Page 1 :

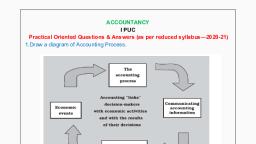

शिक्षा निदे िालय, राष्ट्रीय राजधािी क्षेत्र ददल्ली, Directorate of Education, GNCT of Delhi, Suggestive Answers of Practice Paper, , कक्षा – XI, Class – XI, लेखाांकि(कोड: 055), Accountancy (Code: 055), TERM II (2021-22), , अधधकतम अांक: 40, Maximum Marks: 40, , 1. In order to solve a particular problem with the help of computers, a sequence of instructions written in, proper language will have to be feed into the computers. A set of such instructions is called a ‘Program’ and, the set of programs is called ‘Software’., 2. Two parties to a promissory note are:, (i) Maker or Drawer: The person who promises to pay a certain sum of money as specified in the note., (ii) Payee or Drawee: The person who is being promised or the person who is bound to receive the promised, amount as specified in the note., , 3., , Statement of Profit And Loss, for the year ended…., , Particulars, , Amt.(Rs), , Capital at the End (closing capital), , 6,20,000, , Add: Drawings, , 2,50,000, 8,70,000, , Less: Additional Capital Introduced, , 30,000, , Adjusted capital at the end, , 8,40,000, , Less: Capital in the Beginning (opening capital), , 8,00,000, , Profit Made During the year, , 40,000, , 4. Provision for bad and doubtful debts occurs when there is a possible reason for debtors who are doubtful that, they will not pay the debts on time.

Page 2 :

Particular, , Dr.(Rs.) Cr.(Rs.), , Profit and loss A/c, To provision for doubtful debts, , Dr A/c, , -, , 5. A Central Processing Unit (CPU), also called a central processor or main processor, is the electronic, circuitry within a computer that carries out the instructions of a computer program by performing the basic, arithmetic, logic, controlling, and input/output (I/O) operations specified by the instructions. CPU has two, components:, i., , Control Unit, , ii., , Arithmetic Logic Unit, , 6. The mentioned below are the various advantages of Computerised Accounting Systems., a. Speed, b. Accuracy, c. Reliability, d. Up-to-Date Information, e. Real Time User Interface, f. Automated Document Production, g. Scalability, h. Legibility, OR, Limitations: Inspite of so many qualities, computers suffer from the following limitations., (1) Lack of Common sense: Since computer work according to the stored programs, they simply lack of common, sense., (2) Zero I.Q.: Computers are dumb devices with zero Intelligence Quotient (IQ). They can’t visualize and think what, exactly to do under a particular situation unless they are programmed to tackle that situation., (3) Lack of Feeling: Computers lack feelings like human beings because they are machines. No computer passes the, equivalent of a human heart and soul., (4) Lack of Decision-making: Decision making is a complex process involving information, knowledge, intelligence,, wisdom & ability to judge, Computers cannot make decisions of their own., , 7. (1) Capital Expenditure: Paid to make an asset ready to use, (2) Capital Expenditure: Paid to make an asset ready to use, (3) Revenue Expenditure: Made for the maintenance of asset, OR, Gross, Profit, , =, , Sales + Closing Stock – (Opening Stock + Freight and Packing + Goods, Purchased)

Page 3 :

=, =, , 1,90,000 + 30,000 – (25,000 + 10,000 + 1,40,000), 2,20,000 – 1,75,000 = ₹45,000, , 8. Operating profit =, , Net profit - Rent received - Gain on sale of machines + Interest on loan – Donation, , 1,00,000 - 10,000 - 15,000 +20,000 - 2,000 =, , Rs. 93,000, OR, , Marshaling of Balance Sheet can be made in two ways:, 1. In order of Liquidity: According to this method, an asset which is most easily convertible into cash such as cash in, hand is written first and then will follow those assets which are comparatively less easily convertible, so that the, least liquid assets such as goodwill, is shown last., In the same way, those liabilities which are to be paid at the earliest will be written first. In other words, current, liabilities are written, first of all, then fixed or long-term liabilities, and lastly, the proprietor’s capital. Proforma of a, Balance Sheet in the order of liquidity will be the same as shown in the topic Balance Sheet., 2. In order of Permanence: This method is just opposite to the first method. Assets that are most difficult to be, converted into cash such as Goodwill are written first and the assets which are most liquid such as cash in hand are, written last., Those liabilities which are to be paid last will be written first. The proprietor’s capital is written, first of all, then, fixed or long-term liabilities, and lastly the current liabilities. The Performa of the Balance Sheet in the order of, Permanence will be just opposite to the above., , 9., Journal, Date, Particulars, L.F. Debit Amount (Rs), a) Suspense A/c, Dr., 14,000, To Sales A/c, To Purchases A/c, (Goods sold to Mohan wrongly recorded in Purchases, Book), b), , c), , d), , Purchases A/c, Dr., Sales A/c, Dr., To Suspense A/c, (Credit purchases from Rohan recorded in Sales Book), , 9,000, 9,000, , Suspense A/c, Dr., To Purchases Return A/c, To Sales Return A/c, (Goods returned to Rakesh recorded in Sales Return, Book), , 8,000, , Sales Return A/c, Purchases Return A/c, , 1,000, 1,000, , Dr., Dr., , Credit Amount (Rs), 7,000, 7,000, , 18,000, , 4,000, 4,000

Page 4 :

To Suspense A/c, (Goods returned from Mahesh recorded in Purchases, Return Book), e), , 2,000, , Suspense A/c, Dr., To Purchases Return A/c, To Purchases A/c, (Goods returned to Naresh recorded in Purchases, Book), , 4,000, 2,000, 2,000, , 10., , Books of A, Journal, Date, 2017, Jan. 01, , Jan. 01, , Feb. 04, , Apr. 04, , Apr. 04, , Apr. 04, , June 07, , Particulars, , L.F., , B, To Sales A/c, (Goods sold to B), , Dr., , Bills Receivable A/c, To B, (B accepted the bill), , Dr., , Bank A/c, Discounting Charges A/c, To Bills Receivable A/c, (Bill discounted with the bank @ 18% p.a. for 2, months), , Dr., Dr., , B, To Bank A/c, (Bill dishonoured on due date and noting charges, paid), , Dr., , B, To Interest A/c, (Interest due to be received), , Dr., , Bills Receivable A/c, To B, (B accepted the new bill), , Dr., , Cash A/c, , Dr., , Debit, Amount, (Rs), , Credit, Amount, (Rs), , 30,000, 30,000, , 30,000, 30,000, , 29,100, 900, 30,000, , 30,200, 30,200, , 604, 604, , 30,804, 30,804, , 30,804

Page 5 :

To Bills Receivable A/c, (Bill honoured on due date), , 30,804, , OR, , Nisha’s Journal, Date, 2016, Mar.02, , Mar.02, , June.05, , June.05, , June.05, , Particulars, , L.F., , Purchases A/c, To Asha, (Goods purchased), , Dr., , Asha, To Cash A/c, To Bills Payable A/c, (Acceptance received), , Dr., , Bills Payable A/c, Noting Charges A/c, To Asha, (Bill dishonored), , Dr., Dr., , Interest A/c, To Asha, (Interest due), , Dr., , Asha, To Bills Payable A/c (12,000+150), To Cash A/c, (New Acceptance received), , Dr., , Debit, Amount, (Rs), 19,000, , 19,000, , 19,000, 4,000, 15,000, , 15,000, 30, 15,030, , 150, 150, , 15,180, 12,150, 3,030, , 11., , Liabilities, Trade Creditors, Loan from Naresh, Capital (Balancing Figure), , Credit, Amount, (Rs), , Statement of Affairs, (Previous Year), Amount, Assets, (Rs), 6,270 Stock, 5,000 Cash in Hand, 18,170 Shop Fittings, Trade Debtors, Bank Balance, 29,440, , Amount, (Rs), 12,350, 570, 7,250, 5,280, 3,990, 29,440

Page 6 :

Liabilities, Trade Creditors, Loan from Naresh, Add: Outstanding Interest, (5,000 × 5%), Capital (Balancing Figure), , Statement of Affairs, (Current Year), Amount, Assets, (Rs), 5,890 Stock, 5,000, Cash in Hand, 250, , Amount, (Rs), 11,980, 650, , 5,250 Shop Fittings, 16,930, Less: Depreciation, Trade Debtors, Less: Bad Debts, Bank Balance, , 7,800, (780), 4,560, (270), , 28,070, , 7,020, 4,290, 4,130, 28,070, , Statement of Profit or Loss, (Current Year), Particulars, Capital of the Current Year, Add: Drawings (Rs 100 × 52), Less: Capital of the Previous Year, Profit made during the Current Year, , Amount, (Rs), 16,930, 5,200, 22,130, (18,170), 3,960, , 12., Trading and Profit and Loss Account for the, year ended March 31, 2017, , Dr., Particulars, Opening stock, Purchase, Less Purchases, return, Carriage, Gross profit c/d, , Cr., Amount Particulars, `, 60,220 Sales, 1,99,080, Less :, Sales, return, (1,450) 1,97,630, Closing, stock, 5,170, 86,610, , Amount, , (1,870), , 3,49,630, , Discount allowed, Bank charges, Salaries, Rent and Taxes, 7,680, Add Rent outstanding150, , 3,960 Gross profit b/d, 100 Discount received, 6,420, 7,830, , `, , 2,81,500, 2,79,630, 70,000, , 3,49,630, , 86,610, 2,980

Page 7 :

General expenses, Insurance, 750, Less Insurance prepaid(50), Bad debts, 1,250, Add New provision 8,274, for bad debts, 9,524, Less Old provision (4,650), for bad debts, Interest on loan outstanding, Net profit (transferred to, capital account), , 3,630, 700, , 4,874, 900, 61,176, 89,590, , 89,590, , Balance Sheet as at March 31, 2017, Liabilities, Creditors, Loan, Add Interest on, loan outstanding, , 15,000, 900, , Rent outstanding, Capital, Add Net profit, Less Drawings, , 1,50,000, 61,176, 2,11,176, (6,300), , Amount Assets, `, 18,670 Cash at bank, 15,900 Book, debts, 150 Less:, Reserve for bad debts, Bills receivable, Land and Building, Furniture, 2,04,876 Plant and Machinery, Insurance (prepaid), Closing stock, 2,39,596, , Amount, `, 13,870, 82,740, (8,274), , 74,466, 1,860, 42,580, 5,130, 31,640, 50, 70,000, 2,39,596