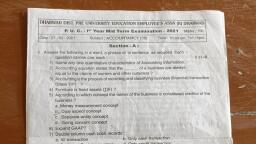

Page 1 :

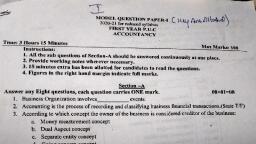

I“\, is (6 First PUC Second Test, December- 2019, , Time : 1-30 Hours, , J.Answer any five questions. Each carries one mark,, , I, , ew, , a, , 6., , , , Subject : ACCOUNTANCY, , Section - A, , State any one cause for depreciation., Depreciation is decline in the value of, A ila, A provision is a charge against ’, a) Profit b) Expense c) Loss d)'None of the above, A bill of exchange is a instrument., A bill of exchange must be in writing (True/False), Give an example for revenue expenditure., , , , Section - B, Il.Answer any two questions. Each carries two marks 2x2=4, 7. Define bill of exchange., 8. What is provision?, 9. State any two features of depreciation., 10. What is balance sheet?, Section — C, III. Answer any two questions. Each carries six marks. 2x6=12, , 11. On 1/4/2018 a firm purchased a machinery for Rs. 1,00,000. It was decided to depreciate the, machinery at 10% p.a. under diminishing balance method. Show machinery A/C for three, years the accounts are closed on 31st March of very year., , 12. On 1/4/2018 Akash drew a three months bill on Vikas for Rs. 50,000. Vikas accepted the bill, and returned to Akash. Vikas honoured the bill on the due date. Pass Journal entries in the, books of both the parties., , 13. Prepare a Trading A/C of Mr. Ashok from the following information for the period ending, , 31/03/2018., , Opening Stock 60,000, Purchase 3, 00,000, Sales 8, 00,000, Purchase return 20,000, Sales return i 30,000, Wages 10,000, Dock & clearing charges 50,000, Closing Stock 50,000, Freight & octroi 6,000, , Coal gas and water 10,000

Page 2 :

Section —D, nswer any two questions. Each carries twelye marks. 2x12=24, , From the following particulars, prepare machinery A/C and depreciation A/C for 3 years, ending 31/3/2018., , i) Machine ‘X’ purchased on 1/4/2015 for Rs 80,000., ii) Machine ‘Y’ Purchased on 30/09/16 for Rs. 50,000., iii) Machine ‘X’ sold on 1/10/16 for Rs.40, 000., The above machines were depreciated at 10% p.a under straight line method on 31st March, Cepy year., On 01-06-2018 Manish drew a two months bill on Dinesh for Rs. 10,000. The bill was duly, accepted. On the same day Manish discounted the bill with the bank for Rs. 9,500. On the duc, date the bill was honoured. Show the journal entries in the books of Manish and Dinesh., From the following trial balance prepare trading A/C, Profit and loss A/C and Balance sheet, as on that date., , Trial Balance as on 31/03/2018., , , , , , , , Sl. No | Name of Accounts Debits(Rs) | Credit(Rs), ik Opening stock 20,000 2) Purchase and Sales 80,000 1,60,000, S Returns : 400 1,200, 4 Wages 12,000 5 Salary 9,000 6 Miscellaneous Income - 12,000, a Rent - 6,000, 8 Drawing and Capital 4,000 80,000, 9 Debtor and Creditors 12,000 14,000, , 10 Cash 6,000 , ll Investments 20,000 , 12 Buildings 86,000 , 13 Furniture 23,800 =, , Total 2,73,200 2,73,200, , , , , , , , , , , , , , Adjustments:, 1. Closing stock Rs. 4000, , 2. Depreciate furniture by 10%p.a and buildings by 157%p.a, 3. Bad debts written off Rs. 500 ., 4, Salary outstanding Rs.1000, , Section — E, (Practical oriented Questions) 2, V.Answer any one question. Each carries five marks. 1x5=05, 17. Prepare a specimen of bill of Exchange., 18. Prepare a balance sheet with five imaginary figures., , 2 ae a2 a A, , ea: gs 4 d

Page 3 :

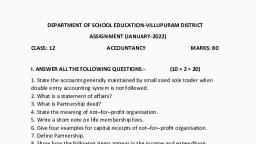

First PUC Mid-Term Examination, October- 2019, Subject: ACCOUNTANCY (30), , , , Time : 3-15 Hours Max. Marks :100, Instructions:, 1. All sub-questions of Section - A should be answered continuously at one place., 2. Provide working notes wherever necessary., 3. 15 minutes of Extra time have been allotted for the candidate to read the questions., 4, Figures in the right-hand margin indicates full marks. |, *, Section - A p, Answer any Eight questions. Each question carries one marks. 8x1=8, 1. Who are Debtors?, 2. Expand CGST., 3. Give any one examples for Revenue Account., 4. What is an Invoice?, 5. Rent paid to landlord is credited to, a) Rent a/c b) Landlord a/e —c) Cash a/c d) none of the above, 6. A brief description of the transaction is called the, 7. Cash Sales are recorded in, a) Sales Book b) Cash Book c) Journal d) None of these, 8. Trail Balance is just a statement and not an Account. (State True or False), 9. Trail Balance is usually prepared at the of the accounting year., 10. State the any one need for preparation of Bank Reconciliation Statement., Section —-B, Answer any Five questions. Each question carries two marks. 5x2=10, 11. Define Accounting., 12. State any two objectives of Accounting., 13. State the rule of debit and credit of Expenses/Losses., 14. What is Double Entry System?, 15. Give the meaning of Subsidiary Book., 16. When Suspense Account is opened?, 17. What is a Bank overdraft? f, 18. What is a Bank Reconciliation Statement?, Section - C, Answer any Four questions Each question carries six marks, 4x6=24, 19. Briefly explain any six accounting concepts., 20. Classify the following into‘Assets, Liabilities, Capital, Revenue / gains and Expenses / Losses, , a) Bad debts A/c b) Sales returns A/c, , c) Drawings A/c d) Investment A/c, , e) Insurance f) Bills payable A/c, , g) Bank loan A/c h) Furniture and Fixtures A/c, i) Discount allowed A/c j) Salary Received A/c, , k) SBI bank A/c 1) Commission A/c, , 1

Page 4 :

Sachin has the following transactions, prepare Accounting Equation:, , a. Business started with cash Z 2,00,000, , b. Purchased machinery for % 20,000, , c. Cash withdrawn for personal use ¥ 40,000, , d. Salary paid % 16,000, , Record the following transactions in the single column cash book of Mr. Ramu, , , , , , , , , , , , , , , , , , , , , , , , , , Date 2019 | Details Amount in &, May 01 Ramu Started business with cash 2,50,000, May 05 Purchased machinery 20,000, May 09 Opened a current A/c in SBI 18,000, May 13 Interest received 2,000, May 17 Bought goods for cash 32,000, May 19 Sold goods for cash 27,000, May 22 Paid commission 3,000, May 24 Received from Nagaraj 8,000, May 26 Advertisement charges paid 6,000, May 30 Paid to Gopal 10,000, Enter the following transactions in the Petty cash book and Balance it., Date 2019 | Particulars 4 Amount in €, June 01 Received cash from chief Cashier 500, June 08 Sent telegrams 30, June 14 Travelling expenses 7, June 18 Newspaper bill 40, June 22 Paid Electricity charges 20, June 28 Stationary purchased 15, From the following transactions, prepare Sales Book., Date 2019 | Transactions Amount in =, July 01 Sold to Ravi on credit 5,000, July 05 Mr. Sagar bought goods from us 8,200, July 10 | Credit sales to Sharath 1,500, July 15 Sold goods to Prakash for cash 3,000, July 20 Credit sales to Mr. Mohan for 71,800, , and spent % 200 for transportation, , , , , , , , , , , , From the following ledger balance, prepare the Trial balance as on 31.03.2018, , , , , , , , , , Ledger Accounts Amount in, Capital 1,00,000, Cash 40,000, Purchases 25,000, Drawings 10,000, Sales 40,000, Return inwards 5,000, Wages 3,000, Debtors 11,000, Commission received 4,000, Bill receivable 14,000, Building 44,000, Carriage ; i 2,000

Page 5 :

i , Section - D, Answer any Four questions, Fach question carries Twelve marks. 4x12=48, 26. Journalise the following transactions in the books of Harsha., , 1-4-2019 Commenced business with cash 2 2,50,000, 5-4-2019 Paid into the Canara bank % 40,000, 8-4-2019, , Bought goods from Deepak on credit % 35,000, 14-4-2019 _ Paid for Postage & 150, , 18-4-2019 Sold goods to Arun & 10,000, , 20-4-2019 — Withdrew from bank for domestic use % 5,000, 22-4-2019 Paid to Deepak 2 33,00 in full settlement of his account., 26-4-2019 | Commission received in advance & 1,200, , 30-4-2019 Arun returned goods to us % 2,000, , 27. Journalise the following transactions in the books of Jeevan and Post them to necessary Ledger, Accounts., 1-5-2019 Started business with cash ¢ 60,000, Furniture 30,000, , Machinery % 10,000 ., 5-5-2019 Purchased goods from Mohan for cash % 45,000, 10-5-2019 Paid for stationary & 2,000, 15-5-2019 Sold goods to Kumar % 25,000, 25-5-2019 | Withdrew cash for office use = 8,000, 28-5-2019 Received cash from Kumar & 22,000 in the full settlement of his account., 28. Record the following transaction in a Double column cash book for June 2019 and balance, , , , , , , , , , , , , , , , , , , , the same:, , Date, , June 2019 | Particulars Amount in, , 01 Cash in hand 45,000, , 01 Cash at bank 20,000, , 06 Purchased goods for cash 8,000, , 10 Paid salary by cheque 4,000, , 14 Deposited into the bank 10,000, , 18 Sold goods and received the cash 24,000, , 22, Withdrew cash for office use 6,000, , 26 Interest received by cheque 3,000, , 30 Withdrew cash for personal use 7,000, , 29. Prepare Double column cash book from the following transactions, Date __| Particulars Amount in &, 1-2-2019 Cash in Hand 10,000, Cash at bank 4,200, , 3-2-2019 | Paid Insurance premium by cheque 22,000, 8-2-2019 | Cash sales 21,000, 9-2-2019 | Payment for cash purchases 15,000, 10-2-2019 | Cash deposited in bank 5,000, 12-2-2019 | Withdrawn from bank for office use 10,000, 18-2-2019 | Received cheque from John 3,000, , 22-2-2019 | Rent paid by cheque 2,000, , 28-2-2019 | Paid to Amith by cheque in full settlement of his account 15,000