Page 2 :

BUSINESS, CHAPTER 4 BUSINESS SERVICES, BUSINESS SERVICES, Auxiliaries or aids to trade refer to those activities which are related to buying and, selling of goods and services.These are also known as business services., Features :, 1.Intangibility: It cannot be seen, touched or smelled.It can only be felt., 2.Inconsistency: Different customers have different demands & expectation.e.g., Mobile services/Beauty Parlour., 3.In Separability: Production and consumption are performed simultaneously .For, e.g. ATM may replace clerk but presence of customer is must., 4.Inventory Loss: Services cannot be stored for future use or performed earlier to be, consumed at a later date. e.g. underutilized capacity of hotels and airlines during, slack demand cannot be stored for future when there will be a peak demand.

Page 3 :

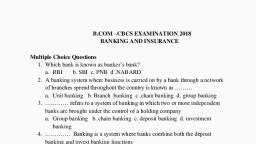

5.Involvement: Participation of the customer in the service delivery is a must e.g. A, customer can get the service modified according to specific requirement., BANKING, The Banking Regulation Act,1949 defines the term banking as ''The acceptance of, deposits for the purpose of lending or investment as and when required.'', Bank is a financial institution which accepts money on deposits, repayable on demand, and also earns a margin of profit by lending money., TYPES OF BANK ACCOUNT, A bank account is a record of the financial transactions between the customer and, the banking institution., TYPES OF COMMERCIAL BANK ACCOUNT, 1.Savings account : The aim of a saving account is to promote savings of the public. A, person can open this account by depositing a small sum of money. He can withdraw

Page 4 :

money from his account and make additional deposits at will.There is no restriction, on number and amount of deposits.In this account the rate of interest is lower than, the rate of interest on fixed deposit account., Benefits :, 1.It encourages savings habit among people., 2.It enables the depositor to earn income by way of interest., 3.It helps the depositor to make payment by way of cheques., 2.Current Account : It is opened by businessman who have a number of regular, transactions with the bank, both deposits and withdrawals.The account holder can, deposit and withdraw money, whenever needed and there is no restriction on, number and amount of deposits.It is also known as demand deposit. Withdrawals are, always made by cheque. No interest is paid on current accounts. Rather charges are, taken by bank for services rendered by it.

Page 5 :

Benefits :, 1.It helps the businessman in their business transactions as there is no restriction on, amount and number of withdrawals., 2.The businessman can make direct payment to their creditors with the help of, cheque., 3.The bank collects money on behalf of its customers., 4.It enables the account holder to obtain overdraft facility., 5.It reveals the information about the credit worthiness of account holder to the, creditors and lenders., 3.Fixed deposit account : Money is deposited in the account for a fixed period is, called as Fixed Deposit account. After expiry of specified period ,person can claim his, money from the bank. Usually the rate of interest is maximum in this account. The, longer the period of deposit, the higher will be the rate of interest on deposit.

Page 6 :

Benefits :, 1.It encourages saving habit among people., 2.The depositor can get loan facility from bank., 3.We can use the amount according to our needs on maturity., 4.Banks get funds for longer time and can use it to give short term loans., 4.Recurring deposit account : The account holder is required to deposit specified, sum of money every month.They are also termed as cumulative time deposits.The, amount together with interest is repaid on maturity. The interest rate on this account, is higher than that of saving deposits., Benefits :, 1.It encourages regular savings habit among the people., 2.The account holder can get a loan facility.

Page 7 :

3.Banks can utilise such funds for granting short term loans to businessman and also, invest such funds in profitable areas., 5.Multiple option deposit account : It is a type of saving Bank A/c in which deposit in, excess of a particular limit gets automatically transferred into fixed Deposit. On the, other hand, in case adequate fund is not available in our saving Bank Account so, as, to honour a cheque that we have issued the required amount gets automatically, transferred from fixed deposit to the saving bank account., Benefits :, 1.He can earn more interest., 2.It lowers the risk of dishonouring a cheque., 3.Fixed amount can be used to purchase assets., 4.It works for investment purpose for us.

Page 8 :

BANKING SERVICES, The primary functions of banks are borrowing and lending of money.Banks also offers, various services to attract customers., Bank Draft, It is an order issued by a bank on any branch of the same bank to pay the specified, amount to the person named in it.The bank issues a draft for the amount in its own, branch at other places or other banks on those places. The payee can present the, draft on the drawee bank at his place and collect the money. Bank charges some, commission for issuing a bank draft., Banker's cheque (Pay order), It is almost like a bank draft. It refers to that bank draft which is payable within the, town. In other words banks issue pay order for local purpose and issue bank draft for, outstation transactions.

Page 9 :

Real Time Gross Settlement (RTGS), RTGS system is an online system for transferring funds in which transfer of money, takes place from one bank to another on a real time and on gross basis., Settlement in Real time means transactions are settled as soon as they are processed, and are not subject to any waiting period. Gross settlement means the transaction is, settled on one to one basis without bunching or netting with any other transaction., This is the fastest possible money transfer system through the banking channel., National Electronic Funds Transfer (NEFT), NEFT refers to a nationwide system that facilitate individuals, firms and companies to, electronically transfer funds from any branch to any individual, firm or company, having an account with any other bank branch in the country. NEFT settles, transactions in batches. The settlement takes place at a particular point of time., The basic difference between RTGS and NEFT is that while RTGS transactions are processed, continuously, NEFT settles transactions in batches.

Page 10 :

Bank Overdraft, It refers to a facility in which a customer is allowed to overdraw his current account, upto an agreed limit.This facility is given to its regular customers and bank charges, intrest on actual amount which is overdrawn by the account holder., Cash Credits, It refers to a loan given to the borrower against his current assets like, shares,stocks,bonds,etc., ELECTRONIC BANKING OR E- BANKING, Banking is a service provided by many banks,in which a customer is allowed to, conduct banking transactions through internet using personal mobile or computer.

Page 11 :

e - banking offers the following range of services :, (i) Electronic Funds Transfer (EFT), (ii) Automated Teller Machine (ATM), (iii) Point of Sales (PoS), (iv) Electronic Data Interchange (EDI), (v) Credit Cards, WAYS OF e - Banking, Automated Teller Machine, ATM is an automatic machine from which money can be withdrawn or deposited by, inserting the card and entering Personal Identity Number (PIN). This machine, operates for all the 24 hours.It is also known as 'Automated Banking, Machine','Automatic Till Machine' or 'Remote Service Unit'.

Page 12 :

Debit Card, A Debit Card is issued to customers in lieu of his money deposited in the bank. The, customers can make immediate payment of goods purchased or services obtained on, the basis of his debit card., Credit Card, A bank issues a credit card to those of its customers who enjoy good reputation.With, the help of this card ,the account holder can buy goods or services up to a certain, limit even without having sufficient deposit in their bank accounts., Internet Banking, It refers to making banking transactions directly with the banks through internet.It, enables people to carry out most of their banking transactions like transferring, money from one account to another,making payments of bill,etc.It is also known as, 'Online Banking' or 'Web Banking'.

Page 13 :

Mobile Banking, It is a system that allows customers to perform banking transactions through a, mobile device.Customers can check their account balances, transfer funds, make bill, payment, etc., Benefits of e - banking to customers, 1.It provides services to its customers 24 hours by 7 days in a week ., 2.Customers can make transactions from office or house or while traveling via mobile, telephone., 3.There is greater customer satisfactions through E-banking as it offers unlimited, access and great security as they can avoid travelling with cash., 4.It promotes a sense of financial discipline by recording each and every transaction., Benefits of e - banking to banks, 1.It lowers the transaction cost., 2.Load on branches can be reduced by establishing centralized data base.

Page 14 :

3.E-Banking provides competitive advantage to the bank, adds value to the banking, relationship., INSURANCE, Insurance is a contract between two parties ,where one party agreed to indemnify, (cover) the loss suffered by other party for a consideration of some money ,known as, premium., The party which promises to indemnify the loss is called 'INSURER'., The persons or the property subject to risks is called 'INSURED'., The agreement providing for insurance is called an 'INSURANCE POLICY’., FUNCTIONS OF INSURANCE, 1.Providing certainty : Insurance can't remove uncertainty of loss but it can provide, certainty of payment for the risk of loss.

Page 15 :

2.Protection : It can't stop the business risk but it can provide some protection, against the risk occured., 3.Risk sharing : Insurance is an arrangement in which large number of people who, are supposed to bear the same risk, contribute to a fund,maintained by the insurance, company.The premium paid by all of them is pooled and in case of loss to any person,, compensation is paid to him out of fund., 4.Assist in capital formation : The funds collected by the insurance company in the, form of premium,are invested by them in various income generation scheme which, leads to capital formation., PRINCIPLES OF INSURANCE, 1.Utmost Good Faith: Insurance contracts are based upon mutual trust and, confidence between the insurer and the insured. It is obligatory to disclose every, material fact and information related to insurance contract to each other., 2.Insurable Interest: It means some pecuniary (economic) interest in the subject, matter of insurance contract. The insured must have insurable interest in the subject

Page 16 :

matter of insurance i.e.life or property insured.The insured will have to incur loss due, to this damage and insured will be benefitted if full security is being provided., 3.Indemnity: Principle of indemnity applies to all contracts except the contract of life, insurance because estimation regarding loss of life cannot be made. The objective of, contract of insurance is to compensate to the insured for the actual loss he has, incurred. These contracts provide security against loss and no profit can be made out, of these contracts., 4.Proximate Cause: The insurance company will compensate for the loss incurred by, the insured due to reasons mentioned in insurance policy. But if losses are incurred, due to reasons not mentioned in insurance policy then principle of proximate cause, or the nearest cause is followed., 5.Subrogation: This principle applies to all insurance contracts which are contracts of, indemnity. As per this principle, when any insurance company compensates the, insured for loss of any of his property, then all rights related to that property, automatically gets transferred to insurance company.

Page 17 :

6.Contribution: According to this principle if a person has taken more than one, insurance policy for the same risk then all the insurers will contribute the amount of, loss in proportion to the amount assured by each of them and compensate for the, actual amount of loss because he has no right to recover more than the full amount, of his actual loss., 7.Mitigation: According to this principle the insured must take reasonable steps to, minimize the loss or damage to the insured property otherwise the claim from the, insurance company may be lost., TYPES OF INSURANCE, 1.Life insurance : Under Life Insurance, the amount of Insurance is paid on the, maturity of policy or the death of policy holder. If the person survives till maturity,he, enjoys the amount of insurance. If he dies before maturity,then the insurance claim, helps in maintenance of his family. The insurance company insures the life of a, person in exchange for a premium which may be paid at once or in some, installments.

Page 18 :

The written agreement or contract which contains all the terms and conditions is, called policy., The person whose life is insured is called the assured., Essential Elements of Life Insurance Contract, 1.It must have all the essential elements of a valid contract like existence of an, agreement,free consent of the parties to that agreement., 2.It is a contract of utmost good faith.The assured must disclose all material facts, about his health to the insurer., 3.The insured must have insurable interest at the time of making the, contract.Without the insurable interest, the contract is void., 4.It is not a contract of indemnity because loss of death cannot be measured in terms, of money that is why the amount payable is fixed at the time of entering into the, contract.

Page 19 :

TYPES OF LIFE INSURANCE POLICIES, 1.Whole Life Policy: Under this policy the, sum insured is payable after the death of, the assured to the heir of the deceased., 2.Endowment Life Assurance Policy: Under this policy the insurer undertakes to pay, the assured a specified sum,on the attainment of a particular age or on his, death,whichever is earlier., 3.Joint Life Policy: It involves the insurance of two or more lives simultaneously. The, policy money is payable on the death of any one to the survivor or survivors.The, premium is paid jointly or by either of them in installments or lump sum., 4.Annuity Policy: Under this policy,the amount is payable in monthly, quarterly, half, yearly or annual installments after the assured attains a certain age. This is useful to, those who prefer a regular income after a certain age., 5.Children’s Endowment Policy: This policy is taken for the purpose of education of, children or to meet marriage expenses. The insurer agrees to pay a assured sum, when the child attains a certain age.

Page 20 :

2.Marine Insurance, Marine Insurance provides protection against loss during sea voyage. The, businessmen can get his ship insured by paying the premium fixed by the insurance, company. The functional principles of marine insurance are the same as the general, principles of Insurance., Essential Elements of Marine Insurance Contract, 1.It is based on the principle of indemnity.Loss can be recovered by insurer but it is, not allowed to make profit out of the contract., 2.The contract is based on utmost good faith.All the material facts should be, disclosed by the insured., 3.The insurable interest must exist at the time of loss,but not necessary at the time, when the policy was taken., 4.Sea perils is the proximate cause of the loss.

Page 21 :

Types of Marine Insurance Policy, 1.Ship or Hull Insurance : When a ship is insured against any type of danger.This, policy is taken to indemnify the insured for losses caused by damage to the ship., 2.Cargo Insurance : When a marine insurance policy is taken by the cargo owner to, be compensated for loss caused to his cargo during the journey.The cargo to be, transported by ship is subject to many risks,like risk of theft , loss of goods in voyage, etc., 3.Freight Insurance : When a marine insurance policy is taken to guard against non, recovery of freight.The shipping company is mainly interested in freight ,which it gets, either in advance or on the arrival of goods.They will not get the freight,if the goods, are lost during transit., 3.Fire Insurance, It provides safety against loss from fire. If property of insured gets damaged due to, fire, insured gets compensation from insurance company. If no such event, happens,then no claim shall be given.

Page 22 :

A claim for loss by fire must satisfy the following conditions:, 1.There must be actual loss., 2.Fire must be accidental and non-incidental., Essential Elements of Fire Insurance Contract, 1.The insured must have insurable interest both at the time of insurance and at the, time of loss., 2.The contract is based on utmost good faith.All the material facts should be, disclosed by the insured., 3.It is based on the principle of strict indemnity.Loss can be recovered by insurer but, it is not allowed to make profit out of the contract., 4.Fire must be the proximate cause of damage or loss., 4.Health Insurance, With a lot of awareness today,Health insurance has gained a lot of popularity., General Insurance companies provide special health insurance policies such as

Page 23 :

Mediclaim for the general public. The insurance company charges a nominal premium, every year and in return undertakes to provide up to stipulated amount for the, treatment of certain diseases such as heart problem, cancer, etc., REINSURANCE, It is a contract of insurance ,in which an insurer enters into a contract with another, insurer to insure the whole or a part of the risk covered by the first insurer.It happens, when the first insurer feels that it can’t bear the risk alone so they transfers the, whole or a part of the risk to other insurance companies., DOUBLE INSURANCE, When more than one insurance policy is taken to cover the same risk., POSTAL SERVICES, This service is required by every business to send and receive letters, market reports,, parcel, money order etc.on regular basis.All these services are provided by the post, and telegraph offices scattered throughout the country. The postal department, performs the following services :

Page 24 :

1.Financial facilities : They provide postal banking facilities to the general public and, mobilize their savings through the following saving schemes like public provident, fund (PPF), KisanVikasPatra, National Saving Certificate, Recurring Deposit Scheme, and Money Order facility., 2.UPC (under postal certificate): It is a certificate issued by the post office on, payment of prescribes fee, when the sender wants to have a proof that he has, actually posted the letters., 3.Registered post : It is a postal service in which mail is registered by the post office, at the time of sending ,in order to assure safe delivery., 4.Parcel : It is a service of a postal administration for sending articles from one place, to another through the post., 5.Speed post : It is a postal service which provides for time - bound and express, delivery of letters , documents and parcels across the nation and around the world., 6.Courier Services : Letters, documents, parcels etc. can be sent through the courier, service. It is a private service.so, the employees work with more responsibility.

Page 25 :

TELECOM SERVICES, 1.Cellular Mobile Services : They are used to provide voice and non – voice, messages,data services and PCO services.Ex – Airtel,Vodafone,Jio etc., 2.Radio Paging Services : It is a one way communication system, in which the pager, company sends a message to a person who has subscribed the pager service., 3.Fixed Line Services : It provides voice and non – voice messages and data services, to stop linkages for long distance traffic., 4.Cable Services : It is one way transmission of entertainment related services to the, subscribers within a licensed area of operation., 5.Very Small Aperture Terminal (VSAT) Services : It is a two way satellite based, communication service ,which is commonly used to transmit narrowband data or, broadband data., 6.Direct to Home (DTH) Services : It is based media services provided by cellular, companies with the help of small dish antenna and a setup box.