Page 1 :

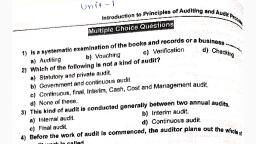

B.COM-III ADVANCED ACCOUNTANCY-II (AUDITING), Wef. June 2020-21, Module-I, AUDITING-meaning, objectives, scope, general principles.

Page 2 :

-Definitions of Audit-, Audit is systematic, independent examination of financial records, irrespective of legal form, whether profit oriented with objective to give opinion, whether financial statements true & fair view., ……. Institute of Chartered Accountants of India (ICAI), An audit is an independent examination of financial information of any entity, whether profit oriented or not, and irrespective of its size or legal form, when such an examination is conducted with a view to expressing an opinion thereon., ……. International Federation of Accountants (IFAC), Auditing is a systematic examination of financial statements, records and related operations to determine adherence to generally accepted accounting principles, management policies or stated requirements……, ……… Robert E-schlosser

Page 3 :

Important elements of Auditing-, To express opinion- on true and fair presentation of the financial information , Independent agency- called auditor….should be free from any interest in financial affaires of company, Systematic examination- of books of accounts, Right to ask- auditor has right to ask for information and explanations from the concerned persons, employees etc., Audit report- after audit the auditor gives his audit report consisting his opinion on financial statements.

Page 4 :

General Principles of Auditing: (SA 200), Integrity, objectivity and independence, Confidentiality, Skills and competence, Work performed by others, Documentation, Planning, Audit evidence, Accounting system and Internal control, Audit conclusions Reporting

Page 5 :

Objectives of Auditing:-, Primary objective, Secondary or incidental objective, , Primary objective-, As per section 143 of Companies Act 2013-, to report the owners that the financial statements give a true and fair view of the state of affairs of the entity., Secondary objective-, Detection and prevention of errors, Detection and prevention of frauds

Page 6 :

Detection and prevention of errors-, Errors of Omission, Errors of Commission, Errors of Principles, Compensating Errors, , Detection and prevention of frauds-, Misappropriation of cash, Misappropriation of goods, Fraudulent manipulation of accounts

Page 7 :

Types of Audit:-, Internal Audit, External Audit, Environmental Audit, Energy Audit, Systems Audit, Safety Audit

Page 8 :

Internal Audit-, Internal Audit is defined as- ‘an independent appraisal activity within an organisation for review of accounting, financial and other operations as a basis of service to the management’., Internal audit is also called as ‘Uncertified Audit’, , External Audit-, External Audit is a Statutory Audit under Companies Act 1956. External Audit is the audit conducted on behalf of the owners under the law., External auditor is expected to act as agents or trustees of the shareholders or members or beneficiaries. , He must protect interest of the owners., External audit is also called as ‘Certified Audit’

Page 9 :

Distinguish between �Internal Audit & External Audit-, Appointment, Compulsion, Qualification, Scope of work, Objectives, Method of working, Report, Status, Removal, Right to meeting, Remuneration

Page 10 :

Environmental Audit:-, A management tool comprising systematic, documented, periodic and objective evaluation of how well environmental organization, management and equipment are performing with the aim of helping to safeguard the environment., It is used as an extremely valuable tool for assessing a company’s environmental management systems (EMS), policy and equipment., It provides the company with recommendations on how it can improve its environmental management practices and reduce the environmental impact., Improved environmental practices often save money in the long run.

Page 11 :

ISO 14000 is a family of standards related to environmental management (EMS)that exists to help organizations—, minimize how their operations negatively affect the environment (i.e. cause adverse changes to air, water or land), comply with applicable laws, regulations, and other environmentally oriented requirements, continually improve in the above., Main areas to be covered in Environment Audit:-, Emergency safety arrangement, No wastage of recourses- (air, water, land, energy, raw materials, human recourses etc.), Hygienic (industrial hygiene), Information assimilation and reporting system, Regulatory mechanism (environmental standards, regulations), Occupational health hazards, No damage to the society, Medical & healthcare, Environmental Impact Assessment, No pollution (Pollution Control System)

Page 12 :

Energy Audit:-, Energy management:-, The strategy of adjusting and optimizing energy, using systems and procedures so as to reduce energy requirement per unit of output while holding constant or reducing total costs of producing the output from these systems., Optimum solution is to –, Minimise the energy cost, Minimise the losses, Minimise the waste without affecting production & quality, Minimise the environmental effects (eg. Greenhouse gases), Energy Audit:-, Energy audit is a systematic approach for decision making in the area of energy management.

Page 13 :

Detailed analysis of energy use in a certain equipment, activity, installation, building, campus-, _ where energy is used, _ when energy is used, _ How energy is used, Objective is to balance the total energy inputs, fuels, identify the areas where waste can occur serves and where scope of improvement exists., Energy Conservation Act, 2001_____, “Energy Audit is defined as ‘the verification, monitoring and analysis of use of energy including submission of technical report containing recommendations for improving energy efficiency with cost benefit analysis and an action plan to reduce energy consumption‘”, Two types of energy audit-, Preliminary energy audit, Detailed energy audit

Page 14 :

Preliminary Energy Audit:, Establish energy consumption in the organization., Establish the scope for saving, identify the most likely and easiest areas for attention., Identify immediate improvements/ savings (low-cost)…set a reference point., Identify area for more detailed study/ measurement., Preliminary energy audit uses existing, or easily obtained data.

Page 15 :

II. Detailed Energy Audit:, Provides a detailed energy project implementation plan for a facility since it evaluates all major energy using systems., Offers the most accurate estimate of energy savings and cost., Considers the interactive effects of all projects, accounts for the energy use of all major equipment., Includes detailed energy cost saving calculations and project cost., Three phases of Audit-, Pre Audit phase, Audit phase, Post Audit phase

Page 16 :

Safety Audit:-, Safety Audit can be defined as verifying the existence and implementation of elements of occupational safety and health system and for verifying the system’s ability to achieve defined safety objectives., Critical systematic inspection of an organization’s activities in order to minimize losses due to accidents., A safety auditor evaluates safety programs and practices within an organization., Measure and collect information about a safety programs’ reliability and effectiveness., Look at whether a safety program meets the company’s stated goals., Examine safety training and response efforts.

Page 17 :

Qualification and disqualification of Auditor [Sec. 141 (3):�Companies Act, 2013]-, Qualification-, Individual: A person is qualified for the appointment as an auditor of the company only if he is a Chartered Accountant within the meaning of the Chartered Accountants Act 1949., Firm (Partnership firm of CA in practice): A firm shall be eligible for appointment as an auditor of the company only if majority of its partners practicing in India are qualified for appointment (i.e. CA), Restricted auditor’s certificate: The holder of certificate under the restricted auditor’s certificates rules 1956 shall be entitled to be appointed as an auditor.

Page 18 :

Disqualification of Auditor [Sec. 141 (3):�Companies Act, 2013]-, A Body Corporate, An officer or employee of the company, A partner or employee of an officer or employee of the company, A person who or his relative or his partner is holding any security in the company or subsidiary company or holding company or associate company or subsidiary of such holding company., A person who or his relative or partner is indebted to the company or subsidiary company or holding company or associate company or subsidiary of such holding company exceeding Rs. 5,00,000/- or who has given any guarantee in connection with indebtedness of any third person of the company…. for an amount exceeding Rs. 1,00,000/-.

Page 19 :

A person or a firm who directly or indirectly has business relationship of such company or subsidiary company or holding company or associate company or subsidiary of such holding company., A person whose relative is a director or key managerial personnel. , A person who is an auditor in more than 20 companies., A person who is engaged in consulting and specialised services., Convicted person.

Page 20 :

Appointment of Company Auditor (section 139):-, Appointment of First Auditor section 139(6)-, In case of newly formed company, first auditor shall appointed by the Board Of Directors within 1 month/ 30 days of the date of registration of the company., The first auditor so appointed shall hold office until the conclusion of the first Annual General Meeting (AGM)., In case of BOD could not appoint in this regard, the board shall inform members of the company who shall appoint first auditor within 90 days at an extra ordinary general meeting., , Appointment of First Auditor in case of Government Company (section 139(7)-, In case of Government Co. first auditor shall be appointed by Comptroller and Auditor General of India (CAG) within 60 days of registration., In case CAG does not appoint the first auditor within the said period, Board shall appoint the first auditor within next 30 days., In case failure of the Board to appoint the first auditor, Board shall inform the members of the company who shall appoint within next 60 days at an extraordinary general meeting., The first auditor shall hold office till the conclusion of the first AGM.

Page 21 :

Appointment of subsequent Auditor 139 (5)-, In case of Government company, subsequent auditor shall appoint by CAG within 180 days from the commencement of the financial year., In case of non-government company, subsequent auditor shall appoint by the members of the company in AGM by passing an ordinary resolution., , Appointment of Auditor in case of Casual Vacancy 139(8)-, Casual vacancy means vacancy in office of auditor due to accidental circumstances such as death, incapacity or disqualification of the auditor., Where a vacancy is caused by the registration of an auditor, shall be filled by BOD within 30 days & appointment made shall be approved in a general meeting within 3 months of the recommendation of the Board., Where vacancy arises in a company whose accounts are subject to audit by an auditor appointed by CAG, shall be filled within 30 days by CAG. (in case of government company)

Page 22 :

Removal and Resignation of the Auditor [Sec. 140: Companies Act, 2013]-, Removal before expiry of term sec.140 (1)-, Passing of Board Resolution (BR), Approval of CG must be obtained within 30 days of passing BR in the application ADT 2., Pass special resolution (SR) at GM which is to be held within 60 days of CG approval., Before taking any action for removal, the auditor shall given a reasonable opportunity of being heard., Resignation by Auditor sec. 140 (2) & (3)-, Resigning auditor should file a statement in 30 days (ADT 3) with company and ROC., State reasons and other facts in the statement., In case of government company statement to CAG also along with Co. and ROC., Penalty if auditor fails to do so: Fine Rs. 50000/- or remuneration whichever is less to 5 lacs.

Page 23 :

Remuneration of Auditor (Sec. 142), Appointment by BOD-, Remuneration is also fixed by BOD, Appointment by Shareholders-, In this case remuneration is determined by the shareholders at AGM., Appointment by Comptroller & Auditor General of India (CAG)-, Remuneration shall be fixed by the company in GM, Remuneration other than audit fees-, Reimbursement of expenses incurred by auditor in relation to audit,, Any facilities extended to the auditor,, Shall not include any other services rendered by the auditor.

Page 24 :

Companies Act, 2013: Provisions regarding Company Auditor-, Appointment of Auditor (Sec. 139), Removal of the Auditor (Sec. 140), Qualification and disqualification of Auditor (Sec. 141), Remuneration of Auditor (Sec. 142)

Page 25 :

Appointment of Auditor of co-operative society:-�(Maharashtra Cooperative Societies Act 1960 [Sec.81] ), Appointment of the auditor: An auditor of co-operative society is appointed by the registrar of co-operative societies and the auditor so appointed conducts the audit in behalf of registrar and also submits his audit report to registrar as well as to the society., The registrar shall audit or cause to be audited by some person authorized by him, the accounts of every registered society at least once a year., , The 97th Amendment to the Constitution of India has made Annual Audit of every Cooperative Society mandatory., , Registrar means a person appointed to perform the duties of a Registrar of co-operative societies under the act., Panel of auditor declared by Government of Maharashtra., Appointed by general body of cooperative society, Maximum for 3 years.

Page 26 :

Procedure Appointment of Auditor in Co-operative society:, , The registrar has the power to appoint an auditor by an order or auditor may be appointed from the panel of auditors maintained by the Registrar, or by a Chartered Accountant., Statutory Auditor is appointed by General Body whereas Internal Auditor can be appointed by the Managing Committee but the auditor should get his name and appointment circulated with the members., The Auditor of the society can be appointed for the term of one financial year., The Auditor shall be appointed at the first AGM of the Society and shall elect to be appointed for maximum three consecutive years., Every year the same auditor liable to re-appointed which is subject to the approval from General Meeting., In case no AGM is conducted in the financial year the society may ask the registrar to appoint the auditor from the panel., On the appointment of Auditor in the Society, Auditor shall give written consent.

Page 27 :

Qualification of Auditor of co-operative society:-, As per Section 81 , Clause 50 of Maharashtra Cooperative Societies (Amendment) Act, 2013 –, , (a) a person who is a Chartered Accountant within the meaning of the Chartered Accountants Act, 1949, who has a fair knowledge of the functioning of the societies and an experience of at least one year in auditing of societies with a working knowledge of Marathi language;, , (b) an auditing firm which is a firm of more than one Chartered Accountants within the meaning of the Chartered Accountants Act, 1949, who have a fair knowledge of the functioning of the societies with a working knowledge of Marathi language;, , (c) a certified auditor, who is a person holding a Degree from a recognized University and also has completed a Government Diploma in Co-operation and Accountancy and who has a fair knowledge of the functioning of the societies and an experience of at least three years in auditing of societies with a working knowledge of Marathi language;, , (d) a Government Auditor, who is an employee of the Co-operation Department of the State, possessing the Higher Diploma in Co-operative Management or the Diploma in Co-operative Audit or Government Diploma in Co-operation and Accountancy with a working knowledge of Marathi language and who has completed the period of probation successfully.

Page 28 :

Chartered Accountant within the meaning of the Chartered Accountants Act, 1949., The person who holds a Government Diploma in co-operative accounts or a Government Diploma in co-operation and accountancy., The person who has served as an auditor in the Co-operative Department of the State Government, and whose name has been included by the Registrar in the panel of certified auditors preserved and published by him in the Official Gazette at least once every three years.

Page 29 :

Disqualification of Auditor of co-operative society:-, Subsection (7), an individual is not qualified to be an auditor of a society if he is not independent of the society and its member societies, and of the directors and officers of the society and its member societies., For the purposes of this section whether or not an individual is independent is a question of fact to be determined having regard to all the circumstances., An individual is presumed not to be independent of a society if he or his business partner—, a. …is a member, a director, an officer or an employee of the society or any of its member societies or a business partner or employee of any director, officer, member or employee of any such society, or its member societies;, b. …is a member of a Credit Committee or any other committee of the society or any of its member societies; or, c. …transacts a substantial amount of business with the society or a member society thereof.

Page 30 :

The provision of professional advice by or on behalf of an individual or his business partner does not by itself deprive an individual or his business partner of his independence for the purposes of this section., An auditor who becomes disqualified under this section must, subject to subsection (7), resign forthwith after he becomes aware of his disqualification., A member of a society may apply to the Registrar for an order or the Registrar may, upon his own motion, make an order declaring an auditor disqualified under this section and the office of auditor vacant., A member of a society may apply to the Registrar for an order or the Registrar may, upon his own motion, make an order exempting an auditor from disqualification under this section; and the Registrar may, if he is satisfied that an exemption would not adversely affect the members, exempt the auditor on such terms as he thinks fit.

Page 31 :

Qualification of auditor: , Apart from the chartered Accountant within the meaning of the Chartered Accountancy Act, 1949, some of the state co-operative Acts have permitted persons holding a government diploma in co-operative accounts or in co-operation and accountancy and also a person who has served as an auditor in the co-operative department of government to act as an auditor., Appointment of the auditor: , An auditor of co-operative society is appointed by the registrar of co-operative societies and the auditor so appointed conducts the audit in behalf of registrar and also submits his audit report to him as well as to the society.

Page 32 :

Vouching-Verification-Valuation, Voucher: ‘A voucher is any documentary evidence by which the accuracy of entries in the books of accounts may be proved’., Vouching: ‘Vouching means careful examination of the original evidence such as invoices, receipts, statements, correspondence, minutes, contracts etc with a view to prove the accuracy of the entries.’, Verification: ‘Verification means to ascertain whether the assets and the liabilities shown in the Balance Sheet are correct and the assets actually exist.’, ‘Verification means confirming the existence, ownership, possession of the assets. ’, Valuation: ‘In valuation appropriate value of the asset is determined.’, ‘Valuation is the analytical process of determining the current worth of an asset.’

Page 33 :

--Vouching--, Definition:-, ‘Vouching means comparing entries in the books of accounts with documentary evidence in support there of.’ ----- Dicksee., Vouching means careful examination of the original evidence such as invoices, receipts, statements, correspondence, minutes, contracts etc. with a view to prove the accuracy of the entries., Vouching means inspection by an auditor of documentary evidence supporting & substantiating transactions. Vouching is the process of checking documentary evidence that the transactions are properly recorded & accounted for., Vouching is not just an inspection of evidence in support and substantiating the accounting data but critical examination of transactions for an accounting period. In short auditor should assure of the validity, accuracy, adequacy, authority, and accountability of disclosed financial data in the books of accounts.

Page 34 :

---Voucher---, ‘A voucher is any documentary evidence by which the accuracy of entries in the books of accounts may be proved’., For every entry there should be some documentary evidence available , these documentary evidence is known as ‘Vouchers’., Receipts, counterfoils, invoices, credit notes, debit notes, pay-in-slip, Bank Reconciliation statements, agreements, resolutions, order books, gatekeeper’s book, broker’s note, statements of debtors and creditors, tender notices etc., Types- I) Primary voucher: All written evidences in original are primary vouchers., II) Secondary voucher: Copies of original vouchers are called collateral vouchers/ secondary vouchers.

Page 35 :

Importance of Vouching:-, Basis of Auditing/ Backbone of Auditing:-, Detecting errors and frauds, Authenticity of transactions, Proper recording and correct evidences, Proper authority, Arithmetical accuracy, Essence for verification, Essence for valuation