Page 1 :

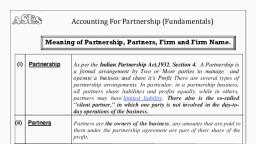

Features of Partnership, 1. Formation, The partnership form of business organization is governed by the Indian Partnership Act,, 1932.The partnership comes into existence with an agreement among partners., 2. Agreement, In a partnership there must be an agreement. The agreement may be oral or written. The, written agreement is known as Partnership Deed., 3. Number of partners, There must be at least two persons to form a partnership. The maximum number limit is, 100, 4. Profit motive, The business carried on by partnership firm must have profit motive. In this way, orphanage,, charitable trust etc. can't become partnership. The partners share the profits in the ratio, mentioned in the partnership deed., 5. No separate legal existence, The partnership firm has no separate legal existence apart from the partners. Firm can't, own property or enter into a contract in its own name. The firm’s name is only a symbol, representing all partners., 6. Restriction on transfer of Interest, No partner can transfer his share in the partnership without the prior consent of all other, partners., 7. Unlimited Liability, The partners of a firm have unlimited liability. Partners are individually and collectively, responsible for the entire debts of the firm. Personal assets may be used for repaying debts, in case the business assets are insufficient., 8. Registration, Registration of partnership is not compulsory. It is optional., 9. Decision making and control, The activities of a partnership firm are managed through the joint efforts of all the partners.

Page 2 :

10. Lack of continuity, The retirement, death, insolvency etc. of any partner brings the firm to an end. However,, the remaining partners may if they so desire continue the business on the basis of new, agreement., 11. Mutual agency, A partner can act simultaneously as a principal as well as an agent of the firm. Each partner, is an agent because he can bind other partners by his acts. Similarly he can also be bound, by the action of other partners. So he is called a principal., , Registration of Firms:, The Partnership Act, 1932 provides for the registration of firms with the Registrar of Firms, appointed by the Government. The registration of a partnership firm is not compulsory. But, an unregistered firm suffers from certain disabilities. Therefore, registration of a partnership, is desirable., Procedure for Registration:, A partnership firm can be registered at any time by filing a statement in the prescribed, form. The form should be duly signed by all the partners. It should be sent to the Registrar, of Firms along with the prescribed fee., , MERITS OF PARTNERSHIP FORM OF BUSINESS ORGANISATION, (a) Easy to Form: A partnership can be formed easily without many legal, formalities. Since it is not compulsory to get the firm registered, a simple, agreement, either in oral, writing or implied is sufficient to create a, partnership firm., (b) Availability of Larger Resources: Since two or more partners join hands to, start partnership firm it may be possible to pool more resources as compared, to sole proprietorship form of business organisation., (c) Better Decisions: In partnership firm each partner has a right to take part in, the management of the business. All major decisions are taken in consultation, with and with the consent of all partners. Thus, collective wisdom prevails and, there is less scope for reckless and hasty decisions.

Page 3 :

(d) Flexibility: The partnership firm is a flexible organisation. At any time the, partners can decide to change the size or nature of business or area of its, operation after taking the necessary consent of all the partners., (e) Sharing of Risks: The losses of the firm are shared by all the partners equally, or as per the agreed ratio., (f) Keen Interest: Since partners share the profit and bear the losses, they take, keen interest in the affairs of the business., (g) Benefits of Specialisation: All partners actively participate in the business as, per their specialisation and knowledge. In a partnership firm providing legal, consultancy to people, one partner may deal with civil cases, one in criminal, cases, another in labour cases and so on as per their area of specialisation., Similarly two or more doctors of different specialisation may start a clinic in, partnership., (h) Protection of Interest: In partnership form of business organisation, the, rights of each partner and his/her interests are fully protected. If a partner is, dissatisfied with any decision, he can ask for dissolution of the firm or can, withdraw from the partnership., (i) Secrecy: Business secrets of the firm are only known to the partners. It is not, required to disclose any information to the outsiders. It is also not mandatory, to publish the annual accounts of the firm., , LIMITATIONS OF PARTNERSHIP FORM OF BUSINESS ORGANISATION, A partnership firm also suffers from certain limitations. These are as follows:, (a) Unlimited Liability: The most important drawback of partnership firm is that, the liability of the partners is unlimited i.e., the partners are personally liable, for the debt and obligations of the firm. In other words, their personal, property can also be utilised for payment of firm’s liabilities., (b) Instability: Every partnership firm has uncertain life. The death, insolvency,, incapacity or the retirement of any partner brings the firm to an end. Not only

Page 4 :

that any dissenting partner can give notice at any time for dissolution of, partnership., (c) Limited Capital: Since the total number of partners cannot exceed 20, the, capacity to raise funds remains limited as compared to a joint stock company, where there is no limit on the number of share holders., (d) Non-transferability of share: The share of interest of any partner cannot be, transferred to other partners or to the outsiders. So it creates inconvenience, for the partner who wants to transfer his share to others fully and partly. The, only alternative is dissolution of the firm., (e) Possibility of Conflicts: You know that in partnership firm every partner has, an equal right to participate in the management. Also every partner can place, his or her opinion or viewpoint before the management regarding any matter, at any time. Because of this, sometimes there is friction and quarrel among the, partners. Difference of opinion may give rise to quarrels and lead to dissolution, of the firm., , TYPES OF PARTNERS, Depending on the nature of agreement and interest taken in the business,, partners are of different types:(A) Based on the extent of participation in the day-to-day management of the, firm partners can be classified as ‘Active Partners’ and ‘Sleeping Partners’. The, partners who actively participate in the day-to-day operations of the business, are known as active partners or working partners. Those partners who do not, participate in the day-to-day activities of the business are known as sleeping or, dormant partners. Such partners simply contribute capital and share the, profits and losses., (B) Based on sharing of profits, the partners may be classified as ‘Nominal, Partners’ and ‘Partners in Profits’. Nominal partners allow the firm to use their, name as partner. They neither invest any capital nor participate in the day-today operations. They are not entitled to share the profits of the firm. However,, they are liable to third parties for

Page 5 :

all the acts of the firm. A person who shares the profits of the business without, being liable for the losses is known as partner in profits. This is applicable only, to the minors who are admitted to the benefits of the firm and their liability is, limited to their capital contribution., (C) Based on Liability, the partners can be classified as ‘Limited Partners’ and, ‘General Partners’. The liability of limited partners is limited to the extent of, their capital contribution. This type of partners is found in Limited Partnership, firms in some European countries and USA. So far, it is not allowed in India., However, the Limited liability Partnership Act is very much under consideration, of the Parliament. The partners having unlimited liability are called as general, partners or Partners with unlimited liability. It may be noted that every partner, who is not a limited partner is treated as a general partner., (D) Based on the behaviour and conduct exhibited, there are two more types, of partners besides the ones discussed above. These are (a) Partner by, Estoppel; and (b) Partner by Holding out. A person who behaves in the public, in such a way as to give an impression that he/she is a partner of the firm, is, called ‘partner by estoppel’. Such partners are not entitled to share the profits, of the firm, but are fully liable if some body suffers because of his/her false, representation. Similarly, if a partner or partnership firm declares that a, particular person is a partner of their firm, and such a person does not disclaim, it, then he/she is known as ‘Partner by Holding out’. Such partners are not, entitled to profits but are fully liable as regards the firm’s debts., , Types of Partnership, Partnerships can be classified on the basis of duration and liability. On the, basis of duration, there are two types of partnerships i.e. particular partnership, and partnership at will. On the basis of liability, there are two types of, partnership, i.e. general partnership and limited partnership., 1. Classification on the basis of duration, a) Particular partnership, b) Partnership at will, a. Particular Partnership

Page 6 :

A particular partnership is one which is formed for a specific time period or for, a particular purpose. It is automatically dissolved on the expiry of the specified, period or on the completion of the specific purpose for which it was formed., Eg: Partnership formed to construct a bridge or building will automatically get, dissolved after the construction of that bridge or building., b.partnership at will, If a partnership is formed without mentioning its duration, it is called, partnership at will. It can continue as long as partners want. It can be dissolved, by any partner at any time by giving a notice of dissolution to other partners., 2. Classification on the basis of liability, a) General Partnership, b) Limited or Special Partnership, a) General Partnership, In general partnership, the liability of partners is unlimited and joint. The, partners enjoy the right to participate in the management of the firm., Registration of the firm is optional. The existence of the firm is affected by the, retirement, death or insolvency of the partners., b) Limited Partnership, Limited partnership is one in which the liability of at least one partner is, unlimited whereas the other partners may have limited liability. The limited, partners do not enjoy the right to participate in the management of the firm., The registration of limited partnership is compulsory. Such a partnership does, not get terminated with the death of any partner with limited liability.