Page 1 :

Financial Management, , B.Tech ENTC Engg., , Unit -1, Introduction to Financial Accounting, Bookkeeping and Recording, Introduction to Financial Accounting, Book kee ping & Recording: Meaning, Scope and, importance of Fina ncia l Accounting. Financ ia l Accounting - concepts and conventions,, classification of accounts, Rules and principles governing Double Entry Book-keeping, system, Meaning, Preparation of Journal, Ledger , Cash book & Trial balance., , 1. What is Financial Accounting?, Financial accounting is the process of preparing financial statements that companies‟ use to, show their financial performance and position to people outside the company, Including, investors, creditors, suppliers, and customers., This is one of the most important distinctions from managerial accounting, which by contrast,, involves preparing detailed reports and forecasts for managers inside the company., , , , Why Is Financial Accounting Important?, , Financial accounting is important for businesses because it helps them keep track of their, financial transactions. In turn, they can make sound decisions on how to allocate their, resources. In addition, financial accounting helps you communicate your business finances to, outside parties such as creditors and investors. The financial statements generated provide all, the necessary information to other parties, which will either encourage or discourage them, from partnering with your business., 2. TYPES OF ACCOUNTING, There are three different classes of accounting which are Financial Accounting, Cost Accounting,, and Management Accounting. The financial literature classifies accounting into two broad, categories, viz, Financial Accounting and Management Accounting. Financial accounting is, primarily concerned with the preparation of financial statements whereas management, accounting covers areas such as interpretation of financial statements, cost accounting, etc., Both these types of accounting are examined in the following paragraphs., 1.Financial accounting, As mentioned earlier, financial accounting deals with the preparation of financial statements, for the basic purpose of providing information to various interested groups like creditors,, banks, shareholders, financial institutions, government, consumers, etc. Financial statements,, i.e. the income statement and the balance sheet indicate the way in which the activities of the, business have been conducted during a given period of time. Financial accounting is charged, with the primary responsibility of external reporting. The users of information generated by, financial accounting, like bankers, financial institutions, regulatory authorities, government,, investors, etc. want the accounting information to be consistent so as to facilitate comparison., Therefore, financial accounting is based on certain concepts and conventions which include, separate business entity, going concern concept, money measurement concept, cost concept,, dual aspect concept, accounting period concept, matching concept, realization concept and, Prepared By Prof. Shaikh R P, ENTC Dept.

Page 2 :

Financial Management, , B.Tech ENTC Engg., , conventions of conservatism, disclosure, consistency, etc. All such concepts and conventions, would be dealt with detail in subsequent lessons., The significance of financial accounting lies in the fact that it aids the management in, directing and controlling the activities of the firm and to frame relevant managerial policies, related to areas like production, sales, financing, etc. However, it suffers from certain, drawbacks which are discussed in the following paragraphs. · The information provided by, financial accounting is consolidated in nature. It does not indicate a break-up for different, departments, processes, products and jobs. As such, it becomes difficult to evaluate the, performance of different sub-units of the organisation. · Financial accounting does not help in, knowing the cost behaviour as it does not distinguish between fixed and variable costs. · The, information provided by financial accounting is historical in nature and as such the, predictability of such information is limited. The management of a company has to solve, certain ticklish questions like expansion of business, making or buying a component, adding, or deleting a product line, deciding on alternative methods of production, etc. The financial, accounting information is of little help in answering these questions. The limitations of, financial accounting, however, should not lead one to believe that it is of no use. It is the, basic foundation on which other branches and tools of accounting analysis are based. It is the, source of information, which can be further analysed and interpreted according to the tailormade requirements of decision-makers., 2. Management accounting, Management accounting is „tailor-made‟ accounting. It facilitates the management by, providing accounting information in such a way so that it is conducive for policy making and, running the day-to-day operations of the business. Its basic purpose is to communicate the, facts according to the specific needs of decision-makers by presenting the information in a, systematic and meaningful manner. Management accounting, therefore, specifically helps in, planning and control. It helps in setting standards and in case of variances between planned, and actual performances, it helps in deciding the corrective action. An important, characteristic of management accounting is that it is forward looking. Its basic focus is one, future activity to be performed and not what has already happened in the past. Since, management accounting caters to the specific decision needs, it does not rest upon any welldefined and set principles. The reports generated by a management accountant can be of any, duration– short or long, depending on purpose. Further, the reports can be prepared for the, organisation as a whole as well as its segments., 3. Cost accounting, One important variant of management accounting is the cost analysis. Cost accounting makes, elaborate cost records regarding various products, operations and functions. It is the process, of determining and accumulating the cost of a particular product or activity. Any product,, function, job or process for which costs are determined and accumulated, are called cost, centres. The basic purpose of cost accounting is to provide a detailed breakup of cost of, different departments, processes, jobs, products, sales territories, etc., so that effective cost, Prepared By Prof. Shaikh R P, ENTC Dept.

Page 3 :

Financial Management, , B.Tech ENTC Engg., , control can be exercised. Cost accounting also helps in making revenue decisions such as, those related to pricing, product-mix, profit-volume decisions, expansion of business,, replacement decisions, etc. The objectives of cost accounting, therefore, can be summarized, in the form of three important statements, viz, to determine costs, to facilitate planning and, control of business activities and to supply information for short- and long-term decision., Cost accounting has certain distinct advantages over financial accounting. Some of them have, been discussed succeeding. The cost accounting system provides data about profitable and, non-profitable products and activities, thus prompting corrective measures. It is easier to, segregate and analyse individual cost items and to minimize losses and wastages arising from, the manufacturing process. Production methods can be varied so as to minimize costs and, increase profits. Cost accounting helps in making realistic pricing decisions in times of low, demand, competitive conditions, technology changes, etc. Various alternative courses of, action can be properly evaluated with the help of data generated by cost accounting. It would, not be an exaggeration if it is said that a cost accounting system ensures maximum utilization, of physical and human resources. It checks frauds and manipulations and directs the, employer and employees towards achieving the organisational goal., 3. Classification Of Accounting, There are three different classes of accounting which are Financial Accounting, Cost Accounting,, and Management Accounting., , , Financial Accounting, , We can define financial accounting as a process of recording, summarizing, and reporting, various transactions that occur over a period of time during the course of business., We gather and convert all the daily transactions into financial statements, balance, sheet, income statements, and cash flow statements., In the preparation of the above, financial accounting uses a bunch of accounting principles., These contain different rules and assumption set out for the preparation of financial statements., There are various different rules and regulations that financial accounting uses for the, preparation and presentation of financial accounting., In India, all financial accounts are prepared in accordance with Generally Accepted Accounting, Principal (GAAP). In the case of International public companies, international financial, reporting standard is applicable together with GAAP., Further, there are two different methodology financial accounting uses to prepare financial, statements:, 1. Accrual Basis, Prepared By Prof. Shaikh R P, ENTC Dept.

Page 4 :

Financial Management, , B.Tech ENTC Engg., , 2. Cash Basis, 3. Combination of both of above., Accrual method entails recording transaction as and when the transaction occurs and revenue is, recognizable or expenses are certain and payable. In the case of the cash method, we record, transactions on the basis of the exchange of cash., , , Cost Accounting, , Cost accounting is a process of recording, summarizing, analyzing, and allocating the cost over, the process of manufacturing a product or providing services., It helps management to determine the cost involved in manufacturing a product or services by, use of different cost accounting method., Further, it helps management to make organization cost-efficient and capable. Cost accounting, acts as a controlling tool., There are different elements of cost accounting like:, , , Material, , , , Labor, , , , Other expenses, , Direct and indirect are the further segregation of the above costs., Different Types of Cost, , , Fixed Cost, , , , Variable Cost, , , , Semi-variable Cost, , , , Opportunity Cost, , , , Sunk Cost, , Let us understand all types in detail:, , , Fixed cost means cost does not vary with the quantity of production, like Salary or fixed, wage., , , , Variable cost varies with a change in the quantity of production like material cost and, labor cost will increase with the increased level of production., , Prepared By Prof. Shaikh R P, ENTC Dept.

Page 5 :

Financial Management, , B.Tech ENTC Engg., , , , Semi-Variable Cost contains two elements of costs one is fixed and another one is, variable. In this type of cost fixed part remains the same up to a certain level of, production but changes after crossing that certain level and variable varies with the, changed level of production., , , , Opportunity cost is the cost of not earning profit from the opportunity of manufacturing a, new product and sale due to limited resources. Or we can say with the limited resources, an organization has to forgo profit of the other product in addition to the existing., , , , Sunk cost is the cost with cannot be recovered once occurred like for producing certain, product machinery is required and purchased. Now, we cannot recover the cost of, machinery whether we carry out production or not., , , Management Accounting, , Management Accounting or Managerial Accounting helps managers to make and implement, business policies for better results. They use financial accounting information for this purpose., Management accounting is a different analysis tool for analyzing accounting information and to, draw out best for the organization. Segregation of these tool under four heads according to their, nature for the better understanding is as under:, 1. Based on Financial Accounting Information, 1. Ratio analysis of financial information contained in financial statements., 2. Comparative analysis of past and current financial information., 3. Through an analysis of fund flow statements and cash flow statements., 4. Analysis of Return on capital employed., 2. Based on Cost Accounting Information, 1. Cost volume and profit volume analysis., 2. Incremental and differential costing method., 3. Standard costing and variance analysis., 3. Based on Mathematics: Techniques like operation research, linear programming, network, analysis etc., 4. Based on Future data information: Budget and budgetary control, budget variance analysis,, business forecasting, project evaluation., , Prepared By Prof. Shaikh R P, ENTC Dept.

Page 6 :

Financial Management, , B.Tech ENTC Engg., , 4. Bookkeeping and Accounting, Book-keeping and accounting are different from each other. Bookkeeping is an important part of, accounting. Accounting is broader than book-keeping. Accounting includes a design of, accounting systems which book-keepers use for the preparation of financial statements, audits,, cost studies, income-tax statements, etc., It also facilitates the interpretation of accounting information for both internal and external users, for business decisions making. It requires skills and experience of an accountant., There is a difference between the two terms bookkeeping and accounting, let us understand what, is bookkeeping and accounting, their processes and difference between the two., While doing Bookkeeping, we need to follow the basic accounting concepts and accounting, conventions., Bookkeeping is clerical in nature. Book-keeping is usually done by junior employees of the, entity. Most of the entities nowadays use computers for bookkeeping rather than recording them, manually. Accounting of an entity depends on its book-keeping system., Book-keeping is the basis for accounting. It is because it is responsible for the proper recording, of financial transactions. Whereas, Accounting involves classification, summarizing and, reporting of financial transactions. It involves the preparation of source documents for all the, financial transactions of the entity., Process of Bookkeeping, 1. Identifying financial transactions, 2. Recording of financial transactions, 3. Preparation of ledger accounts, 4. Preparation of trial balance, , , Accounting, , Accounting includes recording, classifying, summarizing financial transactions in a proper, manner. It deals with common monetary measurement. It is thus a broader concept than, bookkeeping. Bookkeeping is a part of accounting., Only financial transactions which can be expressed in terms of money are recorded. Thus,, accounting enables stakeholders to know the financial position of an entity for the period. It is, concerned with summarizing of the recorded financial transactions. Also, it enables management, to prepare various types of reports., , Prepared By Prof. Shaikh R P, ENTC Dept.

Page 7 :

Financial Management, , B.Tech ENTC Engg., , Process of Accounting, 1. Identifying financial transactions, 2. Recording of financial transactions, 3. Preparing ledger accounts, 4. Preparation of trial balance, 5. Preparation of financial statements, 6. Analysis of financial statements, Solved Example on Bookkeeping and Accounting, Question: There is a difference between the two terms bookkeeping and accounting, Ans. The difference between bookkeeping and accounting is as follows:1. Bookkeeping is concerned with the recording of financial transactions whereas, accounting involves recording, classifying and summarizing financial transactions., 2. Bookkeeping is clerical in nature and usually is the junior staff performs this function, whereas accounting requires skills of accountant and knowledge of various accounting, policies., 3. The Bookkeeping is the base for accounting. Accounting starts where the bookkeeping, ends and is thus broader in scope than bookkeeping., 4. Bookkeeping is in accordance with the accounting concepts and conventions. Whereas,, the accounting methods and procedures for analyzing and interpreting the financial, reports may vary from entity to entity., 5. Financial statements do not form part of bookkeeping. Thus, these are prepared from the, accounting process., 6. The accounting reports help in ascertaining the financial position of an entity, however, not bookkeeping records., , 5. What is double-entry bookkeeping?, Double-entry bookkeeping is a system of accounting for financial transactions that has been, used for hundreds of years. It underpins every cloud based bookkeeping system, banking, system and reporting system used by businesses globally., It allows a business to track all its transactions and helps it to understand how it is performing, in terms of profitability, cash balances and business growth. It also supports all the ongoing, reporting and submission requirements businesses have – VAT returns, annual accounts, tax, returns, etc all rely on double-entry bookkeeping., Prepared By Prof. Shaikh R P, ENTC Dept.

Page 8 :

Financial Management, , B.Tech ENTC Engg., , What are the principles of double-entry bookkeeping?, The principles of double-entry bookkeeping are very simple - every transaction will have, two equal and opposite elements. So for example, if you sell goods your cash balance, increases and your stock levels will go down. This is why accountants talk about things, balancing and make references to a „balance sheet‟ in accounts., The entries resulting from double entry bookkeeping are often referred to as debits and, credits. These represent the two sides of every accounting transaction., A business‟ accounting records, whether simple or complicated, will be an accumulation of, these double entries. These entries can then be summarised in what is called a general ledger,, which represents the sum of all entries, analysed by type., If you record these journal entries in a general ledger, debit entries are recorded on the left,, and credit entries on the right. These are summarised in a trial balance, which shows the, account balances broken down by type being the sum of all related debits and credits. When, done correctly, your trial balance will show the overall balance of credits is the same as the, overall debit balance., Your general ledger will include a page for all your accounts in what is called a chart of, accounts, which are arranged by account categories. A general ledger is usually divided into, at least nine main categories:, 1. Assets, 2. Liabilities, 3. Capital Introduced, 4. Owners‟ equity/shareholding, 5. Income, 6. Expenses, 7. Drawings, 8. Gains, 9. Losses, The main categories of the general ledger can often be reduced into subledgers to include, additional details such as cash, accounts receivable, accounts payable, etc., What is double-entry bookkeeping used for?, Double-entry bookkeeping (which is sometimes referred to as double-entry accounting), allows a business to record all its financial transactions in a structured way. It can then, provide the owners or their accountants with the information they need to deal with all the tax, and financial submission requirements the business will have such as VAT returns, annual, accounts, tax returns and cashflow statements., It also enables business owners to track their finances on a regular basis, helping them to, understand how the business is performing and supporting key financial decisions., Using double-entry bookkeeping to record transactions provides you and your accountant, with a detailed, comprehensive view of your financial affairs., , Prepared By Prof. Shaikh R P, ENTC Dept.

Page 9 :

Financial Management, , B.Tech ENTC Engg., , Who should use double-entry bookkeeping?, Very simply, all businesses will need to use double-entry bookkeeping. It is the only way to, ensure that financial information is complete and correct and will support all the ongoing, reporting functions that business may have., Some business owners will deal with the entirety of their double-entry bookkeeping, however, in most cases bookkeepers or accountants are involved to help set up and run suitable systems, to deal with bookkeeping needs., Examples of double-entry bookkeeping, Some examples of how double-entry bookkeeping works are set out below:, Example 1: Buying with cash, You have started a new takeaway business and want to buy a new phone for when you are out, on deliveries., Under double-entry accounting, you would make two entries: you trade one asset (cash) for, another asset (mobile phone). You must therefore adjust both the cash and mobile phone, accounts in your double entry ledger:, Account, , Debit, , Credit, , Cash, , -, , £1,000, , Mobile phone, , £1,000, , -, , With double-entry bookkeeping, each debit must always have an equal corresponding credit, to keep this equation in balance: Assets = Liabilities + Equity, This is known as the accounting equation, and it is at the heart of double-entry accounting. If, at any point this equation is out of balance, it will mean the bookkeeping process has gone, wrong at some time., In this example, only the assets side of the equation is affected: your assets (cash) decrease by, £1,000 and your mobile phone assets rise by £1,000, and the equation remains balanced., 6. Journal, A journal is a chronological (arranged in order of time) record of business, transactions. A journal entry is the recording of a business transaction in the journal. A, journal entry shows all the effects of a business transaction as expressed in debit(s) and, credit(s) and may include an explanation of the transaction. A transaction is entered in a, journal before it is entered in ledger accounts. Because each transaction is initially recorded, in a journal rather than directly in the ledger, a journal is called a book of original entry., , Prepared By Prof. Shaikh R P, ENTC Dept.

Page 10 :

Financial Management, , B.Tech ENTC Engg., , 7. Ledger, A ledger (general ledger) is the complete collection of all the accounts and transactions of a, company. The ledger may be in loose-leaf form, in a bound volume, or in computer, memory. The chart of accounts is a listing of the titles and numbers of all the accounts in the, ledger. The chart of accounts can be compared to a table of contents. The groups of accounts, usually appear in this order: assets, liabilities, equity, dividends, revenues, and expenses., Think of the chart of accounts as a table of contents of a textbook. It provides direction as to, what exactly will be found in the financial statement preparation., , 8. Meaning And Objectives Of Preparing Trial Balance, If you recall the steps in the accounting procedure you find that at first the transactions are, entered in the Journal and Special Purpose Books like Cash Book, Purchases Book, Sales, Book, etc. From these books items are posted in the ledger in their respective accounts., Finally, at the end of the accounting year these accounts are balanced. To check the accuracy, of posting in the ledger a statement is prepared with two columns i.e. debit column and credit, column which contains debit balances of accounts and credit balances of accounts, respectively. Total of the two columns are if equal, it means the ledger posting is, arithmetically correct. This statement is called Trial Balance., Trial Balance may be defined as a statement which contains balances of all ledger, accounts on a particular date., Trial Balance consists of a debit column with all debit balances of accounts and credit, column with all credit balances of accounts. The totals of these columns if tally it is presumed, that ledger has been maintained correctly. However, Trial Balance proves only the, arithmetical accuracy of posting in the ledger., Objectives of Preparing a Trial Balance Following are the objectives of preparing Trial, Balance, (i)To Check Arithmetical Accuracy : Arithmetical accuracy in ledger posting means, writing correct amount, in the correct account and on its correct side while posting, transactions from various original books of accounts, such as Cash Book, Purchases Book,, Sales Book, etc. It also means not only the correct balance of ledger account but also the, totals of the special purpose Books., (ii) To Help in Preparing Financial Statements : The ultimate objective of the accounting, is to prepare financial statements i.e. Trading and Profit and Loss Account, and Balance sheet, of a business enterprise at the end of an accounting year. These statements contain balances, of various ledger accounts. As Trial Balance contains balances of all ledger accounts, in, financial statements the balances of ledger accounts are carried from the Trial balance for, proper analysis., , Prepared By Prof. Shaikh R P, ENTC Dept.

Page 11 :

Financial Management, , B.Tech ENTC Engg., , (iii) Helps in Locating Errors : If total of two columns of the trial balance agrees it is a, proof of arithmetical accuracy in the ledger posting. However, if the totals of the two, columns do not tally it indicates that there are some mistake in the ledger accounts. This, prompts the accountant to find out the errors., (iv) Helps in Comparison : Comparison of ledger account balances of one year with the, corresponding balances with the previous year helps the management taking some important, decisions. This is possible by using the Trial Balances of the two years., (v) Helps in Making Adjustments : While making financial statements adjustments, regarding closing stock, prepaid expenses, outstanding expenses etc are to be made. Trial, balance helps in identifying the items requiring adjustments in preparing the financial, statements., Trial Balance is generally prepared at the end of the year. However it can be prepared at any, time during the accounting year to check the accuracy of the posting., 9. What is a Cash Book?, A cash book is a financial newspaper which includes all cash receipts and disbursements,, including bank deposits and withdrawals. After that, entries in the cash book are added to the, general ledger., , , , , , , , A cash book is a subsidiary of the general ledger in which all cash transactions during, a period are recorded., The cash book is recorded in chronological order, and the balance is updated and, verified on a continuous basis., Larger organizations usually divide the cash book into two parts: the cash, disbursement journal and the cash receipts journal., A cash book differs from a cash account in that it is a separate ledger in which cash, transactions are recorded, whereas a cash account is an account within a general, ledger., There are three common types of cash books: single column, double column, and, triple column., , How a Cash Book Works, A cash book is set up as a subsidiary to the general ledger in which all cash transactions made, during an accounting period are recorded in chronological order. Larger organizations usually, divide the cash book into two parts: the cash disbursement journal, which records all cash, payments, and the cash receipts journal, which records all cash received into the business.1, The cash disbursement journal would include items such as payments made to vendors to, reduce accounts payable, and the cash receipts journal would include items such as payments, made by customers on outstanding accounts receivable or cash sales., The primary goal of a cash book is to manage cash efficiently, making it easy to determine, cash balances at any point in time, allowing managers and company accountants to budget, Prepared By Prof. Shaikh R P, ENTC Dept.

Page 12 :

Financial Management, , B.Tech ENTC Engg., , their cash effectively when needed. It is also much faster to access cash information in a cash, book than by following the cash through a ledger., Recording in a Cash Book, All transactions in a cash book have two sides: debit and credit. All cash receipts are recorded, on the left-hand side as a debit, and all cash payments are recorded by date on the right-hand, side as a credit. The difference between the left and right sides shows the balance of cash on, hand, which should be a net debit balance if cash flow is positive., The cash book is set up in columns. There are three common versions of the cash book:, single column, double column, and triple column. The single-column cash book shows only, receipts and payments of cash. The double-column cash book shows cash receipts and, payments as well as details about bank transactions. The triple column cash book shows all of, the above plus information about purchase or sales discounts., A typical single column cash book will have these four column headers: “date,”, “description,” “reference” (or “folio number”), and “amount.” These headers are present for, both the left side showing receipts and the right side showing payments. The date column is, the date of the transaction., Because the cash book is updated continuously, it will be in chronological order by, transaction. In the description column, the accountant writes a short description or narration, of the transaction. In the reference or ledger folio column, the accountant inputs the account, number for the related general ledger account. The amount of the transaction is recorded in, the final column., What Is the Purpose of a Cash Book?, A cash book is set up as a subsidiary to the general ledger in which all cash transactions made, during an accounting period are recorded in chronological order. The primary goal of a cash, book is to manage cash efficiently, making it easy to determine cash balances at any point in, time, allowing managers and company accountants to budget their cash effectively. It is also, much faster to access cash information in a cash book than by following the cash through a, ledger., , , What Is the Difference Between a Cash Book and a Cash Account?, , A cash book and a cash account differ in a few ways. A cash book is a separate ledger in, which cash transactions are recorded, whereas a cash account is an account within a general, ledger. A cash book serves the purpose of both the journal and ledger, whereas a cash account, is structured like a ledger. Details or narration about the source or use of funds are required in, a cash book but not in a cash account., , Prepared By Prof. Shaikh R P, ENTC Dept.

Page 13 :

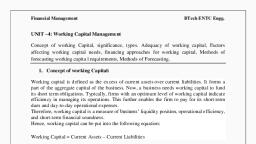

Financial Management, , , B.Tech ENTC Engg., , Ledger versus trial balance – tabular comparison, , A tabular comparison of ledger and trial balance is given below:, , VS, , LEDGER, , TRIAL BALANCE, , Meaning, Principal book of account which is a compilation of, all business transactions segregated and posted, account wise, , Listing of all account balances that is prepared, from individual ledger accounts, , Hierarchy in accounting cycle, After journal and before trial balance, , After ledger, , Quantum of information, Comprehensive – information on all transactions, , Limited – only account balances, , Purpose for preparation, Calculating period end balances of all accounts to, aid in preparation of financial statements, , To ensure that books are in balance i.e.: total, debits equal total of credits, , Timing of preparation, Throughout the accounting period, , Generally once on the last day of the accounti, period, , Format, ‘T’ format, , Columnar, , Prepared By Prof. Shaikh R P, ENTC Dept.

Page 14 :

Financial Management, , B.Tech ENTC Engg., , Balancing and tallying, Balanced but not tallied, , Totaled, and tallying is a must, , Prepared By Prof. Shaikh R P, ENTC Dept.