Page 1 :

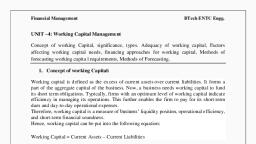

Working Capital Management MCQ With Answers, The major current assets are _____, A. cash and marketable securities, B. accounts receivable (debtors), C. inventory (stock), D. All of the above, View Answer, D. All of the above, The basic current liabilities are _____, A. accounts payable and bills payable, B. bank overdraft, C. outstanding expenses., D. All of the above, View Answer, D. All of the above, There are two concepts of working capital – gross and ____, A. Zero, B. Net, C. Cumulative, D. distinctive, View Answer, B. Net, ______ working Capital refers to the firm’s investment in current assets., A. Zero

Page 2 :

B. Net, C. Gross, D. Distinctive, View Answer, C. Gross, ______ working capital refers to the difference between current assets and current liabilities., A. Zero, B. Net, C. Gross, D. Distinctive, View Answer, B. Net, A _______ net working capital will arise when current assets exceed current liabilities., A. Summative, B. Negative, C. Excessive, D. Positive, View Answer, D. Positive, A ______ net working capital occurs when current liabilities are in excess of current assets., A. Positive, B. Negative, C. Excessive, D. Zero

Page 3 :

View Answer, B. Negative, Investment in current assets should be _____, A. just adequate, B. more, C. less, D. maximum, View Answer, A. just adequate, On the basis of _____, working capital is classified as gross working capital and net working, capital., A. concept, B. time, C. future, D. work, View Answer, A. concept, On the basis of _____, working capital may be classified as: 1) Permanent or fixed working, capital. 2) Temporary or variable working capital., A. concept, B. time, C. future, D. work, View Answer, B. time

Page 4 :

Question 1., Working capital is also known, (A) Operation capital, (B) Operating capital, (C) Current assets capital, (D) Capital relating to main projects of the company, Answer:, (B) Operating capital, Question2., A positive working capital means that –, (A) the company is able to pay-off its long-term liabilities., (B) the company is able to select profitable projects., (C) the company is unable to meet its short-term liabilities., (D) the company is able to pay-off its short-term liabilities., Answer:, (D) the company is able to pay-off its short-term liabilities., Question 3., Working capital =…………., (A) Core current assets less current liabilities, (B) Core current assets less core current liabilities, (C) Liquid assets less current liabilities, (D) Current assets less current liabilities, Answer:, (D) Current assets less current liabilities, Question 4., Other things remaining constant, if the debtors increases as compared to last year it means –, (A) Company has poor credit policy, (B) Company has positive working capital, (C) Company has negative working capital, (D) Company has no working capital, Answer:, (B) Company has positive working capital, Question 5., Which of the following will be considered while calculating working capital?, (1) Short Term Advances, (2) Stock of WIP, (3) Short Term Investments, (4) Perpetual inventory policy, Select the correct answer from the options given below., (A) (2) & (3), (B) (1) & (3), (C) (1), (2) & (3), (D) All of the above except (4), Answer:, (D) All of the above except (4)

Page 5 :

Question 6., Contingencies are – ……….., (A) Added to gross working capital, (B) Deducted from gross working capital, (C) Contingencies are not considered in financial management; it is considered in accounts only, (D) None of the above, Answer:, (A) Added to gross working capital, Question 7., For reducing and controlling working capital requirement which of the following step is required, to be taken –, (A) Increase in manufacturing cycle, (B) Increase of credit period allowed by creditors to the extent that do not affect the production., (C) Increase in credit period given to customers, (D) All of the above, Answer:, (B) Increase of credit period allowed by creditors to the extent that do not affect the production., Question 8., Working capital is a highly effective barometer of a company’s efficiency and effectiveness., (A) operational and servicing, (B) long term, (C) operational and financial, (D) positive and negative, Answer:, (C) operational and financial, Question 10., While calculating working capital based on cash cost –, (A) Depreciation is ignored, (B) Non-cash items are not considered, (C) Debtors are calculated on the basis of cost of goods sold and not on sale price, (D) All of the above, Answer:, (D) All of the above, Question 11., A negative working capital means that -……….., (A) the company has no current assets at all, (B) the company currently is unable to meet its short-term liabilities, (C) the company has negative earnings before interest and tax, (D) the company currently is able to meet its short-term liabilities, Answer:, (B) the company currently is unable to meet its short-term liabilities, Question 12., Which of the following analyzes the accounts receivable, inventory and accounts payable cycles in, terms of number of days?

Page 6 :

(A) Operation cycle, (B) Current asset cycle, (C) Operating cycle, (D) Business cycle, Answer:, (C) Operating cycle, Question 13., Which of the following method is not used for calculating working capital cycle?, (A) Percentage of sales method, (B) Regression analysis method, (C) Operating cycle approach, (D) Trial and error method, Answer:, (D) Trial and error method, Question 20., One of the important objective(s) of working capital management is/are –, (A) To maintain the optimum levels of investment in current assets., (B) To reduce the levels of current liabilities., (C) Improve the return on capital employed., (D) All of the above, Answer:, (D) All of the above, Question 21., Fluctuating Working Capital is also called as —, (A) Reserve Margin Working Capital, (B) Temporary Working Capital, (C) Permanent Working Capital, (D) Variable working capital, Answer:, (D) Variable working capital, Question 22., Operating cycle is also called as –, (A) Working cycle, (B) Business cycle, (C) Current asset cycle, (D) Working capital cycle, Answer:, (D) Working capital cycle, Question 24., Capital which is needed to meet the seasonal requirements of the business –, (A) Gross Working Capital, (B) Reserve Margin Working Capital, (C) Net working capital, (D) Fluctuating Working Capital

Page 7 :

Answer:, (D) Fluctuating Working Capital, Question 25., A higher current assets/fixed assets ratio indicates –, (A) Hedging Approach, (B) Conservative Approach, (C) Matching/hedging Approach, (D) Aggressive Approach, Answer:, (B) Conservative Approach, Question 26., Aggressive approach covers those policies –, (A) where the firm relies heavily on short term bank finance., (B) seeks to increase dependence on long term financing., (C) Both (A) and (B), (D) Neither (A) nor (B), Answer:, (A) where the firm relies heavily on short term bank finance., Question 27., Gross working capital refers to –, (A) the amount utilized at the time of contingencies., (B) the firm’s investment in current assets., (C) the capital which is required at the time of the commencement of business., (D) the working capital which is necessary on a continuous and uninterrupted basis., Answer:, (B) the firm’s investment in current assets., Question 28., A conservative policy implies –, (A) greater liquidity and lower risk, (B) greater risk and lower liquidity, (C) negligible risk, (D) no risk at all with low liquidity, Answer:, (A) greater liquidity and lower risk, Question 29., If a firm has insufficient working capital and tries to increase sales, it can easily over-stretch the, financial resources of the business. This is called –, (A) Overrating, (B) Over trading, (C) Overcoming, (D) Overtone, Answer:, (B) Over trading

Page 8 :

Question 30., Which of the following represents the amount utilized at the time of contingencies?, (A) Reserve Working Capital, (B) Net working capital, (C) Extra working capital, (D) Fixed working capital, Answer:, (A) Reserve Working Capital, Question 31., Permanent Working Capital is also known as –, (A) Fixed working capital, (B) Temporary working capital, (C) Long term funds, (D) Gross margin working capital, Answer:, (A) Fixed working capital, Question 32., A lower current assets/fixed assets ratio means –, (A) Matching/hedging Approach, (B) Aggressive current assets policy, (C) Riskier current assets policy, (D) Conservative current assets policy, Answer:, (B) Aggressive current assets policy, Question 33., Any amount over and above the permanent level of working capital is known as working capital., (A) Temporary, (B) Fluctuating, (C) Variable, (D) All of the above, Answer:, (D) All of the above, Question 34., Current assets are those assets –, (A) Which can be sold by the companies., (B) Which are less important from production angle., (C) Which are held by the companies to pay-off current liabilities., (D) Which are converted in to cash within a period of one year., Answer:, (D) Which are converted in to cash within a period of one year., Question 35., Current assets are usually financed through –, (A) equity capital, preference capital, debentures, bonds and long term bank loans., (B) (A) and (C)

Page 9 :

(C) mode of overdraft, cash credit, public deposits etc., (D) money market instrument and long term securities., Answer:, (C) mode of overdraft, cash credit, public deposits etc., Question 36., To carry on a business, a certain minimum level of working capital is necessary on a continuous, and uninterrupted basis. This requirement is referred to as –, (A) Permanent working capital, (B) Long term working capital, (C) Fixed working capital, (D) Both (A) and (C), Answer:, (D) Both (A) and (C), Question 37., Which of the following is/are method of maximum permissible bank finance as recommended by, the Tandon Committee?, (A) 75% of (Current Assets – Current Liabilities), (B) 50% of (Current Assets – Current Liabilities), (C) 75%of(CoreCurrentAssets-Current Liabilities), (D) 50% of (Core Current Assets-Current Liabilities), Answer:, (A) 75% of (Current Assets – Current Liabilities), Question 38., ………… varies inversely with profitability., (A) Liquidity, (B) Risk, (C) Gross profit, (D) None of the above, Answer:, (A) Liquidity, Question 39., ………….. refers to the difference between current asset and current liabilities., (A) Differential working capital, (B) Net working capital, (C) Operation working capital, (D) None of the above, Answer:, (B) Net working capital, Question 40., Permanent working capital -…………, (A) varies with seasonal needs., (B) includes fixed assets., (C) is the amount of current assets required to meet a firm’s long-term minimum needs., (D) includes accounts payable.

Page 10 :

Answer:, (C) is the amount of current assets required to meet a firm’s long-term minimum needs., Question 42., Hard core working capital is also known as –, (A) Hard current assets, (B) Core current assets, (C) Core current liabilities, (D) Hard current liabilities, Answer:, (B) Core current assets, Question 43., An aggressive policy indicates –, (A) higher liquidity and poor risk, (B) higher risk and poor liquidity, (C) higher risk and higher liquidity, (D) lower risk with lower liquidity, Answer:, (B) higher risk and poor liquidity, Question 44., Tandon Committee Report on Working Capital relates to norms for …………., (A) inventory and receivables, (B) gross profit and inventory, (C) receivable, gross profit and inventory, (D) net profit and receivables, Answer:, (A) inventory and receivables, Question 45., In deciding the appropriate level of current assets for the firm, management is confronted with –, (A) Trade-off between profitability and risk., (B) Trade-off between liquidity and marketability., (C) Trade-off between equity and debt., (D) Trade-off between short-term versus long-term borrowing., Answer:, (A) Trade-off between profitability and risk., Question 46., Which of the following is not correct with matching strategy?, (A) All assets should be financed with permanent long term capital., (B) Temporary current assets should be financed with temporary working capital., (C) Long term assets should be financed from long term capital., (D) Permanent current assets should be financed with permanent working capital., Answer:, (A) All assets should be financed with permanent long term capital.

Page 11 :

Question 47., Paucity of working capital may lead to a situation where –, (A) the firm may not be able to its long term finance, (B) the firm may not be able to meet its liabilities, (C) the firm may not be able to achieve its sale target, (D) the firm may taken some different project with low internal rate of return., Answer:, (B) the firm may not be able to meet its liabilities, Question 48., Which of the following is/are method of maximum permissible bank finance as recommended by, the Tandon Committee?, (A) [50% of (Current Assets – Core Current Assets)] – Current Liabilities, (B) [75% of (Core Current Assets – Current Assets)] – Current Liabilities, (C) [75% of (Current Assets – Core Current Assets)] – Current Liabilities, (D) [80% of (Current Assets – Core Current Assets)] – Current Liabilities, Answer:, (C) [75% of (Current Assets – Core Current Assets)] – Current Liabilities, Question 49., What is difference between current ratio and quick ratio?, (A) The current ratio includes inventory and quick ratio does not., (B) The current ratio does not include inventory and quick ratio does., (C) The current ratio includes physical capital and quick ratio does not., (D) The current ratio does not include physical capital and quick ratio does., Answer:, (A) The current ratio includes inventory and quick ratio does not., Question 50., It is understood that a current ratio of ……….. for a manufacturing firm implies that the firm has, an optimum amount of working capital., (A) 1 (one), (B) 2 (two), (C) 3 (three), (D) 2.5 (two and half), Answer:, (B) 2 (two), Question 51., Which of the following is relevant while planning for working capital requirement?, (A) Identify the cash balance which allows for the business to meet day to day expenses, but, reduces cash holding costs., (B) Identify the level of inventory which allows for uninterrupted production., (C) Identify the appropriate credit policy., (D) All of the above, Answer:, (D) All of the above

Page 12 :

Question 52., A conservative policy means –, (A) lower return and risk., (B) higher return and risk., (C) lower return but very high risk., (D) higher return and higher risk., Answer:, (A) lower return and risk., Question 53., An aggressive policy produces –, (A) higher return and risk, (B) lower return and risk, (C) lower return and very low risk, (D) none of the above, Answer:, (A) higher return and risk, Question 54., Accounts receivable are analyzed by –, (A) the average number of days it takes to make sale., (B) the average number of days it takes to produce the product that company intends to sale., (C) the average number of days it takes to collect an account., (D) Any of the above, Answer:, (C) the average number of days it takes to collect an account., Question 55., Which of the following would not be financed from working capital?, (A) Cash float., (B) Accounts receivable., (C) Credit sales., (D) A new personal computer for the office, Answer:, (D) A new personal computer for the office, Question 56., Which of the following is/are method of maximum permissible bank finance as recommended by, the Tandon Committee?, (A) 60% of Current Assets – Current Liabilities, (B) 7596 of Current Assets – Current Liabilities, (C) 5096 of Current Assets – Current Liabilities, (D) 4096 of Current Assets – Current Liabilities, Answer:, (B) 7596 of Current Assets – Current Liabilities, Question 57., Net working capital refers to –, (A) total assets minus fixed assets.

Page 13 :

(B) current assets minus current liabilities., (C) current assets minus inventories., (D) current assets., Answer:, (B) current assets minus current liabilities., Question 58., Which of the following is correct formula to calculate debtor’s collection period?, , Answer:, (C), Question 59., Which of the following working capital strategies is the most aggressive?, (A) Making greater use of short term finance and maximizing net short term asset., (B) Making greater use of long term finance and minimizing net short term asset., (C) Making greater use of short term finance and minimizing net short term asset., (D) Making greater use of long term finance and maximizing net short term asset., Answer:, (C) Making greater use of short term finance and minimizing net short term asset., Question 60., Working capital is also known as –, (A) Current capital or circulating capital, (B) Work-in-progress capital, (C) Day-to-day capital, (D) Trading capital, Answer:, (A) Current capital or circulating capital, Question 61., Inventory is listed as a part of current assets. Stock or inventory in an organization means, (A) Goods that are readily available for sale, (B) All the assets available for sale, (C) All the raw material, Semi-finished and the finished goods in the organization, (D) Goods that can be sold within a short span of time, Answer:, (C) All the raw material, Semi-finished and the finished goods in the organization

Page 14 :

Question 62., What are the aspects of working capital management?, I. Inventory management, II. Receivable management, III. Cash management, Select the correct answer from the options given below., (A) I, (B) II, (C) III, (D) All of the above, Answer:, (D) All of the above, Question 63., Working Capital Turnover measures the relationship of Working Capital with:, (A) Fixed Assets, (B) Sales, (C) Purchases, (D) Stock, Answer:, (B) Sales, Question 64., Accounts payable are analyzed by the –, (A) average number of days it takes to pay a supplier fixed assets., (B) average number of days it takes to pay a supplier invoice., (C) average number of days it takes to pay a salary of employee., (D) Any of the above, Answer:, (B) average number of days it takes to pay a supplier invoice., Question 65., Which of the following is correct formula to calculate credit period availed?, , Answer:, (B), Question 66., In Current Ratio. Current Assets are compared with:

Page 15 :

(A) Current Profit, (B) Current Liabilities, (C) Fixed Assets, (D) Equity Share Capital, Answer:, (B) Current Liabilities, Question 67., There is deterioration in the management of working capital of XYZ Ltd. What does it refer to?, (A) That the Capital Employed has reduced, (B) That the Profitability has gone up, (C) That debtors collection period has increased, (D) That Sales has decreased., Answer:, (C) That debtors collection period has increased, Question 68., …………… refers to the length of time allowed by a firm for its customers to make payment for, their purchases., (A) Holding period, (B) Pay-back period, (C) Average collection period, (D) Credit period, Answer:, (D) Credit period, Question 69., Working capital management is primarily concerned with the management and financing of:, (A) Cash & inventory, (B) Current assets & current liabilities, (C) Current assets, (D) Receivables and payables, Answer:, (B) Current assets & current liabilities, Question 70., Operating cycles period equals:, (A) Collection period+Inventory holding period – Creditor Payment Period, (B) Collection period-Inventory holding period + Creditor Payment Period, (C) Creditor Payment Period-(-Inventory holding period – Collection period, (D) Any of the above, Answer:, (A) Collection period+Inventory holding period – Creditor Payment Period, Question 71., Which of the following is not a metric to use for measuring the length of the cash cycle?, (A) Acid test days, (B) Accounts receivable days, (C) Accounts payable days

Page 16 :

(D) Inventory days, Answer:, (A) Acid test days, Question 72., Decrease in current assets means –, (A) Increase in working capital, (B) Decrease in inventories, (C) Decrease in working capital, (D) Increase in accounts payable days., Answer:, (C) Decrease in working capital, Question 73., Which of the following is not considered while calculating accounts receivable period?, (A) Bills receivable, (B) Cash sales, (C) Debtors, (D) Credit sales, Answer:, (B) Cash sales, Question 74., Which of the following will not be considered while calculating working capital on cash cost, basis?, (A) Depreciation, (B) Prepaid expenses, (C) Raw material consumed, (D) Bills receivable, Answer:, (A) Depreciation, Question 75., Which of the following assets is not a quick current asset?, (A) Short term bills receivables, (B) Cash, (C) Stock, (D) Debtors less provision for bad and doubtful debts, Answer:, (C) Stock, Question 76., ………… is also known as working capital ratio., (A) Current ratio, (B) Quick ratio, (C) Liquid ratio, (D) Working capital turnover ratio, Answer:, (A) Current ratio

Page 17 :

Question 77., What does the accounts receivable turnover ratio tell us?, (A) How often account receivable received, (B) How many time account receivable is collected, (C) Account receivable balance at the end of the period, (D) Bad debt balance at the year end, Answer:, (B) How many time account receivable is collected, Question 78., The best ratio to evaluate short-term liquidity is:, (A) Working capital turnover ratio, (B) Current ratio, (C) Creditors velocity, (D) All of the above, Answer:, (B) Current ratio, Question 79., Which best describes the gross margin ratio?, (A) Leverage ratio, (B) Liquidity ratio, (C) Coverage ratio, (D) Profitability ratio, Answer:, (D) Profitability ratio, Question 80., Inventory turnover ratio evaluates:, (A) Company’s ability to move inventory, (B) Company’s inventory purchasing efficiency, (C) Both (A) & (B), (D) None of the above, Answer:, (C) Both (A) & (B), Question 81., All of the following statements are true regarding ratios that measure a company’s ability to pay, current liabilities except, (A) Working Capital = Current Assets – Current Liabilities, (B) A higher current ratio is always preferred to a lower current ratio., (C) Inventory and prepaid expense are included in the numerator of the current ratio, but not in the, numerator of the acid-test ratio., (D) In most industries, a current ratio of 2.0 is considered adequate., Answer:, (B) A higher current ratio is always preferred to a lower current ratio., Question 82., Which of the following would NOT improve the current ratio?

Page 18 :

(A) Borrow short term to finance additional fixed assets., (B) Issue long-term debt to buy inventory, (C) Sell common stock to reduce current liabilities, (D) Sell fixed assets to reduce accounts payable, Answer:, (A) Borrow short term to finance additional fixed assets., Question 83., If the trend of the current ratio is increasing, while the trend of the acid-test ratio is decreasing, over a period of time, this could be a warning that the firm is:, (A) Depleting its inventories, (B) Having trouble collecting its receivables, (C) Purchasing too much treasury stock, (D) Carrying excess inventories, Answer:, (D) Carrying excess inventories, Question 84., What relationship exists between the average collection period and accounts receivable turnover?, (A) As average collection period increases (decreases) the accounts receivable turnover decreases, (increases), (B) There is a direct and proportional relationship, (C) Both ratios are expressed in number of days, (D) Both ratios are expressed in number of times receivables are collected per year, Answer:, (A) As average collection period increases (decreases) the accounts receivable turnover decreases, (increases), Question 85., Which of the following statements is most correct?, (A) If a company increases its current liabilities by ₹ 1,000 and simultaneously increases its, inventories by ₹ 1,000, its current ratio must rise., (B) If a company increases its current liabilities by ₹ 1,000 and simultaneously increases its, inventories by ₹ 1,000, its quick ratio must fall., (C) A company’s quick ratio never exceed its current ratio., (D) (B) & (C) is correct., Answer:, (D) (B) & (C) is correct., Question 86., Purchase of stock for cash will current ratio., (A) Reduce, (B) Improve, (C) Not change, (D) Can’t say, Answer:, (C) Not change

Page 19 :

Question 87., Explain the important ratio that would be used in following situation:, A bank is approached by a company for a loan of ₹ 50 lakh for working capital purposes., (A) Capital Structure /Leverage Ratios, (B) Profitability Ratios, (C) Liquidity Ratios, (D) Activity Ratios, Answer:, (C) Liquidity Ratios, Question 88., Instead of “Annual Factory Cost” WIP Conversion Period can be calculated taking “ ……….” as, base., (A) Annual Sales, (B) Cost of Production, (C) Cost of Goods Sold, (D) Cost of Sales, Answer:, (B) Cost of Production, Question 89., If annual sales figure is not available then which of the following figure will be taken as base for, calculation of debtors?, (A) Factory Cost, (B) Cost of Production, (C) Cost of Goods Sold, (D) Cost of Sales, Answer:, (B) Cost of Production, Question 90., If current assets increases by 20% and current liabilities decreases by 20% as compared to last year, figures then –, (A) Working capital decreases as compared to last year, (B) Working capital increases as compared to last year, (C) There will be no change in working capital, (D) Without figures it is impossible to tell whether working capital will increase or decrease, Answer:, (B) Working capital increases as compared to last year, 1. What are the aspects of working capital management?, A. inventory management, B. receivable management, C. cash management, D. all of the above, Discussion, D. all of the above

Page 20 :

2. _________, outflows., A. finance, , function, , includes, , a, , firm’s, , attempts, , B. liquidity, C. investment, D. dividend, Discussion, B. liquidity, 3. Firms which are capital intensive rely on _________., A. equity, B. short term debt, C. debt, D. retained earnings, Discussion, C. debt, 4. Hirer is entitled to claim ___________., A. depreciation, B. salvage value, C. hp payments, D. none of above, Discussion, A. depreciation, 5. Which of the following is not an advantages of trade credit?, A. easy availability, B. flexibility, C. informality, D. buyout financing, Discussion, D. buyout financing, 6. Which of the following are theories for dividend relevance?, A. walter’s model, B. mm approach, C. game theory, D. market value theory, , to, , balance, , cash, , inflows, , and

Page 21 :

Discussion, A. walter’s model, 7. What is not a form of dividend?, A. cash dividends, B. bonus shares(stock dividend), C. share split, D. split reverse, Discussion, D. split reverse, 8. The percentage of earnings paid as dividends is called __________., A. dividend policy, B. payout ration, C. cash dividends, D. reverse split, Discussion, B. payout ration, 9. What are the various methods of estimating cash?, A. receipts and payment method, B. adjusted profit & loss method, C. balance sheet method, D. all of the above, Discussion, D. all of the above, 10. The art of managing, within the acceptable, funds optimally and profitably is called _________., A. integrated treasury, B. treasury management, C. merchant banking, D. none of the above, Discussion, B. treasury management, 11. What are the different types of underlying assets?, A. stocks, B. bonds, , level of risk,, , the consolidated

Page 22 :

C. currency, D. stock indices, Discussion, D. stock indices, 12. What are people who buy or sell in the market to make profits called?, A. hedgers, B. speculators, C. arbitrageurs, D. none of the above, Discussion, B. speculators, 13. Which of the following is a technique that helps the exporter to sell the, receivables to any bank or financial institution without recourse?, A. forfeiting, B. leading & lagging, C. derivatives, D. netting, Discussion, A. forfeiting, 14. Money market financial services not include:, A. bill discounting, B. merchant banking, C. leasing, D. securitisation, Discussion, B. merchant banking, 15. Factoring involves:, A. providing short term loan, B. providing long term loan, C. financing of export receivables, D. management of receivables of borrower, Discussion, D. management of receivables of borrower

Page 23 :

16. The tools of treasury management does not include:, A. foreign exchange management, B. cash management, C. receivable management, D. risk management, Discussion, D. risk management, 17. Under which type of bank borrowing can a borrower obtain credit from a, bank against its bills?, A. letter of credit, B. cash, C. purchase or discounting of bills, D. working capital loan, Discussion, C. purchase or discounting of bills, 18. The factors that affect dividend policy are:, A. tax consideration, B. privatisation, C. foreign investment, D. working cash flow, Discussion, A. tax consideration, 19. To financial analysts, "working capital" means the same thing as __________., A. total assets, B. fixed assets, C. current assets, D. current assets minus current liabilities., Discussion, C. current assets, 20. Which of the following would be consistent with an aggressive approach to, financing working capital?, A. financing short-term needs with short-term funds., B. financing permanent inventory buildup with long-term debt., C. financing seasonal needs with short-term funds.

Page 24 :

D. financing some long-term needs with short-term funds., Discussion, D. financing some long-term needs with short-term funds., 21. Which of the following would be consistent with a conservative approach to, financing working capital?, A. financing short-term needs with short-term funds., B. financing short-term needs with long-term debt., C. financing seasonal needs with short-term funds., D. financing some long-term needs with short-term funds., Discussion, B. financing short-term needs with long-term debt., 22. -Which of the following would be consistent with a hedging (maturity matching), approach to financing working capital?, A. financing short-term needs with short-term funds., B. financing short-term needs with long-term debt., C. financing seasonal needs with long-term funds., D. financing some long-term needs with short-term funds., Discussion, A. financing short-term needs with short-term funds., 23. Which of the following statements is most correct?, A. for small companies, long-term debt is the principal source of external financing., B. current assets of the typical manufacturing firm account for over half of its total assets., C. strict adherence to the maturity matching approach to financing would call for all current assets, to be financed solely with current liabilities., D. similar to the capital structure management, working capital management requires the financial, manager to make a decision and not address the issue again for several months, Discussion, B. current assets of the typical manufacturing firm account for over half of its total assets., 24. The amount of current assets, referred to as __________ working capital., A. permanent, B. net, C. temporary, D. gross, Discussion, , that, , varies, , with, , seasonal, , requirements, , is

Page 25 :

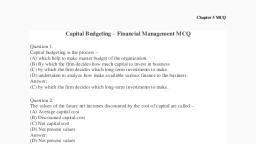

C. temporary, 25. Having defined working capital as current assets, it can be further classified, according to __________., A. financing method and time, B. rate of return and financing method, C. time and rate of return, D. components and time, Discussion, D. components and time, Q 1)---- ensures better forecasting in Capital Budgeting., a) Project evaluation b) Project execution c) Project selection d) Project follow up, Q 2)------ defines Capital Budgeting as “ Capital Budgeting is long term planning for making and, financing proposed capital outlays”, a) J.J. Hampton b) C.T. Horngren c) G.C. Philiphatos d) E.A., , Helfert Q 3) Initial Cash Outflows -------------a) Cost of assets + Installation expenses –Salvage – working capital, b) Cost of assets + Installation expenses + Salvage + working, capitalc) Cost of assets + Cost Installation expenses + working, capital, d) Cost of assets + Installation expenses – Salvage + working capital, Q 4) The expenditure incurred on fixed assets are expected to give return over, a), b), c), d), , One year, Two years, A number of years, Five years, , Q 5)------factor is given utmost importance under payback period method., a), b), c), d), , Liquidity, Flexibility, Time value of money, Interest, , Q 6) Profitability ratio is also known as----a), b), c), d), , Benefit cost ratio, Profit cost ratio, Income expense ratio, Gross profit ratio, , Q 7) The aggregate money infused in current assets is called -----

Page 26 :

a) Net working, capital b) Gross, working capital, c) Surplus capital, d) None of these, Q 8) The idle fund which earns no return is known as ----a) Scarcity of working, capital b) Excess working, capital, c) Fluctuating working capital

Page 27 :

d) Permanent working capital, , Q 9) If the net working capital is negative then it shows that, a) Long term funds have been used for financing long term assets, b) Short term funds have been used for financing short term, , assets c) Short term funds have been used for financing long, term assets, d) Long term funds have been used for financing short term, assets Q 10) is not an item of current liabilities., a) Bills payable, b) Creditors, c) Outstanding, expenses d) Debenture, Q 11) Net operating cycle period is, a) The time taken to convert raw material into finished goods, b) The length of time taken for a rupee invested in current assets to come back with profit, to the company, c) Period from raw material procurement to sale of finished goods, d) The time between payment of purchase raw materials and the collection of cash, for sales Q 12) The size of assets , the profitability and competitiveness are all affected, by, a) Working capital, decisions b) Capital, budgeting decisions, c) Financing decisions, d) Dividend decisions, Q 13) A proposal is not a Capital Budgeting proposal if it, a), b), c), d), , Is related to fixed assets, long term benefits Brings, Brings short term benefits only, Has very large investment, , Q 14) Net present values represents immediate increase in, a), b), c), d), , Firm’s wealth, Firm’s profit, Efficiency, Solvency, , Q 15) The method which does not consider investment profitability is, a), b), c), d), , Pay back, ARR, NPV, IRR

Page 28 :

Q 16) Capital Budgeting decisions involve huge amount of risk due to, a), b), c), d), , Time factor, Money factor, Human factor, Natural factor, , Q 17) Subsidy from government is treated as, a), b), c), d), , Cash inflow of the respective year, Cash outflow of the respective year, Both a and b, None of the above, , Q 18) Project A cost Rs 40,000 . Profit before depreciation and tax is :, Years 1, Profit 8,000, , 2, 10,00, 0, , 3, 15,00, 0, , 4, 19,00, 0, , Tax rate 40%, Cost of capital is 12%, The NPV of the project A, is a) Rs 5,600, b) Rs 5,266, c) Rs, 5,206, d) Rs 6,500, Q 19) A company having ample stock of liquid current assets will require, a) More amount of working capital, b) Lesser amount of working capital, c) Adequate amount of working capital, d) No working capital, required Q 20) Sale of goods on, cash basis, a) Increases working capital requirement, b) Decreases working capital, requirement c) Nullifies working, capital requirement, d) Increases the operating cycle of working capital, Q 21) From the following information calculate raw material storage, period Annual raw material consumption Rs 27,000, Opening stock of raw material Rs, 5,000 Closing stock of raw material, Rs 4,000 Assume 1 year = 360 days, a) 90 days

Page 29 :

b) 60 days, c) 30 days, d) 45 days, Q 22) Permanent working capital is also known as, a), b), c), d), , Core working capital, Net working capital, Permanently blocked in stock, Fixed working capital, , Q 23) Which of the following is not a non cost item?, a) Provision for taxation, b) Interest on, , loan c) Salaries, to staff, d) Goodwill w/off, Q 24) Branch office expenses is an example of, a) Prime cost, b) Factory overheads, c) Office, , overheads d), Selling overheads, Q 25) If prime cost is Rs 25,00,000 & factory overheads are Rs 10,00,000 then the factory, overheads will be, a) Rs, 15,00,000 b) Rs, 35,00,000 c), Rs 20,00,000, d) Rs 30,00,000, Q 26) Which of the following is not a direct expense?, a) Cost of patents, b) Hire charges of special, , equipments c) Factory lighting, d) Cost of drawing &, designs Q 27) Overheads are, a) Direct cost, b) Indirect cost, c) Abnormal cost, d) Avoidable cost, Q 28) Sale of defective material should be deducted from, a) Cost of production, b) Cost of materials

Page 30 :

c) Factory overheads, d) Sales, , Q 29) Contribution is equal to, a), b), c), d), , Sales – cost of sales, Sales – cost of production, Sales – variable cost, Sales – fixed cost, , Q 30) Profit volume ratio is improved by reduced, a), b), c), d), , Variable cost, Fixed asset, Variable and fixed cost, Output, , Q 31) Which of the following can improve break even point?, a) Increase in variable cost, b) Increase in fixed, , cost c) Increase in sale, price, d) Increase in sales, volume Q 32) Fixed cost is, equal to, a) Break even sales x margin of safety, b) Sales x margin of safety, c) Sales x PV ratio, d) PV ratio x break even sales, Q 33) Other factors remaining same , a reduction in selling price will, a) Increase contribution margin, b) Reduce fixed cost, c) Increase variable cost, d) Reduce operating income, Q 34) If margin of safety is Rs 80,000 & profit is Rs 20,000 then PV, ratio will be a) 20 %, b) 25 %, c) 40 %, d) 30 %, Q 35) Which of the following equation is not correct?, a) PV ratio = contribution / sales, b) Sales – variable cost = contribution, c) BEP = Fixed cost / PV, , ratio d) Profit – variable cost, = sales

Page 31 :

Q 36) Cash term implies, a), b), c), d), , Sales on cash, Sales on credit, Consignment, Purchase on credit, , Q 37) 5 C’s does not include, a) Character, b) Capacity, c) Capita, , ld) Credit, Q 38) Following is not the source of credit information, a) Bank references, b) Trade checking, c) Credit, , bureaus, d) Credit, network, Q 39) Increase in accounts receivable, a) Decrease working, capital b) Increase working, capital, c) Increases fixed capital, d) Decreases fixed capital, Q 40) Net float can be maximized by, a), b), c), d), , Delaying payment, Prompt payment, Delaying collection, Prompt collection, , Q 41) Methods of accelerating cash collections include all of the following except, a) Decentralized collections, b) Electronic funds, , transfer, c) Compensating, balances, d) Lockbox system

Page 32 :

Q 42) Which of the following is related to receivable management ?, a) Cash budget, b) Economic order, , quantityc) Ageing, schedule

Page 33 :

d) Balance sheet, Q 43) In response to market expectations the credit period has been increased from 45 days to 60, days., This would result in, a), b), c), d), , Decrease in sales, Decrease in debtors, Increase in bad debts, Increase in average collection period, , Q 44) --- methods can be used for evaluation capital budget, a), b), c), d), , NPV method, Linear method, Percentage method, Profit method, , Q 45) Cash working capital is similar to, a), b), c), d), , Liquid assets, Cash cost working capital, Cash and bank balance + stock, Goodwill, , Q 46) Working capital source of finance is a, a), b), c), d), , Short term finance, Medium term finance, Long term finance, Permanent source, , Q 47) Fixed cost per unit decreases when, a), b), c), d), , Production volume increases, Production volume decreases, Variable cost per unit decreases, Prime cost per unit decreases, , Q 48) Which of the following is not a selling & distribution overheads?, a) Advertisement, b), Factory, lighting, c) Warehouse rent, d) Showroom expenses, Q 49) If the average balance of debtors has increased which of the following might not show a, change in general?, a) Total sales, b) Average payables, c) Current ratio

Page 34 :

d) Bad debts loss, Q 50) Availability of working capital will if the company has a high dividend pay-out ratio., a), b), c), d), , Decrease, Increase, Not affected, Remain adequate