Page 1 :

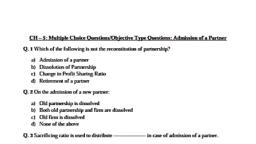

OBJECTIVE TYPE QUESTIONS, STD: XII COMMERCE SUB: BOOK KEEPING AND ACCOUNTANCY, Q.1, (A), (1), Ans:, (2), Ans:, (3), Ans:, (4), Ans:, (5), Ans:, , Attempt all of the sub-questions:, Find odd one:, 1. Introduction to Partnership and Partnership Final Accounts, Wages, Salary, Royalty, Import Duty., Salary, Postage, Stationery, Advertising, Purchases., Purchases, Capital, Bills Receivable, Reserve Fund, Bank Overdraft., Bills Receivable, Building, Machinery, Furniture, Bills Payable., Bills Payable, Discount Received, Dividend received, Interest received,, Depreciation., Depreciation, , 2. Accounts of ‘Not for Profit’ Concerns, (1), Ans:, (2), Ans:, (3), Ans:, (4), Ans:, (5), Ans:, , Trading Account, Profit and Loss Account, Receipts and, Payments Account, Balance Sheet., Receipts and Payments Account, Machinery, Furniture, Computers, Salaries., Salaries, Subscription, Stationery, Interest received, Lockers Rent received., Stationery, Reliance Industries, Venna Vidya Mandir, Laxmi Hospital, Manoj, Sports Club., Reliance Industries, Surplus, Deficit, Net Profit, Capital Fund., Net Profit, , 3. Reconstitution of Partnership (Admission of Partner), (1) General Reserve, Creditors, Machinery, Capital., Ans: Machinery, (2) Decrease in Furniture, Patent written off, Increase in Bills Payable,, R.D.D. written off., Ans: R.D.D. written off, (3) Super Profit Method, Valuation Method, Average Profit Method, Fluctuating Capital Method., 1, , (20), (5)

Page 2 :

Ans: Fluctuating Capital Method, , 7. Bills of Exchange, , Q.1, , (1), Ans:, (2), Ans:, (3), Ans:, (4), Ans:, (5), Ans:, , Retaining, Noting, Discounting, Endorsing, Noting, Trade Bill, Accommodation Bill, After Date Bill, Demand Bill., Demand Bill, Notary Public, Drawer, Drawee, Payee., Notary Public, Discounting Charges, Rebate, Bank Charges, Noting Charges., Noting Charges, Stamp, Acceptance, Draft, Amount., Draft, , (B), , Write the word/phrase/term, which can substitute each of the, (5), following setneces., 1. Introduction to Partnership and Partnership Final Accounts, Person who form the partnership firm., Partners, Amount of cash or goods withdrawn by partners from the business, From time to time., Drawings, An association of two or more persons according to Indian, Partnership Act 1932., Partnership Firm, Act under which partnership firms are regulated., Indian partnership Act, 1932, Process of entering the name of partnership firm in the register of, Registrar., Registration, Partnership agreement in written form., Partnership Deed, Under this method capital balances of partners remains constant., Fixed Capital Method, Proportion in which partners share profits., Profit Sharing Ratio, Such capital method in which only capital account is maintained., for each partner., Fluctuating Capital Method, The account to which all adjustment are made when capital is fixed., Current Account, Expenses which are paid before they are due., , (1), Ans:, (2), Ans:, (3), Ans:, (4), Ans:, (5), Ans:, (6), Ans:, (7), Ans:, (8), Ans:, (9), Ans:, (10), Ans:, (11), , 2

Page 3 :

Ans:, (12), Ans:, (13), Ans:, (14), Ans:, (15), Ans:, (16), Ans:, (17), Ans:, , Prepaid Expenses, The accounts that prepared at the end of each accounting year., Final Accounts, An asset which can be converted in to cash easily., Current Asset/Liquid Asset, Order in which fixed assets are recorded first on Balance Sheet., Order of Liquidation, The account in which selling expenses of business are recorded., Profit and Loss Account, Debit balance of Trading Account, Gross Loss, Credit Balance of Profit and Loss Account, Net Profit, , 2. Accounts of ‘Not for Profit’ Concerns, (1) The form of organization providing services to the society only., Ans: Not for Profit Concern, (2) An account which is prepared by Not for Profit Concern instead of, Profit and Loss Account., Ans: Income and Expenditure Account, (3) Donation received for a specific purpose., Ans: Specific Donation, (4) The receipts which are not recurring in nature., Ans: Capital Receipts, (5) An account which records only revenue items in case of Not for, Profit Concern., Ans: Income and Expenditure Account, (6) Accounts which records only cash transactions in case of Not for, Profit Concern., Ans: Receipts and Payments Account, (7) The income which is earned during the year but not received during, the year., Ans: Outstanding Income, (8) The credit balance of Income and Expenditure Account., Ans: Surplus, (9) The excess of total assets over total liabilities of a Not for Profit, Concern., Ans: Capital Fund, (10) All such receipts which are non-recurring in nature and not forming, a part a regular flow of income., Ans: Capital Receipts, 3

Page 4 :

3. Reconstitution of Partnership (Admission of Partner), (1), Ans:, (2), Ans:, (3), Ans:, (4), Ans:, (5), Ans:, (6), Ans:, (7), Ans:, (8), Ans:, (9), Ans:, (10), Ans:, , Method under which calculation of goodwill is done on the basis, of extra profit earned above the normal profit., Super Profit Method, An account opened to adjust the value of assets and liabilities at the, time of admission of a partner., Revaluation Account or Profit and Loss Adjustment Account, Reputation of business measured in the terms of money., Goodwill, The ratio in which General Reserve is distributed to the old, partners., Old Profit Sharing Ratio/Old Ratio, Name the method of the treatment of goodwill where new partner, will bring his share of goodwill in cash., Premium Method, The proportion in which old partners make a sacrifice., Sacrifice Ratio, Capital Employed x NRR/100 =, Normal Profit, An account which is debited when the partner takes over the asset., Partners Capital Account or Partners Current Account, Profit and Loss Account balance appearing on liability side of, Balance Sheet., Accumlated Profit or Undistributed Profit, Old Ratio – New Ratio =, Sacrifice Ratio, , 4. Reconstitution of Partnership (Retirement of Partner), (1) Credit balance of Profit and Loss Adjustment Account., Ans: Profit on revaluation, (2) The ratio in which the continuing partners are benefited due to, Retirement of Partner., Ans: Gain Ratio, (3) Debit balance of Revaluation Account., Ans: Loss on revaluation, (4) The ratio which is obtained by deducting Old Ration from New, Ratio., Ans: Gain Ratio, (5) Money value of business reputation earned by the firm over a, Number of years., 4

Page 5 :

Ans: Goodwill, (6) Partner’s Account where Loss or Profit on revaluation is, transferred., Ans: Capital Account or Partners Current Account, , 5. Reconstitution of Partnership (Death of Partner), (1), Ans:, (2), Ans:, (3), Ans:, (4), Ans:, (5), , Ans:, , Excess of credit side over debit side of Profit and Loss Adjustment, Account., Profit on revaluation, A person who represents the deceased partner on the death of, partner., Executor/Legal Heir, Accumlated past profit kept in the form of reserve., Reserve Fund or General Reserve, The partner who died., Deceased Partner, The proportion in which the continuing partners benefit due to, death, of partner., Gain Ratio, , 6. Dissolution of Partnership Firm, (1), Ans:, (2), Ans:, (3), Ans:, (4), Ans:, (5), Ans:, (6), Ans:, (7), Ans:, (8), Ans:, (9), , Debit balance of Realisation Account., Loss on realisation/Realisation Loss, Winding up of partnership business., Dissolution of Partnership, An account opened to find out the Profit or Loss on realisation of, assets and settlement of liabilities., Realisation Account, Debit balance of an Insolvent Partner’s Capital Account., Capital Deficiency, Credit balance of Realisation Account., Profit on Realisation /Realisation Profit, Conversation of asset into cash on dissolution of firm., Realisation/Realisation of Assets, Liability likely to arise in future on happening of certain event., Contingent Liability, Assets which are not recorded in the books of account., Unrecorded Assets, The Accounts which show realisation of Assets and discharge of, Liabilities., 5

Page 6 :

Ans: Realisation Account, (10) Expenses incurred on dissolution of firm., Ans: Realisation/Dissolution Expenses., , 7. Bills of Exchange, (1) The extra days which are allowed over and above the term of bill., Ans: Days of Grace/Grace Days, (2) Fees charged by Notary Public for getting the fact of dishonour, noted., Ans: Noting Charges, (3) A person who is entitled to receive the amount of bill of exchange., Ans: Payee, (4) A person in whose favour a bill endorsed., Ans: Endorsee, (5) Officer appointed by government for noting of dishonour of bill., Ans: Notary Public, (6) Cancellation of bill on maturity in return of a new bill for extended, period of credit., Ans: Renewal of Bill, (7) Bill of Exchange drawn and accepted without any valuable, consideration., Ans: Accommodation Bill, (8) Person who is possession of Bill of Exchange., Ans: Holder, (9) Conversion of Bill of Exchange into its present value., Ans: Discounting of Bill, (10) Amount which is not recoverable from Drawee on account of, insolvency., Ans: Bad Debts, , 8. Company Accounts-Issue of Shares, (1), Ans:, (2), Ans:, (3), Ans:, (4), , Amount called-up on shares by the company but not received., Calls-in-arrears, Issue of shares at its face value., Issue at Par, The person who purchase the share of a company., Shareholder, The form of business organization where huge amount of capital, can be raised., Ans: Joint Stock Company, (5) The capital which is subscribed by the public., 6

Page 7 :

Ans: Subscribed Capital, (6) The shares having preferential right at the time of winding up of, the, company., Ans: Preference Shares, (7) The shares on which dividend is not fixed., Ans: Equity/Ordinary Shares, (8) The part of subscribed capital which is not called-up by the, company., Ans: Uncalled Capital, , 9. Analysis of Financial Statements, (1) The statement showing profitability of two different periods., Ans: Comparative Income Statement, (2) The ratio measures profitability between Gross Profit and Net, Sales., Ans: Gross Profit Ratio, (3) Critical evaluation of financial statement to measure profitability., Ans: Analysis of Financial Statement, (4) A particular mathematical number showing relationship between, two accounting figures., Ans: Ratio, (5) An asset which can be converted into cash immediately., Ans: Liquid Asset, (6) The ratio measuring the relationship between net profit and, ownership Capital Employed., Ans: Return on Capital Employed/ROCE, (7) The statement showing financial position for different periods or, previous year and current year., Ans: Comparative Balance Sheet, (8) Statement showing changes in cash and cash equivalent during a, particular period., Ans: Cash Flow Statement, (9) Activity related to acquisition of long term assets and investment., Ans: Financing Activities, (10) The ratio that establishes relationship between Quick Assets and, Current Liabilities., Ans: Liquid Ratio, , 7

Page 8 :

10. Computer in Accounting, (1), Ans:, (2), Ans:, (3), Ans:, (4), Ans:, (5), , The details of Bills Receivable are maintained in this record., Sundry Debtors, Tally software is classified into this category., Mercantile, The short key used to save or accept the information., Ctrl + A, It is damaged software, cracked, nearly fully functional., Pirated Software, The process by which all the calculations are automatically done, by, the accounting software., Ans: Automation, Q.1, , (C), (1), Ans:, (2), Ans:, (3), Ans:, (4), Ans:, (5), Ans:, (6), Ans:, (7), Ans:, (8, Ans:, (9), Ans:, (10), Ans:, (11), Ans:, , Do you agree or disagree with the following statements:, 1. Introduction to Partnership and Partnership Final Accounts, When Partnership Deed is silent, partners share profits of the firm, according to capital ratio., Disagree, Current Account always shows a debit balance., Disagree, It is compulsory to have a partnership agreement in writing., Disagree, Partnership Firm is a trading concern., Agree, An interest on capital is expenditure for the partnership firm., Agree, Partnership is an association of two or more persons., Agree, Partners are entitled to get Salary or Commission., Disagree, The balance of Capital Account remains constant under Fixed, Capital Method., Agree, The Indian Partnership Act came into existence in the year 1945., Disagree, Profit and Loss Account reflects the true financial position., Disagree, Amount borrowed by partner from his business will be debited to, his Current Account., Agree, 8, , (5)

Page 9 :

(12) Sold but un dispatched goods must be part of valuation of closing, stock., Ans: Disagree, (13) Carriage Inward is selling and distribution overhead., Ans: Disagree, (14) Gross Profit is an operation profit., Ans: Disagree, (15) All financial Expenditures are debited to Profit and Loss Expenses., Ans: Agree, (16) Free distribution of goods is debited to Trading Account., Ans: Disagree, , 7. Bills of Exchange, (1), Ans:, (2), Ans:, (3), Ans:, (4), Ans:, (5), Ans:, (6), Ans:, (7), Ans:, (8), Ans:, (9), Ans:, (10), Ans:, , A bill of exchange is conditional order., Disagree, The party which is ordered to pay the amount is known as payee., Disagree, The person in whose favour the bill is endorsed is known as, Endorsee., Agree, Rebate or discount given on retiring a bill is an income to the, Drawee., Agree, A bill from the point of view of Debtor is called Bills Payable., Agree, In case of bill drawn payable ‘on demand’ no grace days are, allowed., Agree, A bill is required to be accepted by Drawer., Disagree, A Bill of Exchange need not be dated., Disagree, A Bill before acceptance is called Promissory Note., Disagree, Renewal is request by Drawee to extend the credit period of the, bill., Agree, , 8. Company Accounts-Issue of Shares, (1), , In case of pro-rata allotment the excess application money received, must be refunded., 9

Page 10 :

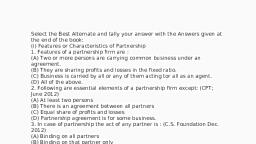

Ans: Disagree, (2) Calls in Advance Account is shown on the asset side of the Balance, sheet., Ans: Disagree, (3) The sAuthorised Capital is also known as Nominal Capital., Ans: Agree, (4) Paid-up Capital can be more than Called-up Capital., Ans: Disagree, (5) Joint Stock Company can raise huge amount of capital., Ans: Agree, (6) When shares are forfeited Share Capital Account is credited., Ans: Disagree, (7) Directors can re-issue forfeited shares., Ans: Agree, (8) When the issued price of share is 12 and face value is 10, the, share is said to be issued at premium., Ans: Agree, (9) Public Limited Company can issue its share without issuing its, prospectus., Ans: Disagree, (10) Shares can be issued for consideration other than cash., Ans: Agree, (D), , Select the most appropriate alternatives from the following and (05), rewrite the sentences:, 1. Introduction to Partnership and Partnership Final Accounts, (1) When there is no partnership agreement between partners, the, division of profits take place in ……. Ratio., (a) equal, (b) capital ratio (c) initial contribution, (d) experience and tenure of partners, Ans: When there is no partnership agreement between partners, the, division of Profits take place in equal Ratio., (2) To find out Net Profit of Net Loss of the business ……….. Account, is prepared., (a) Trading (b) Capital (c) Current (d) Profit and Loss, Ans: To find out Net Profit of Net Loss of the business Profit and Loss, Account prepared., (3) A ………. is an intangible asset., (a) Goodwill (b) Stock (c) Cash (d) Furniture, Ans: A Goodwill Is an intangible asset., (4) In the absence of an agreement, interest on loan advanced by the, 10

Page 11 :

Ans:, (5), , Ans:, (6), Ans:, (7), , Ans:, , partners to the firm is allowed at the rate of …….., (a) 5% (b) 6% (c) 10% (d) 9%, In the absence of an agreement, interest on loan advanced by the, partners to the firm is allowed at the rate of 6%., Liability of partners in a partnership business is ……, (a) limited (b) unlimited (c) limited & unlimited, (d) None of the above, Liability of partners in a partnership business is unlimited., The Indian Partnership Act is in force since ……, (a) 1932, (b) 1881, (c) 1956, (d) 1984, The Indian Partnership Act is in force since 1932., Maximum numbers of partners in a firm are …….. according to, Companies Act 2013., (a) 10, (b) 25, (c) 20, (d) 50, Maximum numbers of partners in a firm are 50 according to, Companies Act 2013., , 2. Accounts of ‘Not for Profit’ Concerns, (1), (2), , (3), (4), , (5), , (6), (7), , (8), , Not for Profit Concerns renders …….. services to public at large., (a) commercial, (b) social, (c) individual, (d) group, Donation for Scholarship Fund is………., (a) Capital Receipt, (b) Revenue Receipt, (c) Capital Expenditure, (d) Revenue Expenditure, Income and Expenditure Account is a …….. Account., (a) Capital (b) Real (c) Personal, (d) Nominal, Outstanding Subscription at the end of the accounting year, represents………, (a) Liability (b) an Expenditure (c) an Asset (d) Capital Fund, Subscription received in advance during the year accounting year, is……., (a) an Income, (b) an Expenditure, (c) an Asset, (d) a Liability, Excess of Income over Expenditure is termed as ……, (a) Deficit (b) Profit (c) Surplus, (d) Loss, Not for Profit Concerns prepares ………. Account instead of Profit, and Loss Account to know the result., (a) Trading, (b) Income and Expenditure, (c) Cash, (d) Receipts and Payments, The closing balance of Receipts and Payments Account usually, represent ………, (a) Closing Stock, (b) Cash and Bank Balance, 11

Page 12 :

(c) Surplus, (d) Deficit, (9) Not for Profit Organisation is also called ……..organisation., (a) Service (b) Trading (c) Profit making (d) Commercial, (10) Expenditure on purchase of Building is a ……. Expenditure., (a) Capital (b) Revenue (c) General (d) Recurring, , 3. Reconstitution of Partnership (Admission of Partner), (1), , (2), , (3), , (4), , (5), , Anuj, and Eeshan are two partners sharing profits and losses in the, ratio of 3:2. They decided to admit Aaroh for 1/5th share, the new, profit sharing ratio will be ……., (a) 12:8:5 (b) 4:3:1 (c) 12:8:1, (d) 12:3:1, Excess of proportionate capital over actual capital represents……., (a) Equal Capital, (b) Surplus Capital, (c) Deficit Capital, (d) Gain, ………. is credited when unrecorded asset is brought into business., (a) Revaluation Account, (b) Balance Sheet, (c) Trading Account, (d) Partners Capital Account, When goodwill is withdrawn by the partners …… Account is, credited., (a) Revaluation, (b) Cash/Bank, (c) Current, (d) Profit and Loss Adjustment, If asset is taken over by the partner …… Account is debited., (a) Revaluation, (b) Capital, (c) Asset, (d) Balance Sheet, , 4. Reconstitution of Partnership (Retirement of Partner), (1), , (2), , (3), , (4), (5), , The profit or loss from revaluation on retirement of partner is, shared, by …….., (a) the remaining partners, (b) all the partners, (c) only retiring partner, (d) Bank, Decrease in the value of assets should be ………. to Profit and Loss, Loss Adjustment Account., (a) debited, (b) credited, (c) added, (d) equal, The balance of the capital account of retired partner is transferred, to his ……… Account if it is not paid., (a) Loan (b) Personal (c) Current, (d) Son’s, Gain Ratio = ……… Ratio Less Old Ratio, (a) New (b) Equal (c) Capital, (d) Sacrifice, New Ratio = Old Ratio + …….. Ratio, 12

Page 13 :

(6), , (a) Gain (b) Capital (c) Sacrifice (d) Current, Apte, Bhate and Chitale are sharing 1/2, 3/10 and 1/5 if Apte retire, their new ratio will be ……….., (a) 5:2 (b) 3:2 (c) 5:3 (d) 2:5, , 5. Reconstitution of Partnership (Death of Partner), (1), , (2), , (3), , (4), , (5), , Benefit Ratio is the Ratio in which ……., (a) The old partner gain on admission of a new partner, (b) The Goodwill of a new partner on admission is credited to, Old partners, (c) The continuing partners benefits on retirement or death, of a partner, (d) All partners are benefited, The ratio by which existing partners are benefited ………, (a) Gain Ratio, (b) Sacrifice Ratio, (c) Profit Ratio, (d) Capital Ratio, Profit and Loss Suspense Account is shown in the new Balance, Sheet on ……, (a) debit, (b) credit, (c) asset, (d) liabilities, Death is a compulsory …….., (a) Dissolution (b) Admission, (c) Retirement (d) Winding, up, The balance on the capital of partners, on his death is transferred to, ………Account., (a) Relatives, (b) Legal Heir’s Loan/Executor’s Loan, (c) Partner’s Capital (d) Partner’s Loan, , 6. Dissolution of Partnership Firm, (1), , (2), , (3), , (4), , In case of dissolution, assets and liabilities are transferred to ……., Account., (a) Bank, (b) Partner’s Capital, (c) Realisation (d) Partner’s Current, Dissolution Expenses are credited to ……… Account., (a) Realisation, (b) Cash/Bank, (c) Partner’s Capital, (d) Partner’s Loan, Deficiency of insolvent partner will be suffered by solvent partners, in their ……… ratio., (a) Capital (b) Profit sharing, (c) sale (d) Liquidity, If any asset is taken over by partner from firm his capital account, will be ………., (a) credited (b) debited, (c) added (d) divided, 13

Page 14 :

(5), , If any unrecorded liability is paid on dissolution of the firm ………, Account is debited., (a) Cash/Bank (b) Realisation (c) Partner’s Capital (d) Loan, (6) Partnership is completely dissolved when the partners of the firm, became ………, (a) solvent (b) insolvent (c) creditor (d) Debtors, (7) Assets and Liabilities are transferred to Realisation Account at their, ………. values., (a) market (b) purchase (c) sale, (d) book, (8) If the number of partners in a firm falls below two, the firm stands..., (a) dissolved (b) established (c) realisation (d) restructured, (9) Realisation Account is ……. on realisation of assets., (a) debited (b) credited (c) deducted (d) closed, (10) All activities of partnership firm ceases on…….. of firm., (a) dissolution (b) admission (c) retirement (d) death, , 7. Bills of Exchange, (1), , The person on whom a bill is drawn is called a ……., (a) Drawee (b) Payee (c) Drawer (d) Acceptor, (2) Before acceptance the bill is called a ……., (a) Order (b) Request (c) Draft (d) Instrument, (3) When the due date of bill drawn falls due on a public holiday, the, payment must be made on the ….. day., (a) same (b) preceding (c) next (d) any, (4) The due date of the bill for 2 months on 23rd Nov. 2019 will be ….., (a) 23rd Jan. 2020 (b) 25th Jan. 2019, (c) 26th Jan. 2019 (d) 25th Jan. 2020, (5) Noting Charges are borne by ……., (a) Notary Public (b) Drawee (c) Drawer (d) Endorsee, (6) There are …….. parties to bill of exchange., (a) five (b) four (c) three (d) two, (7) When a bill drawn for 2 months after date on 3rd Jan. 2020, its due, will be …….., (a) 3rd Jan. 2020, (b) 3rd March, 2020, (c) 5th March, 2020 (d) 6th March, 2020, (8) Notary Public is ………, (a) Govt. Officer (b) Drawer (c)Payee (d) Endorsee, (9) When Acceptor or Drawee does not pay the amount of bill to the, holder on the due date it is known as ……….. the bill., (a) returning (b) discounting (c) honouring (d) dishonouring, (10) The person who accepts the bill treats the bill as ……….., 14

Page 15 :

(a) Bills Payable, (c) Draft, , (b) Promissory Note, (d) Bills Receivable, , 8. Company Accounts-Issue of Shares, (1), , The balance of Share Forfeiture Account is transferred to ………., Account after re-issue of these share., (a) Reserve capital, (b) Capital Reserve, (c) Profit and Loss, (d) Share Capital, (2) Premium received on issue of shares is shown to ……., (a) Liability side of Balance Sheet, (b) Asset side of Balance Sheet, (c) Profit and Loss Account debit side, (d) Profit and Loss Account credit side, (3) Share holders get ………. on shares., (a) interest (b) commission (c) rent (d) dividend, (4) The document inviting to subscribe the shares of a company is …., (a) Prospectus, (b) Memorandum of Association, c) Articles of Association (d) Share Certificate, (5) As per SEBI guidelines minimum amount payable on share, application should be …….. of nominal value of shares., (a) 10%, (b) 15%, c) 2%, (d) 5%, (6) When shares are forfeited the Share Capital is ………, (a) credited, (b) debited, (c) neither debited nor credited (d) none of the above, (7) The liability of shareholder in Joint Stock Company is …….., (a) joint and several (b) limited (c) unlimited (d) huge, (8) The Share Capital which a company is authorized to issue by its, Memorandum of Association is ……., (a) Nominal capital/Authorized capital (b) Issued Capital, (c) Paid up capital, (d) Reserve capital, (9) The unpaid amount on allotment and calls may be transferred to …., Account., (a) calls in advance (b) calls (c) calls in arrears (d) allotment, (10) There must be provision in …….. for forfeiture of shares., (a) Articles of Association (b) Memorandum of Association, (c) Prospectus, (d) Balance Sheet, , 9. Analysis of Financial Statements, (1), (2), , Gross Profit Ratio indicates the relationship of gross to the ………, (a) Net Cash (b) Net Sales (c) Net Purchases (d) Gross Sales, Current Ratio = …………………/ Current Liabilities, 15

Page 16 :

(3), , (4), , (5), , (6), , (7), , (8), (9), , (a) Quick Assets, (b) Quick Liabilities, (c) Current Assets, (d) None of these, Liquid Assets = ………………., (a) Current Assets + Stock, (b) Current Assets - Stock, (c) Current Assets – Stock + Prepaid Expenses, (d) None of these, Cost of goods sold = …………………, (a) Sales – Gross Profit, (b) Sales - Net Profit, (c) Sale Proceeds, (d) None of these, Net Profit Ratio is equal to ……….., (a) Operating Ratio, (b) Operating Net Profit Ratio, (c) Gross Profit Ratio, (d) Current Ratio, The Common Size Statement requires ………, (a) common base, (b) Journal Entries, (c) Cash Flow, (d) Current Ratio, Bills Payable is ……….., (a) Long term loan, (b) Current Liability, (c) Liquid Assets, (d) Net Loss, Generally Current Ratio should be ………., (a) 2:1, (b) 1:1, (c) 1:2, (d) 3:1, From financial statement analysis the creditors are specially, interested to know…….., (a) Liquidity, (b) Profits (c) Sale (d) Share Capital, , 10. Computer in Accounting, (1), , (2), , (3), , The primary document for recording all financial transactions in, Tally is the …………, (a) Journal (b) Trial Sheet (c) Voucher (d) File, ……… displays the balance day wise of a selected voucher type., (a) Record Book, (b) Ledger Book, (c) Journal Book, (d) Day Book, Fixed Deposit Account comes under ……… group., (a) Investments, (b) Current Liability, (c) Bank A/c, (d) Current Assets, , (E), , Complete the sentences:, 1. Introduction to Partnership and Partnership Final Accounts, (1) Partners share profit and losses in ……… ratio in the absence of, Partnership deed., Ans. Partners share profit and losses in equal ratio in the absence of, partnership deed., 16, , (05)

Page 17 :

(2), (3), (4), (5), (6), (7), (8), (9), (10), (11), (12), (13), (14), (15), (16), (17), (18), (19), (20), , Registration of Partnership is optional In India., Partnership business must be lawful., Liabilities of partners in Partnership Firm are unlimited., The balance of Drawings Account of a partner is transferred to his, Current Account under Fixed Capital Method., The interest on capital of partner debited to Profit and Loss, Account., Partners are joint and several liable to for the debts of the firm., Partnership Deed is an article of partnership., The withdrawal by partner for personal use from the firm is debited, debited to his account., Commission payable to partner is liability/Expenditure of the, firm., When partners adopt Fixed Capital Method then they have to, operate Current Account., If partners Current shows credit balance it is shown to the liability, side of the Balance Sheet., The expenses paid for trading purpose are known as trade, expenses., Cash receipts which are recurring in nature are called as revenue, receipts., Return outward are deducted from purchases., Expenses which are paid before due date are called as prepaid, expenses., Assets which are held in the business for a long period are called, Fixed Assets., Trading Account is prepared on the basis of direct expenses., When commission is allowed to any partner, it is expenditure of, the business., When goods are distributed as free samples, it is treated as, advertisement expense of the business., , 2. Accounts of ‘Not for Profit’ Concerns, (1), (2), (3), (4), (5), , Not for Profit Organisation never is engaged in trading activities., Not for Profit Organisation is called service organization., Receipts and Payments Account falls under the category of Real, Account., In Receipts and Payments Account the summary of cash transactons are recorded., Income and Expenditure Account is similar to the Profit and Loss, Account of Trading Concern., 17

Page 18 :

Credit side of Receipts and Payments Account shows payments., Income and Expenditure Account is a Nominal Account., Mumbai University prepares Income and Expenditure Account, Instead of Profit and Loss Account., (9) Subscription received from the members is considered as revenue, receipts., (10) The transactions recorded in Income and Expenditure Account are, related only to the current year., (6), (7), (8), , 4. Reconstitution of Partnership (Retirement of Partner), (1), (2), (3), , (4), (5), , New Ratio (Less) Old Ratio = Gain Ratio, Retiring partner’s share of goodwill is debited to remaining, partners capital account, when goodwill is written off.., Revaluation Account is also known as Profit and Loss, Adjustment, Account., On retirement, the balance at current account of a partner is, transferred to his Capital Account ., A proportion in which the continuing partners get the share of, retiring partner is known as Gain Ratio., , 5. Reconstitution of Partnership (Death of Partner), (1), (2), , (3), (4), (5), , Deceased Partner’s Executors Account is shown on the Liability, side of the Balance Sheet., On death a partner, a ratio in which the continuing partners get, more, share of profits in future is called as Gain Ratio., Deceased partners share of profit up to the death is shown on asset, side of the Balance Sheet., Gain Ratio/Benefit Ratio = New Ratio – Old Ratio., When Goodwill is raised at its full value and it is written off, Goodwill Account is to be credited., , 7. Bills of Exchange, (1), , (2), , Making payment of bill before the due date of maturity is known, as, retirement of bill., Person whose liabilities are more than his assets and is not in, position to pay off his liabilities is insolvent person., 18

Page 19 :

(3), , Amount that cannot be paid by acceptor on account of insolvency, is, known as deficiency., (4) A bill of exchange payable after certain period is known as after, date bill., (5) A bill which is drawn and accepted with valuable consideration is, known as Trade Bill., (6) A person who draws the bill of exchange is known as Drawer., (7) A bill whose due date is calculated from the date of acceptance is, Known as after sight bill., (8) Recording the fact of dishnour of bill is known as noting., (9) When Drawee accepts the bills payable at a particular place only,, it, is known as qualified acceptance as to place., (10) Fees charged by the bank for collection of bill on behalf of holder, is bank charges., , 8. Company Accounts-Issue of Shares, (1), (2), (3), (4), (5), (6), (7), (8), , When face value of the share is 100 and issued price 120, then, it is said that the shares are issued at premium., Authorised Capital is the capital which a company is authorized to, issue by its Memorandum of Association., The difference between Called-up Capital and Paid –up Capital is, known as calls in arrears., Preference share holders get fixed rate of dividend., Equity share holders are the real owners of the company., Joint Stock Company form of business organization in which, capital is raised through the issue of shares., Subscribed Capital is the part of issued capital which is subscribed, by the public., The part of Authorised Capital which is not issued to the public is, known as Unissued Capital., , (F), , Answer in ONE sentence only:, (05), 1. Introduction to Partnership and Partnership Final Accounts, (1) If the Partnership Deed is silent, in which ratio the partners, will, share the profit or loss?, Ans. If the Partnership Deed is silent, partners will share the profit or, loss, In equal ratio., 19

Page 20 :

(2), Ans., (3), Ans., (4), Ans., (5), Ans., (6), Ans., (7), Ans., (8), Ans., (9), Ans., , (10), Ans., , How many partners are required to form a Partnership Firm?, Minimum two persons are required to form a Partnership Firm., What is Partnership Deed?, A Partnership Deed is a written agreement duly stamped and signed, document containing the terms and condition of the partnership., What rate of interest is allowed on partner’s loan in the absence, of an agreement?, 6% is the rate of interest to be allowed on partner’s loan in the, absence of an agreement., What is liability of a partner?, Liability of partner (except minor partner) is unlimited., Why Balance Sheet is prepared?, Balance Sheet is prepared to know the financial position of the, Business in the form of assets and liabilities on a particular date., What are the objectives of the Partnership Firm?, To earn maximum profit is the main objective of the Partnership, Firm., When is partners Current Account opened?, When fixed capital method is adopted by the firm, Partners Current, Account is opened., What is fluctuating capital?, When capital balances of the partners go on changing every year, due to transactions of partners with the firm, it known as fluctuating, Capital., What do mean by indirect incomes?, All incomes other than direct incomes are called indirect incomes., , 2. Accounts of ‘Not for Profit’ Concerns, (1) What do you mean by ‘Not for Profit Concern?, Ans. Not for Profit Concerns are the associations formed for providing, services to members without the aim of profit., (2) Which organizations are prepared Income and Expenditure, Account?, Ans. Not for Profit concern prepares Income and Expenditure Account., (3) What is Receipts and Payments Account?, Ans. An account which is prepared by a Not for Profit Concern to record, summary of cash receipts and cash payments is called Receipts and, Payments Account., (4) Why Income and Expenditure Account is prepared?, Ans. Income and Expenditure Account is prepared to ascertain, whether, the concern has sufficient incomes to meet its expenses or not., 20

Page 21 :

(5) What is Capital Fund?, Ans. Capital Fund is a fund created by Not for Profit Concern out of, Surplus, Entrance Fees, Life Membership Fees, Legacies etc., OR Excess of assets over liabilities is known as Capital Fund., (6) What is Subscription?, Ans. Subscription is the periodical payment made by the members to the, ‘Not for Profit Concern’ for acquiring/maintaining his, membership., (7) What is Legacy?, Ans. Any asset, property or amount of cash which ‘Not for Profit, Concern’ receives as per the provisions made in the will of the, doner after his death is called Legacy., (8) What is Surplus?, Ans. Surplus is an excess of income over expenditure of an Income and, Expenditure Account of ‘Not for Profit Concern.’, (9) What do you mean by Non-recurring Expenses?, Ans. Non-recurring Expenses are the expenses which are made for, acquisition of fixed assets which gives benefits for a long period., (10) To which account Surplus or Deficit is transferred?, Ans. Surplus or Deficit is transferred to Balance Sheet., , 3. Reconstitution of Partnership (Admission of Partner), (1) What is Revaluation/Profit and Loss Adjustment Account?, Ans. An opened and operated by any partnership firm for recording, changes in the value of assets and liabilities and ascertain profit or, loss made on revaluation of assets and liabilities is called, Revaluation Account., (2) What is Sacrifice Ratio?, Ans. A ratio which is surrendered or given up by the old partners in, favour of a newly admitted partner is called sacrifice ratio., (3) What is meant by Reconstitution of Partnership?, Ans. Reconstitution of Partnership means change in the relationship, between/among partners and in the form of partnership., (4) Why is new partner admitted?, Ans. A new partner is admitted to the existing partnership firm to, increase the capital resources of the firm and to secure advantages, of a new entrants skill and business connections., (5) What does the excess of debit over credits in Profit and Loss, Adjustment Account?, Ans. The excess of debit over credits in Profit and Loss Adjustment, Account indicates loss on revaluation of assets and liabilities., 21

Page 22 :

4. Reconstitution of Partnership (Retirement of Partner), (1) What is Benefit/Gain Ratio?, Ans. Profit sharing ratio which is acquired by the continuing partners, on account of retirement or death of a partner is called Benefit/, Gain Ratio., (2) What is meant by Retirement of a Partner?, Ans. Retirement of a partner refers to process in which a partner leaves, the firm or severs his relations with other partners on account of, his old age, loss of interest in the firm etc., (3) What is New Ratio?, Ans. The ratio in which profits and losses are shared by the continuing, partners after retirement of a partner is called New Ratio., (4) How is Gain Ratio calculated?, Ans. Gain Ratio is calculated at the time of retirement of a partner by, deducting old ratio from new ratio., (5) How is the amount due to the retiring partner settled?, Ans. The amount due to retiring partner is settled as per the terms of, partnership agreement or otherwise mutually agreed upon either, in lumpsum or in instalments., , 5. Reconstitution of Partnership (Death of Partner), (1) What is Benefit/Gain Ratio?, Ans. Profit sharing ratio which is acquired by the continuing partners, on account of retirement or death of a partner is called Benefit/, Gain Ratio., (2) To which account profit is to be transferred up to the date of, his, death?, Ans. Profit of the deceased partner, up to his death is transferred to Profit, and Loss Suspense Account/his Executor’s or Legal Heir’s A/c., (3) How death of a partner is a compulsory retirement?, Ans. After the death of a partner, business is not able to get any kind of, services from deceased partner and so we can say that death of, partner is like a compulsory retirement., (4) In which ratio General Reserve is distributed on death of a, partner?, Ans. General Reserve is distributed on death of partner in their old profit, sharing ratio., 22

Page 23 :

(5), , To whom you distribute General Reserve on death of a, partner?, Ans. On death of a partner General Reserve is distributed among all, Partners in their profit sharing ratio., , 6. Dissolution of Partnership Firm, (1) What is Realisation Account?, Ans. Realisation Account which is opened by the firm at the time of its, dissolution to determine profit or loss on realisation of assets and, payments of liabilities is known as Realisation Account., (2) What is dissolution of partnership firm?, Ans. Dissolution of the partnership firm means complete closure of, business activities and stoppage of partnership relations among all, the partners., (3) Who is called insolvent person?, Ans. Whose capital shows debit balance and who is not in a position to, meet his capital deficiency even from his private property is called, insolvent person., (4) What is capital deficiency?, Ans. The debit balance of insolvent partner’s capital which insolvent, partner cannot pay is called capital deficiency., (5) Who should bear the capital deficiency of insolvent partner?, Ans. The capital deficiency of insolvent partner should be borne by the, solvent partner., (6) Which account is debited on payment of dissolution expenses?, Ans. Realisation Account is debited on payment of dissolution expenses., (7) Which account is debited on repayment of Partner’s Loan?, Ans. Partner’s Loan Account is debited on repayment of loan., (8) When is Realisation Account opened?, Ans. Realisation Account is opened at the time of dissolution of, partnership firm., (9) Which accounts are not transferred to Realisation Account?, Ans. Cash/Bank Balance, Profit and Loss Account (Dr. & Cr. balance),, Partner’s loan Account, Reserve Fund etc. are not transferred to, Realisation Account., (10) In what proportion is the balance on Realisation Account, transferred to Partner’s Capital/Current Account?, Ans. The balance on Realisation Account is transferred to Partner’s, Capital/Current Account in their Profit sharing ratio., 23

Page 24 :

7. Bills of Exchange, (1) What do you mean by Bill of Exchange?, Ans. A Bill of Exchange is a written order signed by the drawer,, directing to a person to pay a certain sum of money on demand or, on a certain future date to a certain person or as per his order., (2) Who is Drawer?, Ans. The Drawer of a bill is the person who draws or makes the bill., (3) Who is Drawee?, Ans. The Drawee of a bill is the person on whom the bill is drawn., (4) Who is Payee of the bill?, Ans. The Payee of a bill is the person to whom the bill is made payable., (5) What are Noting Charges?, Ans. Noting Charges are the fees charged by the Notary Public for noting, the fact of dishonour on the face of the bill and official register., (6) What are Days of Grace?, Ans. The three extra days allowed to drawee or the acceptor of a bill for, Making payment on it are called Days of Grace., (7) What do you mean by discounting a bill of exchange?, Ans. Encashment of a bill of exchange with the bank for certain cash, which is less than face value of the bill before its due date by its, drawer or holder is called discounting of a bill of exchange., (8) Who is an Endorser?, Ans. The drawer or holder of a bill of exchange who transfers or, endorses the same in favour of third party is called Endorser., (9) Who is an Endorsee?, Ans. An Endorsee is the person to whom or in whose favour a bill is, endorsed or transferred., (10) What is Retirement of Bill?, Ans. A bill of exchange is said to be retired if its acceptor makes, payment of it before its due date., (11) What is noting of the bill?, Ans. Noting of the bill of exchange is the recording the facts of its, dishonour by a Notary Public., (12) What do you mean by rebate?, Ans. Any discount in monetary terms given by the holder of the bill of, exchange to the drawee, when a bill is retired is called rebate., (13) What is legal due date?, Ans. Date which is arrived at after adding three days of grace to nominal, due date is known as legal due date., (14) What is the relationship between Drawer and Drawee?, Ans. The relationship between the Drawer and Drawee is that of the, 24

Page 25 :

Creditor and Debtor., , 8. Company Accounts-Issue of Shares, (1) What is Equity Share?, Ans. An equity share is the one which has no special preferential right, to, dividend or repayment of capital., (2) What is Preference Share?, Ans. Preference Share is a type of share which enjoys priority of, preference over Equity share for the repayment of dividend at a, predetermined fixed rate and for the repayment of capital., (3) What is Registered Capital?, Ans. Registered Capital or Authorised Capital means maximum limit up, to which a company is authorized to raise share capital., (4) What is Subscribed Capital?, Ans. Subscribed Capital is a part of the issued capital which the company, has actually received by way of application from the public and, also, allotted by the company., (5) What is Paid-up Capital?, Ans. Part of the Called-up Capital which is actually paid by the, shareholders is called Paid-up Share Capital., (6) What is Reserved Capital?, Ans. Reserve Capital is that part of the subscribed capital which is, reserved to be called-up only at the time of liquidation of the, company., (7) What is over subscription of shares?, Ans. When a company received more applications of shares than those, actually offered or issued to the public, known as over, subscription of shares., (8) What is under subscription of shares?, Ans. When a company received applications of shares less than those, actually offered or issued to the public, the issue is said to be under, subscribed., (9) Which account is debited when Share First Call money is, received?, Ans. Bank Account is debited when Share First Call money is received., (10) What do you mean by share issued at premium?, Ans. A company can issue its shares at more than its face value. Excess, of issue price of shares over its face value is termed as shares issued, 25

Page 26 :

(11), Ans., , (12), Ans., , at premium., What is Calls -in -Arrears?, Non-payment of allotment or call money by the applicants inspite, of, repeated remainders are called calls-in-arrears., What is Forfeiture of Shares?, When a shareholder fails to pay allotment or call money or both,, the, company send reminder to the shareholders to make the payment, of, calls in arrears. If shareholder does not respond to reminders and, fails to pay money then, the directors can forfeit his shares., , 9. Analysis of Financial Statements, (1) Mention the two objectives of comparatives statement., Ans. Objectives of comparative statement are:, 1) Compare financial data at tow points of time and, 2) Helps in deriving the meaning and conclusions the changes, in financial positions and operating results., (2) Give the formula of Current Ratio., Ans. Current Ratio = Current Assets/Current Liabilities, (3) State any three examples of Current Assets., Ans. Sundry Debtors, Loose Tools, Cash and Bank Balances, Short term, Loans and advance, Stock and Investments, Prepaid Expenses., (4) Give the formula of Quick of Assets., Ans. Quick Assets = Current Assets – (Stock + Prepaid Expenses), (5) Give the formula of Gross Profit., Ans. Gross Profit = Net Sales – cost of goods sold, (6) Give the formula of Gross Profit Ratio., Ans. Gross Profit Ratio = Gross Profit/Net Sales x 100, (7) State the formula of Cost of goods sold., Ans. Cost of goods sold= Opening Stock + Purchases + Direct Expenses, - Closing Stock, (8) State three examples of cash in flows., Ans. Examples of cash in flows are:, Interest received, Dividend received, Sale of Fixed, Sale of, Investments, Rent received., (9) State the formula of Average Stock., Ans. Average Stock = Opening Stock of goods + Closing Stock of goods, 2, , (10) State three examples of cash out flows., 26

Page 27 :

Ans. Examples of cash out flows are:, Interest paid, Dividend paid, Repayment of short term borrowings,, Purchase of Fixed Assets, Purchase of Investments., , 10. Computer in Accounting, (1) What is CAS?, Ans. CAS means computerized Accounting System which helps, business, firms to implement accounting process and makes it user friendly, with automation., (2) Write the steps to create Ledger Account in tally?, Ans. Steps to create Ledger Account in tally are as Follows:, 1) From Gateway of Tally Screen, click on accounts info., 2) Path gateway to Tally - Accounts Info – Ledgers - Single, Ledger - Choses create., (3) How to view reports in tally?, Ans. For viewing accounting reports in accounting software to click on, report option and select the display option., (4) Write the steps to create a company?, Ans. Following are the steps to create a Company:, 1) After entering into accounting software tally, double click on, the option, create company, under company information. Then, follow navigation path., Gateway of Tally > Company Info>Create Company, 2) Fill the detail information in the company creation form,, displayed on the screen – company creation window., ******************************************************, , 27