , 6.3, , Dividend distribution tax ..................................................................112, , 6.4, , Why FMPS are popular? ...................................................................113, , 6.5, , Overview .......................................................................................113, , 6.6, , What is the name of industry association for the Mutual Fund Industry? ........114, , 6.7, , What are the objectives of AMFI? ......................................................114, , 6.8, , Product labelling in mutual funds – riskometer ....................................115, , 6.9, , Advantages of Mutual Funds .............................................................115, , 6.10, , What is a Systematic Investment Plan (SIP)? ......................................116, , 6.11, , What is Systematic Transfer Plan (STP)? ............................................117, , 6.12, , What is Systematic Withdrawal Plan (SWP)? .......................................118, , 6.13, , Choosing between dividend payout, dividend reinvestment and growth options –, which one is better for the investor? ...................................................118, 6.13.1 Growth option .......................................................................118, 6.13.2 Dividend payout option ..........................................................118, 6.13.3 Dividend reinvestment option .................................................119, Points to Remember……………………………………………………………………………………..120, , 6

Page 7 :

UNIT -4 Mutual Funds Products and Features, 4.1, , Introduction, , A mutual fund is a professionally managed type of collective investment scheme that pools, money from many investors and invests it in stocks, bonds, short-term money market, instruments and other securities. Mutual funds have a fund manager who invests the money on, beha lf of the investors by buying / selling stocks, bonds etc., Mutual Fund Industry Statistics (India) - September 2016, Scheme Name, , Rs. Cr, , Increase/D, ecrease, , Change, (%), , Growth, , Asset Under Management, (AUM) (YoY), , 1,609,370, , 294839, , 22.43%, , , , Asset Under Management, (AUM) (MoM), , 1,609,370, , 169669, , 11.79%, , , , There are various asset classes in which an investor can invest his savings depending on his risk, appetite and time horizon viz. real estate, bank deposits, post office deposits, shares,, debentures, bonds etc. While investing in these asset classes an individual would need to study, the risk and reward closely., Example, Mr. X proposes to invest in shares of M/s. Linked Ltd., This requires a detailed analysis of the, •, , performance of the company, , •, , understanding the future business prospects of the company, , •, , track record of the promoters and the dividend, bonus issue history of the company etc., , However, the above process is cumbersome and time consuming., Alternatively an investor can utilize professional expertise to achieve superior returns at, acceptable risk. This is done by investing through mutual funds which offer various types of, schemes. The fund manager studies and analysis numerous stocks before selection for inclusion, in the mutual fund scheme. Therefore an individual investor benefits from professional fund, management. Another reason why investors prefer mutual funds is because mutual funds offer, diversification. An investor‘s money is invested by the mutual fund in a variety of shares, bonds, and other securities thus diversifying the investor‘s portfolio across different companies and, sectors. This diversification helps in reducing the overall risk of the portfolio., , Indian Scenario, , 64

Page 8 :

In India gold has been the single largest form of savings. Bank deposits, post office schemes and, other traditional savings instruments have been extremely popular and continue to be so even, today. Against this background, if we look at approximately Rs.16 lakh crores 1 which Indian, Mutual Funds are managing, then it is no mean an achievement. However a country traditionally, putting money in safe, risk-free investments has started to invest in stocks, bonds and shares –, thanks to the mutual fund industry., The Rs.16 Lakh crores stated above, includes investments by the corporate sector as well. Going, by various reports, not more than 5% of household savings are channelized into the markets,, either directly or through the mutual fund route. Not all parts of the country are contributing, equally into the mutual fund corpus. 8 cities account for over 60% of the total assets under, management in mutual funds. These are issues which need to be addressed jointly by all, concerned with the mutual fund industry. Market dynamics are making industry players to look at, smaller cities to increase penetration. Competition is ensuring that costs incurred in managing, the funds are kept low and fund houses are trying to give more value for money by increasing, operational efficiencies and cutting expenses. As of September 30, 2016, there are around 39, Mutual Funds in the country as per AMFI. Together they offer around 11460 schemes to the, investor., Data Source: Mutualfundindia.com, Let us now look at some trends in mutual funds in India over the 10 year period from September, 2015 to September 2016:, Growth in Assets under Management over years, , Year on Year increase in number of Accounts / Folios in India Mutual Fund Industry, , 65

Page 9 :

Year, , No of Folios (In Crores), , Mar-12, , 4.65, , Mar-13, , 4.28, , Mar-14, , 3.95, , Mar-15, , 4.17, , Mar-16, , 4.77, , Sept-16, , 5.05, , This module is designed to meet the requirements of both the investor as well as the industry ,, mainly those proposing to enter the mutual fund industry. Investors need to understand the, nuances of mutual funds, the workings of various schemes before they invest; since their money, is being invested in risky assets like stocks/ bonds (bonds also carry risk). The language of the, module is kept simple and the explanation is peppered with ‗concept clarifiers‘ and examples., Let us now try and understand the characteristics of mutual funds in India and the different types, of mutual fund schemes available in the market., , 4.2, , Mutual Funds: Structure in India, , Mutual funds primarily deal in investor‘s money. Therefore a clear structure is laid out to ensure, proper governance., Mutual Funds in India follow a 3-tier structure., , There is a Sponsor (the First tier), who thinks of starting a mutual fund. The Sponsor, approaches the Securities & Exchange Board of India (SEBI), which is the market regulator and, also the regulator for mutual funds., The mutual fund industry is governed by the SEBI (mutual fund) Regulations, 1996 and such, other notifications that may be issued by the regulator from time to time. The sponsor should, have sound track record and general reputation of fairness and integrity in all his business, transactions. Sound track record shall mean the sponsor should, , 66

Page 10 :

•, , Be carrying out the business of financial services for not less than five years, , •, , Have positive net worth in all the preceding five years, , •, , The net worth in the immediately preceding financial year is more than the capital, , contribution in the asset management company, •, , Has profits after depreciation, interest and tax in three of out the five preceding years, , including the fifth year, The sponsor has contributed / contributes not less than 40% of the net worth of the asset, management company, Once approved by SEBI, the sponsor creates a Public Trust (the Second tier) as per the Indian, Trusts Act, 1882. Trusts have no legal identity in India and cannot enter into contracts, hence the, Trustees are the people authorized to act on behalf of the Trust. Contracts are entered into in the, name of the Trustees. Once the Trust is created, it is registered with SEBI after which this trust is, known as the mutual fund., It is important to understand the difference between the Sponsor and the Trust. They are two, separate entities. Sponsor is not the Trust; i.e. Sponsor is not the Mutual Fund. It is the Trust, which is the Mutual Fund., The Trustees role is not to manage the money. Their job is only to see, whether the money is, being managed as per stated objectives. Trustees may be seen as the internal regulators of a, mutual fund., , 4.3, , Who Manages Investor’s Money?, , This is the role of the Asset Management Company (the Third tier). Trustees appoint the Asset, Management Company (AMC), to manage investor‘s money. The AMC in return charges a fee for, the services provided and this fee is borne by the investors as it is deducted from the money, collected from them. The AMC‘s Board of Directors must have at least 50% directors, who are not, associate of, or associated in any manner with, the sponsor or any of its subsidiaries or the, trustees. The AMC has to be approved by SEBI. The AMC functions under the supervision of its, Board of Directors, and also under the direction of the Trustees and SEBI. It is the AMC, which in, the name of the Trust, floats and manages schemes by buying and selling securities. In order to, do this, the AMC needs to follow all rules and regulations prescribed by SEBI and as per the, Investment Management Agreement it signs with the Trustees., Whenever the fund intends to launch a new scheme, the AMC has to submit a Draft Offer, Document to SEBI. This draft offer document, after getting SEBI approval becomes the offer, document of the scheme. The Offer Document (OD) is a legal document and investors rely upon, the information provided in the OD for investing in the mutual fund scheme. The Compliance, , 67

Page 11 :

Officer has to sign the Due Diligence Certificate in the OD. This certificate says that all the, information provided inside the OD is true and correct. This ensures that there is accountability, and somebody is responsible for the OD. In case there is no compliance officer, then senior, executives like CEO, Chairman of the AMC has to sign the due diligence certificate. The certificate, ensures that the AMC takes responsibility of the OD and its contents., , 4.4, , Who is a Custodian?, , The assets of the mutual fund scheme are held by the custodian. A custodian‘s role is safe, keeping of physical securities and also keeping a tab on the corporate actions like rights, bonus, and dividends declared by the companies in which the fund has invested. The Custodian is, appointed by the Board of Trustees. Since the custody of the assets is separated from the, management it protects the investors against fraud and misappropriation., The custodian also participates in a clearing and settlement system through approved depository, companies on behalf of mutual funds, in case of dematerialized securities. In India today,, securities (and units of mutual funds) are no longer held in physical form but in dematerialized, form with the Depositories. The holdings are held in the Depository through Depository, Participants (DPs). Only the physical securities are held by the Custodian. The deliveries and, receipt of units of a mutual fund are done by the custodian or a depository participant at the, instruction of the AMC and under the overall direction and responsibility of the Trustees., Regulations provide that the Sponsor and the Custodian must be separate entities., , 4.5, , What is the role of the AMC?, , The role of the AMC is to manage investor‘s money on a day to day basis. Thus it is imperative, that people with the highest integrity are involved with this activity., •, , The AMC cannot deal with a single broker beyond a certain limit of transactions., , •, , The AMC cannot act as a Trustee for some other Mutual Fund. The responsibility of preparing, the OD lies with the AMC., , •, , Appointments of intermediaries like independent financial advisors (IFAs), national and, regional distributors, banks, etc. is also done by the AMC. Finall y, it is the AMC which is, responsible for the acts of its employees and service providers., , As can be seen, it is the AMC that does all the operations. All activities by the AMC are done, under the name of the Trust, i.e. the mutual fund., The AMC charges a fee for providing its services. SEBI has prescribed limits for this. This fee is, borne by the investor as the fee is charged to the scheme, in fact, the fee is charged as a, percentage of the scheme‘s net assets. An important point to note here is that this fee is included, in the overall expenses permitted by SEBI. There is a maximum limit to the amount that can be, , 68

Page 12 :

charged as expense to the scheme, and this fee has to be within that limit. Thus regulations, ensure that beyond a certain limit, investor‘s money is not used for meeting expenses., , 4.6, , What is an NFO?, , Once the 3 – tier structure is in place, the AMC launches new schemes, under the name of the, Trust, after getting approval from the Trustees and SEBI. The launch of a new scheme is known, as a New Fund Offer (NFO). We see NFOs coming up in markets regularly. It is like an invitation, to the investors to put their money into the mutual fund scheme by subscribing to its units. When, a scheme is launched, the distributors talk to potential investors and collect money from them by, way of cheques or demand drafts. Mutual funds cannot accept cash. (Mutual funds units can also, be purchased on-line through a number of intermediaries who offer on-line purchase /, redemption facilities). Before investing, it is expected that the investor reads the Offer Document, (OD) carefully to understand the risks associated with the scheme., , 4.7, , What is the role of a Registrar and Transfer Agents?, , Registrars and Transfer Agents (RTAs) perform the important role of maintaining invest or, records. All the New Fund Offer (NFO) forms, redemption forms (i.e. when an investor wants to, exit from a scheme, it requests for redemption) go to the RTA‘s office where the information is, converted from physical to electronic form. How many units will the investor get, at what price,, what is the applicable NAV, how much money will he get in case of redemption, exit loads, folio, number, etc. is all taken care of by the RTA., , 4.8, , What is the Procedure for investing in an NFO?, , But before investing in mutual funds or NFOs, the investor must have the KYC in place. The, mutual funds or the KYC Registration Agencies (KRAs) must be approached to complete the KYC, formalities. KYC or know your customer is a form that must be filled giving all details of investor, like name, age, address along with supporting documents like PAN Card and address proof. Once, this is done, the investor is to have a bank account and a demat account for transactions in, mutual fund units for incoming and outgoing of money and units., Once these formalities are complete, the investor has to fill a form, which is available with the, distributor or online. The investor must read the Offer Document (OD) before investing in a, mutual fund scheme. In case the investor does not read the OD, he must read the Key, Information Memorandum (KIM), which is available with the application form. Investors have the, right to ask for the KIM/ OD from the distributor., Once the form is filled and the cheque is given to the distributor, he forwards both these, documents to the RTA. The RTA after capturing all the information from the application form into, the system, sends the form to a location where all the forms are stored and the cheque is sent to, the bank where the mutual fund has an account. After the cheque is cleared, the RTA then, , 69

Page 13 :

creates units for the investor. The same process is followed in case an investor intends to invest, in a scheme, whose units are available for subscription on an on-going basis, even after the NFO, period is over. In an online system, this entire process is carried out electronically from filling of, forms to online payment to allotment of units in the demat account of the investor., , Fund Constituents, , 4.9, , What are the Investor’s Rights & Obligations?, , Some of the Rights and Obligations of investors are:-, , , Investors are mutual, beneficial and proportional owners of the scheme‘s assets. The, investments are held by the trust in fiduciary capacity (The fiduciary duty is a legal, relationship of confidence or trust between two or more parties)., , , , In case of dividend declaration, investors have a right to receive the dividend within 30 days, of declaration., , , , On redemption request by investors, the AMC must dispatch the redemption proceeds within, 10 working days of the request. In case the AMC fails to do so, it has to pay an interest @, 15%. This rate may change from time to time subject to regulations., , , , In case the investor fails to claim the redemption proceeds immediately, then the applicable, NAV depends upon when the investor claims the redemption proceeds., , , , Investors can obtain relevant information from the trustees and inspect documents like trust, deed, investment management agreement, annual reports, offer documents, etc. They must, receive audited annual reports within 6 months from the financial year end., , , , Investors can wind up a scheme or even terminate the AMC if unit holders representing 75%, of scheme‘s assets pass a resolution to that respect., , , , Investors have a right to be informed about changes in the fundamental attributes of a, scheme. Fundamental attributes include type of scheme, investment objectives and policies, , 70

Page 14 :

and terms of issue., , , Lastly, investors can approach the investor relations officer for grievance redressal. In case, the investor does not get appropriate solution, he can approach the investor grievance cell of, SEBI. The investor can also sue the trustees., , The offer document is a legal document and it is the investor‘s obligation to read the OD carefully, before investing. The OD contains all the material information that the investor woul d require to, make an informed decision., It contains the risk factors, dividend policy, investment objective, expenses expected to be, incurred by the proposed scheme, fund manager‘s experience, historical performance of other, schemes of the fund and a lot of other vital information., It is not mandatory for the fund house to distribute the OD with each application form but if the, investor asks for it, the fund house has to give it to the investor. However, an abridged version of, the OD, known as the Key Information Memorandum (KIM) has to be provided with the, application form., , 4.10 What are the different schemes offered by Mutual Funds?, , 1) Equity funds – funds that primarily invests in equity shares of companies., 2) Debt funds - funds which invest in debt instruments such as short and long term bonds,, government securities, t-bills, corporate paper, commercial paper, call money etc., 3) Hybrid funds - These are funds which invest in debt as well as equity instruments, 4) Gold ETF – An exchange traded fund that buys and sells gold., 5) Real estate funds – These funds invest in properties, , 71

Page 15 :

4.11 Category Wise Funds, Scheme wise composition of Assets i.e. Debt / Equity / Liquid, Scheme wise composition of assets, Debt Oriented, schemes, , Equity oriented, schemes, , Liquid Money, Market, , ETFs & FOFs, , Mar-12, , 50%, , 33%, , 15, , 2%, , Mar-13, , 57%, , 27%, , 14, , 2%, , Mar-14, , 52%, , 22%, , 24.30%, , 1.70%, , Mar-15, , 44.10%, , 30.90%, , 23.50%, , 1.50%, , Mar-16, , 43.50%, , 31.10%, , 23.70%, , 1.70%, , Year, , Of the total assets under management of all mutual funds debt funds are the major contributor, which includes income funds and gilt funds., , 4.12 What are open ended and Close Ended Funds?, •, , Equity Funds (or any Mutual Fund scheme for that matter) can either be open ended or, close ended., , •, , An open ended scheme allows the investor to enter and exit at his convenience, anytime, (except under certain conditions) whereas a close ended scheme restricts the freedom of, entry and exit., , •, , Whenever a new fund is launched by an AMC, it is known as New Fund Offer (NFO). Units are, offered to investors at the par value of Rs. 10/ unit., , •, , In case of open ended schemes, investors can buy the units even after the NFO period is, over. Thus, when the fund sells units, the investor buys the units from the fund and when the, investor wishes to redeem the units, the fund repurchases the units from the investor. This, can be done even after the NFO has closed. The buy / sell of units takes place at the Net, Asset Value (NAV) declared by the fund., , •, , The freedom to invest after the NFO period is over is not there in close ended schemes., Investors have to invest only during the NFO period; i.e. as long as the NFO is on or the, scheme is open for subscription. Once the NFO closes, new investors cannot enter, nor can, existing investors exit, till the term of the scheme comes to an end. However, in order to, provide entry and exit option, close ended mutual funds list their schemes on stock, exchanges. This provides an opportunity for investors to buy and sell the units from each, other. This is just like buying / selling shares on the stock exchange. This is done through a, stock broker. The outstanding units of the fund does not increase in this case since the fund, is itself not selling any units., , 72

Page 16 :

•, , Sometimes, close ended funds also offer ‗buy-back of fund shares / units‖, thus offering, another avenue for investors to exit the fund. Therefore, regulations drafted in India permit, investors in close ended funds to exit even before the term is over., , 4.13 What are Equity Oriented Funds?, 4.13.1 Introduction, Equity funds account for around 30% of the total AUM managed by mutual funds. A scheme, might have an investment objective to invest largely in equity shares and equity-related, investments like convertible debentures. The investment objective of such funds is to seek capital, appreciation through investment in this growth asset. Such schemes are called equity schemes., Equity funds essentially invest the investor‘s money in equity shares of companies. Fund, managers try and identify companies with good future prospects and invest in the shares of such, companies. The prices of listed securities fluctuate based on liquidity, international scenario and, numerous other factors. Therefore investment in equity funds carries higher risk. It is necessary, for an investor to understand the features of equity investments in terms of risk and return, before investing., 4.13.2 Equity Fund Definition, Equity oriented Funds are funds that invest the investor‘s money in equity and related, instruments of companies., Section 115 T of the Income Tax Act, 1961 lays down that equity oriented fund means such fund, where the investible funds are invested by way of equity shares in domestic companies to the, extent of more than 65% of the total proceeds of such fund, In case of equity funds investors need not pay long term capital gains. Hence it is important that, this investment norm is met by the fund., , Example, ―Equity long term‖ is a fund hosted by ABC Mutual Fund. This fund has invested 100% of the, funds in international equities. Although this fund is also an equity fund from the investors‘ asset, allocation point of view, but the tax laws do not recognise these funds as Equity Funds and hence, investors have to pay tax on the Long Term Capital Gains made from such investments., Equity Funds are of various types and the industry keeps innovating to make products available, for all types of investors. Relatively safer types of Equity Funds include Index Funds and, diversified Large Cap Funds, while the riskier varieties are the Sector Funds. International Funds,, Gold Funds (not to be confused with Gold ETF) and Fund of Funds are some of the different types, of funds, which are designed for different types of investor preferences. These funds are, explained later., Equity Funds can be classified on the basis of market capitalisation of the stocks they invest in –, namely Large Cap Funds, Mid Cap Funds or Small Cap Funds – or on the basis of investment, strategy the scheme intends to have like Index Funds, Infrastructure Fund, Power Sector Fund,, Quant Fund, Arbitrage Fund, Natural Resources Fund, etc. These funds are explained later., Equity Oriented Funds risk pyramid, , 73

Page 17 :

Equity funds do not guarantee any minimum returns. In terms of risk barometer for equity funds,, index funds are the least risky as they mirror the index stocks, followed by the diversified large, cap funds. Mid cap and sector focus funds are considered more risky., , 4.14 What is an Index Fund?, Index Funds invest in stocks comprising indices, such as the Nifty 50, which is a broad based, index comprising 50 stocks. There can be funds on other indices which have a large number of, stocks such as the Nifty Midcap 100 or Nifty 500. Here the investment is spread across a large, number of stocks. In India today we find many index funds based on the Nifty 50 index, whi ch, comprises large, liquid and blue chip 50 stocks., The objective of a typical Index Fund states – ‗This Fund will invest in stocks comprising the Nifty, 50 and in the same proportion as in the index‘. The fund manager will not indulge in research, and stock selection, but passively invest in the Nifty 50 scrips only, i.e. 50 stocks which form part, of Nifty 50, in proportion to their market capitalisation. Due to this, index funds are known as, passively managed funds. Such passive approach also translates into lower costs as well as, returns which closely tracks the benchmark index return (i.e. Nifty 50 for an index fund based on, Nifty 50). Index funds never attempt to beat the index returns, their objective is always to mirror, the index returns as closely as possible., Tracking Error, The difference between the returns generated by the benchmark index and the Index Fund is, known as tracking error. By definition, Tracking Error is the variance between the daily returns of, the underlying index and the NAV of the scheme over any given period., Concept Clarifier – Tracking Error, Tracking Error is the Standard Deviation of the difference between daily returns of the, index and the NAV of the scheme (index fund). This can be easily calculated on a, standard MS office spreadsheet, by taking the daily returns of the Index, the daily, returns of the NAV of the scheme, finding the difference between the two for each day, and then calculating the standard deviation of difference by using the excel formula for, , 74

Page 18 :

‗standard deviation‘., In simple terms it is the difference between the returns delivered by the underlying, index and those delivered by the scheme. This difference may arise on account of any, of the following reasons, •, , The fund manager may buy/ sell securities anytime during the day, whereas the, underlying index will be calculated on the basis of closing prices of the Nifty 50, stocks., , •, , Cash position in the scheme, , •, , If the index‘s portfolio composition changes, it will require some time for the fund, manager to exit the earlier stock and replace it with the new entrant in the index., , •, , Dividend accrued but not distributed, , •, , Accrued expenses, , A lower tracking error is desirable., , The fund with the least Tracking Error will be the one which investors would prefer since it is the, fund tracking the index closely. Tracking Error is also function of the scheme expenses. Lower the, expenses lower the Tracking Error. Hence an index fund with low expense ratio, generally has a, low Tracking Error., , 4.15 What are Diversified large Cap Funds?, Another category of equity funds is the diversified large cap funds., Cap refers to market capitalization. Market capitalization refers to aggregate valuation of the, company based on the current market price and the number of shares issued. Accordingly, companies are classified into, Large cap companies– typically the top 100 to 200 stocks which feature in Nifty 50, Mid cap companies– Stocks below large cap which belong to the mid cap segment, Small cap – companies – Typically stocks with market capitalization of less than, Rs. 5000 cr., Large cap funds restrict their stock selection to the large cap stocks It is generally perceived that, large cap stocks are those which have sound businesses, strong management, globally, competitive products and are quick to respond to market dynamics. Therefore, diversified large, cap funds are considered as stable and safe. The stocks command high liquidity., However, since equities as an asset class are risky, there is no return guarantee for any type of, fund. These funds are actively managed funds unlike the index funds which are passively, managed, In an actively managed fund the fund manager pores over data and information,, researches the company, the economy, analyses market trends, takes into account government, policies on different sectors and then selects the stock to invest. This is called as active, management., A point to be noted here is that anything other than an index funds are actively managed funds, and they generally have higher expenses as compared to index funds. In this case, the fund, manager has the choice to invest in stocks beyond the index. Thus, active decision making comes, in. Any scheme which is involved in active decision making is incurring higher expenses and may, , 75

Page 19 :

also be assuming higher risks. This is mainly because as the stock selection universe increases, from index stocks to large caps to midcaps and finally to small caps, the risk levels associated, with each category increases above the previous category., The logical Points to Remember from this is that actively managed funds should also deliver, higher returns than the index, as investors must be compensated for higher risks. But this is not, always so. Studies have shown that a majority of actively managed funds are unable to beat the, index returns on a consistent basis year after year. Secondly, there is no guaranteeing which, actively managed fund will beat the index in a given year. Index funds therefore have grown, exponentially in some countries due to the inconsistency of returns of actively managed funds., , 4.16 What are Midcap Funds?, Midcap funds, invest in stocks belonging to the mid cap segment of the market. Many of these, midcaps are said to be the ‗emerging blue chips‘ or ‗tomorrow‘s large caps‘. There can be actively, managed or passively managed mid cap funds. There are indices such as the CNX Midcap index, which tracks the midcap segment of the markets and there are some passively managed index, funds investing in the CNX Midcap companies., , 4.17 What are Sectoral Funds?, Funds that invest in stocks from a single sector or related sectors are called Sectoral funds., Examples of such funds are Banking Funds, IT Funds, Pharma Funds, Infrastructure Funds, etc., Regulations do not permit funds to invest over 10% of their Net Asset Value in a single company., This is to ensure that schemes are diversified enough and investors are not subjected to, concentration risk. This regulation is relaxed for sectoral funds and index funds., Example, AAA Mutual Fund has a banking sector fund. The fund objective is to generate continuous returns, by actively investing in equity and equity related securities of companies in the Banking Sector, and companies engaged in allied activities related to Banking Sector., , 4.18 Other Equity Schemes:, 4.18.1 Arbitrage Funds, These invest simultaneously in the cash and the derivatives market and take advantage of the, price differential of a stock in the cash and derivative segment by taking opposite positions in the, two markets (for e.g. cash and stock futures)., 4.18.2 Multi cap Funds, These funds can, theoretically, have a small cap portfolio today and a large cap portfolio, tomorrow. The fund manager has total freedom to invest in any stock from any sector., 4.18.3 Quant Funds, In case of these funds quantitative models are used for stock selection and allocation of wei ghts, based on company‘s size, financial performance and liquidity., Example, XYZ Mutual Fund has recently launched a quant fund. The SID (scheme information document), specifies the use of a quantitative model for aspects like, •, , Stock price – parameters based on periodic moving average of price, market capitalization, , 76

Page 20 :

•, , Financial parameters – based on key indicators such as EPS, PE, PAT, EBDIT margins, (historical and forecasted)., , 4.18.4 International Equities Fund, This is a type of fund which invests in stocks of companies outside India. This can be a Fund of, Fund, whereby, we invest in one fund, which acts as a ‗feeder‘ fund for some other fund(s), .i.e, invests in other mutual funds, or it can be a fund which directly invests in overseas equities., These may be further designed as ‗International Commodities Securities Fund‘ or ‗World Real, Estate and Bank Fund‘ etc., 4.18.5 Growth Schemes, A mutual fund whose aim is to achieve capital appreciation by investing in growth stocks. They, focus on companies that are experiencing significant earnings or revenue growth, rather than, companies that pay out dividends. A growth fund aims to produce capital appreciation by investing, in growth stocks. They focus on industries and specific companies that are in the phase of, signification revenue growth rather than high dividend payouts. These companies are in the, growth phase and hence require a holding period of 5-10 years. Hence a higher risk tolerance is, required. The time horizon for return is medium to long term., Example, PU Mutual Fund has a Growth companies fund that has an investment objective to invest in, companies / stocks with high growth rates or above average potential., The fund managers will follow an active investment strategy and will be focusing on rapid growth, companies (or sectors). The selection of stocks will be growth measures such as Enterprise, Value/EBITDA (Earnings before Interest, Taxes, Depreciation, and Amortization), forward, price/sales, and discounted EPS (Earning per Share). The primary focus will be to identify ‗high, growth‘ companies, especially in sectors witnessing above average growth. A combination of top down (macro analysis to identify sectors) and bottom-up approach (micro analysis to pick stocks, within these sectors) will be employed. The switch between companies and sectors to be, identified based on relative valuations, liquidity and growth potential., Concept Clarifier – Growth and Value Investing, Investment approaches can be broadly classified into Growth based and Value Based., While Growth investing refers to investing in companies with high growth potential,, Value investing approach is based upon the premise that a stock/ sector is currently, undervalued and the market will eventually realize its true value. So, a value investor, will buy such a stock/ sector today and wait for the price to move up. When that, happens, the Value investor will exit and search for another undervalued opportunity., Hence in Growth investing, it is the growth momentum that the investor looks for,, whereas in Value investing, the investor looks for the mismatch between the current, market price and the true value of the investment., Contra Funds can be said to be following a Value investing approach. For example,, when interest rates rise, people defer their purchases as the cost of borrowing, , 77

Page 21 :

increases. This affects banks, housing and auto sectors and the stocks of these, companies come down. A Value fund manager will opine that as and when interest rates, come down these stocks will go up again; hence he will buy these stocks today, when, nobody wants to own them. Thus he will be taking a contrarian call. The risk in Growth, investing is that if growth momentum of the company goes down slightly, then the, stock‘s price can go down rather fast, while in Value investing, the risk is that the, investor may have to wait for a really long time before the market values the, investment correctly., , 4.18.6 ELSS, Equity Linked Savings Schemes (ELSS) are equity schemes, where investors get tax benefit upto, Rs. 1.5 lacs under section 80C of the Income Tax Act. These are open ended schemes but have a, lock in period of 3 years. These schemes serve the dual purpose of equity investing as well as tax, planning for the investor. However it must be noted that investors cannot, under any, circumstances, get their money back before 3 years from the date of investment., 4.18.7 Fund of Funds, These are funds which do not directly invest in stocks and shares but invest in units of other, mutual funds which in their opinion will perform well and give high returns. Almost all mutual, funds offer fund of funds schemes., Let us now look at the internal workings of an equity fund and what must an investor know to, make an informed decision., , Concept Clarifier – AUM, Assets Under Management (AUM) represents the money which is managed by a mutual, fund in a scheme. Adding AUMs for all schemes of a fund house gives the AUM of that, fund house and the figure arrived at by adding AUMs of all fund houses represents the, industry AUM., AUM is calculated by multiplying the Net Asset Value (NAV – explained in detail later) of, a scheme by the number of units issued by that scheme., A change in AUM can happen either due to redemptions or inflows. In case of sharp, market falls, the NAVs are expected to move down. This may lead to redemption, pressures and the AUMs may come down. Conversely, if the outlook on country and, markets is positive, it may lead to inflow of funds leading to overall increase in the, AUM. Also if the fund is able to produce superior returns as compared to the benchmark, (e.g. Nifty, it may result in inflows into the scheme, leading to an increase in the AUM., , 78

Page 22 :

4.19 What is the Importance of basic Offer Documents (SID AND, SAI)?, Prior to investing, every investor needs to be aware of the basic objective, term and inves tment, philosophy of the scheme. These are fundamental features of the fund and cannot be altered by, the fund house without investor approval., Mutual Fund Offer Documents have two parts:, •, , Scheme Information Document (SID), which has details of the scheme, , •, , Statement of Additional Information (SAI), which has statutory information about the, mutual fund, that is offering the scheme., , The above documents are prepared by the fund house and vetted by SEBI. Investor can, download these documents from the mutual fund website. Investors should understand and, analyse them prior to investing., , Every offer document clearly states that, ―The particulars of the Scheme have been prepared in accordance with the Securities and, Exchange Board of India (Mutual Funds) Regulations 1996, (herein after referred to as ‗SEBI (MF), Regulations‘) as amended till date, and filed with SEBI, along with a Due Diligence Certificate, from the AMC. The units being offered for public subscription have not been approved or, recommended by SEBI nor has SEBI certified the accuracy or adequacy of the Scheme, Information Document., The Scheme Information Document sets forth concisely the information about the scheme that a, prospective investor ought to know before investing. Before investing, investors should also, ascertain about any further changes to this Scheme Information Document after the date of this, Document from the Mutual Fund / Investor Service Centres / Website / Distributors or Brokers., The investors are advised to refer to the Statement of Additional Information (SAI) for details of, ________ Mutual Fund, Tax and Legal issues and general information on www.__________., (Website address), SAI is incorporated by reference (is legally a part of the Scheme Information Document). For a, free copy of the current SAI, please contact your nearest Investor Service Centre or log on to our, website., The Scheme Information Document should be read in conjunction with the SAI and not in, isolation‖., , 4.20 What is the Key Information Document?, The Key Information Memorandum (KIM) is a summary of the SID and SAI. As per SEBI, regulations, every application form is to be accompanied by the KIM., The important contents of KIM are:, , 79

Page 23 :

•, , Name of the AMC, mutual fund, Trustee, Fund Manager and scheme, , •, , Dates of Issue Opening, Issue Closing & Re-opening for Sale and Re-purchase, , •, , Plans and Options under the scheme, , •, •, , Risk Profile of Scheme, Price at which Units are being issued and minimum amount / units for initial purchase,, additional purchase and re-purchase, , •, , Benchmark, , •, , Dividend Policy, , •, , Performance of scheme and benchmark over last 1 year, 3 years, 5 years and since, inception., , •, , Loads and expenses, , •, , Contact information of Registrar for taking up investor grievances, , 4.21 What is NAV?, Net Assets of a scheme is the market value of assets of the scheme less all scheme liabilities., NAV i.e. net asset value is calculated by dividing the value of Net Assets by the outstanding, number of Units., Concept Clarifier – NAV, , Assets, Shares, , Rs. Crs., , Liabilities, , 345, , Debentures, , 23, , Money Market instruments, , 12, , Accrued Income, , 2.3, , Unit Capital, Reserves & Surplus, , Accrued, , Rs. Crs., 300, 85.7, , 1.5, , Expenditure, Other Current Assets, , 1.2, , Deferred Revenue Expenditure, , 4.2, , Other Current Liabilities, , 387.7, , Units Issued (Cr.), , 30, , Face Value (Rs.), , 10, , Net Assets (Rs.), , 385.7, , NAV (Rs.), , 0.5, , 387.7, , 12.86, , The above table shows a typical scheme balance sheet. Investments are entered under the, , 80

Page 24 :

assets column. Adding all assets gives the total of Rs.387.7 cr. From this i f we deduct the, liabilities of Rs.2 cr. I.e. Accrued Expenditure and Other Current Liabilities, we get Rs. 385.7 cr., as Net Assets of the scheme., The scheme has issued 30 crs. units @ Rs.10 each during the NFO. This translates in Rs.300, crs. being garnered by the scheme then. This is represented by Unit Capital in the Balance, Sheet. Thus, as of now, the net assets worth Rs.385.7 cr are to be divided amongst 30 crs., units. This means the scheme has a Net Asset Value or NAV of Rs.12.86., The important point that the investor must focus here is that the Rs. 300 crs. garnered by the, scheme has increased to Rs.387 crs., which translates into a 29.23% gain, whereas, the return, for the investor is 28.57% (12.86-10/ 10 = 28.57%)., Formula for NAV, , NAV=, , Concept Clarifier – Fund Fact Sheet, After an investor has entered into a scheme, he must monitor his investments regularly. This, can be achieved by going through the Fund Fact Sheet. This is a monthly document which all, mutual funds have to publish., This document gives all details as regards, •, , the AUMs of all its schemes, , •, , top holdings in all the portfolios of all the schemes, , •, , loads, minimum investment, , •, , performance over 1, 3, 5 years and also since launch, , •, , Comparison of scheme‘s performance with the benchmark index (most mutual fund, schemes compare their performance with a benchmark index such as the Nifty 50) over the, same time periods, , •, , fund managers outlook, , •, , portfolio composition, , •, , expense ratio, , •, , portfolio turnover, , •, , risk adjusted returns, , •, , equity/ debt split for schemes, , •, , YTM for debt portfolios and other information which the mutual fund considers important, from the investor‘s decision making point of view., , 81

Page 25 :

In a nutshell, the fund fact sheet is the document which investors must read, understand a nd, keep themselves updated with., , 4.22 What are expenses incurred in relation to a ccheme?, There are two types of expenses incurred by a scheme, Initial issue expenses – these expenses are incurred when the NFO is made. These need to, be borne by the AMC., Recurring expenses – These expenses are incurred regularly. These include, o, , fees paid to trustees, custodians, auditor, registrar and transfer agents, , o, , selling and commission expenses, , o, , listing fees and depository fees, , o, , expenses related to investor communication, , o, , service tax, , SEBI has clearly laid down limits for expenses that can be charged to the scheme., The limits for schemes other than index schemes are as follows:, Net Assets (Rs crs.), , •, , Equity Schemes, , Debt Schemes, , Upto Rs.100 crs., , 2.50%, , 2.25%, , Next Rs.300 crs., , 2.25%, , 2.00%, , Next Rs.300 crs., , 2.00%, , 1.75%, , Excess over Rs.700 crs., , 1.75%, , 1.50%, , The above percentages are to be calculated on the average daily net assets of the scheme., The expense limits (including management fees) for index schemes (including Exchange, Traded Funds) is 1.5% of average net assets., , •, , In case of a fund of funds scheme, the total expenses of the scheme including weighted, average of charges levied by the underlying schemes shall not exceed 2.50 per cent of the, average daily net assets of the scheme., , In addition to the limits specified, the following costs or expenses may be charged to the scheme,, namely, •, , brokerage and transaction costs which are incurred for the purpose of execution of trade and, is included in the cost of investment, not exceeding 0.12% in case of cash market, transactions and 0.05% in case of derivatives transactions, , •, , expenses not exceeding of 0.30% of daily net assets, if the new inflows from such cities as, specified by the Board from time to time are at least - (i) 30 per cent of gross new inflows in, , 82

Page 26 :

the scheme, or; (ii) 15 per cent of the average assets under management (year to date) of, the scheme, whichever is higher: Provided that if inflows from such cities is less than the, higher of sub-clause (i) or sub- clause (ii), such expenses on daily net assets of the scheme, shall be charged on proportionate basis, •, , additional expenses not exceeding 0.20 per cent of daily net assets of the scheme, , Any expenditure in excess of the limits specified above shall be borne by the asset management, company or by the trustee or sponsors., Mutual funds/AMCs shall launch new schemes under a single plan and ensure that all new, investors are subject to single expense structure. Investors, who have already invested as per, earlier expense structures based on amount of investment, will be subject to single expense, structure for all fresh subscription., , 4.23 What is Expense Ratio?, Among other things that an investor must look at before finalising a scheme, is that he must, check out the Expense Ratio., , Concept Clarifier – Expense Ratio, Expense Ratio is defined as the ratio of expenses incurred by a scheme to i ts Average, Weekly Net Assets. It means how much of investors‘ money is going for expenses and, how much is getting invested. This ratio should be as low as possible., Assume that a scheme has average weekly net assets of Rs 100 cr. and the scheme, incurs Rs.1 cr. as annual expenses, then the expense ratio would be 1/ 100 = 1%. In, case this scheme‘s expense ratio is comparable to or better than its peers then this, scheme would qualify as a good investment, based on this parameter only., If this scheme performs well and its AUM increases to Rs. 150 cr in the next year, whereas its annual expenses increase to Rs. 2 cr, then its expense would be 2/ 150 =, 1.33%., It is not enough to compare a scheme‘s expense ratio with peers. The scheme‘s, expense ratio must be tracked over different time periods. Ideally as net assets, increase, the expense ratio of a scheme should come down., , Investors today have an option of investing through direct plans. Since the direct plans do not, entail distributor commissions, they may have a lower expense ratio., , 4.24 What is Portfolio Turnover?, Fund managers keep churning their portfolio depending upon their outlook for the market, sector, or company. This churning can be done very frequently or may be done after sufficient time, gaps. There is no rule which governs this and it is the mandate of the scheme and the fund, managers‘ outlook and style that determine the churning. However, what is important to, understand is that a very high churning frequency will lead to higher trading and transaction, costs, which may eat into investor returns. Portfolio Turnover is the ratio which helps us to find, , 83

Page 27 :

how aggressively the portfolio is being churned., While churning increases the costs, it does not have any impact on the Expense Ratio, as, transaction costs are not considered while calculating expense ratio. Transaction costs are included, in the buying & selling price of the scrip by way of brokerage, STT, cess, etc. Thus the portfolio, value is computed net of these expenses and hence considering them while calculating Expense, Ratio as well would mean recording them twice – which would be incorrect., , Concept Clarifier – Portfolio Turnover, Portfolio Turnover is defined as ‗Lesser of Assets bought or sold/ Net Assets‘. A scheme, with Rs.100 cr as net assets sells Rs.20 cr. of its investments. Thus its Portfolio, Turnover Rate would be 20/ 100 = 20%., If this scheme‘s net assets increase to Rs.120 cr and the fund manager decides to churn, the entire portfolio by exiting all stocks, then the Portfolio Turnover would be 120/ 120, = 100%., If the fund manager churns the entire portfolio twice in a single year then we would say, that the Portfolio Turnover rate is 200% or that the portfolio is churned once every 6, months. Liquid funds have very high portfolio turnover due to less maturity of the, paper. Once the paper matures, the fund manager has to buy another security, thus, churning the portfolio., , 4.25 How does AUM Affect Portfolio Turnover?, The scheme‘s size i.e. the AUM can also have an impact on the performance of the s cheme. In, case the scheme performs well and thereby attracts a lot of money flow, it may happen that the, fund manager may not be able to deploy that extra money successfully as he may not find, enough opportunities. Thus an increased fund size may result in lower returns. If the fund, manager tries to acquire significantly large quantities of a stock, the buying pressure may lead to, higher stock prices, thereby higher average cost for the scheme. Also, if the holdings by the, scheme in any stock are huge, then exit may be difficult as selling from the scheme itself can put, pressure on the prices. Thus the first share may be sold at a higher price and as the supply, increases the prices may fall, and the last share may get sold at a lower price., A scheme with a very small AUM does not face these problems but has its own set of problems., The Expense Ratio of such a scheme will be very high as expenses are calculated as a percent of, Average Weekly Net Assets. As the fund size increases, the Expense Ratio tends to go down., Similarly Portfolio Turnover will be magnified as the denominator (Average Net Assets) is small, and hence the turnover appears to be very high., Thus, the investor must look at AUM for the previous few months, say last 12 months and, compare the same with that of the industry and also similar schemes. If it is found that the, scheme‘s performance is in line or better than its peers consistently, even though the AUM is, increasing, then it can be a fair indicator that increased AUM is not a problem for th e fund, manager., , 84

Page 28 :

4.26 How to Analyse Cash Level in Portfolios?, The next logical point of focus must be the Cash Level in the scheme. The Cash level is the, amount of money the mutual fund is holding in Cash, i.e. the amount not invested in stocks and, bonds but lying in cash., If the scheme is having higher than industry average cash levels consistently, more so in a bull, market, it will lead to a inferior performance by the scheme than its peers. However, in a falling, market, it is this higher cash level that will protect investor wealth from depleting. Hence, whenever one is analyzing cash levels, it is extremely important to see why the fund manager is, holding high cash levels. It may be so that he is expecting a fall therefore he is not committing, large portions of monies. It may be so in a bull market or a bear market. The strategy could be, to enter once the prices correct. High cash levels can also be seen as a cushion for sudden, redemptions and in large amounts., , 4.27 What are Exit Loads?, Exit Loads, are paid by the investors in the scheme, if they exit one of the scheme before a, specified time period. Exit Loads reduce the amount received by the investor. Not all schemes, have an Exit Load, and not all schemes have similar exit loads as well. Some schemes have, Contingent Deferred Sales Charge (CDSC). This is nothing but a modified form of Exit Load,, where in the investor has to pay different Exit Loads depending upon his investment period., If the investor exits early, he will have to bear more Exit Load and if he remains invested for a, longer period of time, his Exit Load will reduce. Thus the longer the investor remains invested,, lesser is the Exit Load. After some time the Exit Load reduces to nil; i.e. if the investor exits after, a specified time period, he will not have to bear any Exit Load., Earlier there was a difference between the sale price and the NAV, the difference being the ‗entry, load‘. However SEBI has banned entry loads since May 2009. Further exit loads / CDSC have to, be credited back to the scheme immediately i.e. they are not available for the AMC to bear selling, expenses. Upfront commission to distributors will be paid by the investor directly to the, distributor, based on his assessment of various factors including the service rendered by t he, distributor. Currently for equity funds / bonds funds redeemed within 1 year are charged 1% exit, load. However liquid funds and money market funds normally have zero exit loads., , POINTS TO REMEMBER, A variety of schemes are offered by mutual funds. It is critical for investors to know the features, of these products, before money is invested in them. These include the following:, 1) Equity funds – funds that primarily invests in equity shares of companies., 2) Debt funds - funds which invest in debt instruments such as short and long term bonds,, government securities, t-bills, corporate paper, commercial paper, call money etc., 3) Hybrid funds - These are funds which invest in debt as well as equity instruments, 4) Gold ETF – An exchange traded fund that buys and sells gold., 5) Real estate funds – These funds invest in properties, There are other types of funds within these broad categories, which the investor must be aware, of. They include the following:, , 85

Page 29 :

•, , Index Funds invest in stocks comprising indices, such as the Nifty 50, which is a broad based, index comprising 50 stocks., , •, , Large cap funds restrict their stock selection to the large cap stocks, , •, , Midcap funds, invest in stocks belonging to the mid cap segment of the market., , •, , Funds that invest in stocks from a single sector or related sectors are called Sectoral funds., , •, , Other equity funds ELSS and Fund of funds, , Investments in new fund offers is through the offer documents as issued the mutual funds. These, offer documents have two parts:, •, , Scheme Information Document (SID), which has details of the scheme, , •, , Statement of Additional Information (SAI), which has statutory information about the mutual, fund, that is offering the scheme., , The Key Information Memorandum (KIM) is a summary of the SID and SAI. As per SEBI, regulations, every application form is to be accompanied by the KIM., Another importance concept to be kept in mind is the NAV of the scheme. The NAV or Net Assets, Value of a scheme is the market value of assets of the scheme less all scheme liabilities. . NAV, i.e. net asset value is calculated by dividing the value of Net Assets by the outstanding number of, Units., After an investor has entered into a scheme, he must monitor his investments regularly. This can, be achieved by going through the Fund Fact Sheet., There are two types of expenses incurred by a scheme, Initial issue expenses – these expenses are incurred when the NFO is made. These need to be, borne by the AMC., Recurring expenses – These expenses are incurred regularly., Expense Ratio is defined as the ratio of expenses incurred by a scheme to its Average Weekly Net, Assets. It means how much of investors‘ money, Portfolio Turnover is the ratio which helps us to find how aggressively the portfolio is being, churned., Exit Loads, are paid by the investors in the scheme, if they exit one of the scheme before a, specified time period. Exit Loads reduce the amount received by the investor. Not all schemes, have an Exit Load, and not all schemes have similar exit loads as well., , Exchange Traded Funds (ETFs) are mutual fund units which investors buy/ sell from the stock, exchange, as against a normal mutual fund unit, where the investor buys / sells through a, distributor or directly from the AMC., Practically any asset class can be used to create ETFs. Globally there are ETFs on Silver, Gold,, Indices (SPDRs, Cubes, etc), etc. In India, we have ETFs on Gold, Indices such as Nifty 50, Bank, Nifty etc.)., An index ETF is one where the underlying is an index, say Nifty 50., , 86

Page 30 :

An Exchange Traded Fund (ETF) is essentially a scheme where the investor has to buy/ sell units, from the market through a broker (just as he/ he would by a share)., An investor can approach a trading member of NSE and enter into an agreement with the trading, member. Buying and selling ETFs requires the investor to have demat and trading accounts., Gold ETFs (G-ETFs) are a special type of ETF which invests in Gold and Gold related securities., APs are like market makers and continuously offer two way quotes (buy and sell). They earn on, the difference between the two way quotes they offer. This difference is known as bid-ask, spread. They provide liquidity to the ETFs by continuously offering to buy and sell ETF units., , 87

Page 31 :

UNIT-5 : ETFs, Debt and Liquid Funds, 5.1, , Introduction to Exchange Traded Funds, , Exchange Traded Funds (ETFs) are mutual fund units which investors buy/ sell from the stock, exchange, as against a normal mutual fund unit, where the investor buys / sells through a, distributor or directly from the AMC. ETF as a concept is relatively new in India. It was only in, early nineties that the concept gained in popularity in the USA., ETFs have relatively lesser costs as compared to a mutual fund scheme. This is largely due to the, structure of ETFs. While in case of a mutual fund scheme, the AMC deals directly with the, investors or distributors, the ETF structure is such that the AMC does not have to deal directly, with investors or distributors. It instead issues units to a few designated large participants, who, are also called as Authorised Participants (APs), who in turn act as market makers for the ETFs., The Authorised Participants provide two way quotes for the ETFs on the stock exchange, which, enables investors to buy and sell the ETFs at any given point of time when the stock markets are, open for trading. ETFs therefore trade like stocks. Buying and selling ETFs is similar to buying, and selling shares on the stock exchange. Prices are available on real time and the ETFs can be, purchased through a stock exchange broker just like one would buy / sell shares., Due to these lower expenses, the Tracking Error for an ETF is usually low. Tracking Error is the, acid test for an index fund/ ETF. By design an index fund/ index ETF should only replicate the, index return. The difference between the returns generated by the scheme/ ETF and those, generated by the index is the tracking error., Assets in ETFs, Practically any asset class can be used to create ETFs. Globally there are ETFs on Silver, Gold,, Indices (SPDRs, Cubes, etc), etc. In India, we have ETFs on Gold, Indices such as Nifty 50, Bank, Nifty etc.)., Index ETF, An index ETF is one where the underlying is an index, say Nifty 50. The APs deliver the shares, comprising the Nifty, in the same proportion as they are in the Nifty, to the AMC and create ETF, units in bulk (These are known as Creation Units). Once the APs get these units, they provide, liquidity to these units by offering to buy and sell through the stock exchange. They give two way, quotes, buy and sell quote for investors to buy and sell the ETFs. ETFs therefore have to be listed, on stock exchanges. There are many ETFs presently listed on the NSE. For further details please, check NSE website http://www.nseindia.com, Below path Home>>Products>>Equities>>Exchange Traded Funds, , 5.2, •, , Salient Features, , An Exchange Traded Fund (ETF) is essentially a scheme where the investor has to buy/ sell, units from the market through a broker (just as he/ he would by a share)., , •, , An investor must have a demat account for buying ETFs (For understanding what is demat, please refer to NCFM module ‗Financial Markets : A Beginners‘ Module)., , •, , An important feature of ETFs is the huge reduction in costs. While a typical Index fund would, have expenses in the range of 1.5% of Net Assets, an ETF might have expenses around, 0.75%. In fact, in international markets these expenses are even lower. In India too this may, , 88

Page 32 :

be the trend once more Index Funds and ETFs come to the market and their popularity, increases. Expenses, especially in the long term, determine to a large extent, how much, money the investor makes. This is because lesser expenses mean more of the investor‘s, money is getting invested today and over a longer period of time, the power of compounding, will turn this saving into a significant contributor to the investors‘ returns., , Scheme, , A, , B, , Investment (Rs.), , 10000, , 10000, , Expense Ratio, , 1.50%, , 0.75%, , Term (Years), , 25, , 25, , 12%, , 12%, , 116508.16, , 140835.93, , Compounded Average Growth Rate (CAGR), Amount (Rs.), Difference (Rs.), , 24327.77, , If an investor invests Rs.10,000 in 2 schemes each, for 25 years, with both the schemes, delivering returns at a CAGR of 12% and the only difference being in the expenses of the, schemes, then at the end of the term, while scheme A would have turned the investment into, Rs.1.16 Lakhs, scheme B would have grown to Rs.1.40 Lakhs – a difference of Rs.24,327.77., Post expenses, scheme A‘s CAGR comes out to be 10.32%, while scheme B‘s CAGR stands at, 11.16%., , Concept Clarifier – Buying/ Selling ETFs, An investor can approach a trading member of NSE and enter into an agreement with, the trading member. Buying and selling ETFs requires the investor to have demat and, trading accounts. The procedure is exactly similar to buying and selling shares. The, investor needs to have sufficient money in the trading account. Once this is done, the, investor needs to tell the broker precisely how many units he wants to buy/ sell and at, what price., Investors should take care that they place the order completely. They should not tell, the broker to buy/ sell according to the broker‘s judgement. Investors should also not, keep signed delivery instruction slips with the broker as there may be a possibility of, their misuse. Placing signed delivery instruction slips with the broker is similar to giving, blank signed cheques to someone., , 89

Page 33 :

5.3, , What are REITs?, , REITs or Real Estate Investment Trusts are similar to mutual funds. They invest in real estate, assets and give returns to the investor based on the return from the real estate. Like a mutual, fund, REITs collect money from many investors and invest the same in real estate properties like, offices, residential apartments, shopping malls, hotels, warehouses). These REITs are listed on, stock exchanges. The investors can directly buy and sell units from the stock exchanges., REITs are actually trusts and hence their assets are in the hands of an independent trustee, held, on behalf of the investor. The trustee is bound to ensure compliance with applicable laws and, protect the rights of the unit holders., Income takes the form of rentals and capital gains from property which is distributed to investors, as dividends. Money is raised from unit holders through IPO (Initial Public Offer)., , 5.4, , Why Gold ETF?, , Gold ETFs (G-ETFs) are a special type of ETF which invests in Gold and Gold related securities., This product gives the investor an option to diversify his investments into a different asset class,, other than equity and debt., Traditionally, Indians are known to be big buyers of Gold; an age old tradition. Gold as an asset, class is considered to be safe This is because gold prices are difficult to manipulate and therefore, enjoy better pricing transparency. When other financial markets are weak, gold gives good, returns. It also enjoys benefit of liquidity in case of any emergency., We buy Gold, among other things for children‘s marriages, for gifting during ceremonies etc., Holding physical Gold can have its‘ disadvantages:, 1. Fear of theft, 2. Payment Wealth Tax, 3. No surety of quality, 4. Changes in fashion and trends, 5. Locker costs, 6. Lesser realisation on remoulding of ornaments, G-ETFs can be said to be a new age product, designed to suit our traditional requirements. G ETFs score over all these disadvantages, while at the same time retaining the inherent, advantages of Gold investing., In case of Gold ETFs, investors buy Units, which are backed by Gold. Thus, every time an, investor buys 1 unit of G-ETFs, it is similar to an equivalent quantity of Gold being earmarked for, him some w here. Thus his units are ‗as good as Gold‘., Say for example 1 G-ETF = 1 gm of 99.5% pure Gold, then buying 1 G-ETF unit every month for, 20 years would have given the investor a holding of 240gm of Gold, by the time his child‘s, marriage approaches (240 gm = 1 gm/ month * 12 months * 20 Years). After 20 years the, investor can convert the G-ETFs into 240 gm of physical gold by approaching the mutual fund or, sell the G-ETFs in the market at the current price and buy 240 gms. of gold., Secondly, all these years, the investor need not worry about theft, locker charges, quality of Gold, or changes in fashion as he would be holding Gold in paper form. As and when the investor needs, the Gold, he may sell the Units in the market and realise an amount equivalent to his holdings at, the then prevailing rate of Gold ETF. This money can be used to buy physical gold and make, , 90

Page 34 :