Page 1 :

Public expenditure and public revenue SS2-5, What are the activities of the government?, -Drinking water, -Environmental protection, -Distribution of welfare pension, -Health care, -Education, What is the public Expenditure?, -The expenditure incurred by the government is known as public expenditure., -Government undertakes many activities for the welfare of the people., -Expenditure increases with an increase in the activities of the government., What are the classification of public expenditure?, -Developmental expenditure,, -Non-developmental expenditure., Developmental expenditure, -The expenditure incurred by the government for constructing roads, bridges and harbours, starting up, new enterprises, setting up educational institutions, etc. are considered as developmental expenditure., - The government will receive future revenue from development expenditure., Non-developmental expenditure., -Expenditure incurred for war, interest, pension, etc. are considered as non-developmental expenditure., -The government will not get any revenue from its non-development expenditure., Why does India's public expenditure increase?, -Population growth,, -Increase in defense expenditure,, -Welfare activities,, -Urbanization,, -Natural calamities,, -Infectious diseases., What is Public revenue?, -The income of the government is known as public revenue., What are the sources of revenue to the government?, -Tax Revenue., -Non Tax Revenue., What is tax (What is tax revenue), -Taxes are the main source of income to the government., -Tax is a compulsory payment to the government made by the public for meeting expenditure towards, welfare activities, and developmental activities etc., -The person who pays tax is called tax payer., -The reduction in the income the taxpayer receives by paying taxes is known as the tax burden., 1

Page 2 :

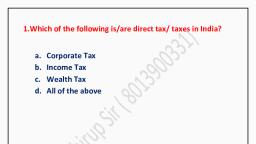

Classify the tax on the basis of bearing tax burden, -Taxes can be divided into two categories on the basis of bearing tax burden, -Direct Tax, -Personal Income Tax, Direct Tax, -When a person pays taxes on himself, it is called direct tax., -The unique feature of direct tax is that the tax payer undertakes the burden of the tax., Major direct taxes in India, -Personal Income Tax, -It is the tax imposed on the income of individuals., -The rate of tax increases as the income increases., -Income tax is applicable to the income that is above a certain limit., -In India the income tax is collected by the central government as per the Income Tax Act 1961., Corporate tax, -This is the tax imposed on the net income or profit of the companies., Indirect tax, -In the indirect tax the tax burden can be shifted from the person on whom it is imposed to another person., -in the case of sale tax the tax burden initially falls on the trader., -But the trader transfers the burden of the tax along with its price to the consumer., -The tax is included in the price paid by the consumer., -This is the peculiarity of indirect taxation., -With a view to simplify the indirect tax system and to introduce one tax across the country Goods and, Services Tax (GST) was introduced by incorporating majority of existing indirect taxes., -The prevailing system will continue for those items that are not included in GST., Goods and Services Tax (GST), -Goods and Services Tax (GST) was introduced in India on 1 st July 2017 merging different indirect taxes, imposed by central and state governments., -Taxes are levied at different stages starting from production to final consumption of goods, and services., -In each stage the tax is imposed on the value added., -Hence tax is collected only on value addition., -The tax paid in the earlier stages need not be paid by the final consumer., -GST registration is mandatory to the traders if the turnover is more than 20 lakh in a, financial year., Types of Goods and Services Taxes (GST), -Central Goods and Services Tax (CGST), -State Goods and Services Tax (SGST), -Integrated Goods and Services Tax (IGST), Central Goods and Services Tax (CGST) & State Goods and Services Tax (SGST), -The Central and State government impose GST on goods and services traded within the state., -The tax imposed by the central government is known as Central GST (CGST)., -And the tax imposed by the state government is known as State GST (SGST)., -These taxes are collected jointly from the consumers and are shared equally by the centre and state, governments., 2

Page 3 :

Integrated Goods and Services Tax (IGST), -The GST on interstate trade is imposed and collected by the central government., -This is known as Integrated GST (IGST)., -The share of the state government on IGST is given by the Central government., GST Rates, -No GST is imposed on essential services and daily consumption goods including unprocessed food items., -And all other goods and service are arranged under four GST slabs., They are:-5%, -12%, -18%, -28%, GST rates as represented by symbols, ! = 0%, @ = 5%, # = 12%, $ = 18%, & = 28%, What are the important information from the GST Bill?, -GST Registration Number, -PAN number, -Date, -Bill number, -Symbols indicating tax rates, -Tax rates, -Items including in -GST, -Items that are exempted from GST., GST Council, -Union Finance Minister, Union Minister of State in charge of finance and state finance ministers are, members of GST Council., -Union Finance Minister is the chairman of GST council, Duties of the GST Committee, -The GST council makes recommendation on the Following., -Taxes, cess and surcharges that are to be merged into GST., -The goods and services that are to be brought under GST., -Determining GST rates., -The time frame for including the excluded items into GST., -Determining the tax exemption limit on the basis of total turnover., What are the other two sources of income to the government?, -Surcharge,, -Cess., Surcharge?, 3

Page 4 :

-Surcharge is an additional tax on tax amount., -This is imposed for a certain period of time., -Usually surcharge is imposed as a given percentage on the income tax., Cess?, -Cess is an additional tax for meeting some special purpose of government., -Cess is withdrawn once sufficient revenue is collected., -Education cess on income tax is an example., -The purpose of this is the development of educational facilities., List the taxes levied by Central, State and Local self Governments in India., Central government, State government, Local self government, -Corporate tax, -Personal Income Tax, -Central GST (CGST), -Integrated GST (IGST), , -Land Tax, -Stamp duty, -State GST (SGST), , -Property tax, -Professional Tax, , What are the non-tax revenue sources of the government?, -Fees, -Fines and penalties, -Grants, -Interest, -Profit, Fees, -Fees is the reward collected for the government's services. License fees, registration fees, tuition fees, etc., are examples., Fines and penalties, -Fines and penalties are punishments for violating the laws., Grants, -Grants are the financial aid provided by one government or organisations for meeting a specific objective., -For example, grants are provided by central and state governments to local self governments., Interest, -Government receive interest for loans given to various enterprises, agencies and countries., Profit, -Profit is the net income received from the enterprises operated by the government. For example, profit, from the Indian Railways., What is Public debt?, -Public debts are loans taken by the government., 4

Page 5 :

-Loans are availed from within and outside the country., -The debt that the government buys from within the country is known as internal debt., -The debt that the government buys from outside the country is known as External debt., Internal debt, -Internal debts are the loans availed by the government from individuals and institutions within the, country., External debt, -External debts are the loans availed from foreign governments and international institutions., Reasons for the increase in India's public debt, -Increased defence expenditure, -Increase in population, -Social welfare activities, -Developmental activities, -Urbanization activities, -Health care, -Reforms in transport sector., Public finance?, -Public finance is the branch of economics that relates to public income, public expenditure and public, debt., -Public finance is presented through the budget., What is a Budget?, -Budget is the financial statement showing the expected income and expenditure of the government during, a financial year., -In India, financial year is from April 1 to March 31., Types of Budget, Balanced budget:- When income and expenditure are equal, it is called a balanced budget., Surplus budget.:- When income is more than expenditure, it is called surplus budget., Deficit budget:- When expenditure is more than income, it is called deficit budget., What is Fiscal policy?, -Government's policy regarding public revenue, public expenditure and public debt is called fiscal policy., -These policies are implemented through the budget., -Fiscal policy influences a country's progress., -A sound fiscal policy helps in nourishing the developmental activities and to attain growth., -The tax rate is increased when there is inflation., -As a result of this, the purchasing power of the people falls., -Similarly, tax is reduced at the time of Deflation., -This will increase the purchasing power of the people., What is the goals of the fiscal policy?, -Attain economic stability., -Create employment opportunities., -Control unnecessary expenditure., -Prevent inflation., 5